INTRODUCTION

Decentralized finance (DeFi) aims to build an open financial system and enable token holders to vote on protocol changes. Compound, a leading DeFi lending protocol, uses the governance token COMP for on-chain voting. While COMP holders can vote directly, Compound also allows delegation where token holders assign their votes to other addresses.

Delegation is intended to enhance the collective participation of the community in the governance process by letting users delegate voting rights if they don't want to actively participate. However, critics argue delegation could lead to vote concentration if large token holders accrue a disproportionate amount of delegated votes. Understanding the dynamics of delegation is important for assessing the decentralization and governance health of protocols like Compound.

This analysis evaluates the impact of delegation on the distribution of voting power within Compound governance. It examines the delegation behavior across different COMP balance tiers and compares decentralization metrics before and after delegation. The results provide data-driven insights into the role of delegation in Compound's governance decentralization. By presenting a detailed study of delegation, this analysis aims to further the understanding of governance dynamics in leading DeFi protocols.

KEY FINDINGS

Data as of July 31, 2023.

-

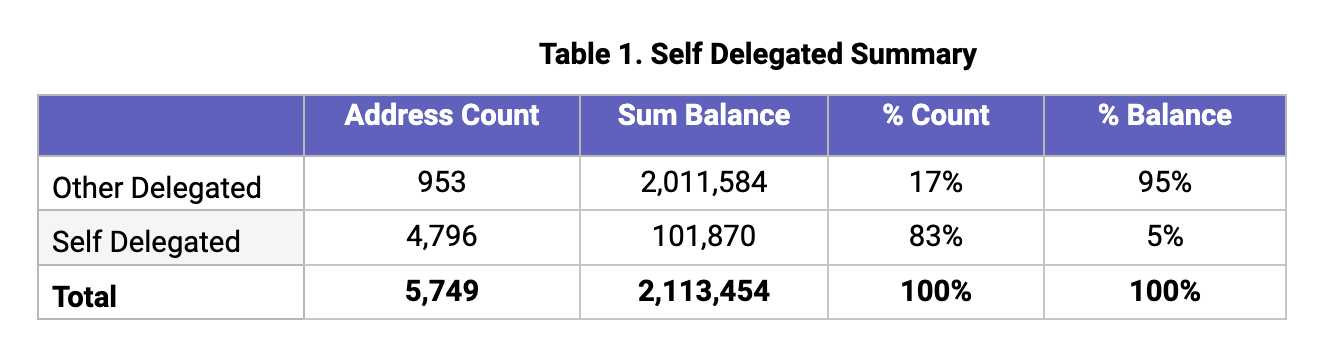

While 83% of addresses self-delegate, 95% of the total COMP balance entered into the governance process is delegated to other addresses. This shows large holders tend to delegate while smaller holders prefer self-delegating. See Table 1.

