Are you seizing the Memes?

I am a big fan of the Memes by 6529. There isn’t any other NFT collection I am aware of with such a diverse selection of artists, and if you are able to collect all cards, you would end up with a great collection of Crypto Art. As they are CC0, the concept of remixing has also been interesting to watch evolve as derivatives and homages have blossomed.

As we approach the end of SZN1, it has become noticeably harder to seize the Memes. Following several failed transactions of my own during primary drop, I decided to have look at the data to understand what might be the drivers. Thanks to blockchain data availability as well as the highly organized nature of the project, I was able to do a weekend analysis into the trends.

Setting the stage

Firstly, I obtained the transaction data from the Manifold Gallery contract that sells the Memes (0x3A3548e060Be10c2614d0a4Cb0c03CC9093fD799), going back to July 2022. Both transactions as well as ERC-1155 transaction events data are needed to map activity to individual Meme cards. Secondly, I obtained the distribution data from the 6529 Collections tweets. This is also obtainable from the 6529 Collections github account.

As this analysis is intended to look at the primary sales, Meme cards that were 100% airdrop have been excluded. Similarly, Meme card #8 had an extended distribution window and did not fully mint out, therefore has also been excluded.

I started by selecting the transactions using the “Purchase” method, with a price of 0.06529 ETH. Mapping transaction hash to ERC-1155 transfer, we are able to see which purchase transactions were for which Meme card. However, this alone will not allow us to categorize failed transactions, which themselves are not tied to an ERC-1155 event.

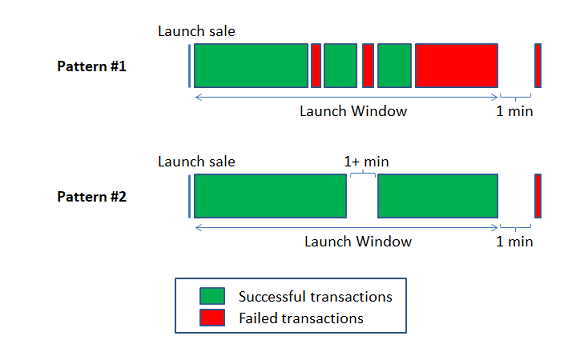

To determine the failure rate, I took an approach where I defined a “Launch Window.” This is a period of time that includes all transactions both successful and failed, until a card is sold out. I did this by taking into account any transaction from launch of allowlist sale until sell out, including any failed transactions that occurred within less than a 1 minute interval of each other. As soon as the next transaction takes place more than 1 minute later, I exclude subsequent transactions.

In cases where a card still had supply available but there was a period >1 minute of no transactions, I still included in the “Launch Window” until it sold out. All subsequent views in the analysis below are looking at the transactions within the Launch Window.

Analysis 1 - Failure rate of transactions at drop

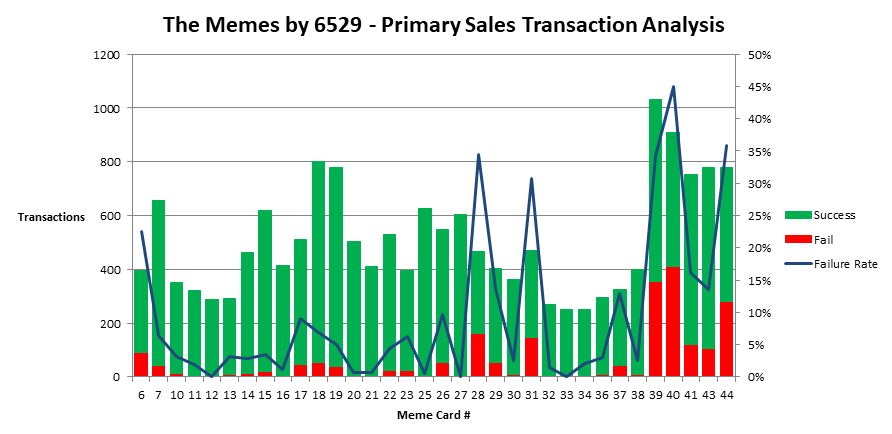

Looking at the Etherscan data, it can be observed that while purchase transaction failure rates have spiked in the past, they have generally stayed within 10% until recently. Starting with Meme card #39, there has been an increase trend where the absolute volume of transaction failures have increased.

The Memes website disallows purchases once all tokens are sold out. If that is the case, why so many failed transactions? The likely reason is a large volume of prospective buyers pressing the buy button at the same time. All the simultaneous purchase transactions are competing to be finalized on the blockchain.

The following list shows the length of each “Launch Window” and how long it took to sell out each card. Note that in the most recent drops, the cards sell out in 1-2 minutes, however there are failed transactions that are confirmed up to 5 mins later.

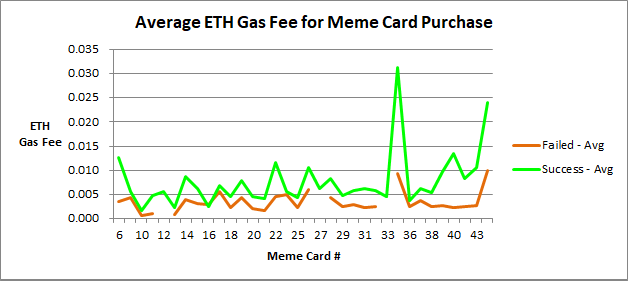

In summary, if you have been unable to buy a Meme card recently, you are not alone! There is a large group of people who are poised to make a purchase at the exact time the drop opens. So how come some transactions finalize faster? We can observe the reason by comparing gas fees of the successful and failed transactions.

Analysis 2 - Contrasting successful vs failed transactions

When we compare the transactions, one thing becomes clear. There is a divergence between failed transactions and successful transactions based on gas fees used. With the volume of transactions competing for the allowlist spots, using the default gas fees may not let your transaction finalize in time to secure a card.

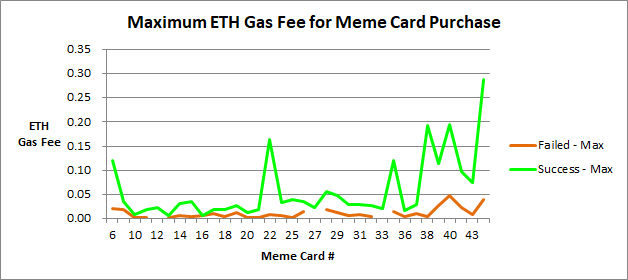

Below is a look at the maximum ETH gas fees used for Meme card purchases. Note the divergence that occurs at card #22, #34, and after #38 onwards. There are certain prospective buyers that want to make sure they secure an edition!

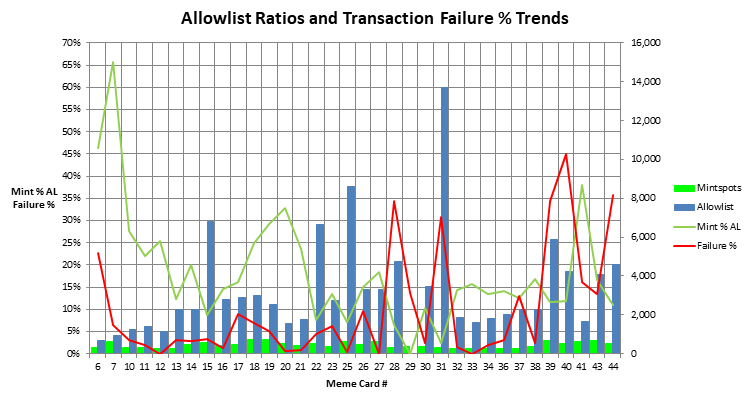

Analysis 3 - Allowlist ratios and transaction failure % trends

Meme card allow lists have trended between 1,000 and 3,000, but a large allowlist did not necessarily lead to an increase in failed transaction % until recently. Cards #15, #22, and #25 all had allowlist spots greater than 6,000, meaning less than 1/10 allowlists would be able to purchase a card. However, failed transactions accounted for less than 5% of purchases.

Looking at the more recent trend, it can be presumed that more people are utilizing their allowlist spot to try their luck at the primary sales drop. Taken positively, this means that the Memes have reached a good level of awareness and broad recognition. Where there is attention, there is value, and the attention appears to be here. As SZN1 comes to a close, this may also mean it is a good timing to reassess edition size so there are enough to go around.

Closing thoughts

Summarizing what I have learned here;

-

The Memes are gaining in popularity and more people are joining the primary sales drop, increasing competition and resulting in more failed purchase transactions

-

The average ETH gas fee paid by successful buyers are multiples higher than those that are not able to buy. If you are joining the primary sales drop, acting within the first minute is required, and adjusting gas fee settings may be advisable.

-

While recent allowlists are larger than before, there have been past drops with large allowlists that took place with relatively low failure rates. It is the rate of individuals making use of their allowlist spots that appears to be increasing.

It is a great thing that we are seeing more and more people value the Memes. For SZN2, it may make sense to increase Meme card supply to match this increase in interest. Finding the right balance between distribution and scarcity is such an interesting concept of this experiment, and one of the reasons I am such a fan of the project. Looking forward to the new iterations and learnings as we continue our journey to the Open Metaverse.