The crypto bull market of 2021 saw the rise of NFTs and in particular, Play-2-Earn gaming.

Spurred on by the likes of Axie Infinity, and reports of gamers earning a living from playing games, Play 2 Earn was lauded as the definitive use case that crypto had been searching for.

Play video games all day, earn a living through crypto. It’s a wet dream for every teenager across the world.

Yet Axie Infinity, as a bellwether for the nascent Play 2 Earn industry, experienced a dramatic fall from grace in the latter half of 2021.

Its reward token, SLP, is down 1,700% from its high to a paltry 1.7 cents, leaving many to believe Axie Infinity had an unsustainable game economy, and in some cases, label it an outright Ponzi Scheme.

Some true believers feel that Axie Infinity can be saved

Players who had previously been able to earn a living were able to earn a part time income at best, and subsequently left the game in droves. Some left for mental health reasons.

So is Axie Infinity the canary in the coal mine for Play To Earn gaming?

Can Play To Earn gaming succeed?

Play To Earn & The Financialization of Fun

At the core of the question of whether Play To Earn can succeed is a philosophical question.

How can it actually be called a game, or fun, when the objective has been inverted to making money?

In their article, ‘The Financialization of Fun’, Mechanism Capital offers a terrific thesis on Play To Earn gaming.

In it, they assess that the inversion of a game’s objective from ‘fun’ to ‘earn’ fundamentally changes the nature of gaming, and creates rise to some as-yet unsolved design problems for gaming companies.

“While crypto and gaming sounds like a promising match, crypto-enabled games aren’t going to go mainstream simply because experienced game developers are working on them. In fact, introducing crypto for many of these games, is going to be a self-defeating endeavour and an extremely difficult design problem due to the limited understanding (and experimentation) around how crypto interfaces with gameplay.”

Design challenges and philosophical ones certainly abound, yet I agree with the author Eva Lu’s assessment that sufficient interest, investment and experimentation will occur to solve them.

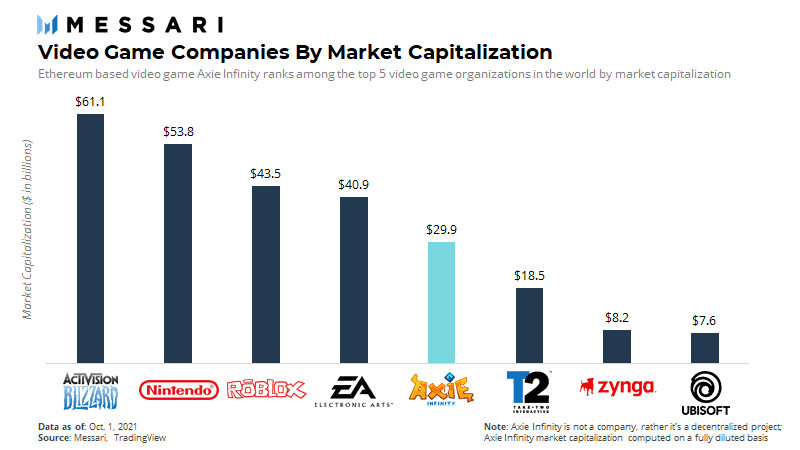

Sky Mavis, after all, has grown to the 5th largest gaming company in the world by market cap, off the back of the success of Axie Infinity.

Is Play To Earn Gaming A Ponzi Scheme?

To further understand if Play To Earn gaming can succeed, we should also explore the Elephant-ish question in the room.

Is Play To Earn gaming a Ponzi scheme?

There is no straight answer for this one, and while I want the answer to be no, technically, there is a strong case that can be made for the answer being yes.

The reason is the tokenomics of every Play To Earn game right now is extremely reliant on new players entering the fray, and partially paying out the players and investors that entered before them.

If new players disappear, the game will die off.

So in that sense, it’s a Ponzi scheme. But by the same token, so is Tesla. If new people stop buying Tesla cars, Tesla will also die off.

Play To Earn games will only survive through constant and consistent innovation, same way Tesla will.

GameFi & The Billion Dollar Play To Earn Problem

There is an incredibly difficult tokenomics (read: economics) challenge at the core of every Play To Earn Game.

The problem is Reward Tokens must have an infinite supply, if you are planning for a hit.

Under the current Play To Earn model, where earning is the primary objective and fun is secondary (‘GameFi’), P2E games must reward players with enough tokens to earn a living, or at least make it worthwhile.

This means players will require hundreds or thousands of tokens per month. For reference, an average Axie player earns 1,000 SLP tokens per month.

Let’s work out the math.

Let’s suggest a conservative amount of 750 tokens per month.

If your P2E game is hoping for a moderate level of success of, say, 10,000 players per month, this means you will have to doll out 90,000,000 tokens per year.

That is a lot of sell pressure.

But you’re not aiming small. Let’s say you have 250,000 players per month (I know a pretty average P2E game that got 500,000 into their beta). Now you’re looking at 2.25 billion tokens per year.

Cryptocurrencies thrive on their scarcity. A hit P2E game simply cannot have that for its reward token. Axie Infinity has succumbed to this fate, and well funded competitors like Thetan Arena copied the Axie tokenomics model and are suffering a similar fate.

Is Building A Play To Earn Game Worth It?

With all these questions and doubts, investors and game developers need to seriously assess if investing into or building a Play 2 Earn game is worth it.

To consider this, let’s study the two different paths a gaming developer could take in this market towards developing a game:

Regular Game (Scenario A)

The game developer incurs all the risk to build a game then sells every unit of their game at a price point they decide, and keeps all of the revenue (less platform fees).

Play 2 Earn game (Scenario B)

The game developer incurs the risk of building a game* beta* (perhaps even just a video and marketing campaign) then sells the first ~5,000–10,000 units of their game (in the form of an NFT), then equips their players to profit from the sale of the next 50,000, 100,000, 1 million units etc of the game sold (via ‘breeding’ NFTs and selling them).

Which would you choose?

If you’re well capitalised, potentially you would choose path A. If undercapitalised, you might choose path B.

Better yet, if you’re an NFT investor, it seems that investing into game NFTs early could offer an exceptional ROI.

If you discover a Play To Earn game early enough and assess it as having enough merit to lure in 20,000 or 50,000 or 100,000 players, then it stands to reason that buying the NFTs will have a positive yield (provided said game features a ‘breeding’ mechanism like Axie Infinity does).

It appears that Play To Earn gaming is worth it, from both a game developer and investor perspective.

Imagine If

I find the two words, ‘Imagine If’, to be the two most powerful words you can use to assist in understanding the far flung potential of any market.

Imagine if you were an early NFT investor in Fortnite?

If Fortnite was a paid-for game (It’s not. It’s free to play) and a crypto, play 2 earn one at that, imagine how lucrative it would have been to invest in Fortnite NFTs early and breed them?

Imagine if simply by breeding these NFTs you could build your own esports team that earned you crypto daily?

Now you’re asking the question that gave rise to gaming guilds and the scholarship model. This is what NFT investors in Axie Infinity are doing right now. They bred so many Axies (the titular NFT in the Axie Infinity gaming universe) that a revenue model emerged where it was possible to loan excess Axies to players in return for a revenue share.

My own gaming guild, Owners Guild, does exactly this.

Imagine if all those points you won playing Tetris were tokens?

This is the type of core imagination exercise one should consider to posit dream scenarios and potential future realities of the Play 2 Earn gaming market.

The possibilities, if Play To Earn gaming gets it right, are endless.

Ask yourself this question: If you were a teenager and the option was there to play video games for a living, would you take it?

Not invest 10,000 hours of your time, become an elite gamer and build up a streaming audience then get sponsorships.

Just be a moderately good gamer, play video games, and earn a living.

It beats $15 an hour at Starbucks, if you ask me.

In Summary

Play To Earn gaming is not over before it’s even begun. This is simply just the beginning.

Games are a $200 Billion USD industry, and as more people begin to earn an income from playing games, then more gaming companies will have to convert to sharing revenue with their players by tokenising gaming assets.

We’re not near to a tipping point yet, but I believe that tipping point may come.

There are many more bumps and bruises and trials and tribulations along the way, but I’m still a believer that Play 2 Earn gaming exhibits potentially the greatest potential of all of crypto.

Even if it is kind of a Ponzi scheme.

If you enjoyed this article, I would appreciate if you would clap or comment! It lets me know if I should continue writing more, or keep my opinions to myself :)

Lloyd Perry is the Director of NFT creative agency Shhh, and Owners Guild, a P2E gaming guild. He is currently working on multiple P2E focused NFT projects. Follow for updates.