*bear with me frens, as I try my hand at summing up the ETH 2.0 MEV landscape for all the smol brains out there now that block building is the hottest game in town

*If you find any of this actionable, useful and profitable after your own careful consideration--or just even find it entertaining--please consider donating by collecting this piece as an NFT.

It goes a long way in helping me write more, is the price of an average gas transaction, and takes 10 seconds just click the button below 👇

Big shoutout and thank you to everyone taking the time to read my work lately and who gave me positive feedback on my first piece regarding Manifold Finance. It occurred to me pretty quickly after publishing it that there was a lot more context to frame this bet in and thus, an invitation to continue researching. In truth, I should have done this piece first and then went into Manifold, but learning, as we all know, is certainly not linear.

This follow-up piece aims to color in the scenery outlined in my first write-up by highlighting broader issues and concepts that are coming to the forefront in the wake of Ethereum’s successful merge to proof-of-stake where MEV and the block building market are concerned.

My hope here is to give readers a deeper and different way to look at MEV and the builder landscape, insofar as that it pivots their working mental model for the future of crypto, specifically Ethereum and other EVMs, in a way that is accessible and actionable.

In doing so, I solidified my own confidence that MEV is the new meta; examine the ethical debates around censorship and exclusive order flow; provide the reader with some context about potential changes that could make the builder market less centralized; and attempt to make my own predictions about the consequences of living in an out-of-protocol PBS environment.

How Should We Think About MEV?

NOTE: the abbreviation MEV was originally short for Miner-Extractable-Value. Since Ethereum has successfully merged to PoS, the term MEV now stands for Maximum-Extractable-Value. Also (idk if anyone else does this but I do in my own head and in the content below) MEV can be used generally like a noun to mean any profit making activities that have to do with transaction ordering, bundling, searching, etc.

Recently, Hasu gave a compelling talk about the future of MEV and listed off 8 predictions about what he thinks is coming Ethereum’s way. I highly recommend listening to the talk as I use it as a foundation for this piece. If you don’t have time to listen, then definitely give this great summarization thread by Shannon Li a once over. She also has a nice MEV primer as well. I am grateful to them both for providing me an outline.

In his talk, Hasu references someone else’s analogy of MEV and tells us to picture a $1000 bill laying in the middle of a highway and the ensuing consequences: cars would stop, the highway would get backed up, you’d have random people walking into the middle of the road to get it, someone would get hurt, ambulances, etc. In this example, the highway is much like the Ethereum blockchain and the $1000 bill represents the exploitable MEV.

I agree and think this is a great visualization; however, I am going to take it one step farther with help from TxStreet:

Picture a very crowded bus station with people (orders/transactions/anything that alters Ethereum’s state) originating from all over (dApps, DeFi, bridges, roll-ups, basic ETH smart contract interactions, etc.) All these people are waiting in line to get onto the next bus (block) out the bus station to their final destination in the blockchain.

As we know, some of these people originate from very rich places and can pay to get to the front of the line (tx queue). But like many public transportation systems, pickpockets, hecklers, and knowledgeable opportunists are waiting to take advantage of people who don’t know better and aren’t from around these parts. Most recently we saw this to the tune of about $1.8mil:

In this analogy, the bus station can be thought of as the public mempool. And the searchers, bots and savvy traders that hang out there are constantly keeping tabs and monitoring who comes through. Some of them may have the in with the ticket-issuer (builder-relay) or even have their fingers in deciding which busses are leaving the station (validators).

If you’re not careful you can end up between two thugs on the bus as you make your way out and find your pockets empty after you get off (sandwich attack).

Or maybe they know two cities (DEXes) are fighting with each other over the same resource (stablecoin) and they make a deal with a third (flashloan) to exploit the difference in opinion over how much they think it is worth (arbitrage).

Perhaps they see a bunch of people with grins as wide as their face getting on the bus and invariably know those people have a load of $$$ waiting for them whenever they get off, or maybe hiding under their coats, so they bribe their way to the front and take it before the bus leaves the station (frontrunning). Or I guess with EIP-1559 would be similar to greasing the bus driver with a tip/ priority fee.

Maybe they are even more predatory and see the ignition to a big Greyhound can be boosted (bridge contract) that ships tokens between chains and decides to drain the reserves for all they got (hack).

These opportunists, often referred to as searchers are very crafty. And because the transparent nature of blockchain all of this data is available if you know how and what to pay attention to.

Forgive me if these scenarios aren’t to the T correct, but I like this example more than the highway one Hasu details because at the end of the day, these blockchains and networks combined together act more like a bustling country than a simple information highway, which is how we are often told to think about the internet. Ethereum, in its most lofty ideals and grandest scale, is meant to re-shape the state itself.

As we can see, if the public mempool is left unchecked it becomes backed up, network fees spike, the station platform becomes filled with bad actors and con-artists looking to extort normal users. So what is there to do?

Insert: MEV-Boost and The Block Auction Market

Instead of going to the public bus station, block builders and relays give users a way to circumvent this potentially predatory environment. By sending orders to an RPC endpoint like Manifold’s SecureRPC or Flashbots, users direct their transaction order flow through an intermediary which protects the users from malicious network actors hanging out in the public mempool.

As a result, builders like Manifold(OpenMEV) and Flashbots(MEV-Boost) sequence the transactions sent to them via their trading/ block building engines through propriety strategies and bundling in such a way to extract the most value from it via these virtual mempools.

They then offer this up to the relays (often themselves but not always*) who in turn aggregate and bid them to the validators selling blockspace who accept bids for blocks from this private market vs. proposing blocks (busses) built out of the public mempool.

Once the auctioned block has been proposed and obtained the supermajority of attestations from the other validators in the chain it is considered justified and added to the blockchain. It’s finalized when the block is considered too expensive to reorg.

THEN the profits from the MEV activities are redistributed back to validators who earn rewards from Ethereum transaction fees + the extra yield gained from MEV to create a boosted staking return, hence MEV-Boost.

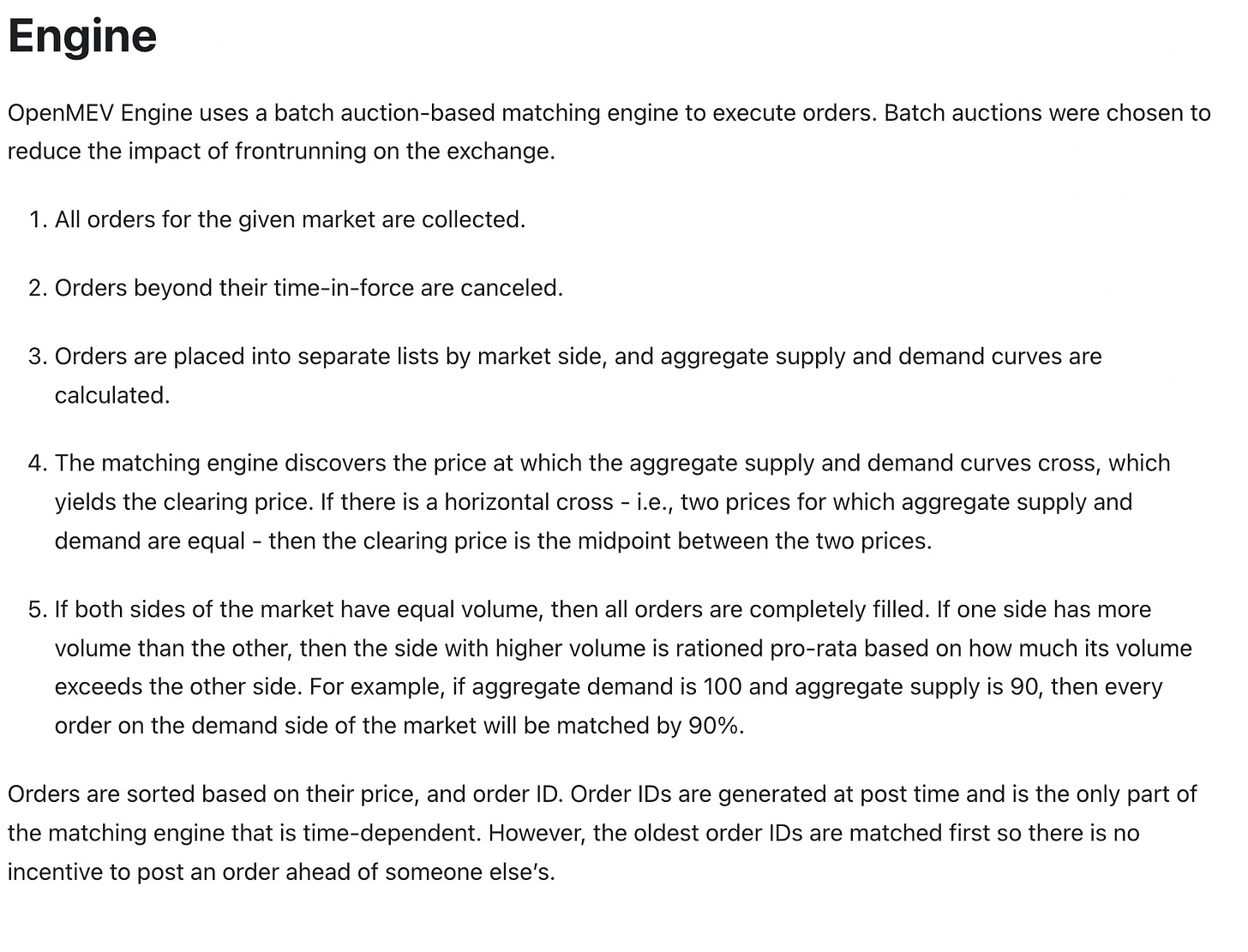

Below is a description of how Manifold’s OpenMEV engine does this with SushiSwap order flow from their docs:

Creating this block auction market for validators to accept block bids from outside the public mempool is the opportunity that Flashbots MEV-Boost software capitalized on and originally started doing for Ethereum miners back in the proof-of-work days (god I’m getting old). Miners who used their service accepted blocks ‘built’ aka ‘bundled’ from their MEV relay to earn more from the blocks they were mining.

However, the biggest concern for a miner is not whether or not they can juice out extra yield per block in transaction ordering, it’s seeking out the cheapest kilowatt-hour possible so they can stay competitive and keep more of their rewards. Now that Ethereum consensus is fully proof-of-stake, 99.9% less energy intensive, and generating validator returns in a more predictable/ stable way thanks to EIP-1559, earning that extra yield amount in MEV suddenly becomes the equivalent of chasing down the cheapest kilowatt hour.

Basically, if you are staking ETH and want to be competitive these days, you have to run some form of MEV-Boost to get the best yield.

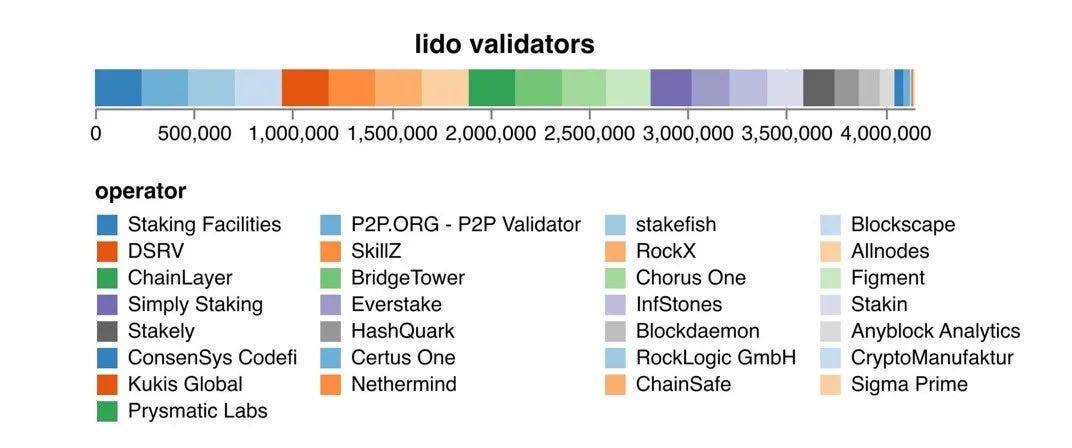

And thanks to liquid staking providers like LiDo, RocketPool, et al. centralizing a lot of the validator power by making exposure to ETH staking super accessible and capital efficient to normal users and validators alike with stETH, where these staking conglomerates choose to sell blockspace to is a big f-ing deal.

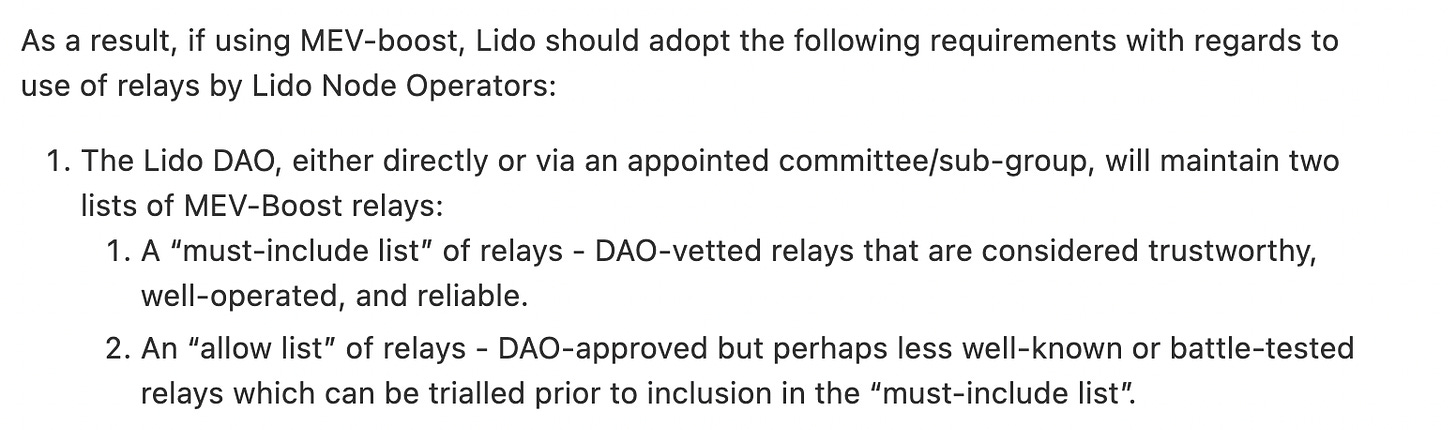

(from the LiDo docs:)

Also, yes I know Lido, etc. are not just one single validator but made up of many validators and that those validators have the right to choose where to sell their blockspace/ which relays to accept block bids from but it’s still another funnel of influence to have to choose from this allow list. It’s because block validation isn’t a simple task (ty x100 foobar) and requires supreme uptime that services like Lido exist to begin with in order make it easy for retail and institutions. However, there can be little denial that the switch to proof-of-stake has made Ethereum more robust.

Interesting tidbit: from the outside looking in you might think validators would just simply choose whichever relays were offering up the highest grossing blocks. But at least, preliminary data (again from this chad Elias Simos) suggests that might not always be the case! **EDIT: my guess is this likely noise at this stage. We’ll see down the stretch. Read full thread.

NOTE: Going forward, I am going to use the term *‘builder-relay’ to describe middleware service providers like Manifold, Flashbots, BloXroute, Eden, etc. bc they are building blocks AND also relaying them to validators. Infura does this also for the Ethereum public mempool (afaik as the base configuration) ((aka MetaMask users)) hence MEV. But a builder does not automatically equal a relay and vice versa. For instance, SecureRPC is described as a relay aggregator, so potentially it could auction Manifold’s own blocks OR it could forward them to Eden or Flashbots relays is how I understand it. Or Flashbots could build a block and send it through SecureRPC. Or anyone could do it and use whatever RPC they like.

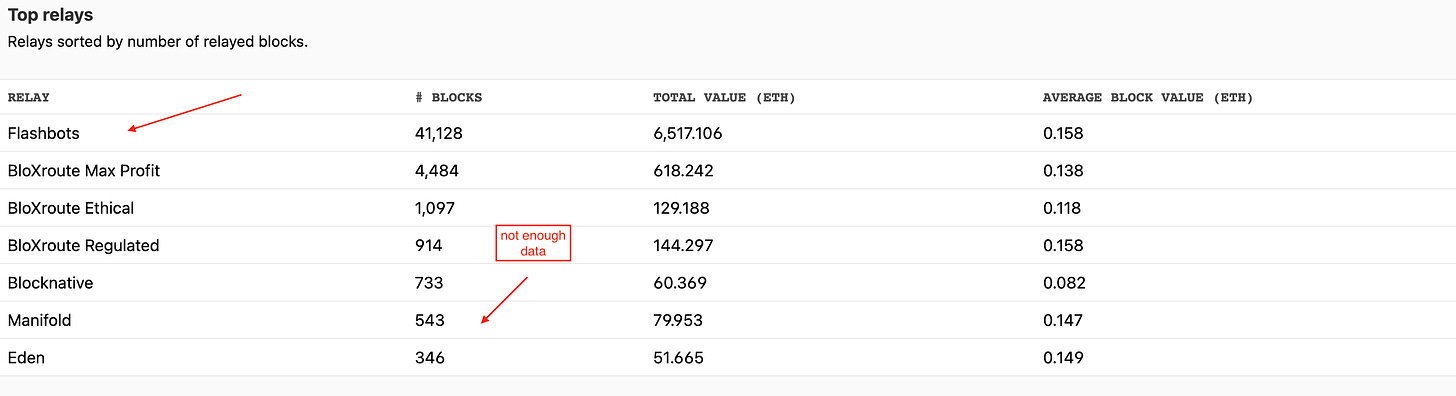

As we can see, Flashbots is clearly in the lead as a builder-relay. However, given ETH 2.0 is still extremely new, there is not a big enough sample size for all the new players in the builder-relay space to make an effective comparison since Flashbots has such a big head start. We simply need more blocks. Probably about a year’s worth or longer to make a true comparison and get an idea of what the playing field is like.

Nor is it very Ethereum whose promise is advertised as an open and decentralized smart computer for all, regardless of your social standing, background or any other demographic.

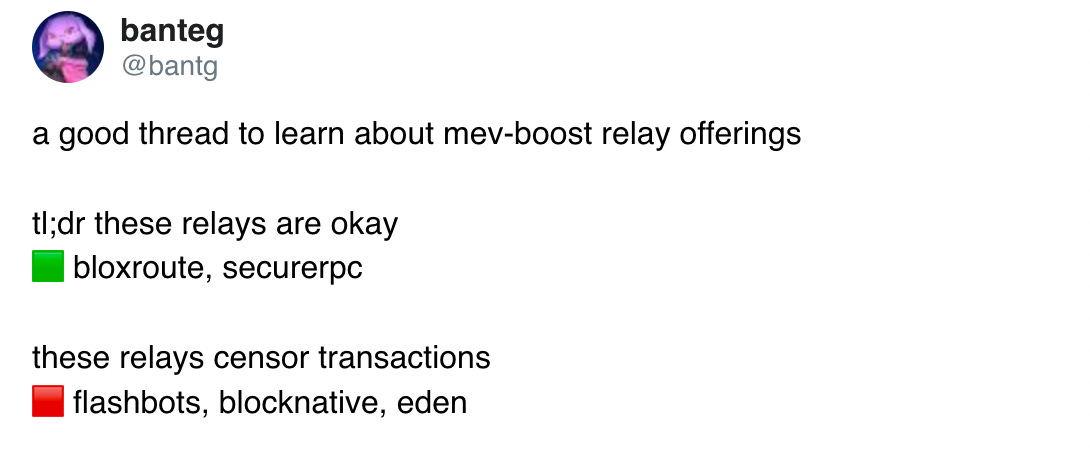

It’s a bit mind-boggling to me that Flashbots has chosen this censorship route. Especially considering Tornado Cash operates in the exact same entity space as they do: a public good for Ethereum users. From where I and many are standing, there really is no need I agree banteg. Still, I consider the other perspective further down.

For this reason, because Manifold is specifically seeking to operate as a non-censoring middleware-solution AND by directing MEV, fees, profit, etc. back to validators+traders by means of their FOLD token, they are operating in a more transparent and accountable way than Flashbots, Blocknative, and others. Which is a fancy way of saying: if they act shitty/ not in good faith, people will dump their token:

***This is not a jibe at the homie CryptoCondom just a great and pertinent example of a consequence that can happen to Manifold but not Flashbots — this is a good thing! I personally decided to reduce bag exposure after some similar concerns as well, which I posted about.***

As a consequence of this, one *could* definitely argue that Flashbots are the bad guys because they lack this direct accountability of public stakeholders and currently account for **almost half **of the blocks being bid to validators, i.e., centralization AND censorship.

To that end though, this is ultimately the design of in-protocol Proposer/Builder Separation to have centralization at the block building level.

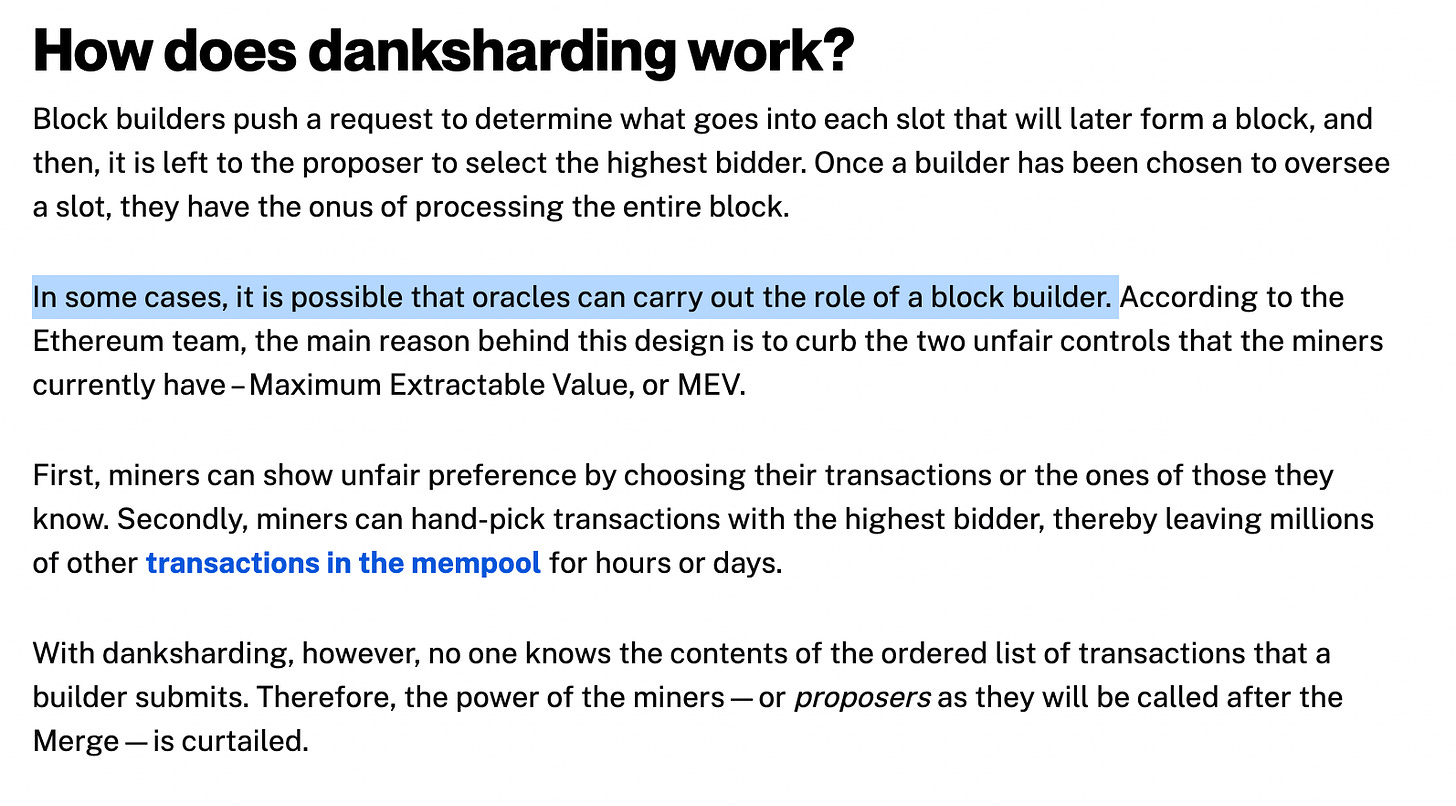

BUT what Flashbots did was do this out-of-protocol for Ethereum. In the true BPS vision (as I understand it**), the Builder-Proposer Separation happens at a protocol level in the public mempool, not by the types of builders we see today.

This doesn’t take into account the huge amount of transaction volume flowing through knee-bending Infura, i.e., MetaMask either. Essentially, the way ETH is structured at the moment post-merge is a lot of trust for these entities to be benevolent actors. And as typical the market no-likey.

Who Controls The Flow, Controls The Chain:

The third prediction Hasu makes in his presentation is that given enough time, the majority of transactions and order flow will be diverted away from public mempools to private builders. I am confident in this sentiment as well, and we are already seeing an insane amount of volume diverted away as I mentioned above with the amount of transactions flowing through the Flashbots builder-relay.

In addition to speed, lower gas costs, and frontrunning protection, private mempools offer possibilities like paying for gas with any token in your wallet or potentially cancelling harmful smart contract interactions with known scams or honeypots. This has the potential to make Ethereum and DeFi MUCH more noob friendly.

By now you have probably felt personally the negative effect of bots in the public mempool wreaking havoc in the form of gas wars, failed transactions, and sandwich attacks. (If you’d like to just see how much, I recommend checking out this dope little website which will tell you just how much MEV you’ve been victim too.)

Or maybe swapped all of your ETH accidentally for SHIB in haste just to have to go back through the hell loop of fiat> CEX> 7 days> wallet again; or run through your Twitter homies to help you with some shekels in a pinch so you can exit your position.

I don’t think I need to even write a sentence about the usefulness of potentially not interacting with a malicious smart contract or honeypot but here it is. Then again, none of this will help you if you just hand over your private keys to your BAYC. All the same, these seamless features crypto natives have grown up without are big plusses for newcomers and existing users alike.

Except it’s not that simple. Legit none of this shit is if you couldn’t tell lmao, at least to this smol one. Anyways—

MEV getting kicked back to users is often spun like a rebate—like it’s just some money that happens to be hiding innately in your DEX swap or NFT flip. That couldn’t be farther from the truth.

A wise anon once said many moons ago, “If you don’t know where the yield is coming from, you are the yield.”

This is pretty accurate when it comes to MEV and the extra $ block builders aim to capture which is primarily done through arbitrage.

Take 1inch (OFAC-compliant) for example. They offer a gas rebate in $1INCH on eligible mainnet transactions. Users get MEV protection via their Pathfinder algo that aggregates and routes order flow to and from different DEXes on the backend in a highly efficient manner. It can snoop out the best swaps looking at liquidity and market depth across pools, as well as consider liquidity in a limit orderbook for any of it’s integrated EVM chains. Pretty neat.

They attract more volume, they get more fees and wiggle room via their aggregator to collect on arbitrage/ batching, and the cycle continues as we know. But the order flow is what you are buying these features with as the user. And in a somewhat similar way, what the 1inch Pathfinder algo does as DEX regarding optimization, block builders are doing for transactions in their private mempools.

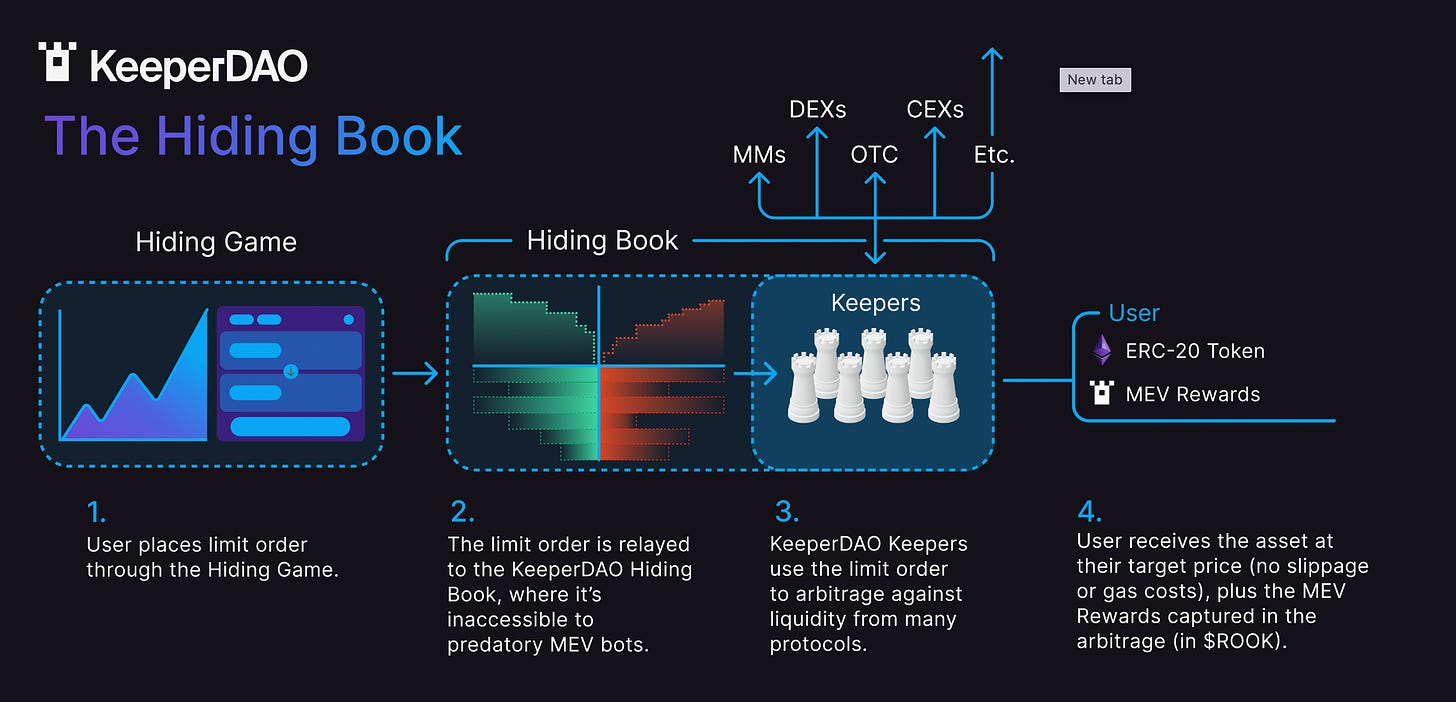

KeeperDAO uses a similar method of arbitrage against the liquidity of its willing traders and feeds this back to traders in ROOK. You don’t have to pay gas or experience slippage, and because of its Keeper network can source liquidity on and off chain.

CoW Protocol is another and one of the first DEXes to offer MEV-protection to traders (iirc) that allows traders to pay for gas in tokens other than ETH. What’s also rad is that any portion of trades that can be done peer-to-peer on the backend are settled that way vs LPs. They utilize and source liquidity from all DEXes and aggregators similar to KeeperDAO (but not CEX/off-chain liq afaik).

DEXes like Cow Protocol and Rook.fi (both only on mainnet) are essentially looking to reduce the amount of MEV available at the execution layer by trying to attract significant amounts of order flow from users at the application level. These services are amazing for Ethereum traders to utilize and protect themselves. We’ve come a hella long way since food tokens in just two years.

But again, make no mistake about it, the ‘MEV Rewards’ these types of swaps circle back to users is a business transaction.

MEV DEX gets order flow → user gets what would have been lost or exploited back to them anyway.

To return back to the bus station analogy, it would be like a person (transaction) getting on a bus like normal except now when they do there’s a high chance they’ll find a $5 bill on the floor of the bus. Whether the $5 is on the floor is not in dispute: it’s whether the passenger picks it up or the driver finds it as everyone is getting off that matters.

Perhaps the biggest value prop of Manifold and other protocols seeking to return MEV back to traders is that instead of just finding money you already had in exchange for help finding it, retail (token holders) has a chance at the whole MEV pie, not just the MEV that can be captured from their own personal trading. And of course no censoring of transactions with Manifold!

from some Manifold Medium article I can no longer find sorry:

BloXroute (second biggest builder-relay) has a unique product available to the public as well called BackRunMe; you can use their RPC endpoint in MetaMask or go to their website to swap through SushiSwap or UniSwap with their product. *BloXroute has no token, but has great docs and is worth its own individual look which I plan on.

Without sufficient order flow from traders, block builders cannot sequence, bundle, optimize—whatever word you want to use—from a high value pool of transactions.

The more order flow, the more MEV, the better yields, the more transaction volume gets sucked into the block builder batching the most profitable blocks. Very similar to how the deepest most liquid markets attract the most trading volume because of less slippage, UX, etc. This is how you end up with a giant like Binance/BNB (also constant shipping and gigabrain like CZ ofc).

And just like the ethical discussion of using a CEX vs. DEX and people opting for the CEX bc > profits, the same can be said about Flashbots and Co. bc even though they are censoring transactions—which the supermajority of crypto evangelists (real ones at least) all agree and attest to being reprehensible—again, almost half of all blocks are being accepted from them via MEV-Boost. Obviously if you send transactions yourself to Flashbots relay you’ll get MEV protection but no $ comes back to you as a trader.

Which is why there is so much opportunity and power to whoever can exploit the weaknesses in Flashbots armor (censorship, not giving some $ back to users) by capturing more transaction flow. It’s why we have projects like Manifold, KeeperDAO, CoW Protocol trying to divert users away.

Thus, a block auction market on Ethereum is one way to circumvent the MEV issues of the public mempool, but since it is happening out-of-protocol, and even though it may look unique, as it stands it creates a potential predatory bottleneck of power at the builder level.

NOTE: Each one of these possible solutions to combat builder centralization could probably have its own write up the length of this article. For the sake of time bc this is already long af—thank you if you are still reading— and bc a lot of it is over my head atm, my aim is to just give a smorgasbord of solutions that I have come across with some commentary. Would love to talk about any of them individually via email or Twitter though! From the goat Vitalik himself (*definitely read):

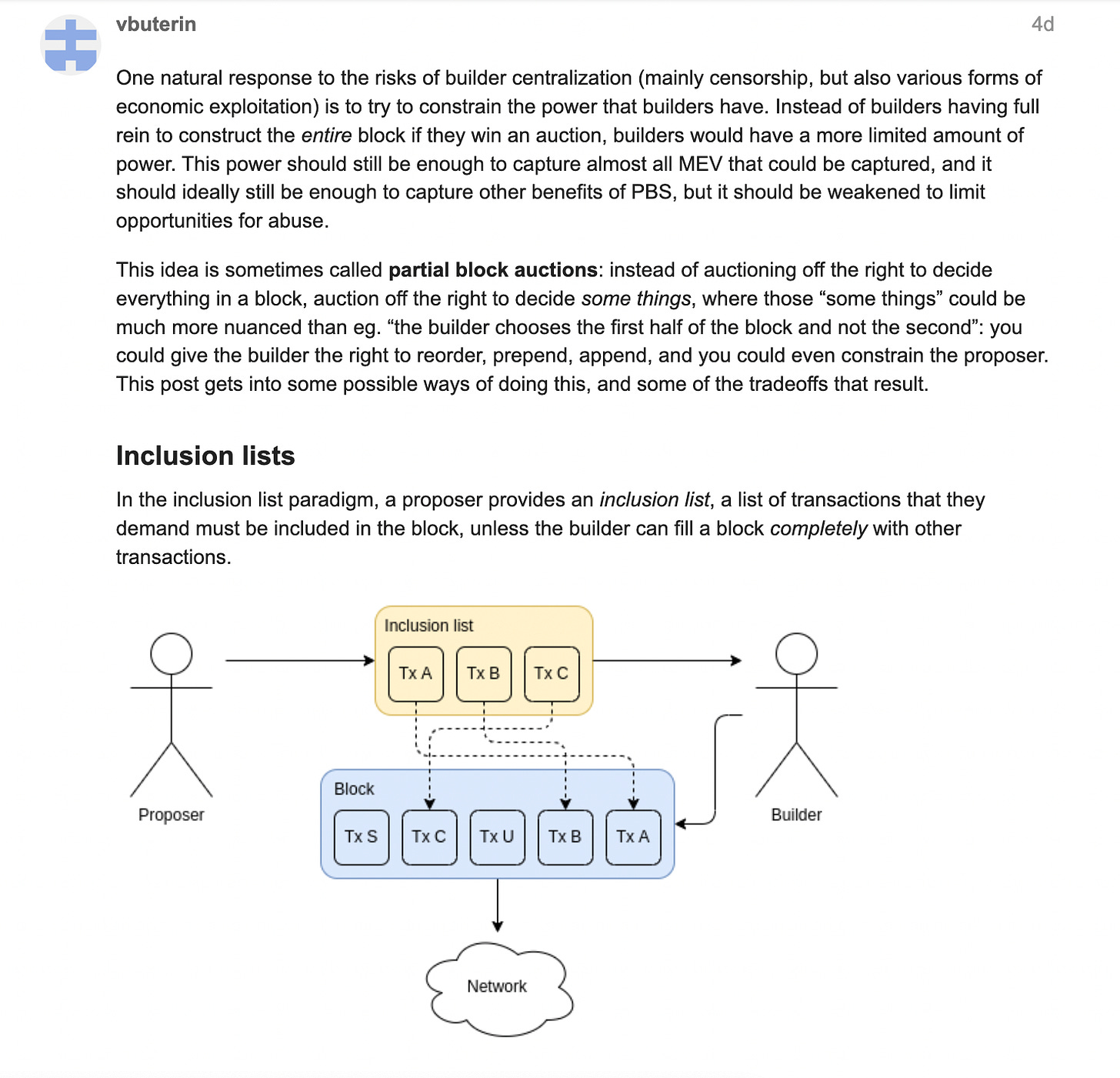

Inclusion lists seem pretty reasonable on the surface bc it would still allow MEV to be captured no problem and decreases some of the centralization in BPS by making builders beholden to the configuration of ETH at the execution layer, which is to say they have to include specific sorts of transactions in each block. However it comes with a slew of consequences that Vitalik addresses, most notably to me that builders could just refuse blocks that have an inclusion list they don’t like, namely, ones that aren’t as profitable as others.

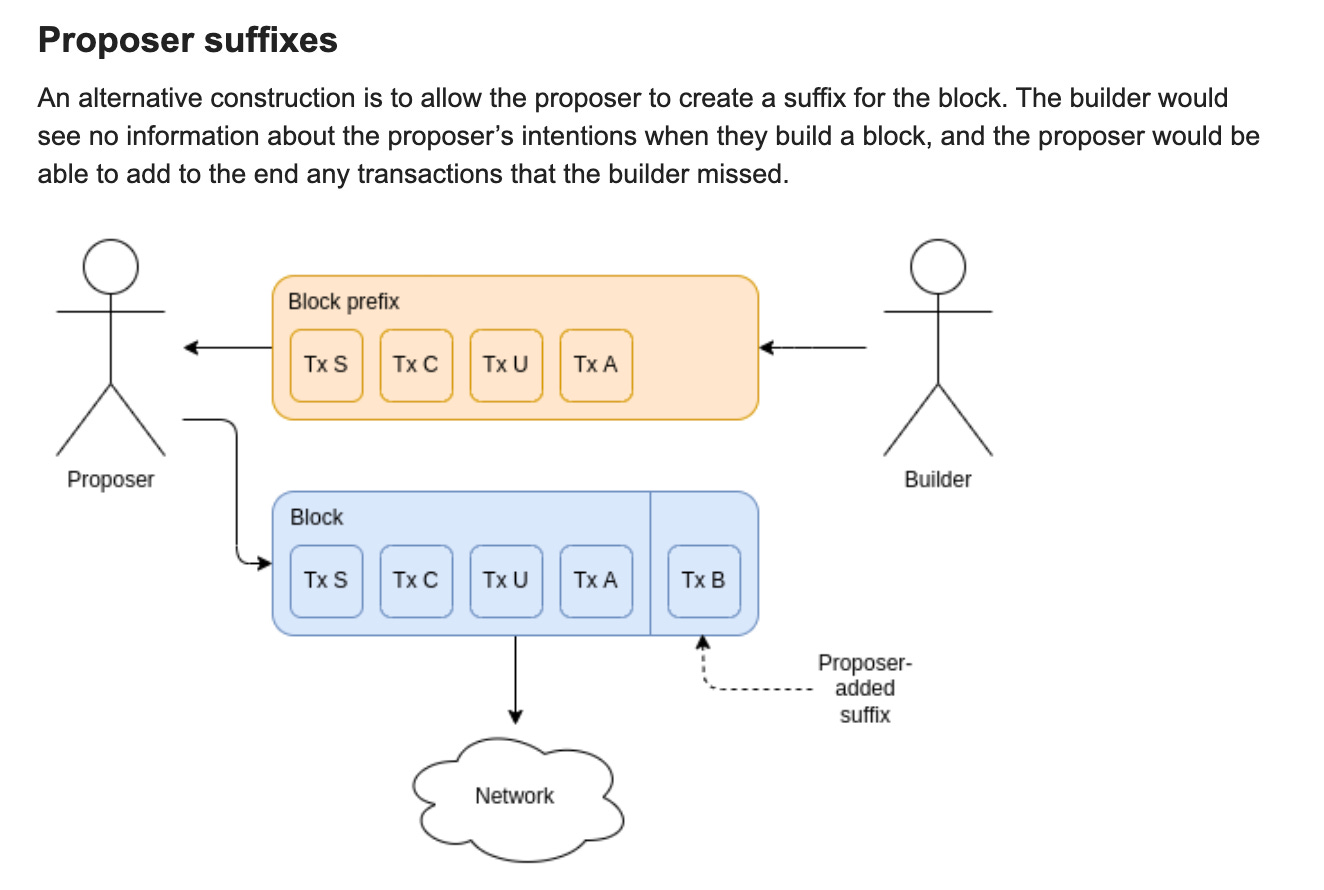

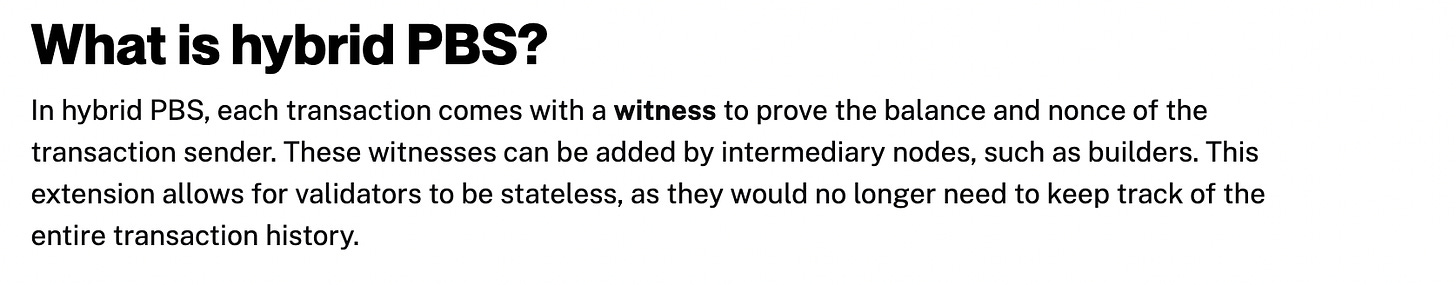

Vitalik mentions proposer suffixes as a solution next which I don’t really get but the main takeaways I think are that proposers could add any transactions builders miss (again decreasing builder power) and attach a suffix to the block. I think he just uses this as an idea-generator bc in this vision validators would need to keep track of the entire Ethereum post-state, which ain’t it/ super resource intensive. Something like this description of hybrid PBS should be the goal right?

This homie Quintus offers some solutions and great ideas here. Specifically, flipping the dynamic of MEV via a very carefully crafted explicit auction for transactions so that extractors/ searchers *have to bid users for their order flow (*sign me up dawg).

In this system, a trusted auctioneer is needed/ users can’t be expected to navigate the auction (market) by themselves and he references Rook as an example. This doesn’t do any good for power centralization though as nice as it sounds. The next idea is a fee-escalator of which ngl could not get a good grasp on at all, so if you do and you’re reading this please hmu!

Obviously, the design of something like this for Ethereum would have to be dialed af and tested/modeled to infinity before the protocol changes. He also does a banging job describing the pitfalls of exclusive order flow in this piece as well. Give him a follow for sure.

The issue with a lot of these solutions is that hard changes often have to be made to execution layer/ execution clients which we all know can take a while.

Plus, the other goal of PBS is that it makes it incredibly easy to implement sharding on Ethereum and allow it to scale. It’s an extremely important and worthy topic to think about.

**Don’t worry Link Marines, I’m getting there (but also please forgive me if I botch the summary). **

Perhaps the most notable, hyped, and novel solution on offer comes from Chainlink in the form of their Fair Sequencing Service (FSS) proposal. In this design, an oracle network orders any transactions sent to the contract and reach consensus on ordering. Then a nonce or suffix is attached to them and shipped off. Yet again though, how order-fairness is achieved becomes a critical discussion.

The main benefits of FSS is that no protocol-level changes have to be made to ANY Layer 1 chain that implements it and it eliminates the threat of MEV from the public mempool. This is probably the solution that has the best chance at being implemented alongside any/some of the other ones briefly mentioned here. And truly, it is the bleeding-edge of tech:

Lastly, another option which Hasu spends quite a bit of time on is threshold encryption (TE) for transactions in the public mempool.

TE makes a lot of sense to me and would completely remove MEV from the picture as far as searchers, but the second order effects mean a lot more trust in validators who could/ have more incentive now to collude because of the time it takes between when a block is accepted and when it is finalized.

Because of this, and the double-edged sword of order-sequencing structures like FCFS (first-come first-served), latency then becomes a giant part of the equation similar to how legacy markets are set up today. Similar to how HFT funds fight for nanoseconds, crypto heavyweights are and will continue to pay for the opportunity to get blocks prioritized milliseconds ahead of their competitors to exploit on-chain opportunities often in conjunction with centralized order flow.

From where I’m standing, I think one of the best solutions per usual is to give users the optionality at the protocol level with TE and Chainlink’s FSS.

If network participants opt for the public ‘mempool’, then their transactions are protected from potential extractors and oracle nodes who would only see the contents of the transaction after the ordering has been agreed upon. This has the effect of transferring and decentralizing power back to users.

Remember, whoever controls the flow can stunt, and at the moment the users don’t have much way to flex this in favor of fairness other than not using Ethereum at all. But if they could choose to use the mempool safely it would (lmao obviously) takeaway the centralized power builders like Flashbots have and stamp out many potential bad actors.

Hasu mentions that the ideal scenario for Ethereum is where the public mempool and UX is just as good as anything you can experience in the private mempool, i.e, comes down to marketing, communities, tech, to draw exclusive order flow away. I think this is a great place to aim that strengthens Ethereum while still pushing forward innovation.

from Vitalik again:

Again though, all of this will likely take SIGNIFICANT time, require considerably more discussion, and be multifaceted—thus, the BPS version of ETH 2.0 that we have today is here to stay for the foreseeable future. The crux of which means, this highly competitive and lucrative market will have only a few key players in it for the time being. So, knowing that what sort of predictions can we make as investors about narratives that will spring up around this new source of yield?

MEV isn’t going anywhere. As long as blockchains exist in the fashion they do (outside of DAGs, which I guess aren’t blockchains anyways), there will always be ways to extract value through arbitrage, order flow and bundling of transactions in a manner that is more profitable for the involved parties.

Even if Chainlink’s FSS gets adopted, I can see latency still becoming a factor; potential manipulation of oracles a concern and new attack vector on ETH at the EL which is not possible today; and even with TE, sharp opportunists will still have the ability for shenanigans based just off the metadata of who sent the transaction or colluding for prioritization.

“MEV arises because of a dirty little open secret in most blockchains: They’re temporarily centralized, in the sense that a single miner gets to decide unilaterally how to order transactions in each mined block.” — Chainlink

Also wouldn’t power then just be centralized in Chainlink as an institution then? I get it would be an oracle network therefore risk significantly mitigated + other giga brain circumventions/tech I don’t understand. But that begets another point: whatever solution arises to be the answer to this builder dilemma likely needs to top out at some level of complication, at least, I’d imagine this an ideal to shoot for.

For all the qualms about BPS, it works fine my g. And literally if OFAC weren’t such freedom oppressing cunts and Flashbots weren’t licking their twat without asking, we’d all be much more focused on what the possibilities of MEV yield could add to the playing field of crypto products vs. censorship (bear market vibes also kek) Which is ultimately what I think is going to happen, and therefore where a lot of opportunity is waiting.

For starters, literally as I am in the midst of writing this Bert drops this thread (definitely read):

This last bit about submitting their blocks to other relays is pretty huge and will help with censorship. Obviously the benefits of open sourcing their code and MEV strats (I hope!) will level the block building playing field I imagine and allow for other block building competitors to enter the market more quickly. These are great steps.

To his credit, I like Bert and do believe Flashbots is net good for Ethereum even though they are censoring transactions at the moment. Stewarding MEV-Boost the way they did—to front-run and stopper a potentially exponentially harmful situation with searchers in the public mempool—so that they could make sure Ethereum was transitioning in good hands vs. the hands of others is a valid cause.

Moreover: it is kind of in crypto’s best interest in this moment to show that some of us are willing to work with regulators in good faith as much as it fucking pains me to say it. Things are tense af globally. Crypto’s only job at this stage is to continue surviving until it becomes too big and ubiquitous to control or fail (we’re not there). So in a sense, Flashbots—I see you bruh; keeping regulators at bay so that Ethereum has enough wiggle room to reach its endgame is a good idea, if that is indeed what you are doing.

It’s also not like there aren’t a variety of other existing privacy-preserving solutions integrated with Ethereum at this very moment for Tornado Cash users (Railgun, Umbra, Aztec, etc.) or other privacy-protecting non-discriminating relays (Manifold, bloxRoute) for sanctioned individuals to use.

My issue is that when given the opportunity to divert even a small amount of MEV back to users vs. validators they decided on validators/ miners. I’d like to see this change and think it has the potential to easily and relatively soon the way things are going. This would spice things up considerably.

Think of all the Flashbots MEV-Boost profits diverted back explicitly to ETH users and token holders. Rook essentially at the block builder level not dApp level. Maybe it’s like 75% of MEV yield goes back to token holders and 25% of it gets split among users when they send transactions to said project’s RPC endpoint—not some 50/50 split like Manifold is aiming to do with FOLD token holders and validators.

I think the implications of this will be massive and disruptive. Through whatever token scheme they decide, the protocol would likely seek to have a decent amount of POL; validators could make up returns via buying the token themselves (especially if it is appreciating rapidly in the right environment); traders would be having a field day, probably Sybil-ing tf out of it —> so I’m guessing there would have to be a volume per day limit per wallet, plus $ threshold to meet, plus holding an amount of the token or staking it kind of like Eden Network. I’m literally just going down the rabbit hole here so if you have something to add to this, again hmu.

Either a token that comes to be speculated on and represent it + future yield by proxy like the above or some other way of lego-ing it to increase yields elsewhere in crypto in a native fashion.

This would be incredible, create its own secondary and derivative markets around the token, and open the door for some truly composable #RealYield that comes from the EL itself.

FOLD could and would represent this rn if there was any sort of clarity to be had on what the xFOLD staking revenue would look like but since it’s been subsidized up to this point, it still remains a question mark. But the sky is the limit for whoever can make a case that they are going to actually be competitive to Flashbots and initiate a token like this successfully. I am/will be watching and waiting for clarity.

Generalized MEV tokens or tokens that represent flows from MEV, also allow treasuries to effectively plan around recapturing some of this value back and subsidizing services to their users without having to attract the volume themselves. Projects like Alkimiya will change the dynamics of the “simple” block auction market as it stands today with blockspace futures and other derivatives. Block builders will probably expand into these products as well. Imagine if you could cover fees for your users for the whole year? or hedge your intensive protocol procedures gas usage? The possibilities are really cool.

I’ll say it one last time, whoever can garner enough order flow to their banner will be king. Once this happens, as things become more open source, the builder market actually has the potential to get more competitive I think, not more centralized as some people fear rn.

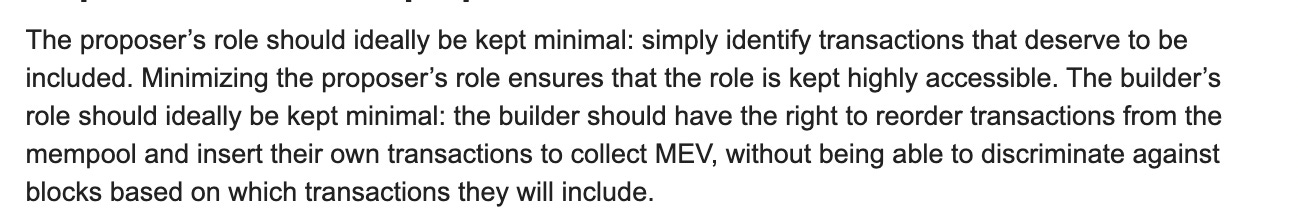

Time and time again we have seen in crypto, where there is a possibility of an avenue for profit, the method and means to obtain it will exist and flourish to the point of almost systemic risk. Another way of saying this, is that crypto’s capacity to reinvent the flywheel and innovate is unmatched. I think this competition in the builder market, especially if Flashbots is true to their word in unwinding their grasp, will be a sight to behold.

I expect the sophistication of searchers to continue to increase steadily as blockchains become more interconnected. Particularly, as the EVM multi-chain reality becomes clearer everyday and builders start incorporating L2’s like Arbitrum and Optimism into their services, new forms of cross-chain MEV will likely become possible.

Malicious multi-block MEV is already a big issue in regards to TWAP oracle manipulation where we’ve seen attackers trigger liquidation cascades to their benefit. Maybe something like this.

With flow coming from many different chains and pulling from an ever increasing high-value mempool of transactions, the possibilities to extrapolate more $ from blocks becomes even greater. In this way, I see specific builders blurring the line and almost becoming like a super rollup with other EVMs/ L2 order flow.

Either as an impetus or a result of these cross-chain MEV opportunities, I predict we see a builder-relay team up with a bridge protocol to work with their order flow/pools to divert profits back to token holders;

or vice versa, and a bridge protocol like Synapse or LayerZero decides to get into MEV for their users themselves.

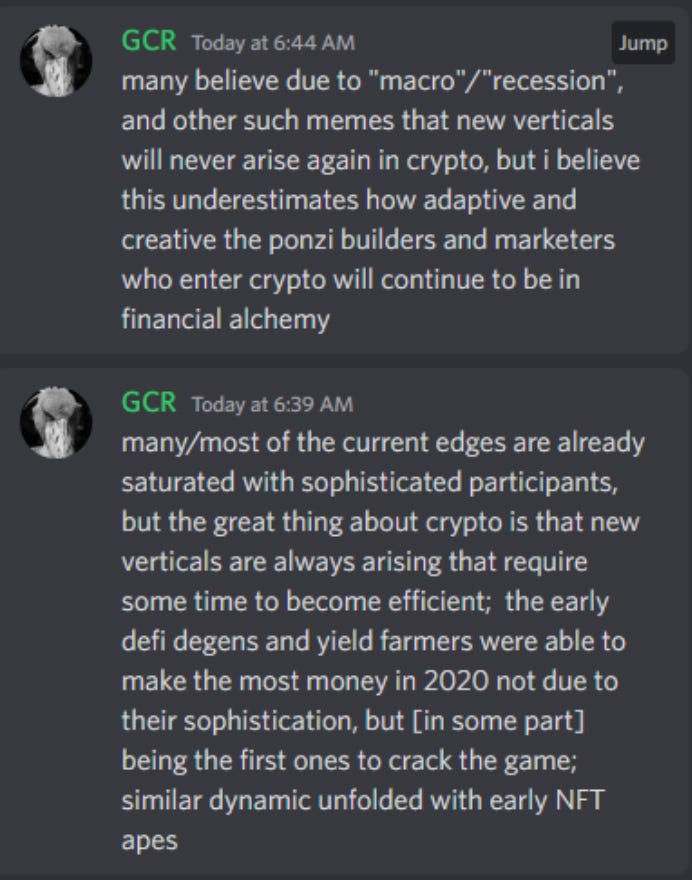

In this same vein, and to make some very specific predictions, I think **UniSwap and/or 1inch will build their own blocks at some point. **Uniswap makes up for the majority of DEX volume by far and has the largest network effects as proprietors of the now sacred formula x*y=k. Simple governance votes to direct order flow from specific LPs to their own block building engine is not a far leap.

In regards to 1inch, what they do for users on the backend at the moment is very similar to the foundation of how arbitrage MEV profits are made anyways that it just seems like an easy jump for me. I think we can definitely throw Matcha/0x in there as well. These come with their own concerns and attack vectors of course.

Consequently, I also predict that DeFi stays true to form and we see a DEX implement some form of veTokenomics or bribe system in directing order flow to builders from specific pools, or see a DEX created to address this opportunity.

Contrary to what I thought six months ago, the NFT glow still alive over much of CT, the rise of the capital-efficient DEX is only beginning. I am surprised each day by the amount of teams creating ways to stretch capital farther, notably GMX’s X4 Swap, protocols such as Silo Finance, and DeFi products like Dopex’s Atlantic Straddles or Umami’s USDC Vault (I am aware I am leaving many out of this list!).

Giving users the optionality to choose where the order flow from LPs is directed will have consequences; namely, that the opaque builder market won’t be able to hide behind complexity and have to have at least one hand on the wheel with respect to PR/marketing/community building. Or maybe institutional flow is all that matters and we see a suits vs. crypto natives dynamic.

Regardless, it’s vitally important the crypto community rallies to the builders that seek to uphold the ideals of an open, decentralized, blockchain-backed world.

Fam, if you made it this far you deserve a POAP ffs. I am beyond humbled and grateful. This one took a lot out of me and I feel like I only scratched the surface!

I hope this clears some of the confusion up that I myself was experiencing in trying to understand BPS and the issues around it. I am convinced no matter how they resolve, the solutions will have big consequences for Ethereum and provide ample investment opportunities for those who remain vigilant.

As always, nothing here is to be taken as financial advice. I write so that I may learn more deeply about crypto, the world, and connect with others. None of us should be making investment decisions based off random cartoon character internet musings without due diligence. As in every other facet of life, no one has any idea what they are doing; alas, least of all, me—I promise you.

Crypto remains, and likely will always remain, a boutique and nascent market with high risk. Everything here is still one giant experiment and if anyone tells you otherwise they are lying.

If you got value from this article and enjoy my writing, please check out other writings and share this one with others. If you dug this one please let me know by liking, commenting, RT-ing or collecting it as a Writing NFT as it goes a long way fr fr<3

Likewise, if you want to collab or talk shop my DMs are open and my email is smolthots@protonmail.com — don’t be shy! Would love to connect with someone who is an ace at custom charts/images/memes.

Need a little time, but next article coming will be about the ways to play this MEV block builder narrative, including another look at Manifold and other tertiary/ more speculative bets. So please subscribe below and be on the look out!

smol thots, big hugs 🙏🤝💚🫡