What in the non-fungible was that

Where to begin… I suppose I’ll just ramble on as to what to make of 2022. Oh what a time to be alive during the days of easy monetary policy and all mighty powell. Money was brrr, everyone was happy, memes galore, and most importantly - up only.

But of course, I’m really referring to 2020. But since then, we are now on our way to normalcy. As I sat in in awe of aLmOsT getting recked - I am officially now considering myself OG.

Lessons learned this cycle

“Past performance are not indicative of future returns” - unknown

TrAdiNg

I’ve heard this quote before passed around the investment community, regardless if it were crypto or equities. Personally, I think it falls under a few things, Technical Analysis, luck in timing, and macroeconomic environment.

Technical Analysis - TA

Technical analysis is an often criticized approach to trading and investing.

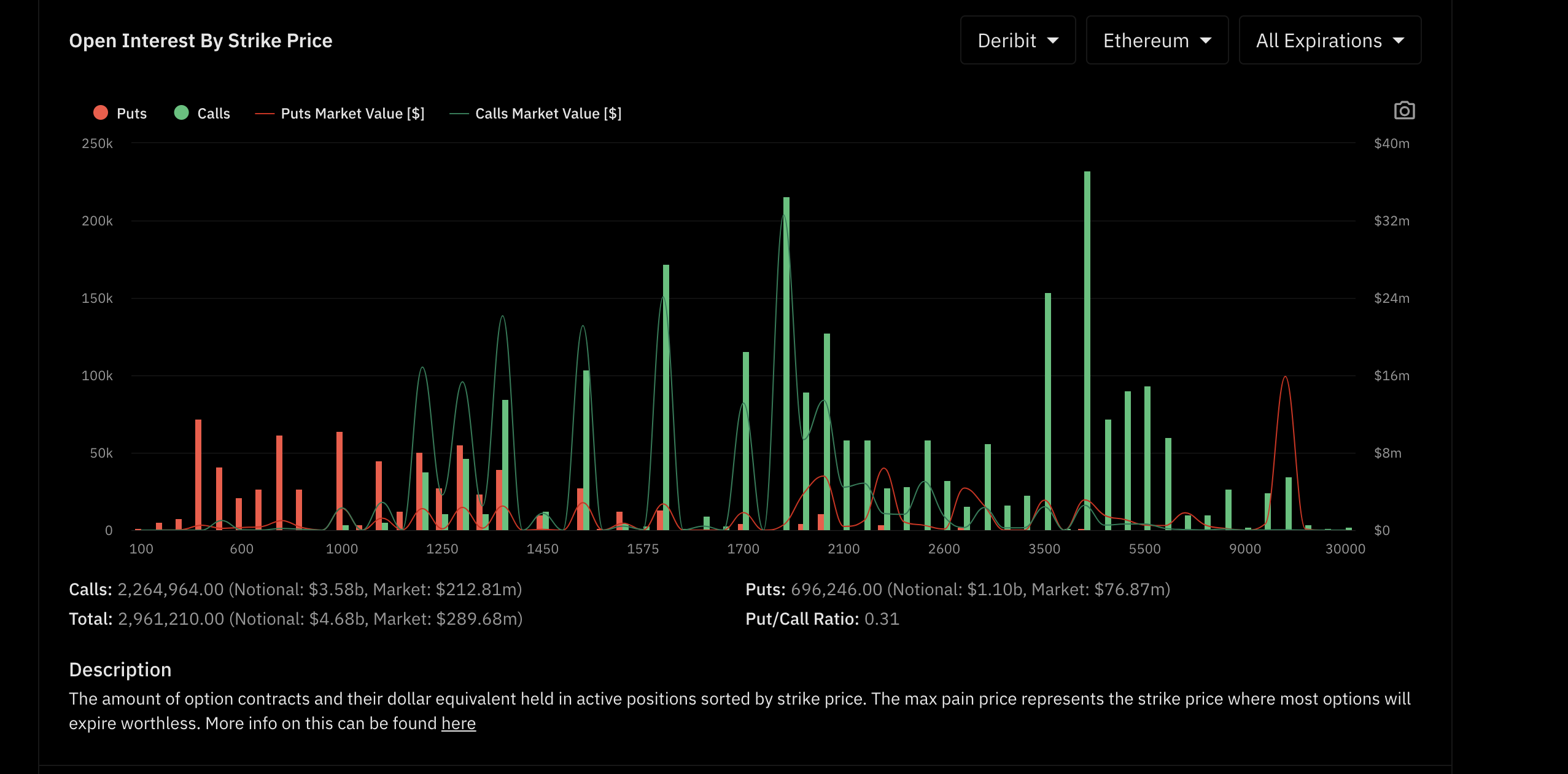

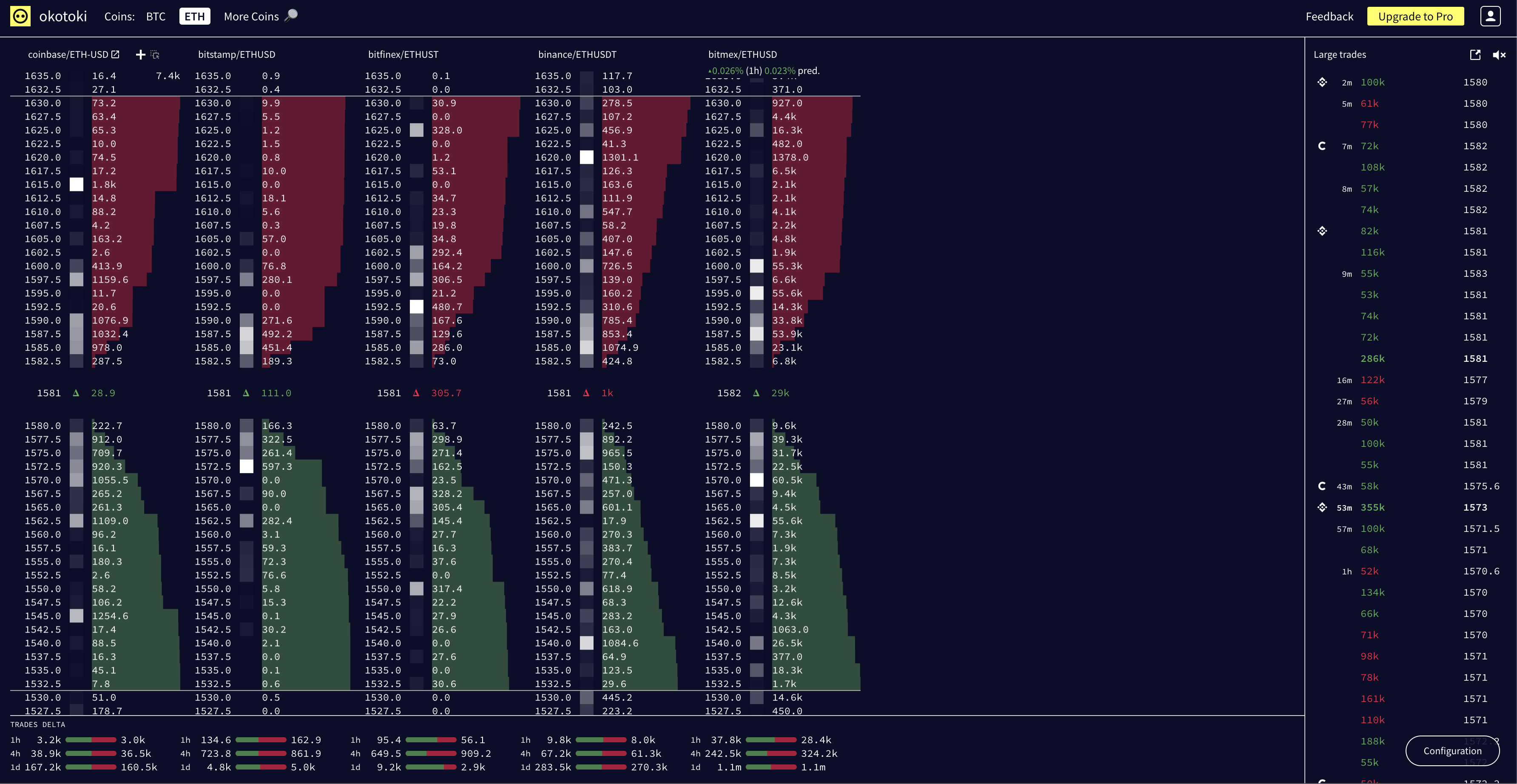

However, I found utilizing the order book and options chain to be extremely useful to supplement with TA. Some helpful sources I used came from basedmoney.io and okitoki.eth

Analyzing the order book and options chain helped me in some ways to determine which direction the market was going. Gauging the order book for instance gives you a good indication of how buyers and sellers are reacting regards to price. The options chain on the other hand helped me gauge where a price was predicted to go based on the strike price and expiration date.

As for my wizardry, things that became helpful were utilizing the idea of support and resistance. Here we begin forming a range as sellers begin to disappear and price action is determined by the market participants. This begins to become a whipsaw-like moment as no one really knows where the price will go.

From experience, this is where patience becomes crucial. However, I do say this with a grain of salt as no one really knows where price will go, regardless of how much one pays attention to order flow or events. Because if you sold at this range, you would have missed the following rally as seen below.

Using Ethereum as an example, if you entered an $ETH trade on May 11, 2020, and sold on November 30, 2020, you would have profited $2,1d27.65 with a 255% ROI, not including fees 🥹.

But of course, how would anyone really know where the price will go? These are merely my assumptions based on historical prices that have already happened. Cue in luck and the macroeconomic environment.

Luck and Macro

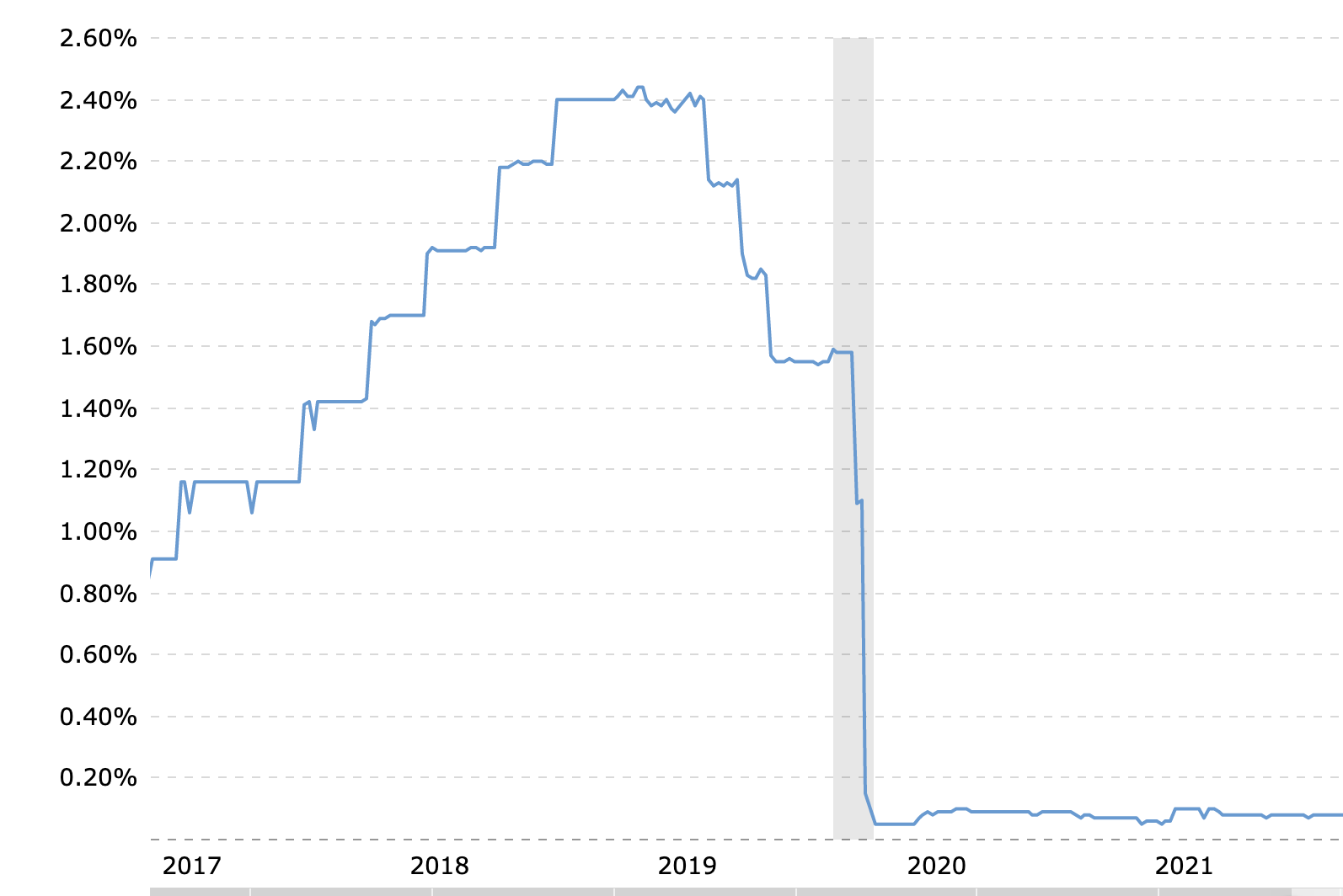

Personally did not see this coming, and would argue that no one did. Regardless of professionals at that moment in time saying that we were due for a pandemic. Nonetheless, everyone got rekt. How luck and macro play into this, is that if you blindly just threw money at the market while unknowingly aware the FED, you would’ve been a millionaire, or rich, by the end of 2020. It wasn’t until the summer of 2020, that I saw the power of Jerome Powell and the FED. We saw a historic move by FED by injecting massive amounts of money to assist the economy and cutting rates to 0.

A realization then came, in that it’s not what’s happening that’s important, but really what the powerhouse of the Federal Reserve does. Tying it all back to now and lessons learned from the roller coaster.

-

TA works to an extent

-

Have profit-taking targets

-

Follow the FED

-

DYOR = Do your Own Research

-

Question everything

I will say. I didn’t totally get rekt. But did hurt. . .

2022

The outcome of 2020 - 2021 was iNfLaTiOn. Due to the infinite supply of money, nothing was the same.

Inflation is still high, though declining.

Below is the change in CPI between 2020 - 2022 courtesy of bls.gov

With the recent move by the FED in early 2021, the music started to slow down. Crypto twitter seems to have faded and begun prepping for crypto winter. Some notable individuals to mention for helping the re-introduction of crypto and Bitcoin are Michael Saylor (bitcoin is not crypto), Anthony Pompliano, and Crypto Twitter.

Focus

Since then, I’ve been collaborating with Global Coin Research (GCR), LimeDAO, and Ganas Ventures. I have found the emergence of DAOs, which are decentralized autonomous organizations, to be interesting and insightful, and continuously learning about the world of venture capital. Primary interests I have liked are NFTs (tokengating), Soulbound tokens, Investment DAO’s, Tokenomics, and On-Chain analysis. I think Web3 will eventually become adopted, and really just a matter of time.

Here’s me hanging out at a DAO conference.

I know right. Insane. Who would’ve thought that a bunch of professionals would implement a video game-like environment and discuss business opportunities?

Until then frens. Stay humble. Stay hungry. DYOR. Stack SATS. WAGMI. 🫡