The next generation of decentralized perps. - by 0xtiago

A Layer1 specific app chain designed for optimal performance on decentralized futures trading.

As 2022 was a year marked by failures from centralized players in the crypto industry, along with a brutal bear market. The demand for decentralized infrastructure was only growing, especially after the gargantuan fraud that was FTX, the second largest derivatives exchange in the whole crypto industry.

Perpetual DEXes have lived their mini bull season apart from the whole markets last year, mainly GMX, which appreciated in price over 500% against BTC & ETH, also made a decent return, 85%, against the US dollar. Even presenting a way worse experience for users, when compared to their centralized counterparties.

Here comes Hyperliquid, a decentralized exchange with a stated mission to replicate the experience of trading in a CEX, like Binance or the extinct FTX, in a trustless and secure way. They are building their own chain so that it could handle the computational intensive application while keeping it decentralized.

Hyperliquid has an on-chain order book, unlike their competitors, which use AMM models (GMX), or has off-chain order books (DYDX).

Products

-

Trading platform

-

HLP vault

-

Liquidator vault

-

Community created vaults

Trading Platform

The trading platform is the best I’ve ever used when talking about perpetual DEXes. They create a seamless trading experience, similar to trading on Binance or the extinct FTX, which was considered a great product by many traders. Some features on the platform:

-

Cross and Isolated margin available

-

Preset take profit and stop-loss orders

-

Up to 50x leverage in any trading pair

-

There are 25 trading pairs live and more being added

-

It is possible to adjust TP/SL by just dragging orders on the chart

-

No gas or trading fees during closed mainnet

HLP Vault

HLP vault is a market maker vault, which acts as the main liquidity pool for the Hyperliquid exchange. Its high-frequency trading (HFT) strategy was designed by Chameleon Trading (team behind Hyperliquid). The vault is now community owned, as anyone can deposit in the vault after putting over U$100 in trading volume.

As stated in the project’s official Twitter page, the strategy runs off-chain, but all the positions are transparent and visible in real-time at their platform.

The vault is not risk-free as it can take on losing trades, like any other liquidity pools. Depositing in HLP is the only way for providing liquidity in the platform at the moment, but the team aims to add external market makers to the platform soon, as they mentioned in their last community call.

Liquidator Vault

The liquidator vault is the only way that one can currently profit from liquidating traders. The vault’s strategy was prior designed and is set to execute the trade when a position’s margin falls below 1% margin, as it marks the position as liquidatable.

Like the HLP vault, the pool’s strategy was also designed by the team, but anyone with access to the platform can provide liquidity to the liquidator vault and share the vault’s revenue.

Community Created Vault

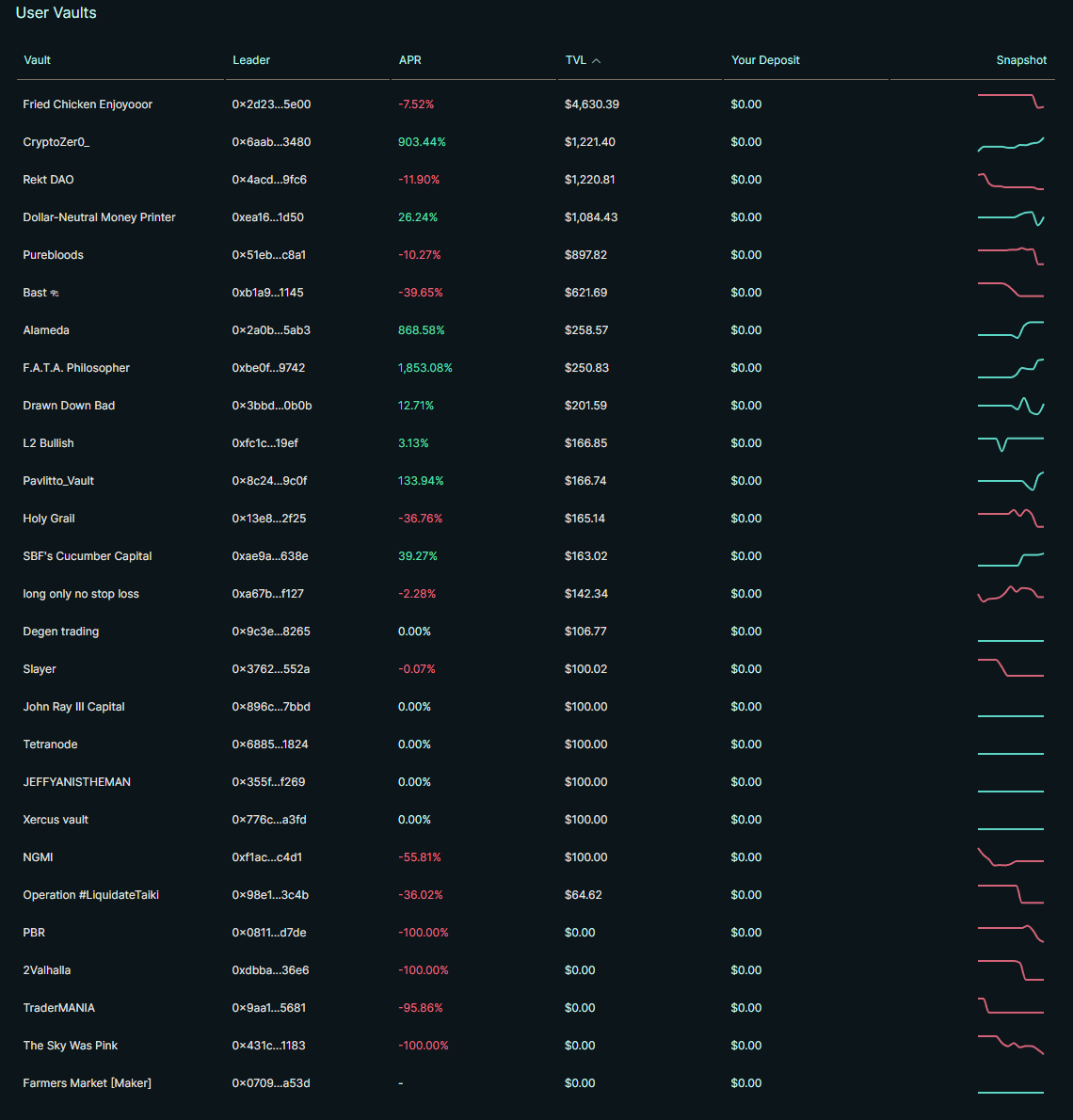

Besides the two vaults mentioned above, users have the opportunity to create their own custom vaults and engage in trading. These user-created vaults operate similarly to a copy-trading strategy. When a user provides liquidity in a custom vault, they can share the gains or losses with the vault’s owner. Furthermore, anyone who creates a vault and earns profits from it will receive 10% of the depositor’s profits as well.

Roadmap

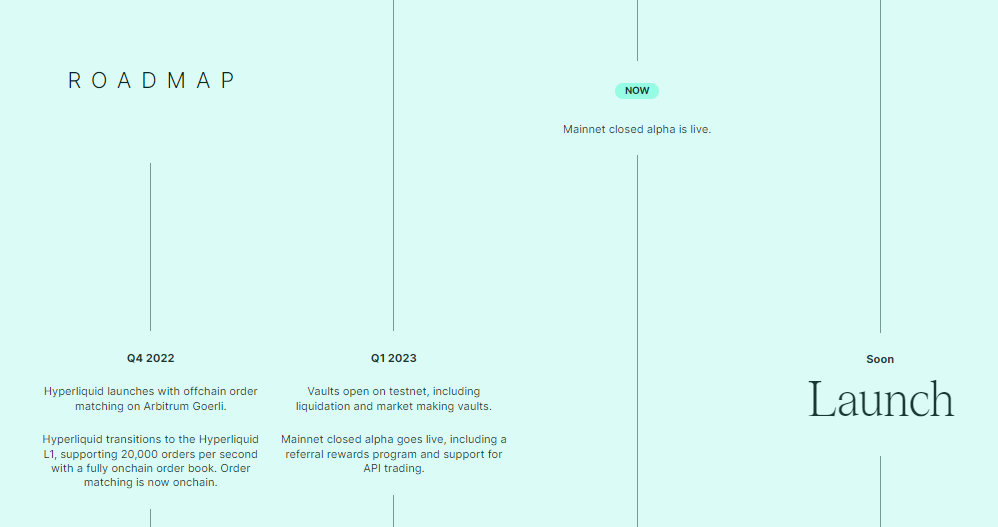

The project launched their testnet on Arbitrum Goerli in Q4 2022 and subsequently transitioned to the L1 testnet, adding vaults in Q1 2023. Hyperliquid also launched their current phase, the Mainnet closed alpha in Q1 of this year.

Currently access to the platform is only possible through a referral link. Users who have access to the platform can create their own referral links, which also can be found in their official Discord.

The team is expecting to maintain the closed alpha version until Q3 2023. If everything goes according to plan, it is possible to see Hyperliquid working in a permissionless manner in just a few months. Additionally, the token will be live to ensure the security of the network.

Technology Overview

Hyperliquid L1

The chain was specifically designed to deliver great performance for derivatives trading. The platform’s order book is built fully on-chain. The chain has a stated throughput at 20,000 TPS.

As for consensus the project uses proof-of-stake, similiar to Cosmos. Users have the option to either run a validator set or delegate their stake to an existing delegator.

Hyperliquid utilizes a “tuned version of Tandermint” to optimize for extremely low latency. For instance, orders placed in the same location as the client are matched within 1 second.

Despite using Tandermint as its consensus mechanism, the platform is not a Cosmos Zone.

Audits are not done yet.

Oracles

The oracles are integrated in the validator set, as they are responsible for publishing oracles’ prices every 3 seconds.

The oracle prices are calculated as a weighted median of spot prices from 4 major exchanges. Binance, OKX, Kraken, and Huobi with weights assigned as 3, 2, 2, and 1 respectively.

When questioned about the decision to develop an in-house oracle system instead of using Chainlink, the team answered that Chainlink is not on the Hyperliquid L1 and does not update prices fast enough.

Onboarding

Typically, being an L1 entails more friction when onboarding users, as it requires a native token for gas, cross-chain bridges, and other complexities. However Hyperliquid operates in a similar manner to DYDX, whereas a user deposits USDC into the chain, much like depositing into a dApp.

Hyperliquid has chosen Arbitrum as the main integration with its bridge, enabling almost instant deposits and withdrawals.

For example, depositing funds onto Hyperliquid is bridging from Arbitrum → Hyperliquid. Withdrawing funds is bridging from Hyperliquid → Arbitrum.

By similar to DYDX, I am referring to the user experience of depositing funds into the protocol. While DYDX operates as a Layer 2 solution on top of Ethereum, Hyperliquid is a Layer 1 blockchain.

Final Thoughts & Considerations

Before discussing the positive aspects, I would like to address my concerns regarding the protocol.

Firstly, audits are not done yet, leaving uncertainty about the potential finds in the final audit report. The Oracle system and the path to decentralization for the exchange preset intriguing challenges that the team will face.

The oracles, which are operated by validators, is a novel way for operating oracles. As this approach hasn’t stood the test of time, it remains to be seen how effective and secure it will be.

Achieving decentralization for a highly computational and high-performance exchange like Hyperliquid will be a challenging task. The computational burden of putting an entire order book on-chain adds complexity to this endeavor.

The growing season for derivatives protocols is still up, even on choppy markets like 2022 to date. The protocol is growing at a decent pace, from $41k in TVL from April 18th to $3.77 million today (June 5th) per DefiLlama.

The platform has a great interface and user experience as a whole, which is very close to the best CEXes available. The platform can capture the demand on two narratives, on-chain derivatives trading and also real-yield, as their vaults should maintain profitability.

The total addressable market is huge for a good decentralized exchange, as the biggest derivatives DEX, DYDX processed a monthly average of $28 billion in volume over the last 12 months, while averaging $451 million in TVL for the same period, according to Token Terminal’s data.

To reach the Ethereum L2’s TVL, Hyperliquid would need to grow 119x. If the team manages to execute their ambitious project well, there is a good chance they can get at least close to DYDX and see a new king in the decentralized derivatives space.

Another important factor that can help to foster adoption to the protocol would be Hyperliquid’s token launch. As a layer 1, they will need a token. The token could give an airdrop to early users, also being a way to retain them. A token can provide the protocol with means to offer incentives, thus attracting users and capital.

The protocol is in its infancy, hence it should be approached carefully. DYOR anon.

Links

https://hyperliquid.xyz

https://twitter.com/HyperliquidX

https://discord.com/invite/hyperliquid

https://hyperliquid.gitbook.io/hyperliquid-docs/

Follow 0xtiago for more analysis!

More Alpha Reports here.