This week, I had a realization: the tactics that Web3 companies use against each other like the vampire attack, the airdrop, and token incentives don’t just have to be used for stealing users from each other - they can also be used for drawing a massive amount of users away from established Web2 companies shockingly fast. In this post, I’m going to use a new NFT marketplace called Blur as an example, because what they just pulled off and how they did it is the blueprint for unseating the current internet giants.

We’re in the early days of a business model shift the size and scope of SaaS. News about smart moves by companies like Spotify, Shopify, Disney, Starbucks, Reddit, and possibly YouTube among others keeps coming out. They are still spending money and experimenting to build internal experience and capabilities because they don’t want to be caught flat footed once adoption reaches critical levels and users expect a more Web3-style relationship with the products they use and the companies they buy from.

Blur?

I’m not going to go into great detail here. For the purposes of this post, it is only important to know that Blur is a relatively new NFT marketplace with a specialized trading UX which launched back in November. As I’m sure many of you out there know: two-sided, consumer marketplaces are incredibly hard businesses to start. They’re especially hard when there is an established giant (OpenSea) doing over $2 billion in daily volume and generating nearly a billion dollars in annual revenue.

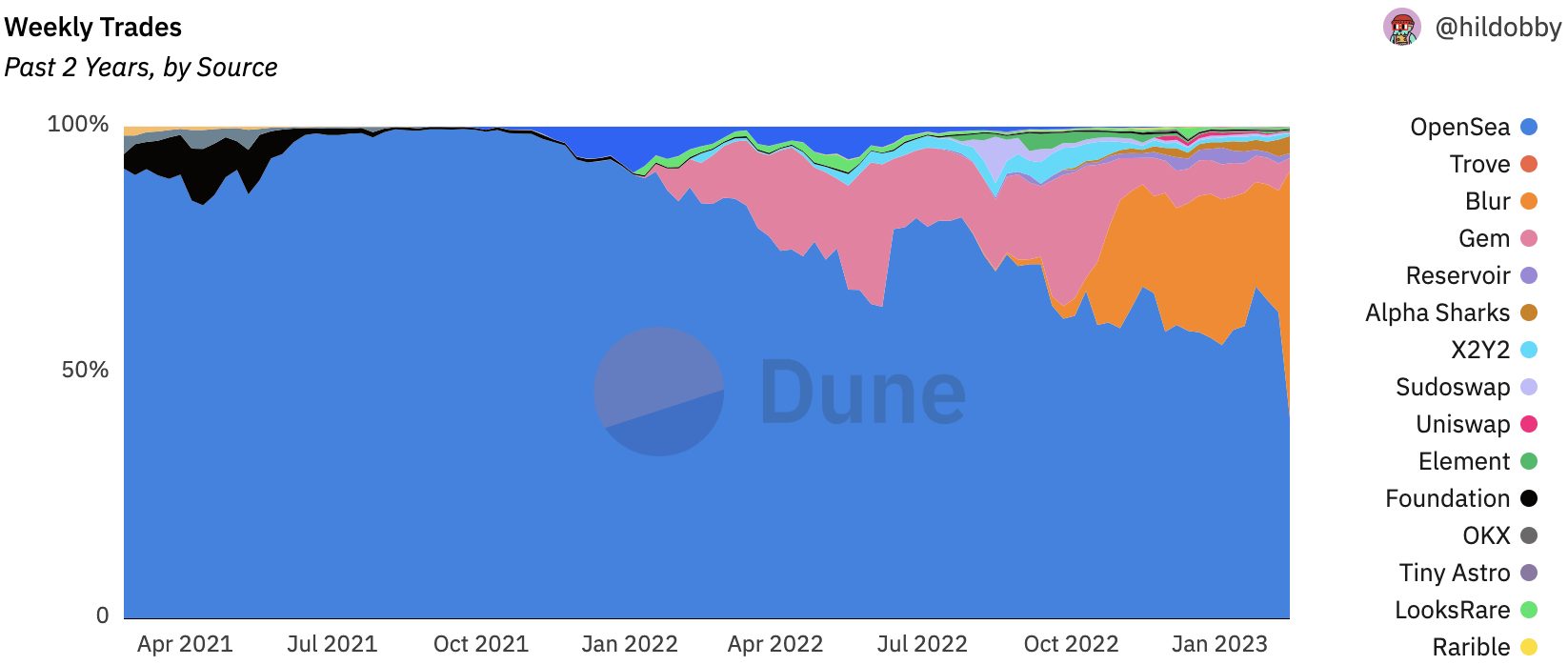

In my last post, I made a comment that when all data is open and on-chain, that all of the competition moves to the UI/UX, and on many axes, Blur improves on what came before. And while you’d expect the easier to use app to win over time as word spreads, what you don’t expect is the new entrant to overtake the long established leader like this:

So How Did They Do It?

There’s some controversy about this latest jump in usage we’re not going to get in to, but there are three main tactics that they’ve used masterfully to bootstrap their marketplace and cement themselves firmly in a leading position.

The Airdrop

The first tactic being used by Blur is the airdrop. You can think of it as simply giving your marketing dollars, in the form of your own cryptocurrency, directly to your users for doing certain things like being an early user, being a power user, or even doing your marketing for you. There have been many others in the past, one notable airdrop is ENS, where the value of the tokens early users received ended up being in the tens of thousands of dollars. Everybody loves free money, so as you can imagine even the rumor of an airdrop is enough for users to flock to certain platforms on the off-chance that they will be given the equivalent of the average US salary.

The Vampire Attack

A great UI/UX is not going to get you new users if you can’t get any of them to see it and use it. So the first step is getting users to try out your innovative product, but you also want to make sure that you’re going to attract the right users, and who better to attract than your competitor’s most active and engaged users. Enter what in Web3 has been dubbed “the vampire attack”.

When Blur launched, their launch announcement included news about an upcoming airdrop of their $BLUR token, the size of which was scaled to the volume of trading you did in the preceding 6 months, and to claim it, all you needed to do was simply list a single one of your NFTs on their marketplace for sale. At the time, the quantity and value of the tokens wasn’t clear, but judging by past performance of other airdrops and the quality of the Blur team and product, the expectation was that the tokens would be pretty valuable.

Many if not all of the top traders at least gave Blur a shot, and many stayed because of the improvements to the user experience. Many of them are also very vocal about what they’re using, what they’re doing, and have loyal followings. Now that the airdrop has happened, we know that some of these people received the equivalent of $100k, some even over $1m simply for using a new product to do what they’re already doing. How many of your power users and independent influencers will stay loyal to you when being offered $100k-$1m, no strings attached, to try out a competitor for a little while?

Ongoing Token Incentives

The problem with paying your users to use your service is that you tend to attract mercenaries, and as soon as you stop paying them, they’ll move on to the next thing. This isn’t easy, not only do you need your product to be better, but you also need your token to retain value in order to keep people doing things to earn them. Blur is doing something innovative here, where they tie the token earning behavior to the new major feature they release - again essentially paying your users to figure out how to use a new feature instead of paying for marketing directly. They also have the box checked for having the best product out there.

No one has solved how to ensure that your token retains value. Most teams just default to governance, but that hasn’t really shown to be a big long-term draw. I’m sure there are some very smart people out there right now building experiments to solve this and I’m personally keeping my eyes on a few to see how their launch plays out. [1]

So What?

So far most of these tactics have been used by Web3 companies on other Web3 companies, but there’s nothing stopping them from doing it to a traditional or Web2 company. Once this happens successfully the first time, the floodgates are going to open and many existing companies are going to start hemorrhaging users to competitors whose business models are incomprehensible at cost structures that are impossible to compete with.

As a disruption theory / Innovators Dilemma nerd this is fascinating to see play out in real-time - what happens when a bunch of small, capital-efficient competitors are able to easily peel off valuable subsets of your users with a targeted interface, support them cheaper than you can, with higher margins?

[1] Overlord for example is one of the big ones that just released a teaser of what their token ecosystem and incentive structure will look like. They are building an entertainment brand, with a gaming ecosystem, animated series, and fashion label in this new Web3 community ownership model. Their latest teaser shows that they’re thinking about using tokens in a similar way to what I just outlined above with Blur, but it looks like they’re building an ecosystem with uses for the token beyond simply governance.

Does anyone else think this looks like they’re telegraphing a vampire attack on competitor’s streamers? Do you think they’re going to see it coming?

Full disclosure: I currently hold many Overlord ecosystem NFTs.