The weekly 🐰 hole (2 July 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (2 July 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

What a rollercoaster this week as BTC failed to break the $32K resistance post-SEC statement on filling inadequacies. Let’s see what other excuses the SEC will come up with to reject a spot BTC ETF.

🐰Content:

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 123.23 bil, with -4.35% weekly change.

Top 10 Chain (In terms of Stables Mcap):

Top inflows:

-

Fuse

-

zkSync Era

-

Flow

-

Cardano

-

IoTeX

Top outflows:

-

Hedera

-

Waves

-

Syscoin

-

EthereumClassic

-

BSC

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

USDC

-

DAI

-

rETH

-

cbETH-bb-a-WETH-BPT

-

Curve USD stablecoin

Top Smart money outflows (including stablecoins):

-

USDT

-

Wrapped ETH

-

Tai Reflex Index

-

USDC (Arbitrum)

-

Wrapped ETH (Polygon)

Top Smart money inflows (excluding stablecoins):

-

rETH

-

cbETH-bb-a-WETH-BPT

-

Curve USD stablecoin

-

R stablecoin

-

Arbitrum

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

TAi reflex index

-

Wrapped ETH (Polygon)

-

Curve DAO token

-

Convex

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BTC

-

BNB

-

Arbitrum

-

Optimism

Revenue

-

ETH

-

Tron

-

BSC

-

Arbitrum

-

Avalanche

DAUs

-

Tron

-

BNB

-

Polygon

-

ETH

-

Arbitrum

Active Developers

-

ETH

-

Polkadot

-

Cosmos

-

Solana

-

BTC

Code Commits

-

ETH

-

Polkadot

-

Solana

-

Cosmos

-

BTC

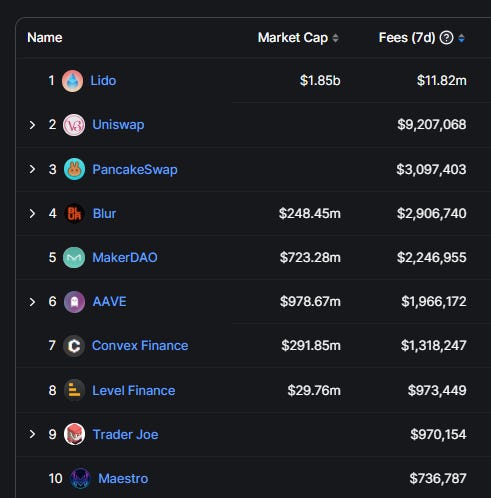

4. Top DAPP Financials

Fees-Generated

-

Lido

-

Uniswap

-

Pancakeswap

-

Blur

-

MakerDao

Revenue

-

MakerDAO

-

Lido

-

Convex Finance

-

PancakeSwap

-

Maestro

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

El Dorado Exchange

-

Level Finance

-

Equilibre

-

Mummy Finance

-

GND Protocol

P/S ratio

FDV Mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

El Dorado Exchange

-

Level Finance

-

Equilibre

-

X2Y2

-

GND Protocol

Holders Revenue

Cumulative revenue attributable to holders 24 Hours

-

Pancakeswap

-

Synthetix

-

Curve Finance

-

Radiant

-

Gains Network

DAUs - Daily

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Metamask

Trending Applications

-

Holograph

-

Project Galaxy

-

Vela

-

Uniswap

-

Spaceid

Raises - Recent funding rounds

-

Outdid

-

Mind Network

-

AlloyX

-

PWN

-

One Trading

5. Movement Analysis

Stablecoin flows:

-

Total stablecoin market cap decreased by 4.35% this week, marking the sharpest drop since May 2022.

-

Fuse, zkSync Era and Flow saw the largest stablecoin inflows.

-

Hedera, Waves, Syscoin saw the largest stablecoin outflows.

Smart Money Movement:

-

Smart money still remaining risk-off with large inflows into USDC and DAI this week.

-

Smart money seems to be stacking up on ARB as the dominant L2 continues to be the premier chain for most on-chain activities.

L1/L2 movement:

- The majority of Dex Volume is still being transacted on ETH Mainnet, with BSC and Arbitrum trailing behind.

DAPP movements:

-

This week, GMX fell out of the top 10 protocol ranking in terms of fees and revenue, while other Perp DEX platforms like Level Finance gained a larger market share.

-

Maestro, a telegram trading bot, is raking in revenues this week.

-

Holograph NFT on optimism is the top trending application this week.

-

Alpha drop by @apes_prologue

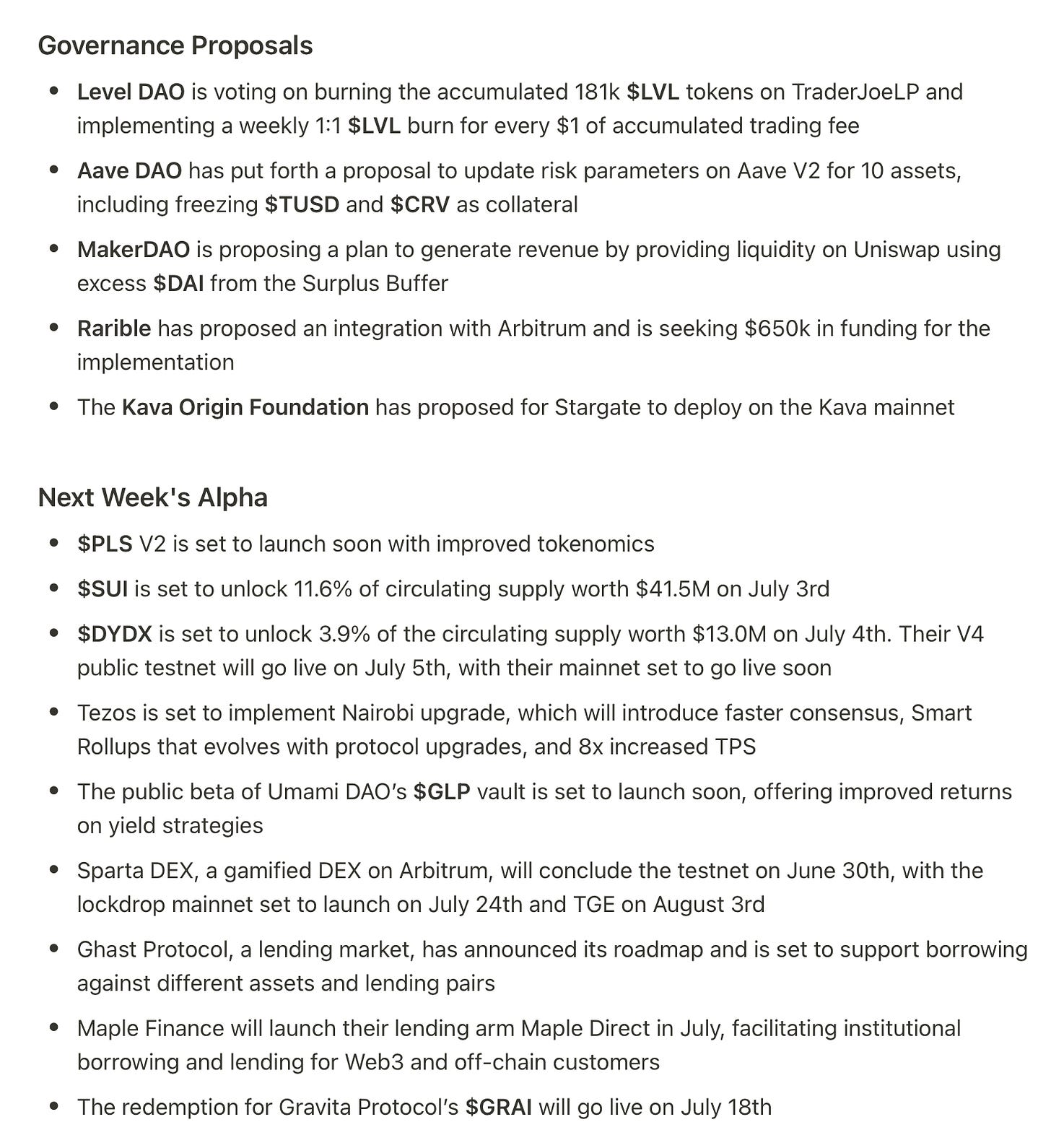

6. TLDR

-

Bull sentiment quickly broke down this week after the SEC came out with a statement regarding the inadequacy of spot BTC ETF fillings.

-

Smart money remains risk-off, with exposure mainly focused on ETH and ETH LSD derivatives.

-

Level finance continues to outpace GMX, and the recent token burn mechanism is set to increase real yield as $LVL token holders reap the benefits of token supply decreasing as trading volume increases.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: