What a week it has been! A lot of folks have been on edge due to ongoing macro factors, and how this has impacted Circle USDC’s solvency. We’ll briefly touch upon these events on this risk update, but look for a post-mortem to be published later in the week detailing these events and how they impacted MAI’s peg. With that said, MAI remains overcollateralized, and peg was quickly restored.

Tik, tok. Next block.

Collateralization Metrics

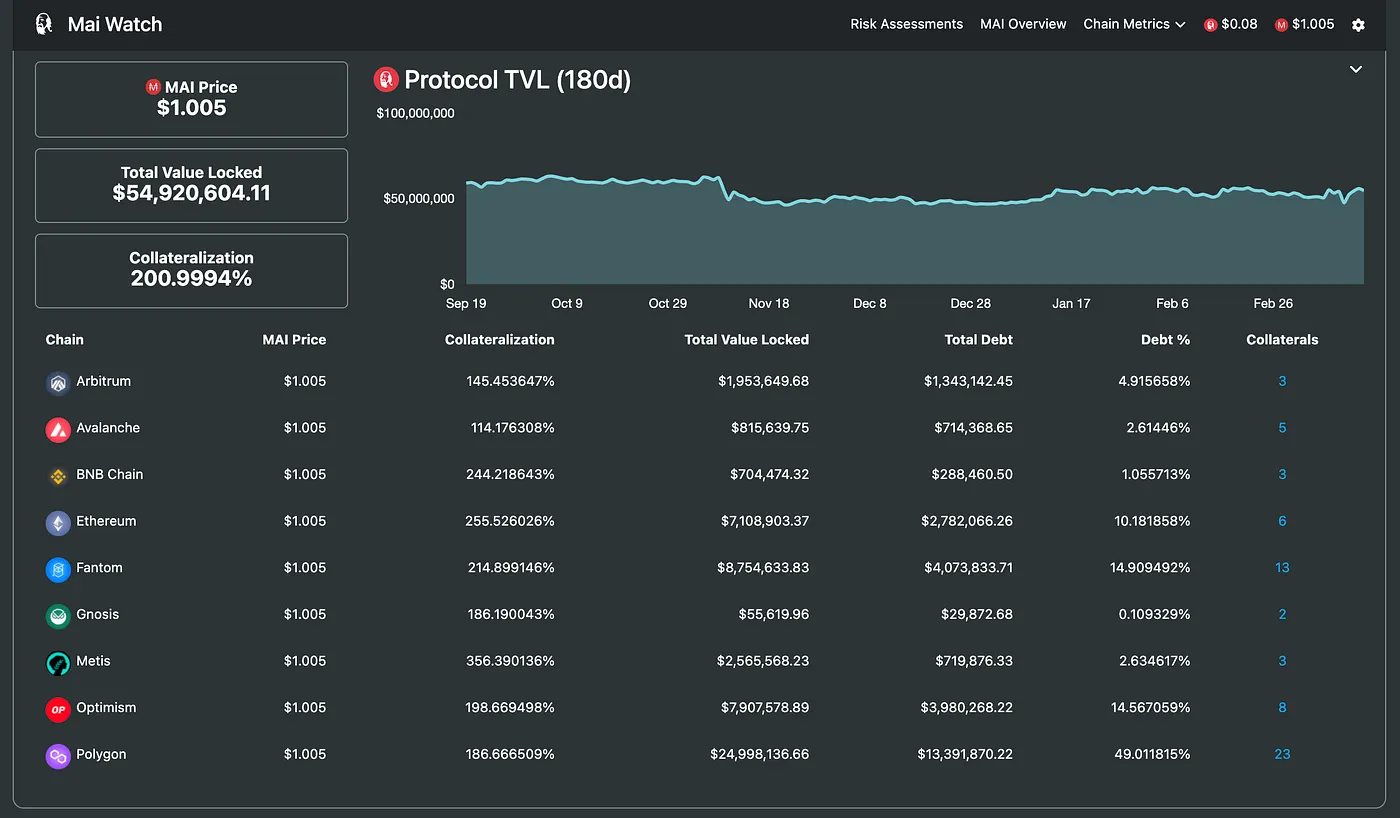

With the latest update to the site (more below under Website Updates), we now have a simple way to track TVL and collateralization metrics. Here’s what it looks like.

Vault debt remains in high demand on Polygon, accounting for roughly 50% of all outstanding debt. Fantom saw a big drop in debt from 20.5% to 13.7%. Interest in MAI on Optimism continues to grow jumping from 8.1% last month to 14.7% this month, with Ethereum debt continuing steady growth from 9.4% to 10.2%, and finally Arbitrum seeing a large increase in debt from roughly 1.5% in February to 4.9% this month. What’s driving these changes?

For one, the situation with Circle caused huge market downturn which lead to high debt repayments. As Ben stated on Twitter, “5M in repayments on @QiDaoProtocol, with liquidations working as expected >95% of repayments came from vaults that are not as profitable to QiDao as V2 vaults.”

The increased focus on V2 vaults continues to drive growth on layer 2’s, as is evident by the numbers presented above. Growth on Optimism is driven by the wstEth and Curve stETH/ETH vaults which not only provide ever growing collateral (thereby lowering the cost of debt to the user over time), but provides the protocol with new revenue opportunities through, for example, adjustable performance fees. Growth on Arbitrum is being driven by the recently launched gDAI vault. The risk committee has placed a tentive debt cap of 8% on gDAI vaults to ensure that C rated collaterals continue to abide by our rule of less than 20% of MAI backing by these types of collateral.

Tik, tok. Next block.

Let’s Talk About The D Word

The biggest news of the week is no doubt the depegging of Circle’s USDC from the US dollar. We will go into detail on this in an update in a few days, but this risk update would not be complete with at least a brief recap of the events that unfolded.

Four days ago, it became apparent that Silicon Valley Bank had become insolvent, leading to a bank run. Silicon Valley Bank was one of six banking partners used by Circle to hold USDC cash reserves, and the company held $3.3B of its reserves there (7.6% of total cash reserves of $43B). This lead to crypto Twitter going into a frenzy over whether Circle USDC had become undercollateralized. As a result, people began selling off their USDC for seemingly “safer” stablecoin options such as USDT (Tether) which in turn caused Tether’s peg to go over $1. USDC’s peg dropped as low as $0.82 as a result before recouping back up to roughly $0.94.

The problem is that USDC never actually depegged from the dollar. Circle always redeems USDC 1:1 for USD. In fact, the majority of Circle backing, a bit over 74% in fact, is not backed by cash reserves but by short dated US treasuries. For full information on USDC’s backing, see Circle’s Transparency & Stability report available on their website. If we look at the price where USDC’s peg restabilized before moving back up to peg with the March 12 news, USDC’s peg traded at roughly 7% of 1:1 — roughly the same number of reserves in question.

By March 12, it became apparently that Circle had already initiated a funds transfer out of Silicon Valley Bank on Thursday, March 9 to other partner institutions such as BNY Mellon. Once this news was released publicly, along with the “definitely not a bailout” of banking institutions by the US government, USDC’s price began its march back up to peg.

From Circle founder and CEO, Jeremy Allaire:

At the time of this writing, essentially all stablecoins across the market, including USDC, have regained their peg, though USDC’s total market cap continues to suffer and currently sits at $37.52B from it’s March 11 high of $43.61B. We’ll continue to watch this closely.

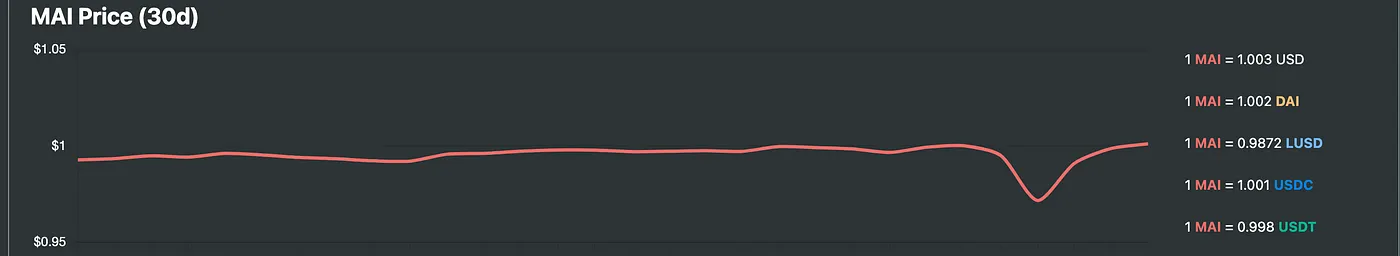

Fortunately, decentralized stablecoins such as MAI recovered their peg much quicker than other options. Of particular note are both LUSD (Liquidity USD) and MAI. LUSD’s peg dropped below $1 by a smaller percent than most of the rest of the market due to its backing being comprised exclusively byETH. MAI’s peg dropped as low as $0.9015 but quickly recovered along with USDC and DAI to the $0.94 level, before continuing its upward trend to $1. The price drop for MAI could be correlated to its partial backing by DAI derivatives (gDAI, Aave Market DAI, Yearn DAI, etc) as DAI is currently 58.6% backed by USDC. In subsequent days, MAI continued trading at $1 (even slighly above at times) while DAI and USDC’s peg continued to lag.

In fact, peg is so strong that the protocol recently did its first 1M MAI debt ceiling raise on Optimism, quickly followed by a 700K MAI debt ceiling on Arbitrum. At the moment of this writing, MAI’s peg continues to be strong and slighly above $1 (1.0005 USD) on chain. More on this below in the Website Updates section.

Huge kudos to the team and the community for helping make MAI a powerful alternative in the stablecoin market.

If anything, the events of the past week should be a call to action to expand the market’s focus on decentralized stablecoins, and that regardless of what happens in the macro environment, blockchains continue to do their job and make blocks.

Tik, tok. Next block.

The Vault Watchlist

Look for new vaults to launch soon. Discussion has been opened to add Balancer stETH/ETH and Balancer stMATIC/MATIC BPTs as collateral, and we’ll be adding risk assesments for both options on Mai Watch in the next day or two.

No suggested changes have been proposed to accepted collateral types. We continue to closely monitor C rated collaterals to ensure protocol security.

Tik, tok. Next block.

Website Updates

As highlighted above, there have been some new additions to Mai Watch this week. The major new addition is the “Chain Metrics” section, which in a previous update was labeled as “Protocol Health”. This new dashboard breaks down protocol data by chain, providing per chain MAI price, collateralization percentages, TVL, debt percentage, and more. In an effort to increase transparency, we’ll continue to add new data to these pages, with a breakdown of asset type (volatile/stable/interest bearing) coming up in the next release sometime next week.

An important new change to the “MAI Overview” page (previously named “Overview”) is the addition of comparative peg pricing. Along the MAI trailing price chart, you will now see the price of MAI in USD (global peg), along with the conversion rate between 1 MAI and other major stablecoins such as DAI, LUSD, USDC, and USDT. We hope this easy to read widget will provide a simple to read format to compare MAI to other stablecoins and help ease peg concerns. We’ve also added a similar widget for MAI’s normalized volatility to see the latest volatility data as compared to similar stablecoin projects.

Finally, we removed the backing type donut chart and replaced it with a backing meter inspired by the “Stablecoin Exposure” feature present in Beefy’s own vault dashboard. As stated previously, this feature will be further expanded in an upcoming release so users can further drill down into the data.

Tik, tok. Next block.

If you’d like to get in touch, find us on Twitter, @qidaorisk or on QiDao’s Discord, geekvine#8496.