The weekly 🐰 hole (16 Apr 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (16 Apr 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

I've been checking charts all this time, avoiding noise from Twitter. The way the upward movement is happening, the way htf resistances are being tested... it clearly looks manipulated, no real demand.

Once again, the biggest bull trap I've ever seen. But they won't trap me. kek

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 131.8 bil, with -0.25% weekly change.

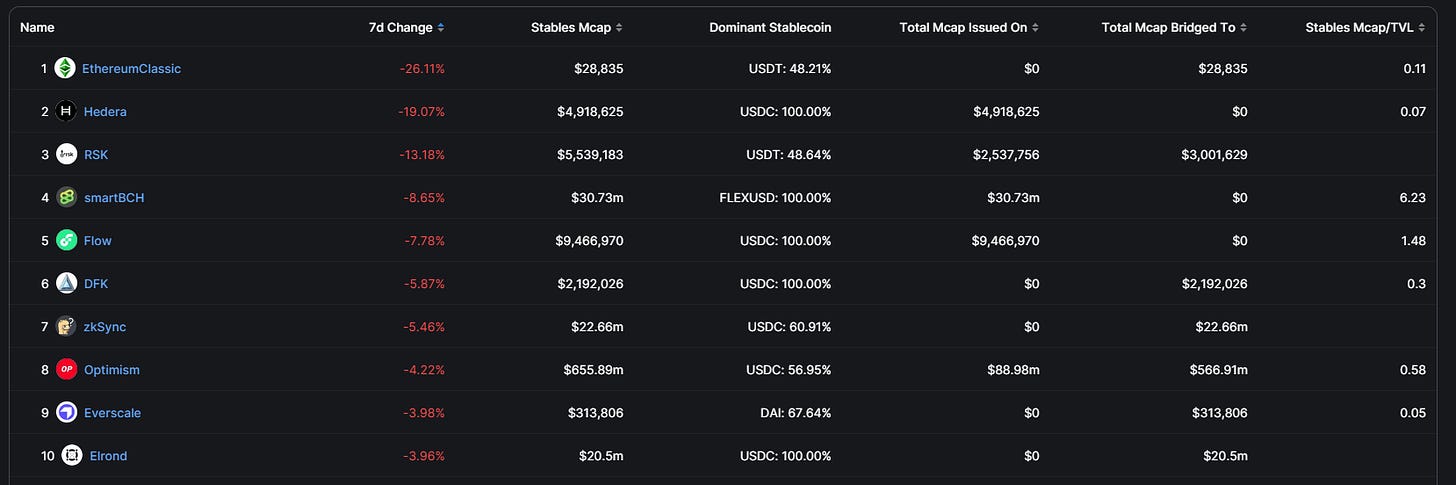

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Ergo

-

Waves

-

Gnosis

-

Cardano

-

Aptos

Top outflows:

-

ETH classic

-

Hedera

-

RSK

-

smartBCH

-

Flow

2. Smart Money Movement

Cr: @ozfrox

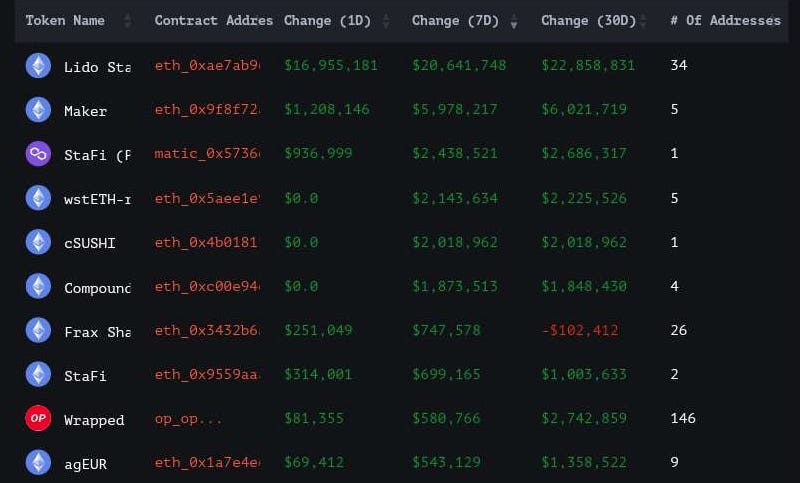

Top Smart money inflows (including stablecoins):

-

Lido Staked ETH

-

USDT

-

Maker

-

StaFi (Polygon)

-

wstETH

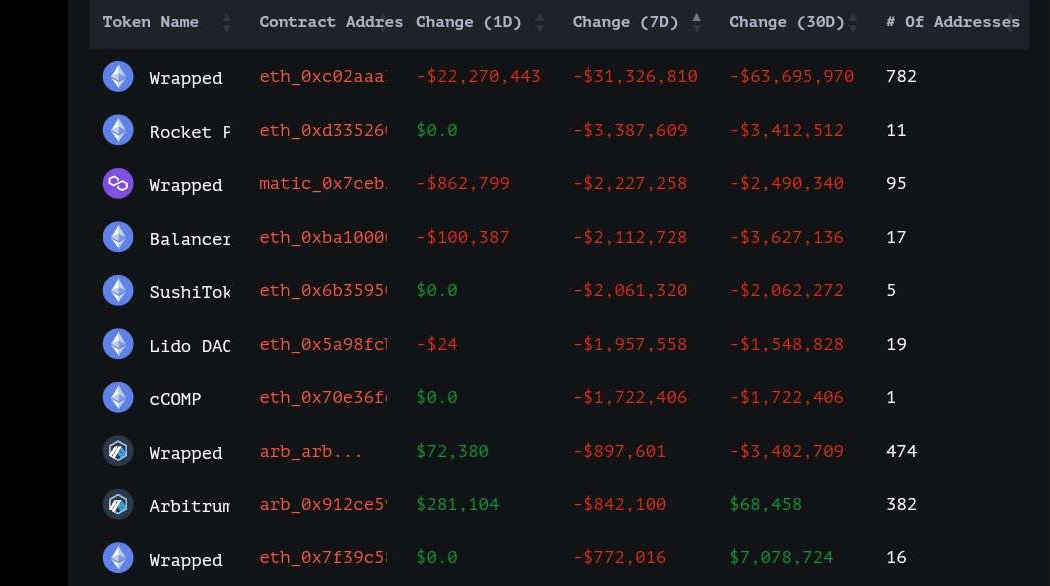

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

RPL

-

Wrapped ETH (Matic)

-

Balancer

-

Sushi

Top Smart money inflows (excluding stablecoins):

-

Lido Staked ETH

-

Maker

-

StaFi (Polygon)

-

wstETH

-

cSUSHI

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

RPL

-

Wrapped ETH (Polygon)

-

Balancer

-

Sushi

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

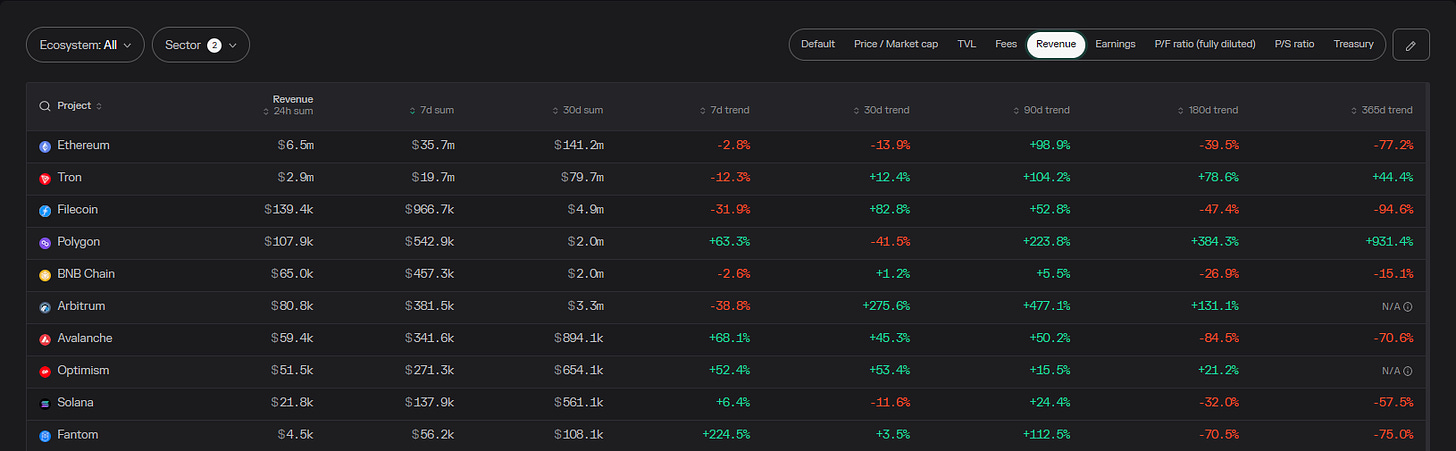

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

BNB

Earnings

-

ETH

-

Tron

-

BNB

-

Arbitrum

-

Tezos

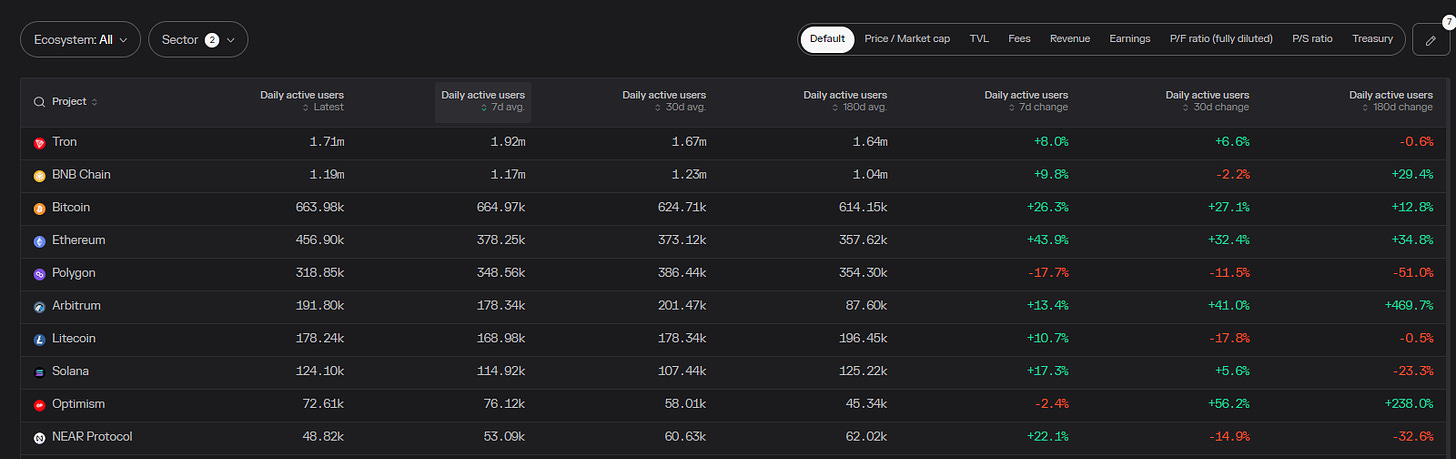

DAUs

-

Tron

-

BNB

-

BTC

-

ETH

-

Polygon

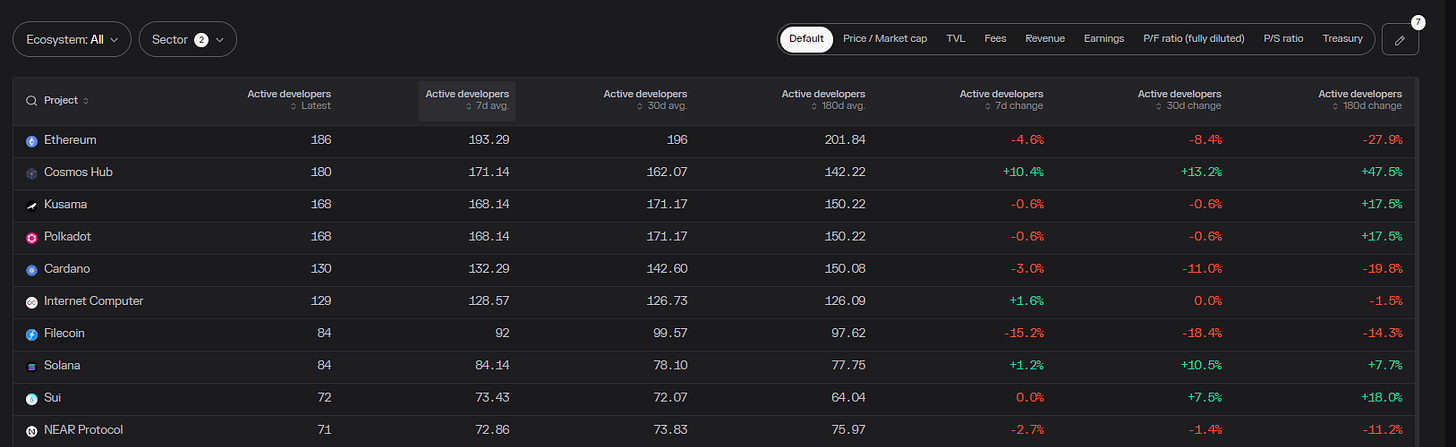

Active Developers

-

ETH

-

Cosmos

-

Kusama

-

Polkadot

-

Cardano

Code Commits

-

Kusama

-

Polkadot

-

Gnosis

-

Helium

-

Internet Computer

4. Top DAPP Financials

Fees-Generated

-

dYdX

-

GMX

-

Level

-

Lido

-

Opensea

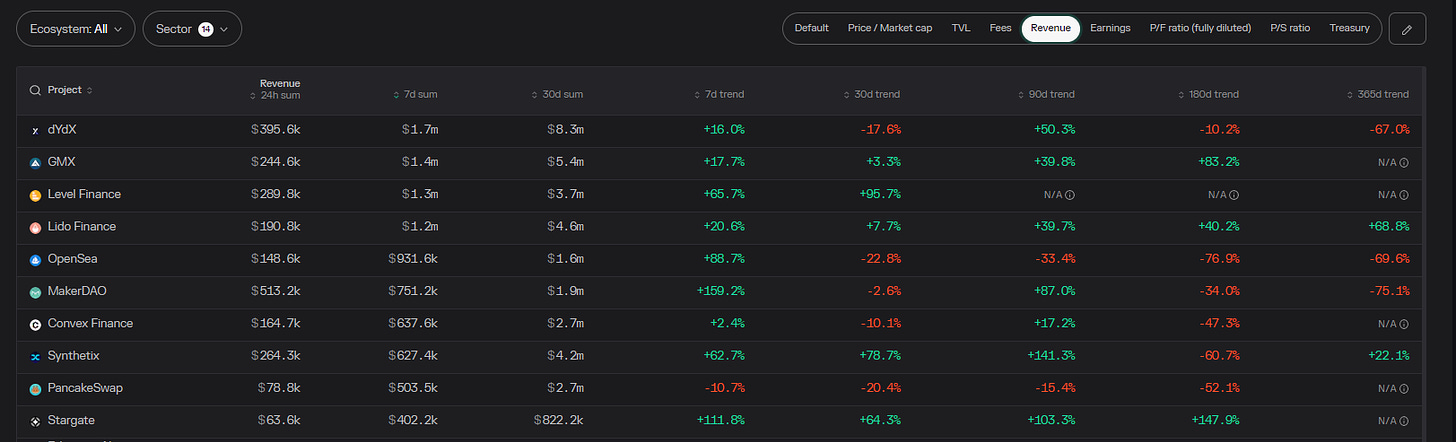

Revenue

-

dYdX

-

GMX

-

Lido

-

Level

-

Convex

Earnings

-

GMX

-

Lido

-

Opensea

-

MakerDAO

-

dYdX

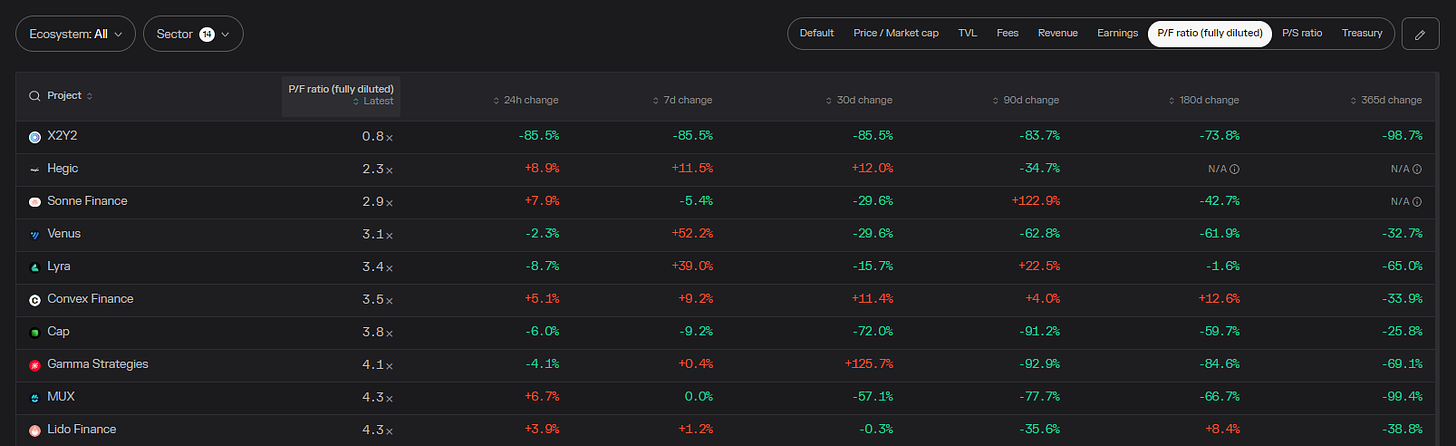

