The weekly 🐰 hole (16 July 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (16 July 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

🐰Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 127.20 bil, with -0.2% weekly change.

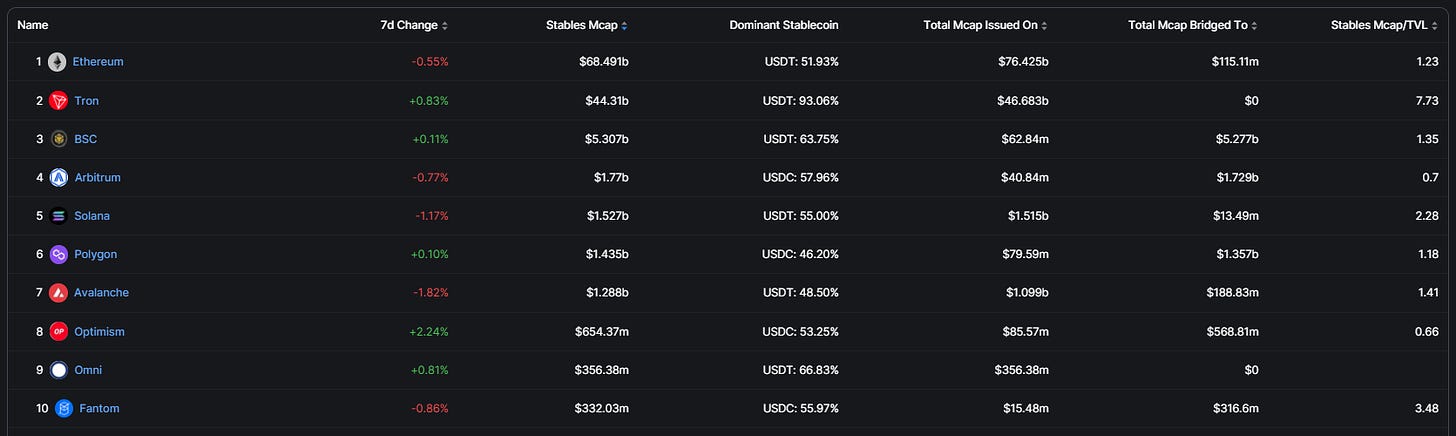

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Terra Classic

-

Kava

-

Mixin

-

StarkNet

-

Gnosis

Top outflows:

-

Waves

-

smartBCH

-

Algorand

-

Karura

-

Hedera

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

USDT

-

eUSD

-

wstETH

-

Pancakeswap

-

USDT (Arbitrum)

Top Smart money outflows (including stablecoins):

-

USDC

-

Dai

-

Coinbase Wrapped Staked ETH

-

stETH

-

Wrapped ETH

Top Smart money inflows (excluding stablecoins):

-

wstETH

-

Pancakeswap

-

rETH

-

Pepe

-

GMX

Top Smart money outflows (excluding stablecoins):

-

Coinbase Wrapped staked ETH

-

stETH

-

Wrapped ETH

-

Wrapped ETH (Polygon)

-

Strike

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

Arbitrum

-

BSC

-

Avalanche

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Cosmos

-

BTC

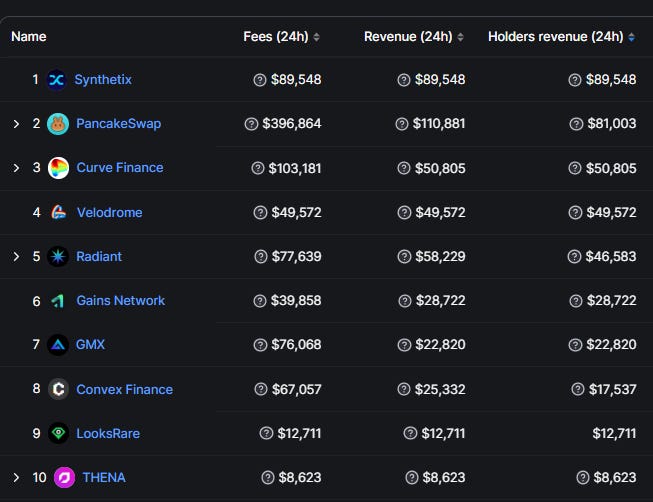

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Pancakeswap

-

MakerDAO

-

GMX

Revenue

-

MakerDAO

-

Lido

-

Convex Finance

-

PancakeSwap

-

Synthetix

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

UniDex

-

Mummy Finance

-

Level Protocol

-

Solarbeam

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

El Dorado Exchange

-

UniDex

-

Level Finance

-

Velodrome

-

X2Y2

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

Synthetix

-

Pancakeswap

-

Curve Finance

-

Velodrome

-

Radiant

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

Trending Applications

-

Opensea

-

Lifeformcartoon

-

Dexalot

-

Rocketpool

-

Layer3

Raises - Recent funding rounds

-

Ion Protocol

-

Xterio

-

Artela

-

Aark Digital

-

Sound

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap remained flat this week at -0.03% decrease.

-

Terra Classic, Kava and Mixin saw the largest stablecoin inflows.

-

Waves, SmartBCH, Algorand saw the largest stablecoin outflows.

Smart Money Movement:

- There is a notable increase in Alts purchased by Smart Money post-XRP lawsuit partial win. Some notable purchase includes Pancakeswap, Pepe, GMX, Frax and Rollbit.

L1/L2 movement:

-

L2s remains the hotbed of Defi activity with Arbitrum continuing to hold its dominance over on-chain transactions.

-

It is notable to see Solana catching up with a 145% increase in Dex Volume.

DAPP movements:

-

GMX fees increased significantly with the imminent launch of GMX V2, which promises lower fees, low latency oracles and more trading pairs.

-

Level Finance’s revenue exceeded GMX by USD50K this week.

-

Alpha drop by @apes_prologue

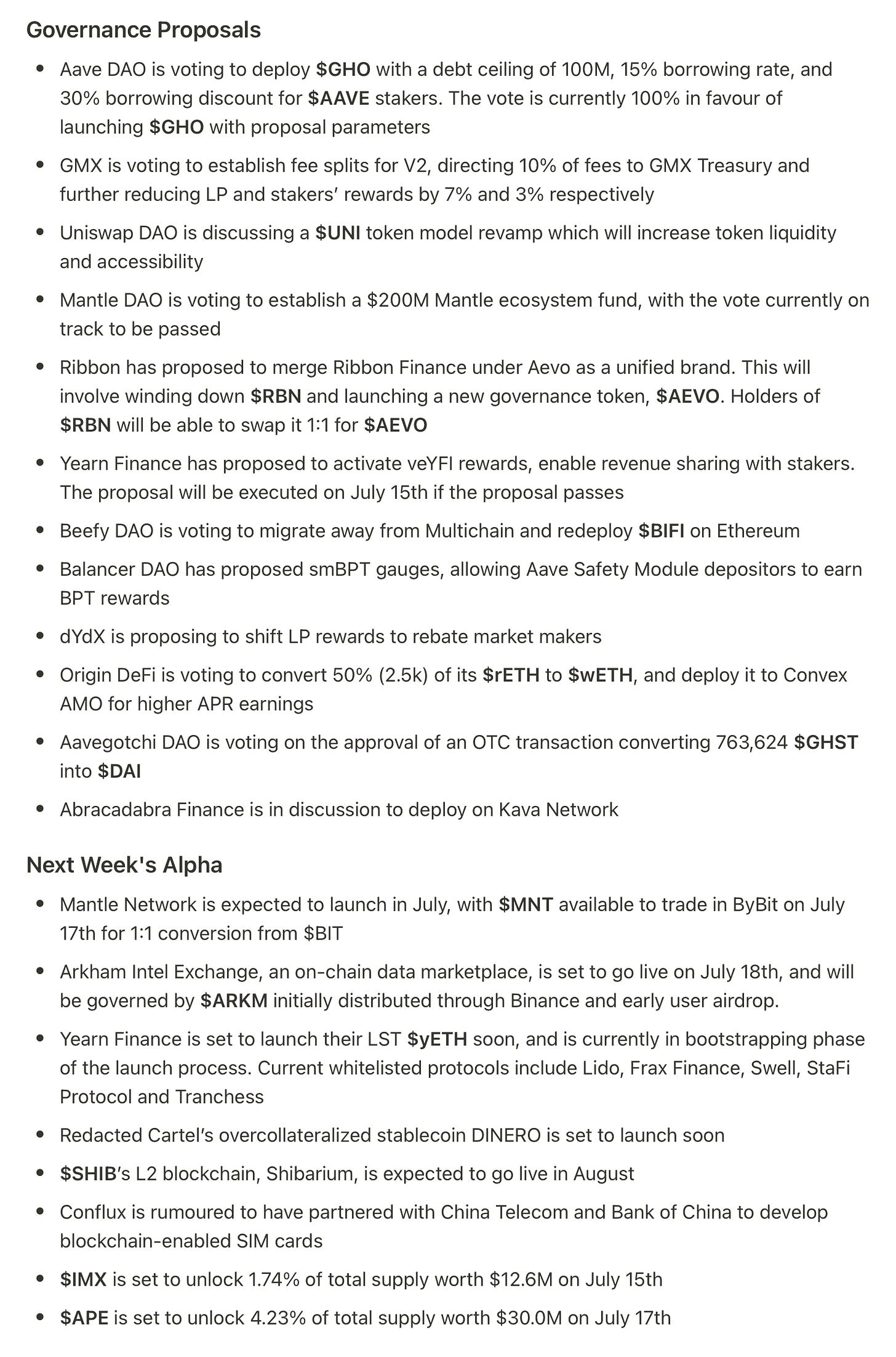

6. TLDR

-

Market sentiment has changed, and it will be foolish to adopt a bearish outlook when inflation, recession and regulatory risk have been reduced.

-

While there may not be new liquidity entering the ecosystem, excess sidelined liquidity is finally reentering various crypto positions as seen from the increased stablecoin inflows into exchanges.

-

As explained by an Anon on 4chan, welcome to the start of the golden Bullrun degens.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: