The weekly 🐰 hole (23 Apr 23) of liquidity movement & DeFi analysis - by zj.valz

Welcome to the weekly 🐰 hole (23 Apr 23) of liquidity movements & defi analysis, where we uncover key trends and insights into the top protocols and hidden gems.

When you bought the top thinking it was the start of the new bull market but it’s all psyops and you are now down bad.

-

Stablecoin flows

-

Smart Money Movement

-

Top L1/L2 Financials

-

Top DAPP Financials

-

Movement Analysis

-

TLDR

1. Stablecoin Flows

Total Stablecoin MCAP = 130.85 bil, with -0.69% weekly change.

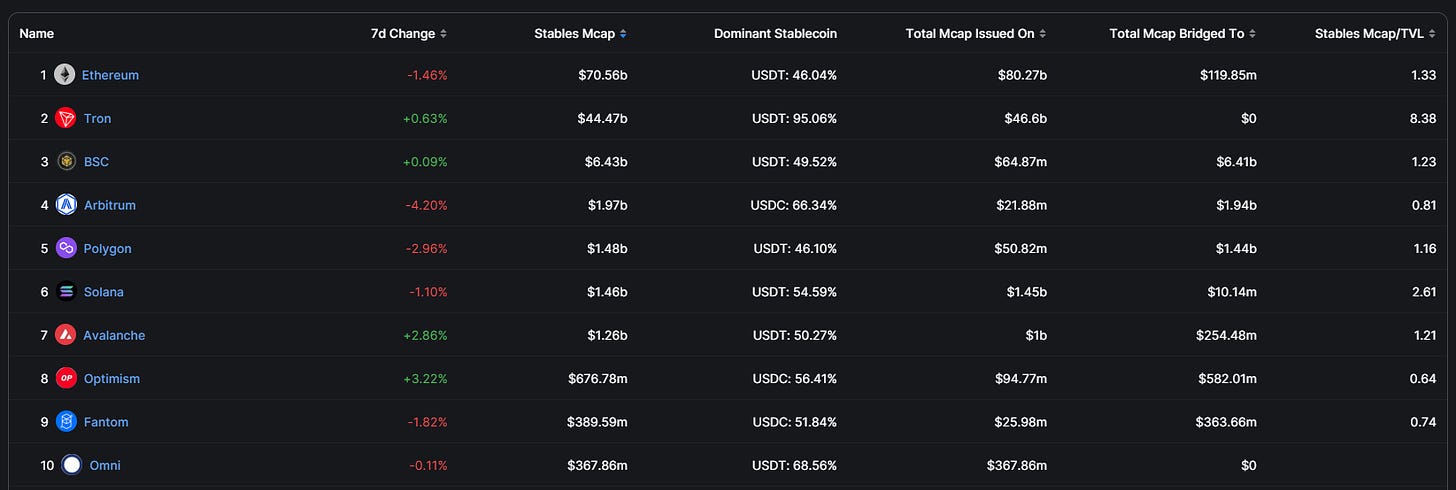

Top 10 Chain (In terms of Stables Mcap):

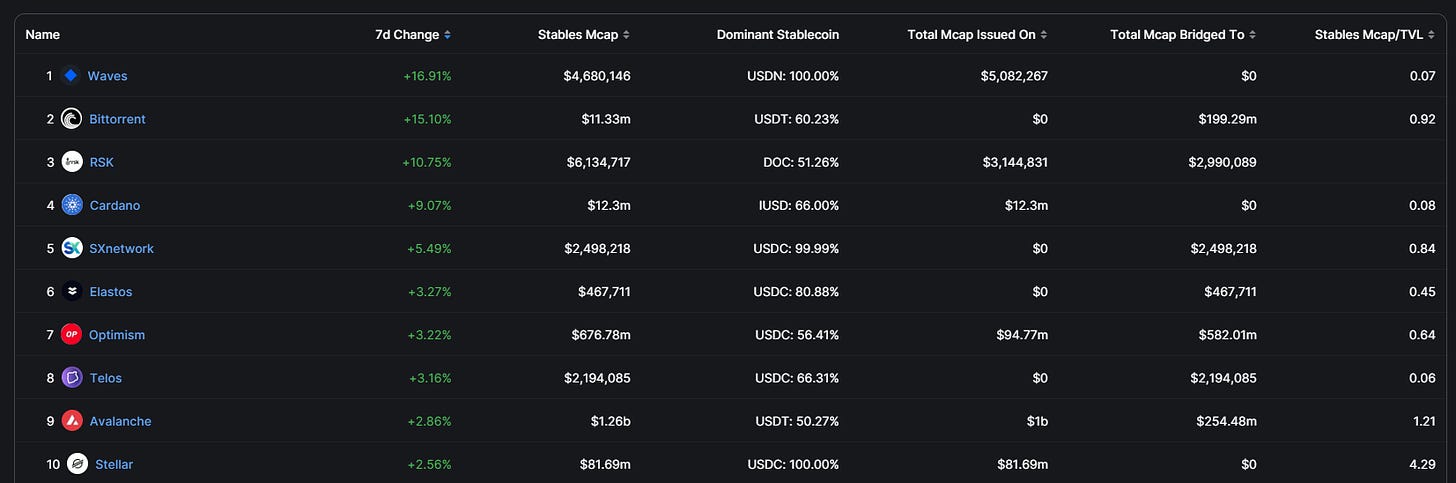

Top inflows:

-

Waves

-

Bittorrent

-

RSK

-

Cardano

-

SXnetwork

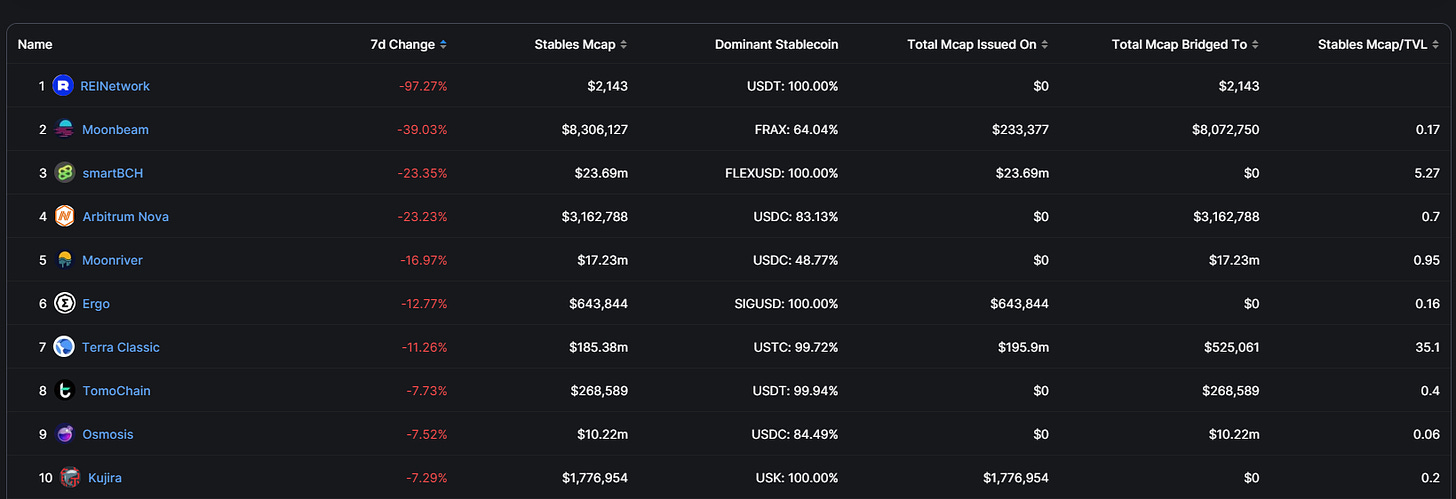

Top outflows:

-

REINetwork

-

Moonbeam

-

smartBCH

-

Arbitrum Nova

-

Moonriver

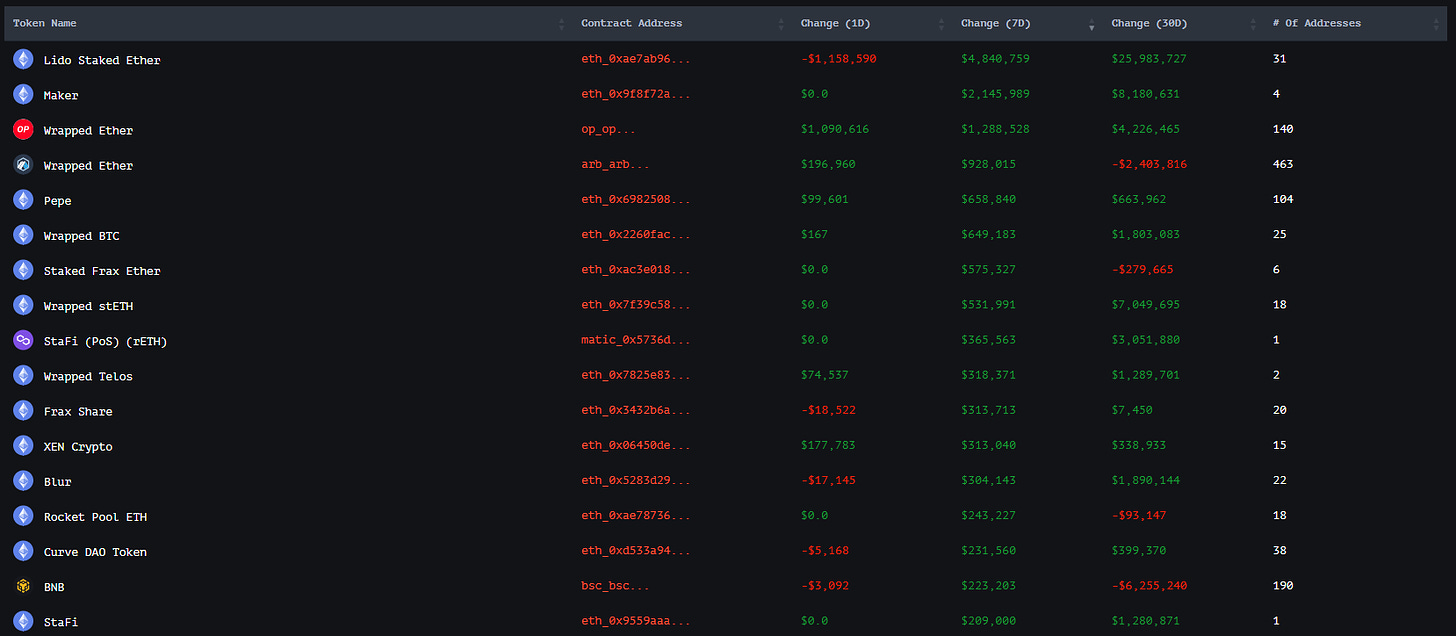

2. Smart Money Movement

Cr: @ozfrox

Top Smart money inflows (including stablecoins):

-

Lido Staked ETH

-

Maker

-

USDC

-

USDT

-

Dai

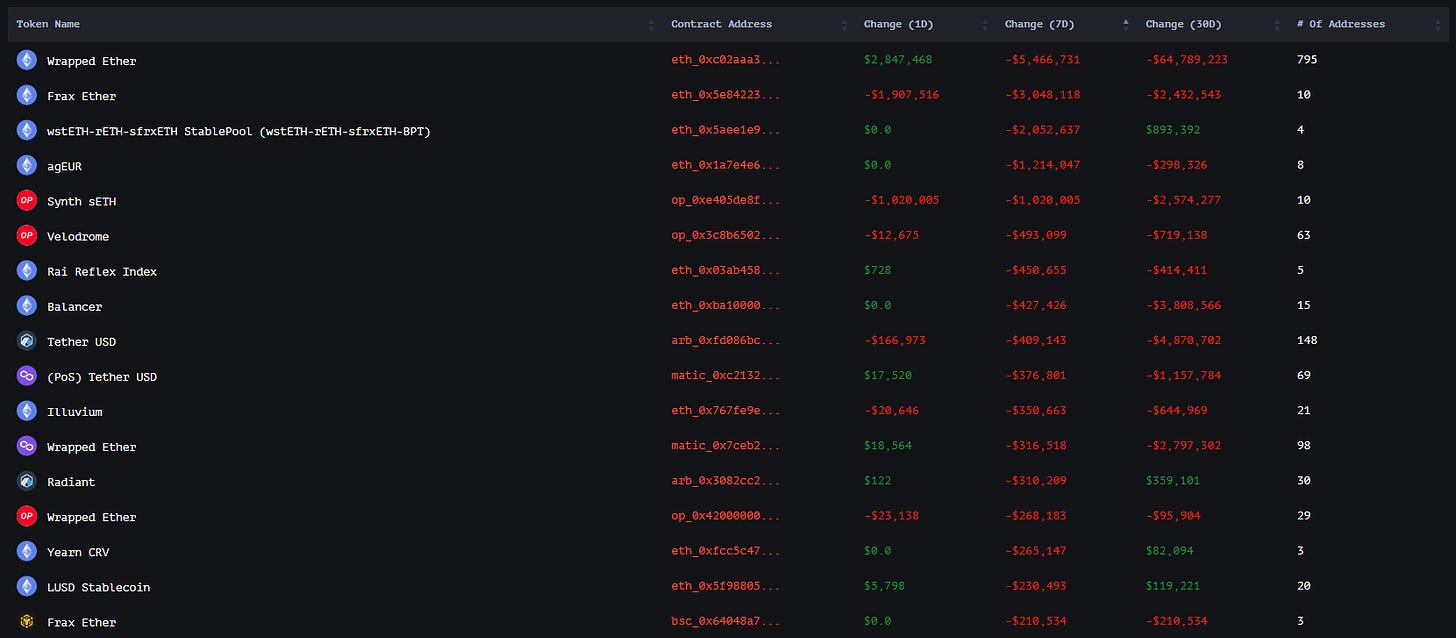

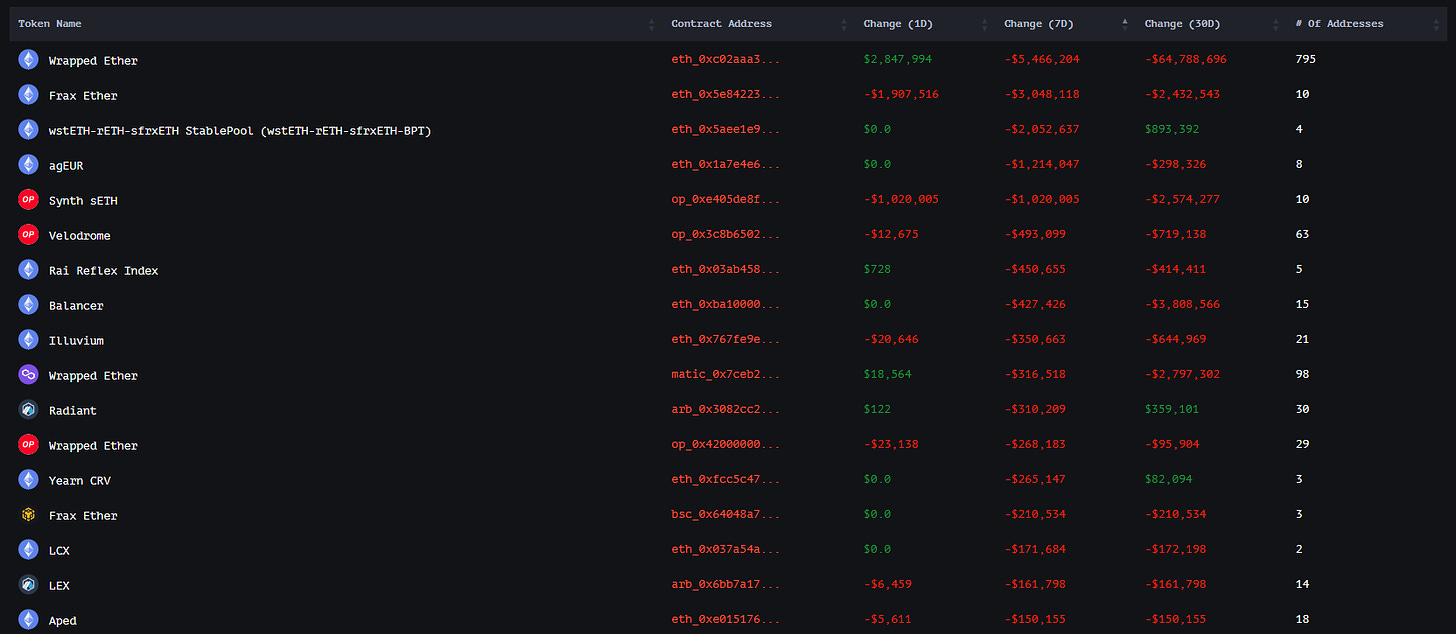

Top Smart money outflows (including stablecoins):

-

Wrapped ETH

-

Frax ETH

-

wstETH-rETH-sfrxETH stablepool

-

agEUR

-

Synth sETH

Top Smart money inflows (excluding stablecoins):

-

Lido Staked ETH

-

Maker

-

Wrapped ETH (OP)

-

Wrapped ETH (ARB)

-

Pepe

Top Smart money outflows (excluding stablecoins):

-

Wrapped ETH

-

Frax ETH

-

wstETH-rETH-sfrxETH stablepool

-

agEUR

-

Synth sETH

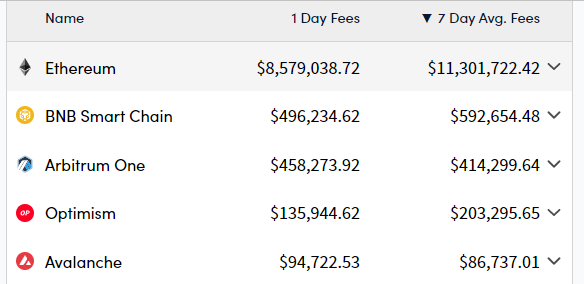

3. Top L1/L2 Financials

Fees-Generated

-

ETH

-

BNB

-

Arbitrum

-

Optimism

-

Avalanche

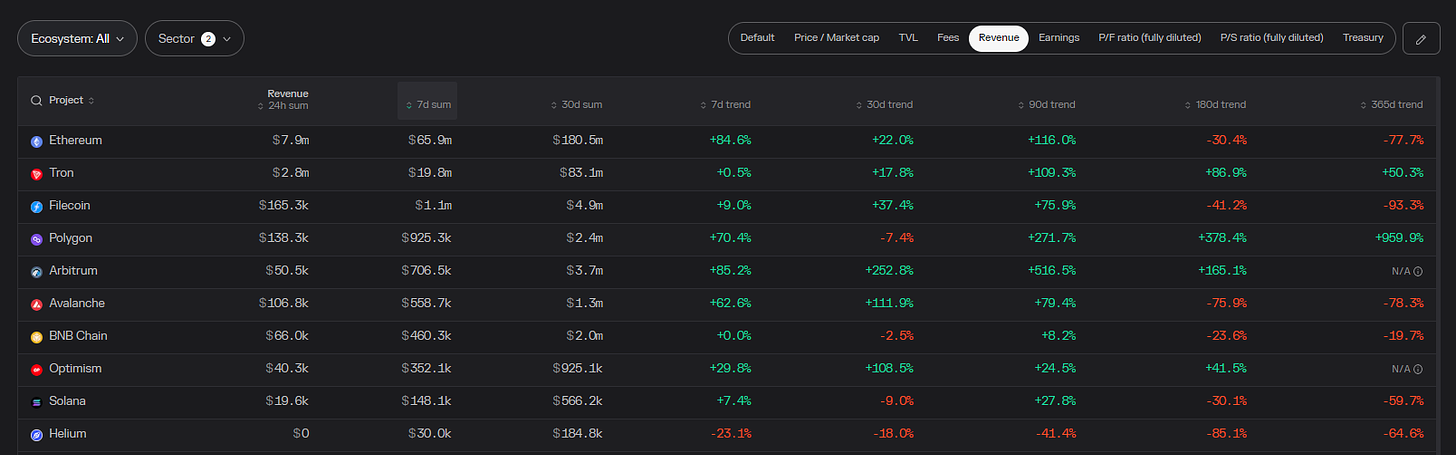

Revenue

-

ETH

-

Tron

-

Filecoin

-

Polygon

-

Arbitrum

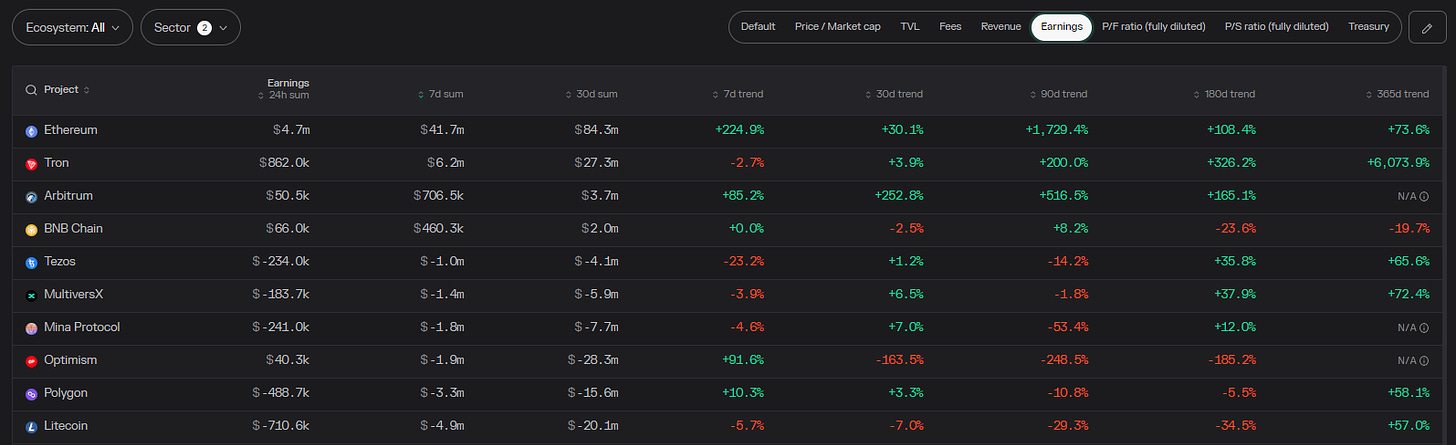

Earnings

-

ETH

-

Tron

-

Arbitrum

-

BNB

-

Tezos

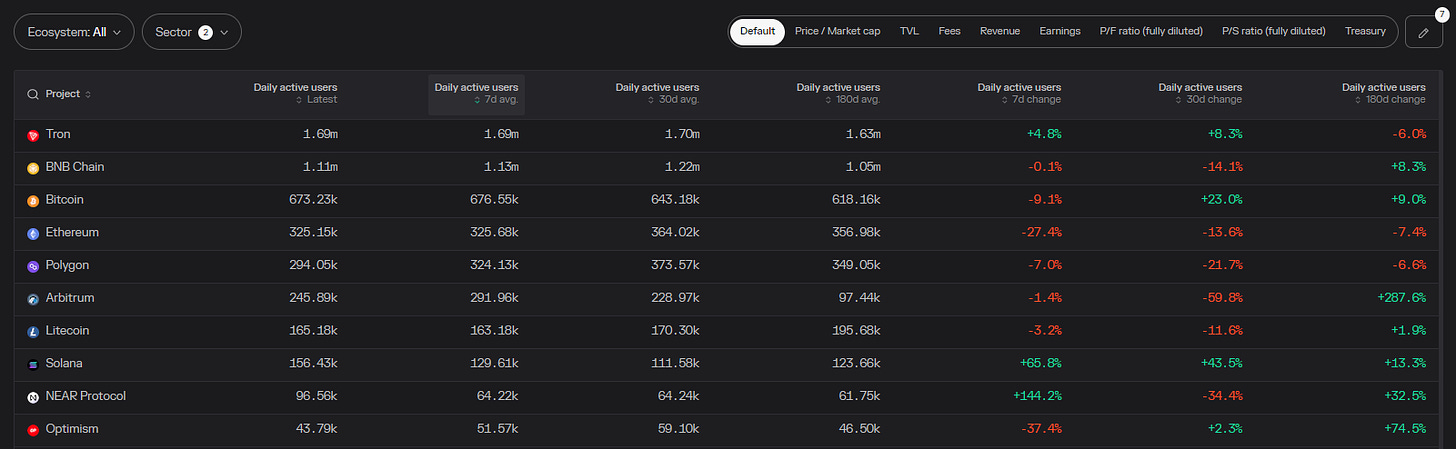

DAUs

-

Tron

-

BNB

-

BTC

-

ETH

-

Polygon

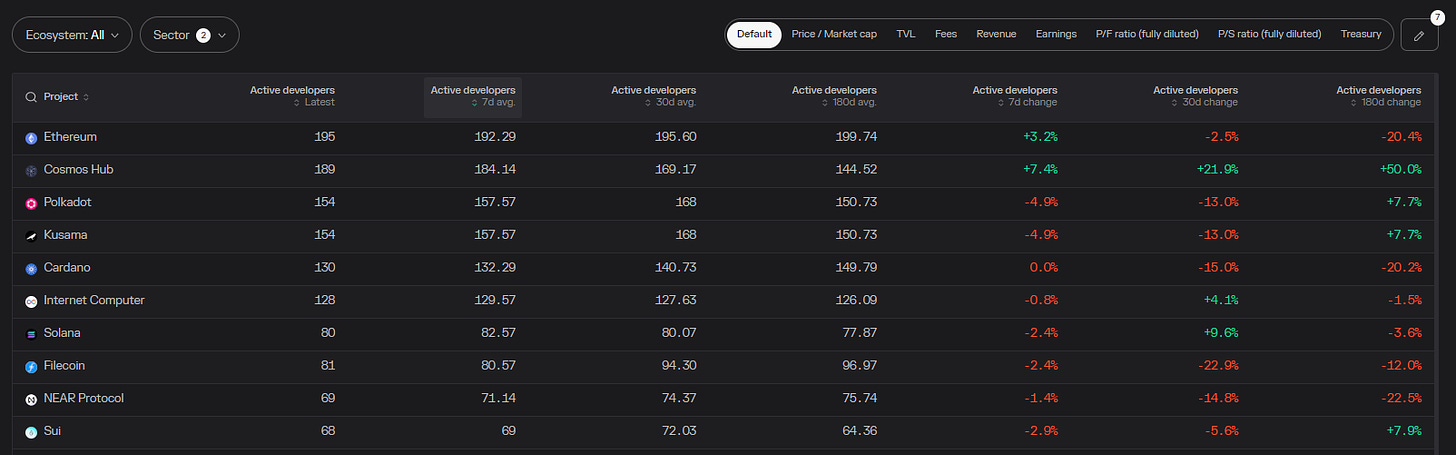

Active Developers

-

ETH

-

Cosmos

-

Polkadot

-

Kusama

-

Cardano

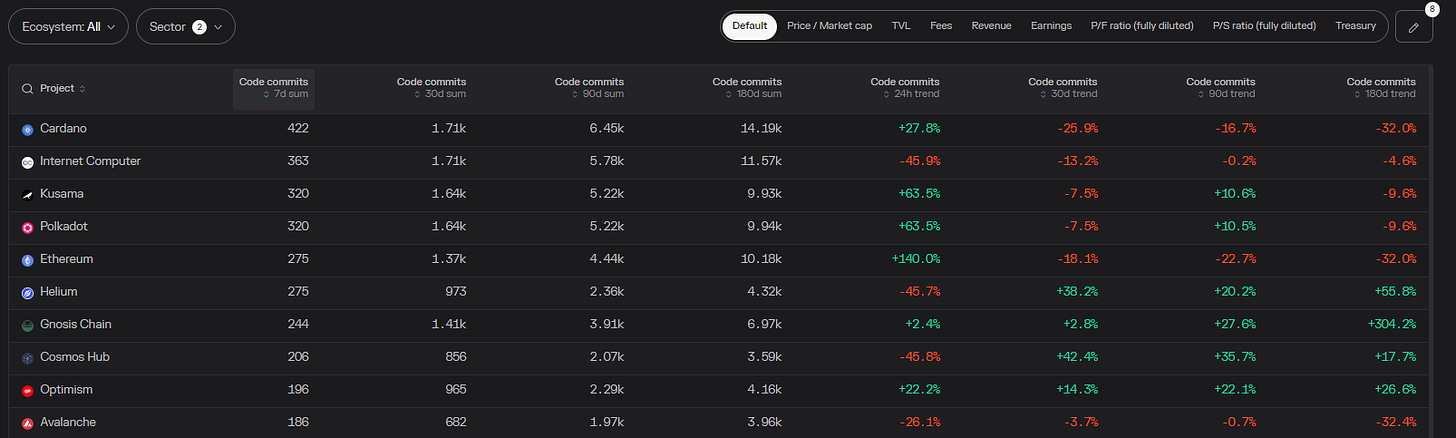

Code Commits

-

Cardano

-

Internet Computer

-

Kusama

-

Polkadot

-

ETH

4. Top DAPP Financials

Fees-Generated

-

Uniswap

-

Lido

-

GMX

-

Convex

-

Level

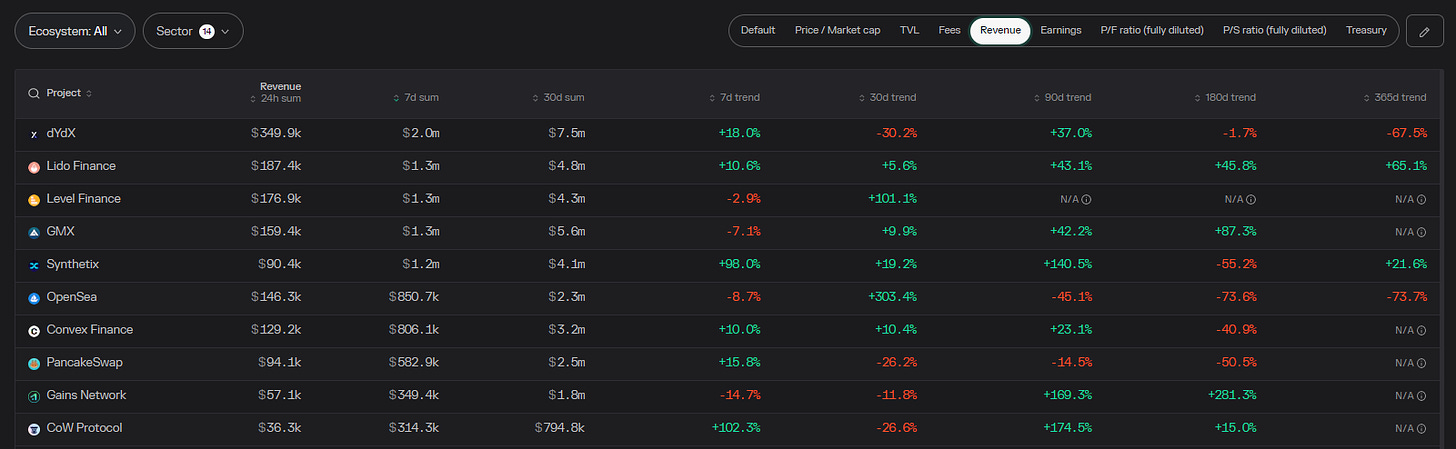

Revenue

-

dYdX

-

Lido

-

Level

-

GMX

-

Synthetix

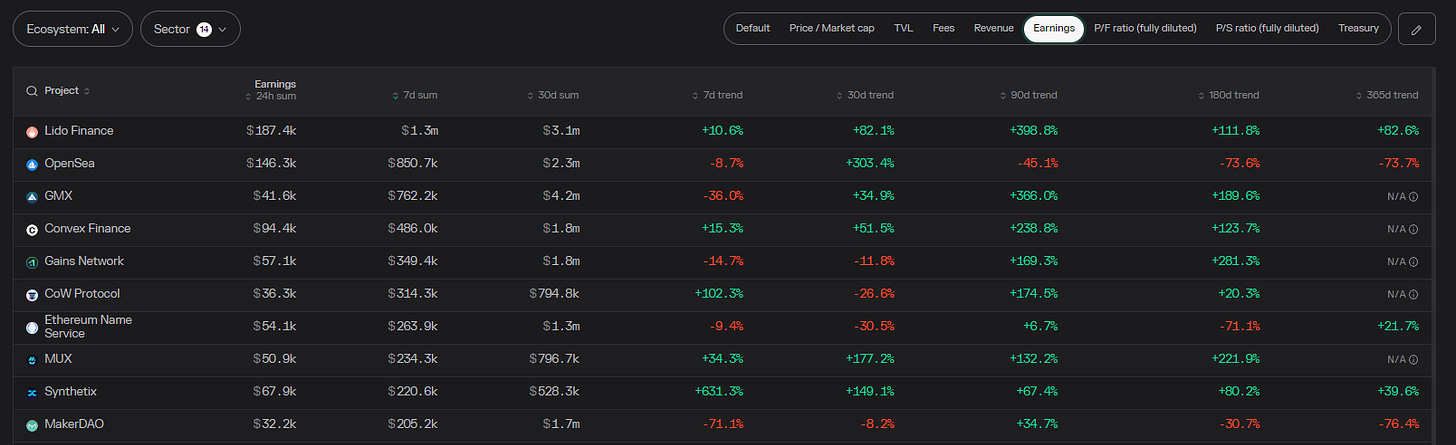

Earnings

-

Lido

-

Opensea

-

GMX

-

Convex

-

Gains network

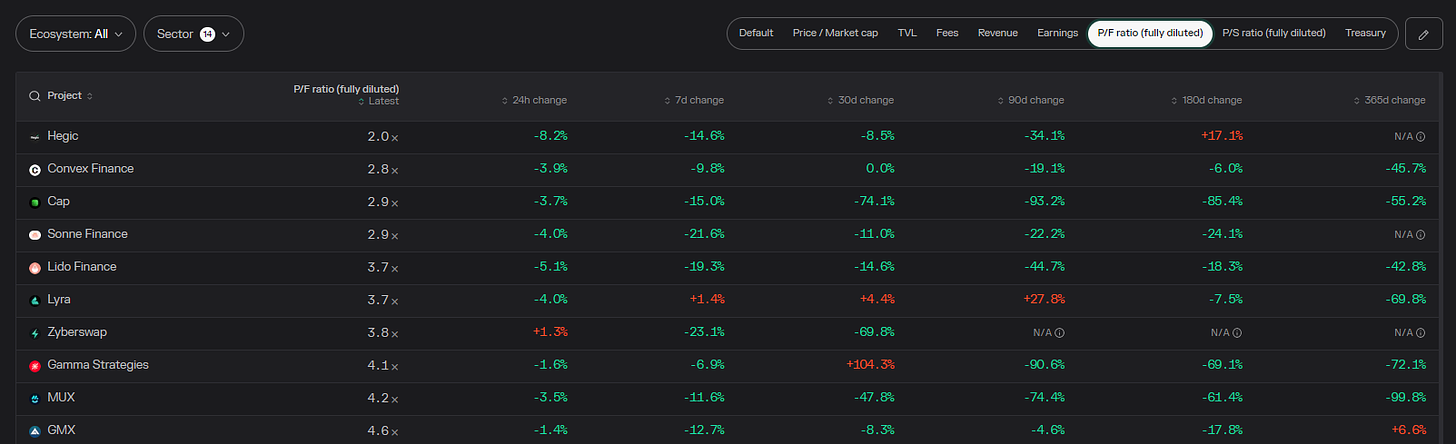

P/F Ratio

Relative valuation of protocols (Lower the no. the “better”)

-

Hegic

-

Convex

-

Cap

-

Sonne Finance

-

Lido

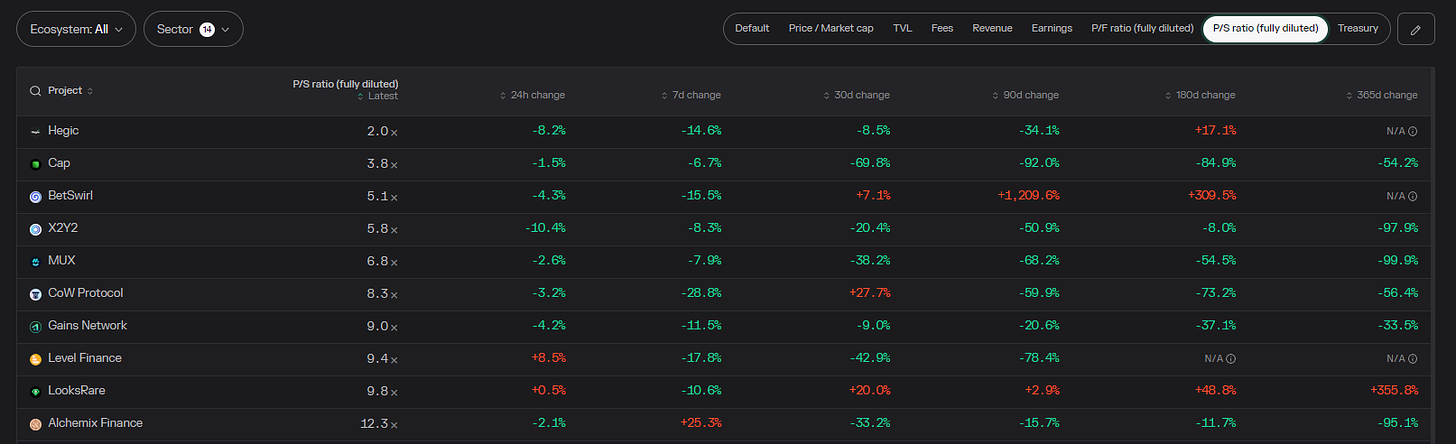

P/S ratio

FDV mcap/Annualized Revenue (Take this metric with a pinch of salt as revenue figs used could be annualized and not actual revenues earned)

-

Hegic

-

Cap

-

BetSwirl

-

X2Y2

-

MUX

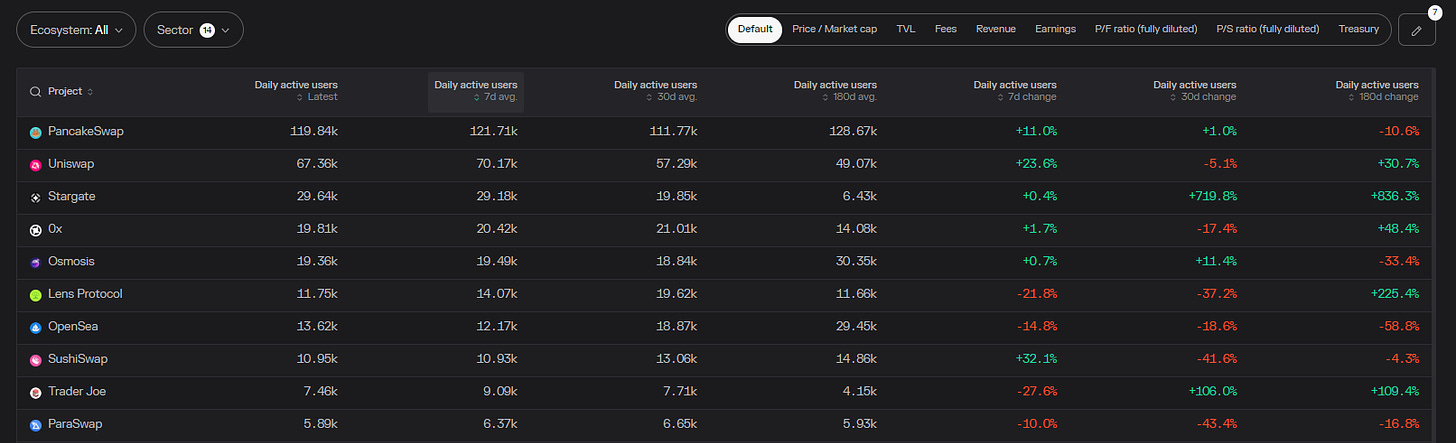

DAUs

-

Pancakeswap

-

Uniswap

-

Stargate

-

0x

-

Osmosis

5. Movement Analysis

Stablecoin flows:

-

Total Stablecoin Market dropped slightly this week to $130.85 billion.

-

Optimism saw the highest liquidity inflow this week amongst the top 10.

-

Arbitrum Nova saw significant outflows at -23.23%, perhaps it is still too early for an L3.

Smart Money Movement:

-

Smart money started rotating back into stables as the market corrects.

-

Smart money is buying Lido Staked ETH to earn yields while crypto crabs sideways.

L1/L2 movement:

-

Arbitrum and Optimism fees remain strong despite the recent market correction. L2s remain the place to transact on-chain with its low fees and the number of superior Defi products built on top of it.

-

A large number of code commits on Cardano and Internet Computer could indicate that something big is imminent. Will keep an eye out on these 2 L1s.

DAPP movements:

-

As ETH staking becomes the default risk-free rate for crypto users, Lido remains DeFi's favourite protocol for parking ETH and earning yields. The protocol occupies top spots in terms of fees, revenue, and earnings generated.

-

Level Finance is crushing the Perp Dex game with its revenue outperforming GMX this week despite having a 12x smaller Circulating Mcap.

-

Alpha drop by @apes_prologue

6. TLDR:

-

My overall thesis remains the same, we will continue going sideways until new money enters the market sometime in late 2023/ 2024.

-

Start staking ETH with premium LSD protocols (e.g. Lido, RPL, etc) to earn yields as withdrawal risk has been eliminated post-shanghai upgrade.

-

Understand that markets can remain irrational longer than you can remain solvent. It is better to spend time identifying solid protocols generating real revenue outside of token incentive programs.

-

Taking the emotion out of investing and focusing on facts will allow u to find alpha where others are not looking and front-run the narrative.

P.s. I may have positions in the projects discussed in this article. Please note that this article is not intended as financial advice, and I encourage readers to conduct their own due diligence and ape responsibly.

Conclusion

That’s it Anon, hope you enjoyed the 🐰hole this week.

Follow me @zec_jay on Twitter or subscribe to this substack for more weekly deep dives.

Source:

Credits: