The weekly 🐰 hole (28 May 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (28 May 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

🐰 Content

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

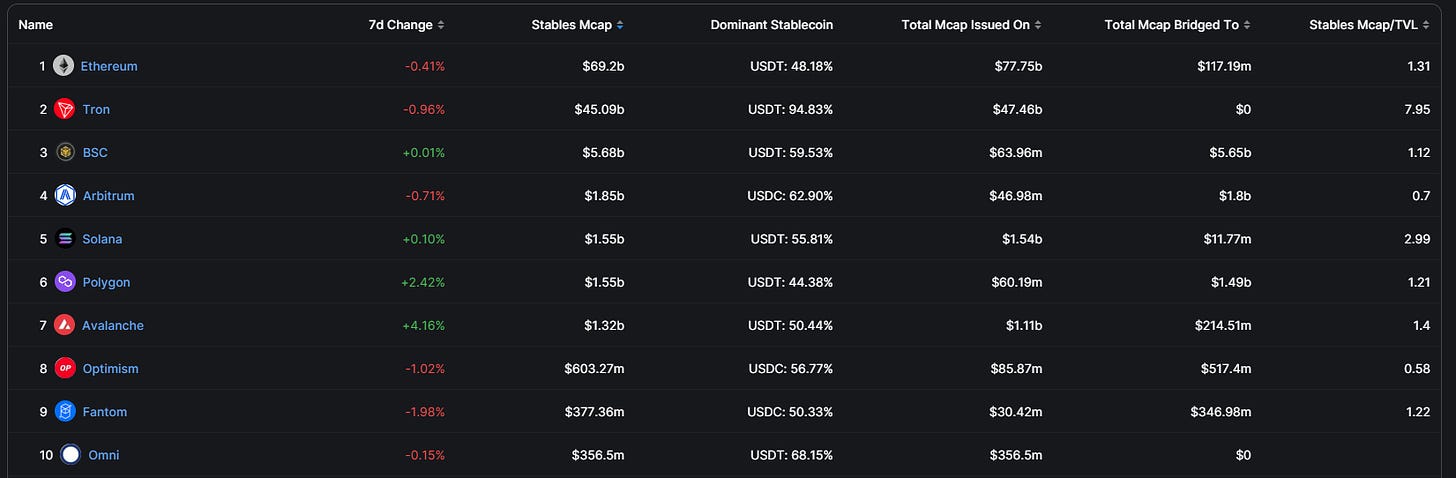

1. Stablecoin Flows

Total Stablecoin MCAP = 129.31 bil, with -0.43% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Evmos

-

Hedera

-

StarkNet

-

Flow

-

SXnetwork

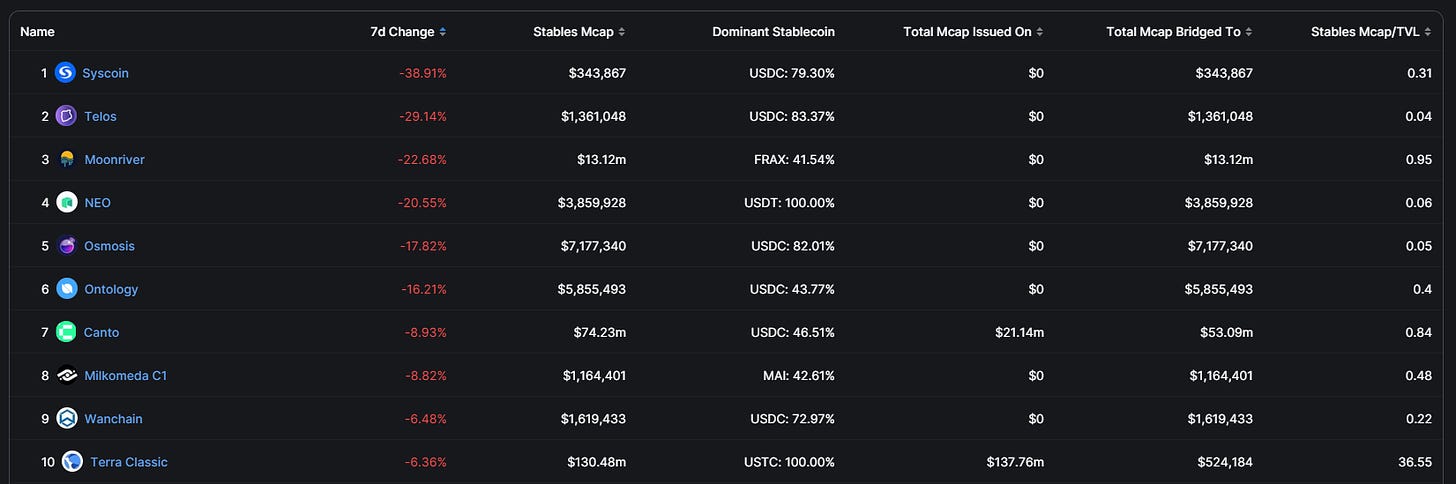

Top outflows:

-

Syscoin

-

Telos

-

Moonriver

-

Neo

-

Osmosis

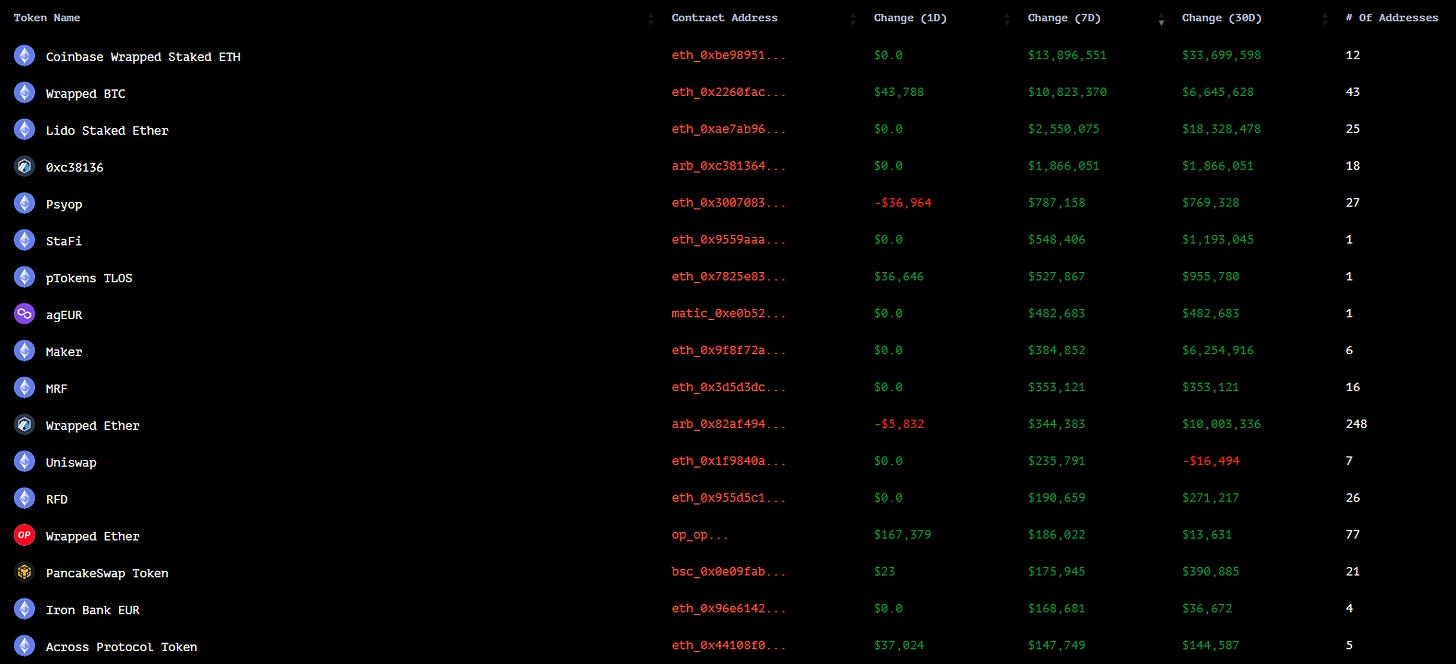

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Coinbase Wrapped Staked ETH

-

Wrapped BTC

-

USDC

-

MIM

-

Lido staked ETH

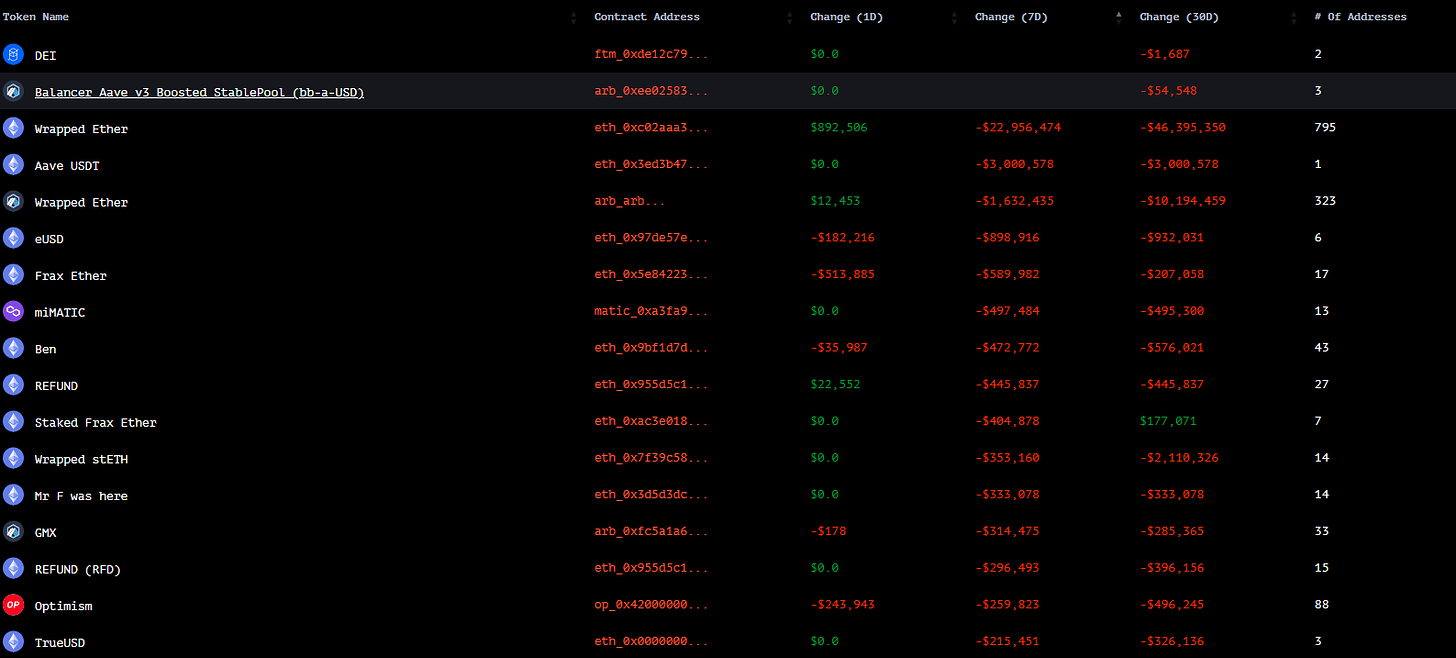

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

USDT

-

Dai

-

Aave USDTUSDC

-

Wrapped ETH (Arbitrum)

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

Wrapped BTC

-

Lido staked ETH

-

Jimbo

-

Psyop

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Aave USDT

-

Wrapped Ether

-

eUSD

-

Frax Ether

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

BNB

Earnings

-

ETH

-

Tron

-

BNB

-

Optimism

-

Arbitrum

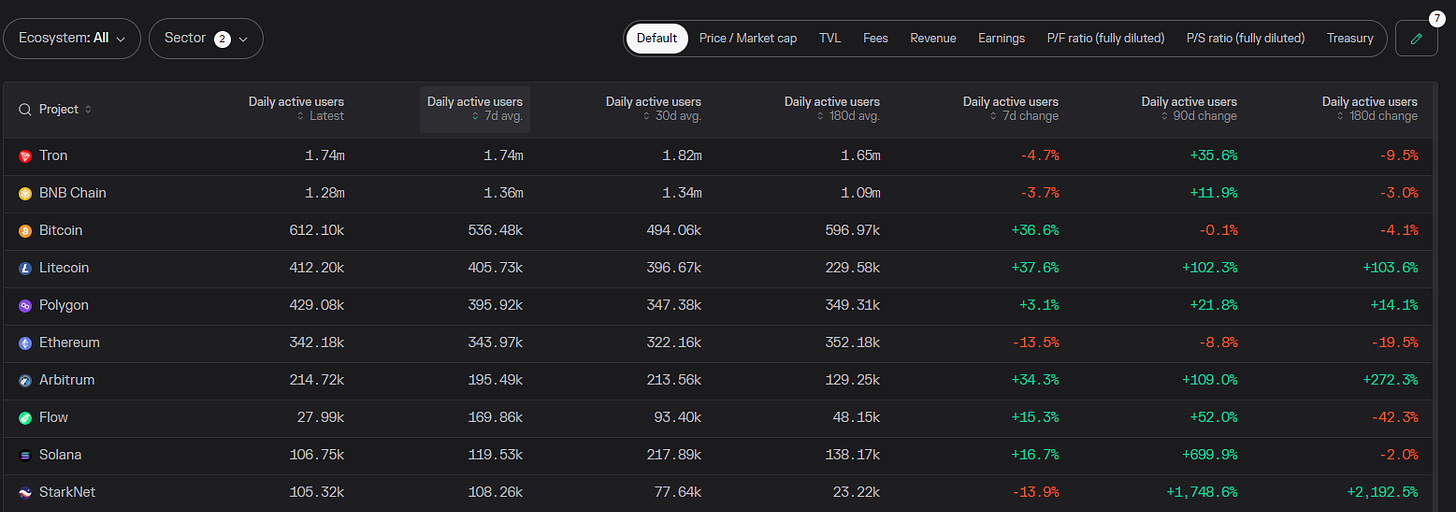

DAUs

-

Tron

-

BNB

-

BTC

-

Litecoin

-

Polygon

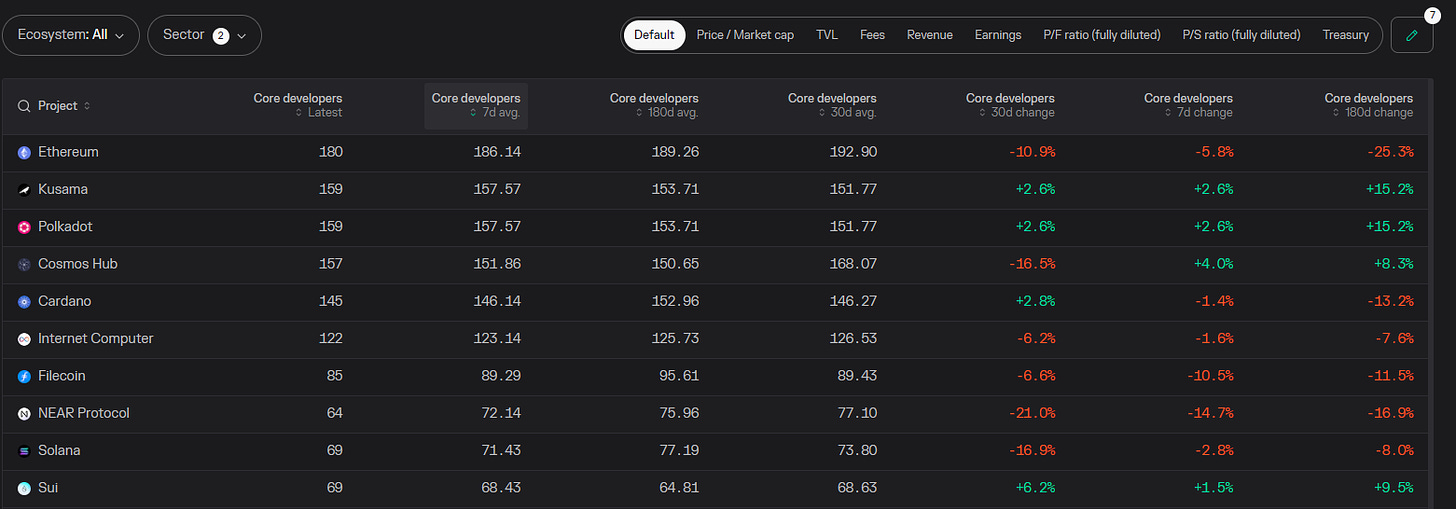

Active Developers

-

ETH

-

Kusama

-

Polkadot

-

Cosmos

-

Cardano

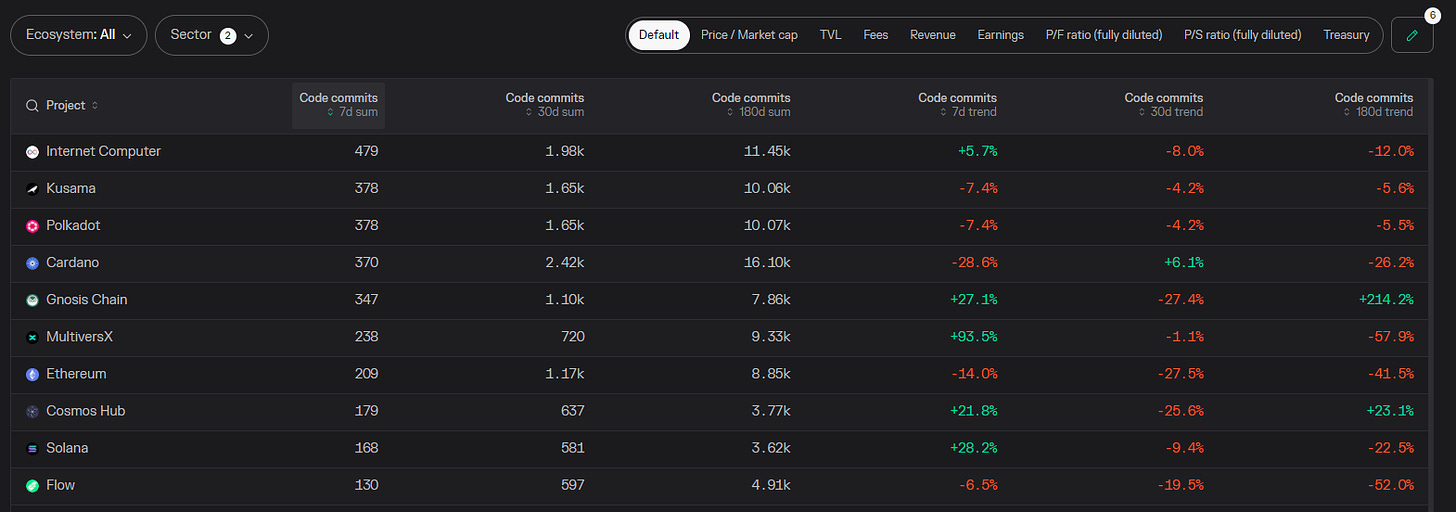

Code Commits

-

Internet Computer

-

Kusama

-

Polkadot

-

Cardano

-

Gnosis Chain

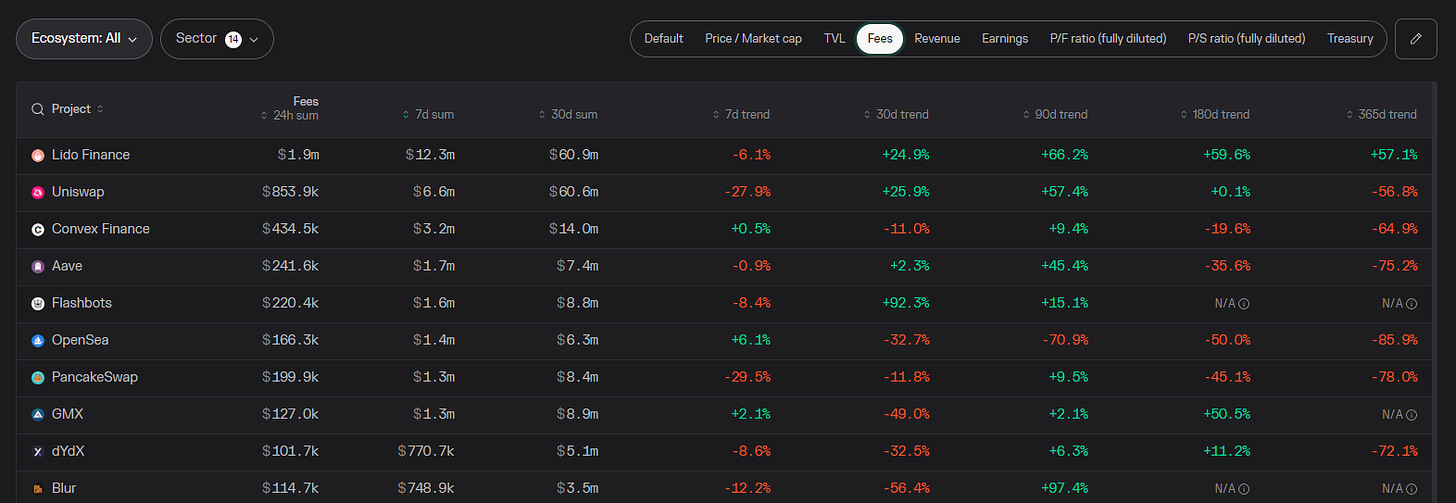

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Convex

-

Aave

-

Flashbots

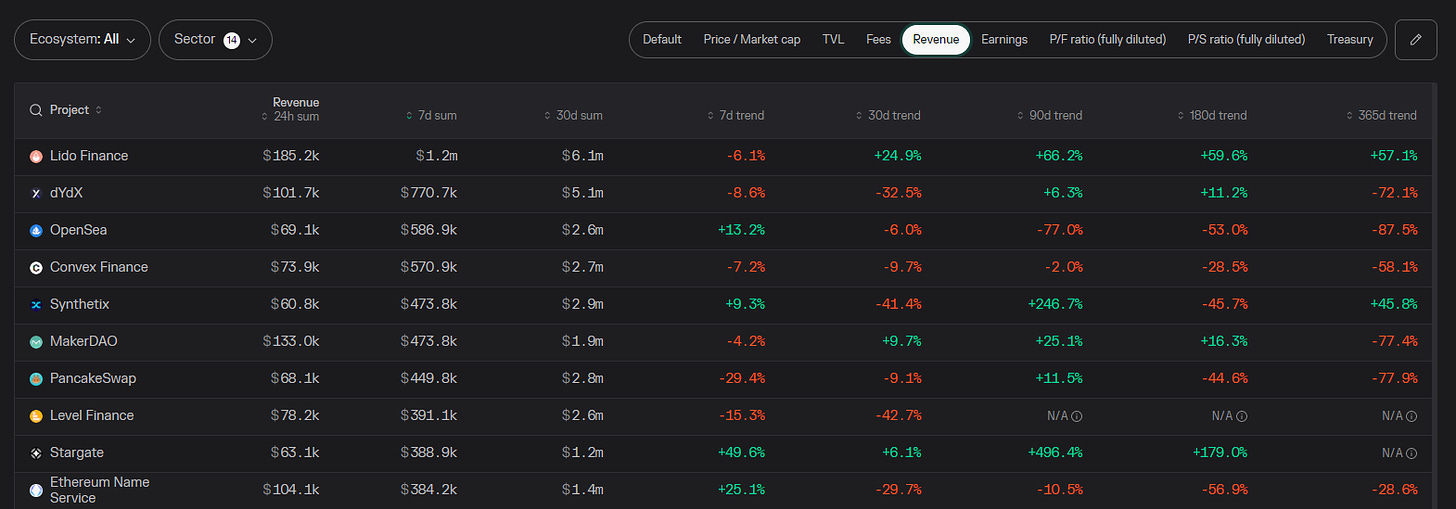

Revenue

-

Lido

-

dYdX

-

Opensea

-

Convex

-

Synthetix

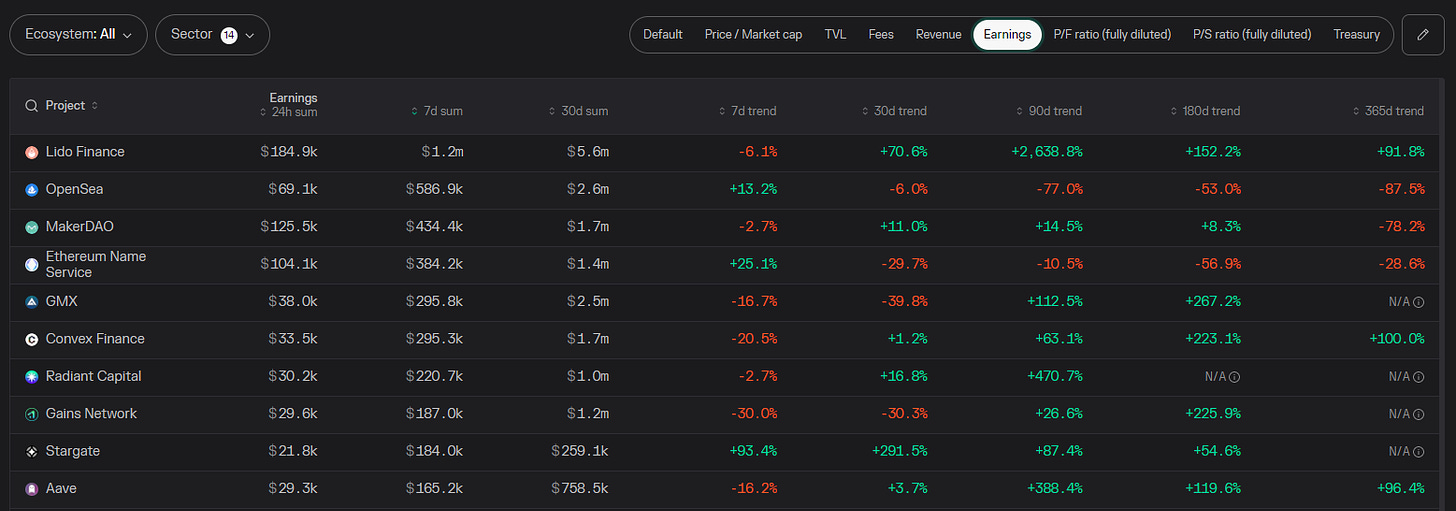

Earnings

-

Lido

-

OpenSea

-

Maker

-

ENS

-

GMX

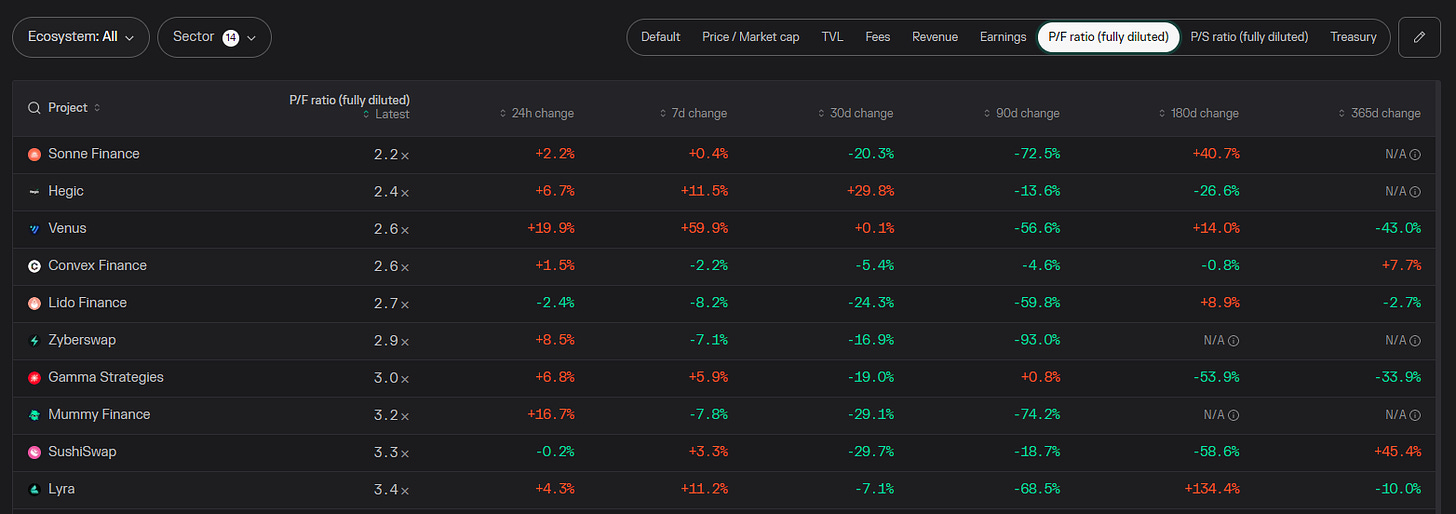

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Sonne Finance

-

Hegic

-

Venus

-

Convex

-

Lido

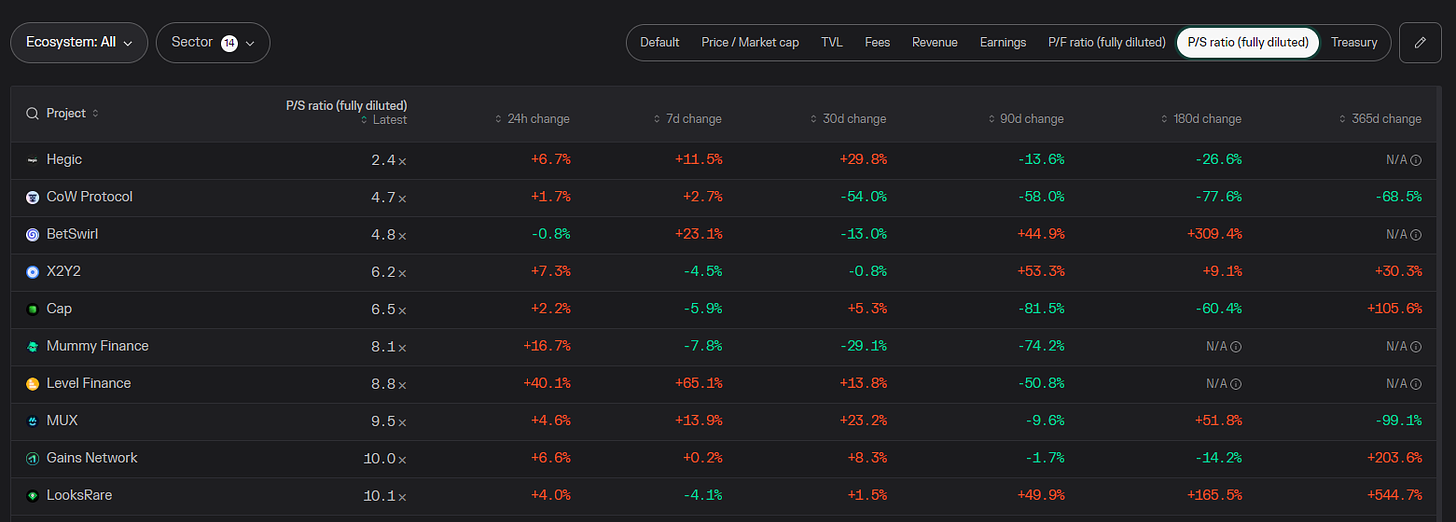

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

CoW

-

BetSwirl

-

X2Y2

-

Cap

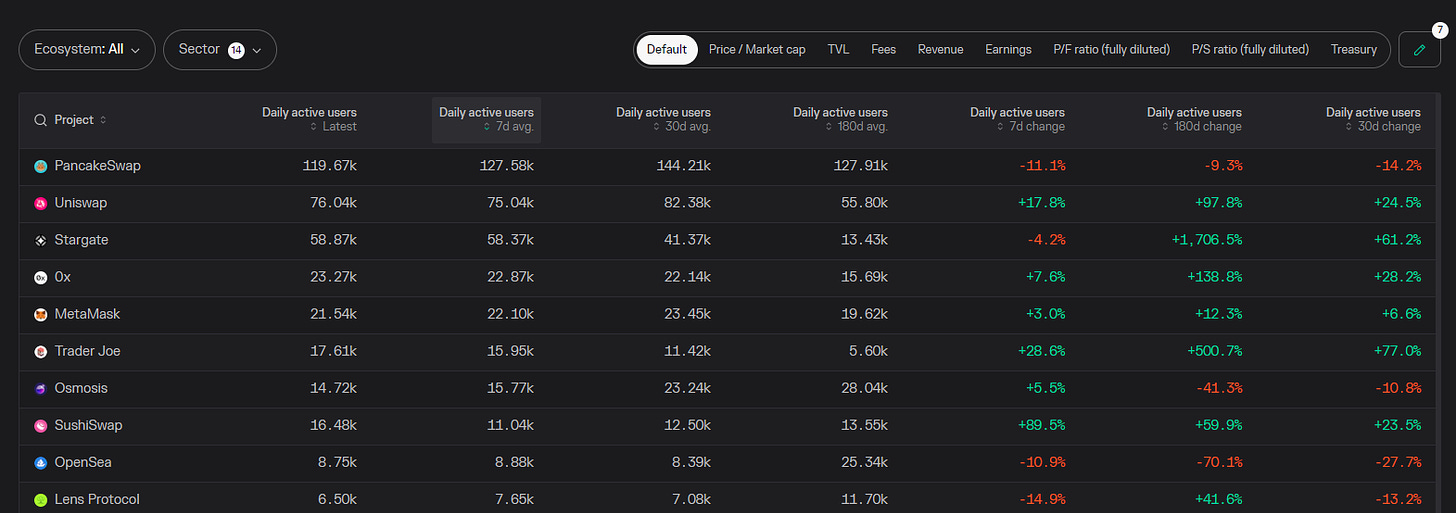

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap continues its downtrend this week at -0.54%.

-

Evmos, Hedera and Starknet are seeing significant stablecoins inflows this week.

Smart Money Movement:

- Smart money continues to accumulate ETH derivatives (Coinbase wrapped staked ETH, Lido staked ETH). LSDfi summer could come sooner than we realise.

L1/L2 movement:

-

Arbitrum maintains its lead as the top L2 this week, with a $2.35 billion TVL in the midst of the current crab market.

-

ZK Sync era TVL continues to climb, becoming one of the fastest L2 to reach $131 million TVL.

DAPP movements:

-

LSD continue to be the top category performer this week.

-

Swell network voyage is now live, pearl airdrops have been confirmed for Stakers and LP participants.

- unshETH dropped alpha in their recent AMA. Here is a quick summary of the current status of unshETH’s roadmap.

- Alpha drop by @apes_prologue

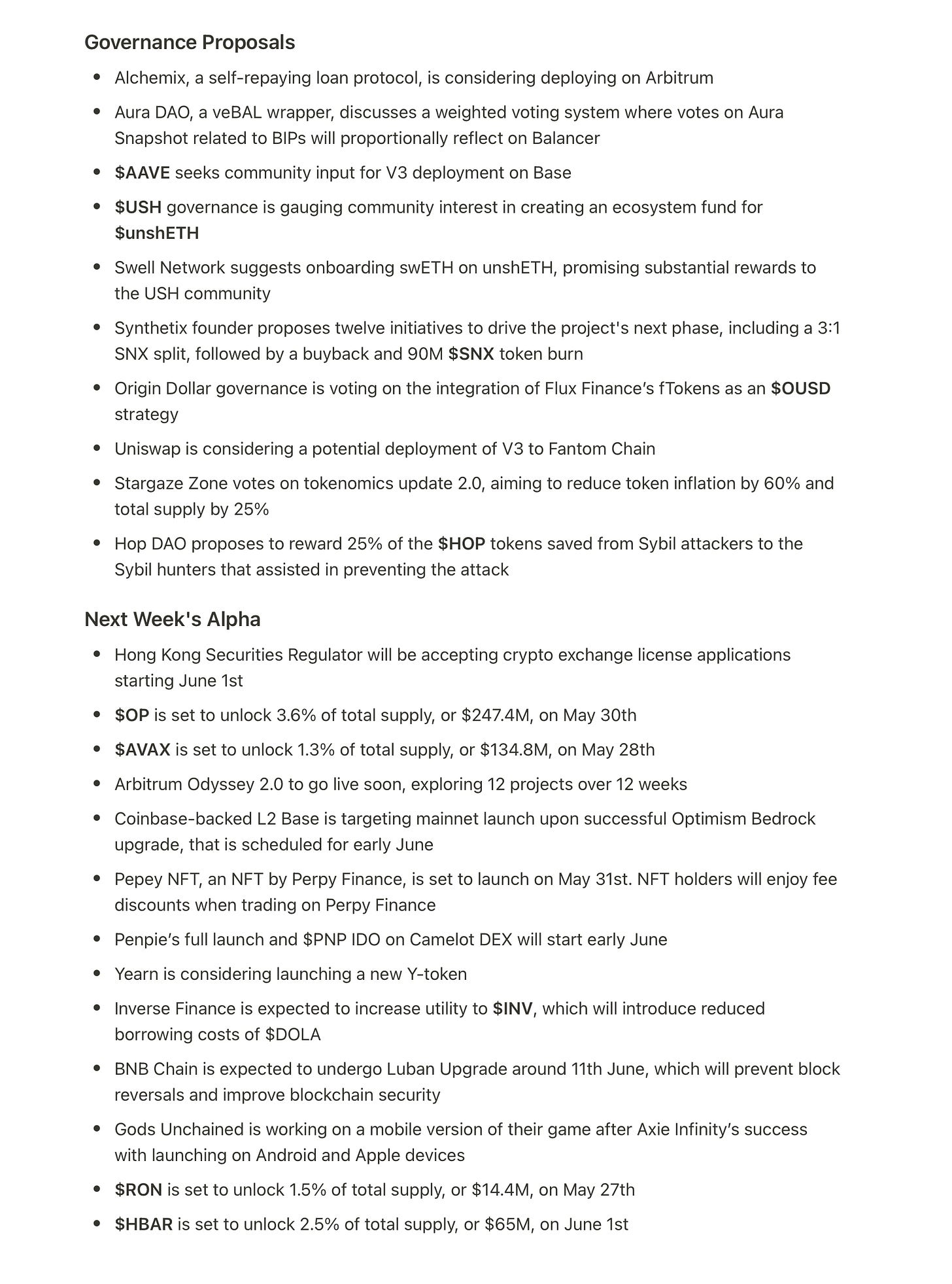

6. TLDR

-

Another slow week as the market continues to chop sideways. It is probably the time to reposition your portfolio into good protocols in profitable categories (e.g. LSDfi, Perpetual Dexes, etc)

-

Truflation’s latest US CPI forecast is at 2.87%. After 18 months of bear/crab, the light at the end of the tunnel seems close.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: