There is nothing quite like standing up to your neck in the deep end of bullish euphoria that demonstrates why avarice is one of the seven deadly sins. In crypto, we watch greed topple more kings from their hills than any other market or industry because leverage is basically free + infinite when everyone is making their own money. Greed is an inner world of scarcity looking out at an outer world of pure abundance. Avarice boils down your self-worth to an arbitrary measure of wealth that you can never get eye level with. It is the craving for a facade of wealth; a hunger that doesn’t abate. It is also lacking creativity in extremis when you simply opt-in to the game everyone seems to be playing, and every outlet is selling. At the top, the mirrors are hyper-magnified and myriad. Everyone is rich didn’t you hear? How could you not be in this market?

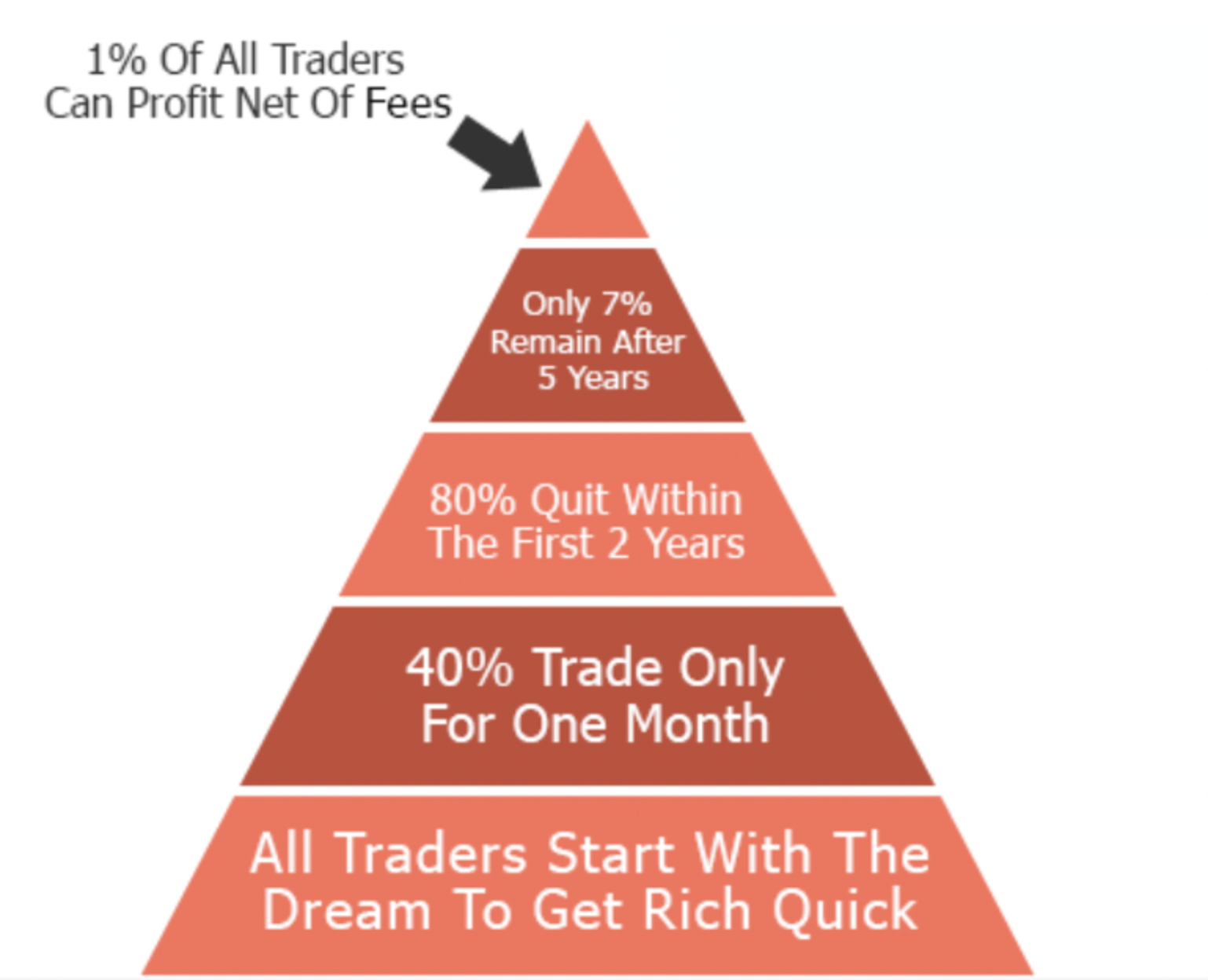

The pervasive truth here is evident for crypto speculators more than anywhere: 99% of market participants are NGMI because they fail to master their own psychology and lack the will to press on after only a few months. Even more likely, they just straight zero their account. Crypto traders and investors are also faced with smart contract risk (rugs), lack of transparency (surprisingly), an increased frequency of outright scams, plus other anomalies like de-peg risk. Additionally, because the responsibility of managing your own wealth comes with a hefty amount of accountability, personal operational faults, namely in the form of lost seed phrases, are the most common catastrophe. Poor UX drives us farther away from mass adoption than anything.

It’s also a boon to those who are tech savvy enough to still get on the rollercoaster anyways because this ride moves fast. Market cycles that take 10 years in equities, happen in 6 months sometimes in crypto. Karma recycles much quicker here than TradFi. That’s why you see people constantly lean on the axiom “if you’re still here congrats you might make it.” All it takes is one cycle to realize it’s not a pipe dream to just stumble upon a million dollars. A few months in crypto and you almost instantly become unemployable. Simply by the virtue of statistics, just by sticking around you put yourself in the position to eventually be “lucky.” Not squandering the good fortune when you find it is arguably the much harder task than finding it in the first place (but if you have some extra will take ty).

I found Treasure at the end of October ‘21 and was circling it cautiously, despite dabbling in more treacherous financial experiments previous to that point based off nothing more than a hunch, or mentally noting the frequency of the ticker being shilled by large accounts + “chart looks good.” Stupidity, not due diligence was being rewarded. In retrospect, I spent most the bull market swimming in the middle curve (again), getting burned hopping coins all year when I could have just been holding waiting for my price alerts to go off. To think about the voracity of my risk appetite back then grosses me out now. My only saving grace was that I’d been riding the LUNA gravy train all year waiting for the triple digits I knew in my plums were to come (however briefly).

The transition from 2021 to 2022 was a watershed experience for me. Yes, the markets were peaking; but so too was my emotional volatility. I was a year out from the unravelling of a deep eight-year relationship that covid had pressure-cooked to a breaking point. I’d spent a good part of the year in flux, in medicine, and nearly the whole of it in confusion, intellectually and somatically. My nervous system was absolutely shot from the stress of change reflected poignantly by the frenetic kinetics of a market that would just not stop. The year of brrrr was offering an avatar-level glimpse into chaos theory. The question of “What should I buy next?” was constantly circling my head, along with “Who am I now?” and “When does this stop?” like three little birds.

At the same time, I was decompressing into my first year of sobriety after 15 in the bottle which had me in a constant state of epiphany. The visceral sharpness of clarity in my mind and body was peak, even though my meditation practice had also fallen to the wayside, along with my patience for market moves. As anyone who routinely turns to a substance for stress management, navigating the summits of overwhelm for the first time without a trusty chemical handrail can be treacherous psyche to hike. I was eating one meal a day, and it was likely Chinese food because I was so glued to my computer in preparation for the near-certain eventuality of “making it” that if I wasn’t watching the chart and “managing” my trade, I’d miss my moment to sell and/or get btfo. I was in my own negative feedback loop, miles away from baseline. Within cells. Within cells interlinked.

Still, “as long as the music is playing, you’ve got to get up and dance.”

Truth be told, I didn’t have the emotional bandwidth to even decipher what MAGIC was when I first came across it because it felt like there was so freaking much happening at the time. Blue chip PFPs and any other gaming/metaverse tokens were ripping, as the hot ball of money rolling around decimated any preconceived notion of a ceiling on even the most useless of tokens. It was a laborious task to make an informed decision then. The closer we get to the inflection point, the less you need to look at the chart. Similar to trying to pour a glass of wine on a carousel that keeps spinning faster and faster. It was much easier on the mind to shoot from the hip and wake up with a 40% gain the next day on whatever seemed to be polluting your Twitter feed the most.

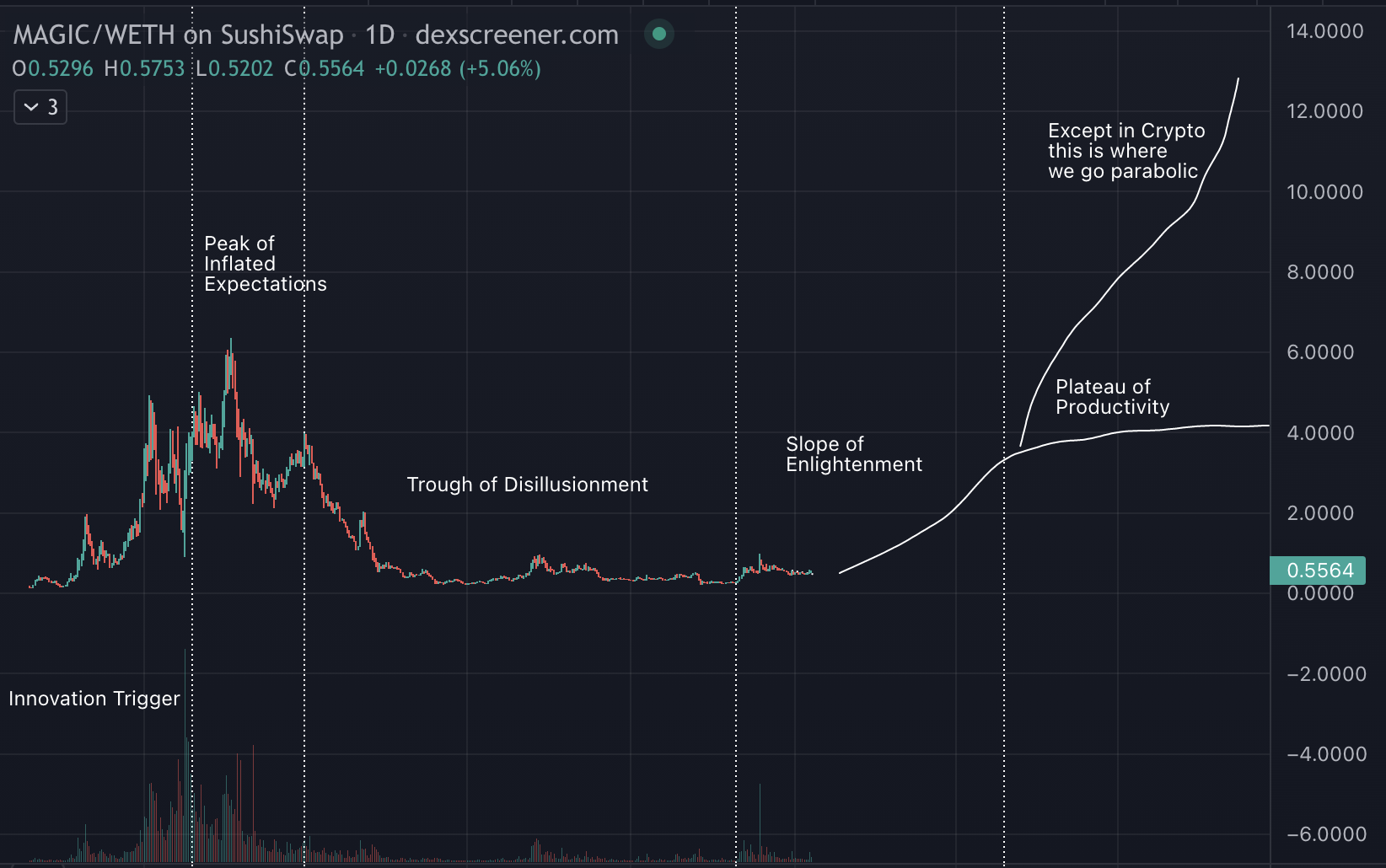

MAGIC launched at $0.00 mid-September 2021 and after about three months-ish time, it was knocking on $5 per fun-fueled EEE-backed token by the first week of the New Year. This would momentarily become the unequivocal top before it retraced back down to almost 80 cents in lieu of the launch of Bridgeworld and the Atlas Mine on January 24th, 2022. This v1 release coincided with a large part of the initial MAGIC supply becoming unlocked from the retired Genesis Mine. MAGIC would bounce back close to $5 again in a matter of few days, posting an over 400% weekly banger by January 29th to those lucky enough to catch the tail.

I take us to this moment in particular because BTC, and particularly ETH, were shitting the bed. Ethereum was down over 30% and putzing around (before ultimately bouncing). MAGIC was pretty much beta negative at this point in hang time. When the market is pumping and your coin is pumping more, it’s an amazing feeling. When bittlecorn and efferium are puking and your token is headed up and to the right, tis ecstasy. The hype was as palpable with MAGIC as the frothy cope of everyone convinced, including myself, that ETH was soon headed to 10k as promised. In these moments, you can almost feel the collective subconscious of the market as one mind reflected through your own, the intensity of a train running on fumes with the final destination in sight, the heartbeat of the trend getting slower and slower and slower.

Needless to say for anyone who was there, but the Treasure Discord around this time was absolutely popping.

Delusional Moonbois (v1) were planning future yacht parties based off double digit--or even triple digit--price per MAGIC valuations (newsflash: nothing has changed :). The conversations were not about whether the metaverse was still a thing, or if Web3 gaming stood a chance against Web2 studios, they were about how to acquire more Smol Land, or what the BW game dynamics would be like when Essence of Starlight were 10 MAGIC a pop. Free mints around anything MAGIC-eco related could pay the bills. Genesis Legions were spawning Aux Legions, who were summoning more Aux Legions, who were questing for Treasures, and all of it was printing ✨ baby.

People from all walks of life were coming to add to the TreasureDAO momentum that was quickly snowballing. You had the former head of Netflix volunteering alongside ex-Google devs while passionate OGs would handhold hyped-to-the-gills newbs on how to get from Coinbase to MAGIC. Arbitrum was picking up TVL steam by simply just working as intended as every chain was routinely stress-tested to a breaking point. Meanwhile, anons across the newly conceived Treasure-verse silently blissed out to the ambient beats of Ekali on the Bridgeworld homepage, and prophesized about what was to come.

With an increasingly bad taste in my mouth about the future of UST, my initial interest in Treasure slowly grew into a blessed distraction from my less appetizing but slowly pacifying inner life, and I became more and more hooked the higher price climbed. Shitposting and scheming in the Treasure chat with the community around this time was some of the most fun I’ve had in crypto to date. I had convinced my IRL friends to buy (le sigh sorry homies) and we were debating the best game routes in our own Discord. In between trying to stay up-to-date on everything TreasureDAO related, I was picking fights with !doggy and silently adding fuel to the fire with choice bull memes to any tiff I was online for.

The possibility that MAGIC and GameFi could be insulated from the very real macro headwinds everyone was warning about, certainly seemed possible in the moment. Why not? Why not us? They chirped. Smolcoin was coming. BattleFly would onboard millions. You own an All-Class Legion? Congrats, what color would you like the interior of your Lambo? I was desperately trying to get my other crypto mates to all-in Lifeverse because Roberttacos was spamming the channel every 10 minutes with 10k Seed of Life floor promises, and as we neared the end of the most outrageous bull market in history, like a degenerate zombie operating solely from binary instincts, I pressed the green button whilst I quieted the other voice in my head saying no no no!

Dissecting Community in Crypto

The merits of a strong community are touted all over crypto, and tech at large. Yet at this stage in the bear market, with regulation undoubtedly on the 2023 horizon, what we refer to as communities on CT are little more than a stressed group of bagholders poking around a Discord, waiting for devs to do something. Naturally, we are highly self-aware of this. The perpetual inside joke of every downtrend is that bagholders = newest crop of community members. Alas, we meme ourselves so that we may live.

So far too, unclear regulation also means it’s semi-unwise to waltz around referring to all your stakeholders as investors because if anyone asks, they’re holding tokens not securities, in case anyone is asking. This means LARPs abound and opportunity is evergreen. It’s a free crypto world and an opaque lens we must look through to know where to step in it.

We do this with DAOs too, dumbing them down to “a group chat with a bank account,” which again is accurate when we consider what the majority of DAOs actually are in practice. A look at TreasureDAO as a DAO deserves its own piece. For the sake of this essay, I am going to try to stick with community as the aperture of illumination for the moment, even though the two stand shoulder to shoulder. Mais continuons.

Fwiw, I don’t see these observations as particularly good or bad. They’re just on point. A natural consequence in the dissolving of traditional barriers in financial markets is that we remove the film over the inner workings and get closer to the base essence which makes markets tick: human psychology.

The only eternally correct prediction here is that people are predictable. We can now meme even the most complex of topics down to the farthest left of the bell curve for all to understand. These ideas then flood inboxes across the globe within seconds of being thought. Everything that can be a brand automatically becomes one, especially you, whether aware of it or not. In the open market, at a time where everyone gets the bulk of their information from social media, it looks like less DYOR, more hype-driven parabolas bc new coins shiny. Thus, what we tend to witness as ‘community’ gets reduced down to its definition: a group of people who share a common interest or belief.

That unifying view in crypto is that everyone is holding the same token, whether it be an ERC20 or NFT, whatever. Anyone who speculates temporarily finds themselves aligned in the same dream of the future with similar thinking market participants. This can be as encompassing as passionate Tesla investors who will willingly volunteer to get microchips in their head when the time comes, or as surface level as DOGE to a dollar. It matters not. When we invest, we are betting on a brand --a sum of all the expressions-- of the expected outcome. Marketing becomes philosophy. Advertising becomes research. And for most retail investors it often comes down to little more than an aggregated feeling carried forth from a never-ending speculative dialogue across platforms like Reddit, Twitter, StockTwits, Discord, Telegram, et al., which is a far cry from how it used to look.

Blockchains and smart contracts give us the rails to organize around ideas in ways that have never been possible before. We have leaped forward and multiplied from the Bitcointalk forums of old in our hyper-tokenization and social media rehypothecation. What we have seen to date are just the very first iterations of what is possible after we remove middlemen and restore ownership of networks to users. I’ll be the first to admit, it has not always been pretty; nor does it always work as advertised; nor is the often promised crypto-everything future many rigidly outline set in stone (though I believe it highly likely).

We are very much reinventing the wheel here. And the wheel was just a wheel for a very long time before it was a car.

In the wild, I often call these disparate groups of token holders ‘communities’ myself, even though they fall quite far from the branch of my personal experience of what I feel community is. My vision of community is based in a feeling of love. It’s something the body resonates en masse, not a complicated series of expectations the mind creates around potential profit, though profits certainly help. If your coin is out here completely changing people’s financial destinies like we see every bull market, the conversation changes, and for good reason. Money is the key source of leverage on all forms of capital in this single-player game. Price appreciation can potentially bootstrap a community very quickly.

This is essentially the perennial (and unimaginative imho) NFT playbook set in motion by Yuga this past cycle. Get this, hear me out, what if: another token. BAYC → BAKC → MAYC→ ApeCoin → Otherside Land → ad infinitum. It works because human psychology is repeatable af.

We are greedy little mammals. We’ll sing your praises up until the very moment the rug is pulled out under us if we think the juice is worth the squeeze. Even then, all it takes is a few months time + a new username, and the real sycophants and masochists funnel right back in line. This is a feature and a flaw of the pseudonymous economy. You don’t have much to lose because you can always start over; whatever you enter you can also leave on a dime. The same reason scammers and frauds are prevalent also puts a check on cancel culture. Just find a new pfp and start over because the escape pod is always there. On-chain credentials will help weed out a lot of the negative aspects of this over time.

Make people rich and good chance they’ll never leave, even if the well runneth dry. Nostalgia is one of the most powerful motivations we have. But these uninventive incentive models disguised as innovation only last until the rubber meets a new road--a special road--another project, and the community built on profits jumps to the new more profitable ship. Bootstrapping a group of early believers is an easy and repeatable feat, but you can only lead a horse to water a few times before they know their way to the stream. Keeping the faith and magnetic field of good vibes alive is something else entirely. Knowing how to foster organic community growth is a skill that rivals any menu of programming languages on a resume, but it gets much less credit.

In theory, a community should be a key symbiotic component to any crypto project’s mission and ecosystem, not just a chorus of ‘wen sirs’ and price predictions. Likewise, teams would do well to distinguish between the people who use your service and people who are devoted to your mission. I use SushiSwap all the f-ing time but I am not part of the Sushi Community. Though, when it comes to pulling together a visual of what the Sushi Community looks like, they’d likely take my type of user, a novice farmer with a little Sushi as a result, and lump it into the mix. Even though when push comes to shove, I have no allegiance to Sushi whatsoever. My loyalty is perpetually up for grabs.

That’s not a slight at Sushi either. I watch the gamut of projects confuse their rent seeking audience with community all the time. Arbitrum enthusiasts and MAGIC-maxis are no different. I have pointed out false flags as we watch bots Sybil the daylights out of the potential ARBI airdrop. Daily active users != dust sitting in people’s wallets. For a project like Treasure whose main activity is via NFTs in game worlds, looking at MAGIC holders alone is kind of a non sequitor. Less than $5 worth of MAGIC cannot be considered ecosystem participants. True they may have NFTs but we end up missing the forest for the trees. When we champion data without context, it ends up being counterproductive to our point. It’s stat-washing. Graph debauchery. And I say all of that with the deepest respect and just in an attempt to stay unbiased frens fr fr 🙏.

Teams that just prop the tent up on a Discord server with a multi-sig and call the people in it “community members” push us farther and farther into a tokenized dystopia. God help me if I ever have to jump through hoops for a whitelist spot ever again. The marketing tactics that projects employed to get people to put in some version of work for NFTs last go around in hopes of indirectly capturing a vestige of community was nauseating. These constituents are primarily stakeholders looking to flip. They are here for profit. Although I am of the mind that the subset of market participants here now, who are legitimately in it for the tech/art/privacy, is actually at an ATH--and that is a great great thing--if you are still here it is highly likely because there is some road left to walk to your financial freedom.

Just like the ego grasping for meaning in materialism, as soon as the CT hive mind captures something noteworthy, the profundity of it vaporizes in our hands as every phrase becomes a new coin; every buzzword a new trend; every thread a greater narrative; every non-issue a potential crisis to nuke us into the generational lows or God candle us back to relevancy. Here in crypto, the word community has come to taste like the thumbs up emoji to Zoomers; a broad brush that gets used to paint anyone regardless of where they sit on the map . We love our community! The (insert project) community is the best on the planet. Ape stronger together. Blah blah blah. Bruh.

If we’re earnestly using the word ‘community’ in regards to some PFP collection of trippy looking ducks, or some airless fruit token, then the plot is lost, I’m sorry I’m not sorry. We need to sober up and get real with ourselves to make it out the Dark Ages into the Renaissance. We need a revival of quality, for the individual and the collective.

*Note: I know this in reference to NFT God (rip mate, all the best) but the link to David Chapman’s book Meaningness is a must read and foobar hits a vein here.

It’s a completely arbitrary farce to lump together a group of stakeholders, of varying degrees, and put them under the same umbrella. All it does is further drive home this massive illusion that we are somehow all going to make it within the context of the only place perhaps on earth we are 100p not all going to make it: the market.

And I say that as a straight up eternal optimist. It’s insanity, as expected in a world the mind creates. The lack of heart behind it is glaring. Those who have experienced IRL community building know there is a spirit quotient that cannot be magically reproduced. It’s what makes a group of people feel like home and words fall short. You feel it. It’s intangible. Mark me:

I do not mean to trash community here. I mean to elevate it.

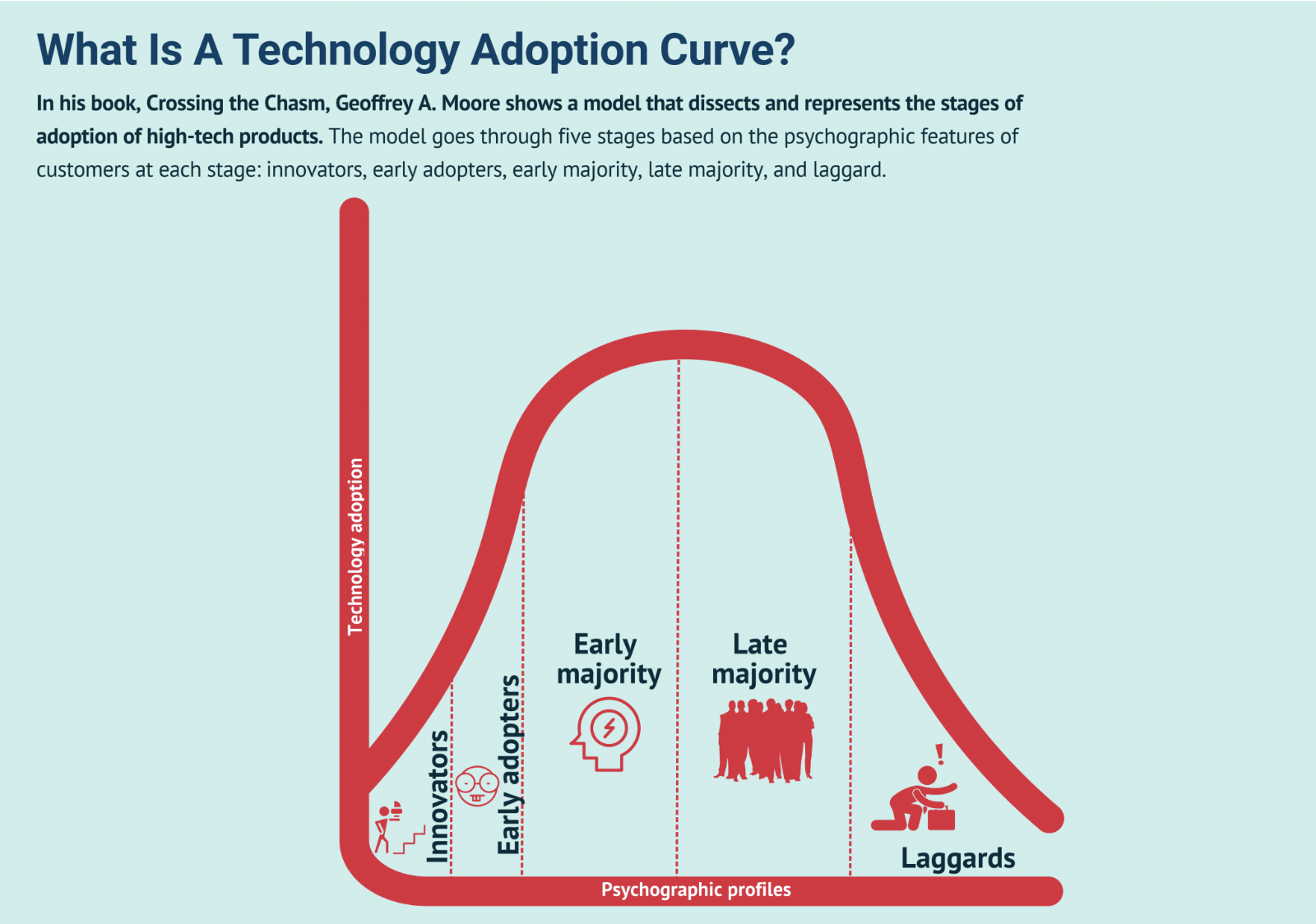

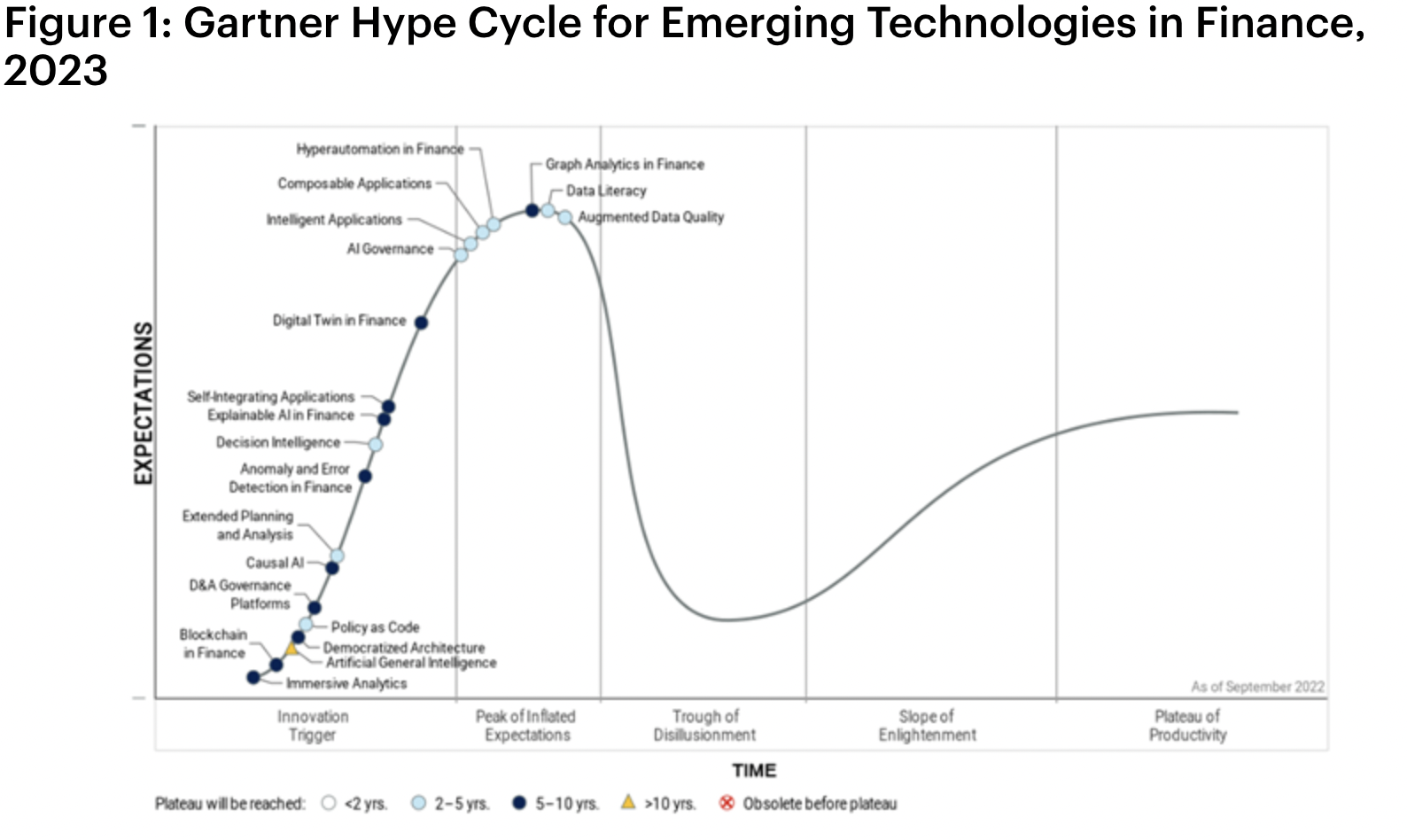

Moore’s Technology Adoption Curve should be familiar to everyone who suffered any secondary education. If you are investing in blockchain tech, or anything for that matter, I argue it is a helpful framework. Every community in crypto can be overlayed and dissected against this bell curve. It doesn’t matter if it’s BTC, ETH, SOL, BAYC, Punks, whatever -- we can use this rubric to x-ray any group of stakeholders for any project at any given point in time. For our purposes, I will of course do it with TreasureDAO.

-

Innovators: Devs, team, founders, and the lucky insiders that know them fall into this group. Seed round investors. They can end up in this extremely small niche that create the idea or have access to it before anyone even knows its a thing. This is John Patten, Karel, all the initial core Treasure Team who laid the foundation. I’d also include anyone from the original Loot community that jumped in.

-

Early Adopters: These are the Treasure OGs. They were farming MAGIC in the Genesis Mine. Staking Treasures. They got Genesis Legions and were spending time in the Discord with early team trying to figure out how they could help with the vision. Risk-takers. Early moonbois. Smol minters. One-year Atlas Mine lockers.

-

Early Majority: This subset includes the risk-aware, but you go first and tell me how the water is. These are the NFT rotatooors whose interest got peaked and then captured. MAGIC was above $2, people they trusted on Twitter were mentioning it, and they were in the Discord asking questions and taking notes. They bought a little at first. Then they bought a lot. SoL holders. Swing traders.

-

Late Majority: Top-buyers. Late moonbois. Leapt in at $5 certain that MAGIC was going to a $100. Their CT friend who seems to do very well for themself told them to check out MAGIC. They learn about Arbitrum at the same time they learn about TreasureDAO. They don’t want to miss out.

-

Laggards: Anyone who has been introduced to TreasureDAO during the downtrend. They find their way randomly or through one of the partner games. Maybe they win access to a free mint or win a giveaway, or their friend does, that gets them interested. They aren’t quite sure what they are buying, but it’s part of their Arbi Token Index many other people seem to get it.

In this way, we sort of inverse the typical bell curve that you see memed everywhere. The more right, the more casual of a community member you likely are, and vice versa. This is because the above model doesn’t factor in time to the equation as it pertains to strengthening communal bonds, which is a crucial component to how deeply individuals identify with the community in question, and how others outside the tribe view them.

The excerpt from Meaningness foobar mentions in that tweet responds to this a bit more acutely. It classifies subculture participants as creators, fanatics, geeks, mops, and most importantly sociopaths. Mops would be those who will only care superficially about the project no matter what happens. They won’t game, but they’ll be around, openly criticizing and not thinking very hard. Sociopaths are the most hardcore of the group. They leverage the brand socially and solidify the culture that may have been there but hard to pin down. Mops and sociopaths can turn up at anytime.

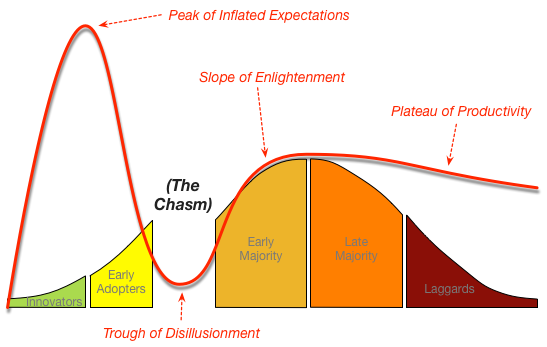

Which is more what I mean: over a long enough time horizon, even the current late majority that stick around become OGs. TreasureDAO is only on year two of its 10 Year Vision. Truly, if you are here now you will be looked back on as an early adopter, not just for Treasure, but for all of crypto. The axis is always shifting. If we fit the technology adoption curve into the first part of the classic Gartner Hype Cycle, we can get a better model to work with that we can adjust to different timeframes.

When it comes to crypto communities, there is a distinct and noticeable second order Lindy Effect that parallels the asset itself. This effect can basically be summed up as the hypothesis that the longer a technology or idea has existed, the longer its life expectancy, ie, the longer something survives, the greater the probability of it continuing to survive. BTC is the de facto example. Any other dinosaur token in the top 20 that doesn’t make sense when you stop and think about it are also perfect references.

The reason this effect can be observed is because again, human psychology is predictable and repeatable. We have evolved to trust things more the longer they’ve been around. Things that don’t fade, by definition can’t be fads. I mean, Bitcoin is still here right? I should probably just buy some don’t you think? Just in case. You can trace this edge of the human psyche back to Pascal’s wager if you want. These patterns of thinking very demonstrably shape our world. The longer you consider yourself a part of a group, the more ingrained the identity of that community becomes as part of your own identity.

This is why I say the Lindy Effect of a crypto community is actually parallel not correlated to the coin itself. It might be unintuitive at first, but if you think about it what is more important, Bitcoin or the idea Bitcoin represents to those who believe in it? Do you think if BTC got regulated out of existence (pls spare me your comments) that maxis would just got back to fiat? Not likely. The freedom a decentralized financial movement represents will always be > any coin, even if BTC started it all. Ideas that become sticky, become reality. It can quite literally be anything.

Moreover if we like, we can go a step further and even attach an exponent to the equation by considering how much financial and emotional resources a person has invested in the project. You can begin to ask yourself where you fall on this curve and where other people you interact with in the community online also fit in. We can start looking under the right rocks for data. Chapman tries this when he mentions the perfect ratio of mops to geeks is about 6:1.

Obviously, aggregating some sort of community measure is more an art masquerading as precise science than a hard and fast metric we can stack against every cashtag. Still, it’s a context we can use to tame our biases. A basic rubric helps us from slipping on the slope of repeatable fallacies we walk all the time, most aptly here, Confirmation Bias and Sunk Cost. By understanding how, when, and why people become parts of specific community, we can better determine what actually makes a community strong vs. up for grabs.

The internet has bestowed upon us the means to find other people with similar values and connect with strangers instantly--as if by magic (got ya)--through the portals in our pockets, and further entrench our “chosen” belief systems within a shared global discussion, not just the people that live in our town. Relationships become reinforced in this echo chamber of same ideals. Links of thought ossify and outward perceptions harden. For the aligned who seek enlightenment, it can be Eden. For those who wander life only looking for what they think is correct reflected back to them, it is a drug.

Polarity can be a Trojan Horse of suffering because you are always positioned to be in opposition, even to those who are likely your closest allies. The internet greatly increases the distance between these poles as our humanity often dissolves quickly behind a computer screen, while it simultaneously spurs incredible good.

One of my favorite bull market moments was when Cobie and Ledger were leading spontaneous Twitch stream raids mid-pandemic and giving away loads of cash and attention to artists, completely changing their financial destinies. Absolute legends. Where we focus attention that is what grows. We have weaponized the viewer, for better or worse, and downgraded awareness. Only through viewing ourselves as separate from the whole can we devolve into the perpetual open warfare that is Twitter, where hashtags, likes, and followers are 100x leveraged to stir up the drama de jour while bands of bots, lurkers, and dopamine junkies javelin each other in the comments. A fascinating crystallization of the collective unconscious.

In the shadow of a world starved for identity, maximalism becomes common. It is a low stress way to form identity.

Many are quick to equate maximalism with religion, but Balaji tell us this is simply not the case. Maximalism is a doctrine. Balaji talks about how the internet enables a greater variance of opinions to take form with Lex Fridman in their 8hr chat covering Balaji’s recent user guide The Network State (and many other fascinating topics). To me, maximalism is a firm set of principles that usually allows for little grace. On the CT battlefield, this looks like BTC Maxis vs. ETH Maxis vs. what Balaji refers to as Woke Capital.

Laughing at stupid dot ETHs while drowning yourself in Bitcoin rhetoric is no different than pro-nouners forcing you to walk some tightrope of identity politics you’re unfamiliar with or → shame. You either think fiat money is the devil or → shame. ETH flips dinosaur BTC or → shame. An orange Bitcoin symbol or a rainbow flag flying in a Twitter bio falls on different sides of the same coin. The dogma that forms around tokens like BTC and ETH; other L1s like Solana or Cardano; rollups like Arbitrum and Optimism; and of course, the “bluechip” NFT collections like BAYC and Punks, are all examples of open market tribalism. It is a fundamental part of our human experience to be drawn towards the group whose ideas and values we believe to be in line with our own, even if it is decisively mimetic, or seemingly deterministic.

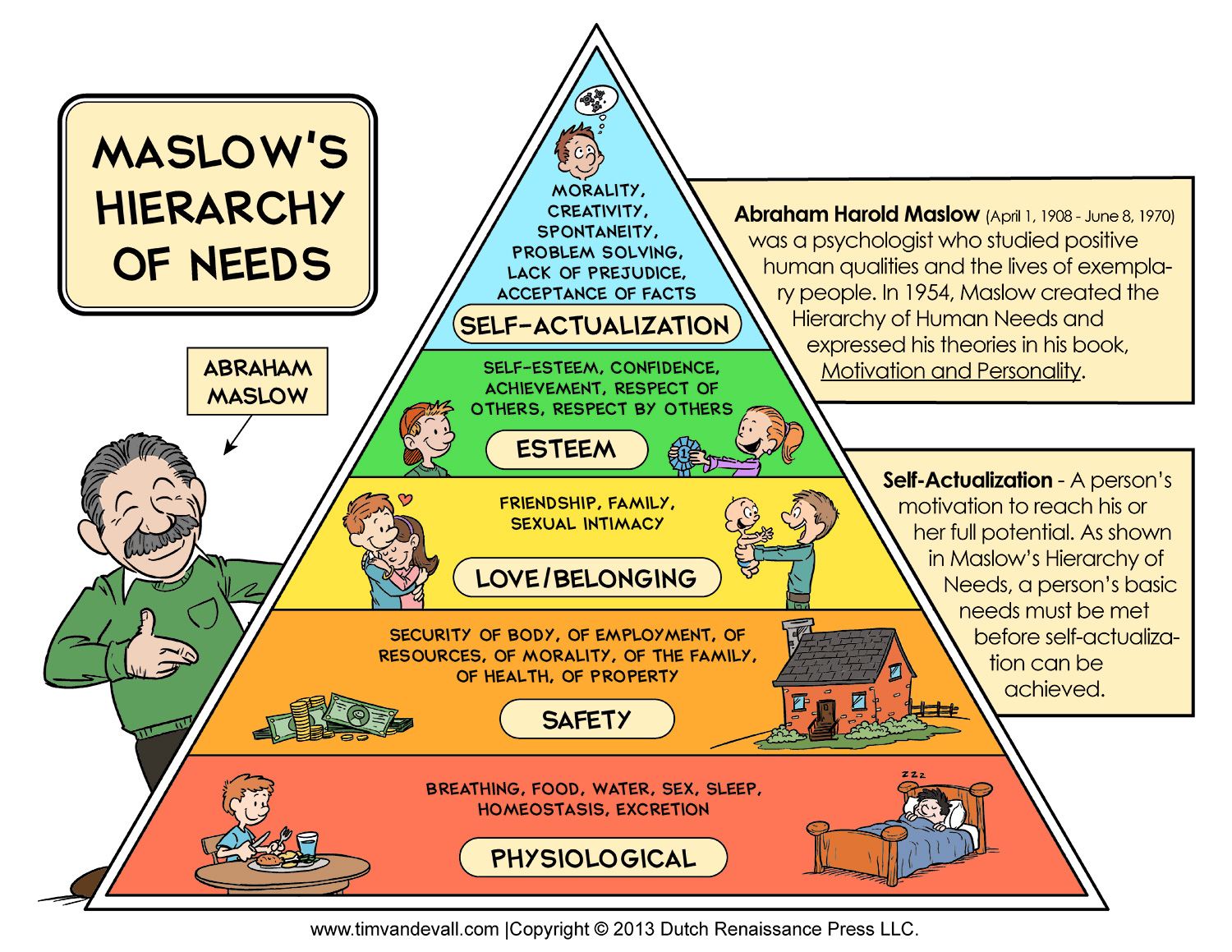

Wrapping up identity politics with asset prices is not a new game. See anecdotes from, Tulip Mania; South Sea Bubble; The Gold Rush, et al. The recipe for identity changes in the markets, and only recently in a very public open way. Your psychology is completely altered when your financial well-being and identity become tied to the success of the underlying asset. We see this around hobbies, and of course around tech brands like Apple, Nike, whatever--but it is a distinct level deeper when you are also trying to make it from price appreciation of the commoditized version of this cumulative belief. This is because in this manifestation money is our direct line to physical, emotional, and even spiritual (free time) security. When we invest irresponsibly we are directly jeopardizing the thickest parts of Maslow’s Hierarchy of Needs. The stress of needing to profit throttles us directly into survival mode.

Again, everything that can be a brand in this day and age is. A token for this, a token for that. For most people, I agree: it is ill-advised to identify with a ticker. For the individual in question there is often no inner work being done for the person to draw the necessary lines in their mental landscape between conviction and identity, which leads to a distorted perceived reality, ie, token maximalism. I’ll use myself as a quick pseudonymous example:

I am writing this under the moniker smol thots, with a Smol Brain PFP, and am a big supporter of TreasureDAO (lmao clearly jfc)--evangelical you could say--but I’m not delusional enough (sorry moonbois) to not do what is in the best interest for my investments, nor should you or anyone; nor does anyone in the world expect you to behave differently, which is why, if you strip away enough layers of the onion, people come to find TA works. It’s game theory. Market profile. It approaches the market as an extension of the mind.

In her book Market Mind Games, Denise Shull proclaims (correctly) in a semi-entertaining way that we project our own feelings onto this inanimate object called ‘the market’ we identify with subconsciously and consciously. She insists if you want to make good trading decisions, you need to consider the emotional and social influences working on your decision making before you crack open a spreadsheet. Though it is perhaps the most impersonal experience on the planet, completely irrespective to anything that is happening in your minutia of existence, we can’t help but to fasten our own narratives to red and green candles.

My sports team lost today AND Ethereum is down. This year is terrible.

I finally got the job I’d been applying for and BTC is pumping. LFG.

Believe you me, as I detailed in the first part of this essay, I am no savant in this department.

Impersonalizing the market can easily be the hardest part of trading as it is just too easy to tie each tick as a point for or against the PnL of life. Our subconscious ego-dominated thinking leads us to this duality: if my plan works out, then it was always mean to be. If it falls apart, then Dear Universe, there must be a mistake. Why me? Why now?

We project these stories onto our localized reality all the time. We don’t respond to what happens, we respond to our perception of what happens. It doesn’t matter if we’re watching the 1min chart or going tit for tat with xxBoofinJesus2687 in the comments. In the online arena, sarcasm is thrown out with the bathwater as we fire off GIFs in solidarity with doxxed, anon, and pseudonymous randos around the world. The incentive for introspection is nada. Meanwhile the laurels of reactiveness are RT’d in perpetuum et unum diem.

Thus, our intuition is always to stuff the new world through old forms. For instance, how we continuously try to fit BTC and ETH into the formal definition of money/ security/ commodity. It’s like trying to fit an elephant into a shoebox. Semantics pulls us farther and closer at the same time. Language often lacks the acuity needed to describe contemporary miracles. As usual, we rely on the status quo to make sense of what’s happening.

And unfortunately, the status quo today leaves us noticeably void of the kinship and camaraderie humans are meant to encounter outside of our nuclear family units. So when we erase the borders in our decentralized blockchain Odyssey in search of a New World, it’s no wonder we find a revival and emphasis of this core tenet of our being online: humans are social creatures. We are genetically primed for community.

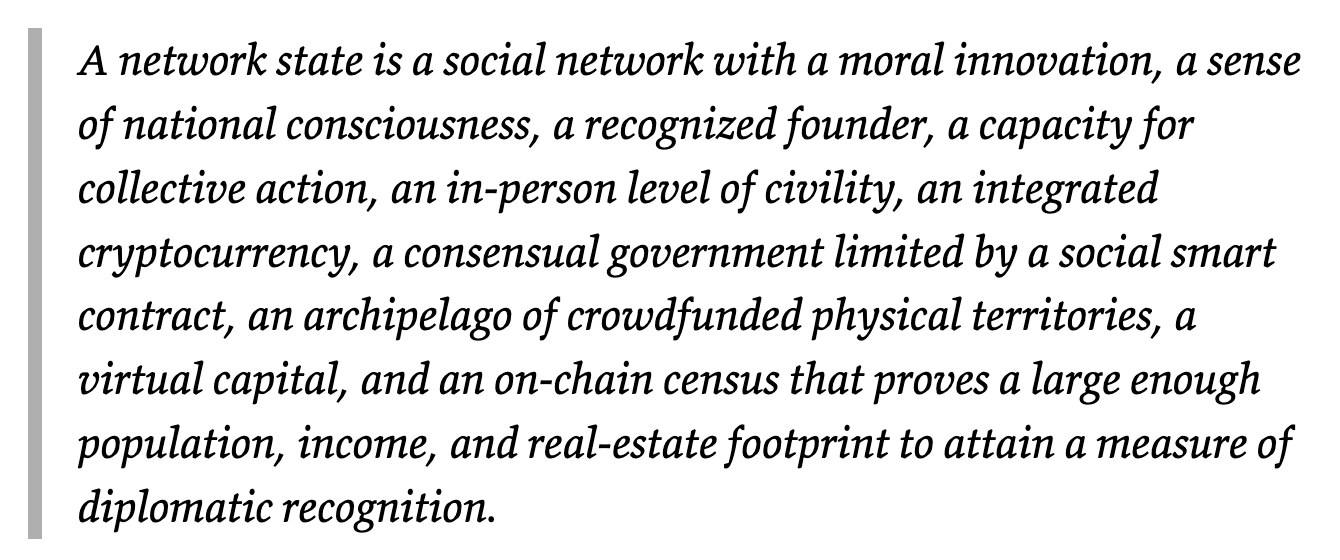

Balaji details in his book how history is actually a story of morals written by the winners, and how the Network has grown to become one of the three most powerful forces in the world, next to God and State. He shows us how we are quickly moving from a discretionary view of history to an on-chain ledger of record thanks to Bitcoin. Masterfully, a vision of the world is painted where start-up societies spring forth from the cloud into a greater network of decentralized nation-states, whose citizens are aligned by their similar values, not the socioeconomic, genetic, or geographical placements of randomness. And it all starts with the forming of crypto-empowered communities online.

Where Community Transcends The Network State Begins

In this new global upgrade of Society-as-a-Service, you opt-in because you share a key primary value with the group at large. This is what I meant when I say real community needs to be felt in spirit, not just experienced on a surface level, otherwise the motivation is not strong enough for you to opt-out of the groupthink you currently subscribe to.

Balaji calls this the One Commandment. It is one-thing-ism. Carnivore Society believes only meat is food; Gaia Society puts the earth first; Bitcoin society says BTC is the only sound form of money. Balaji proclaims that the rallying cry for these tribes needs to be binary for survival and growth. As a moral entrepreneur the complexity must be manageable. One Commandment startup societies are all similar in that they claim there is some moral deficit in the world which needs to be fixed, and their doctrine makes a case for why their version of society is better than the one you are currently a part of.

In that same podcast with Lex, Balaji comments how quickly many people retrofitted his capital N, capital S, ‘Network State’ into a more common vernacular for what we have grown to see examples of everyday: a network state. These network states look like large online tribes of morally aligned digital personas gathering around specific hashtags (or coins), flitting in and out of Discords of flourishing communities, living in sub-Reddits, huddling for ideological warmth in Telegram and DMs.

They are the precursor demographics that will populate the metaverse, and already are. Some will likely materialize in physical diplomatically recognized user-owned governments, others will live perpetually online. A lowercase network state offers a needed segue and necessary freedom in idea expression; it’s a new destination for community. Thanks to verifiable digital ownership, we can organize around ideas and financially mobilize en group unrestricted.

The best strategy, as Patten has said, is build the tools and get out of the way for the community as fast as possible. In Web3 there is no hard ownership by creators; you are creating in collaborative dialogue with the community. Builders aren’t building on their own anymore and if they are they are at a complete disadvantage. Who hath curate the most proper vibes, shall reap the most outsized reward. You can’t copy paste true community because a real community member has invested more than just $, they have invested part of their self at an ego level. Token holders != community.

In a very similar vein, Balaji refers to The Network State not as a book, but a set of tools for founders of new digital societies to attract citizens to their vision→ a composable blueprint for society. TreasureDAO aims to provide the same parallel of tools for those looking to bootstrap their ideas into existence in the metaverse.

Treasure’s interconnected metaverse is an organic budding network state whose One Commandment is MAGIC. TreasureDAO’s true value proposition is that it is able to offer Community-as-a-Service.

When you build on TreasureDAO, you are plugging into their ever-growing network of players, traders, and partners who support you by default in their one belief of “MAGIC over everything.” If you adopt MAGIC as your savior, the Treasure community immediately becomes your community too. Their brand equity gets leveraged. They are tapping their social and cultural capital and making it composable.

Intellectual and financial resources are abundant. In the era of Network States, what will always be debated and in short supply is real supporters, OGs, devoted early adopters, fanatics, sociopaths, take your pick. Games are a natural medium for bootstrapping passionate community because just like the market, we invest and project emotionally onto the external, and now, digital world.

As a result, GameFi will flourish in the open metaverse. Fun is a social primitive. Positivity is an emotional one. Thanks to Web3 Gaming those can now be integrated alongside DeFi legos as well. Watch. In a diverse and flexible economy of games, community can be recycled and cool can become evergreen (new games + interoperability + cross-game play) as more projects decide to build with Treasure. This is why I love crypto. It truly allows for win-win-win scenarios.

Describing TreasureDAO as a network state doesn’t have to mean anything incredibly profound either. What this looks like, even probably in its most advanced version, is just a deep online community that bleeds out into the real world. The power of crypto is that it lets this community transmute into the physical world financially vs. closed gaming systems where the user is at the whims of the creator.

In many ways, there wasn’t even an option before now as the friction points were too many, between gas, liquidity, tech, you name it. No matter what you were doing, you had to build your own community from scratch. NFTs completely changed this, along with high throughput blockchains. NFTs cut right to the root state of community with low supply memberships built on an open network with a transparent ledger. NFTs allow you to trade community.

The infrastructure Treasure is building with MAGIC, Treasures, Trove, Bridgeworld, MagicSwap, and soon its own NFT AMM, player guild platform, and wallet architecture, will allow basically anyone with a big enough vision to come tap into its social organism of sprawling digital networks and thrive. Now there is another option with Treasure: come build your world with us and we’ll help you. It doesn’t even have to be a game!

Maybe it’s some social discord equivalent but for matchmaking games; a GameFi item aggregator that tells you the paths available to you with certain items across metaverses; a decentralized oracle network for the stats accompanying the plethora of dynamic NFTs and characters that will be traversing across the magicsphere. This sentiment is echoed by the interconnected Arbitrum community, itself a fringe demographic of the greater ETH network state.

If you build by yourself, you need to find a way to stand out. Build with Treasure and you are spotlighted. This is launchpads v3. Where you actually have a suite of tools, guidance, infra, and most importantly, successful tokenomics to stand your idea on. To my knowledge it has not been done successfully until now and that is a big deal. The Beacon is the best example of how powerful this can be. They were building their game on their own and saw what MAGIC and Treasure offered and pivoted. It’s by far been the most successful game in the Treasure ecosystem (to my knowledge) and they just walked through the front door. Kuoro Beasts is another recent great example.

A lot of this may seem redundant or unnecessary, but understanding how identity, markets, tribalism, doctrine, governance, all start to come together is extremely important in order to view the true value proposition of what TreasureDAO is offering: a composable and interoperable distillate of a vibrant community that can be integrated and built on by anyone.

True community is anti-fragile. It is a part of our identity.

It is incredibly sticky because it is innate to our human quest for belonging to an idea bigger than our own self, while still delineating our own uniqueness in relationship to the greater collective. It’s not just the next chair we hope to sit on until the hype is done. There is no expiration date on deep community.

When we identify with a part of the whole outside of ourselves, we do not simply invest, we re-invest, continuously, automatically. The ego at code level is just a a filter; it literally only exists by creating the illusion that it is somehow separate from the world around it.

Therefore, as the identity that you come to call ‘you’ evolves in parallel with the different constellations of people you encounter in life--family, friends, community, which themselves are conceptually overlapping--the self-rendered image becomes reinforced in the reflection from these different ‘nodes’. But the mind can’t tell the difference. Once the psychological handshake has been made, letting go of a part of you can be extremely difficult and is why some people never change. To the ego, every change literally feels like death.

Treasure’s strong moral objective to get people to opt-in is MAGIC. Why have thousands of in-game tokens trying to be metaversal reserve currencies when we can rally around one and prosper together? Why build alone behind closed doors when you can build in the open with us and when one game does well, we all do well?

It’s open source vs. proprietary. It’s an abstraction of selflessness which creates authenticity, which is mission critical: the vibes can’t be superficial here because cheap plastic communities are a dime a dozen in crypto as clowns prey on the aspirations of people trying to break free of the matrix. In a robust community your casualties become catalysts. People lift each other up. You infuse one another with the spirit of the times, the magic (got ya again) of the moment.

What Hurts You, Blesses You

Few will remember the very early days of BAYC before it x1000 where it was just a couple of people scratching out art pixels on a digital bathroom stall wall while listening to LoFi jams, but if you do, you could tell there was just a different vibe to it in comparison to anything else in NFT Land at that time.

You can’t put your finger on it but you just know. This intuitive intelligence is what the best discretionary traders are able to use without hesitation. It’s what happens when you tap into the aggregated awareness of the hive mind in the early moments before a trend starts. It is d e e p pattern recognition informed by remembered fractals of market psychology as mirrored through the individual. These moments are palpable. It’s the same feeling I got when I found Treasure in the beginning and a big part of the reason I am still here today. In a world full of vanilla, if something feels special it is special.

As discussed, there are a few time-tested ways to kickstart a community in crypto. The number one route is make all your supporters rich, which BAYC has done an excellent job at by recreating hype cycles with derivative token projects. There is a very high chance that if you jumped into BAYC last year at any point, you made money, either through underlying price appreciation, or Yuga simply just leveraging their brand equity and airdropping holders multiple figs.

Another way to form deep community, le sigh, is shared trauma.

Negative events allow you to build community. Stress tests that don’t completely ramshackle a project to its knees, are often necessary battle scars on the road to victory. We can look at the the f-ing minefield of 2022 for all crypto participants as an example. DeFi held its ground. We’re still here and the crypto revolution is now even more Lindy.

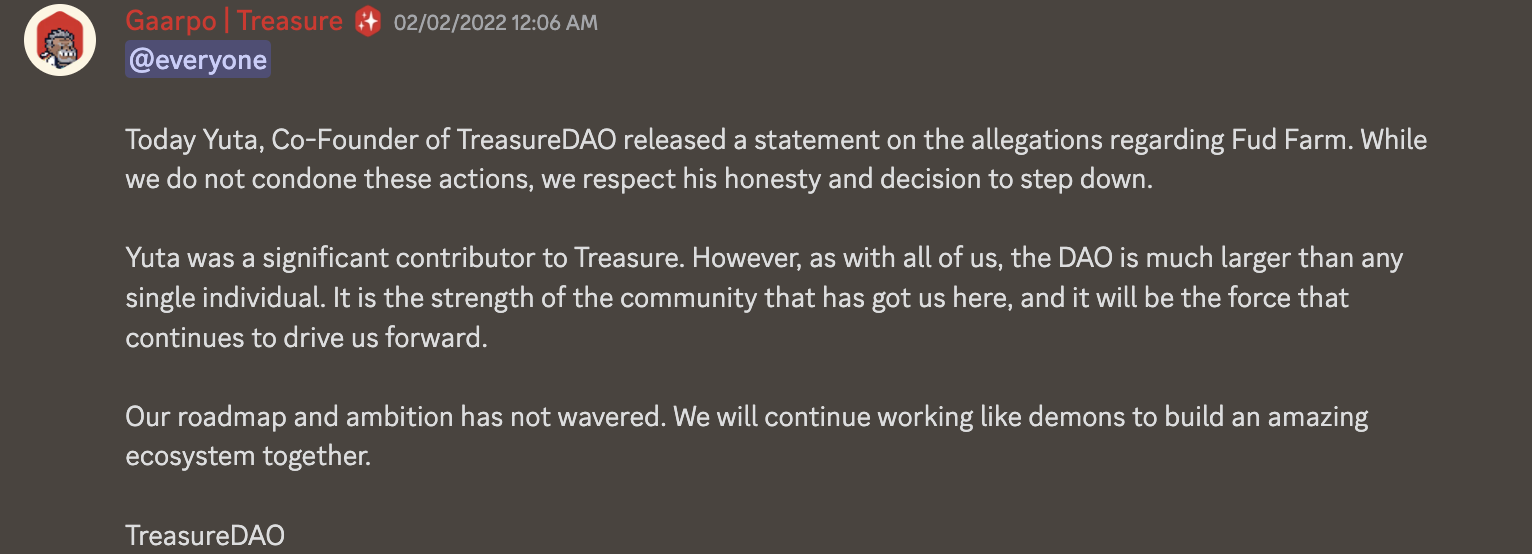

Shortly after BW dropped, a few weeks after Wonderland was collapsing in on itself and Daniel Siesta was coming clean with Sifu involvement, TreasureDAO had its first tail risk of building in the open come to light via a ZachXBT thread. John Patten’s friend and co-founder Yuta had been indicated to doing dev work for Fud Farm and other projects that were what Zach called ‘slow rugs’ in disguise, along with another dev JC.

Ultimately, he was hired by other people to do dev work and juggling projects to make cash during peak NFT bull market, something along these lines. Trying to find meaningful work while the music was still playing. On the case of blatantly bad and scammy, this was mild in my opinion. 99% of all NFT projects are trending towards zero they just have no idea. In fact, I’d say most project creators know this. They just do it because they’re shit traders and morally bankrupt.

In an act of good faith, considering the valuation of Treasure at this time and the negative consequence optics like these can have immediately and down the road, Yuta removed himself from the equation, rather than insist on pressing forward, for the betterment of everyone involved and to take the drama back down to zero so that the Treasure team could build outside of his shadow. Pretty based, and wise, considering the overall mood of the market at this time. Like I’ve mentioned, putting the whole before the self is the key to authenticity.

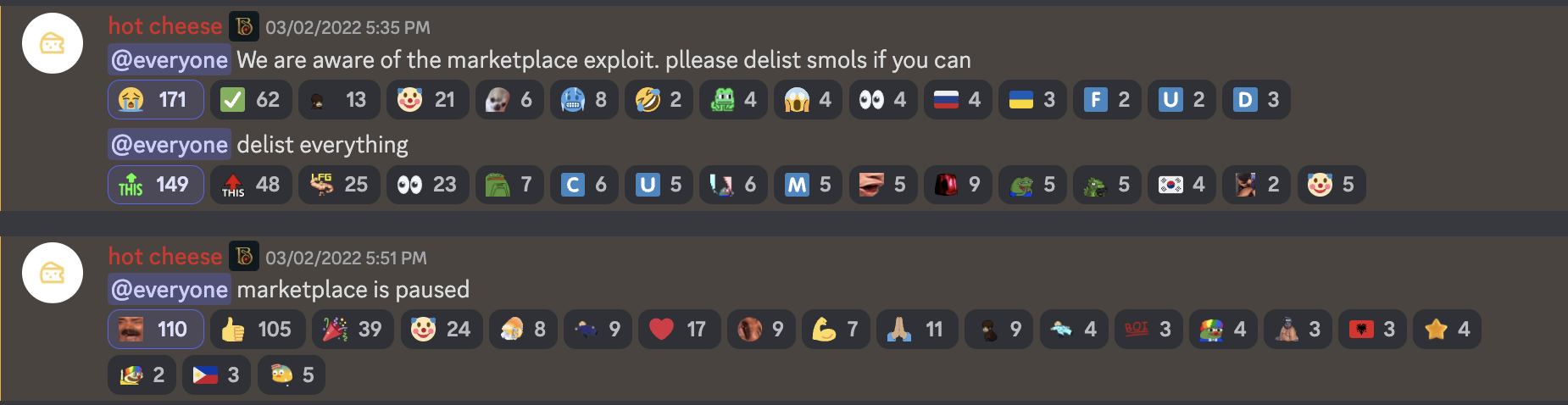

After this dirty laundry and drama was swept swiftly under the rug, the good times kept on rolling for a few more days until the start of March when a few smol owners started noticing their NFTs disappearing from their wallets.

The NFT project Shogun had decided to use the original Treasure Marketplace code for their game because it was open source. This was before the generalized next gen marketplace Trove was built. The hackers, after exploiting Shogun, realized where the source code was originally from, began emptying stealing any NFTs left for sale up on the Treasure Marketplace.

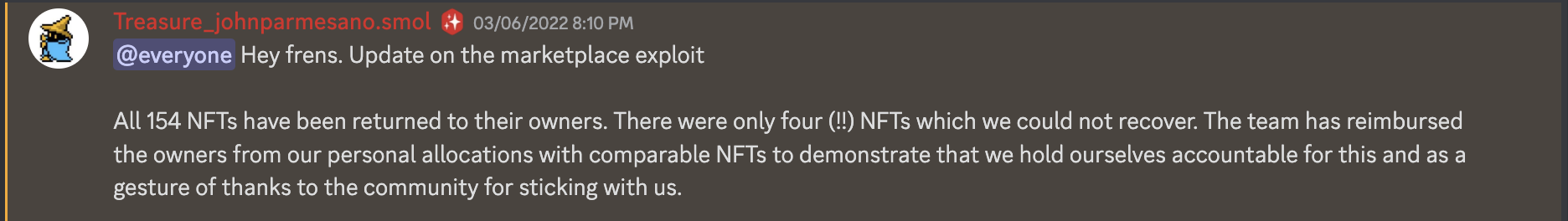

The always-on community in the Discord at this time were able to realize what was happening pretty quickly and alert the team. In fact, a few savvy members who discovered what was going on started white hat exploiting the bug in order to save the NFTs of frens who were not around to de-list. After coordinating and some sleuthing of the Treasure team, the marketplace was paused and successfully audited and reopened, and later retired in lieu of Trove. In the end, all but 4 NFTs were recovered and those owners were reimbursed from the team’s pocket. If you’d like to read the post mortem it’s here.

What happened to the marketplace allowed the people who were ready for the long haul to voice their intention, that they were. Suddenly, everyone who was there was now an OG because everyone had been through some shit together. Everyone was an early adopter now. The bell curve had reset. There was a common psychological resource everyone now shared for warmth. It offered a chance for community members (the ones who saved frens PFPs) and the Treasure team to demonstrate their loyalty to the dream Treasure was building. It served as an aperture for camaraderie to be experienced. In pain, there is the gift of wisdom. In darkness there is also light. Humanity exists in these spaces between. This was a communal dip to double down on if you were a true believer. It effectively turbocharged group identity.

As such, a robust community allows projects to weather negative headwinds in a way that allows them to bounce back even harder. It is the epitome of Resilience 1.0 vs. Resilience 2.0; it is an absolute superpower. Crypto calls for endless humility because trailblazing is failure incarnate. Every hero falls from grace eventually. When you put people up high, gravity has no choice but to get to work. Transparency is the remedy. It’s how you architect a community that is leaderless yet unified.

Smolverse is the case study for this, whose whole concept has been about empowering the creativity of individuals within their community with an emphasis on good vibes. Creating custom smols for individuals creates the opportunity for special feelings of ownership to take place. In this way, Smolverse is really a social experiment as much as it is the flagship brand (and soon game) for TreasureDAO. For Smols, acts of good nature have become an integrated part of the culture, and as the OG NFT project of Treasure (and Arbitrum) this has seeped into the Treasure community as a whole.

In an authentic crypto community there is always a buyer. There is always an apostle. There is sacrifice. There is kindness.

Transparency allows token holders to transcend from a data point to a felt reflection of the individuals who make up the network. Walled gardens and ivory towers are how we got here. A return to good dialogue and good people being good to one another is how we bounce back from our current ethical lows as an industry, and enter a new trend of interconnected integrity that stretches across network states, of all kinds. Truly, if we want to understand how the whole, we must start by looking within.

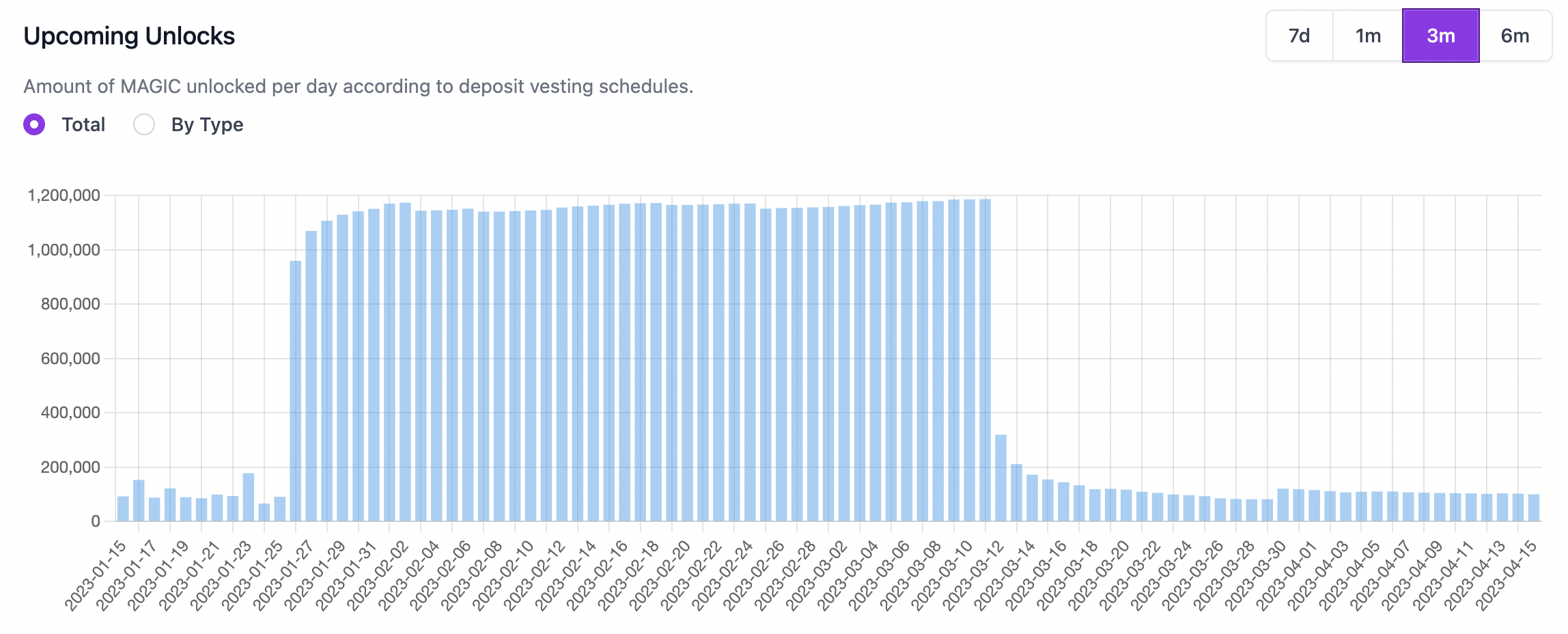

As I was writing this piece, the Treasure team introduced a proposal for TIP-23 that would decommission the Atlas Mine entirely, and rework the emissions schedule of MAGIC so that they could incentivize active players > passive liquidity. This is also in response to the the slew of MAGIC (about 1m per day) set to unlock from the Atlas Mine from January 25th through early March, the supermajority of which is holders who locked MAGIC for one year.

One person looks at this and sees the perfect short. Another looks at it and sees the most committed in the ecosystem. The discussion around this TIP in the Discord has been nothing short of illuminating for me while writing this piece in regards to the various psychological profiles of community as showcased by the Treasure community itself. I have my own views on what this means for Treasure as a whole, but it’s been a real eye-opener for how people project their own narratives onto any situation, mostly entirely unaware that they are even doing so. It offers a live vantage point for me to see how nurturing a thriving organic community is truly an art form and collective effort.

When I try to picture what TreasureDAO is building, it reminds me of one person trying to keep 10 plates spinning all at once while the floor (the market) is also moving. Crypto moves at an exponential rate. What is new can be replaced before the day is up. Even within the time span of me writing this series, the ground has shifted and my Part 2 game mechanics overview is exponentially trending towards obsolete lmeow.

The goal here is obviously to keep all of them spinning, however slowly, but one or two are naturally bound to fall because you only have two hands. You have to anticipate the fall. The way TreasureDAO does this is with its community who rallies around having a good time just as much as profit. The Treasure Community’s resiliency and support then gets extended as a service to everyone who builds with them. As I outlined in Part 1, and just like Balaji’s One Commandment insists for startup socities, there needs to be something deeper driving value creation in the metaverse. The Treasure Community is anti-fragile because FUN is semi-fungible.

From one → to many → one → many → back to one, over and over again. The oscillation continues as we weave the double helix of our imaginations into a shared iteration of Now. The network offers a hologram universe overlayed our own that will become inseparable from awareness as we strive towards a fifth dimension that is also us, where we can double click physical objects or stand our avatars at precise coordinates in cyberspace to represent a collective feeling. As we float in the uncertainty of our experienced four dimensions (x y z + time), crypto drifts us closer to the oneness that is our birthright. The decentralized metaverse is our fire escape, even if you think it’s just JPEGs and crypto bros. The Infinite Mind = infinite iterations. Nowhere else will be more frictionless than our digital multiverse which will allow the spectacle of this Cambrian explosion of consciousness to unfold.

McLuhan argues that a "message" is, "the change of scale or pace or pattern" that a new invention or innovation "introduces into human affairs". He uses the example of a lightbulb as a medium without any content. He says, “a light bulb creates an environment by its mere presence.” The metaverse is the same. How we come to interact through it, with NFTs, community, DAOs, social media, etc. will strongly influence the fundamental nature of how we think about ourselves, each other, and the future.

In the age of networks, online community is the primary social medium through which we will experience humanity, and thus, the tools we use to help shape community, like the ones offered by Treasure and blockchains at large, will have a significant impact on our experience (message) of being human. What happens to us as we slowly erode the physical body from the experience of being human? When we remove the senses that inform us who we are, which is who we were, where do we end up? I’m not quite sure.

But I do know this smol would like to have some fun along the way.

If you made it all the way here thank you!

I will introduce a fourth standalone part to this series that will be about network effects likely before summer. I wanted to do it here but this is already a novel woof. Also, there are many future announcements or catalysts for TreasureDAO and MAGIC between here and there that will likely make the overview much more pertinent. There are MANY things I didn’t discuss here but will cover in future threads on Twitter or other essays.

Reminder: all opinions here are my own, I am not affiliated with the team in anyway, and nothing I say here or elsewhere is financial advice.

This journey really took it out of me. If it’s within your ability to collect any one of these essays, it would mean the world.

I’d love to keep writing all the time but the immediate opportunity costs for endeavors like this without guaranteed income make it hard. So if you collect, it really does help me with the flexibility to write more because my size is not size 🫡 (yet).

That being said, if you want to hire me to write something please hit me up.

And if you are reading this rn, know that I love you and am grateful that you are here. I offer you the biggest of hugs and invite you to reach out and connect! PEACE! 💚✨