A data-driven NFT investment fund

We are still very early on the adoption curve of digital collectibles. And while markets are currently well off the highs of the last cycle, there is meaningful value to capture for investors who recognize the opportunity in a largely misunderstood asset classes. We saw NFTs enter mainstream dialogue as pieces of art. Now, their use cases and potential applications are expanding significantly.

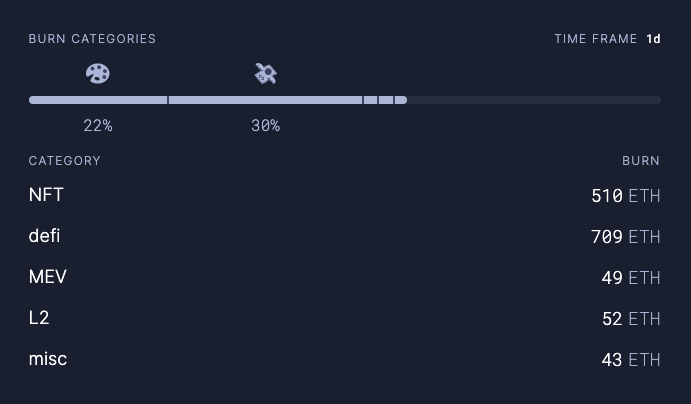

The NFT market and overall transaction volume continues to operate impressively. According to the on-chain data from ultrasound.money, NFT transactions are burning the second highest amount of ETH on Ethereum, second only to DeFi. Investors and crypto users are still trading in NFTs actively.

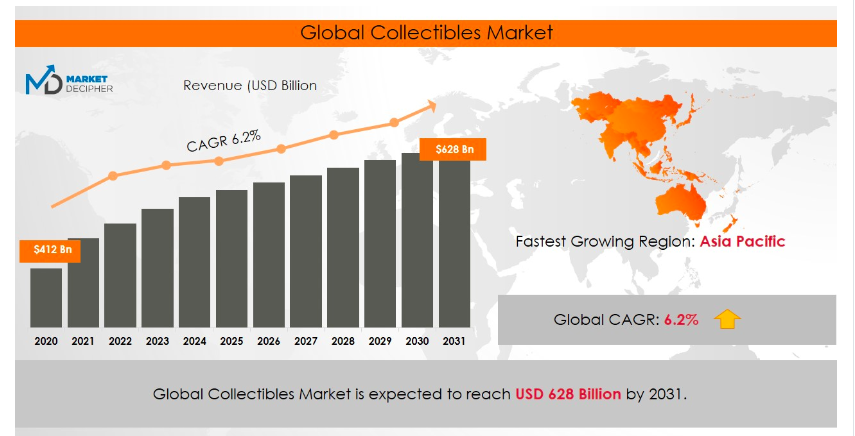

With one estimate of the digital collectible market size valued at $402B in 2021, we are routinely seeing 7 figures transactions of BAYC and CryptoPunks that are maintaining value despite the bear market. The NFT industry is witnessing enormous growth with some product segments acquiring as high as a 1,400% growth in a quarter, i.e., around 14 times the broader NFT market’s 19.2% CAGR, according to MarketDecipher. The NFT market is thriving.

We expect mainstream society to be brought into the NFT market as well-known brands pull their customers into the space. We’ve already seen Nike, Porsche, Disney, Starbucks and many more building out digital collectible strategies. These multinational companies see revenue and brand-building opportunities in the NFT market, and we’re bullish on their ability to build easy-to-navigate UX/UI’s for late-adopters to begin collecting.

Announcing Generational JPEGS: A Data-Driven NFT Investment Fund

As a result, we’re using our native web3 expertise and track record as a basis for the launch of a first-of-its-kind investment fund called Generational JPEGs. GEN.JPG is a data-driven digital asset investment vehicle focused on current and future blue chip NFTs.

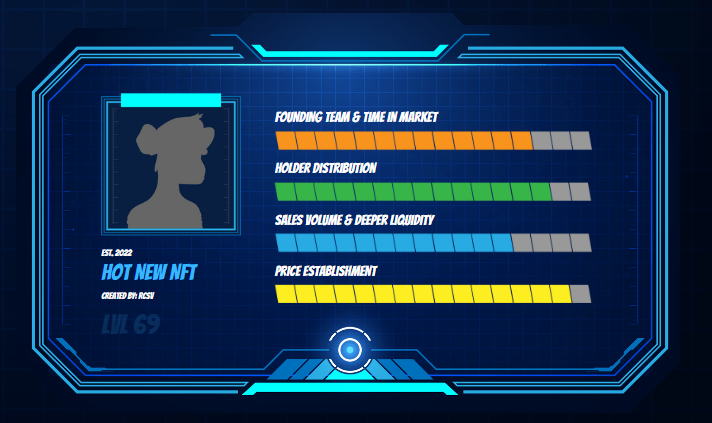

A blue-chip NFT transcends pure speculation and creates an asset-backed store of attention-based value via hype, community and cultural relevance. Think BAYC or Crypto Punks; NFTs with millions of dollars in transaction volume that are status symbols and build communities from around the world. Here are some of the core metrics that drive our investment approach.

-

Founding team with experience building in web3, and projects with sufficient time in market

-

Wider holder distribution that can withstand volatility better and require less maintenance

-

Collections with higher sales volume and deep liquidity that present more optimal exit opportunities

-

Projects that establish and hold price points and have natural stickiness

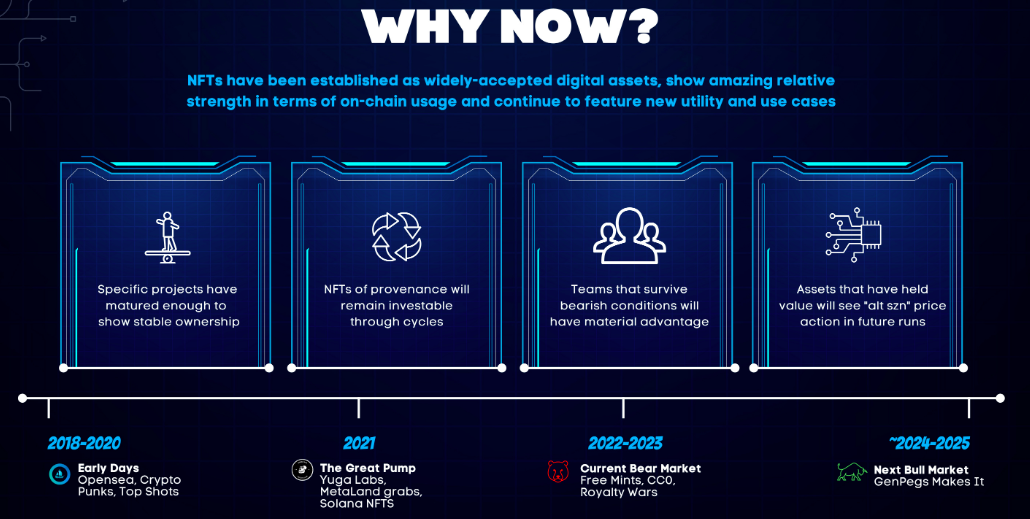

The best investment opportunities come from steeply decreased valuations and downturns. We believe that NFTs fit this bill well; we have seen transaction volume decrease since the onset of the crypto bear market, and they have continued to prove resilient. NFTs have been established as widely-accepted digital assets, show amazing relative strength in terms of on-chain usage and continue to feature new utility and use cases.

In our perspective, specific projects have matured enough to show stable ownership and NFTs of provenance will remain investable through cycles. And the teams that continued building and survived the bearish conditions will have a material advantage over the tourists that try to jump into the bull market when it returns. We expect the NFT assets that have held their value will see ‘alt szn’ price action in future runs.

Interested in getting involved?

Generating alpha on digital asset investments in web3 means breaking free from the tradfi tools and investment models. NFTs are complex and specific knowledge of transacting, recognizing strong communities, and investment potential is required. As a team of builders with previous success generating returns in RCS DAO, we have a competitive edge to find investment value in this asset class. We’re shipping purpose-built proprietary tooling to support our investment decisions and then using those results to help inform and improve feature sets.

We’re openly looking for individuals and organizations that are passionate about the space to contribute and/or partner on what we’re building. If you’d like to learn more or set up a time to chat, please let us know via this form.

Interested, accredited investors are welcome to submit the form or contact us at gmi@genpegs.xyz. Availability is limited.