A new way to earn yield and unlock the full power of your liquidity. - by Evix

An Omnichain Lending Protocol Optimized for Yield

Debt is a very powerful tool in tradFi/DeFi. However, one of the common problems that DeFi users have to face is the inability to use the liquidity provided in the ecosystem to take out loans.

In most cases, they have to make concessions which results in capital inefficiency within DeFi.

Curvance therefore aims to unlock this "inefficient" liquidity by positioning itself as a Yield Optimized Lending Protocol. The goal is to allow users to generate optimized returns while maximizing the efficiency of their capital through peer-to-peer lending.

The initial focus will be on the Curve, Convex, Aura and Frax ecosystems. Tokens such as $cvxCRV, $auraBAL, and many others, will then be able to generate a return similar to that offered on their original platforms but with the possibility of using them as collateral to secure stablecoin loans.

In doing so, Curvance becomes a captivating tool in the upcoming DeFi Wars and the icing on the cake, thanks to Layer Zero, it unlocks its use and its benefits across multiple chains.

Contents

-

Lending

-

Borrowing

-

Omnichain

-

$CVE

-

Conclusion

Lending

The Model

The model used will be that of the multi-pool lending market, where each pool is isolated but has multiple assets. This system is at the crossroads between the conventional shared pools of AAVE V2/Compound V2 and the isolated pool model of Compound V3.

Stablecoins providers (lenders) will be able to choose the pools they wish to provide based on their risk tolerance i.e. the assets supported by each pool.

This structure allows better capital efficiency than that of pools with a single fully isolated token, while limiting the risk propagation to the entire protocol in case of default of one of them. However, it should be noted that each new asset introduces risk into the pool that accepts it.

Returns

By providing liquidity to borrowers you are rewarded. You therefore receive an interest rate and potential incentive in $CVE.

The interest rates depend on several factors such as price volatility, token liquidity, the Minimum Collateral Ratio, and many others that will determine the interest curve. This curve will determine the interest rate based on the use of the pool.

You've got it, the interest curve can differ between assets and their respective pools. During heavy use of the pool, the rate will tend to change drastically.

$CVE incentives may also be granted to you based on bi-weekly votes. For this, you will need to provide liquidity in the incentivized pools.

Borrowing

As mentioned earlier, Curvance allows you to unlock a portion of the liquidity of your locked capital by using it as collateral to borrow stablecoins while keeping their return. This creates capital efficiency and leverage opportunities.

Collaterals

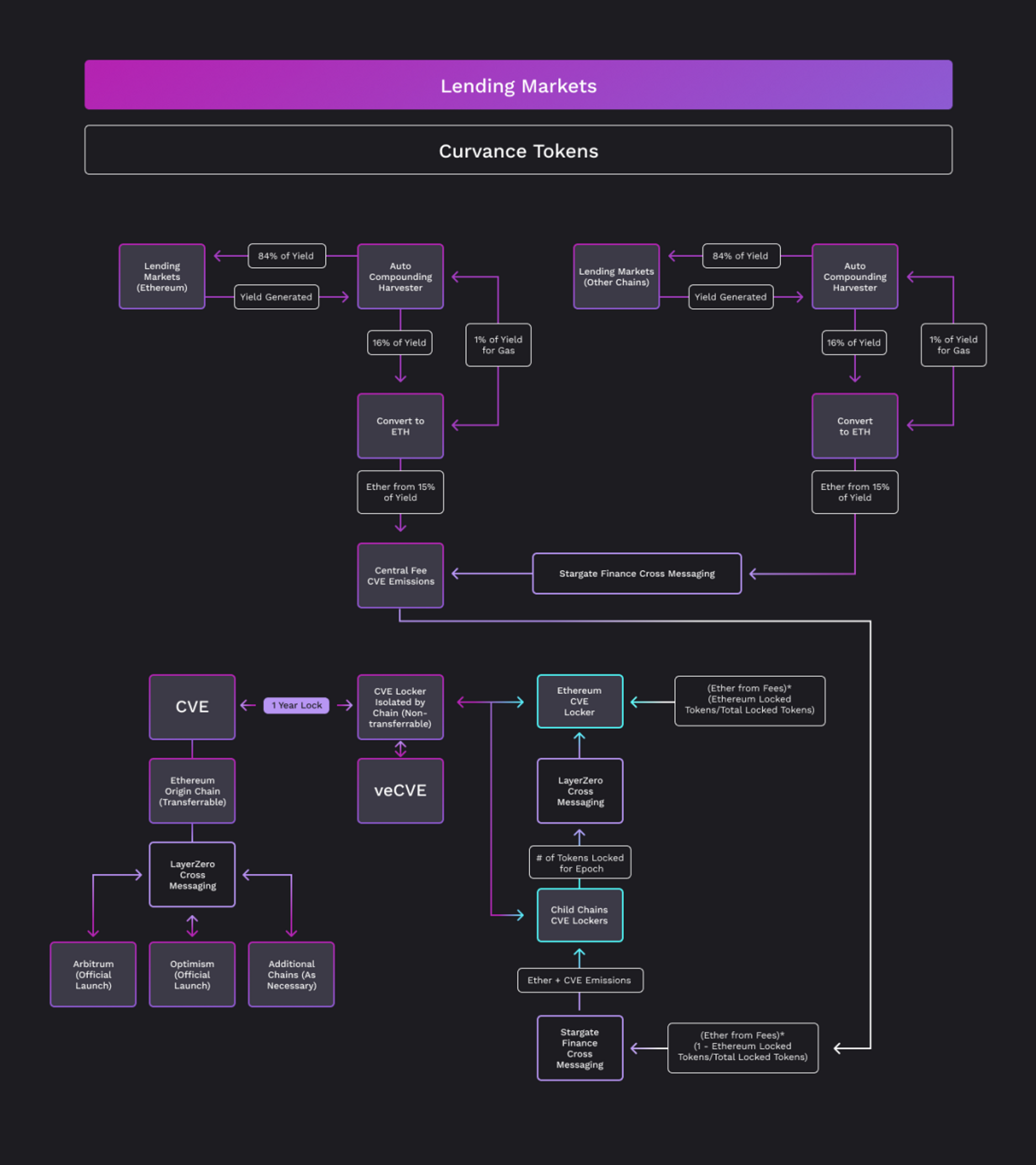

When you deposit an asset in Curvance, it is directed into a vault. Then from the vault, the asset is deposited in its original protocol to generate a return that is auto-compounded (-15% fee).

You receive in exchange a cToken that represents your share of the vault. You can then decide to use this cToken as collateral to take out a loan.

The technology that allows this is ERC-4626.

Interest Rate

The interest rate of your loan is determined by its interest curve and its utilization rate. Note that after 80% utilization of a pool, this rate increases drastically.

Minimum Collateral Ratio and Liquidations

Since the loans are over-collateralized, each asset has a Minimum Collateral Ratio (MCR). This is the maximum percentage of the asset you can borrow based on your collateral.

For example: ccvxCRV has an MCR of 150%, so you can borrow up to 50% of its value in stablecoins.

If the collateralization ratio of a loan falls below its MCR, the loan will then be subject to liquidation. During a liquidation, the collateral is sold to repay the loan until the borrowed amount no longer exceeds the MCR.

Note that liquidations are not automatic. The system is based on a community of liquidators who are incentivized by receiving a portion of the collateral.

Oracles

To determine the price of assets, Curvance will use a two-oracle design. The oracles used will vary between Chainlink, Curve, UniV3, Velodrome, Pyth Network, and others. When calculating the price of an asset, the price most favorable to the protection of lenders will be chosen.

Example: If one oracle gives a price of $100 and the other $101, a user can borrow with $100 of collateral value. If a user risks being liquidated, and the borrowed stablecoin shows $1 on one oracle and $1.01 on another, the price of $1.01 will be retained.

If the prices of the oracles diverge too much due to manipulation or market volatility, the loan service may be paused on the asset until the prices converge again. The same applies if a price movement is much stronger than average. This allows liquidations to be done correctly and prevents flash loan attacks.

Omnichain

Using the cross-messaging of LayerZero and Stargate Finance, Curvance has developed a communication layer between Ethereum, which is the canonical chain, and an unlimited number of "child" chains. This allows users to lock $CVE for veCVE on any chain while fully benefiting from the benefits of veCVE.

Simply put, you will receive a share of the protocol's revenues and a pro-rata governance power based on your number of veCVE, regardless of the chain they are on.

Gauges

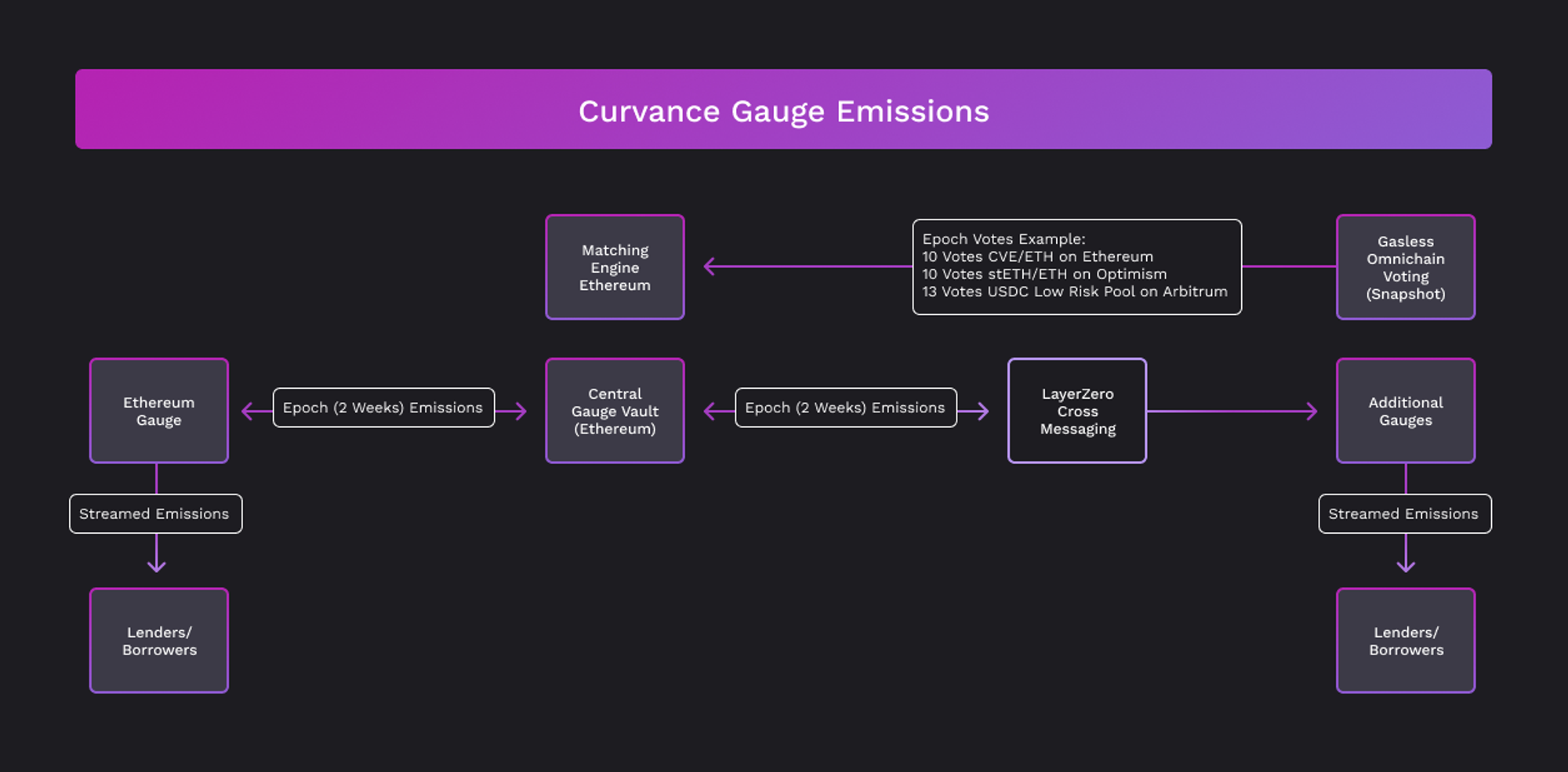

Similar to Curve, Curvance has a gauge system to gamify the issuance of its token. The Curvance system, as you have understood, is omnichain.

Therefore, we have governance power (among other things, power over the direction of emissions) and potential emissions on all integrated chains.

For the voting system, the protocol uses Snapshot which totals the votes across the chains. At the end of a voting epoch, they are moved on-chain to Ethereum in the "Matching Engine". This will determine what proportion of emissions should go to each chain and then bridge them via the cross-messaging system to the child gauges which will distribute the $CVE to the relevant pools for the upcoming epoch.

Fees & Emissions

Similar to votes, accumulated fees and the number of veCVE from each chain are totaled on Ethereum via LayerZero technology. There is then a calculation and distribution of $ETH proportional to the number of veCVE from each chain.

$CVE - Curvance’s native token

The $CVE is the native token of the protocol. It will be used to incentivize the use of the protocol and can be locked for veCVE to be used to its full potential.

Some Metrics and Ways to Obtain

You can find the different allocations, emission schedule, and distribution here. For those looking to get their hands on $CVE early, here are two ways:

-

CVE Call Options for "Early Adopters" / Quality testnet users and Beta users 😉

-

Via Primapes if you are part of the DAO. (Private Round)

veCVE

By locking $CVE you will get veCVE. However, Curvance uses a slightly modified voting escrow model.

Here you only have the possibility to lock your $CVE for a unique duration of one year.

Your number of veCVE decreases linearly as your lock reaches maturity.

With veCVE you get:

-

Platform fees (Proportional to your share of the supply)

-

Governance power (Including the power to vote on gauge emissions)

-

Potentially Bribes (As with any ve system with emissions)

We mentioned it earlier, but let's go back to the gauges a bit. To encourage the contribution of stablecoins and the deposit of assets, a part of the supply has been dedicated.

This part is distributed over a duration of 12 years and every two weeks veCVE holders can vote its direction.

So you understand that holding veCVE amounts to controlling this distribution. Wen Curvance Wars?

The protocol fees come from the rewards of the assets deposited. The yield they generate is taxed at 15%, and an additional 1% is taken to compound the positions.

These 15% are distributed in the form of $WETH in proportion to the number of veCVE held.

Boosted Rewards

A "continuous lock" feature will allow users to keep a maximum lock duration of their $CVE continuously without having to manually re-lock all the time, thus saving time and gas. Users who have activated this feature will receive a multiplier bonus on their voting power (10%).

The goal is to reward users who are most aligned with the protocol in the long term.

In addition, users who receive $CVE can also activate a feature that will lock the $CVE received for veCVE for a 10% bonus.

The goal is to reward users who lock their rewards and therefore allow better alignment of interests.

Conclusion

Curvance's value proposition is really interesting. It's not just another protocol trying to win a governance war, but rather a protocol that comes to graft onto the ecosystem to bring opportunities.

There is an initial focus on the previously mentioned protocols, but keep in mind that this is just the beginning. Velodrome, Chronos, Eigen layer, and other ecosystems are in Curvance's sights, and the technology used is made for easy and quick integrations.

The size of the potential markets is just huge, so the growth potential is as well.

Building on LayerZero allows for rapid adaptability, and if the action takes place on a particular chain, rest assured that Curvance will be part of it. Launch planned around Ethereum, Arbitrum, Optimism and potentially launch on zkSync, Scroll, and Quai in the future.

Even though it's not a metric to take literally, high-quality investors and partners are, for me, a good omen.

To stay nuanced, however, we must take into account that the use of Curvance adds an additional layer of risk for users, and even though the unlocking of collateral is something huge, everything remains to be proven.