The weekly 🐰 hole (9 Apr 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (9 Apr 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

Just buy LSD bro?

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 131.93 bil, with 0.21% weekly change.

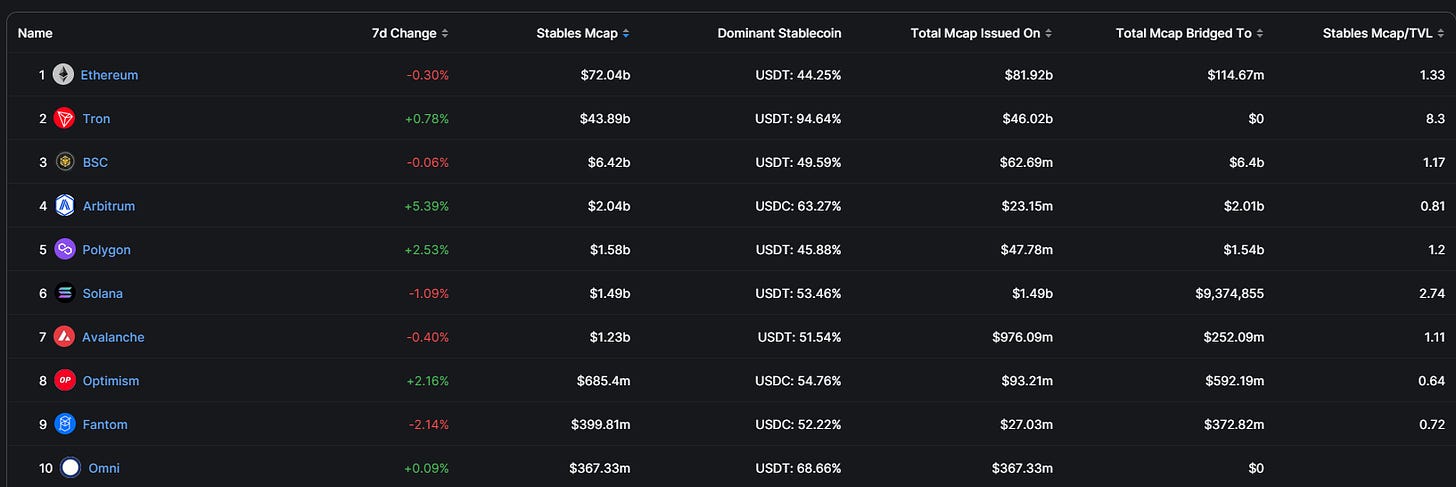

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Aptos

-

StarkNet

-

OKExChain

-

Canto

-

Arbitrum Nova

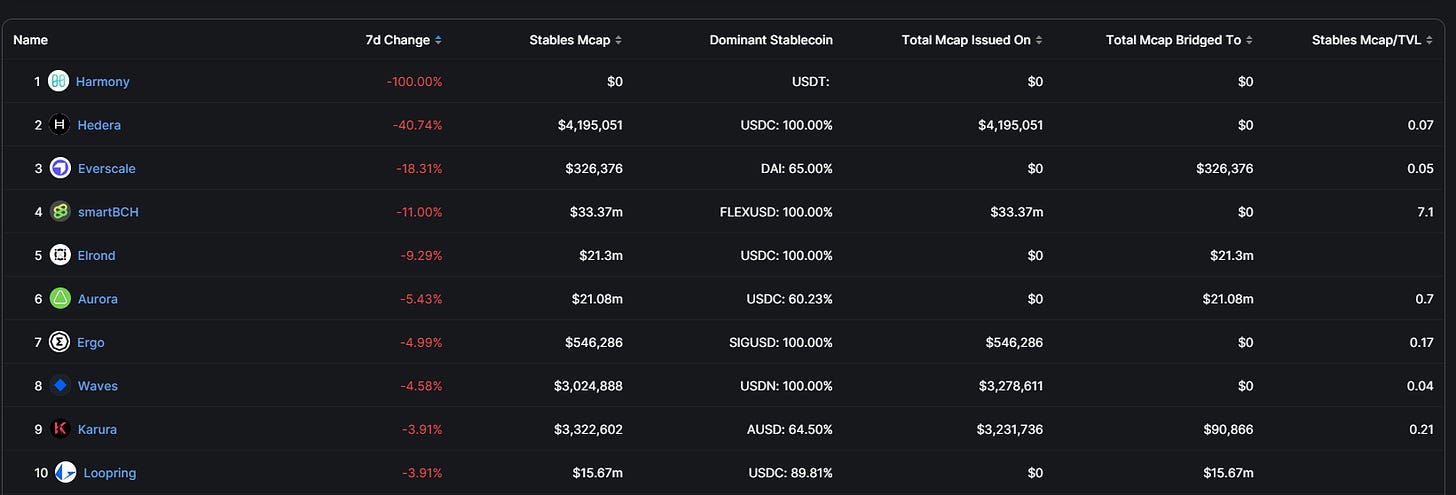

Top outflows:

-

Harmony (Probably a UI bug)

-

Hedera

-

Everscale

-

smartBCH

-

Elrond

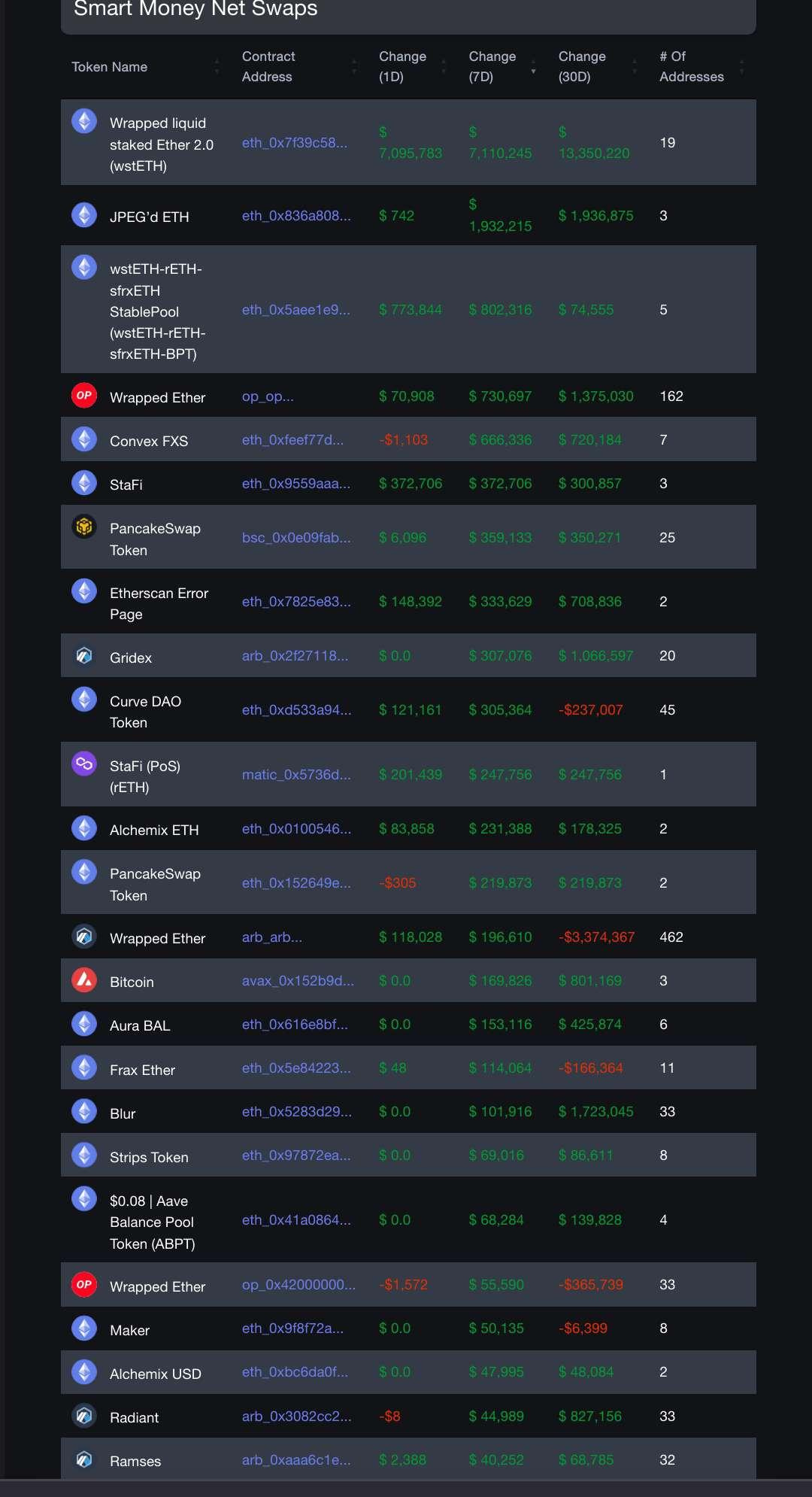

2. Smart Money Movement

Cr: @ozfrox

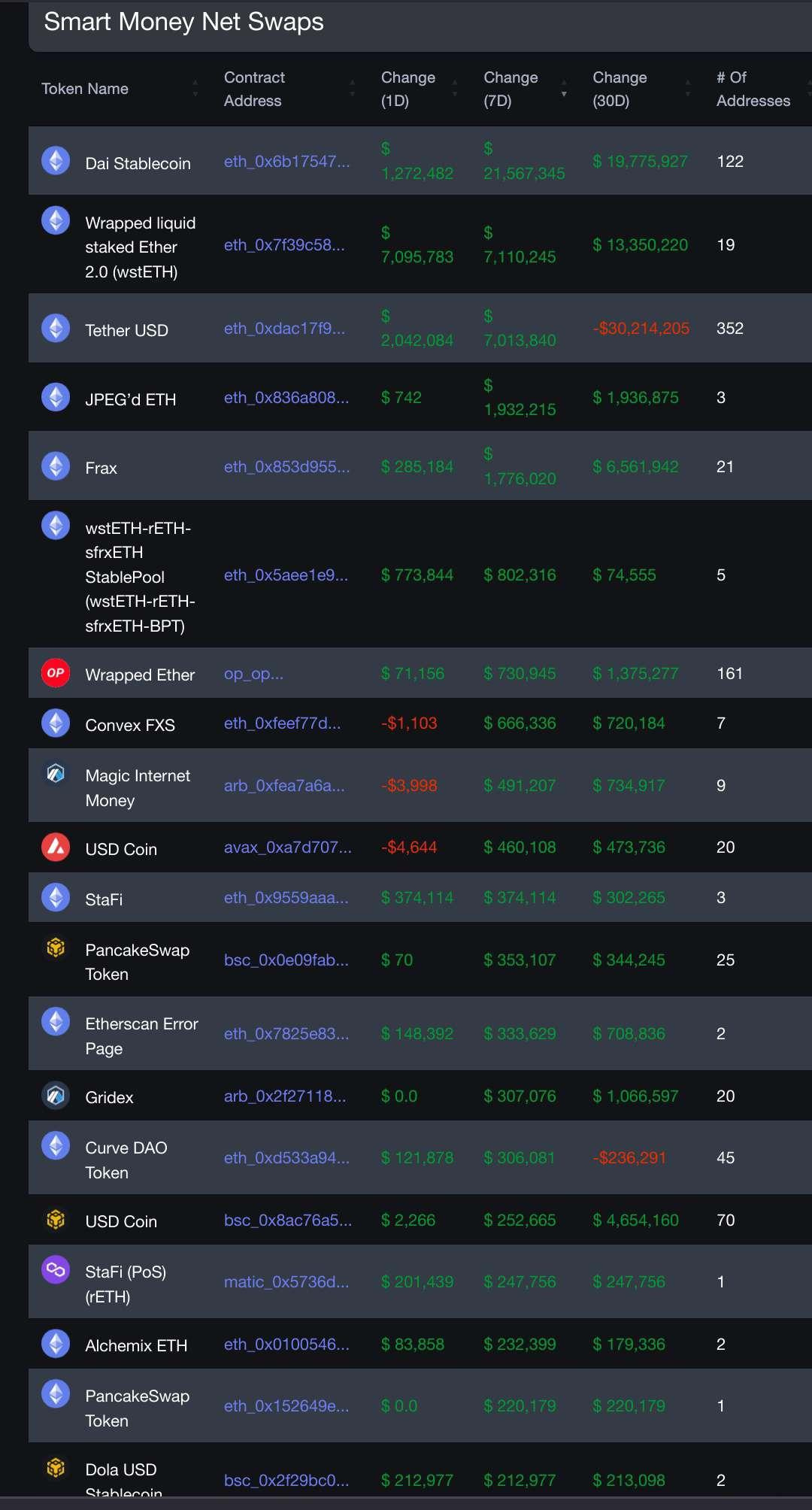

Top Smart money inflows (including stablecoins):

-

DAI

-

wstETH

-

USDT

-

JPEG

-

Frax

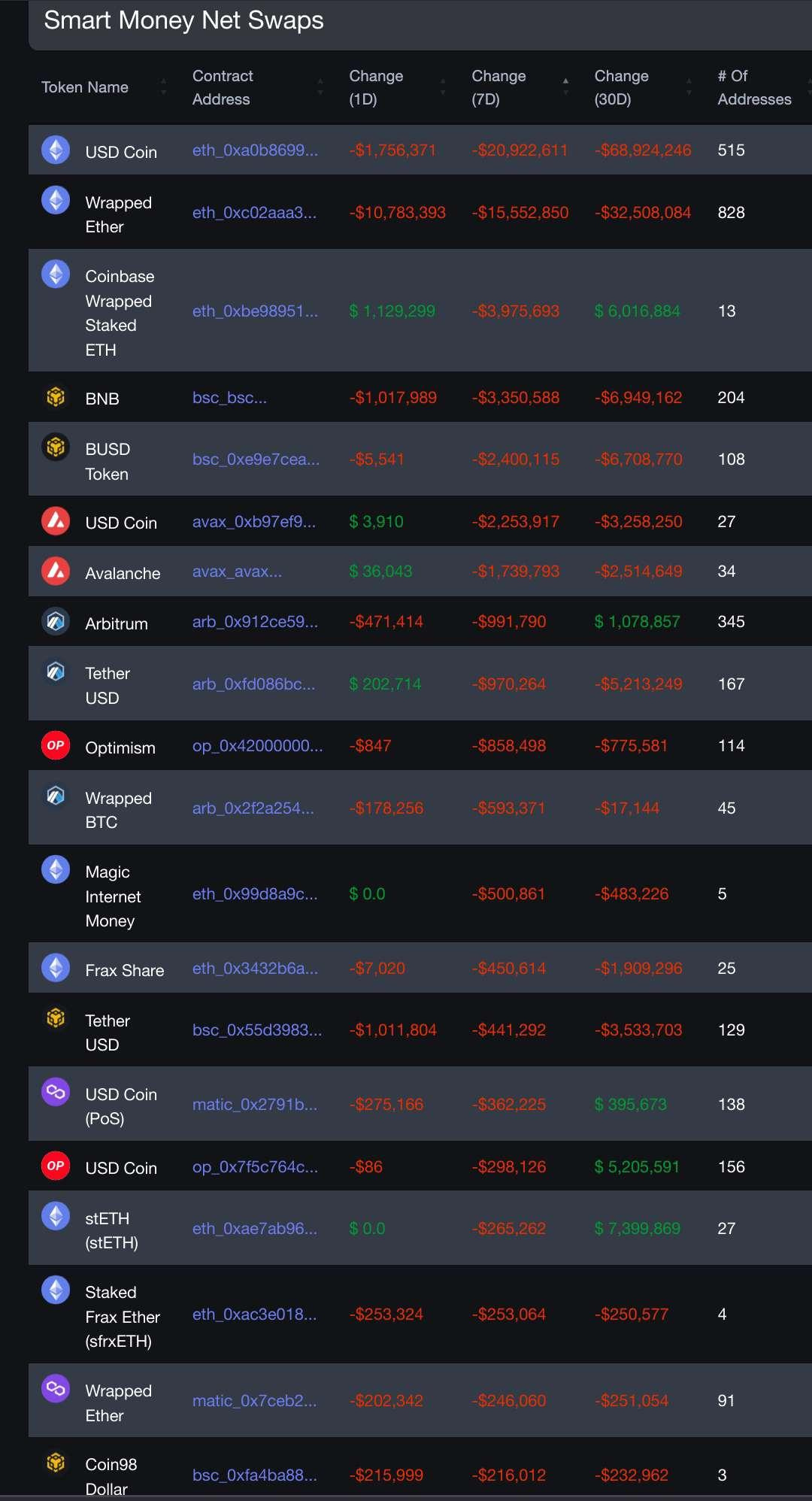

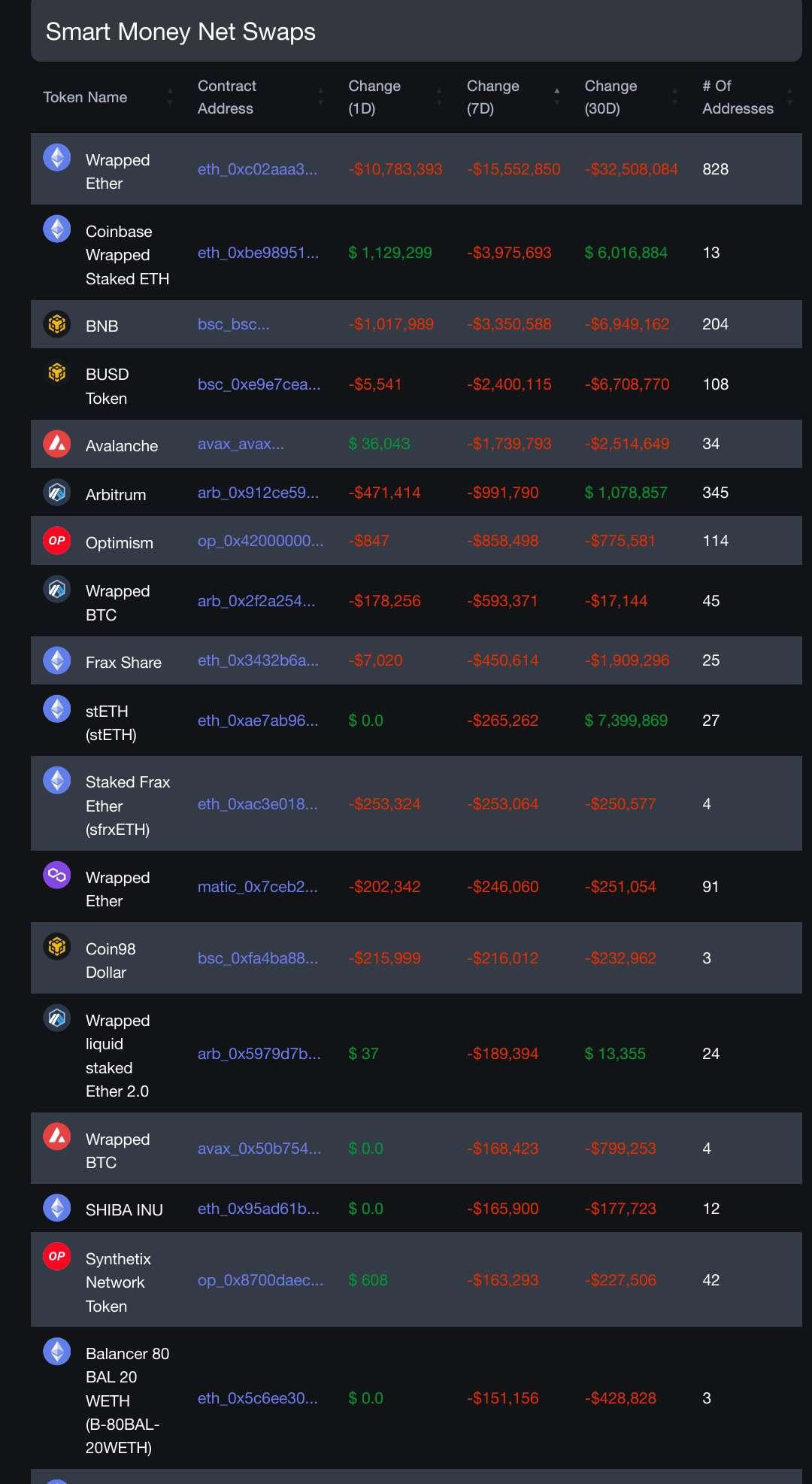

Top Smart money outflows (including stablecoins):

-

USDC

-

Wrapped Ether

-

Coinbase Wrapped Staked ETH

-

BNB

-

BUSD

Top Smart money inflows (excluding stablecoins):

-

wstETH

-

JPEG

-

wstETH-rETH-sfrxETH

-

WETH (Optimism)

-

Convex

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Coinbase Wrapped Staked ETH

-

BNB

-

BUSD

-

AVAX

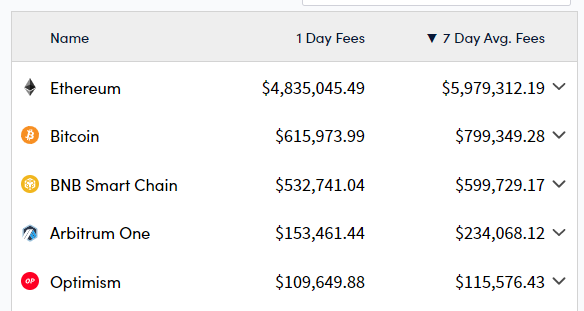

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

Filecoin

-

Arbitrum

-

BNB

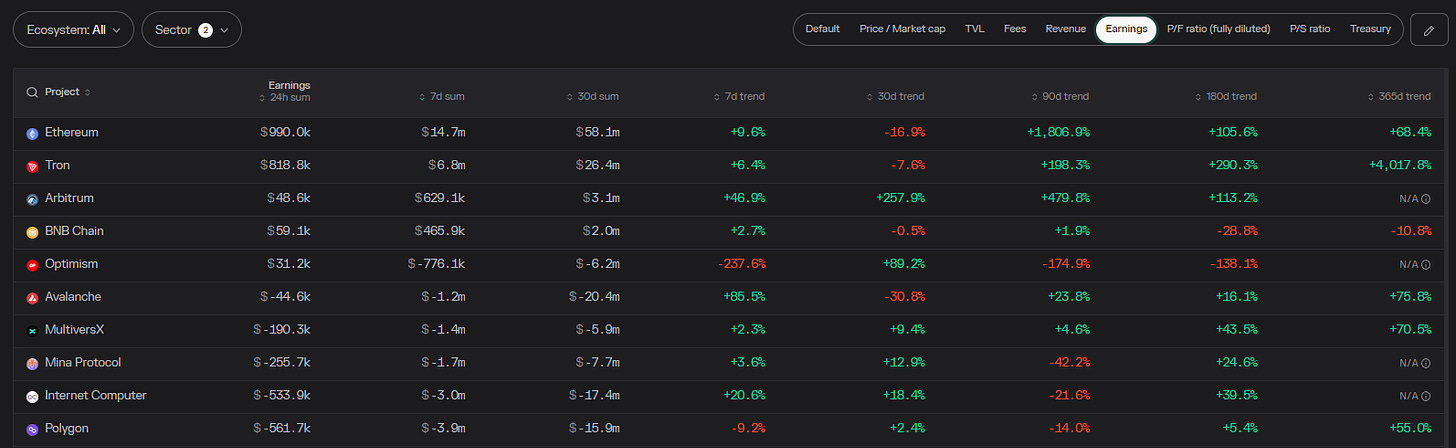

Earnings

-

ETH

-

Tron

-

Arbitrum

-

BNB

-

Optimism

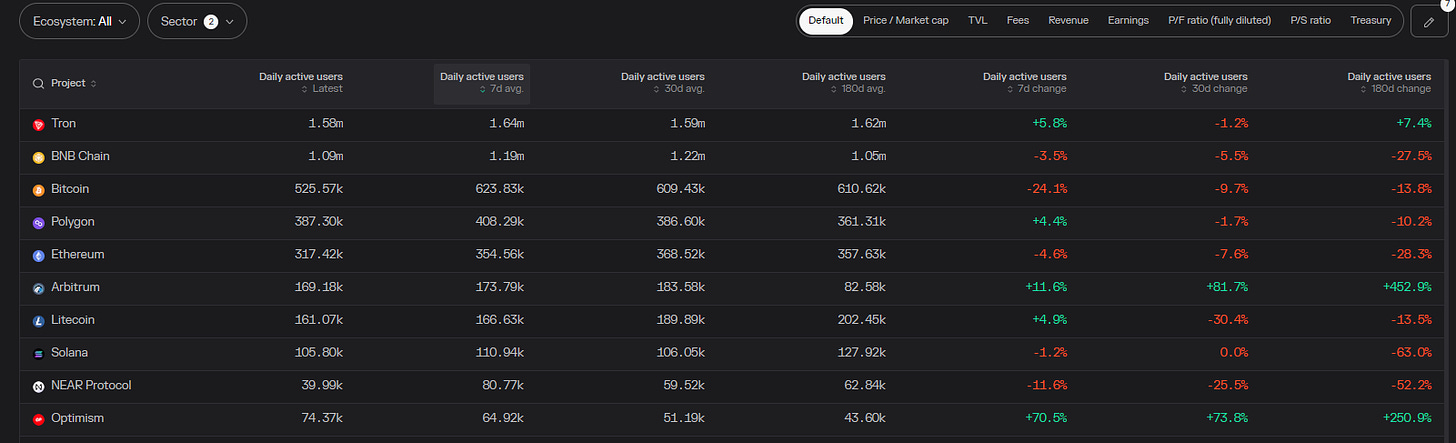

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

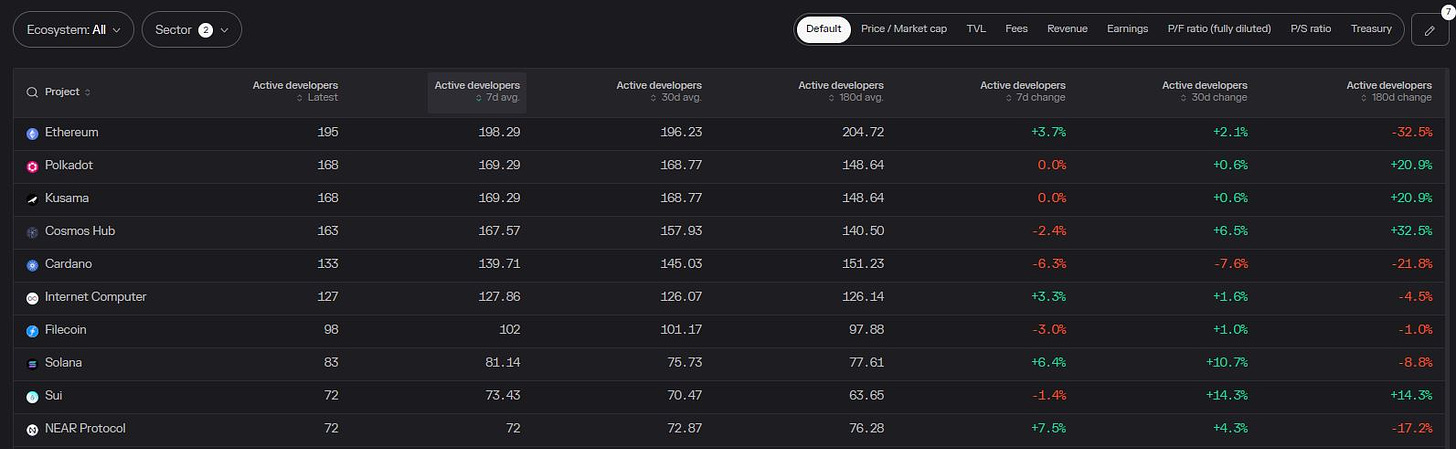

Active Developers

-

ETH

-

Polkadot

-

Kusama

-

Cosmos

-

Cardano

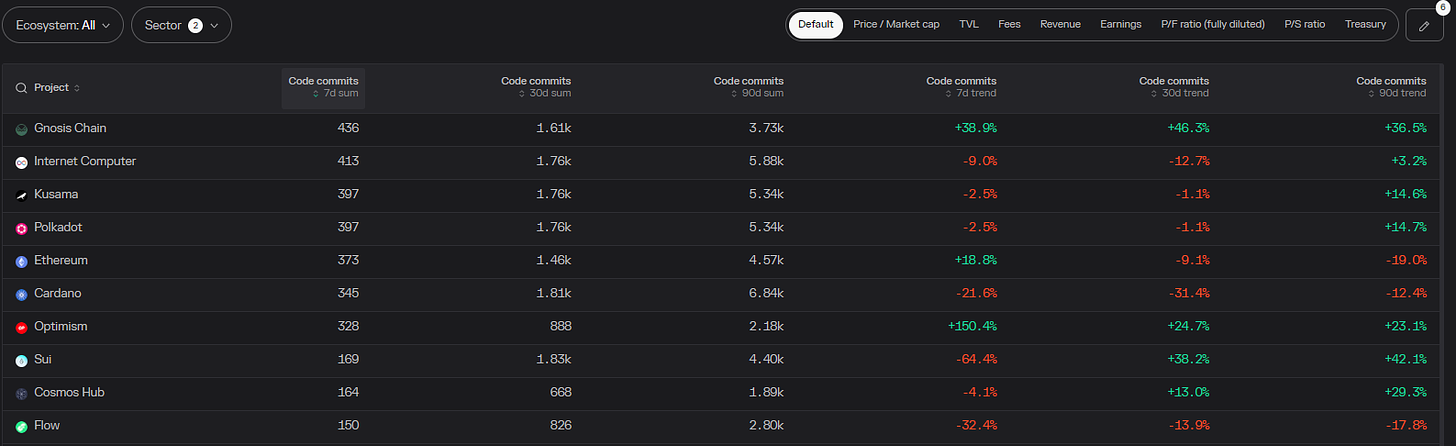

Code Commits

-

Gnosis Chain

-

Internet Computer

-

Kusama

-

Polkadot

-

ETH

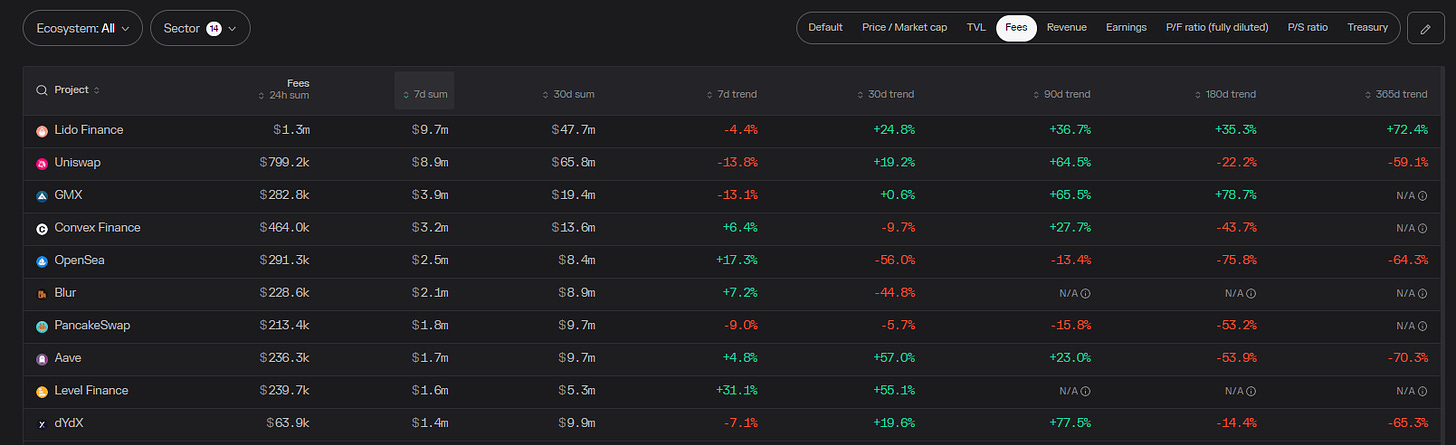

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

GMX

-

Convex

-

OpenSea

Revenue

-

dYdX

-

GMX

-

Lido

-

Level

-

Convex

Earnings

-

GMX

-

OpenSea

-

dYdX

-

Gains Network

-

Ethereum Name Service

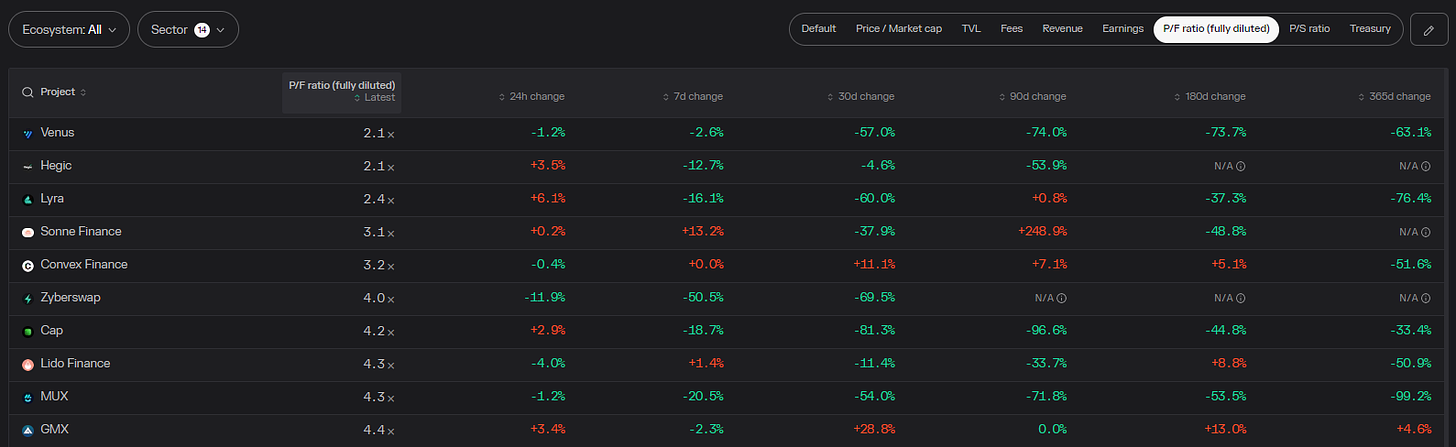

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Venus

-

Hegic

-

Sonne

-

Lyra

-

Convex

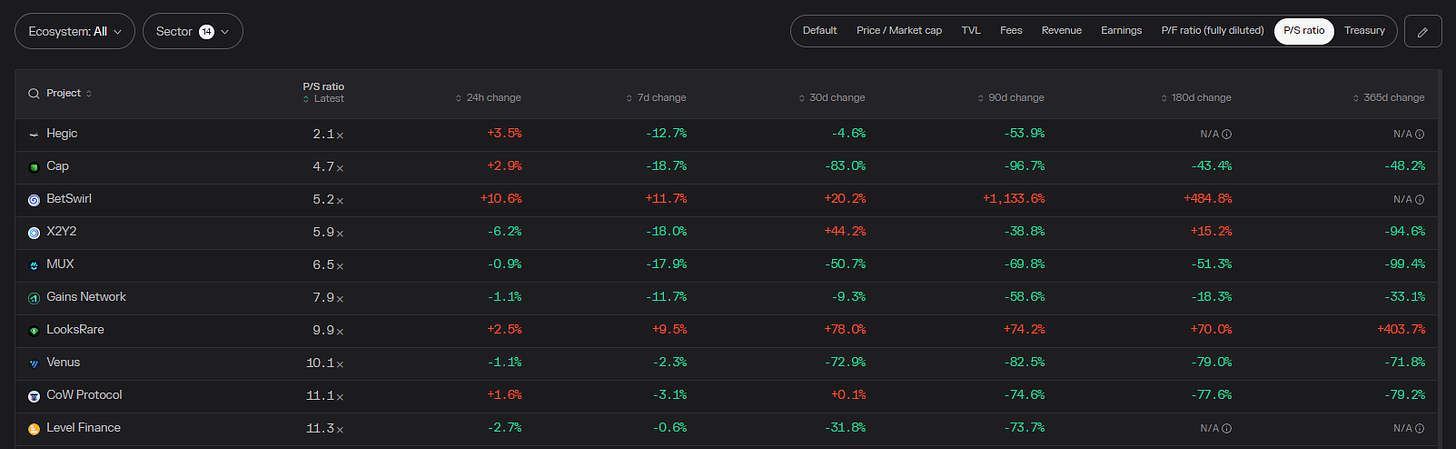

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

Cap

-

BetSwirl

-

X2Y2

-

MUX

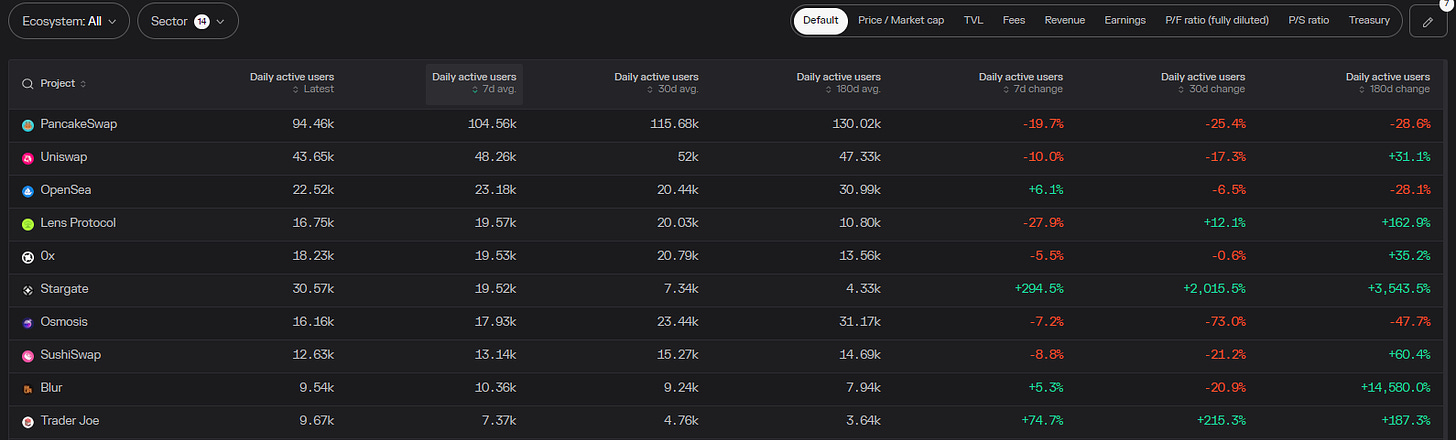

DAUs

-

Pancakeswap

-

Uniswap

-

OpenSea

-

Lens Protocol

-

0x

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market remained relatively flat this week at 131.93 billion.

-

Aptos received the largest stablecoin inflow this week at 33.25%.

-

Alt L1s continue to lose to L2s, with the latter seeing more stablecoin inflows each week.

Smart Money Movement:

-

Smart Money are increasing their DAI/USDT stablecoin exposure.

-

ETH derivatives remain the top investment category amongst Smart Money with the anticipated Shanghai Upgrade on 12 April 2023.

-

Various Alts are bleeding against ETH as Smart Money started rotating back into stablecoins/ETH ahead of the volatile environment next week.

L1/L2 movement:

- zkSync Era TVL continues to climb amidst this crab market as legitimate protocols started launching their products on the chain.

DAPP movements:

-

LSD protocols captured the majority of Defi’s focus this week, with Lido taking the top spot in fees generated ahead of the Shanghai Upgrade next week.

-

$GMX remains one of the top protocols with solid financials. The rumoured synthetics launch in April could be bullish for GMX. Cr: @apes_prologue

- Do take caution as next week will be highly volatile with both CPI results and Shanghai Upgrade happening on 12 April 2023.

6. TLDR

-

Shanghai Upgrade and CPI release on 12 April 2023 will make trading highly volatile. I do think it will be a “sell-the-news” event and recent price action seems to indicate a downward move is imminent.

-

Use this time to consolidate your positions and prepare dry powder on the side to snipe entries on solid protocols.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: