The weekly 🐰 hole (26 Mar 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (26 Mar 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

What an eventful week with $ARB airdrop, Fed raising interest rates and further banking crisis. Let’s see how the crypto market responded to these events.

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

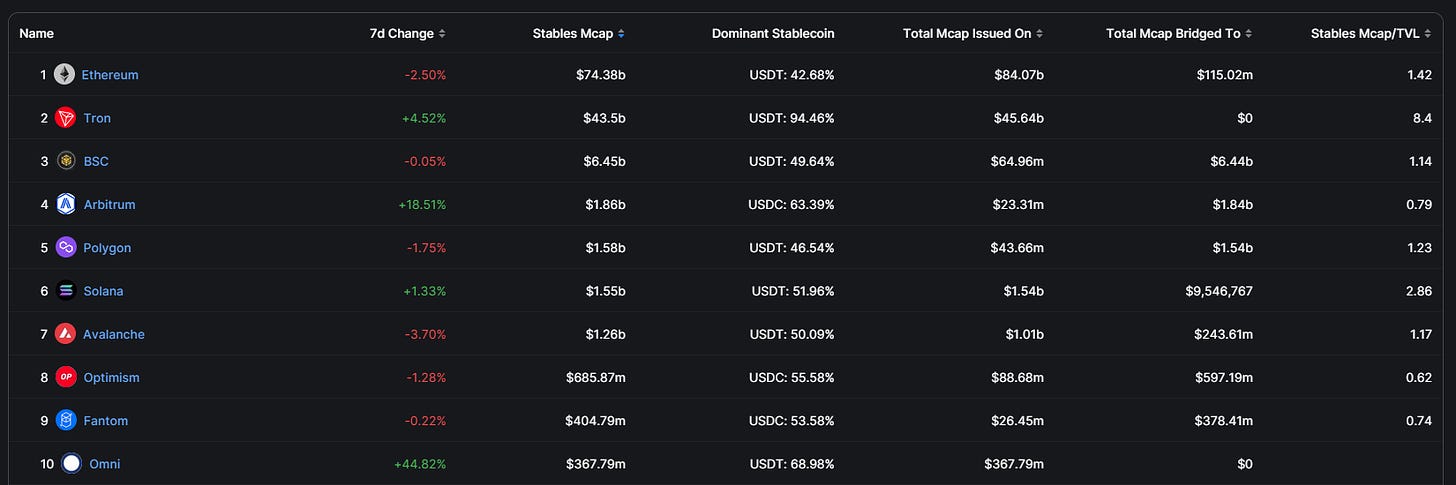

1. Stablecoin Flows

Total Stablecoin MCAP = 133.77 bil, with 0.20% weekly change.

Top 10 Chain (In terms of Stables Mcap):

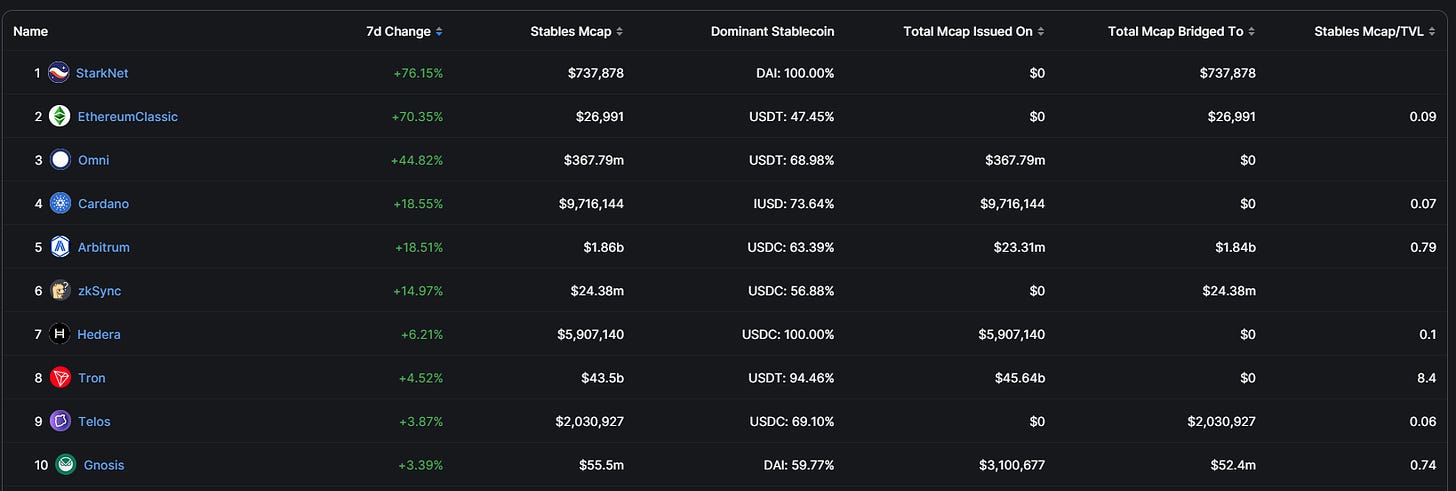

Top inflows:

-

StarkNet

-

EthereumClassic

-

Omni

-

Cardano

-

Arbitrum

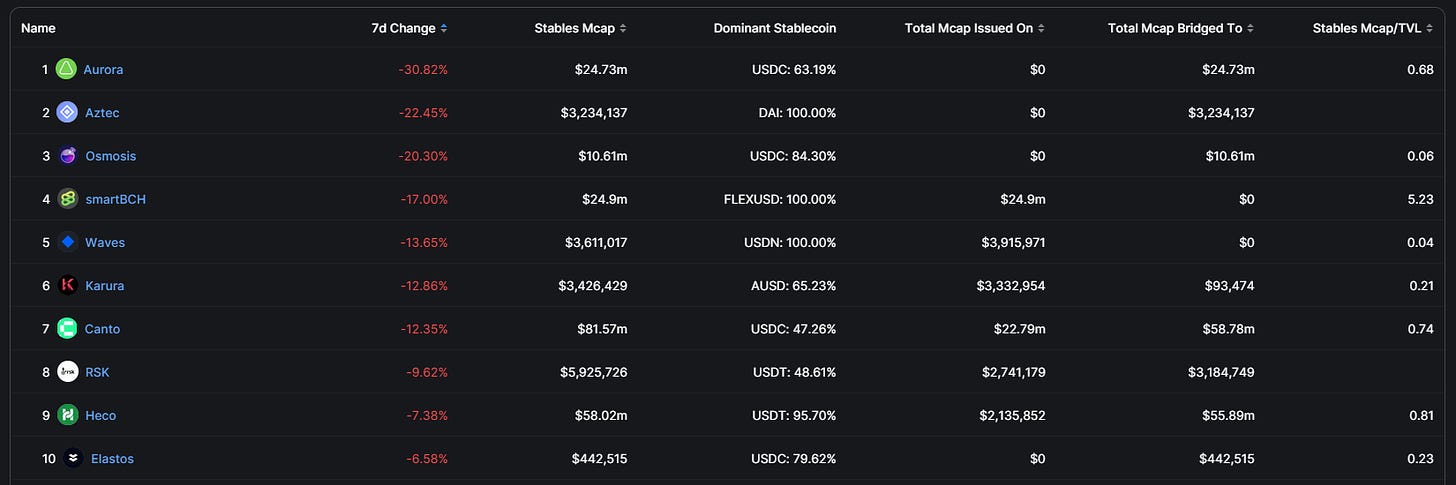

Top outflows:

-

Aurora

-

Aztec

-

Osmosis

-

SmartBCH

-

Waves

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Coinbase Wrapped Staked ETH

-

USDC

-

Arbitrum

-

USDT

-

wstETH

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

USDT

-

USDC (Arbitrum)

-

Wrapped BTC

-

Radiant

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Arbitrum

-

wstETH

-

agEUR

-

stETH

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Wrapped BTC

-

Radiant

-

wstETH-rETH-sfrxETH

-

Stasis EURS token

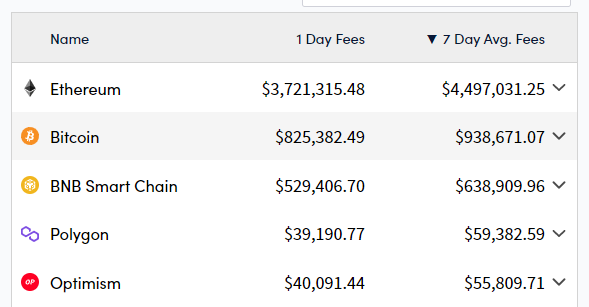

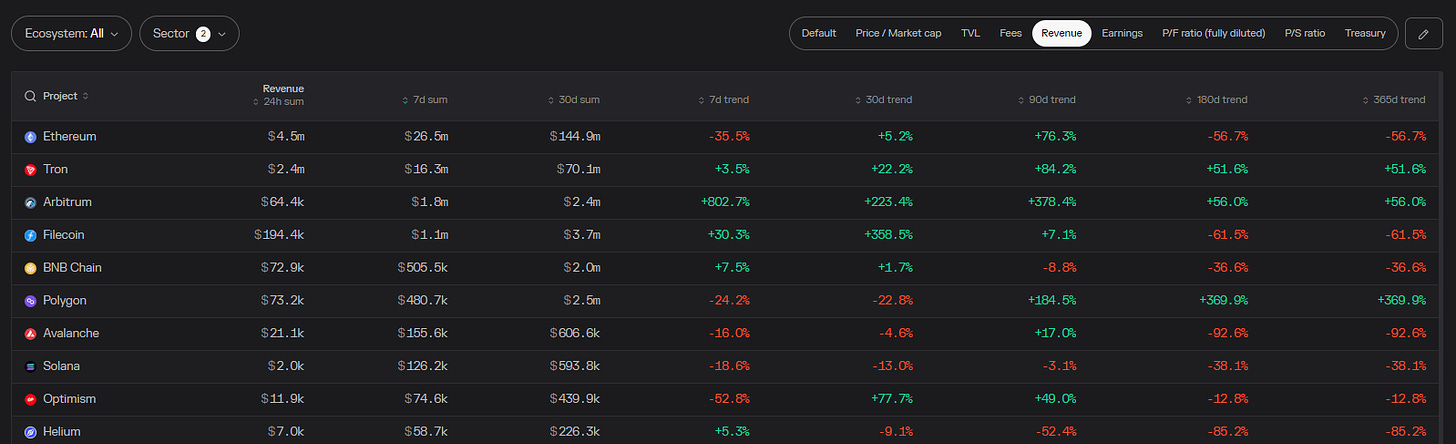

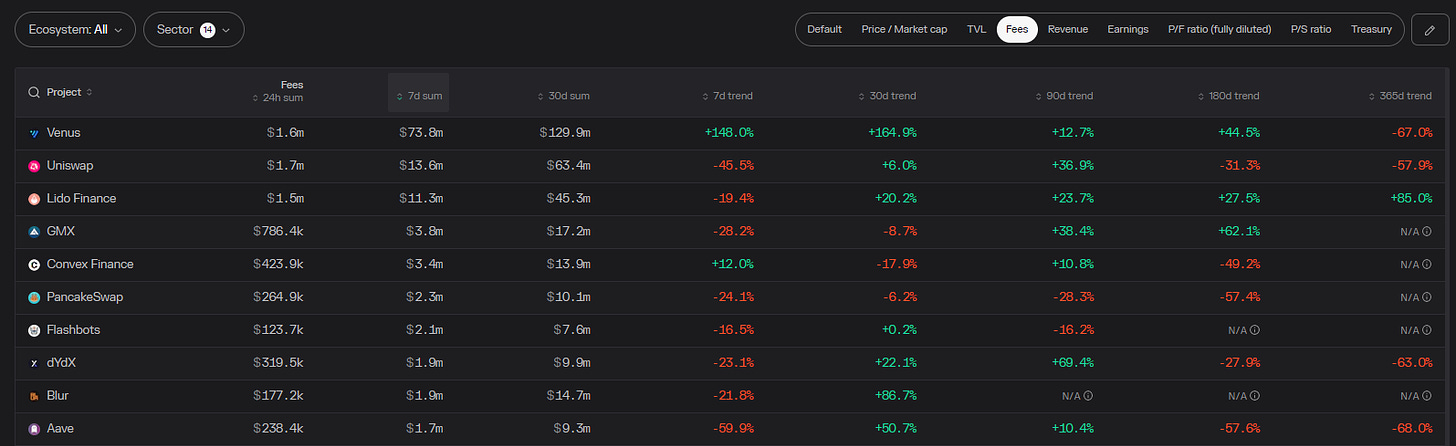

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Polygon

-

Optimism

Revenue

-

ETH

-

Tron

-

Arbitrum

-

Filecoin

-

BNB

Earnings

-

Tron

-

ETH

-

Arbitrum

-

SX

-

MultiversX

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

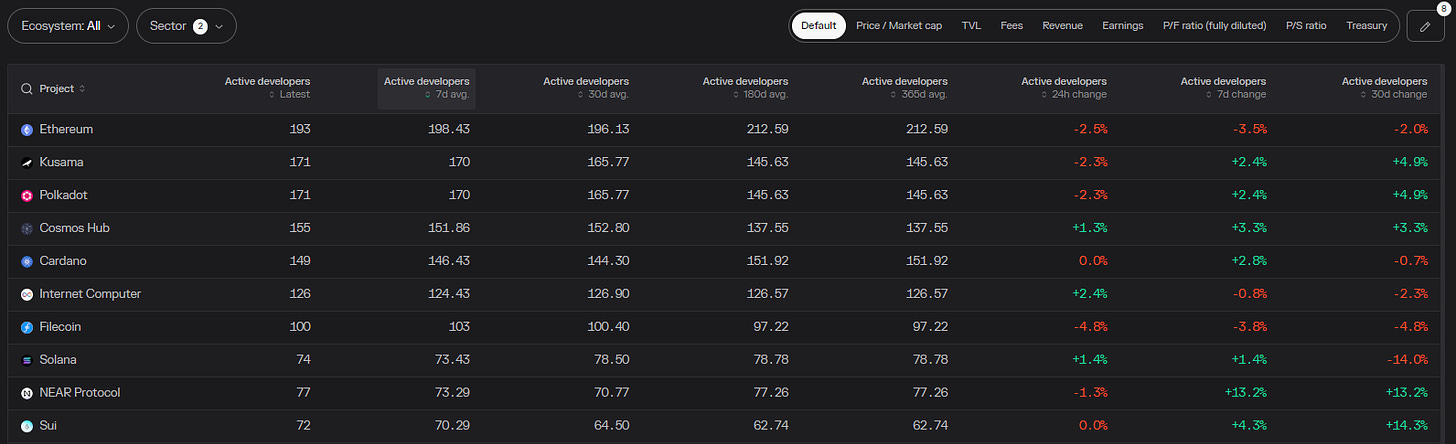

Active Developers

-

ETH

-

Kusama

-

Polkadot

-

Cosmos

-

Cardano

Code Commits

-

Gnosis Chain

-

Kusama

-

Polkadot

-

Internet Computer

-

Cardano

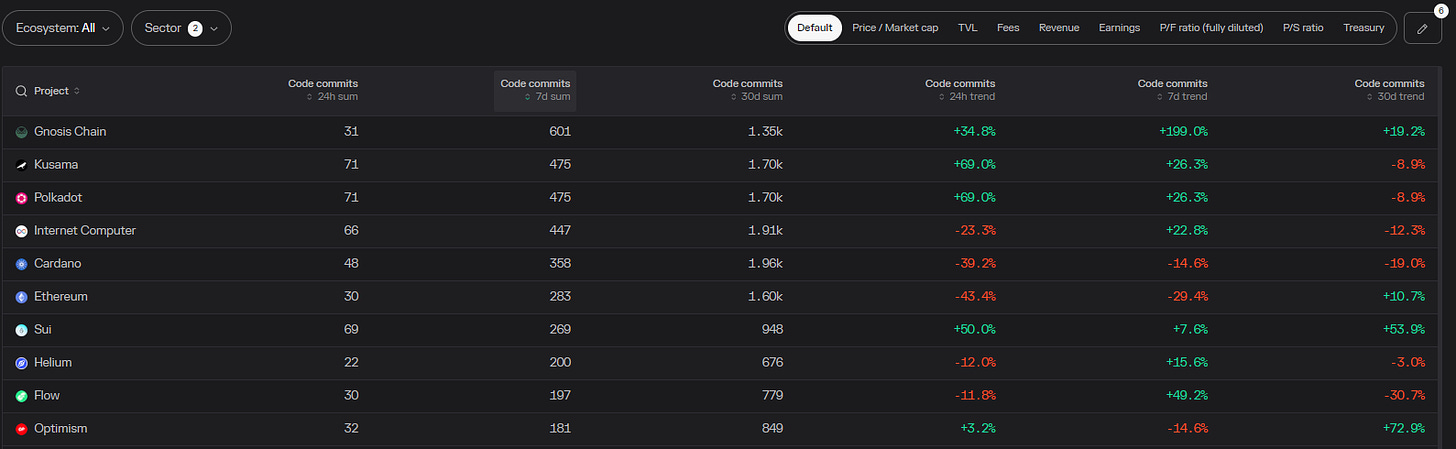

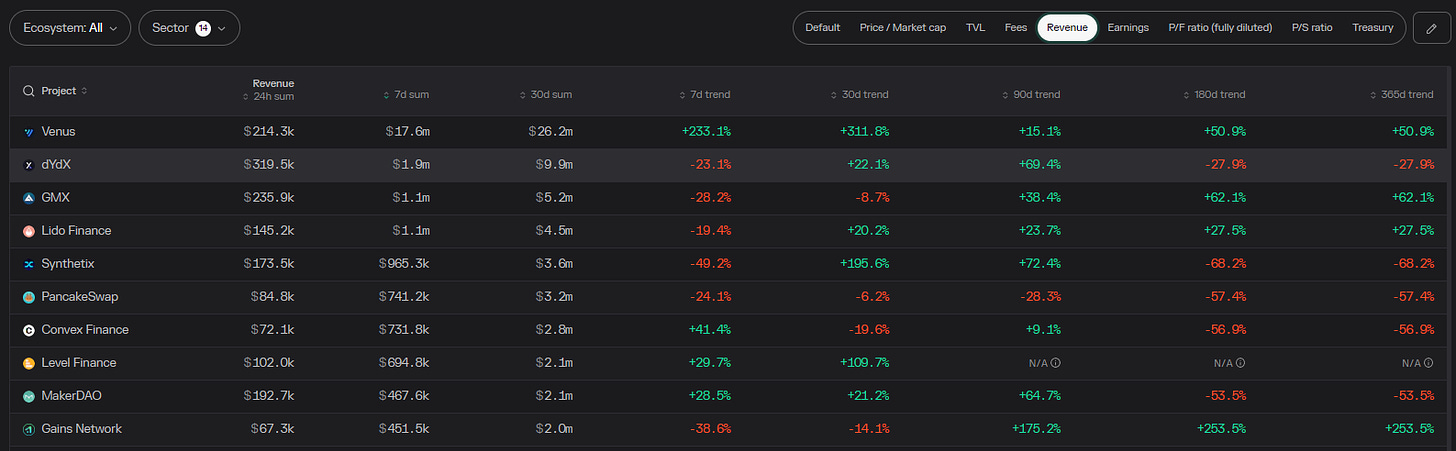

4. Top DAPP Financials

Fees-Generated

-

Venus

-

Uniswap

-

Lido

-

GMX

-

Convex

Revenue

-

Venus

-

dYdX

-

GMX

-

Lido

-

Synthetix

Earnings

-

Venus

-

Lido

-

dYdX

-

GMX

-

Gains Network

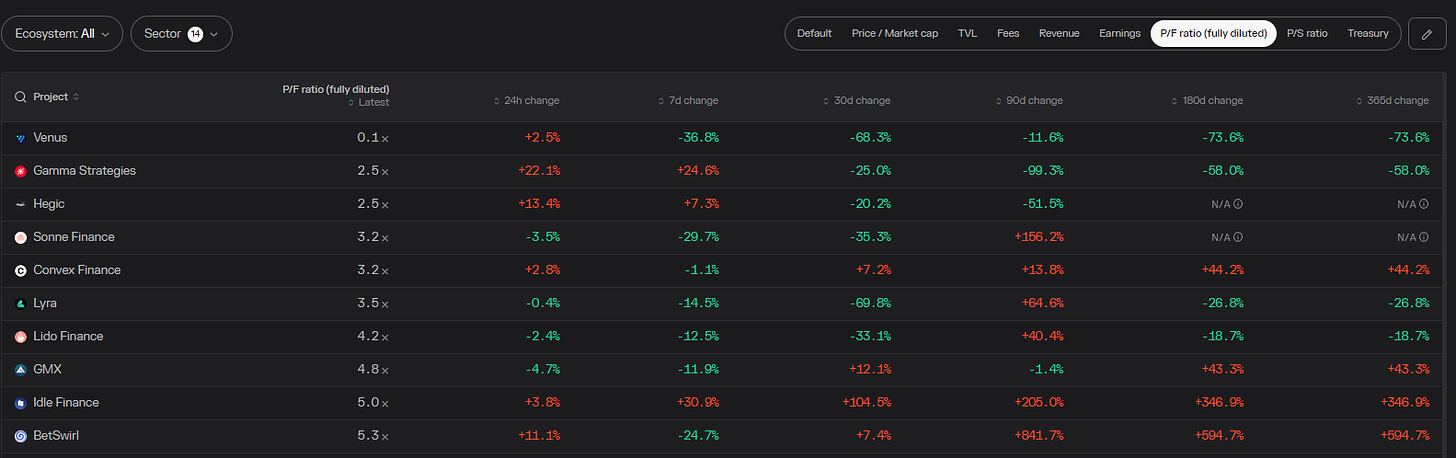

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Venus

-

Gamma Strategies

-

Hegic

-

Sonne

-

Convex

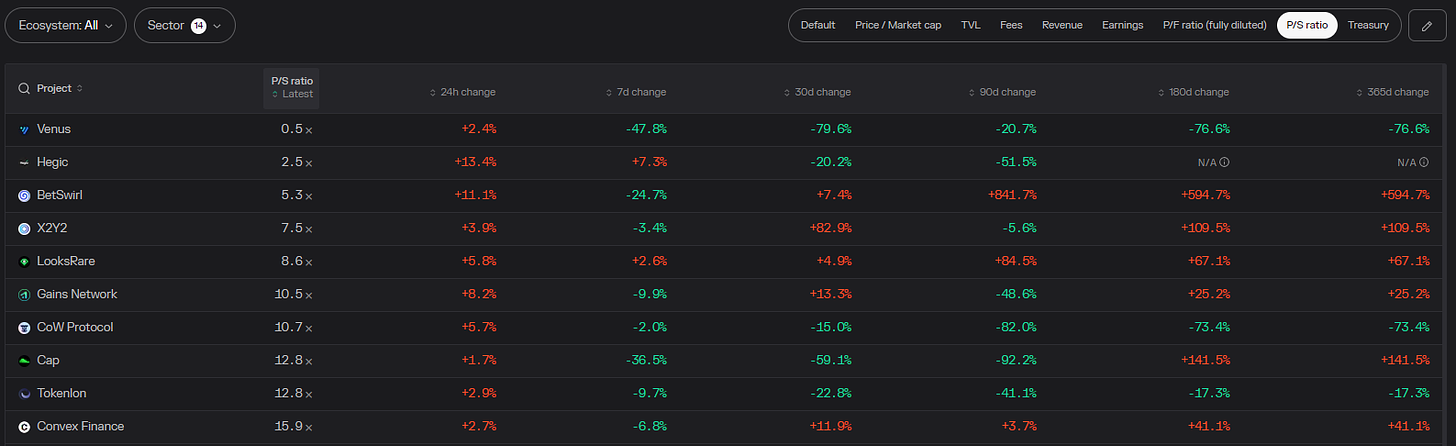

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Venus

-

Hegic

-

BetSwirl

-

X2Y2

-

LooksRare

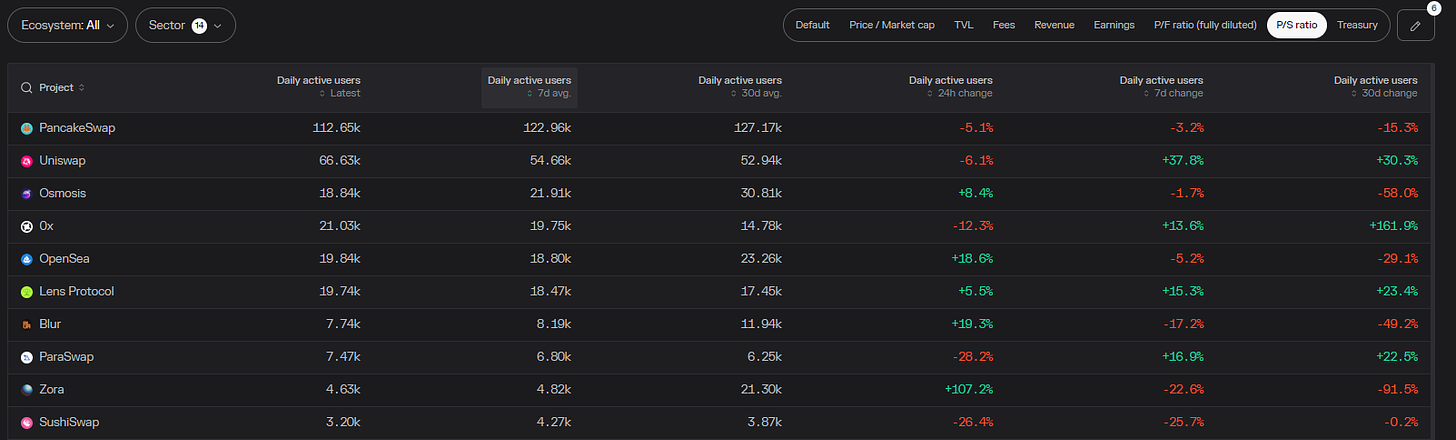

DAUs

-

Pancakeswap

-

Uniswap

-

Osmosis

-

0x

-

OpenSea

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market remains relatively flat this week as people process the effects of the current banking crisis and what the Fed’s latest rate hike means going forward.

-

Arbitrum received the largest stablecoin inflows amongst the top 10 in response to $ARB airdrop and incentive programmes.

-

Starknet & zkSync is seeing large stablecoin inflows as Airdrop Farmers swoop en-mass following the success of $ARB airdrop.

-

The Cosmos ecosystem saw the largest outflow.

Smart Money Movement:

-

Smart money piled in on trading $ARB this week as one of the biggest L2 finally launched their token.

-

A number of smart money started taking profits off the table on some Arbitrum alts like $RDNT, $GRAIL and $GMX post $ARB airdrop.

L1/L2 movement:

-

Arbitrum TVL is about to hit its previous ATH, will be interesting to see what happens to the ecosystem once this is breached.

-

ZK narrative is here with StarkNet and zkSync seeing large stablecoins inflows as rotators attempt to farm the next upcoming airdrops. Will be actively watching for new DAPP launches on these 2 chains.

-

Gnosis Chain saw a huge number of code commits this week, will be interesting to see what they are building.

DAPP movements:

-

Venus Protocol topped all metrics this week (except for DAUs) outperforming defi favourites like Uniswap, Lido, dYdX and GMX.

-

Opensea is on a 3-week losing streak as NFT users opt for alternative marketplaces like BLUR.

-

LSD remains a dominant sector with sustainable financials. I have a strong conviction that LSD protocols will outperform the market this April post-ETH Shanghai upgrade.

6. TLDR

-

With the recent I/R hike, the market is 50/50 in either direction. It is probably a good idea to keep some stables on the side to catch local bottoms.

-

$ARB remains fundamentally undervalued on a DAU and TVL basis. I am still holding a large chunk of my airdrop and will not sell it anytime soon.

-

LSD protocols remain fundamentally sound, probably a good idea to allocate some capital to undervalued projects in this space.

-

ZK season is here with the launch of the zkSync era mainnet. However, only bridge an amount you are willing to lose as the chain is still in the Alpha stage and there are limited DAPPs available.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: