The weekly 🐰 hole (21 May 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (21 May 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems

Time to pick a side Anon, sometimes being on the left curve plays out.

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

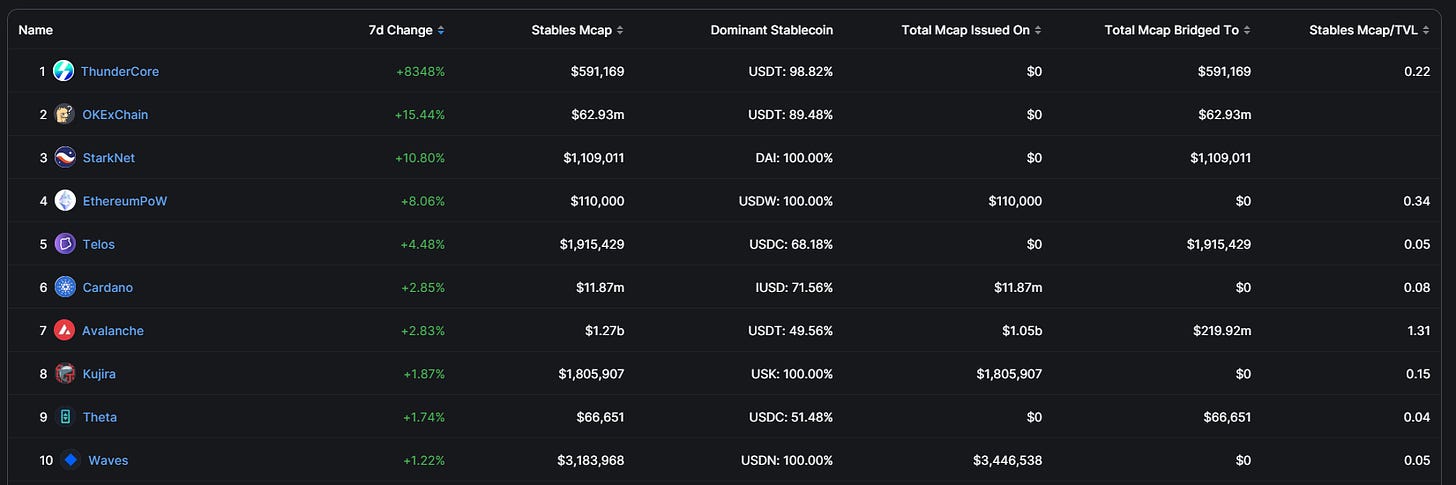

1. Stablecoin Flows

Total Stablecoin MCAP = 129.86 bil, with -0.43% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

