The weekly 🐰 hole (2 Apr 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (2 Apr 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

The US government just sold their BTC, Stablecoin market cap is going down, rotators are rotating, welcome to the crab market Anon.

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

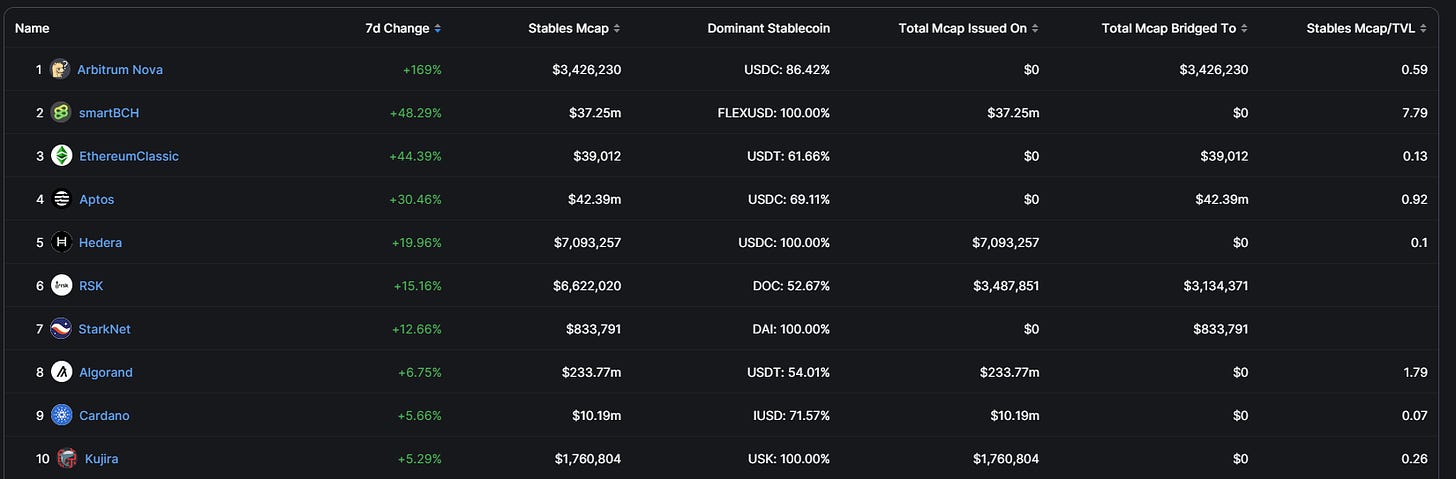

1. Stablecoin Flows

Total Stablecoin MCAP = 131.81 bil, with -1.58% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Arbitrum Nova

-

Smart BCH

-

EthereumClassic

-

Aptos

-

Hedera

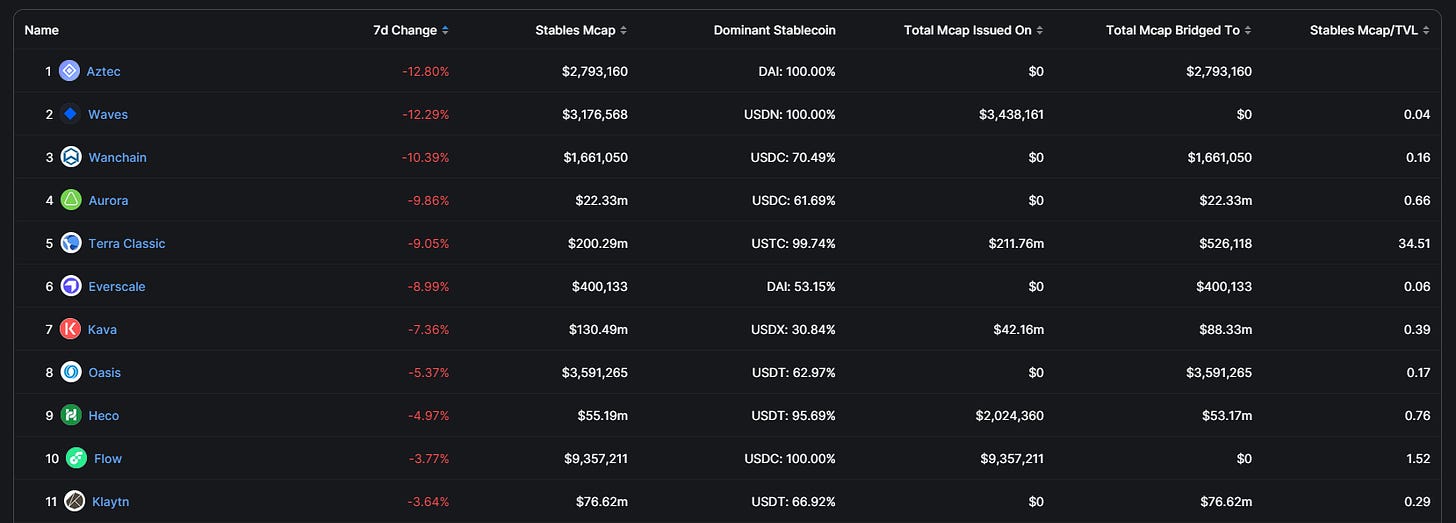

Top outflows:

-

Aztec

-

Waves

-

Wanchain

-

Aurora

-

Terra Classic

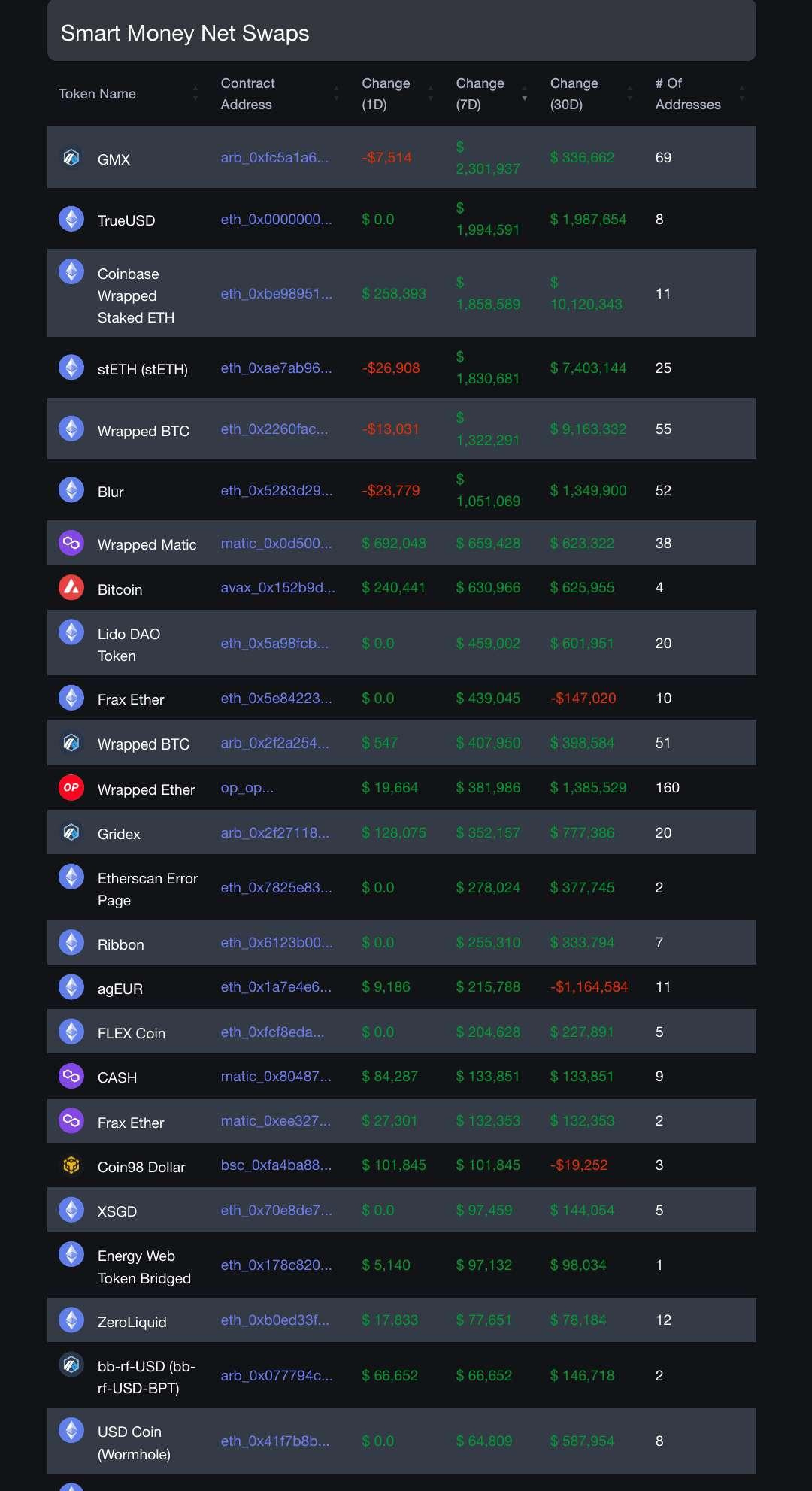

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

USDT

-

USDC (Arbitrum)

-

GMX

-

TrueUSD

-

stETH

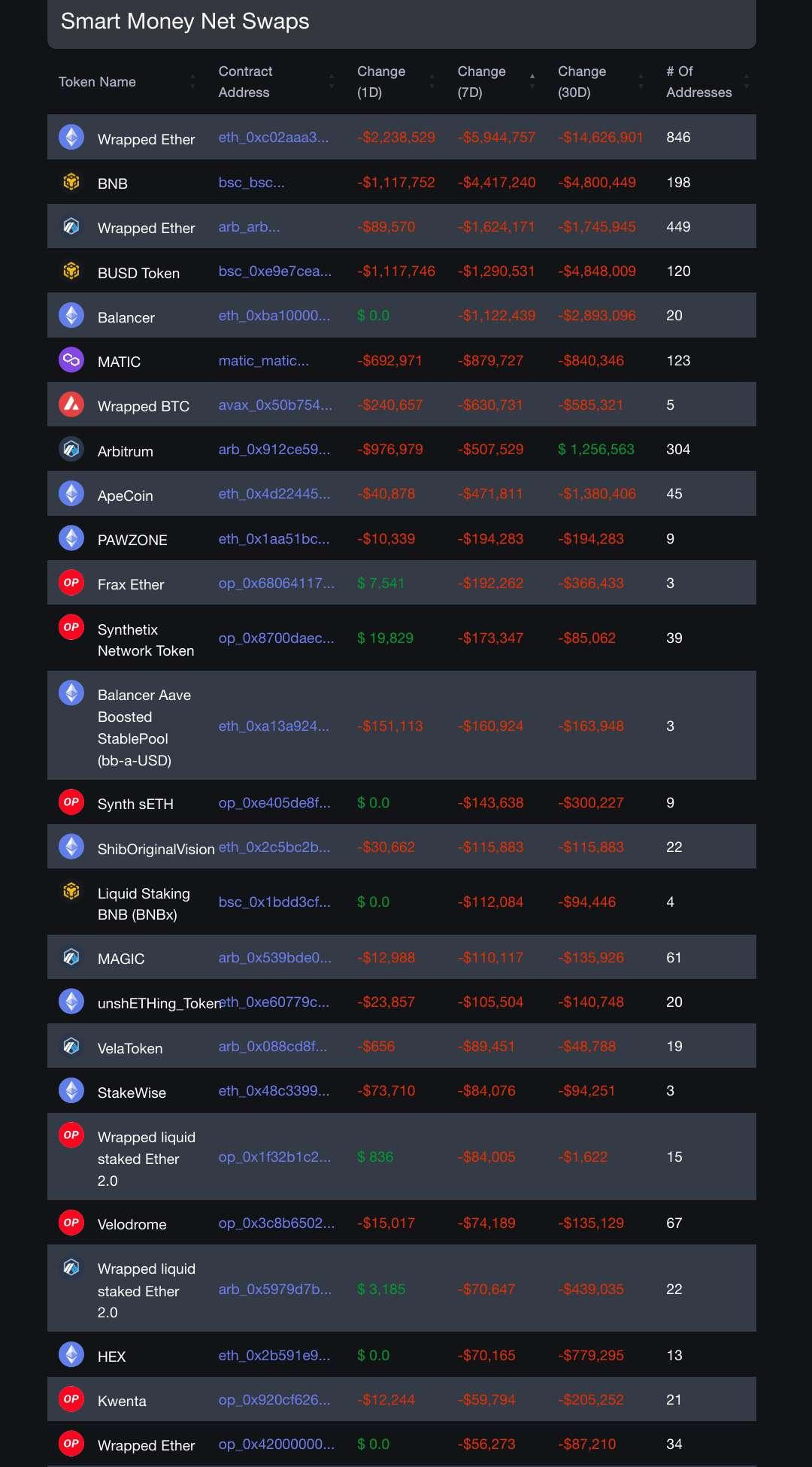

Top Smart money outflows (including stablecoins):

-

USDC

-

Wrapped Ether

-

USDT (Arbitrum)

-

USDT (BNB)

-

BNB

Top Smart money inflows (excluding stablecoins):

-

GMX

-

TrueUSD

-

Coinbase Wrapped Staked ETH

-

stETH

-

Wrapped BTC

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

BNB

-

Wrapped ETH (Arbitrum)

-

BUSD

-

Balancer

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

Optimism

-

Polygon

-

Solana

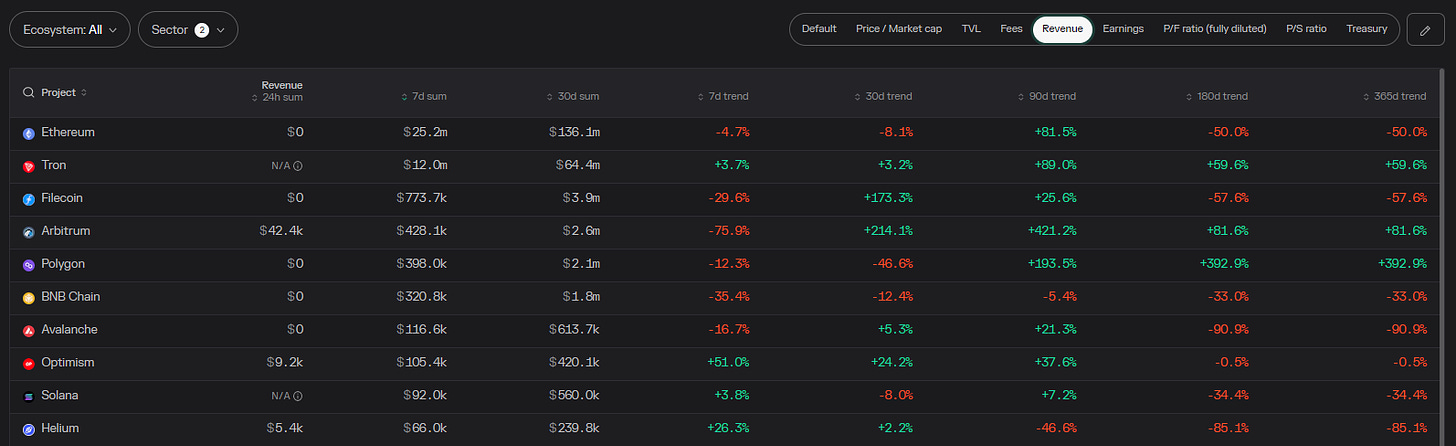

Revenue

-

ETH

-

Tron

-

Filecoin

-

Arbitrum

-

Polygon

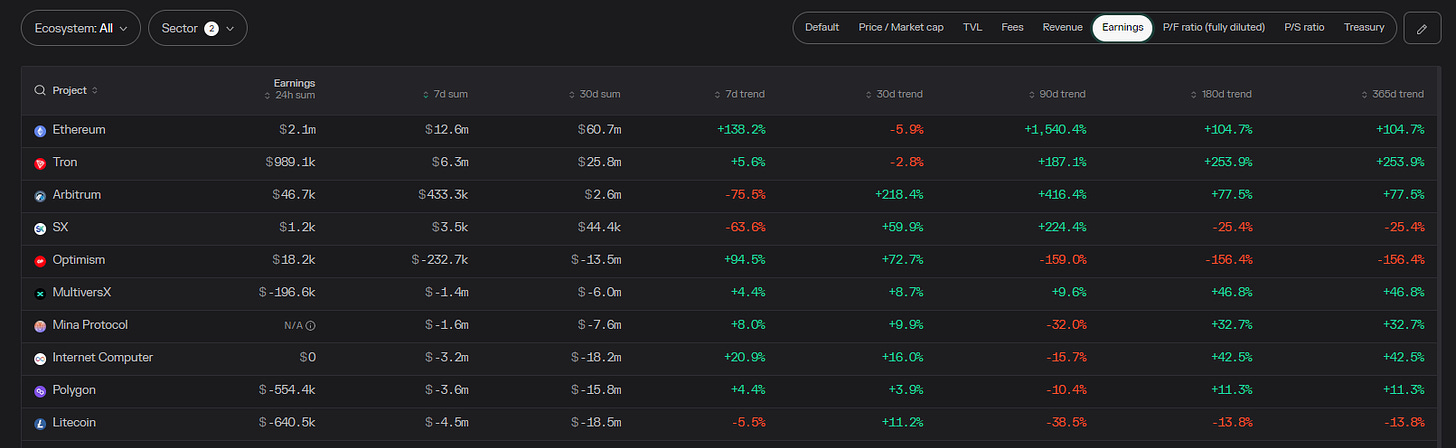

Earnings

-

ETH

-

Tron

-

Arbitrum

-

SX

-

Optimism

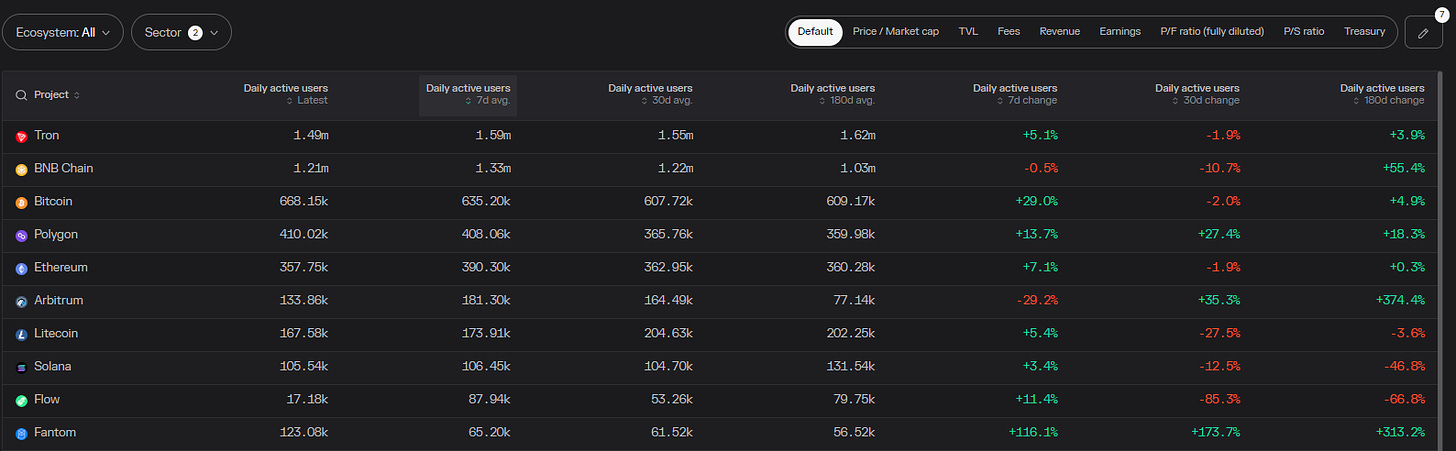

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

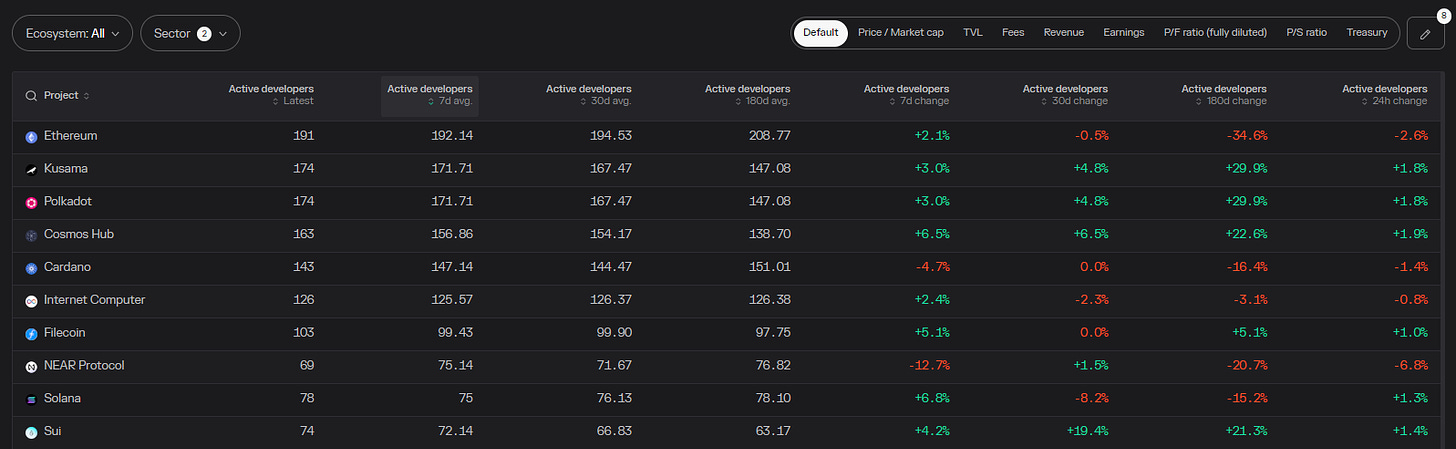

Active Developers

-

ETH

-

Kusama

-

Polkadot

-

Cosmos

-

Cardano

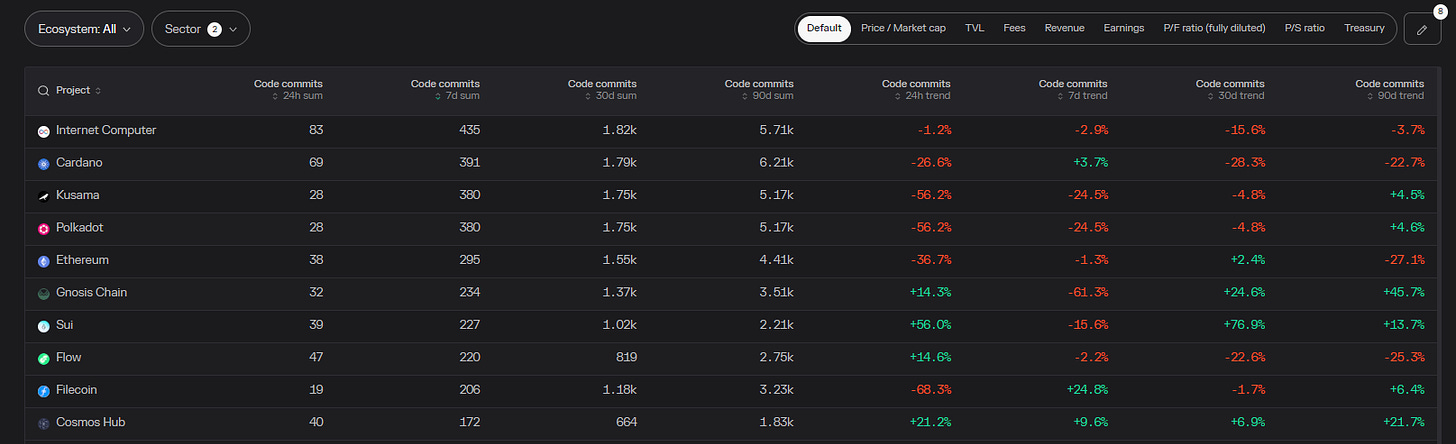

Code Commits

-

Internet Computer

-

Cardano

-

Kusama

-

Polkadot

-

ETH

4. Top DAPP Financials

Fees-Generated

-

Uniswap

-

Lido

-

GMX

-

Convex

-

OpenSea

Revenue

-

Synthetix

-

dYdX

-

GMX

-

Lido

-

Level Finance

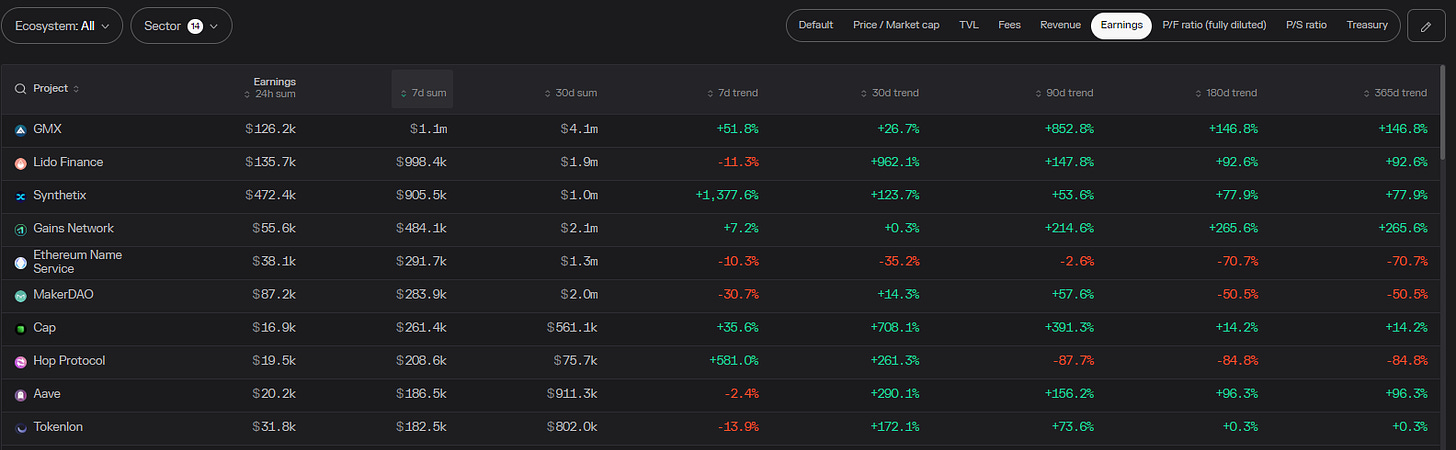

Earnings

-

GMX

-

Lido

-

Synthetix

-

Gains Network

-

Ethereum Name Service

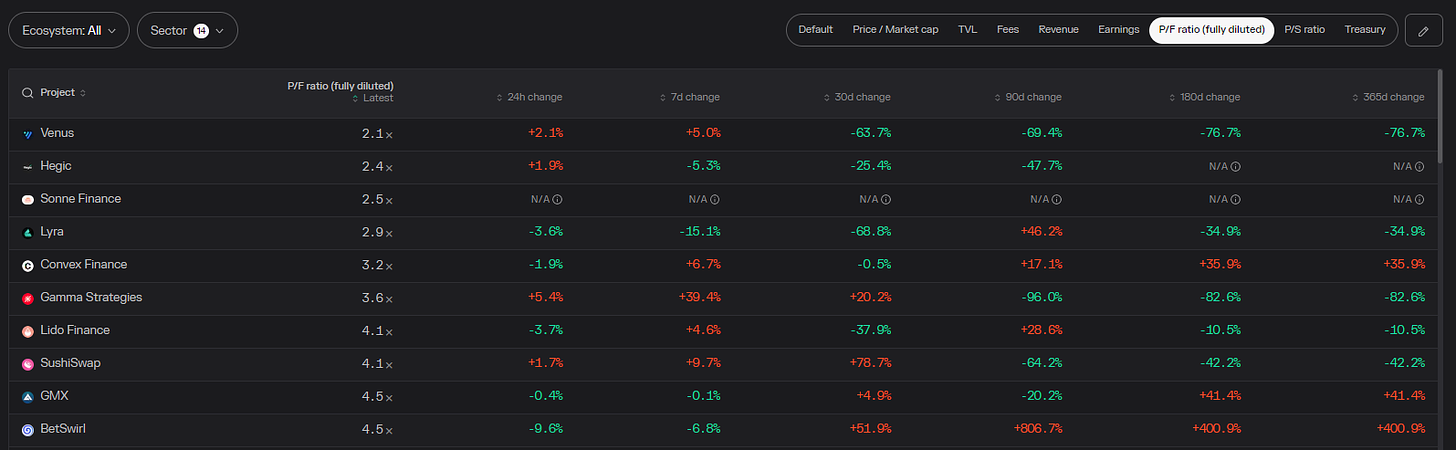

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Venus

-

Hegic

-

Sonne

-

Lyra

-

Convex

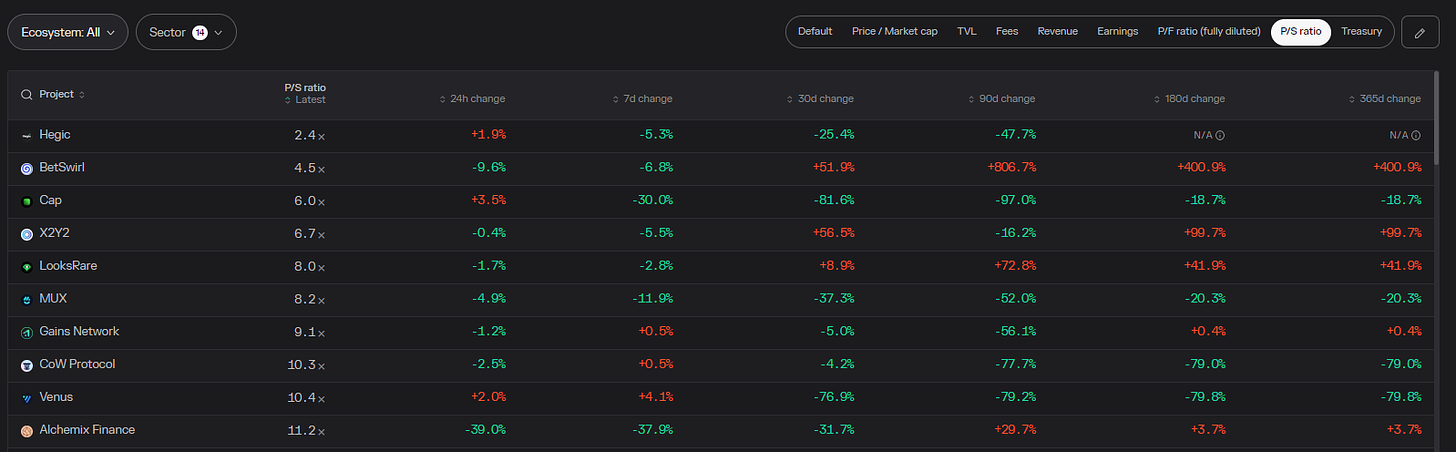

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

BetSwirl

-

Cap

-

X2Y2

-

LooksRare

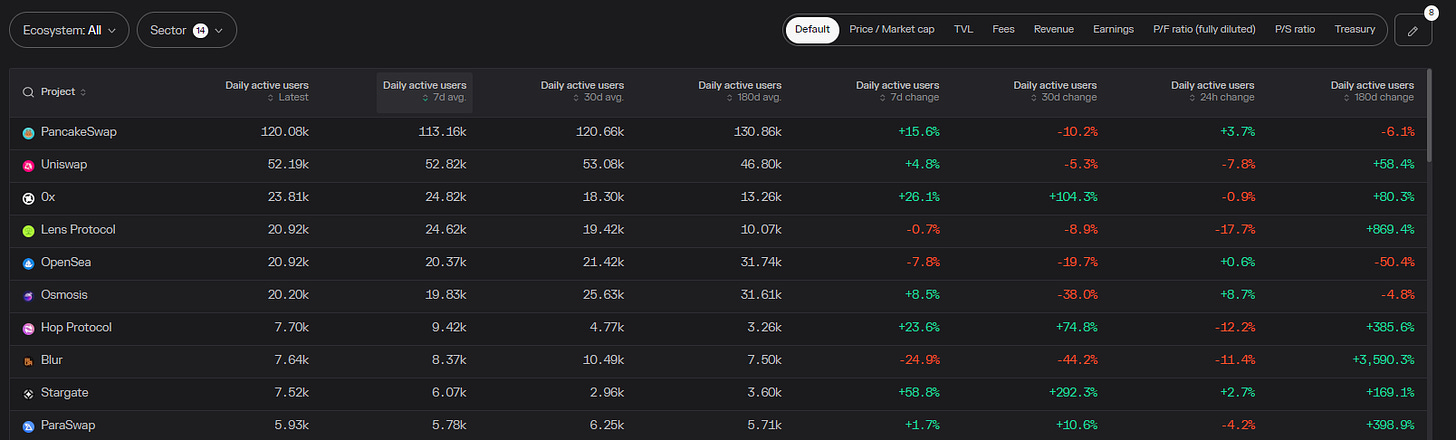

DAUs

-

Pancakeswap

-

Uniswap

-

0x

-

Lens Protocol

-

OpenSea

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market went down by -1.58% this week.

-

Arbitrum Nova received the largest stablecoin inflow this week at 169%.

-

Aztec saw the largest stablecoin outflow this week at -12.29%.

Smart Money Movement:

-

BNB chain is seeing significant outflows (e.g. BUSD, BNB, etc) as the CFTC lawsuit weighs down on Binance future outlook.

-

ETH derivatives (e.g. Coinbase staked ETH, stETH, etc) remain Smart Money’s go-to investment as they front-run arbitrage/farming opportunities ahead of the planned Shanghai upgrade on 12 April 2023.

-

GMX continues to perform well throughout 1Q 2023 with Smart Money increasing their stake in the protocol.

L1/L2 movement:

- Arbitrum TVL hit its previous ATH and came down slightly. Liquidity has remained sticky post-$ARB airdrop, which is rare. I have a strong conviction Arbitrum chain will shine throughout the rest of 2023.

-

ZK hype is dying down, with ZK sync and Starknet seeing reduced liquidity inflows this week. High gas fees and the lack of Dapps on both chains are withholding further liquidity from flowing into the ecosystem. However, this will most likely improve over time as more protocols start launching on these chains.

-

Internet Computer continues to build in this crab market with many code commits this week.

DAPP movements:

-

Synthetix and Defi perpetual protocols remain the top revenue-generating protocols this year, capturing top spots across various metrics consistently. I will be watching this space closely to identify any +EV opportunities.

-

Shanghai upgrade has been confirmed on 12 Apr 2023, LSD protocols (e.g. LDO, RPL, SWISE, etc) could perform well this month.

6. TLDR

-

Crab season is here to stay at the moment. It is a good time to monitor your positions by cutting losses and doubling down on winners, with a focus on protocols with positive cashflows.

-

$ARB remains fundamentally undervalued on a TVL and DAU level, despite recent allegations regarding the misuse of funds and poor communication.

https://twitter.com/blockworksres/status/1641843788716060672?s=20

-

Perpetuals and LSD protocols are my biggest conviction holds. Probably a good idea to watch these 2 sectors to identify +EV opportunities that will outperform BTC/ETH.

-

ZK season remains in full swing with mainnet launch announced across various protocols. Try to bridge some funds, and play around with native Defi Apps in ZK-EVM chains to qualify for potential airdrops.

https://twitter.com/apes_prologue/status/1641447947778007044?s=20

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: