*Note: there were many early contributors and believers in TreasureDAO whom I may not give proper recognition in these explorations, but who definitely played a valuable part in helping Treasure grow into what it is today. So while I use John Patten as the lead visionary in this series, I don’t mean to forget the MANY wonderful early anon builders and team who were--and are still--working tirelessly to make the MAGIC happen day in and day out. I salute and thank you 🫡.

This is the first of three parts in my--perhaps, very naive attempt--at painting a digestible picture of the metaverse TreasureDAO is bringing to life.

I have no affiliation with the team or any of the projects. I’ve simply just been enamored with the spirit of Treasure and the promise of MAGIC since shortly after they launched. Writing this is my way of giving back in hopes that when someone asks you what the metaverse is all about, you show them this.

These essays are not going to tell you why you should be bullish on TreasureDAO, but how you should think about TreasureDAO, and more broadly the concept of the metaverse, and value creation therein.

I believe the Red Pill this industry needs to demonstrate to the masses what is possible when you combine all these different technologies together is encapsulated in TreasureDAO’s crypto cosmovision.

Nothing I ever write is financial advice. Opinions are my own. Constructive criticism and opposing viewpoints are always welcomed, especially from any founders, team, or Treasure OGs who find this.

Love you frens.

Vibe Check

End of August 2021, #NFTSummer is fading as the space continues to walk the shrinking plank of yield out along the risk curve, aided and abetted by BAYC’s outrageous luck and very public success. The level of cringe is nauseating, as “devs” and “teams” look for any excuse to keep the carousel going with countless new schemes for Utility™ creeping up each day.

Every other tweet on your feed is some version of “Omg thank you Walton team !<333” except regurgitated in NFT format. People are posting nudes for WL spots, Beeple is still relatively sane by CT standards, and suddenly every normie can describe what a Veblen good is.

DeFi 1.0 is dead. DeFi 2.0 is the future. GM is now a culture. WAGMI.

Rebase tokens on every chain have popped up because OHM is about to print (again), while I am preparing (unbeknownst to myself) to get hot and sweaty in the “metaverse” with a mass of anons in TempleDAO opening ceremony (FML).

These days, a x10 is considered “OK, but not great”; there is an entire subreddit full of people who, hand-to-god, are convinced GME is about to trade at $10k a share; Do Kwon is still the hero and Terra is still Money.

PFPs, at first bashed and deemed meh, have become the apex predators of non-fungibles; however, more abstract takes on the substance of ‘Crypto Art’ are also flourishing.

ArtBlocks is doing well, along with those who grasped that niche market early on. 1-of-1 diehards who are “in it for the art” preach their virtue in the name of 6529. Coinbase is collecting thousands of engineers to create an NFT marketplace that will eventually do a few hundred transactions a day in volume (kek). In this dystopia, Tezos is a relevant blockchain, you are paid to borrow, and GameFi is the ‘next big thing’ but no one can exactly tell you why or how.

Meanwhile: our protagonist kindles a fire from a spark of imagination, as he and others animate new life from the bones of what was widely considered then--and still to this day by most, even in the Treasure universe--a simple fad and cash-grab collection.

The project is Loot (for Adventurers) and our man is John Patten.

John Patten, a former DeFi writer himself, got his feet wet working with Osmosis DEX on Cosmos before co-founding Treasure with anon fren Gaarp and others. Osmosis is unique in its approach to AMM architecture allowing customization of bonding curves, fees, and multi-assets on their liquidity pools. Essentially, it treats every pool as a DAO and seeks to align incentives with stakeholders through this flexibility.

OSMO has been kicking for a minute now, and in many ways is where I believe DeFi 1.0 AMMs like Uni and Sushi are going to eventually end up in design. As it should, pliability for liquidity providers to create their own incentive models around a LP or other digital assets will become paramount as the DeFi experiment continues to emphasize capital efficiency and UX.

Most importantly for our tale though, this time at Osmosis oriented John to the value of community and how implementing user feedback laid the bricks for a robust protocol to take shape. It’s a pillar of Osmosis and as we’ll see, the absolute quintessence of TreasureDAO today. Moreover, I believe it entrenched in him the idea of what was possible by bridging the tech of DeFi and NFTs together, or rather--not viewing them as separate things at all--and gave him the chance to seep in inspiration from brains like Sunny Aggarwal.

Thus, having already been sufficiently primed, when Loot dropped it was immediately captivating and inspiring to John in contrast to many who had a hard time grokking the concept, as it challenged their fundamental views on what an NFT was, including myself.

For those not familiar, Loot is a digital card with randomized ‘adventure gear’ as its contents. Each NFT is just an item list, as if you were going to check your inventory in an RPG, but no images.

However, real nerds and fantasy enjoyooors have been tapping into this mana for a long time. Word-based adventure games are nothing new, the most popular of which, lives on today in the imaginations of Dungeon Masters and on tabletops across the globe. The best games power on the player’s imagination. Constraint is elemental to creativity. The medium is the message.

Many NFT projects at this time were literally just copy-pasting smart contracts, adding new JPEG images, running them through some AI trait randomization filter, booting up a Discord server and calling it a day. Loot said, actually, here’s a template, what kind of ideas can come from this? What kind of world can we build off this?

World building is what we are primed to do as humans. Storytelling is as inseparable from our conscious experience as the fleshy avatars we explore the world with. There is rarely a moment we aren’t projecting our Self along the golden thread of our own narrative. We create fictions instantaneously, consistently, and relentlessly to establish mental models that help us navigate our subjective viewpoint. We are our own walking legends, reinforcing the lore that is Me (pronounced mEEEEEeeeee!) in every moment.

Meditation is the timeless call to arms to bring awareness to this, and why it is such a powerful tool for living. By simply realizing that we and the world around us are nothing more than an experienced stream of thoughts and feelings, and that our lives are just a bundle of moments stringed together, one after another, comprised of this aware data, we can begin to detach from our perceived ‘reality’ and shape our experience of it.

Donald Hoffman, a cognitive psychologist with a PhD in computational psychology, distills it hard and straight for us:

Science has proven spacetime is not fundamental. So what is?

He proposes consciousness, and I think whether you believe the same or not, it offers us a chance to draw interesting parallels as we consider the continued creation of cyberspace.

I personally conceptualize the metaverse as the overlay of a digital universe with our physical world.

A background explorer of sorts, with the alchemical means of transmuting objects from IRL to AR to VR and any pocket of sentience in between. In these rendered matrices of existence, where spacetime is also not a given--where you can fly to different planets at will or flip through fantasy worlds like you would programs on a television--what is fundamental here?

In short, whatever we decide is fundamental:

Money in The Metaverse

To the many people in crypto and outside of it who doubt the metaverse as a worthy objective or understand the profundity of its implications, the above is a pretty out-there concept.

This is not helped by VC culture co-opting our mission as their own last cycle, giving us all forms of tokenized pixelated shit to sift through while clueless MSM reinforces the negatives with flashy headlines. We saw many implementations of the metaverse these past two years, whether it was people trying to bridge the promises of DeFi and NFTs together unsuccessfully (RIP JEWEL Chads), or just negligently funneling cash into “GameFi” projects like Gala Games that were basically just a poor designed website at best (at the time).

Coincidentally, shortly after Treasure was conceived, Chris Dixon and Naval Ravikant sat down with Tim Ferriss to discuss the state of crypto and the NFT hype. It’s tinged with classic bull market flavor, and recent enlightening DD about a16z being the next SBF aside, they talk about Loot in particular and its promise as an experiment:

Indeed, many people took the constructs Loot provided and ran with it, but most absolutely pale in comparison to the umbrella that is the Treasure universe and the builders, players, and traders therein. Never before have the means existed for verifiable ownership and fluid exchange of these monies across time and space existed until now.

It’s akin to a bunch of people walking around a dark room, unaware of who else is in there, and suddenly someone turns on a light. With Web2, you basically could only stay where you were and throw things to other people. With Web3, you can walk over to other people, exchange clothes, dance, fuck--whatever.

And while all the VCspeak might make you sick, don’t let it distract from the goal because it is a worthy one: the metaverse needs its own decentralized resources to nourish networks and seed community.

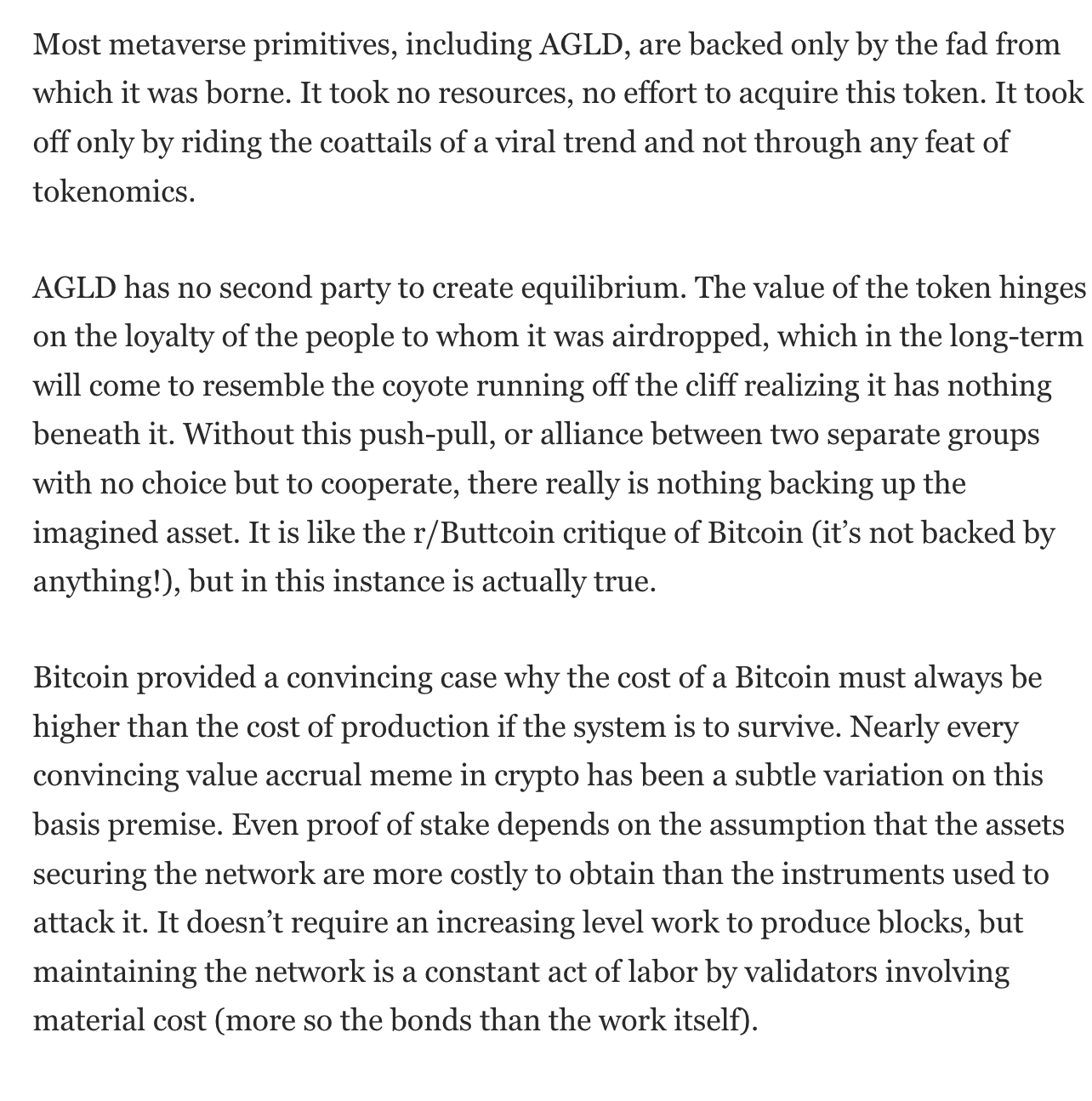

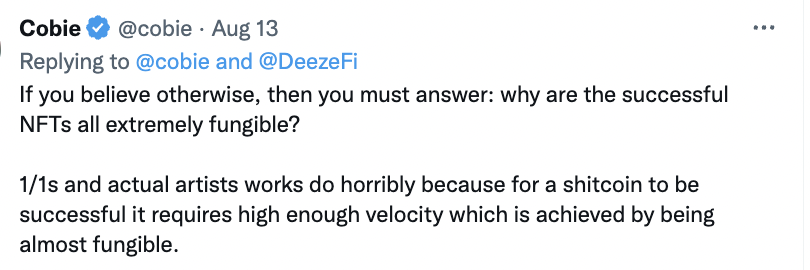

Loot decided that was AGLD which turned out to be nothing more than another airless token, and though momentarily inspiring, the knockoffs and their counterparts were also just lead balloons, lest we forget:

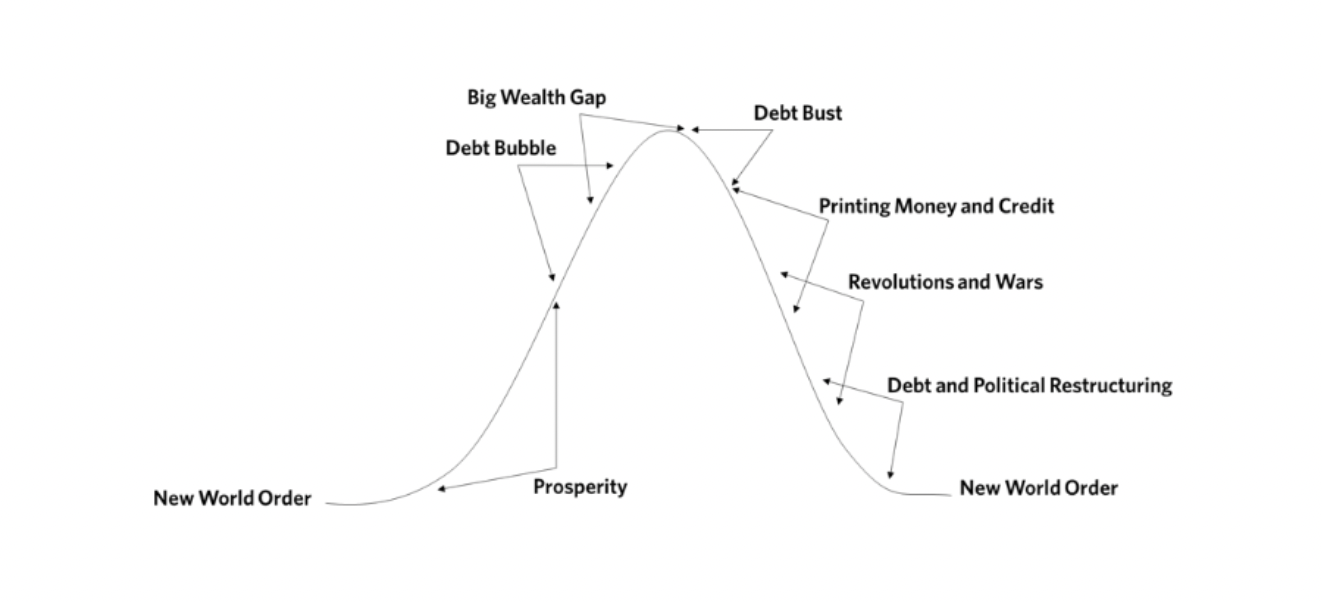

One of the main kernels of truth that BTC Maxis like to stand on is that each BTC is backed by energy in the material world giving it “actual” value. I thought this myself for a long time and that it was akin to a commodity-based (gold) currency in a way. Proponents like to claim because BTC is extracted via a (now) electrically demanding procedure, each one is backed by the energy it takes to mine the coin into existence, or the hard math of the algorithm. These make it attractive as a money, but:

BTC is actually not “backed” by anything. It doesn’t need to be.

The network itself is SECURED by the energy intensive and hardware specific process it takes to win a block reward, of which if you want to partake, takes considerable resources on your end these days to join in the incentive model. Yes, run your node and take part in consensus, but it is not part of the incentive structure.

This security is only reinforced by the PRICE of Bitcoin heretofore. Each fungible bitcoin itself is nothing more than the commoditized proof of its ledger at a given point in space and time represented by its price. Bitcoin’s price is a reflection of how valuable the community around BTC believes BTC to be as a technology/ money/SoV.

BTC as a fungible store-of-value is no different than any other money because currency is first and foremost a SOCIAL construct.

So while Saylor preaches from his highly leveraged BTC pulpit, and insists people to loan against their homes in the same tone a la SBF’s “sell me all the SOL you have at $3 and fuck off”, the truth is:

BTC’s price is backed by no different a perception than the world’s current shared belief in USD as a reserve currency, which is a consequence of US diplomatic and military prowess, suchlike the artistry of the BTC network and code. That’s it. End of story. Good day.

However, needless to say, BTC is an infinitely HIGHER QUALITY and more DESIRABLE money and SoV in almost every sense than the contemporary fiat house of cards we are forced to transact in, because of this secure network.

ETH comes down to the same concept. It is only as valuable as the people who use and believe in its network believe it to be.

I personally believe whether PoW or PoS is more secure can’t even be discussed fully because we do not have enough data for these blockchains at massive scale (over 1b DAUs). Risk vectors can change at larger tx volumes and market caps. As legitimate and more sophisticated nation-states enter the fray, the game changes. Everything until then is a hypothesis and crypto is still a boutique market and colossal monetary experiment.

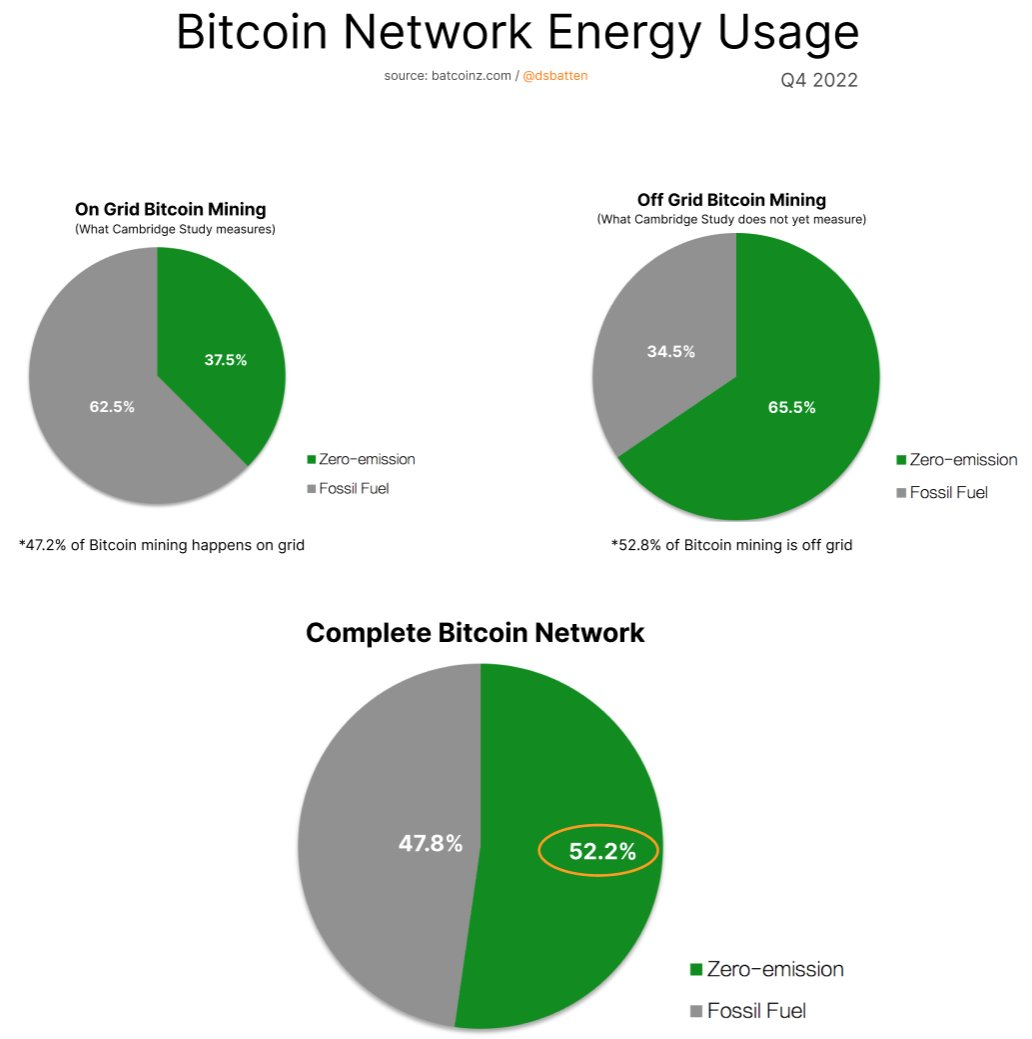

I believe over time that ETH will become the preferred ultra-composable form of money and SoV simply because its move to PoS will make its incentive model more accessible to more people. Mining BTC has become extremely exclusive and totally reliant upon ASIC machinery, the most competitive models and majority of which are made in China by Bitmain, though more companies like WhatsMiner and Canaan are trying their best.

Still, the supply for these ASIC miners are bottlenecked through a few companies and if you as an entrepreneurial spirit would like to get involved, because of how competitive the market is from deep-pocketed giants dominating hash rate, if you want to not just piss money away each KWH, you’ll have to set up shop under the same roof as their rigs through a hosting service. Every miner capitulation the pie gets smaller too.

Even though I think BTC mining is net-positive for renewable energy and weaning off grid energy sources, the fact that in order to reap the rewards of ETH staking will only take a button-click to swap from ETH to the staking derivative of your choice will win out with the masses because frictionless-ness is extremely important in the metaverse.

Of course, ETH validators have their own potential centralization risk (like literally any network), and the entire crypto industry is perpetually at risk from AWS, regulators, and the fiat-backed stablecoins we are propped up on, most acutely BTC because short of P2P exchanges it relies heavily on centralized intermediaries to acquire natively vs. DEXes.

And fwiw, I believe we need both a SoV and a global smart computer accessible to all, and that the future is symbiotic not maximalist. It’s the Ego that says there can only be one; that there must be separation; real life or the internet--but not both.

What John Patten proposed that was innovative is that while we can argue all day over PoS vs. PoW, in the metaverse there is less wiggle room.

In a hyperbolic and imaginary world, there needs to be a conceptual proof-of-work, some form of transmutable user sweat equity that anchors the world or the dream will fall apart. Another way to say it:

Because there is legit nothing of value to start with, the mechanics for value creation need to be created first. Not imaginary world→then pick what looks shiny.

In our current meatspace there are physical laws we are constantly pushed up against and confined by. BTC and ETH are tethered to this material reality, the yin and yang progenitors which have allowed this Wild West most of us can’t leave to stretch to the shores of acceptance and taste the seas of real adoption. To pour the foundation of the metaverse though, we need different raw materials to make the concrete so that we may stand upon it and etch the tabula rasa from our own imaginations.

Here, joy becomes the collateral and creates intrinsic value for individuals to circle the wagons around. This philosophy was the impetus for the MAGIC token’s initial design, and as we’ll see in this essay and the following ones, one of several key guiding insights established early on that has kept TreasureDAO one of the most slept on projects in all of crypto.

Static vs. Dynamic

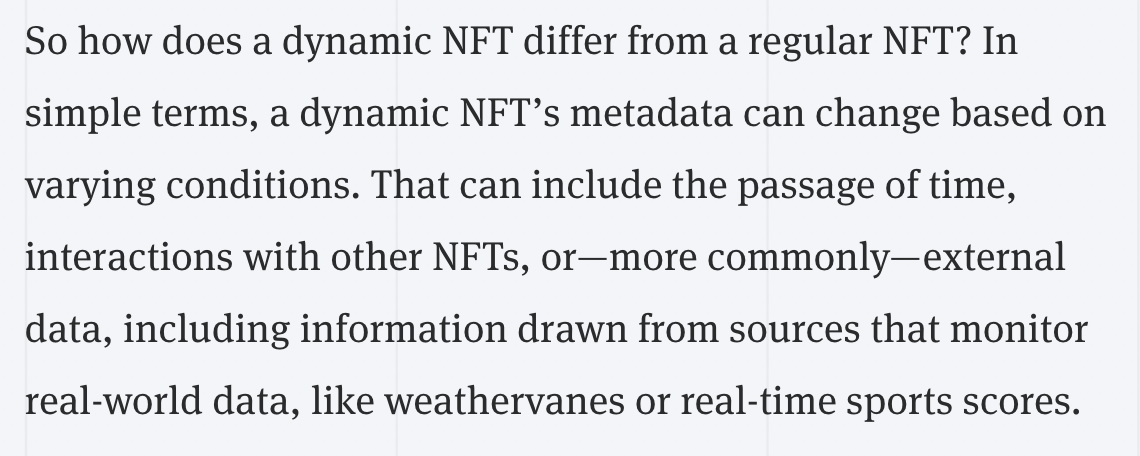

Another relatively revolutionary epiphany Patten cultivated, was that the most popular iteration of static PFP NFTs were just the starting point for this transition of DeFi to GameFi, and that dynamic free-mint collections held endless promise and accountability.

The mind when presented with something new, will naturally always want to compare the new thing to its database of past experiences and information. That’s a sick car, reminds me of a Porsche. This ice cream kind of tastes like cake. It’s like Ethereum but faster. Oh this is like a receipt! No wait--it’s actually like a Pokemon Card or a Beanie Baby; it’s a digital collectible.

We cross-reference qualia all day long.

This is part of the reason PFPs were kind of laughed at when they first started making the rounds and why so many people slept on them. Oh sweet so I can trade baseball cards online? GTFO. Except, they weren’t trading cards or art: they were status pieces for digital brands sprouting up left and right; gateways to digital community at a time when Covid had forced us all inside. We are social creatures. Even if that social aspect becomes more and more abstract and synthetic via technology.

To this day, I still think one of the best analogies for NFTs I’ve heard is espoused by Dixon halfway through that interview:

Naval expounds a few moments later:

Now, it’s not like the breadth of customization or many use cases for NFTs was some big secret to NFT fans, but while Treasure was having its Big Bang, most projects were just copying ideas from Web2 into Web3 based off what they saw the people in front of them doing.

This is why most metaverses we’re stuck holding now the dust has cleared are actually very uninspiring remakes of The Sims (sorry Sandbox); or only accessible for those who were early, rich, or dying to be either (sorry Otherside); or grew to be unbearably cringe imho (again, sorry Yuga); or just completely empty (not sorry Decentraland); or all of the above (looking at you Zuck, minus the CTRL Labs snipe 🤝).

Simultaneously, we transitioned from basic liquidity mining in DeFi Summer 2020 to a new genus of complex reward models that seek to rope traders in with sustainable APY or #RealYield. Except we don’t call it a game. We just keep coming up with fancier nomenclature for the word ‘profit’ or slap a V2 on it.

Take GMX for instance. Their multiplier points system for increased ETH yield the longer you stay staked is at its core just a simple passive game; veTokenomics, gauges, bribes, auto-leveraging, yield aggregators, et al. are just gamification of digital financial instruments. Look at GNS, a perp platform but you have the option to stake an NFT in their DAI Vault to boost your rewards and lower trading fees. More games.

All trading and investing is (obviously) a game at its core. The greatest intellectual game on earth some would venture and I’d agree. As the fiat experiment races to its known end and the metaverse springs to life simultaneously, the perimeters between what is money, a derivative, a primitive, an investment, dissolve. Patten saw this clearly, and was one of the few not naive enough to box the watershed tech of NFTs in with all the low effort 10k takes polluting the discussion.

From the jump, Treasure has always been focused on interoperability and composability across metaverses vs. necessary building their own expanse. The motive was to steward fertile ground, not reap a harvest.

The real metaverse is an amalgamation of many solo universes and communities, which themselves are endless in their own origin myths and storylines. It’s an overlay of pixel onto physical--skeuomorphism in reverse--Proof of Imagination. 6529’s Open Metaverse ethos embodies this well.

It further solidifies my core belief too, as we lean our faces against the glass of AI waiting for it to look back, that an open and decentralized internet is the main mission critical objective when it comes to maximizing freedom for future generations. But how do you build a dynamic breathing digital landscape?

Answer: with dynamic breathing digital characters.

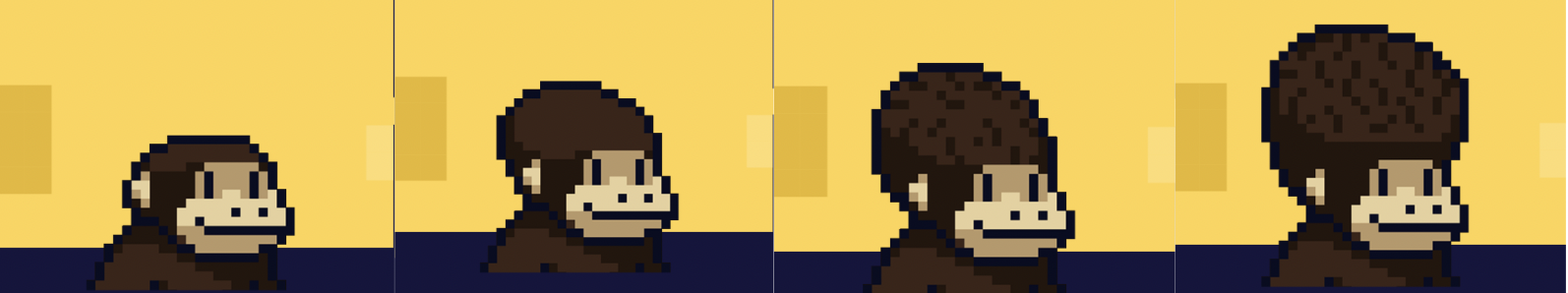

Smol Brains were one of the first dynamic NFTs that I personally encountered, and definitely the first hit collections on Arbitrum. For those who are completely unfamiliar:

Smol Brains are the flagship collection of NFTs in Smolverse, alongside their frens Swol Bodies. You can send (stake) your Smols to school (or your Swols to the gym) and their heads (or muscles!) will get bigger as their IQ increases the longer they stay staked. After being stranded on the moon, they are currently on their way to Smolville, which will be one of TreasureDAO’s first in-house high-fidelity games.

Deceivingly, this concept is actually MUCH more innovative than a monkey’s head growing.

Anything can grow with this smart contract: IQ, XP, power, age, loyalty, towns, planets--you name it--and pull the data that influences this growth from anywhere as long as there is an oracle for said information. The chain reactions from this are pretty endless and amazing to think about. Let’s take metaversal weather as an example.

Say there is a benevolent brood of Smol Witches perfecting a potion with different Smol Treasures. After it has stewed for a certain amount of time, they are imbued with the powers to change the weather of Smolville, making it rain MAGIC bananas to every Smol Citizen. But in this sense, the weather is just a smart contract waiting for conditions to be met. In a classic game universe, these events are mostly local to you. In the metaverse, they are potentially life-changing for many.

I think Fortnite, Apex Legends, Roblox, et al. are all ahead of their time in regards to shared digital experiences like this for players, with WoW being the trailblazer, but they are limited by their centralized self-imposed borders, ie, their distinct lack of interoperability, ability to overlap with one another, and player-ownership. They similarly rely on a myriad of Web2 tools and cash flow that is not available here in crypto.

What the Treasure team has been working on over the past year is making tooling for these vital game components, the above of which is called their ‘School Contract’, so that builders who decide to come build on Treasure can utilize them in an organic way in conjunction with their other universal primitives. And this is really just the tip of the iceberg of possibilities that the team sees with NFTs and what they have to offer.

For instance, outside of POAPs, Guild.xyz, and similar wallet-based verification platforms that prove your on-chain identity and humanness, like Gitcoin Passport or RabbitHole, the Recruits you can get for near-free to play Bridgeworld (the base layer game for all of Treasure) demonstrate an excellent use-case for SoulBound NFTs in the wild. The limit is one per wallet, and conceptually offers an amazing way to build incentive models around a player base, or retroactively distribute items as the collective narrative for the world changes.

I think characters are the perfect application for SBTs. Just like if you were going to grind any RPG, your hero is yours and can’t be replicated. Or--consider the opposite--you have an NFT that’s tradable up until they consume or interact with a certain item in a game, and then that character is now tied to your wallet forever, as an achievement. More tooling.

In one of the more recent Twitter spaces with OriginsNFT, Patten was describing the future landscape for GameFi and how people would interact with crypto. He said it’s very reasonable to expect fractionalization of bluechip NFTs and for those fractions to become money for the subsequent communities. As I’ve preluded to, this is essentially the entire premise the initial Treasure collection hinged upon, and is a huge part of the flexibility John saw with use cases for NFTs within DeFi from the get-go.

When you play some questing game and need to craft a new item or upgrade a certain one like you would in WoW, each one is idiosyncratic, but there is more than one, which makes them for lack of a better term: semi-fungible. These kind of NFTs will have many copies of themselves like game skins, weapons, spells, houses, etc. For the digital worlds being built, these sort of items will become as good as money, because, again money is a social construct. In these game worlds, these game items become the most valuable and sought after currencies in existence by players.

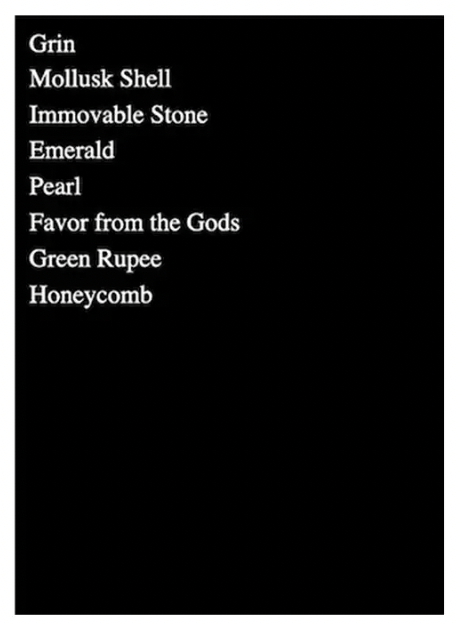

Treasures are this, and more. They are a semi-fungible primitive of the TreasureDAO ecosystem and anyone is free to incorporate them into anything they do. **Treasures are unique monies of the metaverse.

**They are multifaceted monetary legos that may be built on and integrated at will. Treasures are designed as resources with distinct game mechanics behind them so they can become malleable productive assets for any metaverse, which in turn, allows particular incentive models to be created around them by anyone who has enough imagination to dream them up.

Treasures can boost yield, break, they can be consumed, combined, they can be crafted, they can be hunted, forgotten, they can stack, fragment, and become more (or less) rare based off any data desired. Again, the pivotal functions at play here are composability and interoperability. Right now the metaverse is grotesquely static (as is much of blockchain).

Subsequently, this shines a light on another important consequence of dynamic NFTs vs. your basic PFP project: items, characters, land, traits, etc. can become provably rare over time via user interaction and time spent contributing to the world building, not just randomly distributed via a set with no effort put behind it. I personally have always found it strange that we put a premium on ‘all gold’ NFTs in a collection in a space that is trying to put forth a digital asset to replace gold? For most projects it’s literally just a lottery; a roulette wheel.

Treasures, and the design behind them known as Bridgeworld, provide a composable system of rarity and in-game value for any other “cartridge” to plug into. Let’s stretch the Smol Witches example a bit further.

The potion is done. It has become it’s own semi-fungible NFT. MAGIC is raining from the sky. You, a weary Smol Traveler headed to say the likes of Realm, LifeVerse, or even a more distant sister universe like KPRVERSE, and you would like to take some of this potion with you. You must pay each Smol Witch a Witches Broom and offer up 3 Bottomless Elixir to obtain one Magic-Imbued Bottomless Elixir that you can take with you.

This new item has a half-life of a month and can’t be used in Smolville. You must take it with you to another metaverse, where you can issue economic stimulus and impact the game there at will. After you drink it and use its power, you’ve successfully completed a side quest making your Smol more rare in the process, and SoulBound to your wallet forever.

Again, this isn’t some crazy new idea. Game worlds have been operating like this for decades now.

But thanks to the tech of smart contracts, NFTs, and blockchain, this can be done in a way where the gamer has actual ownership of the world and the ramifications of events therein. We don’t have to keep interacting with the vaporized shadows of these experiences anymore. We can actually start our ascent from the cave. We can keep some of the experience with us forever.

tl;dr Ready Player Smol is closer than you think anon.

Free Mints = Accountability

When JPatten forked the Ethereum mainnet Loot contract to make the 10k black cards each containing 8 Treasures on them, it was nigh impossible to preemptively quantify the domino effects that would take place and evolve the card contents into the NFTs that help construct the thriving Treasure ecosystem that lives on Arbitrum today.

Of the 10k, 9k were free to mint, with 1000 originally reserved for a Founders Reserve. That quickly got 86’d though, and of the 1000 all but 25% were dished out to Loot, xLoot, and AGLD communities as homage. The leftover 250 were then kept as protocol-owned liquidity.

Hot take: it’s really not easy to do a fair launch.

Teams try to reverse engineer the equation and distill the components of organic growth everyday and fail. Veteran experience told the Treasure team the only way the DAO was going to be successful long term was if they were incentivized to keep building.

Transparency is one of the main reasons builders choose to come work in “Web3” because here they are not isolated or relegated into the scenery. On blockchain you can build in the open, and in tandem with supporters in real-time. Game studios previous to this were all closed door. The latter is much easier, and the former is way more rewarding.

As I’ve stated multiple times, the playbook at this time of peak euphoria was just build hype up to a mint→price pumps the first 24-48hours→ you get a consolation t-shirt. It’s because of this model that 99% of all NFT projects are just airless BS ERC-20 tokens in disguise.

Paid mints make the creators rich without providing any value; airdrops stimulate nothing besides a prisoners dilemma and predatory liquidity.

Free mints catalyze community, which attract really special people, who attract even more special people.

Giving away ownership removes the self from the formula and aligns holders and creators in a natural way. They allow the stakes to grow linearly with effort.

One issue around Loot in the beginning was that Dom Hoffman (a Treasure supporter then and today) was already very successful and pretty well known, which imparted a bit of stigma. Everyone who came to work on Treasure in the early days were just unknown builders and enjoyooors, including Patten which allowed the vision to be at the front, not a person. Satoshi understood this, which is why removing himself from the picture is widely regarded as the immaculate conception of blockchain, giving it the freedom to become the crypto movement it is today.

Therefore, it was quite clear and obvious to John and the early team that whatever they did, in order to prioritize the player first, the entry price was always going to be free. This root philosophy flattened the traditional hierarchy of user-mods-team, and allowed TreasureDAO and the projects growing there--like Smol Brains--to grow while keeping an aligned community even as the hype picked up.

Again, I believe it’s important to reiterate that the entire starting Treasure team were all just community members who were passionate about the idea John had put forth and decided to jump on board. This shared inspiration is not something that can be directly replicated. Muse is fleeting. It’s unique in action, but similar in essence amongst all huge success stories. This kinship strengthens the social contract between community and team as much as it blurs the lines of it.

And as we’ll see in the next installment, for anyone building or living in TreasureDAO that social contract is horcruxed in the MAGIC token itself.

Thank you for reading anon, fr it means a lot. We only get so many moments on earth and if you choose to spend some of them reading my writing, I am truly grateful and hope this was inspiring to some.

Stay tuned for Part 2 and Part 3 where I’ll get more into the weeds. If you haven’t yet, please give me a follow on Twitter, RT this write-up, and subscribe to my Mirror!

Lastly, if you did enjoy it and feel generous, please consider collecting. It goes a long way.

smol thots, big hug 🙏🤝💚🫡