The weekly 🐰 hole (5 Mar 23) of smart money movements & analysis - by zj.valz

We’ll uncover key trends, insights into the top DeFi protocols, and hidden gems.

The market is down bad, but let’s see what the figures are telling us.

Overview

-

Stablecoin flows

-

Smart Money Movement (Chainedge is under maintenance, no visibility this week)

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

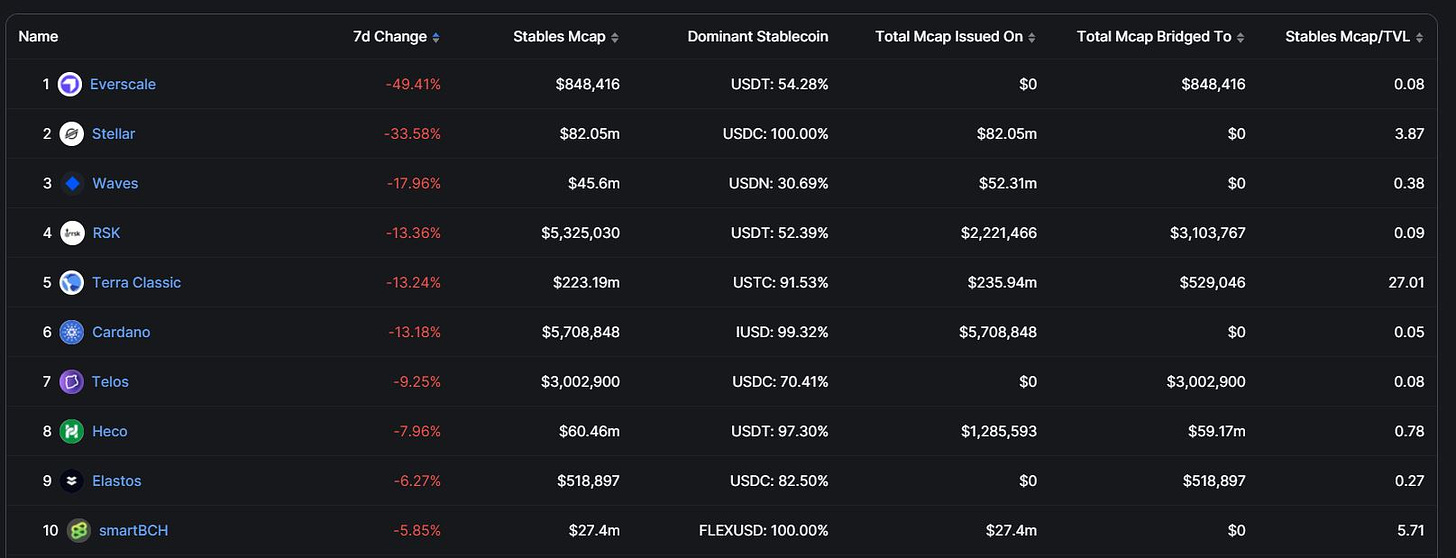

1. Stablecoin Flows

Total Stablecoin MCAP = $134.89B with -0.42% weekly change.

Top inflows:

-

Hedara

-

Kujira

-

Bittorrent

-

Flow

-

Tezos

Top outflows:

-

Everscale

-

Stellar

-

Waves

-

RSK

-

Terra Classic

2. Smart Money Movement

(Gainers/Losers, excluding stablecoins)

