The rapid evolution of the cryptocurrency ecosystem having several projects being launched at a swift pace has propelled the emergence of creative and collaborative mechanisms for fundraising new projects. Initial Coin Offerings (ICOs) became a prevalent fundraising approach in the cryptocurrency industry during the 2016/2017 bull-run, through which projects were able to raise money by selling a part of their total token supply to the public. ICOs were mainly deployed through Ethereum’s ERC-20 protocol standard, and they rapidly became a leading use case for ETH-based tokens. However, there were enormous challenges associated with the ICOs, most of which revolve around inadequate investor protections or control mechanisms, that exposes most investors to existential risks. Nevertheless, after the market downturn and “ICO bubble burst” in 2018, the concept of Initial Exchange Offerings (IEOs) became predominant in 2019, largely spearheaded by centralized exchanges. IEOs crowdfunding model was similar to ICOs, although in this case, most of the projects were vetted by the respective exchanges.

Progressively, Initial Desk Offering (IDO) is regarded as a successor to both the ICOs and IEOs as it is a novel fundraising method in the crypto space by leveraging on the permissionless model of Decentralized Exchanges (DEXs).

Overview of how Initial DEX Offerings (IDO) works

Initial DEX Offerings (IDOs) were introduced to compensate for the shortcomings and centralization issues of the “traditional” ICO and IEO crypto crowdfunding model, because an IDO is facilitated by decentralized exchanges (with no central control mechanism) to organize the fundraising, as opposed to a centralized exchange.

An Initial DEX Offering (IDO) fundamentally works because Decentralized Exchanges (DEXs) can be used to bootstrap instant liquidity for tokens through its liquidity pool providers. To facilitate trading, projects (mostly using the Proof-of-Stake consensus mechanism) tend to contribute liquidity to the DEX by allocating a portion of their funds. The proof-of-stake consensus mechanism requires investors to store their funds in the supported token, for the chance to validate and earn rewards in exchange for their “stake” in the network.

Unlike IEO which requires a long-vetting process and exchange fees before fundraising, almost any project can launch using an initial dex offering. Although, this also has its demerits as it has sometimes leads to the launch of many poor-quality projects or outright scams. To get an allocation in an upcoming IDO, most platforms typically require their users to hold their own native tokens so as to increase the odds of participation. Therefore, in order to avoid lotteries, most DEXes give guaranteed allocations based on the number of native tokens a user holds. Thereby, incentivizing larger holders.

Investors can immediately begin trading the project token following the project’s launch. Once the IDO is live, early investors can sell their tokens at a premium. With a liquid exchange, the gas fees for executing a new smart contract are negligible because sufficient liquidity is provided for trading pairs. The smart contracts help to manage the asset token and liquidity pool.

Process for Initiating an Initial DEX Offering (IDO)

Although launching an IDO can be independently conducted in a decentralized manner, without the need for Know Your Customer (KYC) or other bureaucratic requirements. However, there are still some procedural phases which must be duly followed. These phases include the following:

1. Devising a business strategy

2. Creating a market collateral

3. Assessment of the DEX Launchpad requirements

4. Cryptocurrency creation and token launch

Devising a business strategy for the project/token

This process involves the creation of a strategy for the token offering which would be launched on a DEX platform. During this phase, it is important for the project teams to explicitly simplify the main problem that the project is attempting to solve, the funding allocation plans, the decision on the blockchain that the project would run on, as well as further tactics on how to maintain the project momentum even after the IDO.

Creating a market collateral

A website and a project whitepaper are the minimum marketing collateral required for an IDO launch.

Firstly, a fully functional website with enlightening details relating to the project enhances the brand image of the project, which consequently aids in boosting investors’ confidence to participate in the Initial DEX offering (IDO). Also, clarity, in terms of the outline of the project goals, and future roadmaps in the whitepaper further increases the motivation and willingness of investors towards working collaboratively to enhance the actualization of the project objectives.

The whitepaper should typically contain educative content regarding the project and other associated aspects such as the tokenomics so as to enlighten the potential investors and users of the project. Finally, in addition to the website and whitepaper, some form of social media presence (through platforms such as Github, medium, telegram and Twitter) helps in attracting not just investors for the IDO, but other curious early adopters and core contributors to the protocol as well.

In certain cases, some Launchpads provide marketing services to increase the visibility of the IDOs launching on their platforms.

Assessment of the DEX requirement

This stage simply involves the evaluation of the various launchpads, so as to ascertain if the project meets the platform's requirements (based on consensus or whitelisting) for IDOs.

Cryptocurrency creation and token launch

After devising the project business case, creating the market collateral, and then deciding on the most suitable DEX launchpad for an IDO, the next phase involves creating the cryptocurrency. Presently, the process of launching a cryptocurrency has been simplified using technologies such as Cointool that enable individuals or project teams with limited technical skills to figure within a short timeframe. Asides from the token generation event, the challenge in most cases, deals with establishing real-world value and utility for the cryptocurrency that would attract users and investors,

After the Token Generation Event (TGE) and Initial DEX Offering (IDO) is completed, the decentralized exchange can then list the token for trading. The listing is accomplished through the use of an automated market maker (AMM). In most cases, rather than setting a fixed price, the issuer can conduct an auction, resulting in the token price being determined by supply and demand. Additionally, certain projects may offer incentives to investors to provide liquidity and earn more token rewards. This can assist the project in gaining and maintaining momentum.

Difference between ICO, IEO and IDO

Although a brief outline of the major cryptocurrency fundraising methods beginning from ICO, to IEO and then IDO were outlined earlier in the article, it is important to clearly highlight their differences or areas of similarities.

Unlike IEOs which rely on centralized exchanges, IDOs are self-organized and decentralized as projects can directly exchange the tokens without any need to pay an exchange ‘intermediary’ fee as in the case of IEO. However, for ICOs, the issuers manage all the responsibilities. This contrasts with an IEO, which is managed by a centralized exchange.

IDO on the other hand could be seen as a mix of ICO and IEO. The key difference is that IDO replaces the centralized exchange (CEX) with a decentralized one (DEX). This, therefore, solves some of the challenges present in an IEO, such as issuers not being allowed to list tokens with competing exchanges or the requirements for token issuers to pay a sizeable token stack in order to be listed on an exchange.

ICOs are also highly centralized, which makes them vulnerable to rug-pulling and other unethical practices that put investors at high risk. ICO tokens are often minted after the sale, and token minting takes place on the company’s website. This approach comes with significant costs. That’s because the token issuer requires the token to be listed on the prominent centralized exchanges.

In addition, one of the main differences between IDOs compared to ICOs is that there is no premise at all. This typically boosts investor confidence, because a high pre-mine allocation in most cases increases the emission rate of the token over the long term. ICOs often offer insiders and early investors favourable terms that aren’t available to retail investors. Such favorability is impossible with IDOs because smart contracts do not provide the ability to do so. This is why IDOs are often viewed as a fairer fundraising method. Furthermore, unlike ICOs, where lockup periods are common practice, IDO tokens are instantly tradable which makes them attractive to most traders.

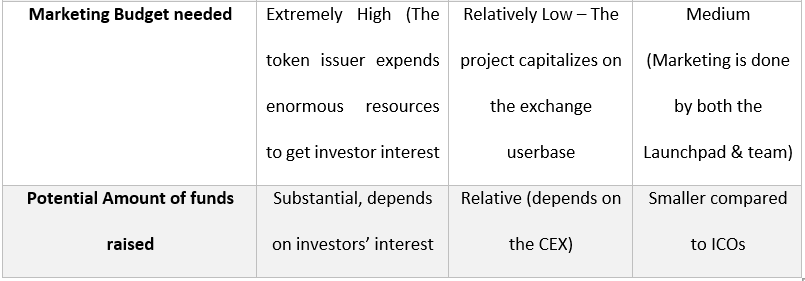

The table below outlines the main characteristics and differences between the three major cryptocurrency fundraising methods, using eleven different comparison criteria.

The table above indicates that there are enormous differences between ICOs, IEOS and IDOS in terms of the fundraising model, the platform used and intermediary fees, level of investor protection, the smart contract management, investor perception and even potential amount of funds that could be raised.

Issues and solutions

IDOs also has its associated issues and limitations which are important to address, for instance hackers have been known to exploit bugs in some IDO smart contract, thereby vanishing with the tokens. Another essential issue in this case, deals with the scalability or fundraising constraints associated with IDO. For instance, it is not uncommon for ICOs to be able to raise more than $1 billion. For IDOs, this is unheard of. However, in order to overcome this limitation, there is a growing trend whereby projects tend to launch their IDOs on multiple launchpads so as to capture a wider range of investors across multiple blockchains.

IDO Launchpads across blockchains

IDO launchpads pro entities with a decentralized opportunity to create a token-based project and raise funds for the project development and advancement. Importantly also, it provides an avenue for the average retail investor, to gain ownership in different crypto projects from inception. Thereby eliminating the barriers of entry and participatory rights that were previously reserved for institutional investors.

Some of the renowned and reputable IDO Launchpads across various blockchains are outlined below:

Avalaunch (Avalanche)

Avalaunch is the main launchpad offering projects within the Avalanche ecosystem a platform for decentralized fundraising. This platform offers a secure avenue for investors to gain exposure to vetted early-stage Avalanche ecosystem projects.

Avalaunch requires users to acquire and stake the native Avalaunch (XAVA) tokens to unlock access to IDOs. However, in a bid to make accessing IDOs as fair as possible, Avalaunch provides all users with a guaranteed allocation for each IDO they apply for. Although the size of this allocation is related to the number of XAVA staked and the chosen lockup period. Furthermore, in order to prevent whales from getting most of the allocation, there is a maximum per-person allocation limit in place.

Every sale on Avalaunch will be broken into three rounds, and each round begins with a different fraction of the total amount available for the token sale:

1. Validator Round — 10% of the total sale

2. Community Staking Round — 85% of the total sale

3. Public Round — 5% of the total sale

Each round has a different set of requirements which a user will need to satisfy in order to register for that round. A verification is required for all rounds. After completing the requirements, users still need to register for a sale during the set registration period in order to participate.

Validator Round (Requirements):

- Own and operate an Avalanche network validator node.

- Create an account and complete the KYC Application.

- Verify ownership of your node in the KYC application (This node must be active during both registration and sale to qualify.).

- Verification of the C-Chain wallet in the KYC Application.

Community Staking Round (Requirements)

- Create an account and complete our KYC Application.

- Verify the C-Chain wallet in the KYC Application.

- Stake XAVA in the Avalaunch Allocation Staking Application.

There is no minimum of XAVA you must stake, but the more you stake, the larger your allocation will be. The Avalaunch platform offers guaranteed allocations to all stakers, but there is also a maximum allocation set for each sale in order to enable fair allocation.

Public Round (Requirement)

- Create an account and complete the KYC Application.

- Verify the C-Chain wallet in our KYC Application.

Users do not need to stake XAVA to be eligible for this round, but because it is only 5% of the total sale, your allocation is likely to be smaller than the previous two rounds.

BSCPad (Binance Smart Chain)

The BSCPad primarily support fundraising for projects building in the Binance Smart Chain (now BNB Chain) ecosystem. BSCPad has hosted IDOs for well over 60 projects — averaging more than six launches per month. BSCPad employs a tier-based system to determine how users can participate in its IDOs. Users need to stake at least a fixed minimum number of the native BSCPAD tokens to access their tier on the platform and will either be part of the lottery round or guaranteed allocation round.

The current tiers, and respective staking requirements in the BSCPad are as follows:

- Bronze (1,000 BSCPAD): 1 lottery ticket

- Silver (2,500 BSCPAD): 3 lottery tickets

- Gold (5,000 BSCPAD): 7 lottery tickets

- Platinum (25,000 BSCPAD): Guaranteed allocation (pool weight: 10)

- Diamond (50,000 BSCPAD): Guaranteed allocation (pool weight: 30)

- Blue Diamond (75,000 BSCPAD): Guaranteed allocation (pool weight: 60) + private allocations

20% of the allocation is shared between lottery ticket winners (Bronze, Silver and Gold) whereas the remaining 80% is shared between guaranteed allocation tiers (Platinum, Diamond and Blue Diamond).

CardStarter (Cardano)

The CardStarter launchpad is a decentralized accelerator connecting early-stage projects within the Cardano ecosystem with a community of donors within the ecosystem. Each project launching on CardStarter must contribute to the platform’s insurance treasury, which would serve as a form of financial protection for investors against potential project failures. Prior to any IDO, the CardStarter accelerator program provides successful applicants with access to services such as:

1. Token Engineering,

2. Security Audits,

3. Social media awareness and branding support.

In terms of participation requirements, users need to stake at least 100 CardStarter (CARDS) tokens on the platform to participate in a lottery or must stake at least 1500 CARDS tokens to get a guaranteed allocation for each IDO.

DAOMaker (Ethereum)

There are numerous Ethereum ecosystem launchpads, however DAOMaker currently stands out due to its longevity, but also its reputation for facilitating the fundraise of some renowned tokens such as My Neighbor Alice, Lossless Protocol and Orion Money. Despite being one of the first platforms to democratize access to investing in new projects through IDO-like offerings, DAOMaker has also pioneered several token sale formats, including the Dynamic Coin Offering (DYCO) and more recently the Strong Holder Offering (SHO), thereby revolutionalizing the way investors gain access to new projects.

To participate in DAOMaker’s IDO, users need to hold at least 500 DAOMaker (DAO) tokens in their wallets and be registered to the DAOPad platform.

NearPad (NEAR)

NearPad is a launchpad platform specific to the NEAR ecosystem. The platform launched in September 2021 and plans to become the go-to fundraising platform for NEAR projects, and is also building a DEX and yield aggregator. Similar to other launchpads, NearPad uses a tier-based system to determine how users access IDO allocations depending on the number of the native PAD tokens which a user stakes.

Solanium (Solana)

As a Solana-centric launchpad, Solanium helps Solana ecosystem projects easily raise funds through decentralized swap pools, while providing a secure way to distribute tokens to IDO participants. Solanium uses a staking system that includes an in-built mechanism to incentivize long-term supporters. To participate in Solanium IDOs, users need to hold xSLIM tokens, which are obtained by staking either Solanium (SLIM) tokens or SLIM LP tokens.

The exact amount of xSLIM received depends on the number of SLIM or SLIM LP tokens staked and the selected time lock (click here to access the Solanium xSLIM calculator).

Depending on the number of xSLIM held, users are assigned to one of five tiers:

- Tier 1 (100 xSLIM): 1 lottery ticket

- Tier 2 (1,000 xSLIM): 12 lottery tickets

- Tier 3 (5,000 xSLIM): 100 lottery tickets

- Tier 4 (10,000 xSLIM): Guaranteed allocation

- Tier 5 (50,000 xSLIM): Larger guaranteed allocation

Gaming and Metaverse Launchpads

In addition to the various ecosystem-specific IDO Launchpads outlined above, there are some IDO Launchpads specifically tailored for gaming or metaverse-based projects.

Gamestarter (Initial Game Offering)

Gamestarter is considered more of an “IGO” platform, rather than a typical IDO launchpad. Gamestarter is a central hub for gaming and NFT-focused projects to begin their journey on the Binance Smart Chain, Solana, and Polygon networks. While many launchpads have a more generic outlook on the projects they pick, Gamestarter is focused on giving gaming startups an exclusive presence and provides a transparent means for retail investors to invest in crypto gaming projects using the Gamestarter (GAME) native token.

FireStarter (Initial Metaverse Offering)

Similar to Gamestarter, Firestarter the first Initial Metaverse Offering (IMO) focused launchpad. FireStarter is presently based on the Polygon network, supporting the fundraising and incubation process of NFT, GameFi, and Social Token projects. The platform offers an opportunity for investors to be part of the formation and growth of Metaverse-integrated projects in their early stages.

New NFT, GameFi, and Social Token projects can readily use this platform to raise funds, allowing the community to invest using the Firestarter (FLAME) token. Thereby, fostering projects that are entirely driven by community and magnified by culture, in a bid to expand the scope of the Metaverse. The FireStarter IMO Launchpad further provides marketing and community-building support for projects.

The Author (Andrew Sawa) is a Blockchain research analyst and crypto enthusiast. He has a BSc in Information Technology and a Masters Degree in Management. He has written extensively on various crypto topics, including DAOs, Defi, IPFS and Gamefi.