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

X2Y2

-

Hegic

-

Sonne

-

Venus

-

Lyra

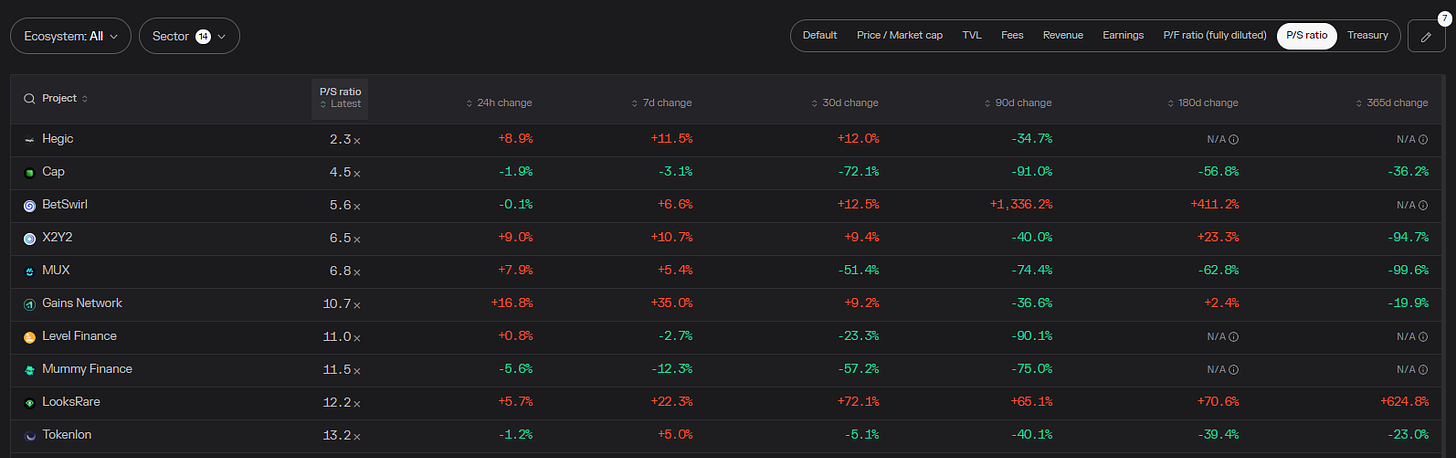

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

Cap

-

BetSwirl

-

X2Y2

-

MUX

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

OpenSea

-

Lens Protocol

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market remained relatively flat this week at 131.8 billion.

-

Top 10 protocols in terms of Stables Mcap all went down slightly this week

-

Despite the recent bullish price action, stablecoin liquidity remains relatively flat, which suggests that there is no new money entering the crypto ecosystem yet.

Smart Money Movement:

-

Smart money appears to be relatively risk-on, as evidenced by the increased exposure to various LSD protocols, particularly Lido.

-

Here are some notable Alts being bought by Smart Money: $Maker, $StaFi, $Comp, and $FRAX.

L1/L2 movement:

-

L2s like Arbitrum and Optimism beat out Alt L1s in terms of 7-Day Avg. Fees generated and continue to gain substantial market share over its Alt L1 counterparts.

-

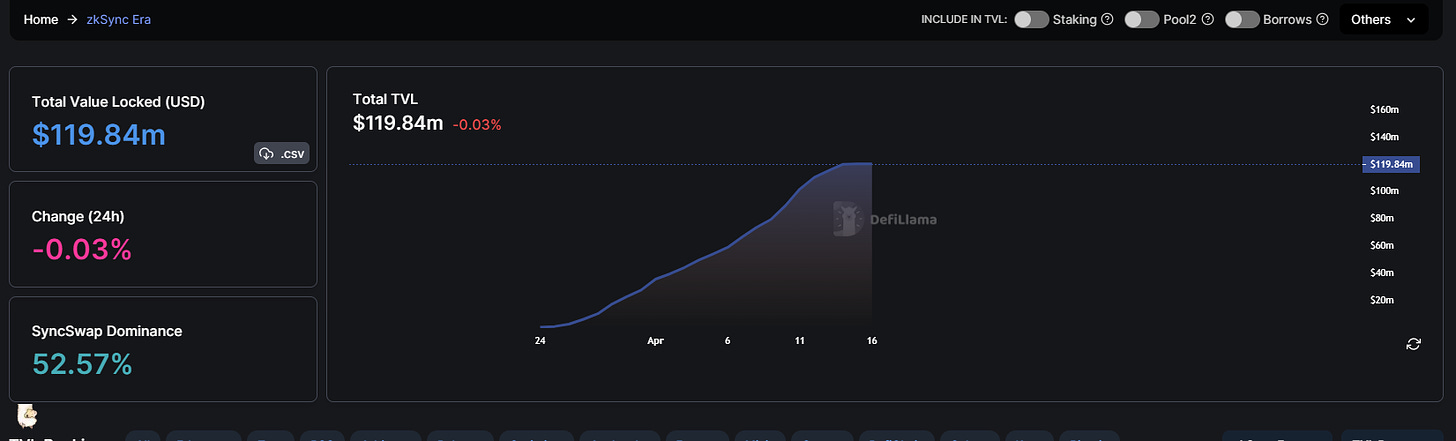

ZK sync era’s TVL seems to be levelling out. Scams are rampant in this new chain, always do DD before entering any presales and use a burner wallet.

DAPP movements:

-

Perp Dexes are crushing their revenue figures with dYdX, GMX and Level occupying the top 3 spots this week, outperforming Lido and Opensea.

-

Stargate’s DAUs exploded with airdrop rumours following Layerzero’s latest fundraising round.

6. TLDR:

-

Shanghai Upgrade successfully completed, and ETH price went up to the disbelief of many bears.

-

While I am glad my portfolio is going up, I remain short-term cautious as liquidity remains relatively flat in crypto.

-

Perp dexes remain my biggest conviction holds with a focus on Perp dex aggregators like Mux Protocol and Unidex Exchange.

-

Also keeping an eye out for UnstoppableFi with their upcoming SpotDex launch this month.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: