03.27.2021

The recent run in crypto prices and the blossoming zeitgeist around all things blockchain has drawn comparisons to the dot com bubble. I have no plans to prognosticate on crypto prices, but I find the comparison fascinating given the role bubbles have played in major technology shifts over the past few centuries. Are there interesting parallels we can draw between today and those previous shifts? And what might those parallels teach us about the impact the blockchain could have on society?

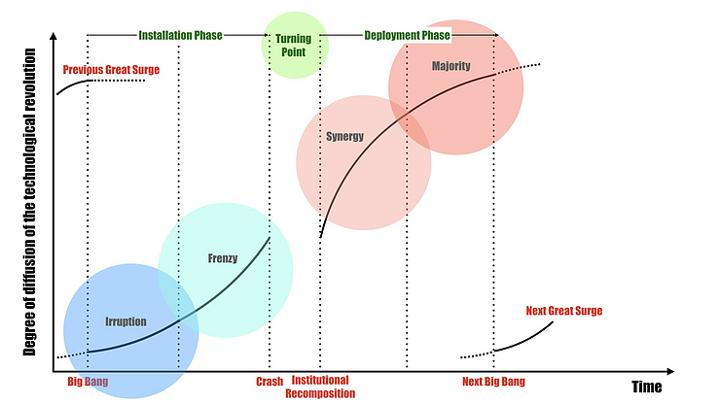

Referring to everything that touches the blockchain as a single thing called the blockchain is a gross oversimplification of what is happening in the space. But it feels about the same as using the internet as a catch-all term for everything that touches the internet, YOLO. Plus, there is a reason for thinking about the blockchain holistically, as a single constellation of related technologies, and it has to do with technology revolutions and the work of Carlota Perez. Technology revolutions are periods of accelerated technological progress when new innovations are rapidly adopted and abrupt changes in society occur. If you aren't familiar with Carlota's work, she studied the major technology revolutions of the past few centuries and recognized a consistent pattern among the interplays between capital markets, new technologies, the global economy, and society. She observed that each revolution has two phases: (1) installation phase, when the core infrastructure needed for the new paradigm is built (highways for automobiles), and (2) deployment phase, where the technology gains widespread adoption and externalities emerge (increasing adoption of the automobile + highways = suburban expansion). See a graph of the In each of these revolutions, a key ingredient was a constellation of new and existing technologies that, when combined, enabled a paradigm shift. This is why looking at the blockchain as an agglomeration of related technologies can be useful, specifically when thinking about potential long-term implications.

The innovations that fuel these revolutions are often built on the back of technology breakthroughs from prior generations. Universal electricity was an innovative technology in the early 20th century, but by the 1970s, and the birth of the microprocessor, electricity was a commodity and served as a foundational layer for the computer age. The internet's adoption rate followed a similar trajectory to that of electricity; and will undoubtedly play a foundational role in the next revolution.

Technology, on its own, is actually a poor indicator for when a paradigm shift will happen. One of my favorite aspects of Carlota's work is how it highlights human behavior as a vital determinant of tech revolutions. How the changes in how we interact with technology—our collective technology *best-practices—*are the highest signal indicators of a pending revolution. And it is the changes in human behavior around the blockchain that get me most excited about its potential impact.

The most challenging form of innovation is changing human behavior. It is the one persistent and unknowable variable new technology must solve to unlock adoption. When viewed through that lens, the fervor around the blockchain bodes well for its staying power. Despite a user experience that is objectively pretty terrible, millions of people are flocking engage. Sure, some of the draw has been to speculate on crypto prices, but I think it's deeper than that. Discussions about the future of blockchain with people close to the space often turn from heady to pollyannaish. You can almost hear the echoes of someone describing the potential of the internet in the 90s. It's like a religion, and newly baptized members are spreading the word. Attracting more people to experiment and engage with these technologies. I found this recent announcement from Visa a particularly strong signal that corporate affinity for the blockchain is growing. Minds are being changed, and behavior along with them. That is as strong a signal as any that we are in the midst of meaningful and broad-based technological change. It's also a tell-tale sign that things might be frothy in blockchain land.

To be clear, I am not saying we are in a blockchain bubble, that a crash is imminent, or even that long-term correction is inevitable. I am also not saying that a crash won't happen. Do I think the path to broad-based adoption for the blockchain will be linear and smooth? It seems unlikely. But how the vicissitudes play out, I won't pretend to know.

What I do believe is that the blockchain is here to stay. As my friend Packy McCormick is apt to say, "genies don't go quietly back into bottles." There are certainly some overvalued, highly speculative, and even fraudulent projects in the space. But there are many others, built by legitimate teams focused on solving real problems, that have the potential to meaningfully change how we interact and exchange value with one another. Finding stability will take time. Matriculation of the masses will happen as the user experience improves and use cases expand. And judging by the broad range of project types popping up almost daily, this seems to be underway. The road ahead won't be without bumps and setbacks, but the adoption of the blockchain will exponentially expand in the coming decade. The community of builders and believers is passionate. And they're not going anywhere.

The revolution is now begun. It's gonna be a wild ride.