A look into “the everything DEX” - by Vorpaxis

Overview

Project: Vertex Protocol

Category: DEX (spot, perpetual)

Launch: Testnet (live), Mainnet Q1 2023

Chain: Arbitrum

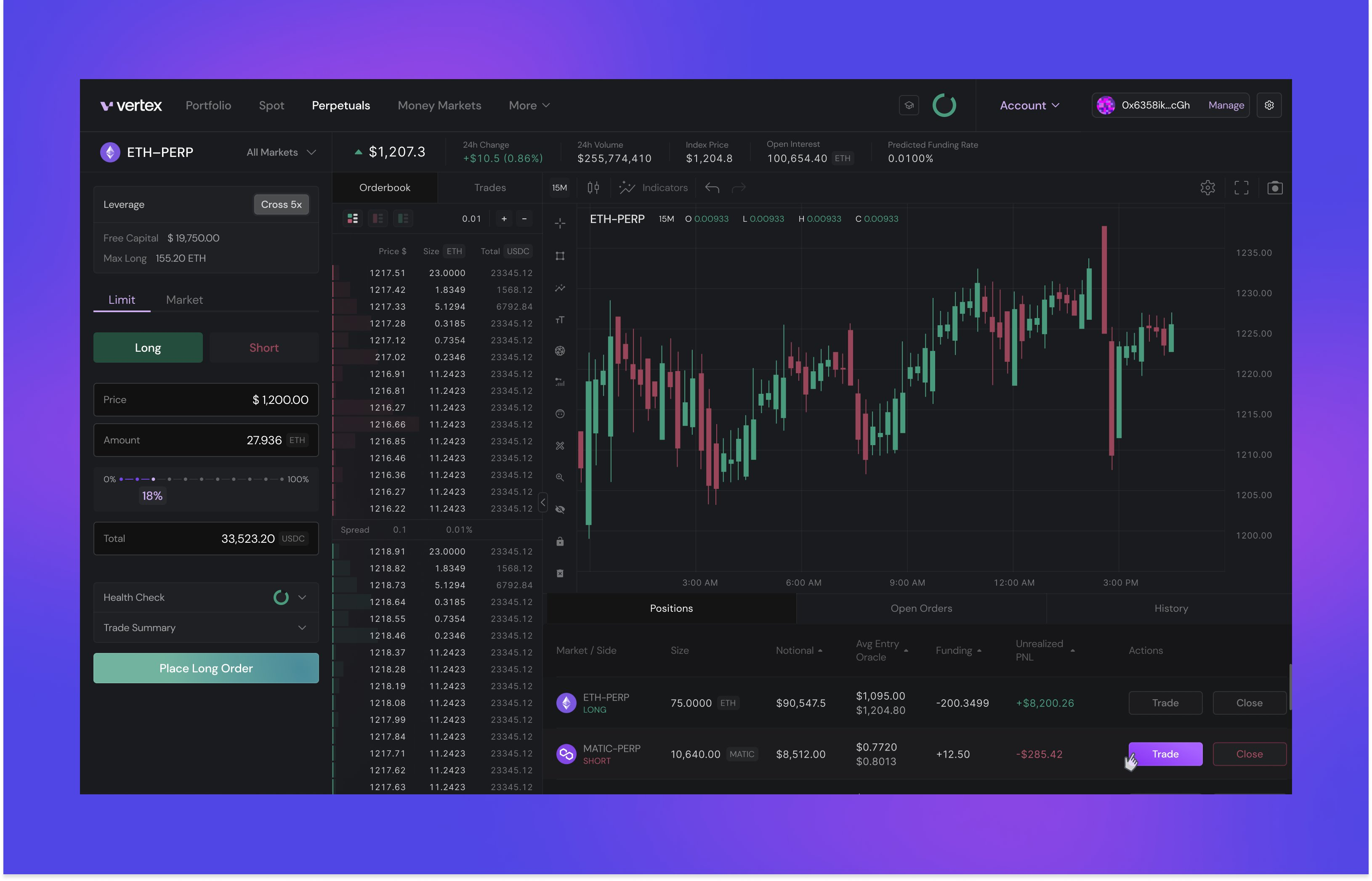

Vertex aims to create an orderbook based decentralized exchange to facilitate cross-margined trading of spot and derivatives, while including a money market to utilize leverage and yield products. They aim to differ from the current products on the market by installing fiat on and off ramps, Web2 style sign-ins with self custody, and multiple user interfaces (lite and pro). Essentially they want to bring the centralized trading experience to decentralized finance.

The name ‘Vertex’ was born from ‘Vertically Integrated DEX’. By encapsulating a large amount of products into one protocol (similar to how centralized exchanges do) Vertex aims to provide the most efficient and frictionless trading experience for users.

The User Experience

Vertex views users in three categories, all with different user experience requirements: the DeFi native users, the retail users and the automated traders.

Retail user: Vertex sees the issues obtaining retail users being predominantly from on and off ramps, bridging issues, and wallet user experience. They aim to solve these issues by offering fiat deposits through credit cards or banks and withdrawals directly to bank accounts. Also, they plan to integrate bridging directly to Vertex from various blockchains, and employ single sign-in options (SSO’s) which allow users to create a wallet similar to a Web 2 experience (such as an email/social media account login).

Automated Traders: These traders would be professional institutions and market makers. The experience required for them is latency, capital efficiency and low cost. Utilizing Arbitrum, low cost transactions are possible. Vertex plans to offer a SDK package allowing anyone to build software to integrate with the exchange directly. A money market allows these traders to maximize their capital usage.

DeFi Natives: Vertex views these users as the ones that power decentralized ecosystems, enabling growth in return for token based incentives. Typically these are the users that test products and are valuable for engagement and feedback.

Products

Vertex plans to feature the following products:

-

Pro trading UI and Lite trading UI

-

Leverage across Spot and Perpetual markets

-

Orderbook with Cross-Margin (multiple collaterals) for spot and perpetuals

-

a ‘Weighted Margin’ system

-

Native markets for basis trading (instead of two separate markets)

-

Money Market that allows assets to be both available for borrowing against and used as collateral

-

Integration of AMM’s into Vertex Orderbooks

And on the roadmap, future features are listed as:

-

Leveraged yield farming for staked assets (looping)

-

Crypto Indices

-

Token Launchpad (ICO) with subsequent listing onto the orderbook

-

Unconventional perpetuals (RWAs or NFTS)

-

Prediction Markets or Binary Options

Tokenomics

$VRTX - Vertex plans to decentralize the protocol with the VRTX token. It would be the protocols governance and utility token.

$VRTX can be used to:

-

Pay for protocol trading fees

-

Participate in crypto basket auctions*

-

Covert to xVRTX (liquid staking token)

*Crypto basket auctions are coins that are for sale by the protocol. I believe they come from trading fees. VRTX is the only method of payment for these cryptocurrencies. Participants bid in VRTX and at the end of the auction, the winners VRTX is burnt in exchange for the coins. The user also acquires some voVRTX.

xVRTX

-

Acquired through staking VRTX (Minimum 2 week locking period)

-

Liquid and transferable

-

One xVRTX = One vote in governance

-

Shares in protocol revenue

-

After 2 weeks xVRTX can be re-staked for another duration or assigned to back the insurance fund (incentives will depend on protocol need)

-

Staking xVRTX also generates voVRTX (described below)

Vertex plans to utilize a ‘user score’ in the form of voVRTX. Your voVRTX score can be boosted from a range of 1.0 - 2.5x. The benefits of having a higher score include greater voting power and revenue share potential. It can be boosted in the following ways:

-

Pledging more xVRTX for longer periods (continuously re-staking for up to 6 months to reach max multiplier of 2.5x)

-

Pledging to the insurance staking fund* backstop (3 week lockup, and immediately reaches max multiplier of 2.5x)

-

Paying for trading fees with VRTX. VRTX spent on trading fees will be burnt, and a voVRTX score is assigned that expires after 3 months

-

Participating in crypto basket auctions (described above)

Note: A user may retrieve their xVRTX at any time (except for when xVRTX is in a lock window). However, doing so resets their voVRTX score back to zero.

* The insurance staking fund is a backstop for the protocol in the event the insurance fund is drained. Pledgers to this fund receive various rewards, such as an immediate full voVRTX boost (2.5x), ability to participate as a liquidator and earn protocol liquidation revenue. The risk is 50% of the users xVRTX has the potential to be lost in an event where the fund is drained.

There is no information in the documents regarding the distribution of the tokens or team/investors vesting schedules. However, this infographic displays the utility of the token well:

Protocol Revenue Streams

Exact fee information for trading was not available in the current iteration of the docs (the litepaper). I imagine that once the full whitepaper is released those details will be provided. Generally spot/perpetual DEXs generate revenue from trading fees. Vertex also includes a money market and onboarding service, so they may be able to capture fees in those areas as well.

Other Information

Vertex’s test net is currently live and available at app.vertexprotocol.com. There is a walkthrough in their documents outlining how to use the test net.

Comparable projects: dYdX, Vela

Conclusion

Vertex has ambitious goals in an increasingly crowded decentralized trading market. Central limit orderbook style trading is quite popular, and if done correctly has the potential to capture significant market share. Competitor projects have typically used tokens to incentivize market makers to provide the required liquidity and attract traders. Without these details, its difficult to know how Vertex plans to attract such liquidity. The tokenomics are interesting - having a user score creates some incentive to hold onto staked tokens assuming revenue and volume are good. The purchasing of the other coins from revenue with VRTX is also a unique idea. The perpetual DEX wars on Arbitrum are heating up, and it will be interesting to see how it works out for Vertex!