Background

When designing RentFun's marketplace, we encountered a significant challenge in the process of NFT rental price discovery.

Traditionally, we could have simply adopted OpenSea's order book mechanism and allowed lenders and renters to list their preferred rental prices without any guidance. However, we believe that this approach falls short in facilitating effective rental price discovery. Renting an NFT differs from traditional trading, such as on OpenSea.

In trading, you can typically set a price based on your preferences. The perceived value of an NFT's sale price being overpriced or underpriced may not be easily discernible due to the absence of a valuation mechanism for NFTs.

Renting, on the other hand, presents a completely different scenario. If the rental price is excessively high, one might question why they wouldn't simply use that money to purchase the NFT instead of renting it.

For instance, the floor price of Smol Brain currently stands at approximately 575 $MAGIC, which means you could acquire a Smol Brain by paying 575 $MAGIC.

But what does it mean when you discover that you have to pay around 200 $MAGIC per month to rent a Smol Brain? It simply doesn't make sense for renters in such a scenario.

Certainly, NFT owners have the right to set any price they desire for lending out their NFTs. However, what purpose does it serve if NFT owners cannot rent out their NFTs in the long run?

Therefore, it is essential to establish suitable guidelines for both renters and NFT owners to determine the appropriate rental fee range. This will greatly enhance the efficiency of NFT rentals.

To better understand this concept, let's draw a comparison with household rentals.

Price to Rent Ratio of Household Rental

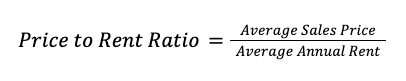

Let's recall the concept of household rentals. In the realm of real estate, there exists a useful metric known as the Price-to-Rent Ratio. This ratio plays a crucial role for both landlords and renters in assessing whether the rental price is reasonable.

The Price-to-Rent Ratio is calculated by dividing the price of a property by its annualized rent. This metric aids in determining whether it is more advantageous to purchase the property or opt for renting it.

The Price-to-Rent Ratio serves as a fundamental benchmark in household rentals. In a similar vein, NFT rentals can also benefit from a comparable metric to guide both NFT owners and renters towards fair and reasonable rental prices.

Introducing Rent-to-Floor Ratio

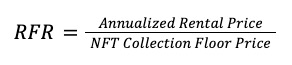

Therefore, we are excited to introduce a similar ratio for NFT rentals, which we have coined the Rent-to-Floor Ratio (RFR).

The RFR is calculated as follows:

Let's explore how the Rent-to-Floor Ratio (RFR) will be utilized within RentFun's marketplace.

1) For NFT Owners

Imagine NFT owner Alice wants to lend out her Smol Brain NFT #9438 on RentFun. How should she determine a reasonable rental fee?

First, Alice can check the RFR ratios of other listed Smol Brain NFTs on RentFun to gain an understanding of the current RFR range.

Next, she can assess the potential rental demand for her Smol Brain #9438. If Alice believes her NFT is particularly rare and likely to attract many renters, she may choose to set a higher RFR ratio.

Based on Alice's chosen RFR ratio, the RentFun marketplace will automatically calculate the corresponding rental price per hour for her Smol Brain #9438.

In a way, the RFR can be viewed as an Annual Percentage Yield (APY) for NFT assets. NFT owners essentially establish an expected APY for the NFTs they wish to lend out, providing a framework for determining their rental fees.

2) For Renters

Consider renter Bob, who wants to rent a Smol Brain NFT on RentFun. He can begin by filtering the available Smol Brain NFTs based on the attributes he values, such as the IQ amount.

Bob can then compare the RFRs of each filtered Smol Brain NFT to determine which one offers a more reasonable rental price.

3) For NFT Traders

NFT traders can also leverage the RFR statistics of each NFT listed on RentFun. By analyzing the RFRs, traders can assess which NFTs have the highest potential for generating passive income.

This information allows traders to make informed decisions when purchasing NFTs from specific collections, selecting the NFTs that offer the most attractive prospects for generating returns.

In Conclusion

The RFR mechanism represents an ongoing exploration by RentFun to discover the most effective way to facilitate ideal deals for both NFT owners and renters.

While providing a secure and user-friendly marketplace for NFT rentals is a foundational aspect of our platform, it is not our ultimate goal. RentFun's ultimate objective is to establish an efficient platform where NFT owners can quickly and securely lend out their NFTs, and renters can easily find the NFTs they desire to rent.

With this vision in mind, we are committed to pioneering advancements in the NFT rental space. Our goal is to continuously improve the RentFun platform, ensuring that it meets the needs of both NFT owners and renters, and ultimately creates a seamless and satisfactory experience for all parties involved.

We are dedicated to our mission and will strive to lead the way in the evolving landscape of NFT rentals.

About RentFun

RentFun is an NFT renting marketplace that allows users to rent original NFTs through Access Delegation Protocol on Arbitrum. RentFun’s Access Delegation Protocol allows the NFT owners easily and safely delegate the access rights of the NFTs to renters without losing their ownership.