The AMM for all market conditions - by 0xtiago

The AMM for all Market Conditions

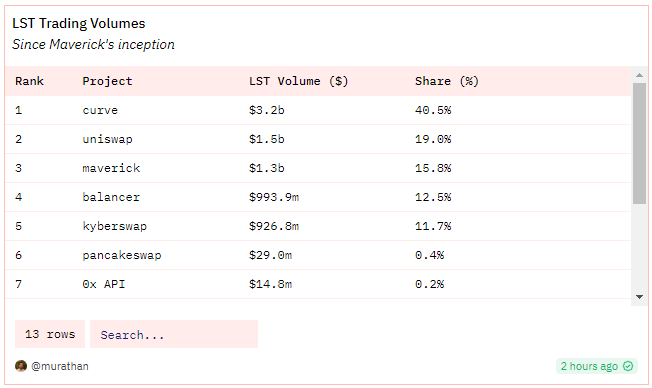

As withdrawals were enabled on Ethereum mainnet in April after a successful Shapella upgrade, we have witnessed a significant strengthening of the liquid staking protocols narrative. This has led to the surge of numerous new projects in this sector, the so-called LSD/LST projects. These projects created high demand to build infrastructure around these protocols. The LSDfi narrative was born.

The demand for ETH staking is up only, and especially the demand for ETH accumulating yield while being liquid. For liquid staking providers to succeed and gain real traction, they need two things; liquidity and volume.

The problem involving providing liquidity for these assets is that their value relative to ETH, their "stable" peer, increases steadily. Which creates a lack of capital efficiency in the DEXes models we are used to, it also keeps a high maintenance and gas intensive position, as liquidity providers (LPs) need to be actively exiting and re-entering positions for maximum capital efficiency.

This is the problem that Maverick aims to solve with its innovative dynamic distribution AMM model. Despite being just over 3 months old, the decentralized exchange has already processed over $2 billion in volume, with pairs involving LSTs accounting for over $1.2 billion, representing more than 50% of its total volume.

Before we dive deep into Maverick protocol and its novel mechanism, let’s give a brief walkthrough on the evolution of automated market makers (AMMs).

AMM Models:

Let's recap the progression of the main AMM models and how we got here. The first being the well-known constant product AMM (x*y=k) model from Uniswap V2. This model laid the foundation for automated market making. Building upon that, Uniswap V3 introduced the then innovative concept of concentrated or range liquidity. In this version, users have the flexibility to select a specific price range and evenly distribute their liquidity across that range. This advancement provided users with greater control over their LP positions.

Constant product AMM:

The constant product model was a great innovation at the time it was launched. This was the first AMM model that really worked, removing barriers so that any user could be a market maker, regardless of how sophisticated they were.

However, it does have some problems, these being very low capital efficiency for LPs and consequently a considerable slippage, even on small trades. This low capital efficiency is a consequence of the liquidity in a pool being in an infinite range, which means most of the liquidity is not being used in a constant sum pool.

Concentrated liquidity AMM:

The concentrated liquidity model, introduced in Uniswap V3, improves capital efficiency and the slippage problem by orders of magnitude compared to the constant product model. As users gained the ability to select price ranges, AMMs transformed into much more efficient and customizable products. However, this advancement also resulted in a more sophisticated and actively managed product.

The narrower the range of a liquidity pool, the more capital efficient it will be, but it will also be more susceptible to impermanent loss. If an LP’s position falls out of range, it automatically stop collecting fees, it buys the under-performing asset and its capital efficiency becomes zero.

If you want to dive deeper into the history of AMMs, read this article by the Maverick team.

Maverick AMM

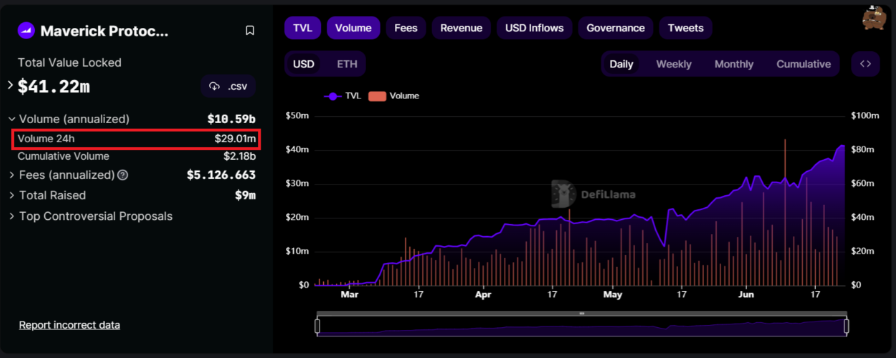

Maverick AMM has been attracting a lot of attention lately, mainly due to the large volume traded in relation to its TVL, coupled with its rapid growth. Maverick is able to process high volume related to its TVL as a result of its high capital efficient mechanism. Processing about $29 million in daily trades, with only $41 million in TVL.

The DEX utilizes the dynamic distribution AMM model, developed and titled by its team. This model solves a significant problem in this industry, which is the capacity to provide liquidity in a directional manner.

Dynamic Distribution AMM & Maverick’s Liquidity Shifting:

A dynamic distribution AMM means that LPs can specify a range and set parameters for liquidity movement alongside price variation. Maverick introduces automated liquidity strategies built in house so that LPs can take advantage of greater capital efficiency. These strategies are made possible by a mechanism called liquidity shifting.

A liquidity position on Maverick is define by a set of parameters

-

Assets pair

-

Bin width

-

Fee rate

LPs can determine the pool they wish to add liquidity to and decide how they want to distribute their liquidity within a specific price range. The smallest unit of a price range is referred to as a bin, and LPs can choose how many bins they want to allocate their liquidity.

The width of the bins can vary from 0.01% to 50%. This width represents the level of price variation required for the liquidity range to transition between bins. For example, in a volatile pool, it is suggested by the protocol to use a bin width of 2%. This means that with every 2% of price movement, the liquidity shifts from one bin to the next.

The introduction of non-uniform liquidity deposits by Maverick is an important feature that allows for the concentration of varying amounts of liquidity in each bin. This flexibility enables the utilization of advanced strategies to optimize the range of deposited liquidity. Non-uniform liquidity deposits can prove valuable in advanced strategies, such as hedging impermanent loss or setting up buy or sell orders within the liquidity pool.

Maverick's liquidity shifting mechanism enables the provision of the aforementioned directional liquidity. This mechanism comprises automated strategies developed by the team to offer optimized solution for LPs. There are four pre-defined strategies available, which include:

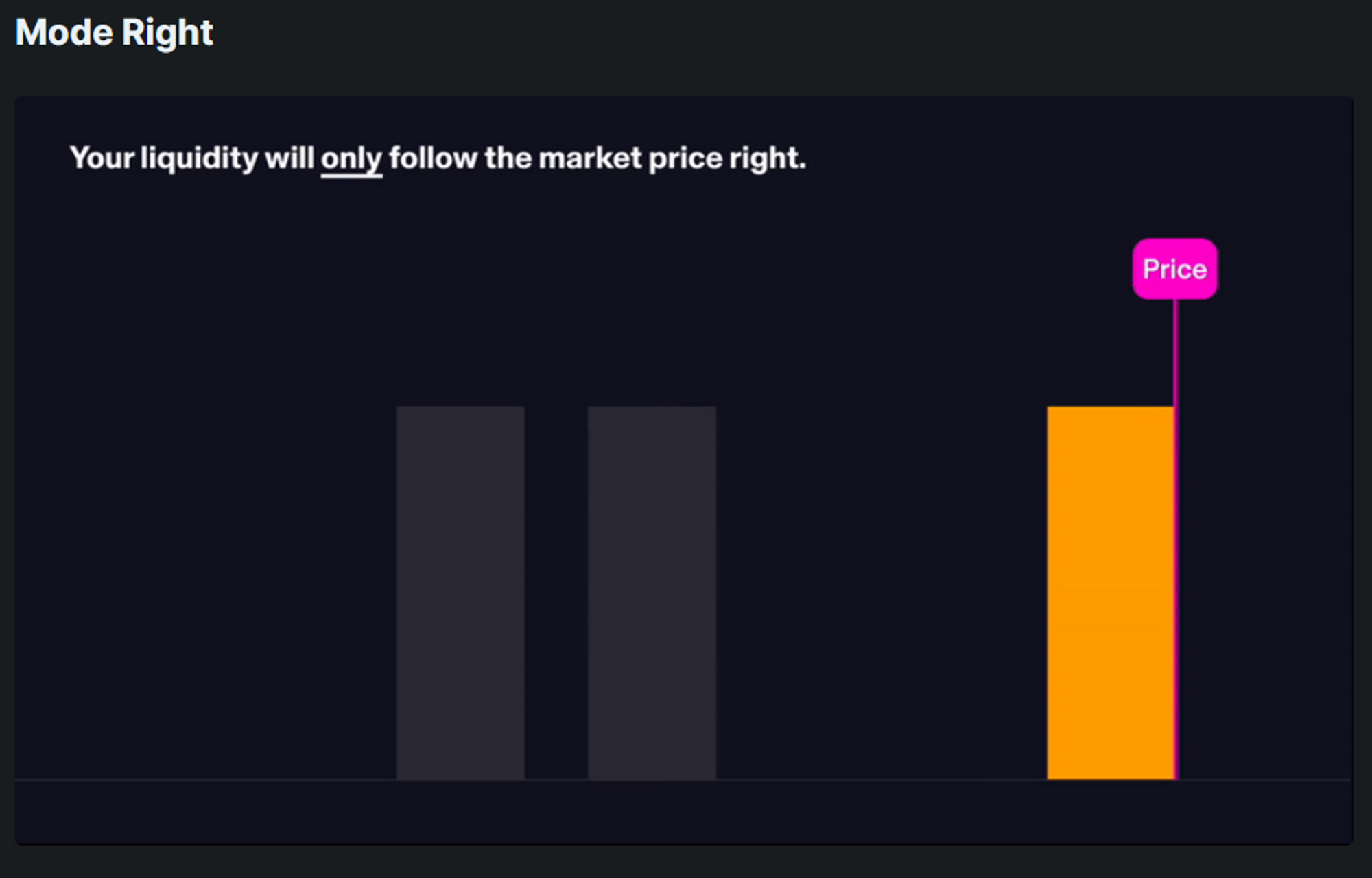

Mode Right

TL;DR: Liquidity moves when the price of the base asset go up, but it does not move when the price falls.

-

A move to the right is configured when the price of the base/right asset rises. In this case, the strategy utilizes the quote/left asset to profit from the upward price movement of the base asset.

-

Right mode is designed to follow the price movement in a single direction, allowing LPs to execute an active liquidity strategy to take advantage of a bullish price movement. LPs' liquidity automatically moves to the right to be able to follow the market movement.

-

For this type of strategy to be effective, the price cannot move up in a linear/parabolic fashion. In fact, the ranges need small variations for the strategy to be profitable.

-

As the image below shows, the liquidity bin is always settled right behind the price, so LPs can capture fees in these small price fluctuations to maximize their capital efficiency.

The right mode is just an automated strategy and it is not a guarantee of profits. It can be a favorable strategy to use when there is a bullish sentiment surrounding an asset.

Mode Left

TL;DR: Liquidity moves when the price of the base asset is falling, but does not move when price appreciates.

-

A move to the left is configured when the price of the base asset falls. In this case, the strategy utilizes the base asset to profit from the upward price movement of the quote asset.

-

Left mode is designed to follow the price movement in a single direction, allowing LPs to execute an active liquidity strategy to take advantage of a bearish price movement. LPs' liquidity automatically moves to the right to be able to follow the market movement.

-

For this type of strategy to be effective, the price cannot move down in a staright line. In fact, the ranges need small variations for the strategy to be profitable.

-

As the image below shows, the liquidity bin is always settled right in front of the price, so LPs can capture fees in these small price fluctuations to maximize their capital efficiency.

The left mode is just an automated strategy and it is not a guarantee of profits. It can be a favorable strategy to use when there is a bearish sentiment surrounding an asset.

The goal of these strategies is to generate fees for LPs while maximizing capital efficiency and mitigating impermanent loss. But it is important to mention that in both strategies mentioned above, there is a risk of impermanent loss if the market moves in the wrong direction. Since liquidity will not move in the opposite direction. This could cause the LP to be swapped completely for the under-performing asset, resulting in IL.

Mode Both

TL;DR: Liquidity follows the price in either direction.

-

The both mode is a slightly riskier mode than the 2 above mentioned, as the range of LPs will always use both strategies, thus going in whatever direction the price goes.

-

There is a higher risk because LPs become more volatile, and you can also take a permanent loss, because the pair is executing trades constantly.

-

Ideal strategy for less volatile pairs such as LSTs, because there should not be a sudden change in price, so the exposure to a risk of permanent loss (PL) is very low.

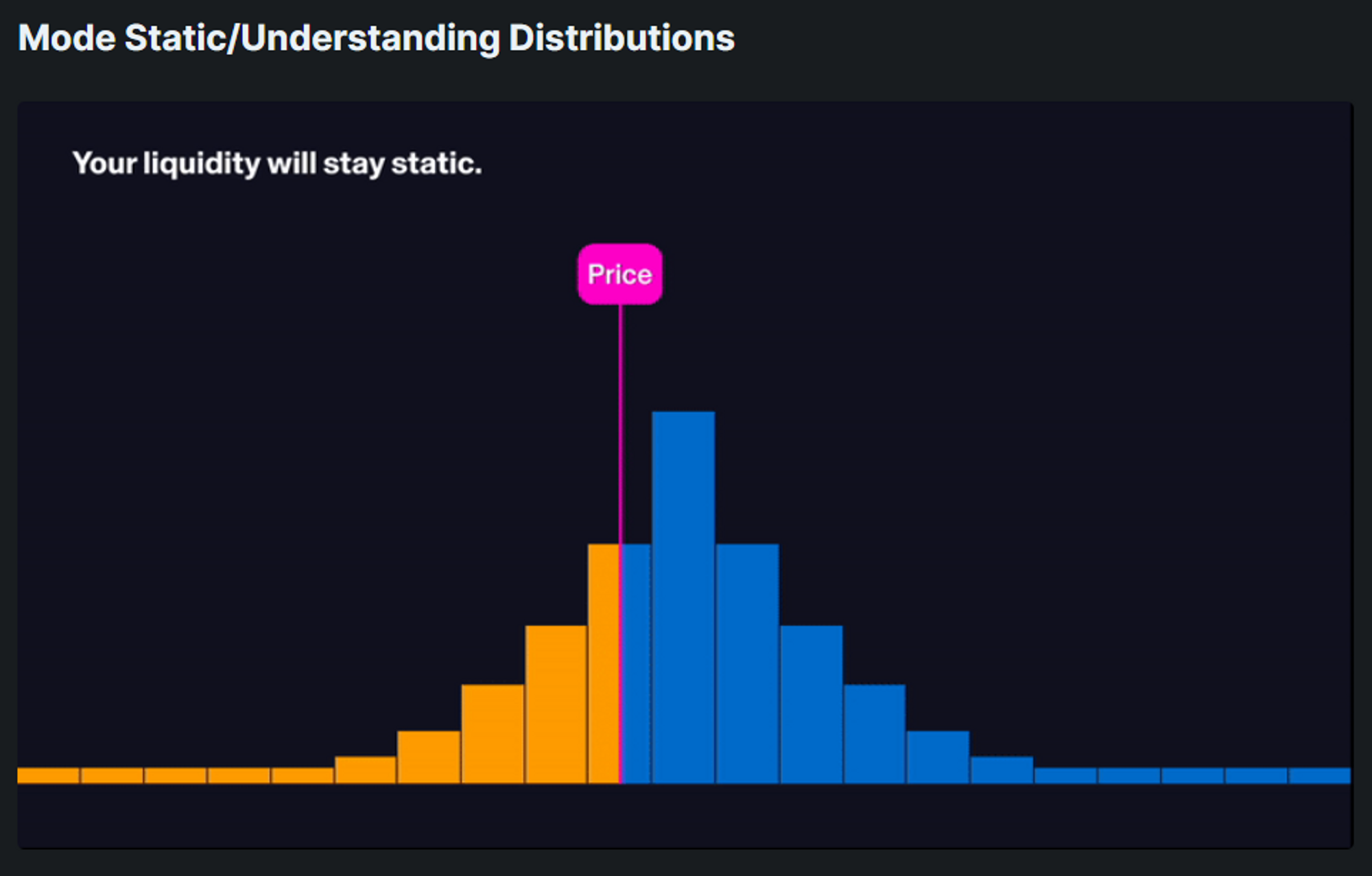

Mode Static

TL;DR: Liquidity does not move in any direction. It works similar to the range model.

-

Static mode allows a user to be a liquidity provider without using any liquidity shifting strategy from Maverick. It is similar to models used in other AMMs.

-

The model tends to be less capital efficient than those presented above.

-

In static mode it is possible for LPs to choose the ranges of their interest and customize their position bin by bin.

There are three standard options on Mode Static:

-

Exponential - Starts with liquidity concentrated around the current pool price and spreads the rest of the deposited liquidity out so that the liquidity in the bins is reduced exponentially.

-

Flat - Distributes liquidity evenly in its entirety, similar to the constant product AMM model (x*y=k).

-

Single Bin - Distributes all the liquidity in the bin that is active.

In the flat and exponential models, users can specify the desired price range percentages. Maverick's interface will select the appropriate amount of bins based on the width of the bins in each pool.

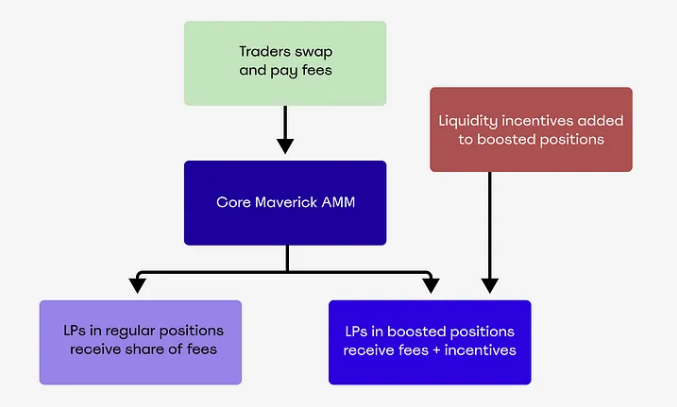

Boosted Positions

Boosted positions are incentivized pools, seemingly like any other AMM, but Maverick's flexible nature gives greater freedom for incentivized positions to be in the exact range of liquidity desired. Boosted positions can benefit in two ways:

-

LPs can add liquidity on already existing incentivized pools.

-

Boosted positions can be incentivized with extra token rewards from third parties like protocols or DAO treasuries.

Maverick's flexibility and ability to customize liquidity enables protocol’s partners to incentivize liquidity at the exact points they need, meaning it makes incentivizing much more efficient and directed to their goal, such as a stablecoin or LST peg.

Tokenomics, Airdrop & the upcoming “Maverick wars”

$MAV token has three utilities in Maverick’s ecosystem, it will be used for staking, voting and boosting (incentives).

Maverick announced on June 25th that a snapshot was taken for the airdrop on June 22nd. The eligibility will be available in the protocol’s website soon, but the criteria are detailed in their blog post. It will take into account a combination of the factors below:

-

Liquidity Providing, by TVL and duration

-

Achieving Contributor or higher roles in Maverick Warrior Program

-

Participation in Snapshot governance votes

-

Trading volume using Maverick UI

-

Holding Maverick MAVA NFTs

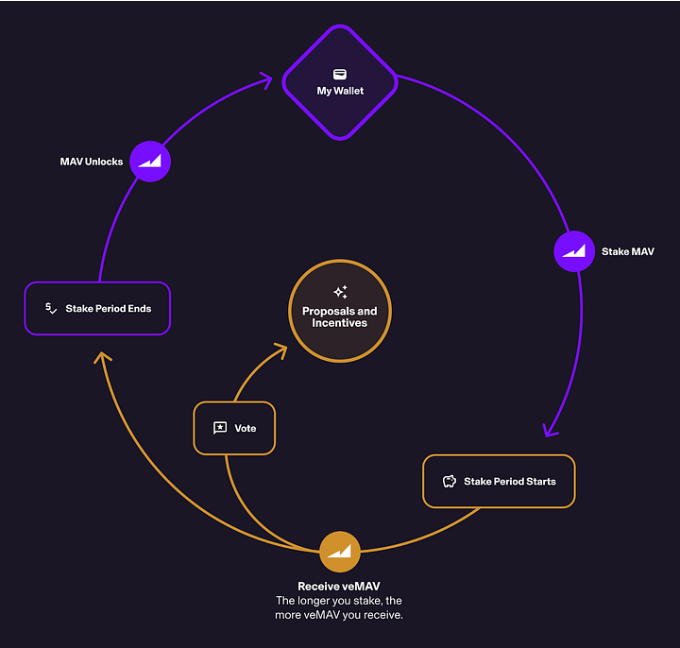

The full launch of the ve-model will be released in two stages:

-

Stage 1, the launch of veMAV smart contract, which will allow users to lock MAV token to earn veMAV;

-

Stage 2, the launch of Maverick’s Liquidity Directing Voting mechanism, with which users can use veMAV to vote and direct platform and external incentives to certain liquidity pools.

The protocol will be rewarding on-chain activities such as liquidity providing. The stage 1 of incentives are already live since June 22, 20:00 UTC. According to their blog post, any LP activity will count for rewards and the team will add a leaderboard in their frontend soon. The token will go live on June 28th, at 12:00 UTC

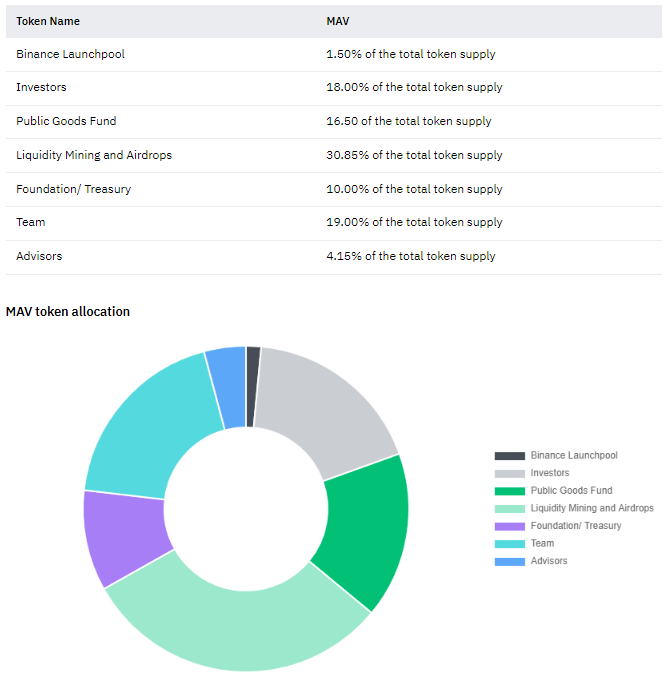

Distribution

Maverick announced its token with the vote-escrowed (ve) mechanism as a way to generate incentives and attract liquidity. The model was first introduced by Curve and was very successful there, as it was interesting for projects focused on stablecoins to have a large voting power in Curve's governance, which attracted liquidity and consequently adoption for their stablecoin. Frax is a good example of a stablecoin protocol playing the Curve wars in a superb manner.

How does veMAV work?

Maverick's governance works similarly to Curve and Balancer, where users lock MAV into a staking contract and receive veMAV. From there, it is possible to vote on proposals and direct liquidity. The longer tokens are locked in, the higher the rewards.

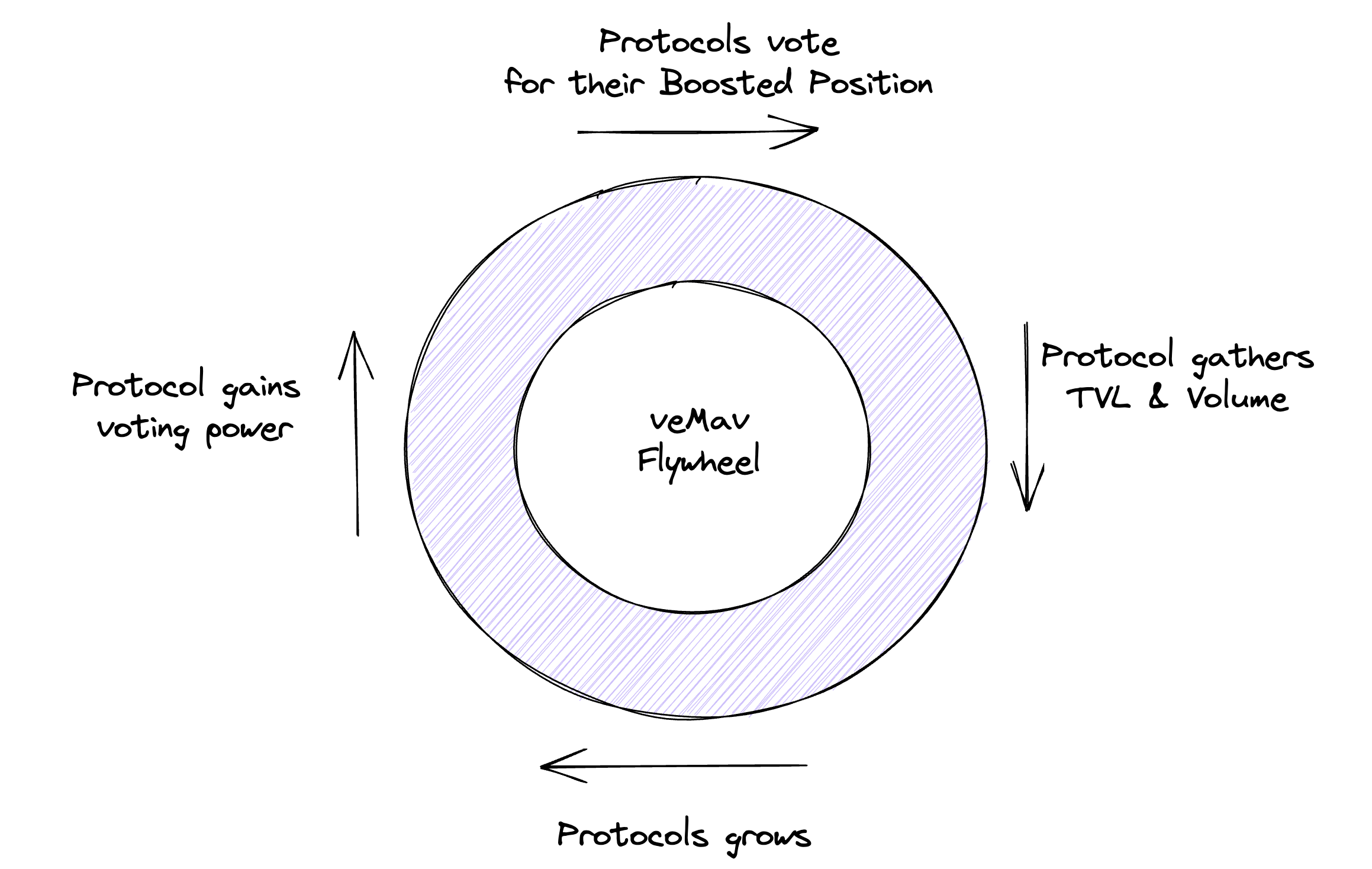

Maverick's ve mechanism displays better efficiency compared to the previously mentioned protocols, thanks to its boosted positions. With LST projects being able to target incentives to the desired price range, they can effectively maintain their peg.

This model aligns perfectly with Maverick’s objective of becoming the main exchange route for trading LST pairs. In the upcoming dispute for LST liquidity and the “Maverick wars", the veMAV token will play a crucial role in distributing incentives and solidifying the exchange’s position as the "liquidity hub" for LSTs.

Final Thoughts & Considerations

Innovation in the DEX business has been scarce outside of Uniswap. However, Maverick has managed to introduce significant innovations in terms of capital efficiency and LP positions management.

With the development of its dynamic distribution mechanism, the protocol quickly found product market fit within just over 3 months of implementation on mainnet. This brings a unique and ideal solution to the current market scenario, taking into account the growing LSDfi narrative and the continuous emergence of new protocols in the liquid staking sector.

The liquidity shifting mechanism is particularly well-suited for providing liquidity in LST pairs, as its tokens’ price appreciates at a pre-programmed constant relative to ETH. The protocol is building its competitive MOAT around this ability to provide high capital efficiency and low-maintenance liquidity for LST pairs.

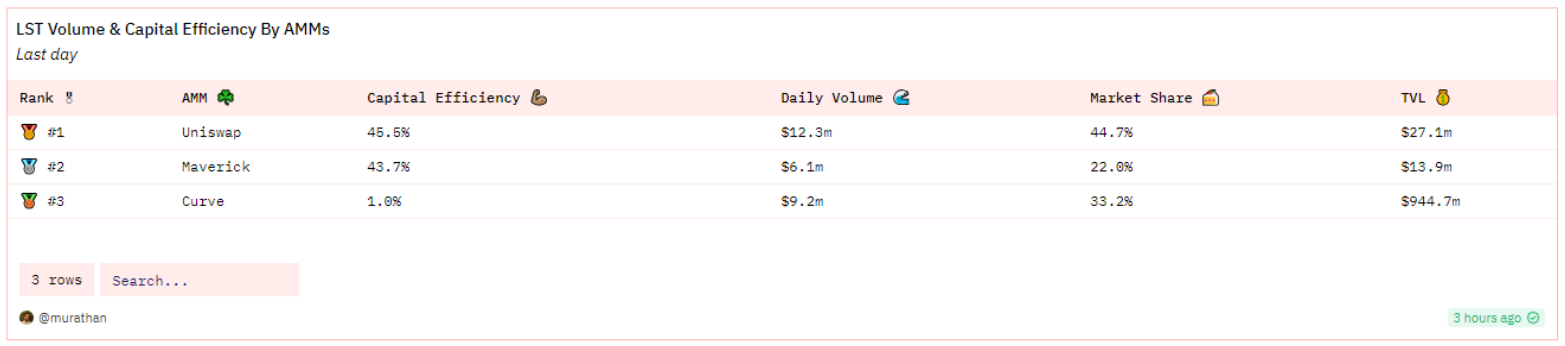

Despite having a considerably smaller Total Value Locked (TVL) compared to Uniswap and Curve, Maverick is successfully gaining market share and processing competitive volume in LST pairs. Its capital efficiency is on par with or higher than its competitors day in and day out.

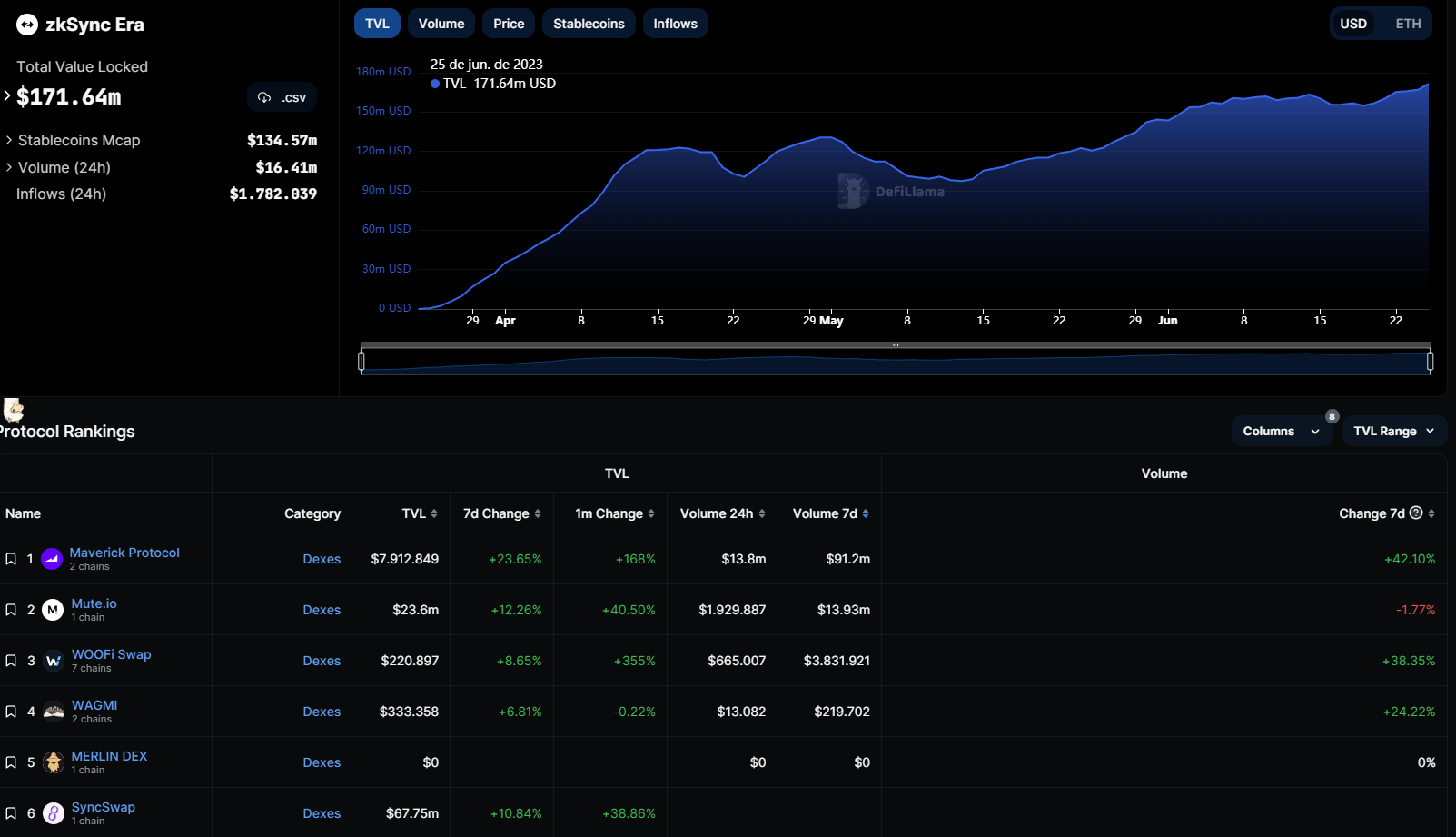

The project has made some intriguing decisions, one of which is expanding the exchange to the ZkSync Era instead of choosing Arbitrum or Optimism, both of which have rapidly growing ecosystems and user bases. According to Bob Baxley, a core contributor to the project, the decision to opt for the zk roll-up was driven by the desire to gain a first-mover advantage in a promising Layer 2 solution that has been gaining traction. Thus far, the strategy has proven successful, with the protocol experiencing a 24% increase in TVL and a 37% increase in volume over the past 7 days. This accounts for approximately 84% of the transaction volume in DEXes on the new chain, as reported by Defillama.

Another exciting decision by the team was the utilization of the ve model alongside the announcement of their token launch. Although the protocol is gaining market share, the industry remains highly competitive, especially with Trader Joe V2.1 and the upcoming Uniswap V4. To secure its position in the LST niche and beyond, Maverick needs to continue attracting TVL and traders.

Maverick will face the same problem that all new DEXes face, competing for market share with Uniswap, a project that released its V1 in 2018. Additionally, Uniswap boasts one of the strongest and most respected brands in the industry. Uniswap accounts for about 25% of all TVL of DEXes and around 45% of weekly transaction volume, highlighting how capital efficient the industry pioneer is.

However, Maverick is well positioned to follow a similar path as Curve, by becoming a specialized niche protocol. Whether it’s stablecoins for Curve, or LSTs for Maverick, both categories need abundant liquidity to attract users and gain traction. Both protocols have mechanisms for specialized LPs within their respective niches, combined with the powerful incentive model of the ve tokens. Maverick’s incentives can potentially create a similar flywheel to what Curve experienced.

With the emergence of new liquid staking projects aligned with the financial power that Maverick will possess with its soon-to-launch token. The "Maverick wars" are poised to become a significant focal point in the market. What we currently know is that they are very well positioned and have plenty of dry powder to competing for the top spot in the LST trading niche and beyond.

It is not possible to pin anything yet, but when the token launches and incentives start to be thrown around, then it will be clearer to see how effective their strategy is.

All views are my own (0xtiago), nothing said here is financial advice, the protocol is still new, so you know what to do. DYOR anon.