The weekly 🐰 hole (14 May 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (14 May 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems

“Trust me bro, just send money to eth_ben wallet and we gucci” - Retail

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

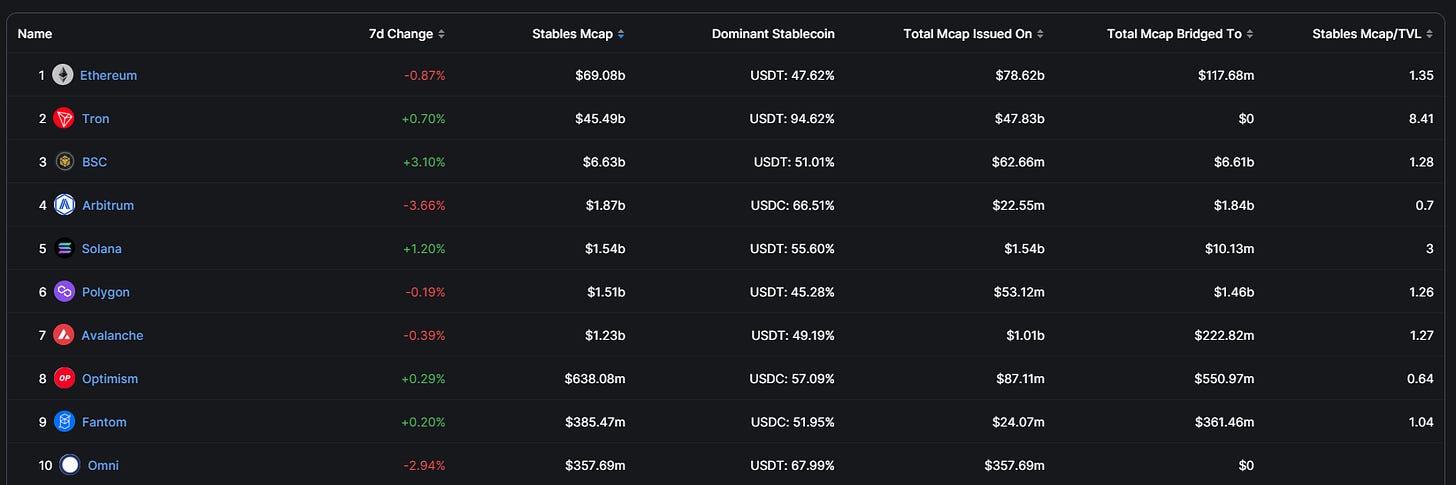

1. Stablecoin Flows

Total Stablecoin MCAP = 130.42 bil, with -0.16% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

RSK

-

Moonbeam

-

Kava

-

BSC

-

Tomo

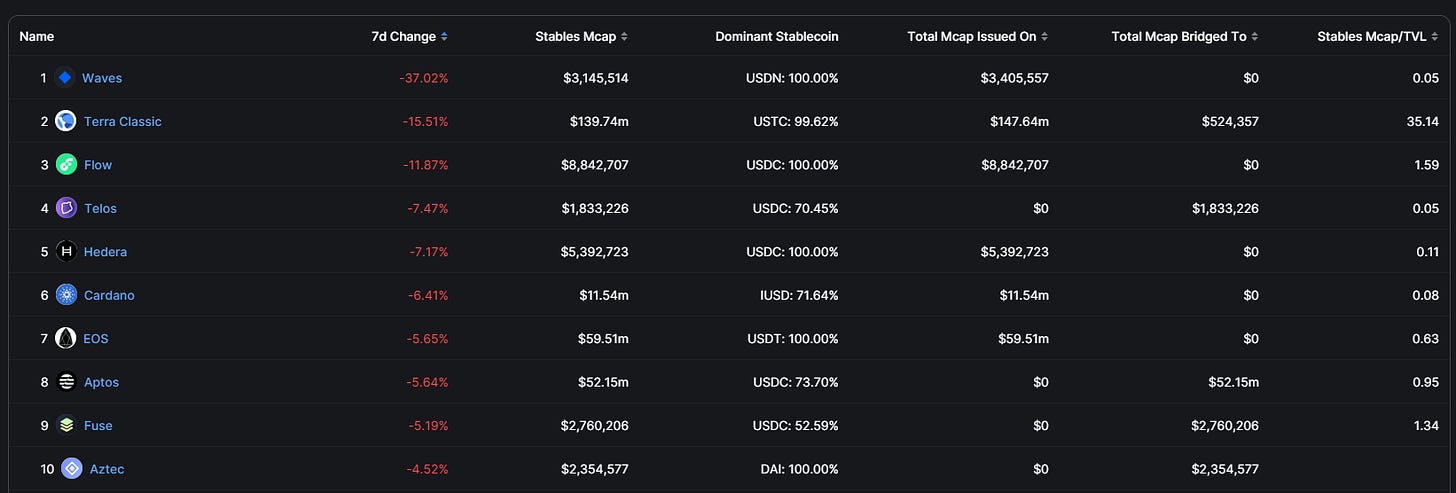

Top outflows:

-

Waves

-

Terra Classic

-

Flow

-

Telos

-

Hedera

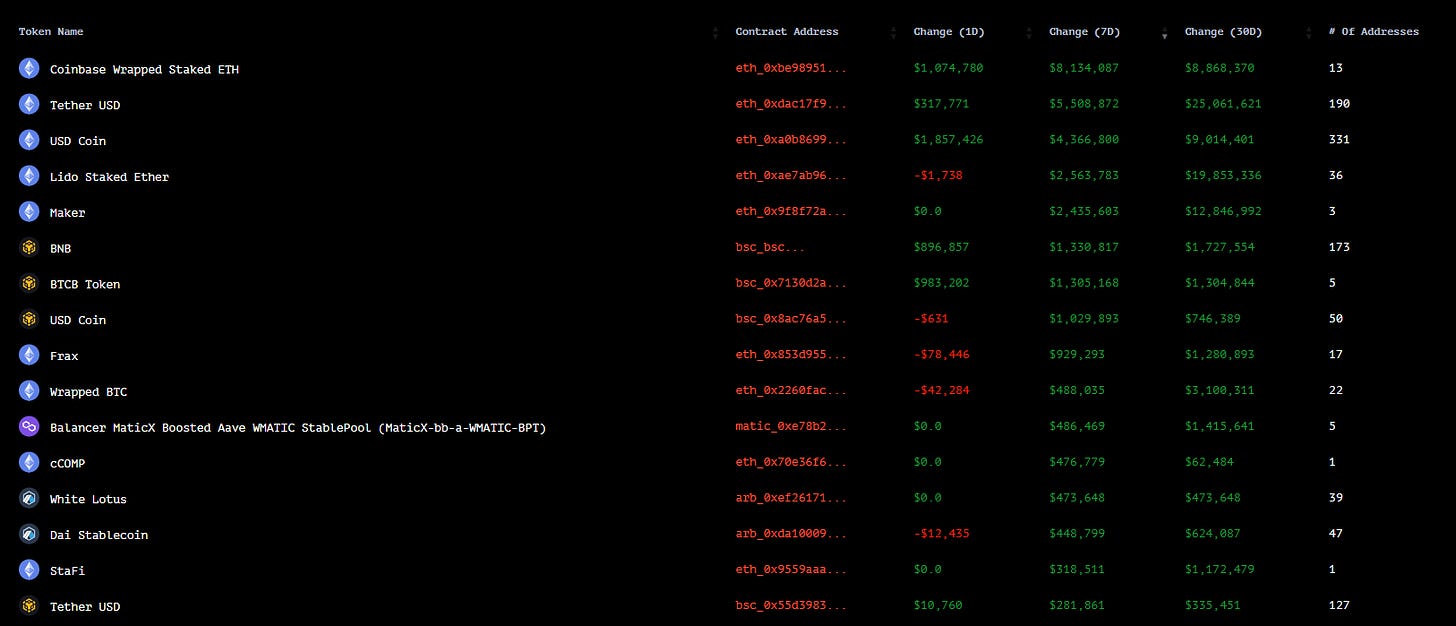

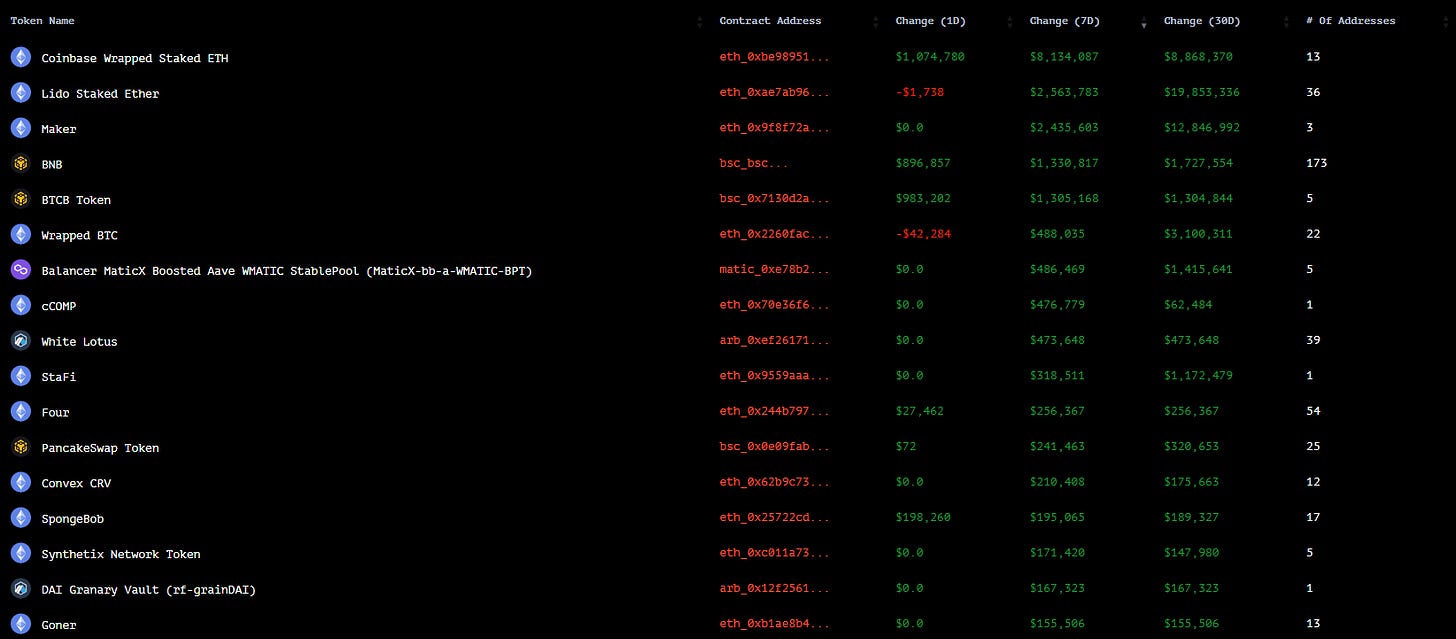

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Coinbase Wrapped Staked ETH

-

USDT

-

USDC

-

Lido Staked ETH

-

Maker

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

Pepe

-

USDT (Arb)

-

Dai

-

Wrapped ETH (Arb)

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Lido Staked ETH

-

Maker

-

BNB

-

BTCB

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Pepe

-

Wrapped ETH (Arb)

-

Avalance

-

Balancer

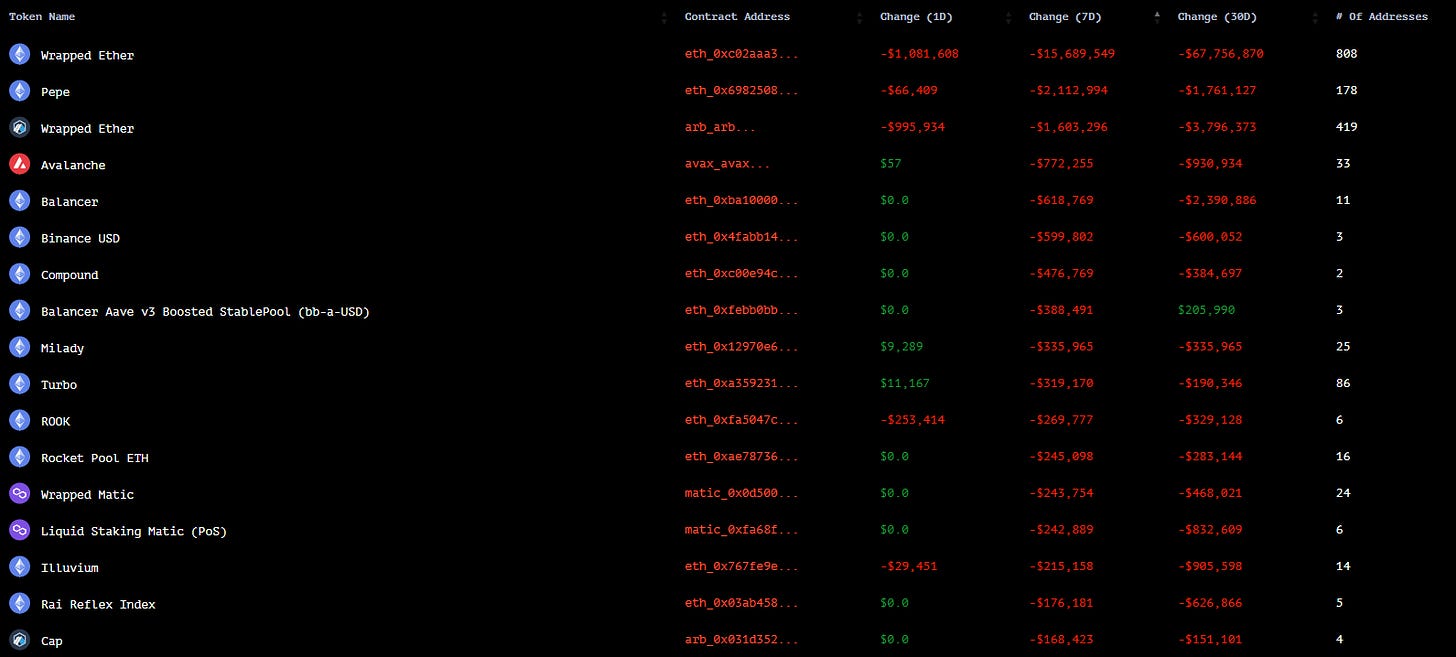

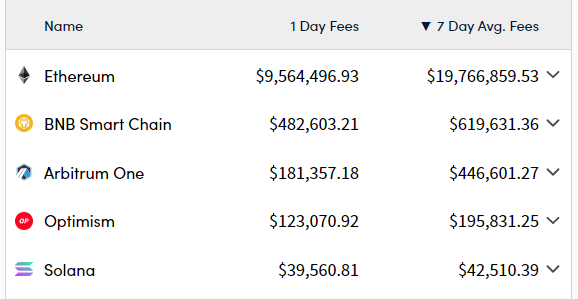

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

Arbitrum

-

Optimism

-

Solana

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

BNB

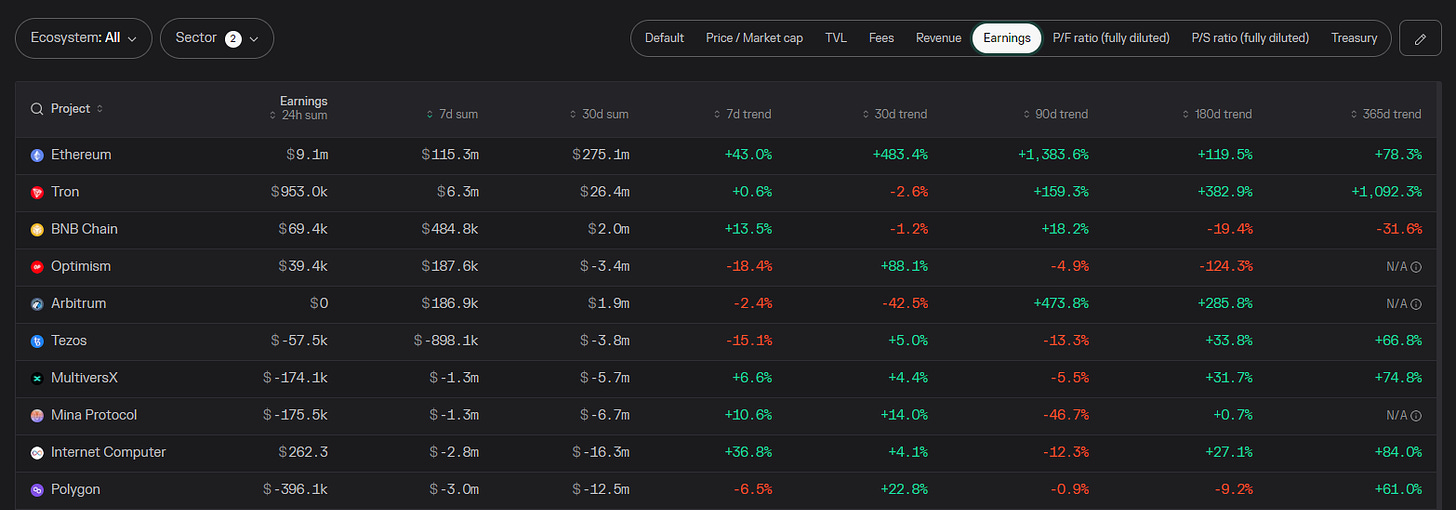

Earnings

-

ETH

-

Tron

-

BNB

-

Optimism

-

Arbitrum

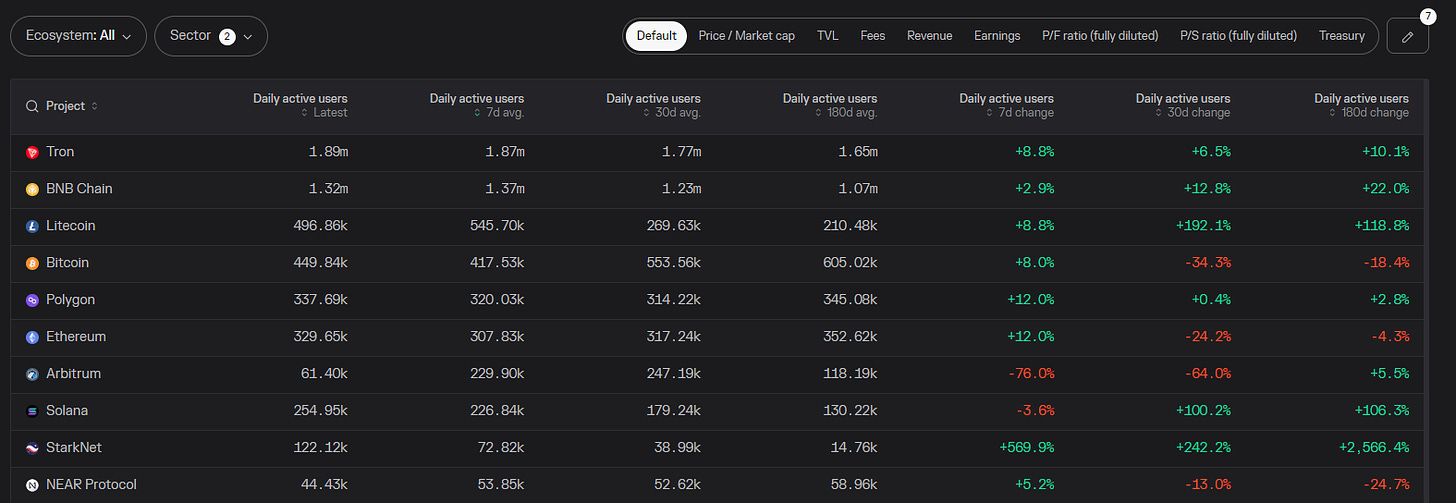

DAUs

-

Tron

-

BNB

-

Litecoin

-

BTC

-

Polygon

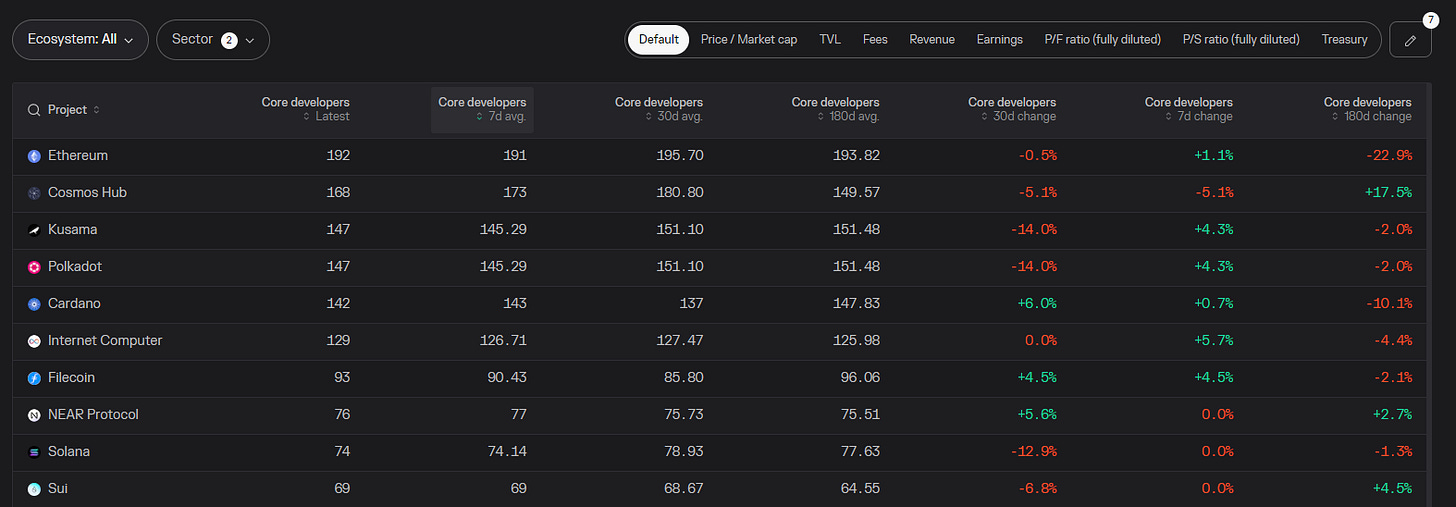

Active Developers

-

ETH

-

Cosmos

-

Kusama

-

Polkadot

-

Cardano

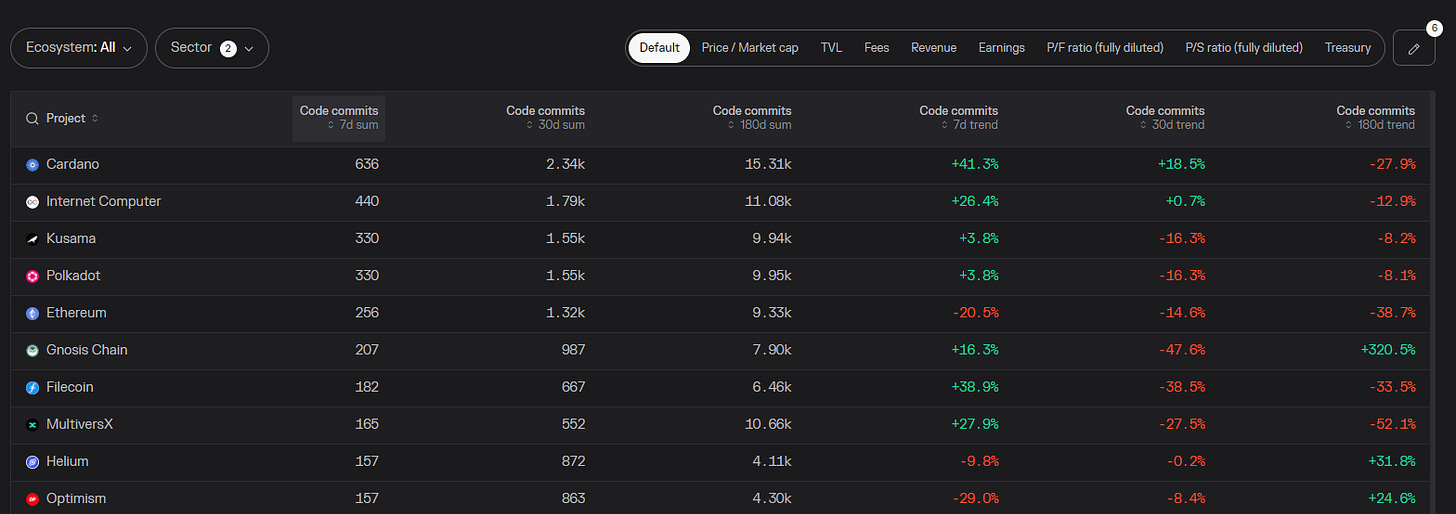

Code Commits

-

Cardano

-

Internet Computer

-

Kusama

-

Polkadot

-

ETH

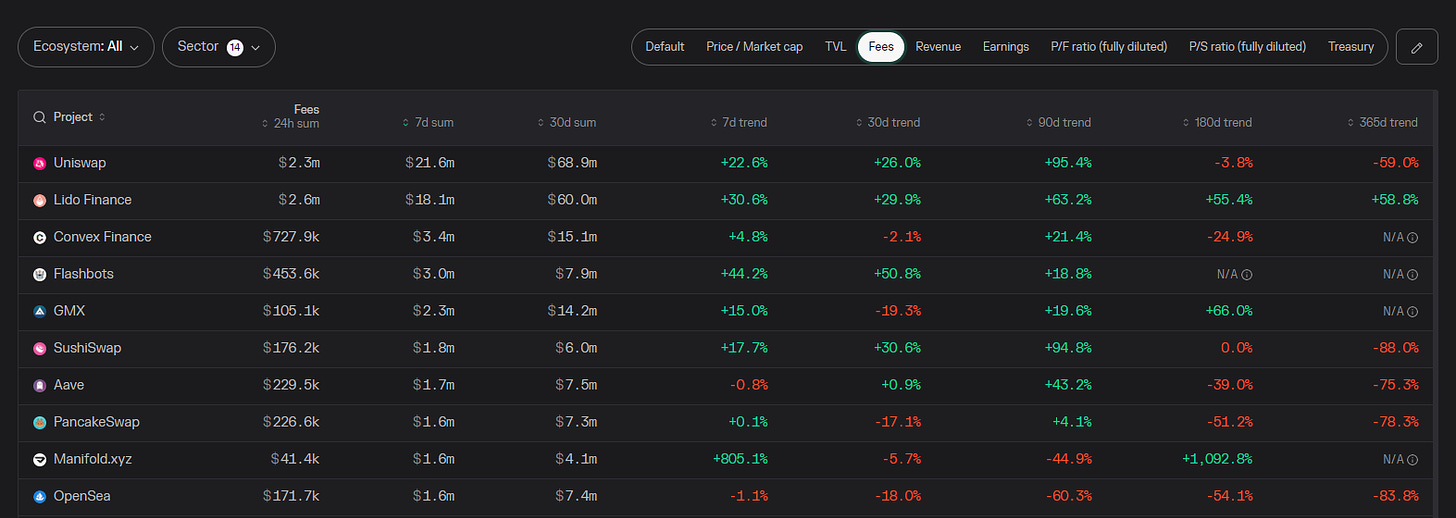

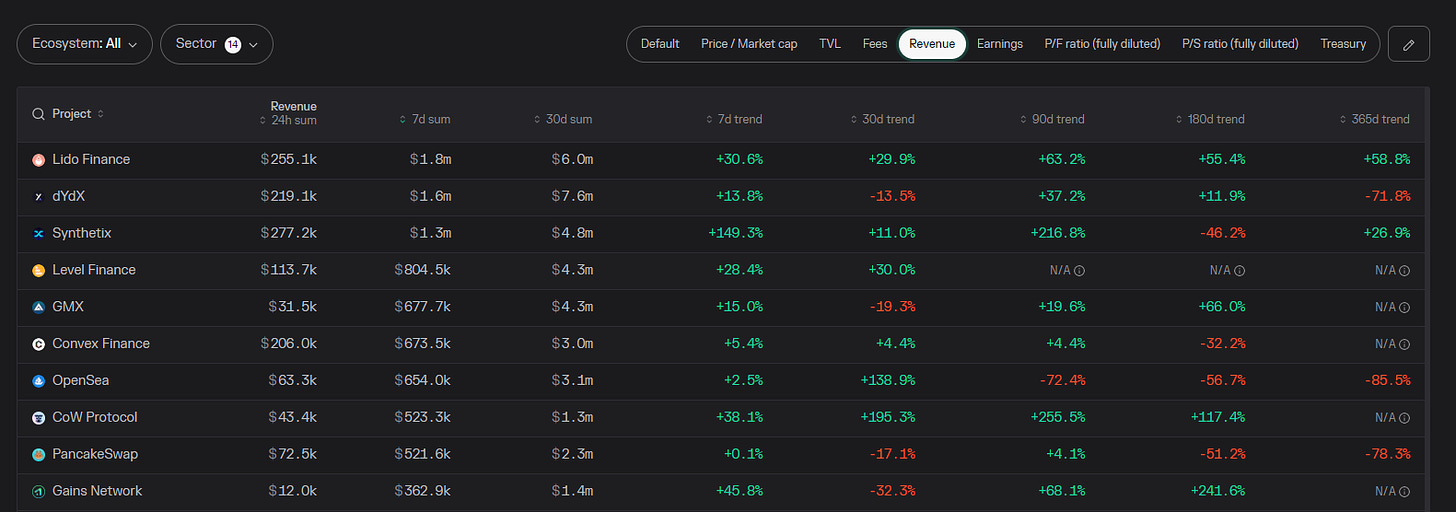

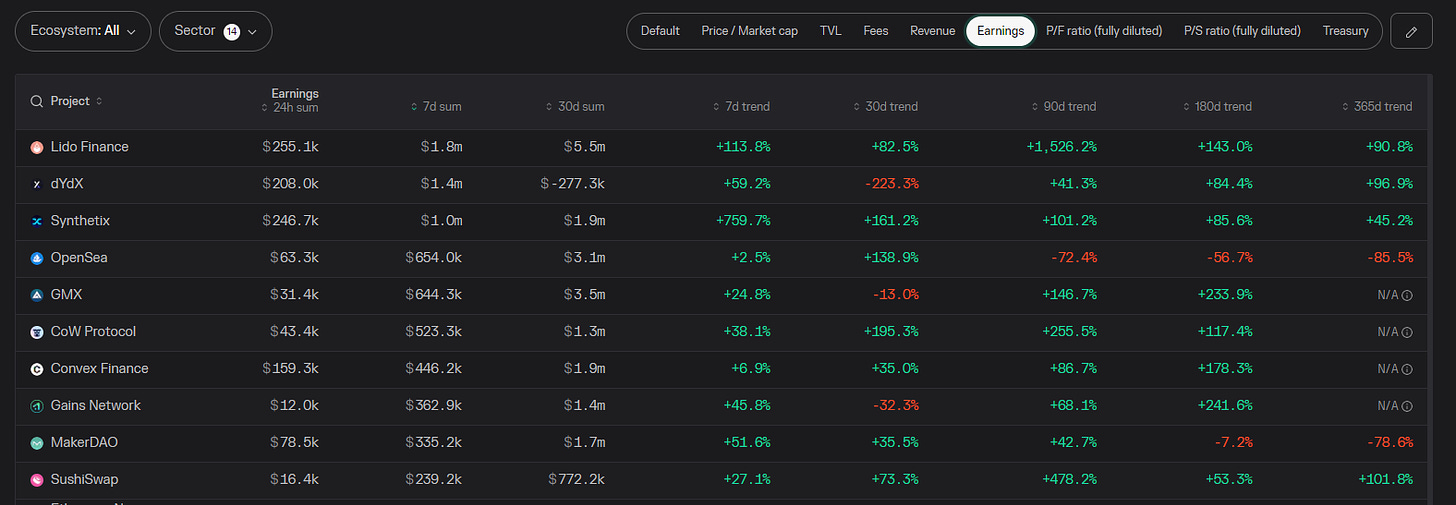

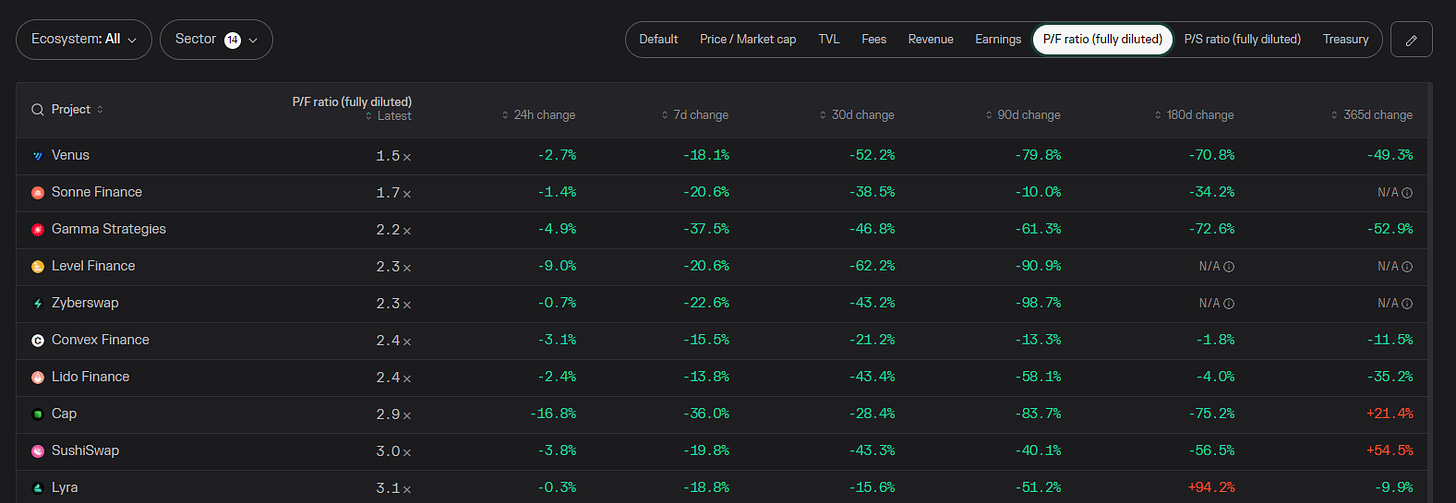

4. Top DAPP Financials

Fees-Generated

-

Uniswap

-

Lido

-

Convex

-

Flashbots

-

GMX

Revenue

-

Lido

-

dYdX

-

Synthetix

-

Level

-

GMX

Earnings

-

Lido

-

dYdX

-

Synthetix

-

Opensea

-

GMX

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Venus

-

Sonne Finance

-

Gamma Strategies

-

Level

-

Zyberswap

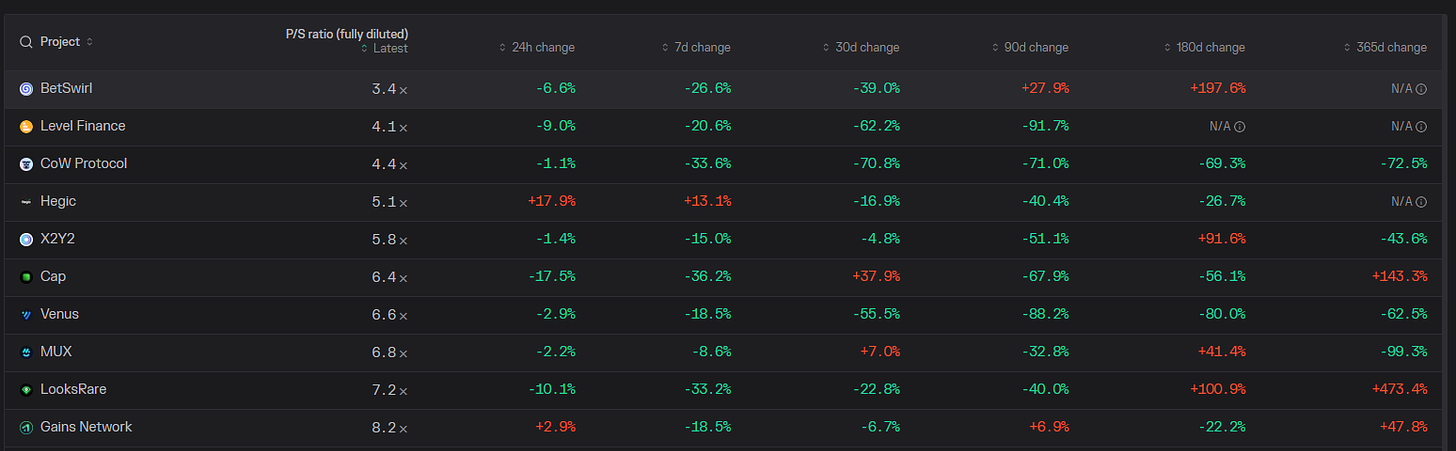

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

BetSwirl

-

Level

-

CoW

-

Hegic

-

X2Y2

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

Osmosis

-

0x

5. Movement Analysis

Stablecoin flows:

-

The total Stablecoin Market remains relatively flat at $130.42 billion despite the sell-off across most chains.

-

BSC managed to attract the most stablecoin liquidity this week at 3.10%.

Smart Money Movement:

-

Smart money is playing defensive currently, with the majority scaling back to Stables, BTC and ETH.

-

Meme coin mania seems to be over as smart money dumped their $Pepe stack.

L1/L2 movement:

-

BNB remain one of the stronger Alt-L1 in terms of Fees, Revenue, Earnings and DAUs.

-

Cardano and Internet computer is seeing huge code commits this week, do keep a look out for upcoming development news from these 2 Alt L1s.

DAPP movements:

-

MEV protocols like Flashbots and Manifold shot up in ranking in terms of fees generated as sandwich attacks become highly profitable during Memecoin season.

-

Lido's fees, revenue, and earnings skyrocketed this week ahead of the V2 upgrade on May 15th.

-

Alpha drop by @apes_prologue

6. TLDR

-

Not much movement this week as capital continues to rotate to the next shiny narrative while the market corrects after 4 months of sustained growth.

-

The lack of liquidity in the market will exacerbate any downward price action, especially during token unlocks. Don’t attempt to catch falling knives and wait for a trend reversal before deploying.

-

Don’t even attempt private sales/pre-sales, you will get rekted by insiders before you can break even.

-

Focus on defensive plays (Stables, BTC and ETH) and keep a lookout for undervalued altcoin opportunities.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: