Over the last month, the total crypto market cap has fallen about 20%. It’s been a tough time for the crypto space, but these are the kinds of swings we have to deal with in cryptocurrency.

I’ve read so many bearish articles and posts on the crypto market in the past few weeks, and it honestly surprises me how many people act as if crypto, DeFi and NFTs are in their own “bubbles.” They forget to look at the bigger picture.

The End of the Hedge Strategy

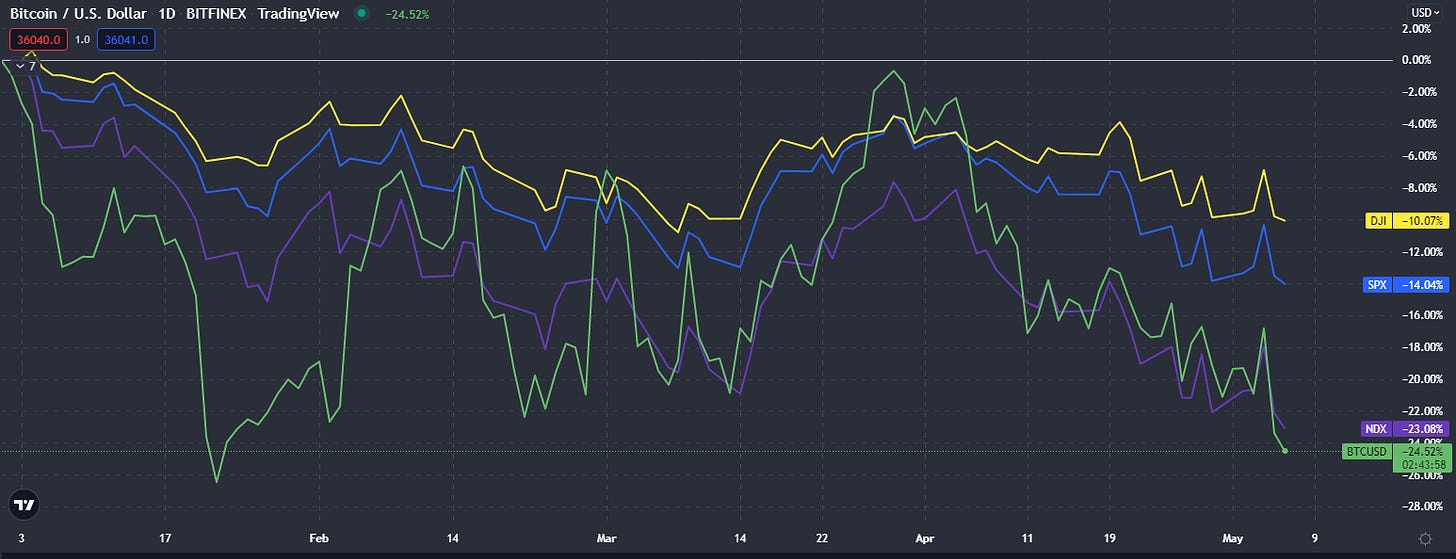

For many years, bitcoin and other cryptocurrency was often considered to be a hedge against the traditional markets and governmental inadequacy. That is obviously no longer the case.

During the 2021 bull run, money from mainstream, traditional financial entities flooded into the market. The majority of that money is still there today, so it makes sense that bitcoin/crypto would act more like the mainstream markets than it did in the past, and that’s exactly what’s happening.

I’ve been feeling the pain as much as anyone else this year, but the price action of bitcoin compared to the US stock markets has given me a lot of resolve. In my opinion, this is the first step towards mass adoption.

The Bigger Picture

It is more important than ever to look at the global market as a whole before making a conclusion about the state of the cryptocurrency market.

If you got into crypto as a hedge against your stock market investments, then it’s probably time to reconsider your strategy and make changes to your portfolio. However, I suspect most of my audience got into crypto to make larger returns. In that case, if you can afford to do so, now is the time to turn off the charts and wait.

The global economic market is a complicated beast and there are very few people alive that truly know what the future holds. In my opinion, there are just two ways to look at this situation:

#1 - History Repeats

The first view revolves around the idea that, over the long-term, the global market will eventually bounce back and hit new all-time highs once again. This will almost certainly happen, just like it always has in the past, so it’s a very safe bet to look at our situation from this point of view.

Furthermore, it’s also very likely that the crypto market will follow along to new highs as well. It may lag behind a bit, or it might lead the way, but it’s hard to imagine a scenario where crypto gets left behind at this point. This is not 2018. Cryptocurrency as an investment is on a completely different level now.

#2 - A Change of the Tide

The second view point is a little more radical and less likely, but it’s not impossible. For the die-hard decentralization fanatics, blockchain addicts and defi degens, we are right on the cusp of a major shift in the world’s economy.

If government policies and other factors fail to revive the global markets, eventually consumers will be forced to look elsewhere, and you could make the argument that crypto is in the perfect spot to take advantage of the opportunity.

While this scenario is less likely, it would create the largest transfer of wealth in history and the entire crypto community would be dancing to the tune of ridiculous returns on a weekly basis.

So, are you the strong and steady practical type, or are you the dreamer?

Either way, there’s no reason to get too low on the current conditions in the crypto markets. Hopefully, you’ve held back enough cash to withstand the fight for months to come and, if so, all you need to do is leave your crypto investments alone, maintain a macro-view of the markets and live your life. Otherwise, you may find yourself selling the bottom…

Follow me on Twitter @SayWhenCrypto!