-

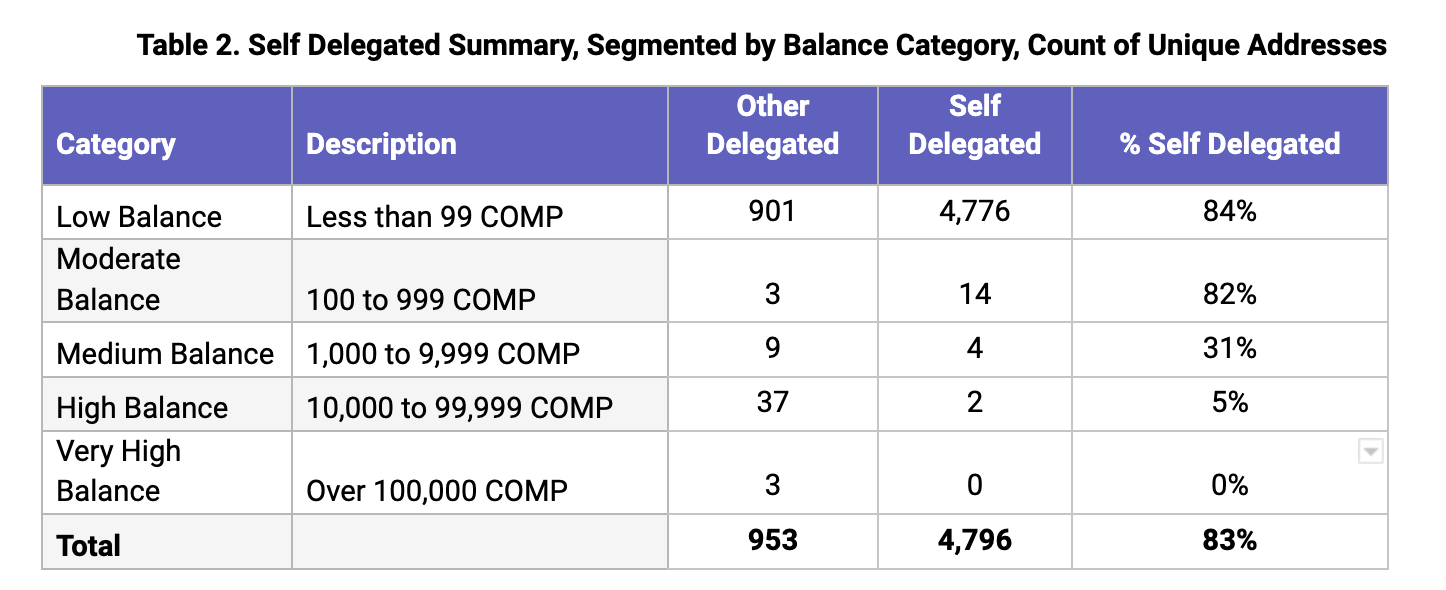

Segmenting addresses by balance tiers indicates delegation is far less common among higher balance holders. Only 5% of High Balance and 0% of Very High Balance addresses self-delegate, versus 84% of Low Balance addresses. See Table 2.

-

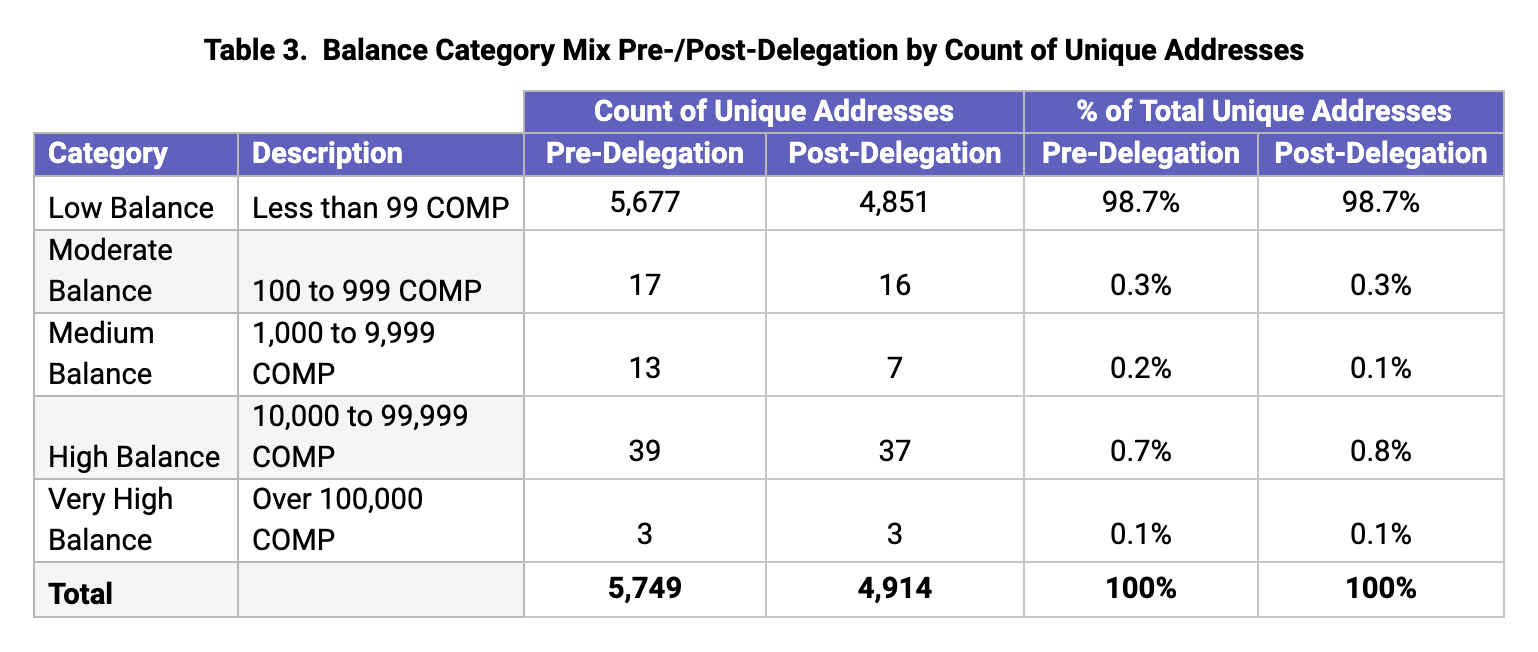

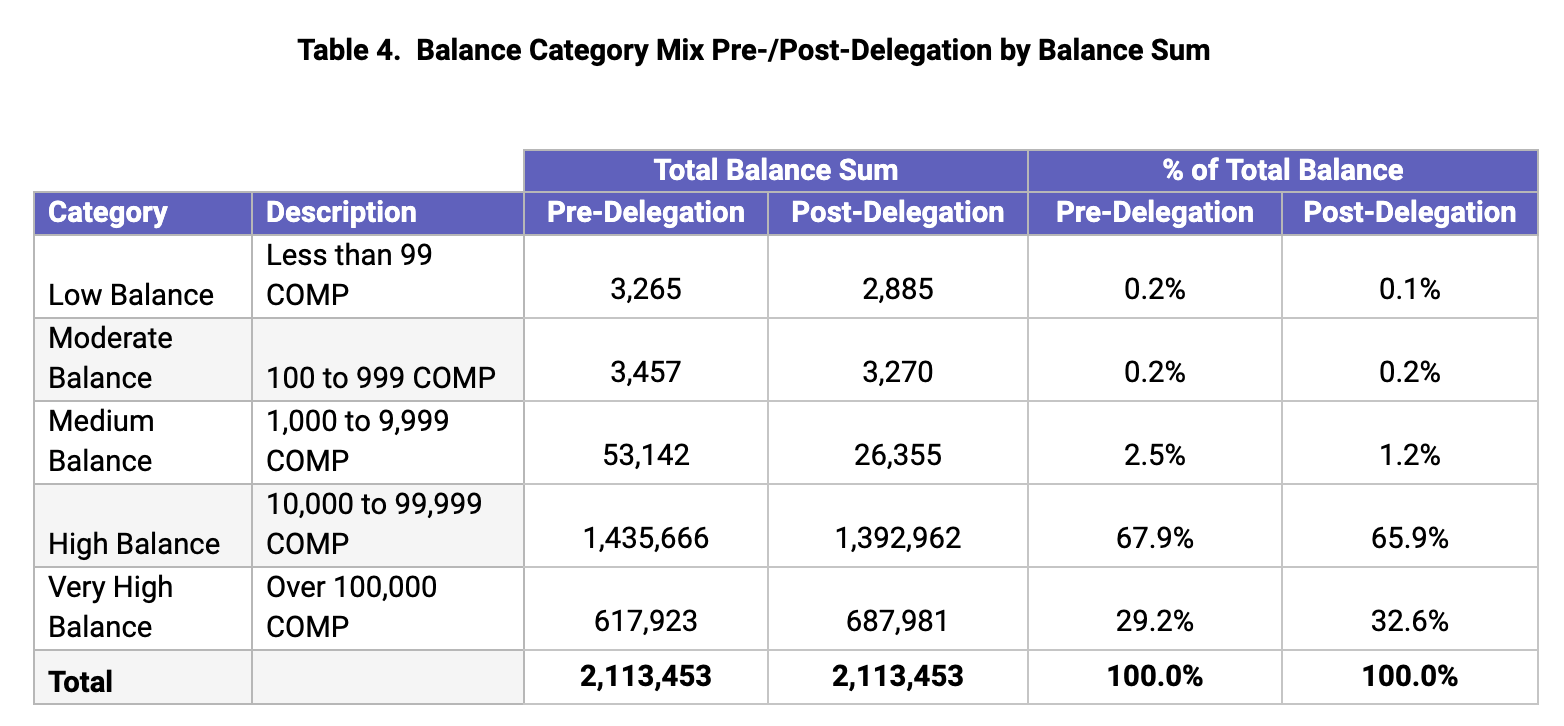

Despite delegation from large holders, an evaluation of balance category mix pre- and post-delegation shows that their COMP still flows to other large holders. See Tables 3-4.

-

Delegation has no material impact on the balance proportion of lower COMP holders. Delegation does impact the relative share between Medium, High, and Very High balance holders; the Very High balance holders increase from 29% of the total balance pre-delegation to 32% post-delegation. There is a corresponding drop in the Medium and High balance holders’ share post-delegation. See Table 4.

-

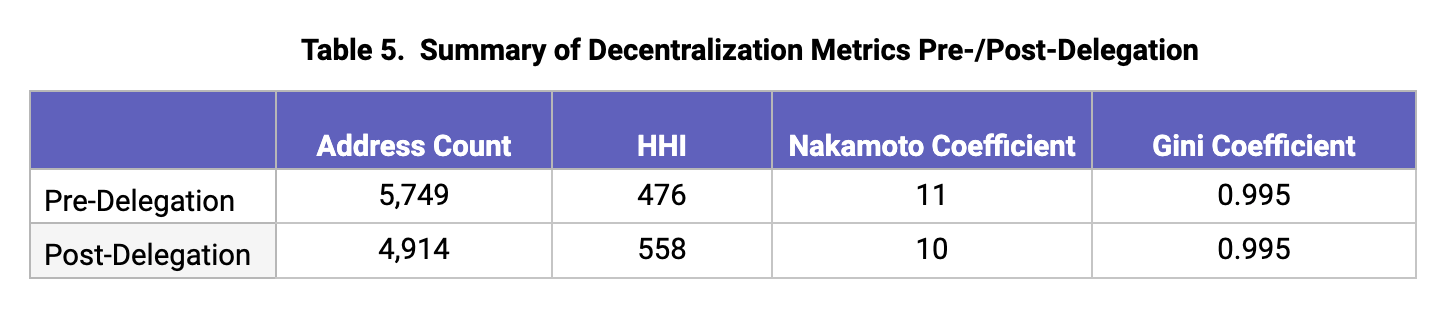

Delegation has the potential to be a significant factor in calculating metrics such as Nakomoto coefficient, Herfindahl-Hirschman Index (HHI), and the Gini coefficient for assessing the level of concentration/decentralization in governance voting. Based on the findings of this post and scores depicted in Table 5, changes observed in common decentralization metrics before and after delegation are moderate. This implies factors like participation rates and base COMP distribution may be greater drivers of decentralization than delegation alone.

-

The post-delegation scores in Table 5 indicate room for improvement in on-chain voting even with the current address distribution and participation. While there are over 4,900 addresses with a positive balance post-delegation, the highest voting participation on a specific proposal was only 619 participants in Proposal 111: Risk Parameter Updates for 2 Collateral Assets executed on July 4, 2022.

-

Technical improvements in the delegation process such as fractional delegation (Franchiser Spec) could also have a significant positive impact. This would open new opportunities for higher COMP holders to not have to solely delegate to other high balance holders; allowing flexibility to allocate a mix to a greater variety of interested persons across the spectrum of COMP holdings. While fractional delegation alone is insufficient to fully decentralize protocol control from major holders, its implementation can distribute tangible governance feedback not achievable under the current model. By allocating even modest vote percentages to smaller holders, their collective input can incorporate a genuinely wider range of opinions and insights that strengthens governance decisions.