Key Highlights

-

Trading and Real Estate

-

Opportunity in Digital Real Estate Investing

-

Parcl v1 upgrade to Parcl v2

Overview

Parcl is a decentralized real estate trading platform built on the Solana blockchain.

Parcl offers fractionalized real estate trading through synthetic assets. They are a digital representation of an asset reflected as a token created by a smart contract on the blockchain. Similarly to derivatives, investors do not own an asset but gain exposure to an underlying asset made possible by a financial contract.

The founders are Trevor Bacon, Kellan Greiner, and Jason Lewis with backgrounds in Wall Street and data science. Trevor Bacon developed a curiosity amid the pandemic on why he could not trade portions of cities. This deep curiosity developed into a problem that introduced the creation of parcl.

The project was established in 2021 and has been growing since. The founders chose to build on the Solana because of its transaction speed and being economically cost-effective. Parcl recently launched its new protocol version earlier this 2023 called Parcl v2.

How Parcl Works

Integration

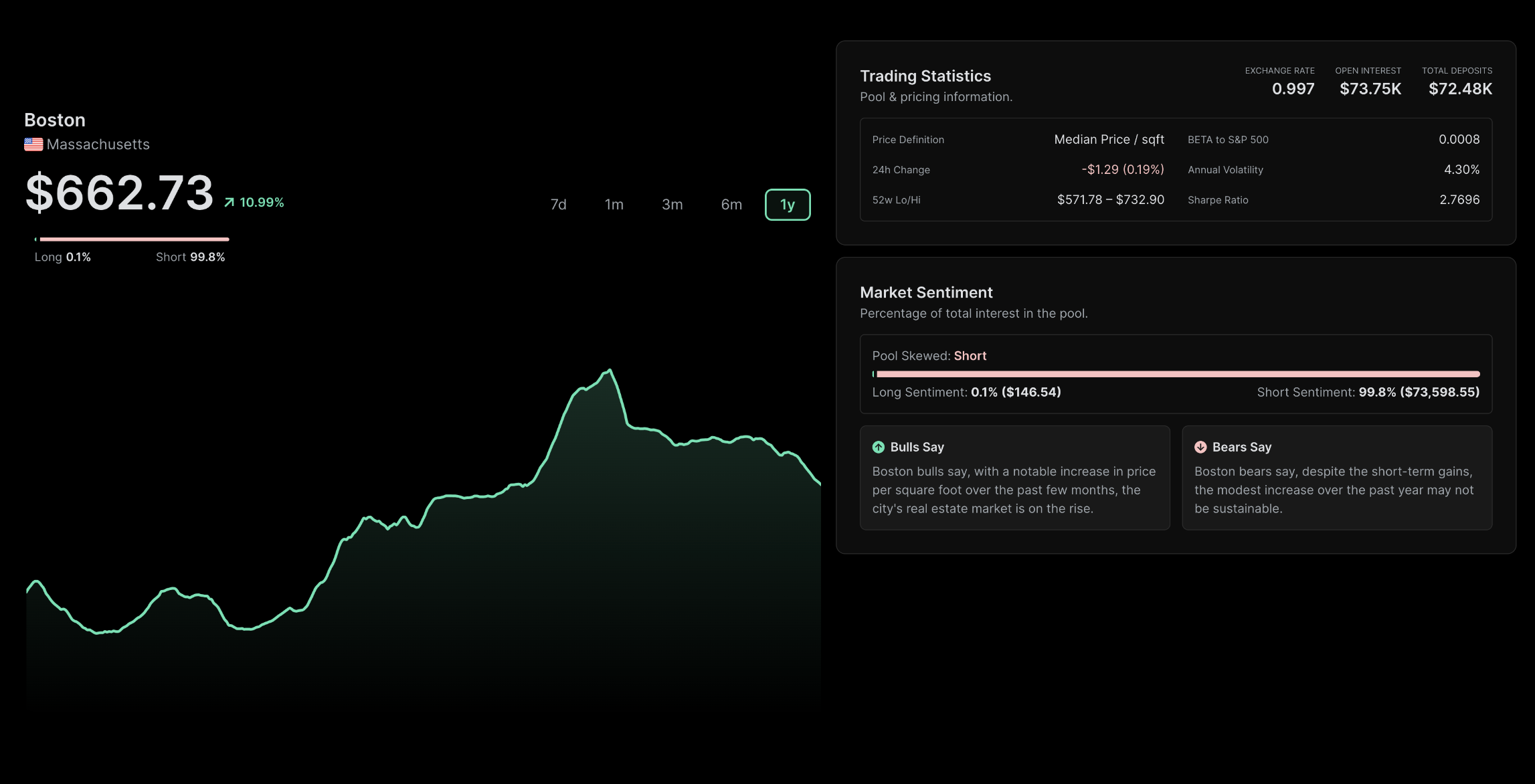

Parcl is composed of various components that work together in order for it to all work. In that sense, traders and liquidity providers collectively influence the liquidity pool. The liquidity pool is where fees, profit, and losses are derived from. As provisions are made, they then create the exchange rate for a created liquidity pool. The greater participation there is in the liquidity pool, the higher the exchange rate. The higher the exchange rate, the higher the profit potential.

However, LP’s must also recognize the risk of impermanent loss can happen if price changes in the liquidity pool and the value of the original deposit declines. LP’s effectively want greater participation in the liquidity pool as it offers them greater yield on deposits.

Understanding the relationship between each component of parcl is important as it directly influences investment outcome, due to investor decisions.

Liquidity

There are two types of investors on Parcl, and they are Traders and Liquidity Providers. Traders are the investors that use parcl to bet on the direction of a price of land. Liquidity providers or LP’s, use parcl to gain exposure on a market. To do this, a liquidity provider will deposit $USDC into the liquidity pool, in exchange to earn yield. Collectively, both traders and LP’s are essential in influencing the liquidity pool as they are both capital providers.

Monetization

Parcl generates fees in 3 ways. These are through skew impact fee, trade fee, and liquidation fee. The skew impact fee is the fee that a trader pays if they create an imbalance in a market. The skew is the market between buyers and sellers. The skew was designed to discourage traders so they do not tamper the skew because it affects the pool. Fee rates increase due to a larger position, which then changes the skew impact. Opposite to that is the lower the trade position, the less its effect on skew impact.

Trading fees and liquidation fees are created by the pool creator when they create a pool. 60% of trading fees are reinvested into the pool and 40% are added to the protocols vault as liquidity tokens as indicated on their updated protocol v2.

It is then important to consider the position size as it will affect the liquidity pool.

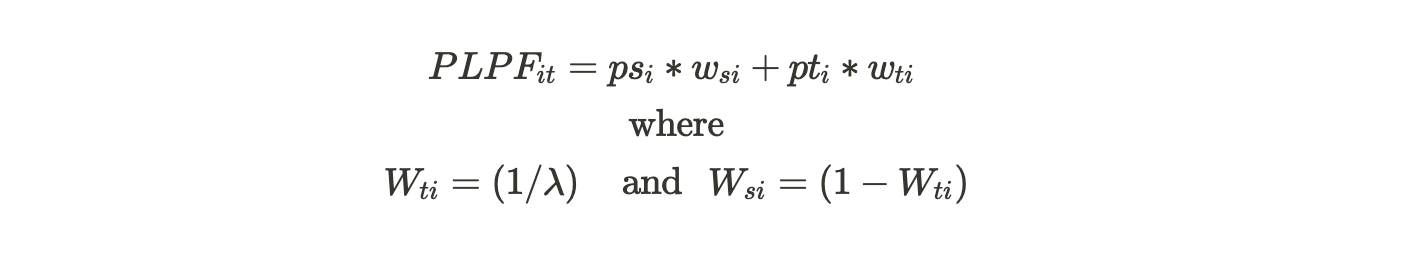

Parcl Labs Price Feed

Price feeds that are shown on the marketplace are created by Parcel Labs using the Parcl Labs Price Feed method. This consists of a three-step process looking at the relationship between volatility and the real estate market, incorporating historical and time series analysis, and examining estimates. Below is the formula used to calculate and determine the parcl price feeds.

-

psi = moving median price

-

wsi = weights of sales

-

pti = median price of timely sources

-

wti = weight for timely sources

-

λ = decay factor

This process allows the creation of the price feeds and is updated daily in real-time.

Trading

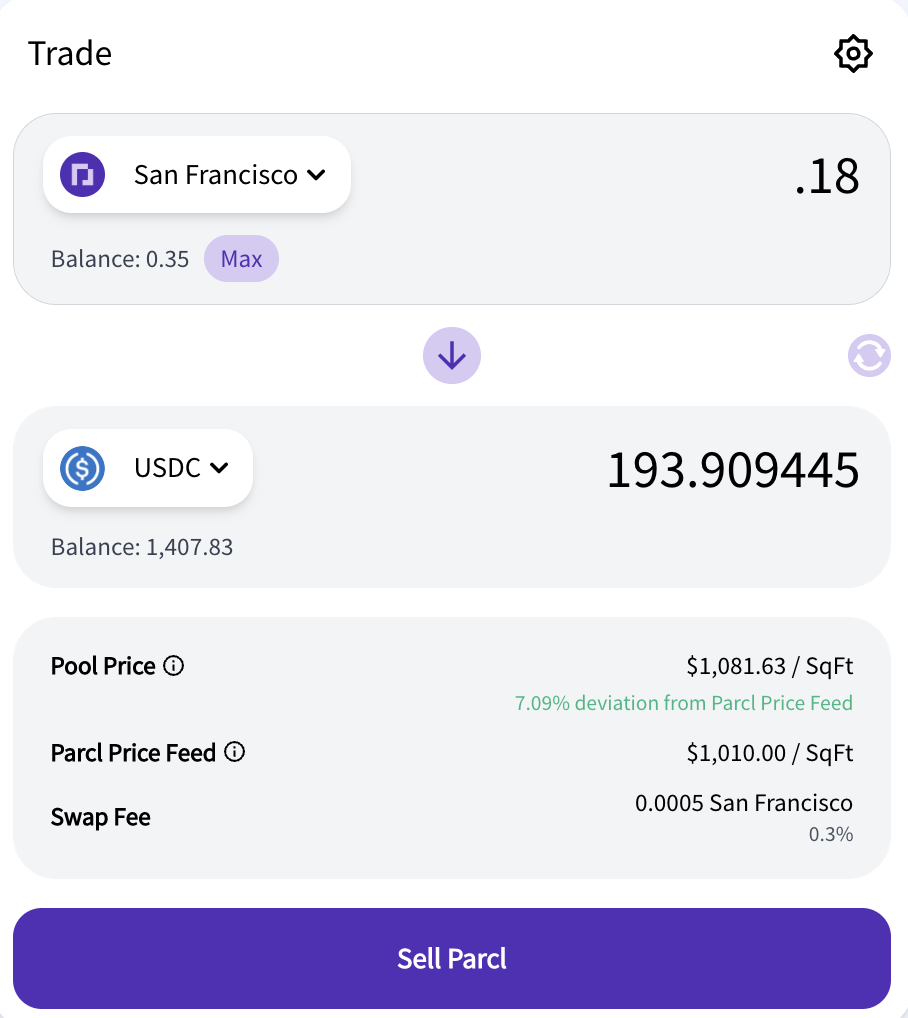

Parcl is unlike any trading platform as it enables the ability to buy, sell, hedge or short real estate. When an investor visits the marketplace, they will be able to see the open real estate market. Once here, they are able to buy, sell, or even short a position. Entering a buy position allows investors to speculate in the upward direction of a market. Opposite to that is entering a short position. This is when a trader expects that the price will fall. Shorting the market is a simple process that any trader can follow, though at their own risk. A step-by-step process for shorting a parcel can be seen below.

-

Fund Phantom wallet with $USDC

-

Go to “Borrow” tab on parcl platform

-

Click “Open Position” and choose the amount of $USDC for collateral

-

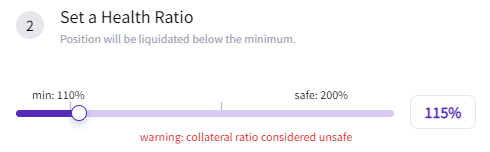

Determine “Health Ratio”

-

Confirm borrow amount

The Health Ratio is the minimum $USDC collateral amount you need to have for every $1 of parcl token debt you owe. Below are examples of an open short position, and the health ratio.

A range is established to determine between minimum and safe and can be seen below. A trader should aim to be above the minimum level and in the safe region.

The above is an example of a short position on a portion of the San Francisco real estate market at .18 parcels of land for 193.909445 of $USDC.

Investors also have the ability to hedge given that their desired real estate market is available on the marketplace. Hedging allows value protection as it can mitigate losses of property value during downturns through increasing share value in parcl shares.

Markets

Parcl currently has 19 open real estate markets available for trading.

Opportunity in Digital Real Estate

The global real estate market in 2021 was valued at 3.69 trillion. In 2022 it was expected to be valued at 3.81 trillion. Between 2021 to 2022, global home prices increased 6%. Despite that, this has also caused a global phenomenon that has forced others to be sidelined as affordability draws further away. Parcl is looking to solve this problem with decentralized fractional trading.

Parcl is unique because it allows trading fractional shares of properties, rather than having to purchase an entire property. Tokenization of real estate has now created a new opportunity within alternative asset investing with the introduction of Real World Assets. A major benefit of blockchain implementation is streamlining the home ownership process.

Real world assets such as residential property, bonds, or commodities are now able to be purchased and sold globally. The use of blockchain in real estate creates efficiency through cost cutting, increased liquidity, and creates a borderless and permissionless environment.

Risk and Challenges

Parcl currently faces many risks and challenges. The United States continues to be in limbo in how to approach crypto. Which in turn has left the cryptocurrency industry back to a state of confusion as regulation seems to be unclear by the SEC. However, legal traction looks to be improving as a drafted bill supported by Republican Patrick McHenry was created to provide legal clarity and framework with handling crypto in the United States.

Unfortunately, there is still uncertainty and lack of clarity on how real world assets are to be regulated. Risks in real world assets continue as the most recent incident being with lending protocol Goldfinch and their loss of $7M.

The lack of clarity in legal framework in the United States has made it difficult for parcl to operate in. Which is why parcl does not currently cater to customers based in the United States.

Team

The Parcl team is comprised of former founders, data scientists, software engineers, and former tradfi wall st. professionals. More of their background can be found here.

Trevor Bacon // Founder & CEO

10+ years experience within tradfi equity research.

-

Force Hill Capital Management LP: Portfolio Manager

-

Millennium: Senior Analyst / Portfolio Manager

-

Hutchin Hill Capital: Senior Analyst

-

BarclaysBarclays: VP - Equity Research

Kellan Grenier // Co-Founder, COO & Head of Strategy

10+ years experience within tradfi equity research.

-

Force Hill Capital Management LP: Analyst

-

Nomura: VP

-

GfK

-

Haber Trilix Advisors, LP

Jason Lewris // Co-Founder & Chief Data Officer

10+ years experience in Data Science.

-

Parcl Labs: Co-Founder

-

Parcl: Co-Founder + Chief Data Officer

-

Microsoft: Senior Data and Applied Scientist

-

Deloitte: Data Scientist

-

Capital One: Data Scientist

David Josephs // Lead Blockchain Engineer

- Head Blockchain Engineer

Tom Bonanni // Lead Front End Engineer

10+ years experience in Software Engineering.

-

Fingerpaint

-

Afito.com: Founder

-

Radius8 Inc: Front End Engineer

-

AirAllow: Software Engineer

Jesus Leal Trujillo // Principal Data Scientist

7+ years experience in Data Science.

-

Parcl Labs: Principal Data Scientist

-

Deloitte: Data Scientist / Manager

-

The Brookings Institution: Research Analyst and Associate Fellow

-

Idea Foundry: Consultant

Zhibin Dai // Data Engineer

6+ years experience in Data and Software Engineering.

-

Parcl: Lead Data Engineer

-

Capital One: Data Engineer

-

Clarity Insights: Consultant Data Engineering

-

B.Yond: Software Engineer

-

PwC: Associate - Tax Data Analytics

Conor Pritchard // Content Manager

5+ years experience as crypto native entrepreneurial journalist.

-

RDX Works: Social Media Manager

-

Parcl: Marketing Content Manager

-

Cumbernauld Colts F.C.: Digital Media Executive

-

TheCryptograph: Editorial & Founding Team

Valuation

Parcl has raised a total of $11.5M to date. The initial raise was on Dec 2, 2021 at $3,972,465 for their Seed round. Their most recent raise was on May 17, 2022, at an unknown Series totaling $7.5M.

While there is no historical average on what founders should provide as equity ownership during fundraising, there is some indication from previous research findings. Maximilian Fleitmann (co-founder) of Base templates recommends between 10% - 20% as appropriate. Founders Network mentions that founders should only provide 10% - 20% equity ownership and to also not surpass 25%. Lars Albright of Unusual Ventures mentions that founders should offer between 20% - 30% equity ownership to investors.

That said, this range between 10% - 30% distribution will be used as a hypothetical ownership to determine pre-money and post-money valuation.

Using the provided data and assumptions, a 10% allocation would output a pre-money valuation of $103.5M or $104M rounded, with a post-money valuation at $115M. A 15% allocation would output pre-money valuation at $65,166,667 or $65M rounded, and a post-money valuation at $76,666,667 or $77M rounded. And lastly a 20% allocation would output pre-money valuation at $46M, and a post-money valuation at $57,500,000 or $58M rounded.

There are two ways to calculate pre-money valuation which can be seen expressed as formulas below.

Example 1

- pre-money valuation = post money valuation - fundraised amount

Example 2

- pre-money valuation = (fundraised amount / % equity share sold) - fundraised amount

To calculate post-money valuation, we divide the fundraised amount by the percentage of equity ownership provided. And this is how it would look like as a formula below.

- post-money valuation = fundraised amount / % equity share sold

Galaxy Digital previously released their Q2 2023 crypto venture capital report. The report found that the median pre-money valuation for Q2 2023 was valued at $17.93M. Using the hypothetical scenario, this would put Parcl’s valuation as overvalued.

Traction

Parcl has gained a substantial following since inception. They recently upgraded from parcl v1 to parcl v2. In parcl v1, the protocol was able to establish itself as the first platform that enabled the trading of synthetic real estate derivatives. This accomplishment also included a global footing and more than thousands of users. Parcl v2 however, will now focus on upgrading the trading experience for traders.

Since then, parcl has now become a non-custodial automated market maker.

The upgrade now includes features such as a 10x leverage feature that does not require margin, a newly implemented accounting model that verifies trades are settled in collateral from a pool rather than dollar-for-dollar accounting, added geographical locations, and improving market depth to name a few. The upgrade overall increases trader experience and offers many more features.

Competitors

Parcl’s most relatable competitor is Lofty. Lofty is a real estate blockchain investment platform that is built on Algorand. Similar to parcl, Lofty allows investors the opportunity to buy or sell fractions of properties to gain exposure to the real estate market. The difference with parcl is that it is the only current protocol that allows investors to trade fractions of properties. This is what makes the parcl protocol unique.

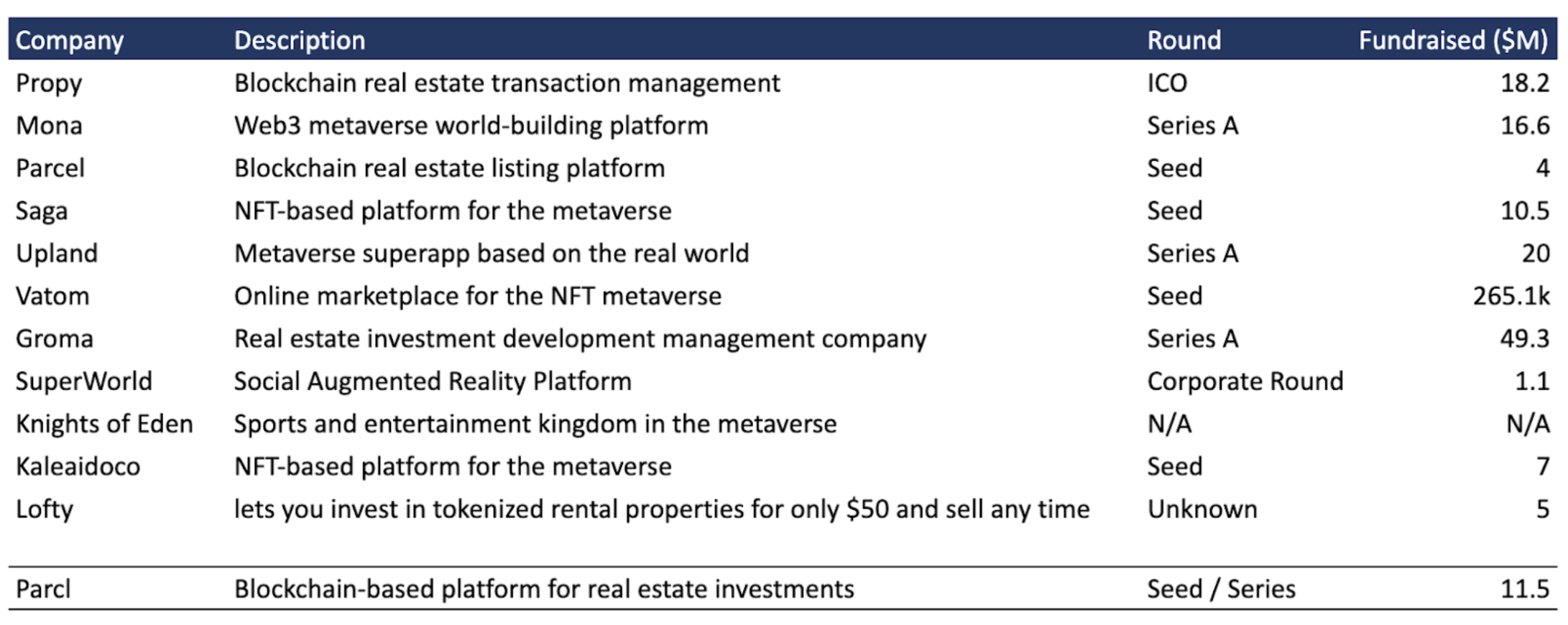

The growing interest in digital real estate is clear as shown from previous capital raises. Total fundraised amount from competitors including parcl netted $143,465,100 or $143M rounded. The most significant capital raise was from Groma, a real estate investment company having raised $49M.

Parting Thoughts

Parcl provides a new opportunity in digital real estate investing. It distinguishes itself as a stand alone protocol that enables trading of digital fractionalized real estate. However, regulatory clarity may need to be answered in order for the crypto industry to move forward as a whole. The crypto community currently awaits what becomes of the FTX collapse. This should provide some encouragement to the crypto industry despite the harm it caused to the industry.

There is much more to be excited about within crypto and real world assets. This is evidenced by the continued interest of institutional entities such as Blackrock and JPMorgan discussing Bitcoin spot ETFs. Citi earlier in the year mentioned the potential value of real world assets to be between a $4 - 5 trillion industry by 2030.

It is difficult to not be excited about the overall future of the crypto industry given the continued institutional interest. Parcl continues its strides despite the continuation of crypto winter. Parcl has potential as it is currently the first of its kind. But, regulatory clarity must be outlined in order for the industry and protocol to move forward.