ThunderCore

-

OKExChain

-

Starknet

-

EthereumPoW

-

Telos

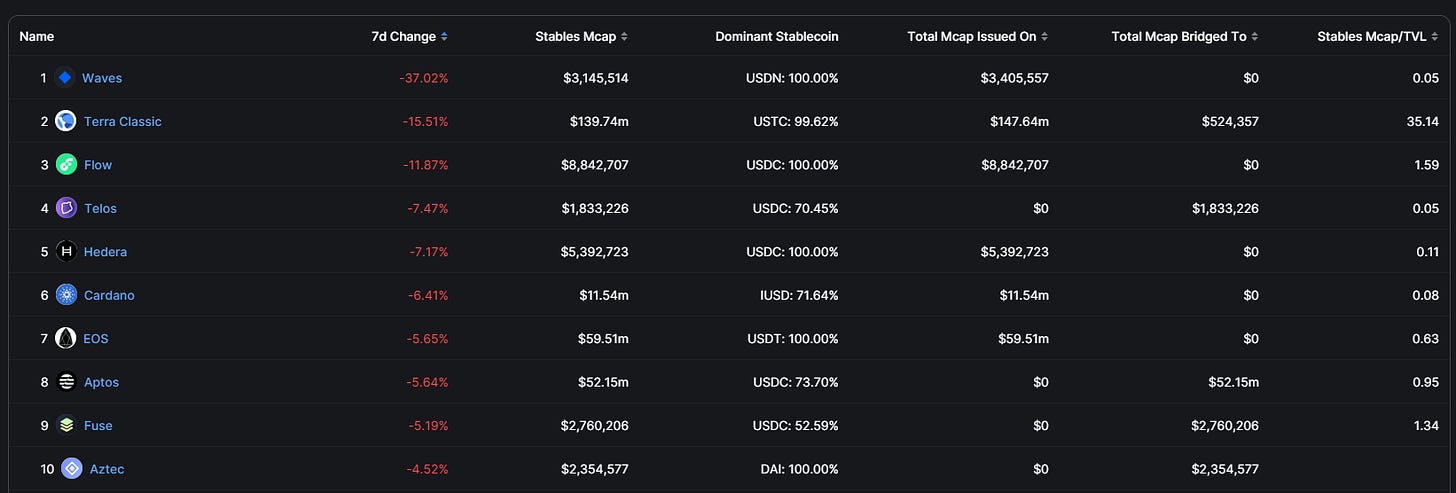

Top outflows:

-

Hedera

-

BSC

-

Canto

-

RSK

-

Metis

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Coinbase Wrapped Staked ETH

-

Lido Staked ETH

-

Dai

-

Frax Share

-

Maker

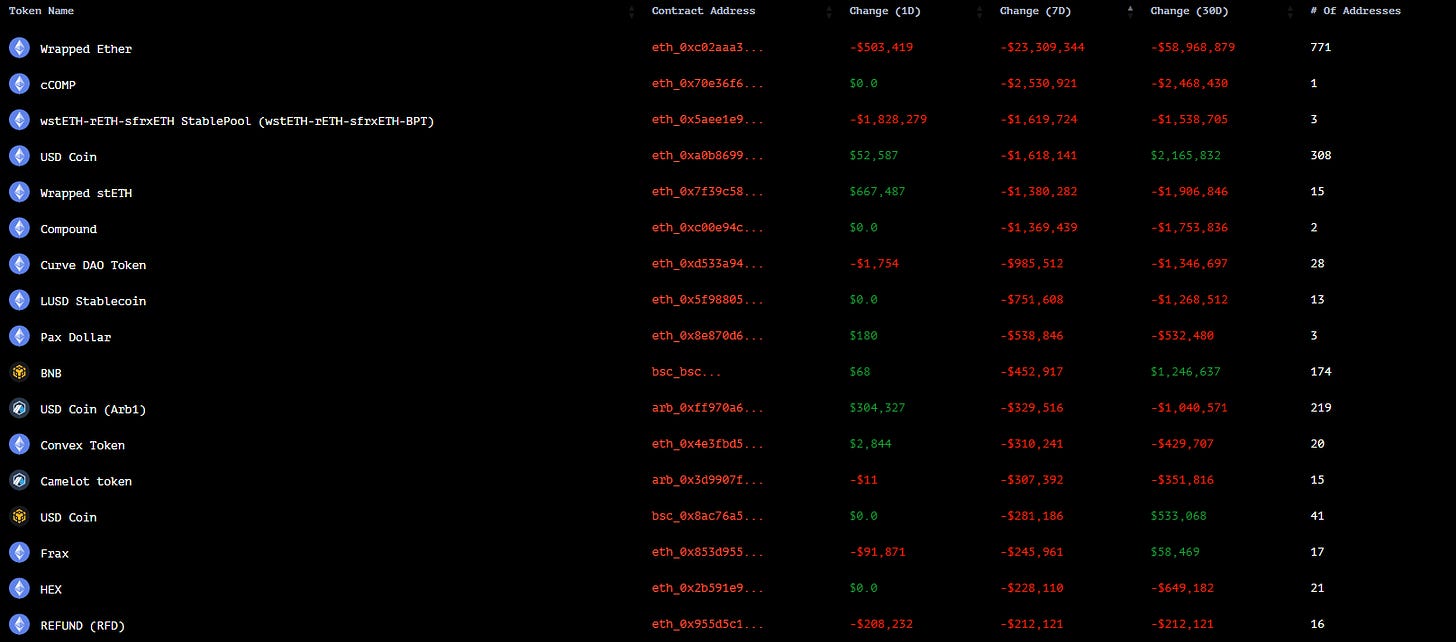

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

cCOMP

-

wstETH-rETH-sfrxETH stablepool

-

USDC

-

Wrapped stETH

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Lido Staked ETH

-

Frax Share

-

Maker

-

Staked Frax Ether

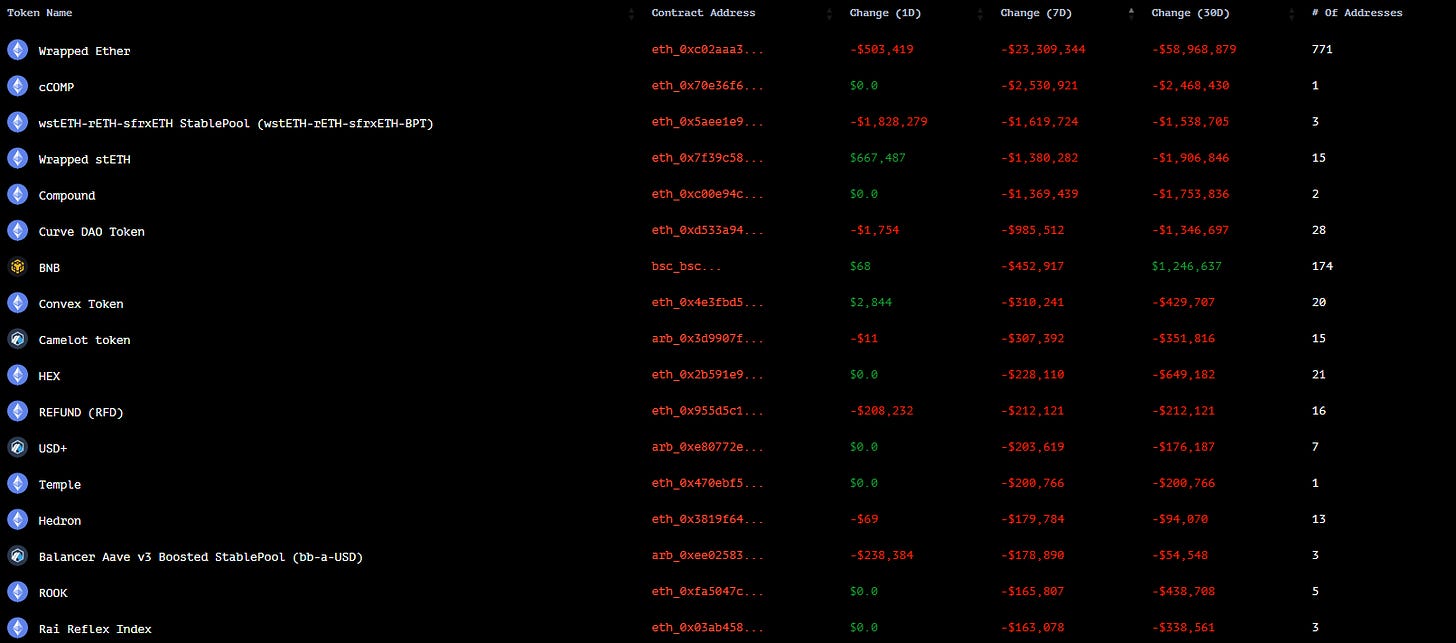

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

cCOMP

-

wstETH-rETH-sfrxETH stablepool

-

Wrapped stETH

-

Compound

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

BNB

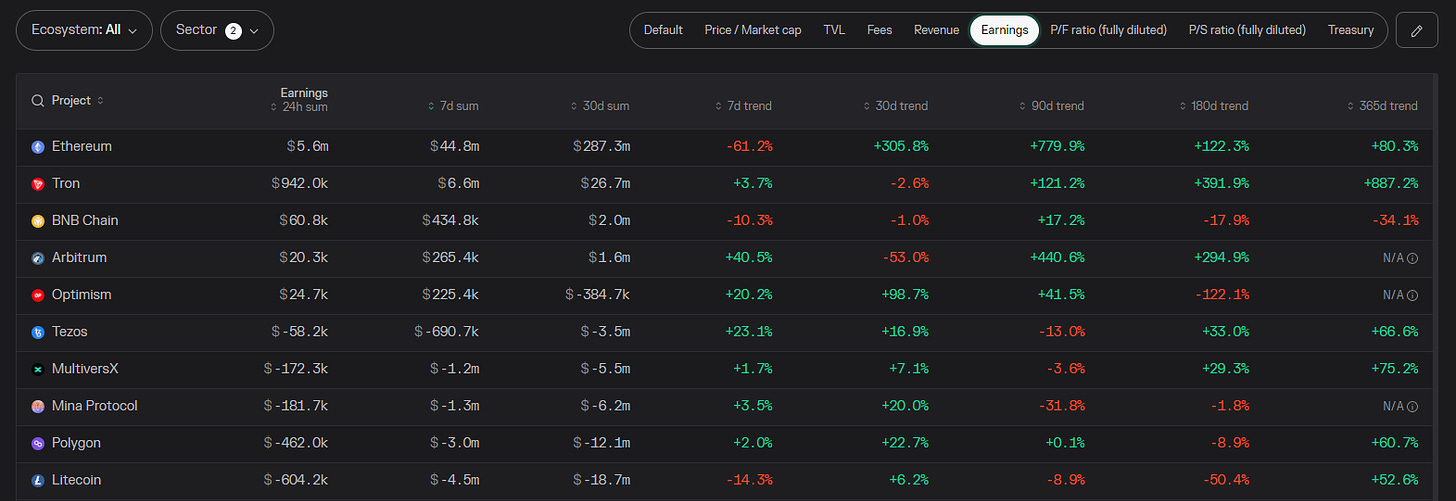

Earnings

-

ETH

-

Tron

-

BNB

-

Arbitrum

-

Optimism

DAUs

-

Tron

-

BNB

-

BTC

-

Litecoin

-

Polygon

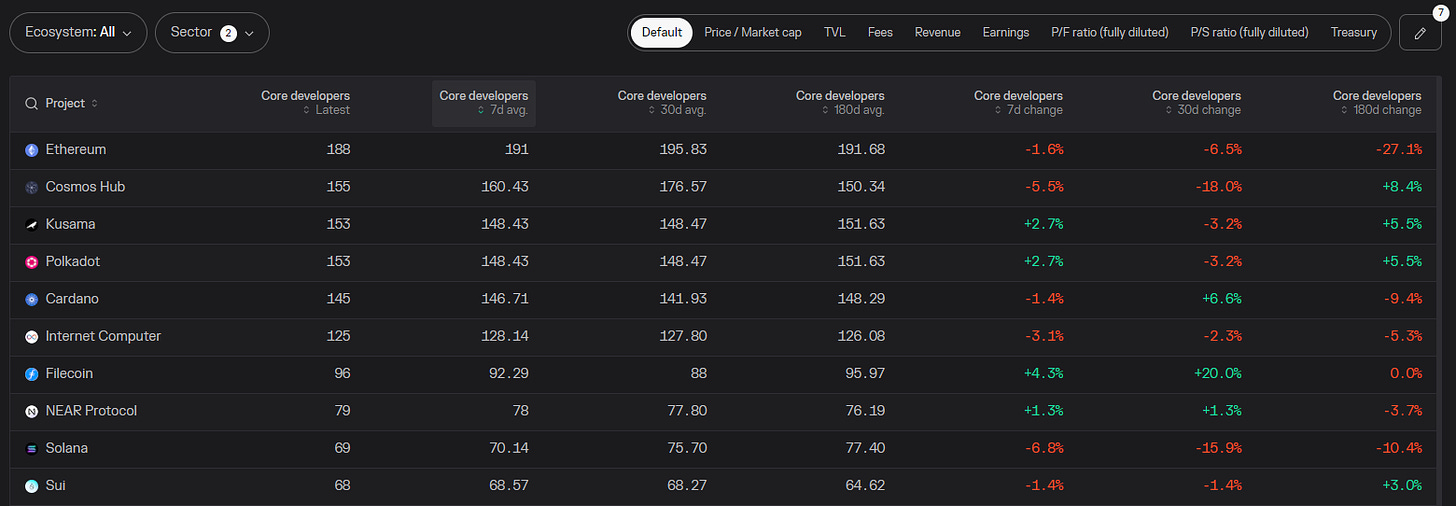

Active Developers

-

ETH

-

Cosmos

-

Kusama

-

Polkadot

-

Cardano

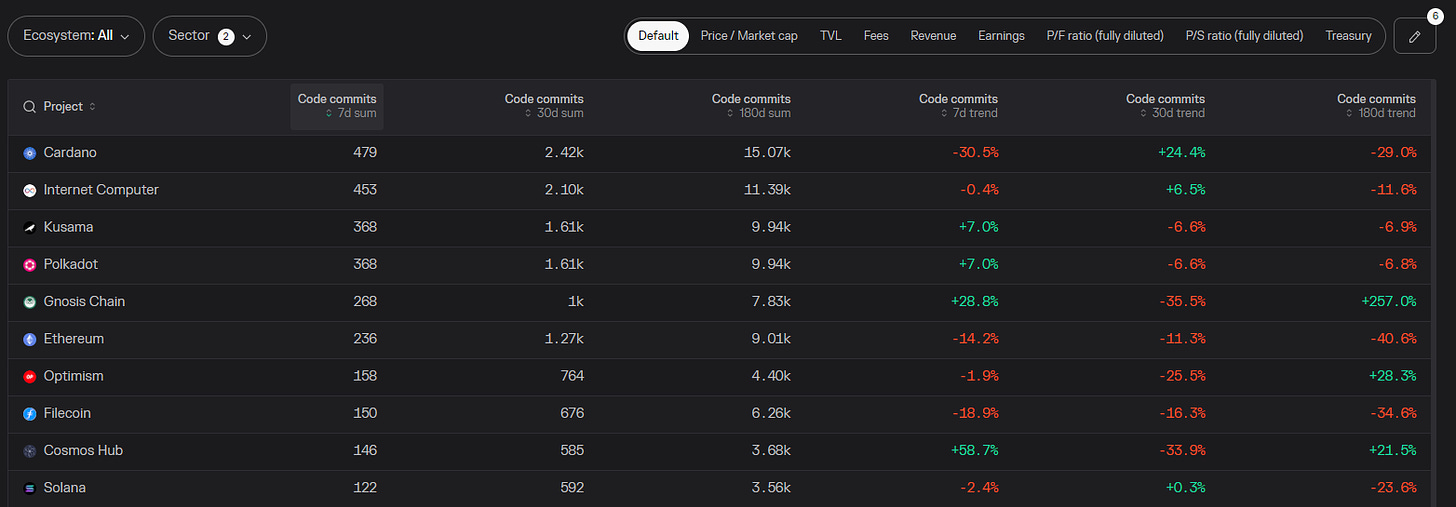

Code Commits

-

Cardano

-

Internet Computer

-

Kusama

-

Polkadot

-

Gnosis Chain

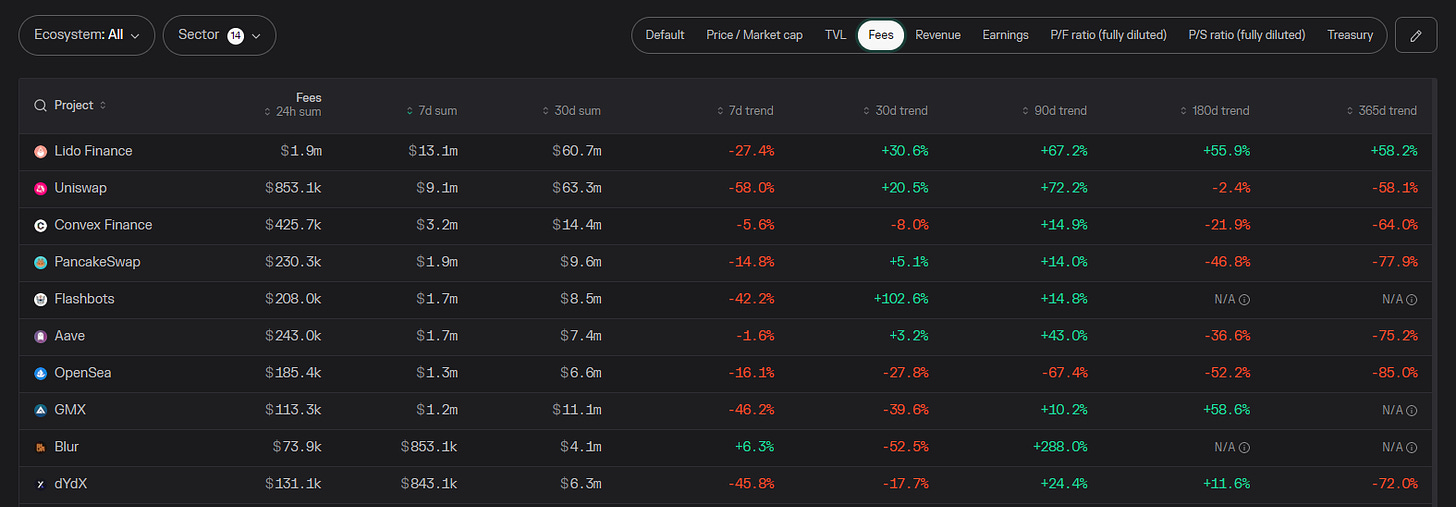

Fees-Generated

-

Lido

-

Uniswap

-

Convex

-

PancakeSwap

-

Flashbots

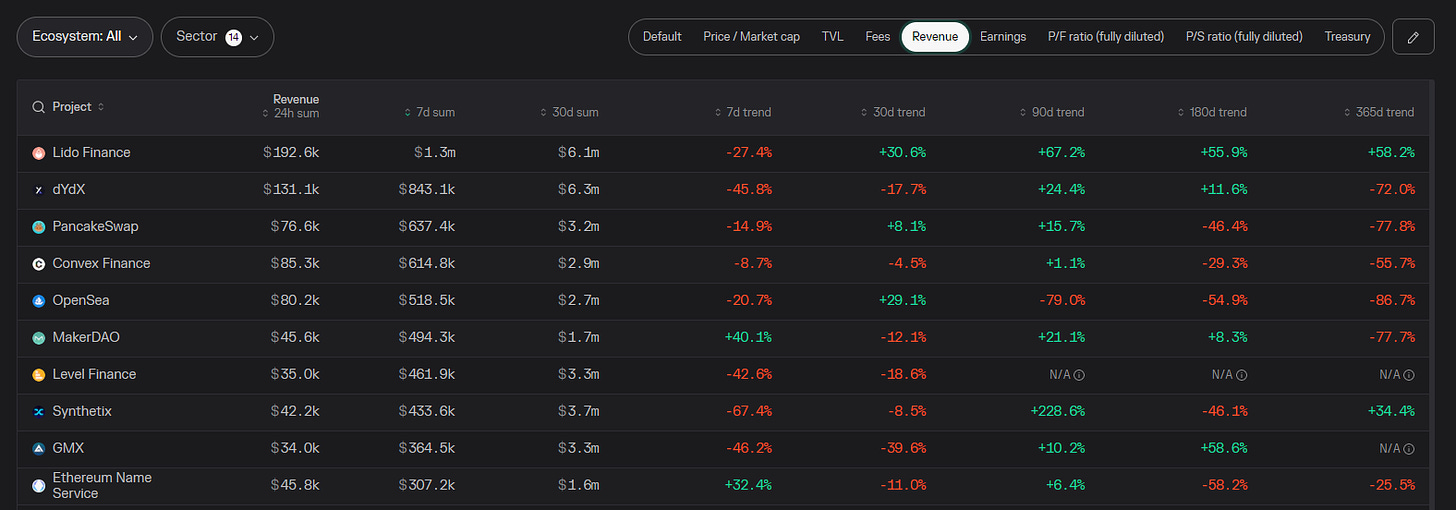

4. Top DAPP Financials

Revenue

-

Lido

-

dYdX

-

Pancakeswap

-

Convex

-

OpenSea

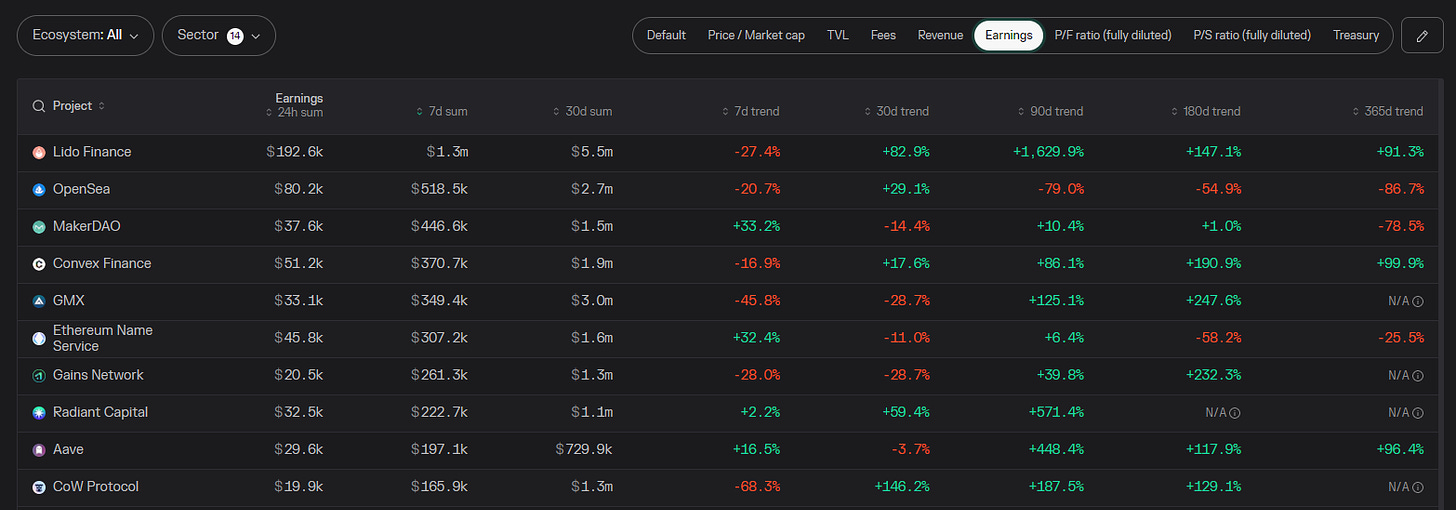

Earnings

-

Lido

-

OpenSea

-

Maker

-

Convex

-

GMX

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Venus

-

Sonne Finance

-

Gamma Strategies

-

Level

-

Zyberswap

*P.s. there seems to be a bug on Tokenterminal for ApeSwap, will disregard that in this week’s ranking*

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

BetSwirl

-

CoW

-

Level

-

X2Y2

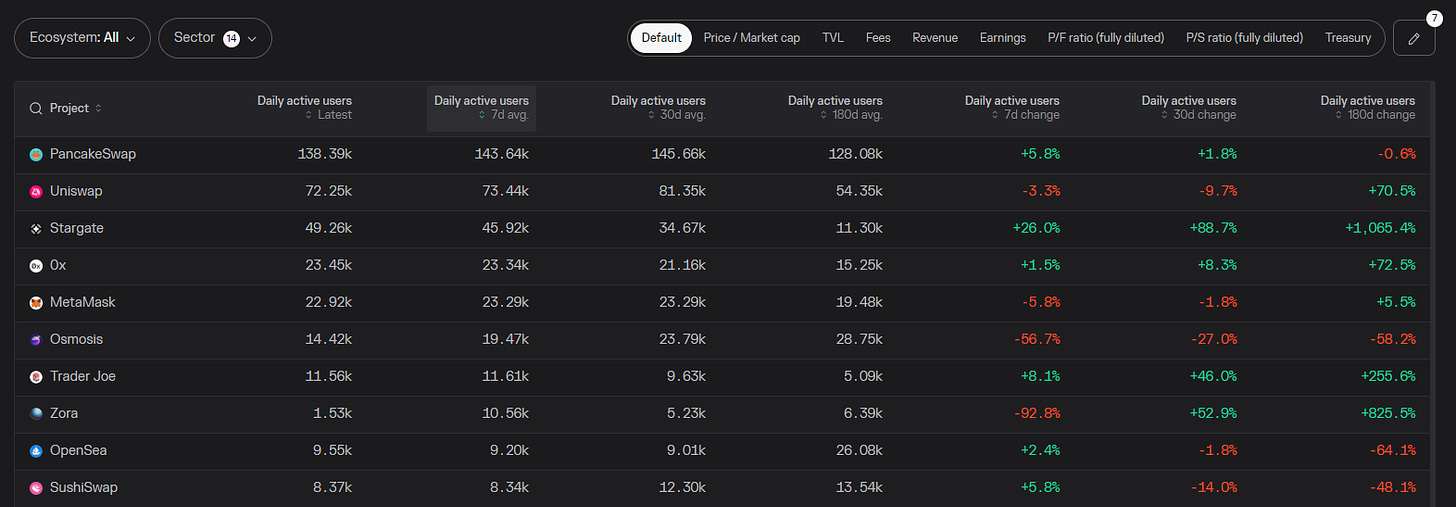

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

5. Movement Analysis

Stablecoin flows:

-

The total Stablecoin Market has finally breached below $130 billion, falling to $129.86 billion as the fed’s balance sheet continues to decline.

-

ThunderCore, OKExChain and Starknet are seeing large stablecoin inflows this week.

Smart Money Movement:

-

LSDfi Summer seems to be here, with smart money positioning themselves in various LSD protocols (e.g. Coinbase Wrapped Staked ETH, Lido Staked ETH, Frax ETH)

-

Smart money has started to accumulate Frax as Frax continue to grow in the midst of this crab market.

L1/L2 movement:

-

L2s have become a premier hub of Defi innovation, with L2 activity surpassing ETH and continuously increasing.

-

Here are the Top L2 protocols in terms of TPS:

-

I will not be surprised if Cardano is ramping up its code base to catch up to ETH and L2s, but only time will tell if users will be incentivised to migrate over.

DAPP movements:

-

MEV protocols like Flashbots and Manifold have dropped in ranking as Memecoin season is over and sandwich attacks are not as profitable.

-

LSDfi season is here with Lido continuing to rake in fees, revenue and earnings post-V2 upgrade.

-

Alpha drop by @apes_prologue

6. TLDR:

-

With Smart money accumulating FRAX, the Stablecoin industry is another sector to start paying more attention to during this crab market, especially with Tether’s billion-dollar net profit in 1Q 2023.

https://twitter.com/samkazemian/status/1658320651797819392?s=20

-

If you have spare ETH laying around, you can deposit them into Swell, an upcoming LSD protocol for LSDfi summer. There are also rumours that early stakers might get an Airdrop.

https://twitter.com/swellnetworkio/status/1658170407277715458

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: