The weekly 🐰 hole (11 June 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (11 June 23) of liquidity movements & DeFi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

Sigh…the market is puking again… maybe it’s time to hand in those McDonald's recruitment forms my fellow degens.

🐰 Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 128.19 bil, with -0.73% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

ThunderCore

-

Polygon zkEVM

-

zkSync Era

-

Ontology

-

Moonriver

Top outflows:

-

Kardia

-

Telos

-

TomoChain

-

Kava

-

Wanchain

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

USDT

-

Coinbase Wrapped Staked ETH

-

stETH

-

Matic

-

Wrapped BTC

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

USDC

-

TAI reflex index

-

Dai

-

Balancer

-

Frax

Top Smart money inflows (excluding stablecoins):

-

Coinbase Wrapped Staked ETH

-

eUSD

-

wstETH

-

Wrapped ETH (Polygon)

-

Wrapped ETH (Arbitrum)

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Aave USDC

-

Tai reflex index

-

Balancer

-

Wrapped ETH (Polygon)

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

Arbitrum

-

Optimism

-

Solana

Revenue

-

ETH

-

Tron

-

BSC

-

Avalanche

-

Arbitrum

DAUs

-

Tron

-

BNB

-

BTC

-

Polygon

-

ETH

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Cosmos

-

BTC

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Pancakeswap

-

GMX

-

Level Finance

Revenue

-

Pancakeswap

-

Lido

-

Convex Finance

-

Metamask

-

Level Finance

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

Equilibre

-

Equalizer Exchange

-

Level Finance

-

Mummy Finance

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

El Dorado Exchange

-

Equilibre

-

Equalizer Exchange

-

Level Finance

-

X2Y2

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

GMX

-

Synthetix

-

Convex Finance

-

Pancakeswap

-

Level Finance

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

Raises - Recent funding rounds

-

HyperPlay

-

Taiko

-

Lens Protocol

-

Informal Systems

-

Argus

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap continues its downtrend this week at -0.55%. However, despite the recent SEC lawsuit wave, this drop is relatively muted, which could indicate that crypto natives view this as a nothing burger.

-

zk-rollup chains like Polygon zkEVM,zkSync Era and StarkNet continue to attract significant stablecoin flows despite the current regulatory uncertainty.

-

Kardia, Telos and TomoChain saw the largest stablecoin outflows.

Smart Money Movement:

-

Smart money is playing relatively defensively, with large conversions into USDT and the continued accumulation of ETH and its derivatives.

-

Smart money started buying $OX from OPNX, a new crypto exchange started by previous 3AC founders Su Zhu and Kyle Davies.

L1/L2 movement:

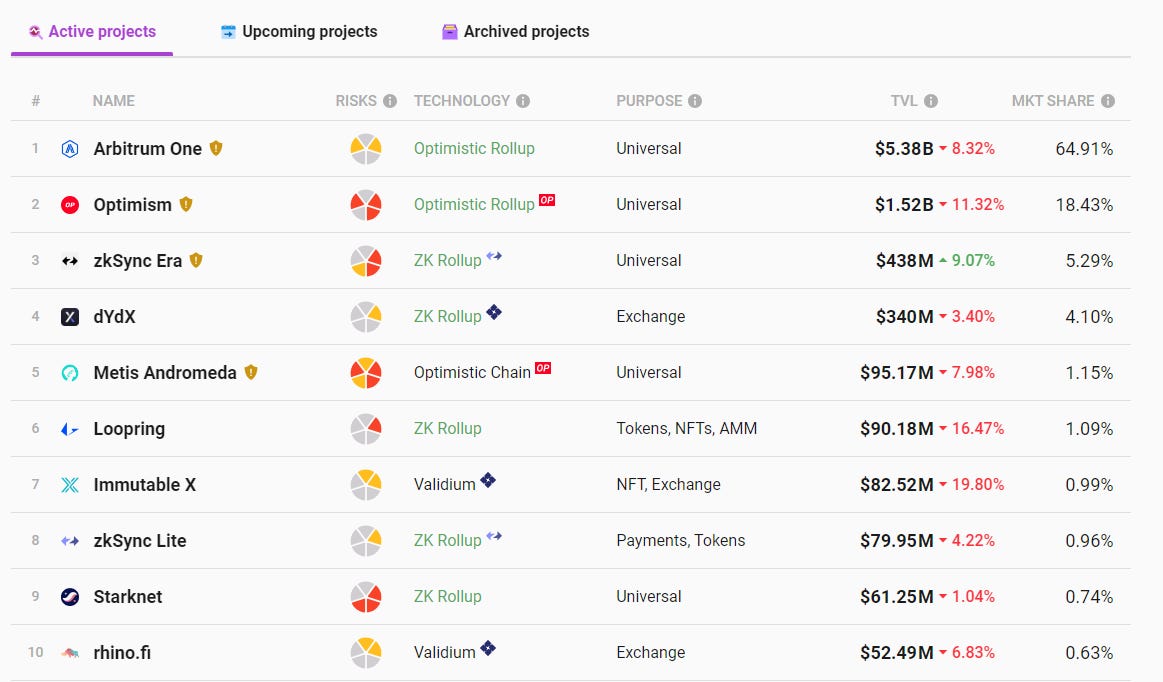

- zkSync’s TVL is the only one in the green this week as it continues to grab market share from existing optimistic rollups like Arbitrum and Optimism.

DAPP movements:

-

Perp dexes like GMX and Level Finance rakes in fees as trading volatility spike with the recent market dump.

-

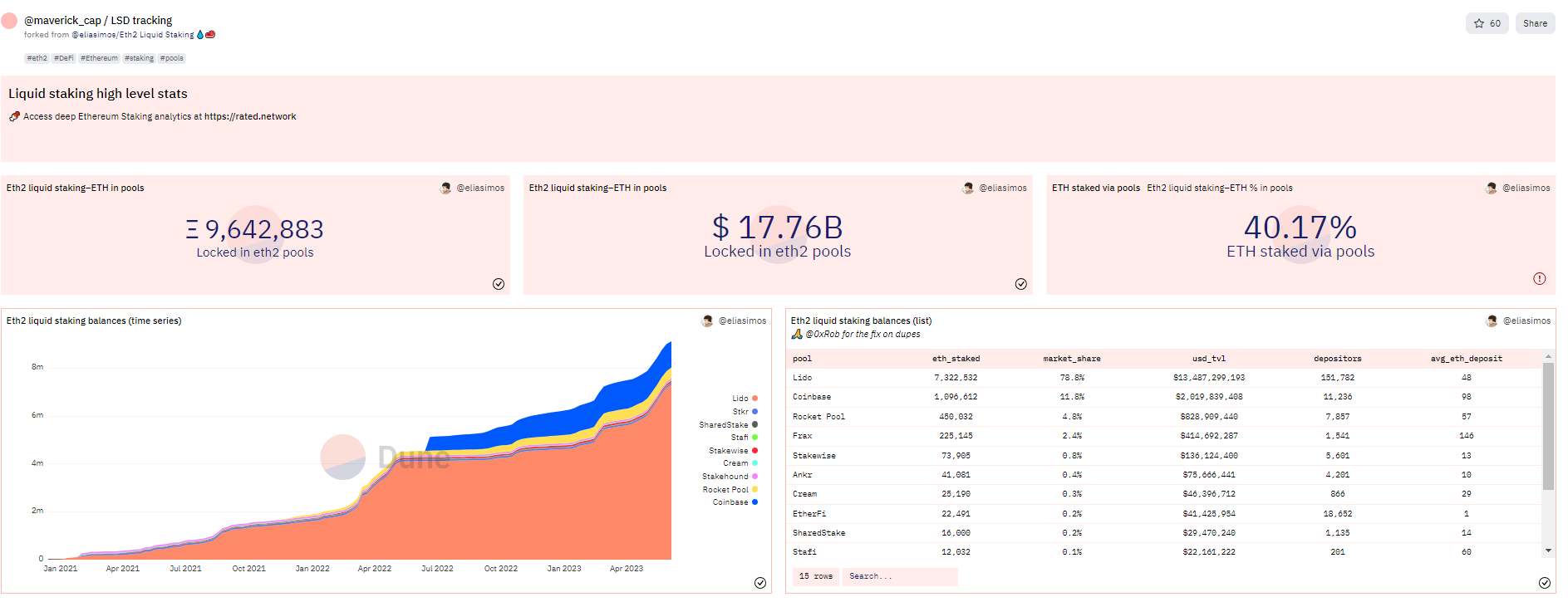

~17.8 billion worth of $ETH has been locked in LSD protocols, and the growth shows no sign of stopping. LSD aggregators/swaps/black holes could reap the benefits of this burgeoning asset class.

- Alpha drop by @apes_prologue.

6. TLDR

-

LSDfi summer is primed to take off. I would spend some time now identifying protocols that provide a unique product-market fit in this burgeoning asset class.

-

Institutions continue to adopt blockchain technology despite the current regulatory uncertainty. If you are getting weak-handed now, you are NGMI.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: