The weekly 🐰 hole (9 July 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (9 July 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

🐰Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

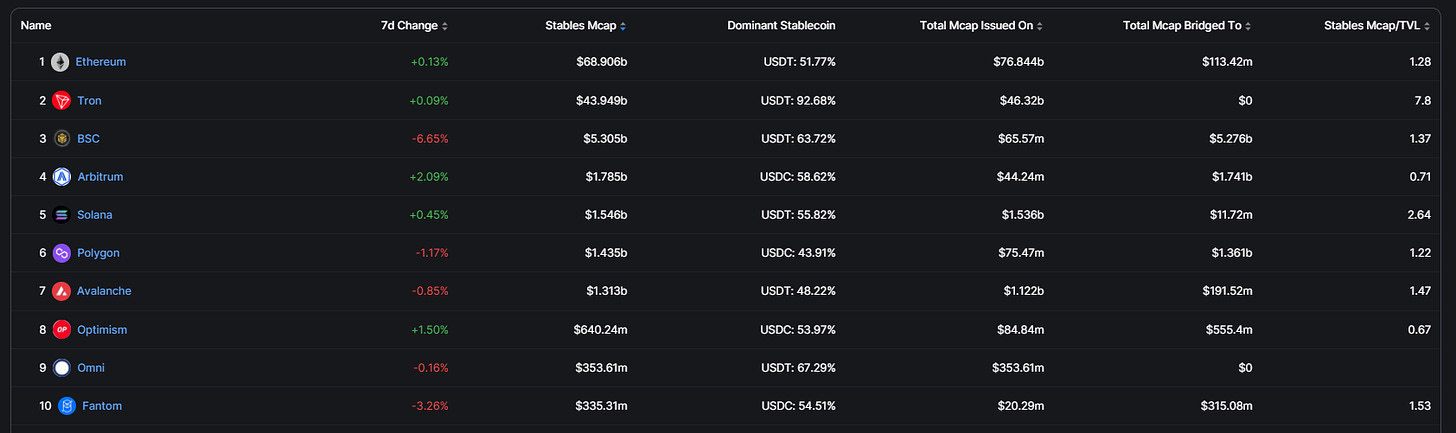

1. Stablecoin Flows

Total Stablecoin MCAP = 127.27 bil, with -0.2% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Hedera

-

Waves

-

Polygon zkEVM

-

EVMOS

-

Stellar

Top outflows:

-

Dogechain

-

smartBCH

-

EthereumClassic

-

Oasis

-

Kava

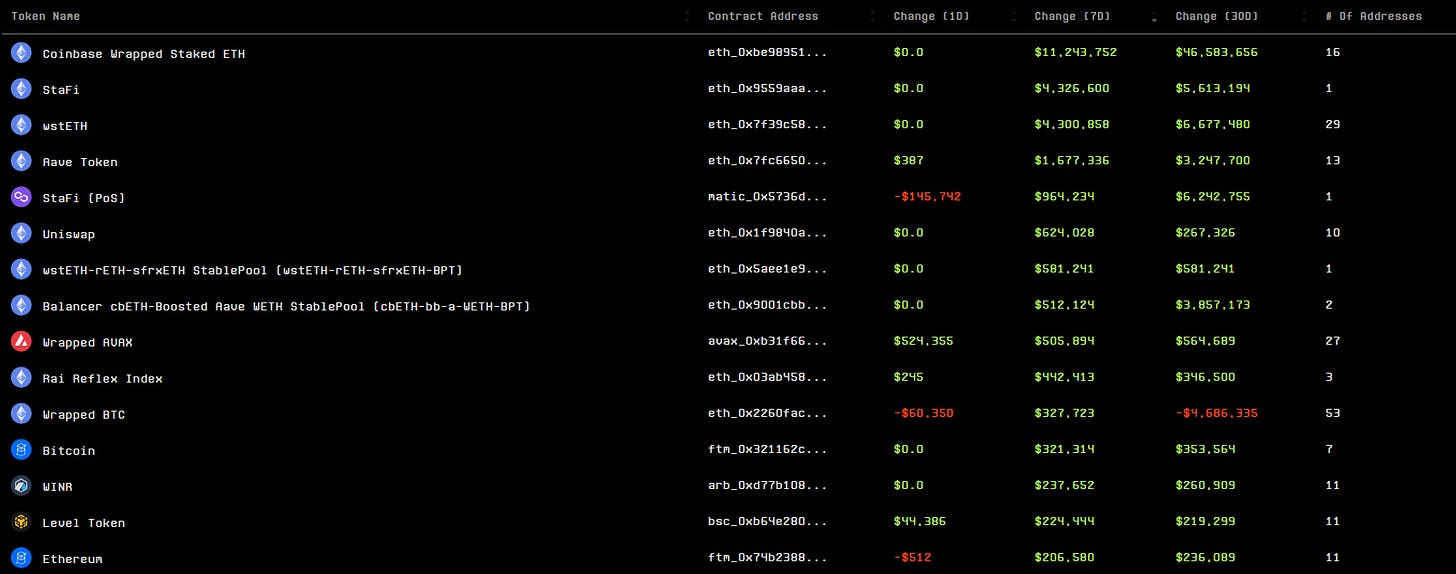

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Coinbase Wrapped Staked ETH

-

Stafi

-

wstETH

-

USDC

-

Curve USD stablecoin

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

Dai

-

stETH

-

Arbitrum

-

rETH

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Stafi

-

wstETH

-

Aave

-

Stafi (Polygon)

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

stETH

-

rETH

-

nUSD

-

with-bb-a-wETH-BPT

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Fantom

Revenue

-

ETH

-

Tron

-

BTC

-

BSC

-

Arbitrum

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Cosmos

-

BTC

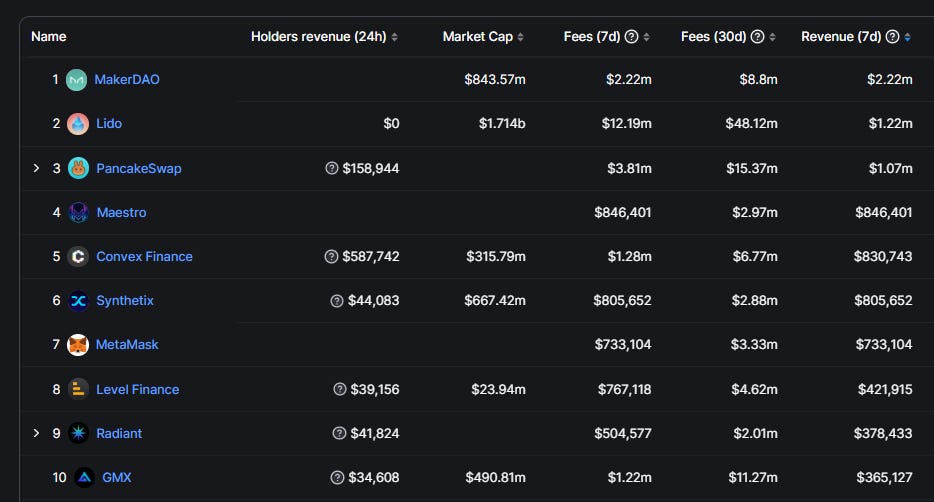

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Pancakeswap

-

MakerDAO

-

AAVE

Revenue

-

MakerDAO

-

Lido

-

PancakeSwap

-

Maestro

-

Convex Finance

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

Level Finance

-

GND Protocol

-

Mummy Finance

-

Solarbeam

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

El Dorado Exchange

-

Level Finance

-

Equilibre

-

GND Protocol

-

X2Y2

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

Convex Finance

-

Pancakeswap

-

Synthetix

-

Radiant

-

Curve Finance

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

Trending Applications

-

Arbitrum

-

Project Galaxy

-

Element Market

-

Phi

-

XEN

Raises - Recent funding rounds

-

Shardeum

-

Magic Square

-

Supersight

-

CryptoQuant

-

Web3Go

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap remained flat this week at -0.2% decrease.

-

Hedera, Waves and Polygon zkEVM saw the largest stablecoin inflows.

-

Dogechain, SmartBCH, EthereumClassic saw the largest stablecoin outflows.

Smart Money Movement:

-

Smart Money remains relatively quiet this week with slow accumulation into OG defi coins like Aave and Uniswap.

-

Some Alts purchased by Smart Money this week include AVAX, Rai Reflex Index, WINR, Level, Pendle and JPEG.

L1/L2 movement:

-

Huge fees in FTM Ecosystem this week due to the Multichain hack as users begin pulling funds from FTM due to the L1’s exposure to the now-suspended bridge.

-

zkSync Era continues to dominate daily TPS as airdrop farmers flock en mass. However, the Defi experience on the chain remains subpar compared to Arbitrum.

DAPP movements:

-

Lido continues its dominance in the DAPP rankings.

-

Level Finance PF ratio is looking attractive compared to other Perp protocols.

-

Arbitrum is the top trending application this week.

-

Alpha drop by @apes_prologue

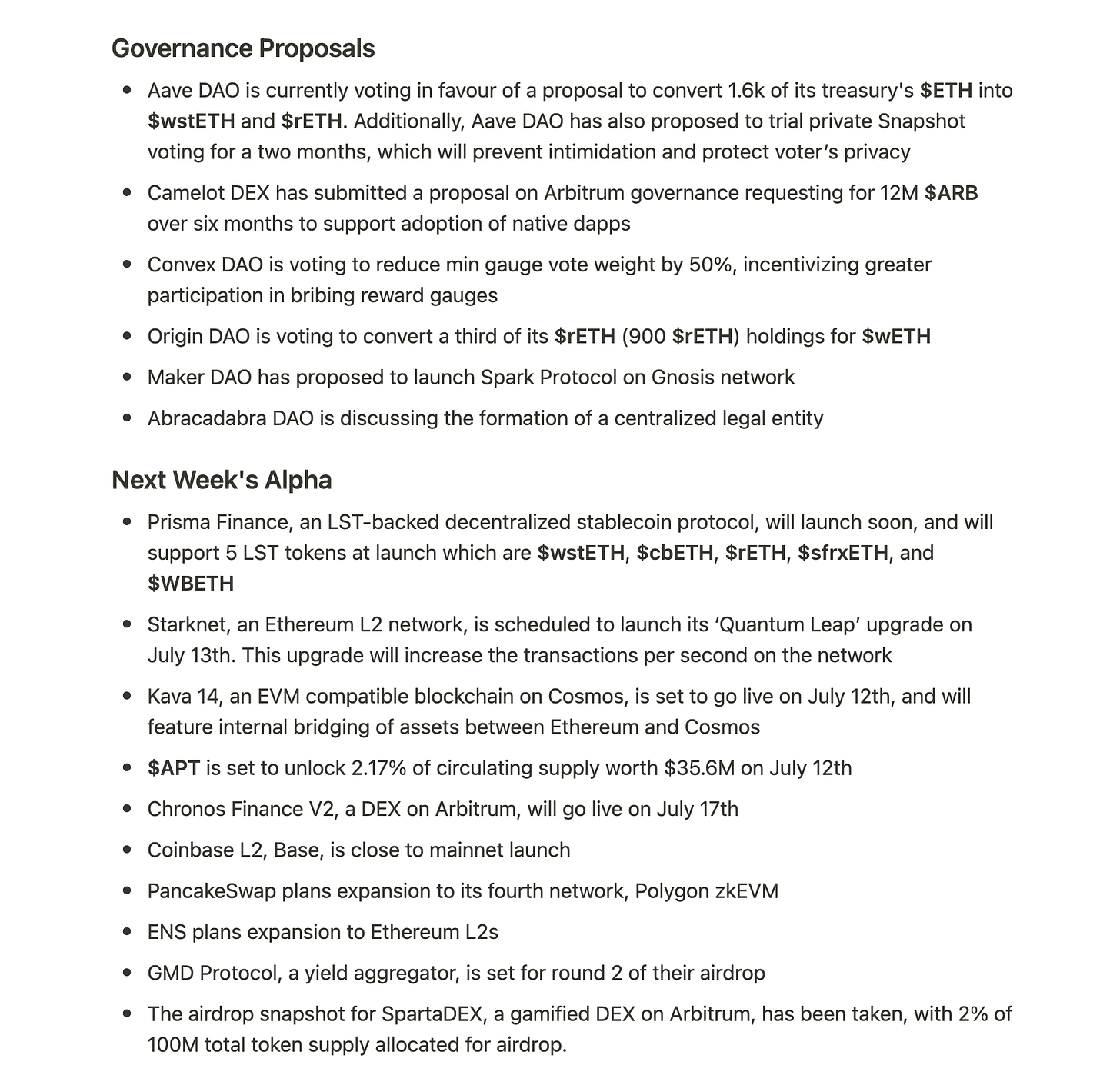

6. TLDR

-

Smart Money continues to accumulate slowly as the market crabs sideways, with notable inflows into OG DeFi projects like AAVE and Uniswap.

-

We seem to be at the final innings of the bear/crab market with inflation coming down to the 2% range, I am starting to accumulate quality ALTs in preparation for the coming bull run during the next BTC halving.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: