LandX: From Fields to DeFi

LandX: From Fields to DeFi by 0xEvix.

Currently, there are few protocols connecting the real world to DeFi, and even fewer that bridge DeFi with tangible resources outside of financial assets such as bonds. As a result, most DeFi assets are highly correlated with the crypto market and traditional finance, while stablecoins are subject to inflation.

The LandX protocol proposes a solution by tokenizing commodities and their future productions. These commodities come from agriculture, including wheat, rice, soybeans, and corn.

LandX is based on 3 tokens and 3 actors, so grab a coffee, start your LoFi playlist, and let me explain everything to you.

Summary

-

Introduction

-

LandX: How it Works

-

Two Tokens

-

xTokens

-

cTokens

-

-

Three Actors

-

Farmers

-

Validators

-

Investors

-

-

-

$LNDX

-

Staking

-

Fees

-

Tokenomics and Acquisition

-

-

xBasket

-

xUSD

-

Conclusion

Introduction

Farmers who want to expand by modernizing their facilities, for example, need funds. However, they may encounter difficulties in raising this capital due to complex administrative procedures, their location, or unfavorable conditions.

DeFi investors, on the other hand, have little to no means of exposure to agricultural commodities on-chain. While real-world assets (RWA) are a growing field, it is still a very new sector in DeFi. There is still much to be done, especially in the field of agricultural commodities where nothing has been accomplished yet.

Thus, the LandX protocol was designed based on this observation.

LandX allows farmers to obtain capital in exchange for a percentage of the future production from their fields. In other words, they can tokenize their future harvests and sell these tokens as they see fit.

The protocol offers DeFi users the opportunity to acquire yield-generating assets from the real world, as well as tokens backed by commodities.

All of this may still seem a bit unclear, I understand. Let's dive into the details.

LandX: How it Works

Two tokens

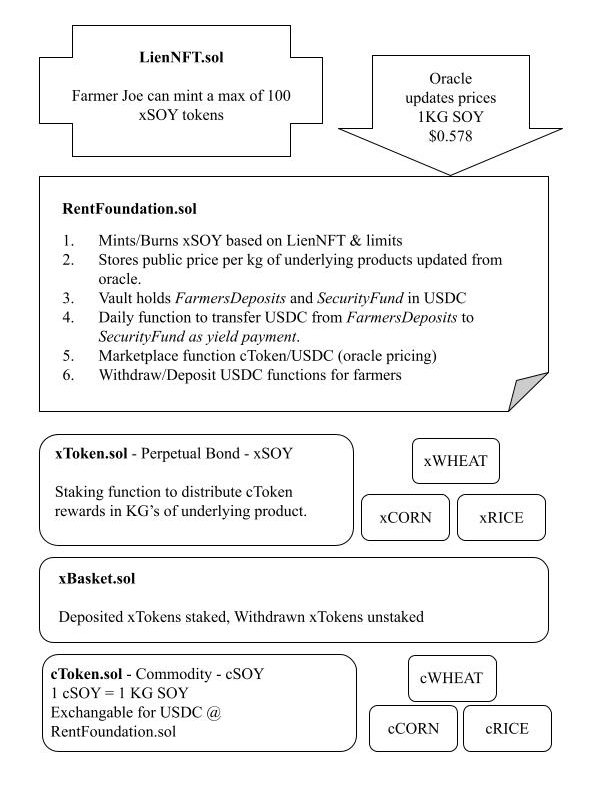

As explained earlier, farmers will be able to tokenize the future yield of their lands.

We will have:

-

A token that represents the right to future harvests: xToken

-

A token that represents the harvested commodity: cToken

Each of these tokens is an ERC-20 that can be traded and used in DeFi.

Initially, LandX will focus on rice, soybeans, wheat, and corn. Therefore, we will have xSOY, cRICE, and so on.

xTokens

xTokens are received by farmers during the process of tokenizing the future yield of their lands. They essentially represent the right to receive the yield of future harvests.

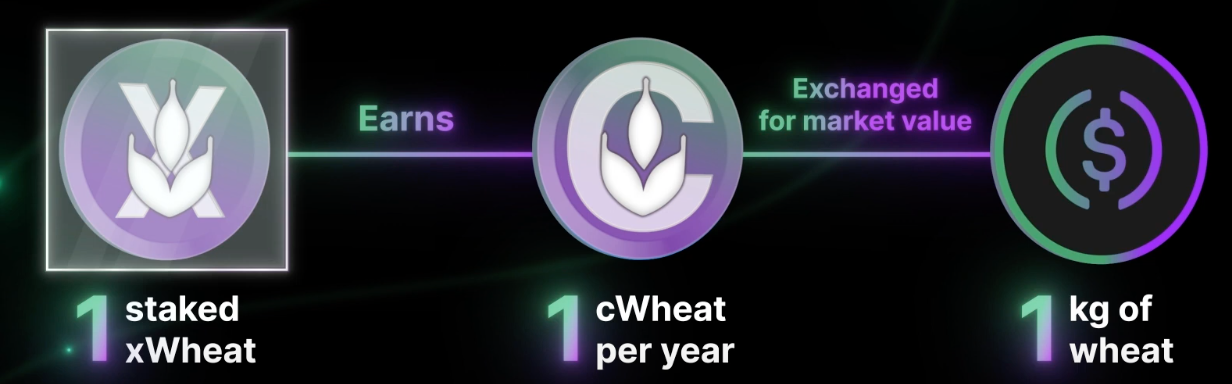

Each xToken entitles its holder to receive 1 kilogram per year of the underlying commodity yield. This kilogram is represented by a cToken.

xToken holders can stake their tokens and receive 1 cToken per xToken each year. The distribution of yield happens daily, so 1 staked xToken allows for receiving 1/365th of a cToken every day.

The price of the xToken is influenced by market appreciation.

cTokens

cTokens are the on-chain representation of the underlying commodity. 1 cToken is equivalent to 1 kilogram of the commodity.

They are obtained when staking xTokens and can be directly exchanged on LandX's internal marketplace for USDC.

The price of cTokens comes from an oracle that reports the price of one kilogram of the commodity on traditional markets. Thus, the price of 1 cToken is expected to reflect the price of 1 kilogram of the commodity.

Three actors

This whole system operates with 3 actors: farmers, validators, and investors.

Farmers

Farmers commit to distributing a portion of their future harvests in exchange for xTokens that they can sell. It's a way for them to raise capital.

To acquire xTokens, they enter into an agreement with LandX through a contract in which they commit to delivering 1 kilogram of the underlying commodity per granted xToken over a duration of 49 years.

For example, if a farmer obtains 1000 xTokens, they will have to fulfill their obligation by paying the equivalent of 1000 kilograms of the underlying commodity in raw form or fiat currency each year for 49 years.

This contract acts as a pledge, serving as the first security in the event of default by the farmer. In case of non-payment, a portion of their land can be seized to repay their obligations.

After a thorough due diligence and qualification process, the contract is handed to the farmer in the form of an NFT. They can then deposit the NFT into a dedicated smart contract and claim their xTokens.

In case of contract termination, the farmer can proceed in the same manner by depositing xTokens into the smart contract, equivalent to early repayment. As time passes, the required number of xTokens to fulfill their obligations decreases.

Once the xTokens are claimed, the farmer can use them as they see fit.

However, they will need to provide the equivalent of 12 months' worth of yield as collateral on the platform.

Validators

Validators act as the bridge between farmers and the protocol. They are responsible for the due diligence process, qualification, and guiding farmers throughout the process.

Validators provide local legal expertise and help farmers understand how the system works. In some cases, they handle storage, resale, or payment transmission.

They have a responsible role and receive a 1% commission of the financing amount as compensation.

They also need to stake a certain amount of $LNDX (the native token of the protocol) as a pledge of good faith to provide protection to investors. This can be compared to a slashing system.

Investors

Investors enable farmers to raise funds by purchasing xTokens. Whether they are DAOs, individuals, or other entities, xTokens offer them diversification and real-world yield.

All protection measures such as pledges, collateral deposits, the slashing system, and the due diligence process are implemented to safeguard them against internal system malfunctions.

$LNDX

Initially, and in order to grow properly, the protocol will have a certain degree of centralization but will gradually transfer governance to the DAO.

$LNDX is the native token of the platform. Holding and staking $LNDX will allow capturing the value of the protocol through fee redistribution and having governance power. As mentioned earlier, they will also be required to become a validator.

Staking

To benefit from the fees and governance power, you will need to stake your $LNDX or rather lock them to obtain veLNDX.

The locking period will range from 1 to 48 months, and of course, the longer you lock, the more veLNDX you receive, thus receiving more fees and power.

Fees

The yield from xTokens incurs a 10% fee. These fees will be redistributed as follows:

-

60% to $LNDX holders

-

35% to the LandX treasury

-

5% to LandX Choice

Tokenomics and Acquisition

Regarding tokenomics, I refer you to this article.

It is also possible to participate in the private round through PrimapesDAO.

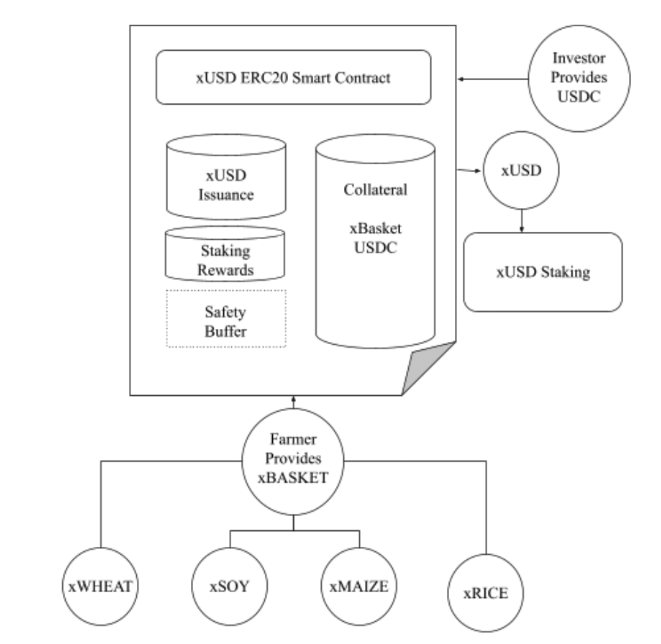

xBasket

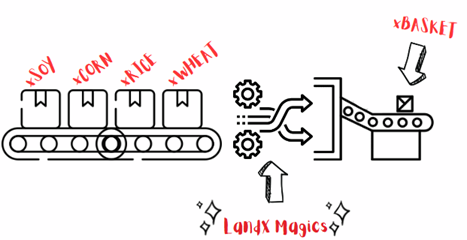

Similar to other LandX tokens, xBasket is an ERC-20 token tradable in DeFi. The uniqueness of xBasket is that it represents a basket of xTokens, providing exposure to each of them while optimizing gas.

This brings an additional level of diversification by accessing the yield of the four underlying commodities.

Users can directly purchase, mint by providing an equivalent amount of the four tokens, or redeem them for an individual token.

1 xBasket represents 0.25 xSOY, 0.25 xCORN, 0.25 xRICE, 0.25 xWHEAT.

Of course, the underlying xTokens are staked, and the yield is auto-compounded.

xUSD

xUSD is an algorithmic stablecoin designed to be pegged to the US dollar (USD).

Unlike other algorithmic stablecoins, xUSD is overcollateralized to reduce depeg risks.

Its uniqueness lies in the fact that its collateral is composed of RWAs (Real-World Assets) available in the LandX ecosystem. These assets are represented by xTokens. The xTokens are bundled together in the xBasket index, which serves as collateral for xUSD.

A comprehensive description of the stablecoin would likely make this article too long, so I invite you to read this article by LandX about it or, for a deeper dive, read the dedicated whitepaper here.

Conclusion

Now we arrive at my personal conclusion, which is solely my own (0xEvix).

I find the protocol interesting and the team dedicated. The idea of building a real bridge between farmers and DeFi is superb, and in the long run, it is certain that blockchain and DeFi will serve multiple sectors of the real world in ways we may not even imagine yet.

I also want to point out that I deliberately omitted emphasizing points such as the need for farmers' financing, the positive effects LandX could have in the world, the protocol's commitment to responsible practices, etc.

However, I am just a simple Ape. I am not aware of the needs/problems of farmers or their real concerns. Therefore, it is very difficult for me to assess the demand for such a product.

RWAs are indeed growing, but I believe it is still early for a value proposition like this. I may be wrong.

Furthermore, reading in the documentation that "LandX is a decentralized system to reduce the impacts of food scarcity and instability on a local and global scale." feels a bit "too much," although I do not question the team's good intentions.

I will keep an eye on the project's development and success, and I wish the team much success.

Follow @LandXFinance

Website: https://testnet.landx.fi/

Twitter: https://twitter.com/landxfinance

Discord: https://discord.com/invite/landx