Under maintenance

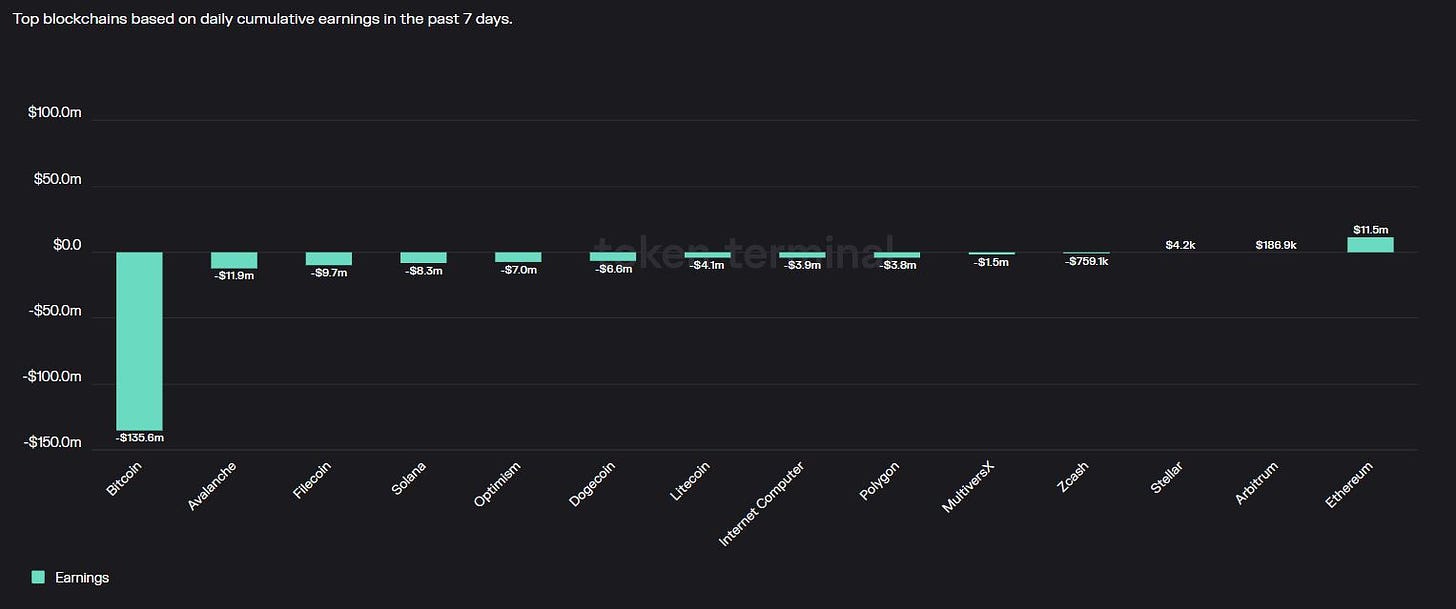

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

BTC

-

Arbitrum

-

Optimism

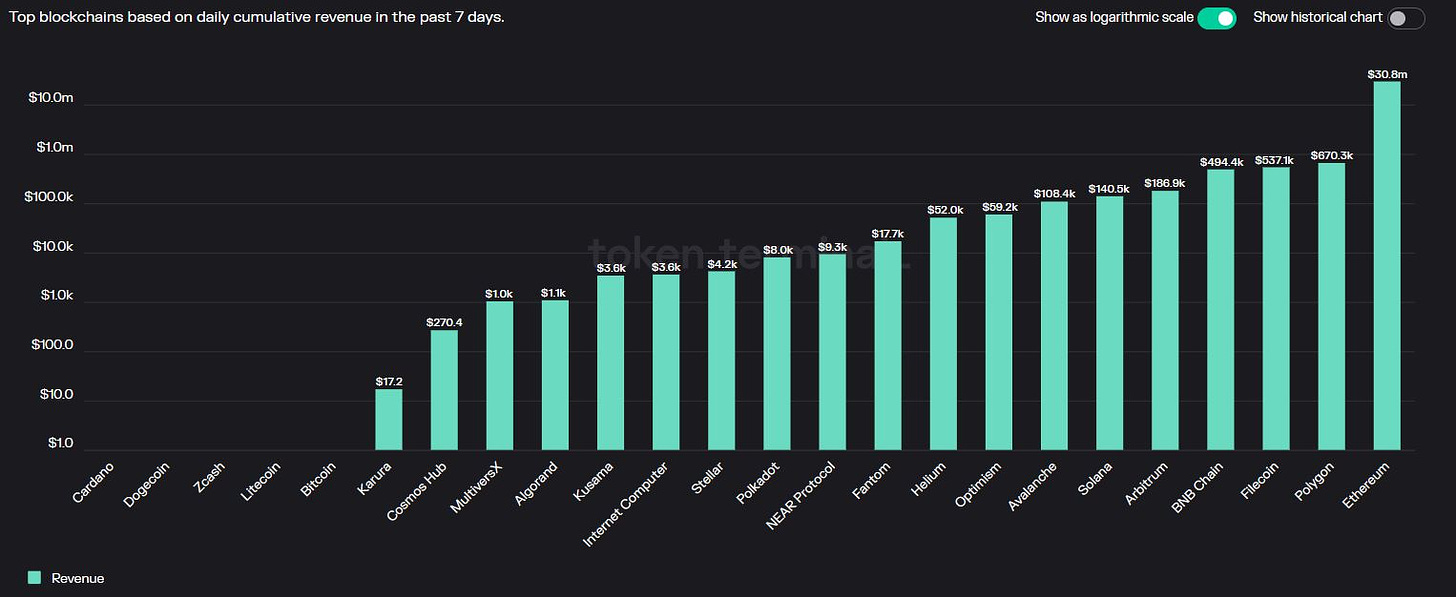

Revenue

-

ETH

-

Polygon

-

Filecoin

-

BNB

-

Arbitrum

Earnings

-

ETH

-

Arbitrum

-

Stellar

-

Zcash

-

MultiversX

DAUs

-

BNB

-

ETH

-

Polygon

-

Litecoin

-

Solana

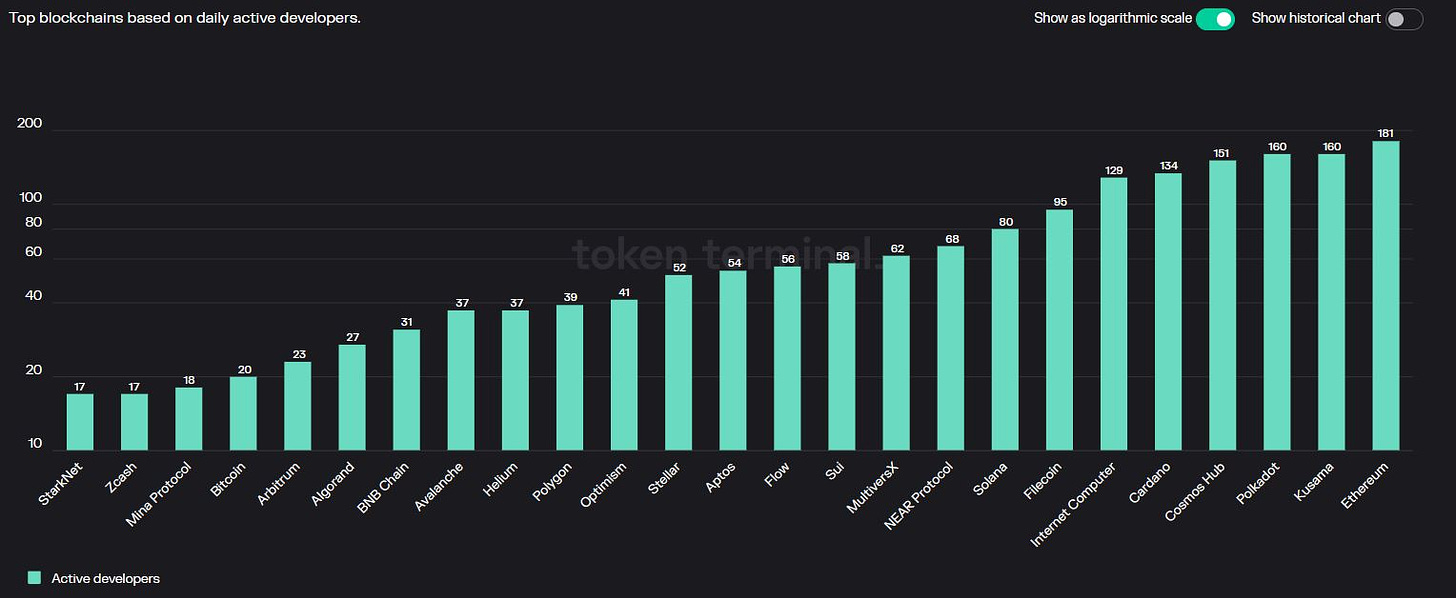

Active Developers

-

ETH

-

Kusama

-

Polkadot

-

Cosmos

-

Cardano

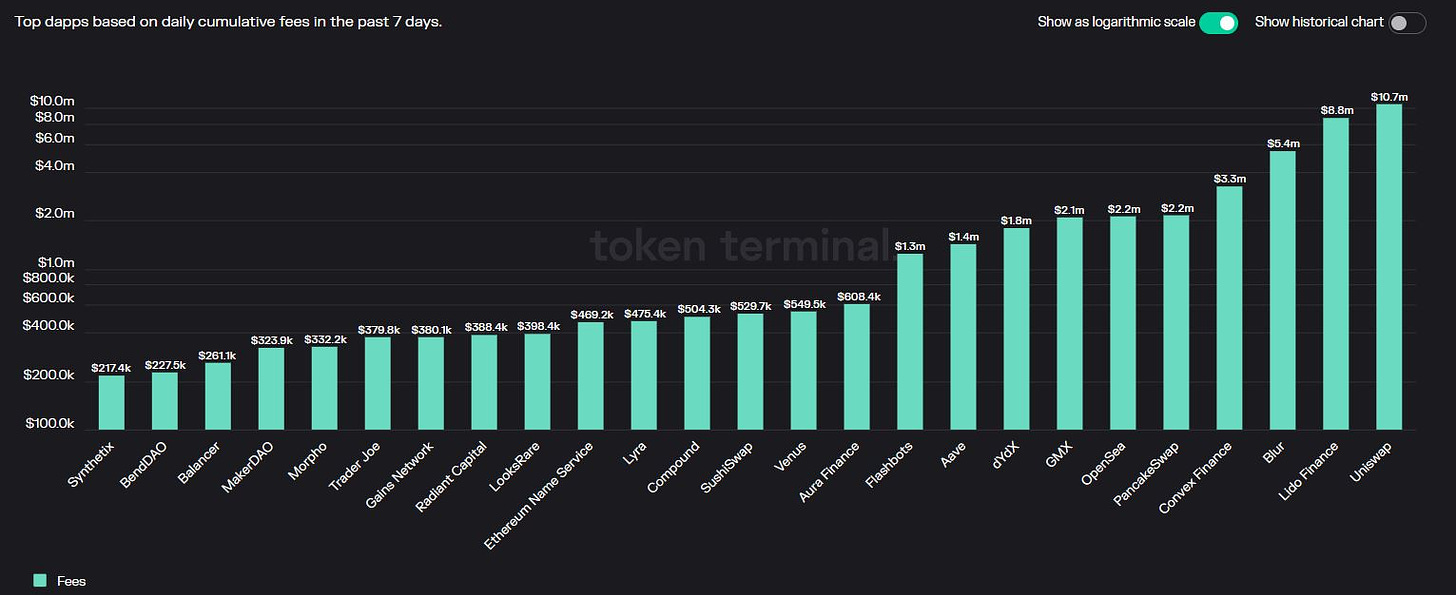

4. Top DAPP Financials

Fees Generated

-

Uniswap

-

Lido

-

Blur

-

Convex

-

Pancake Swap

Revenue

-

dYdX

-

Lido

-

Pancakeswap

-

Convex

-

GMX

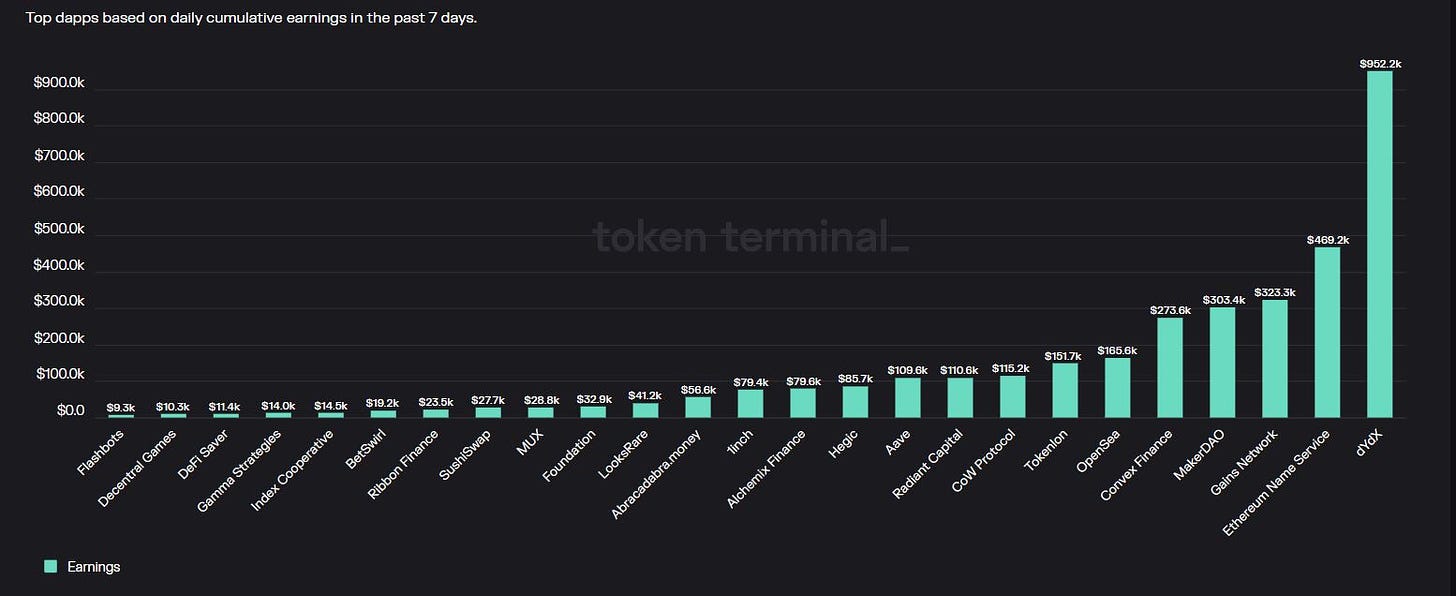

Earnings

-

dYdX

-

ENS

-

Gains

-

Maker

-

Convex

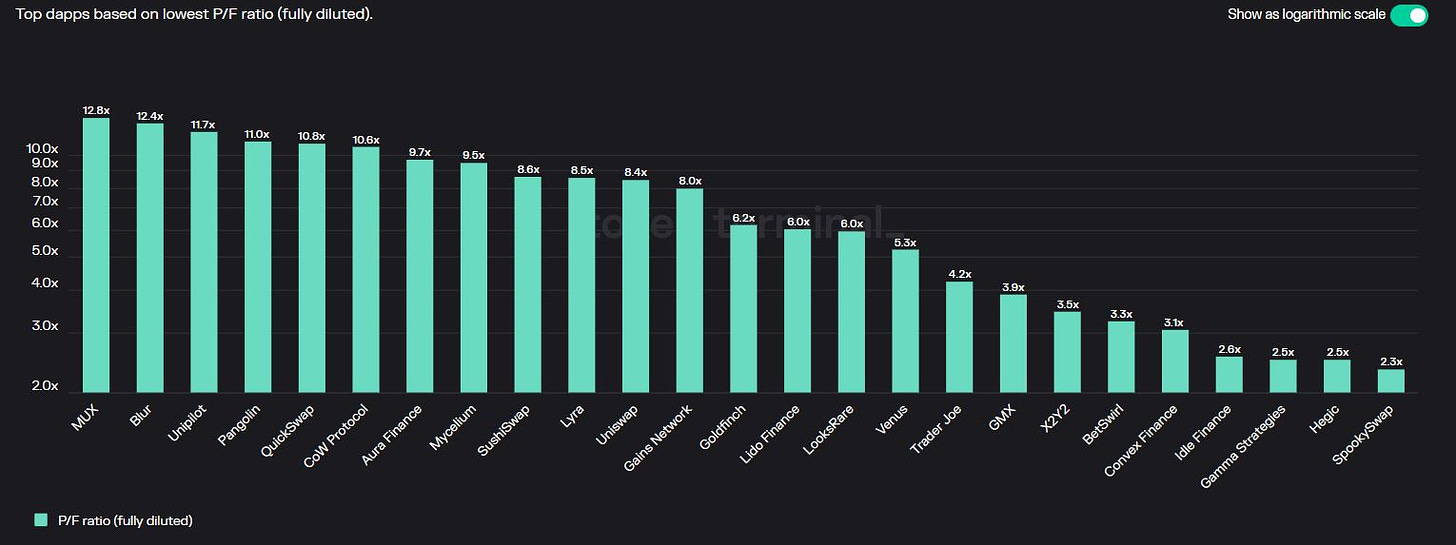

P/F Ratio

Relative valuation of protocols (lower the no. the “better”)

-

Spookyswap

-

Hegic

-

Gamma

-

Idle

-

Convex

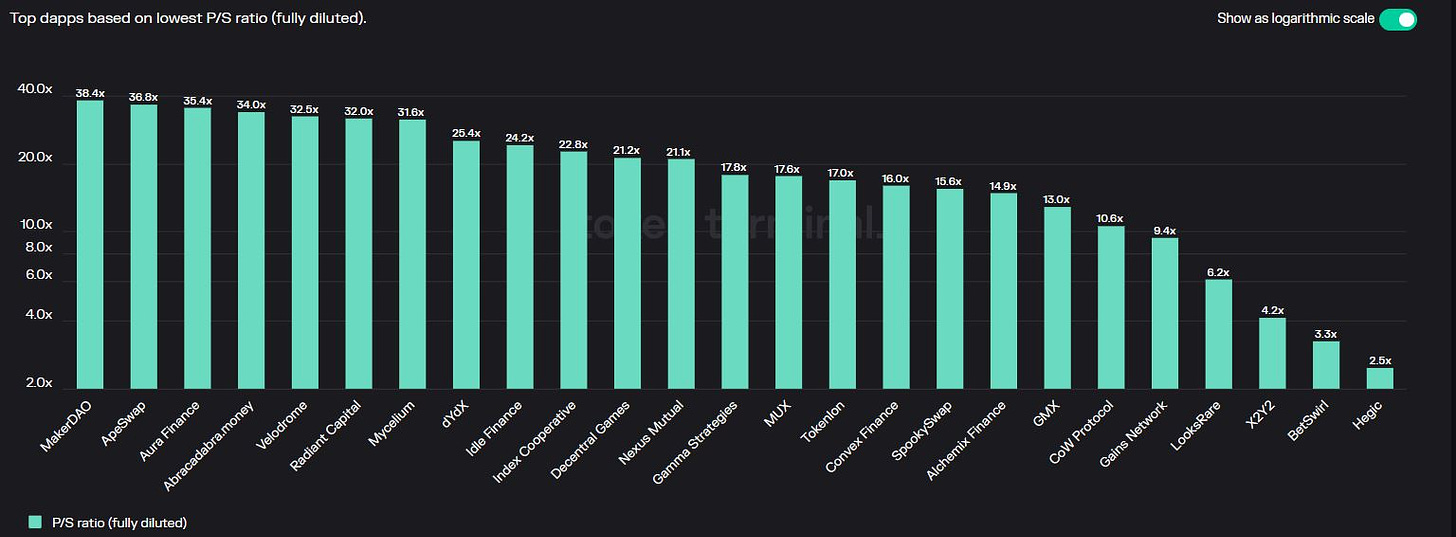

P/S Ratio

FDV mcap/Annualized Revenue (take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

BetSwirl

-

X2Y2

-

Looks

-

Gains

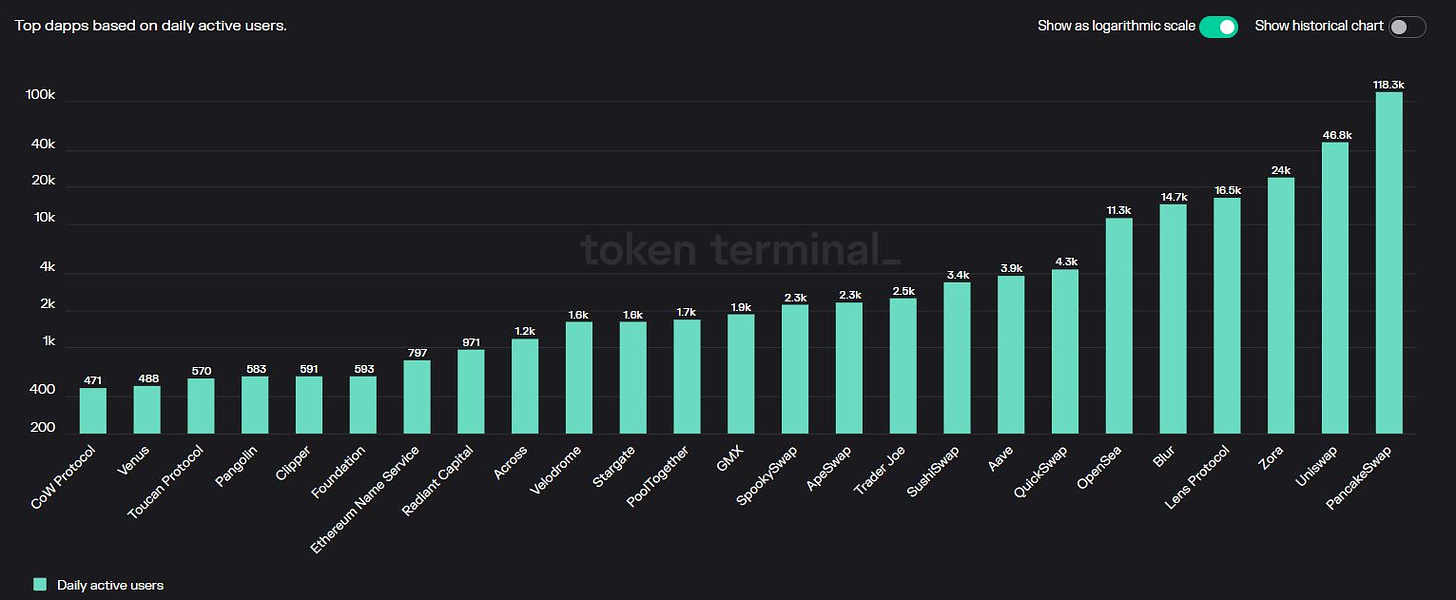

Daily Active Users

No. of distinct addresses interacting with the DAPPs. (Note this is not 100% accurate as a user could be using multiple wallet addresses)

-

Pancakeswap

-

Uniswap

-

Zora

-

Lens

-

Blur

5. Movement Analysis

Stablecoin flows:

-

Trade carefully as liquidity is still being drained out of the system. It is still PVP mode, don’t play the game if u are inexperienced.

-

Hedera seems to have received a bulk of stablecoin inflows this week but note that there aren’t many DAPPs there.

-

L2s still receive the bulk of inflows, however double digits inflow into Arbitrum seems to have ended and difficulty is ramping up.

-

OP is seeing sizable inflows into the ecosystem, could be worth paying some attention there.

Smart Money movements:

- No visibility here as @chainedge is down today.

L1/L2 movements:

-

The age of Alt-L1s seemed to be over for now, if u are not paying attention to L2 space u are NGMI.

-

Arbitrum and OP still occupy top spots across various metrics which is a good sign of the roll-up thesis.

DAPP movements:

-

Opensea has been dethroned across all metrics, seems like the decision to reduce fees to 0% in response to Blur is hitting their profits. Only time will tell how sustainable this move is.

-

Perp dex is here to stay, with healthy and sustainable profits. It’s time to bet big on the leading perp dexes while prices are cheap in anticipation of increased volatility in the coming weeks.

6. TLDR

While the market is red across the board, it's a good time for you to look at your holdings and cut losses on losers while doubling down on profitable winners.

A few interesting projects I am paying attention to include:

-

Berachain

https://twitter.com/cowperwoodeth/status/1631814859229736961

-

Sector Finance launch on Arbitrum

-

UniDex

https://twitter.com/UniDexFinance/status/1625806951111172097

-

Y2K

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to my Substack for more weekly deep dives like this.

Credits:

https://chainedge.io/ (Down this week)