Another month, another risk management update. Time sure flies when you’re having fun! Let’s get right to some protocol metrics, vault updates, and what’s new at Mai Watch.

Collateralization Metrics

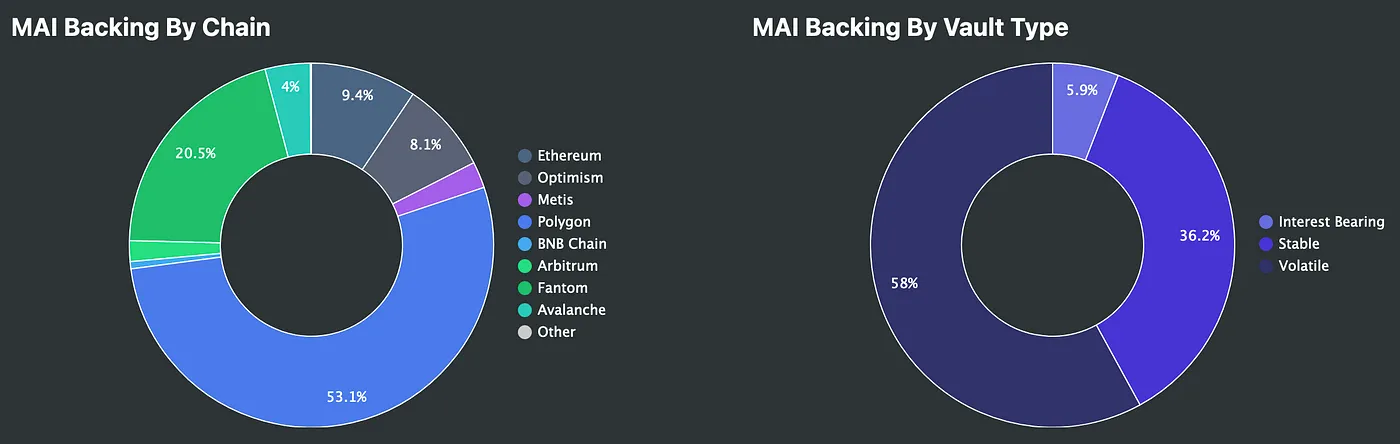

Overall, collateralization metrics remain relatively flat across chains as our top TVL chains continue to be Polygon (down 1.3% from last month), Fantom (up 0.1%), Ethereum (down 0.2%), and Optimism (up 2.2%). The addition of LDO rewards to both the Beefy OP Curve ETH/stETH and Wrapped Staked Ethereum on Optimism along with the focus on increasing protocol revenue and adding additional debt ceilings to these two vaults have driven the value movement to Optimism.

We expect Polygon borrowing to continue to expand this month with the launch of the new Staked Matic vault from Lido and gDAI vault from Gains. Staked Matic vaults have already received a second debt ceiling increase of 30000 MAI, and a gDAI increase is soon to follow. In addition, incentivized MaticX vaults from Stader Labs will be launching soon further driving on chain demand for MAI. If you missed the Twitter Spaces with Qi Dao and Stader, be sure to give it a listen.

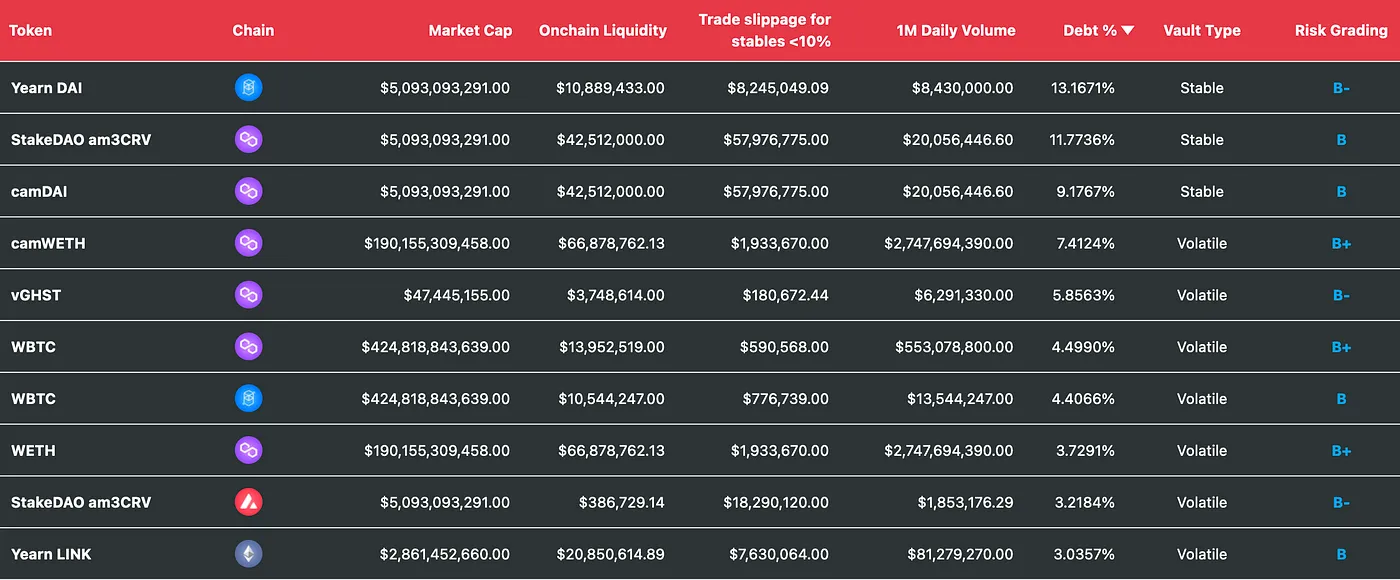

The top ten vaults by debt saw no movement from our previous update still comprising of three stable and seven volatile asset vaults, though the aforementioned increases on Optimism have seen a move up on Beefy OP Curve ETH/stETH (at #12), potentially making it the first interest bearing vault to be placed in the top ten within the next few weeks based on historical increases.

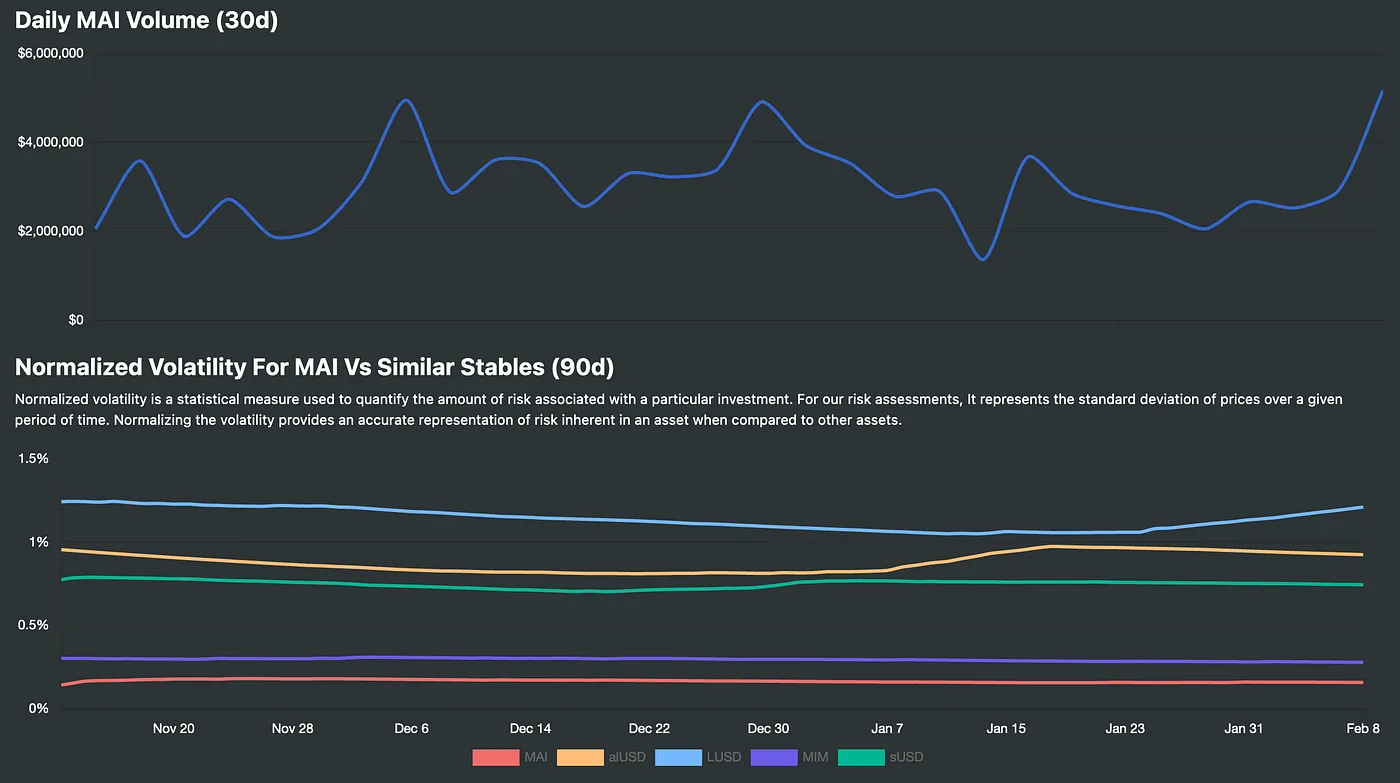

As market conditions have changed and overall sentiment appears to be relatively bullish based on recent CPI data and macro outlook, MAI volume has received a much needed boost over the past week with current daily volume holding above $6m and growing.

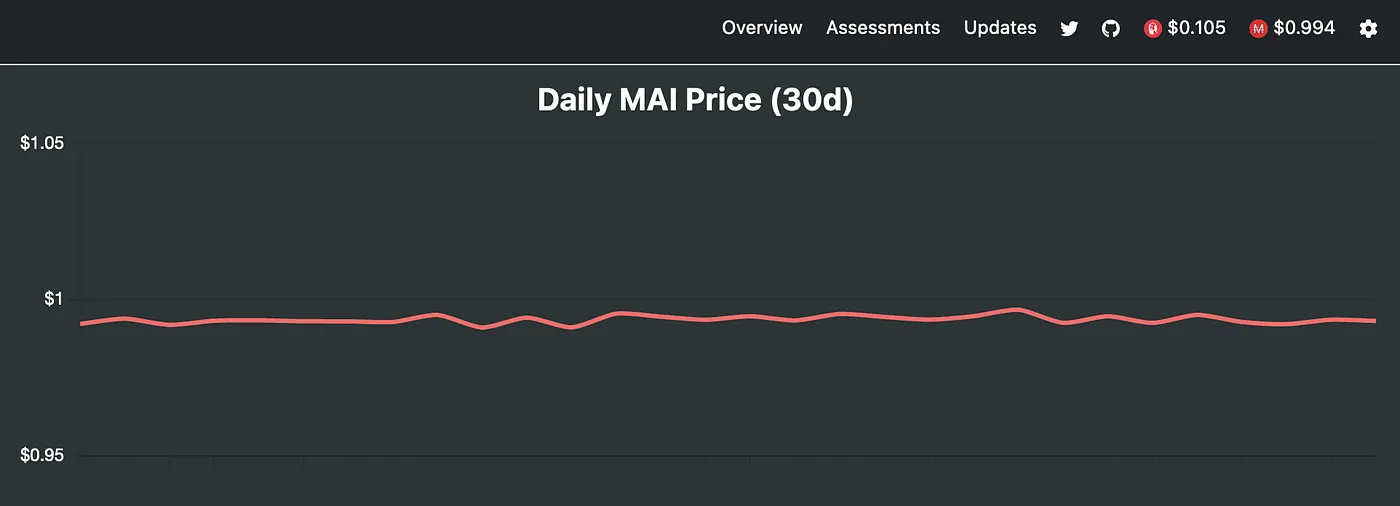

While this has had no impact on MAI volatility as compared to other stablecoins, particularly LUSD, we have seen a slight uptick in the MAI peg as a result of the increased volume. Peg remains a bit soft over the past several weeks though, and the team continues to work with partners to continue increasing MAI volume and liquidity.

Debt Ceiling Recommendations

Due to the peg concerns, the committee is making no detailed debt ceiling recommendations, though focus should remain on recent interest bearing assets as they provide additional revenue to the protocol which can be used to further build on partnerships and improving liquidity. The partnership with Gains has tremendous potential upsides for Qi Dao and both the team and community should continue to focus on expanding this partnership in new and interesting ways.

The Vault Watchlist

No suggested changes from the previous update for vault deprecations, so please refer to the previous update for a full list.

Website Updates

We’ve been hard at work for some time on adding additional information to Mai.Watch. Yesterday, we pushed a seemingly small update comprising of dozens of bug fixes and minor UI updates for a better user experience. Of note should be the slightly reworked navigation menu which will continue to evolve as these new features go live to the community. So what can you expect to see soon?

- Additional information in the “Overview” tab such as total MAI liquidity incentives, top MAI pool data, etc.

- A new “Protocol Health” menu option which will share statistics on QI locking, detailed emissions data, protocol revenue information, and more.

- Continued improvements to the collateral assessments.

- More secret stuff we’re not quite ready to share yet.

If you’d like to get in touch, find us on Twitter, @qidaorisk or on QiDao’s Discord.