Thesis: Crypto is pure arbitrage masquerading as an investment market.

The HODLer’s Fallacy is the belief that time in the market leads to long-term upside. This article unpacks why crypto rewards execution and not conviction.

The Problem with HODLing

The crypto industry has built itself around a fundamental misconception: that superior returns come from selecting superior assets. Retail investors, venture capitalists, and index builders all fall into the same trap: trying to identify long-term winners in a market that systematically punishes selection.

In reality, crypto is a wealth extraction system disguised as investing.

In this sector, the software is often incidental and the token is the product. This harbors a perverse dynamic: protocols are built to justify tokens, not the other way around. The result is a massive token overproduction where retail investors become exit liquidity for private round gains.

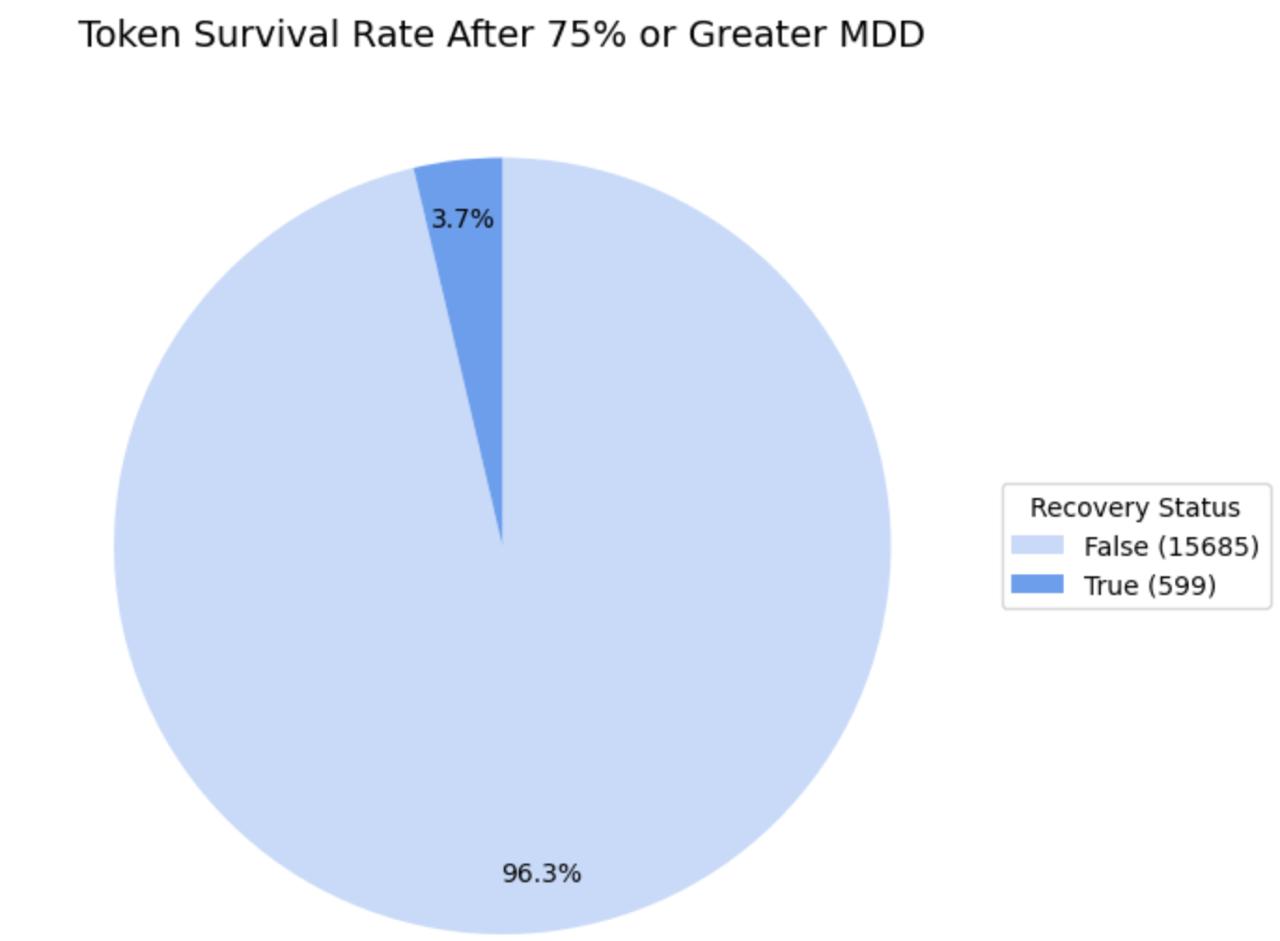

Of 16,000+ tokens analyzed, just 3.7% have ever recovered from a 75%+ drawdown, defined as revisiting the midpoint between their all-time high and low. This isn't a bear market phenomenon or poor timing…it's empirical evidence that the system is working as intended: to transfer wealth from public buyers to private sellers.

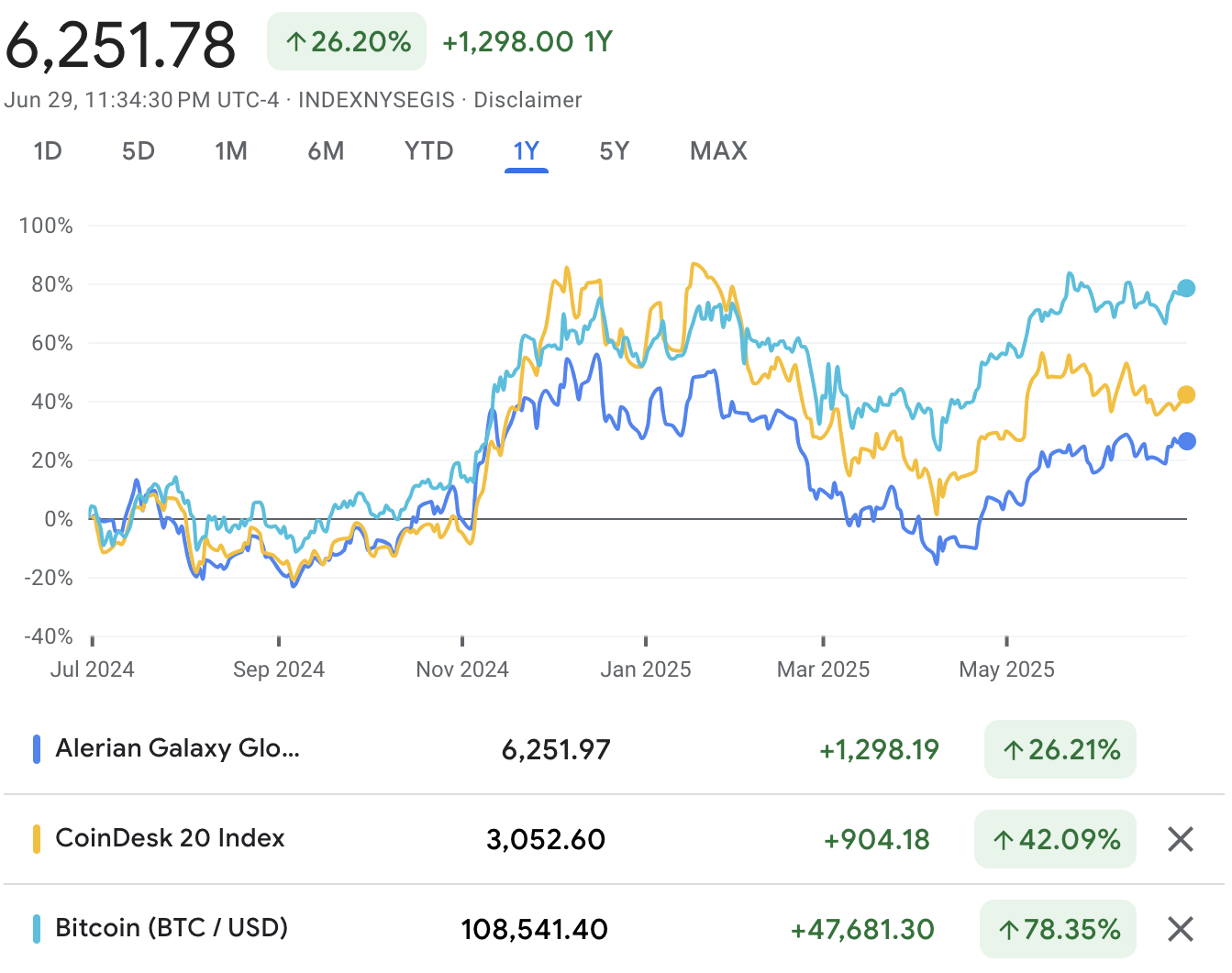

Furthermore, Bitcoin’s rising market cap dominance since 2023 highlights a critical trend: most altcoins underperform BTC over time. In traditional markets, sector-, geography, and business model-level diversification exists because companies generate independent cash flows. However, most of crypto operates as a homogenous asset class: speculative tokens driven by identical factors (liquidity, narrative, momentum).

Any altcoin-heavy crypto index systematically loses to Bitcoin because diversification doesn’t exist in a single-factor market. Consequently, indices that are underweight on Bitcoin like the CoinDesk 20 (CD20) have materially underperformed.

This mirrors the difficulty of long-term alpha generation in equities. According to the SPIVA U.S. Year-End 2024 report, roughly 65% of active large-cap U.S. funds underperformed the S&P 500 in 2023. Furthermore, over the 15‑year period ending in December 2024, no equity category saw a majority of active managers beat their benchmark.

The implication is similar in crypto: beating the benchmark is arduous, especially for long-only strategies that rely on asset selection without access to hedging, leverage, or rebalancing.

The Illusion of Value

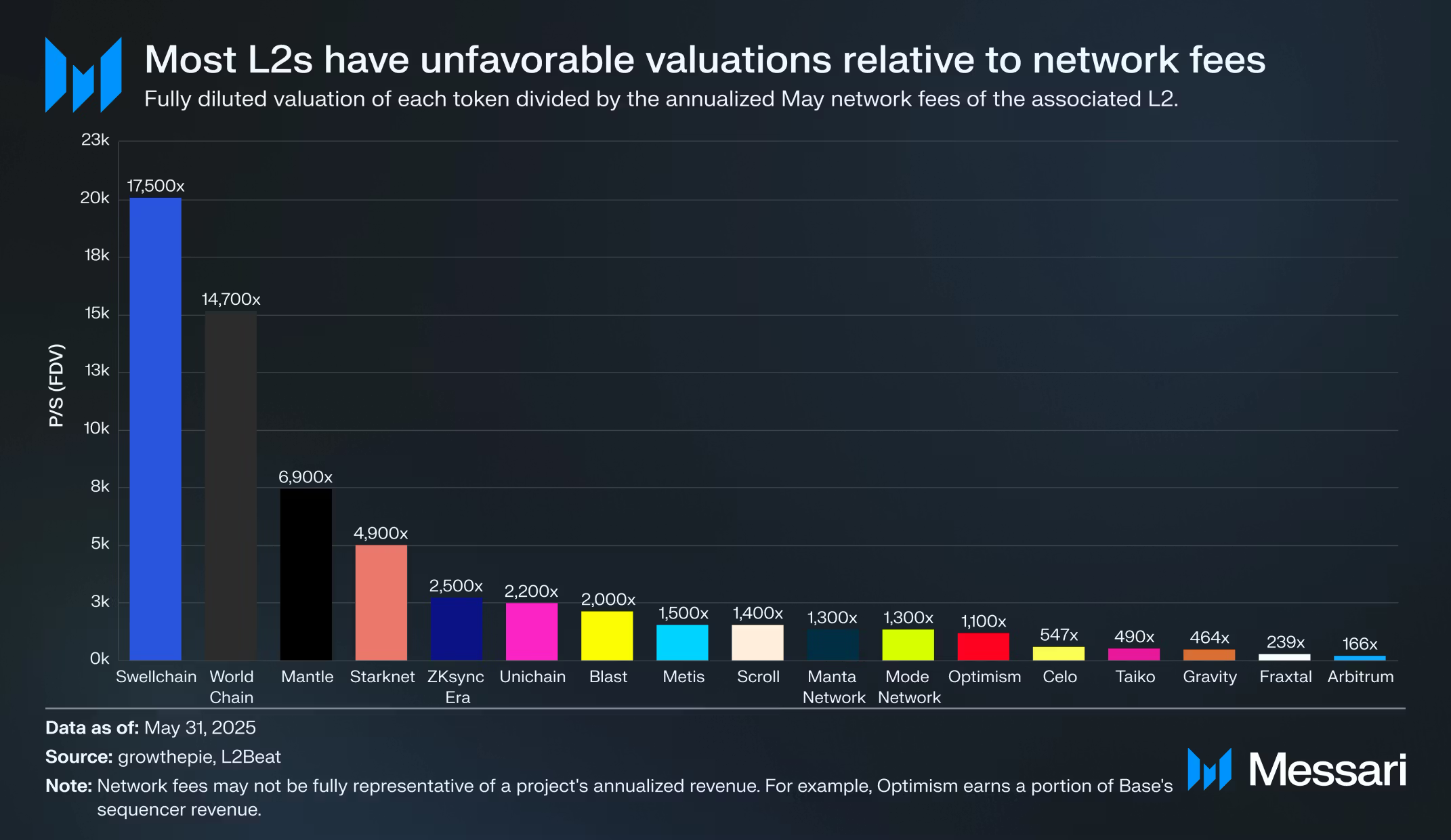

The recent “revenue meta,” where protocols are now evaluated based on actual onchain fee accrual, reflects a growing discomfort with baseless, narrative-driven valuations that defined prior cycles.

For years, tokens were priced on storytelling, market size projections, and speculative roadmaps. Fundamentals like usage, monetization, and margin structure were secondary at best. But in a market where most assets decay and supply outpaces demand, capital is seeking sustenance and evident paths to value accrual.

The systematic destruction is measurable. Since Q1 2024, nearly 86% of tokens at $500M+ launch FDV experienced at least a 75% drawdown, with around 53% tokens down over 90% to date. Still, many trade at structurally overpriced revenue multiples and face continuous unlocks.

What appears to be a discount is often just a slower path to zero.

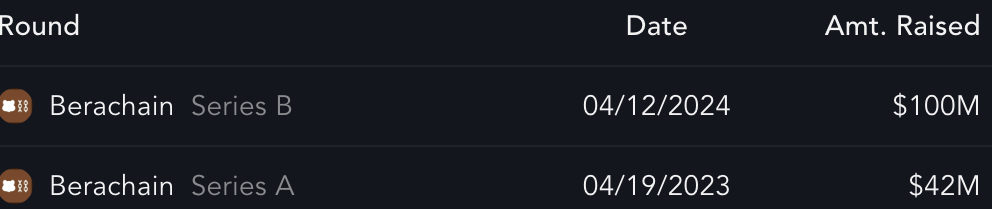

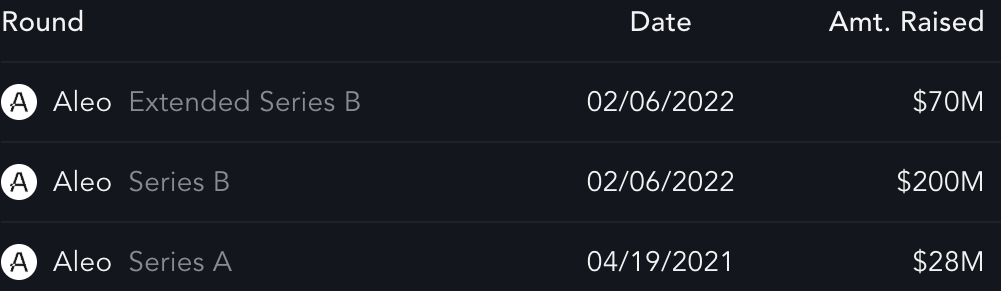

This is visible across L1 and L2 fundraises, with valuations that assumed product-market fit. Hence, these platforms were priced for mass adoption before any fee capture materialized.

In contrast, some of the clear winners this cycle were revenue-generating protocols:

-

Hyperliquid generates ~ $927M in annualized revenue; HYPE is up 525.14% since Q4 2024.

-

Maple generates ~ $15.6M in annualized revenue; SYRUP is up 114.49% since Q4 2024.

-

Aave generates ~ $584M in annualized revenue; AAVE is up 94.36% since Q4 2024.

These outcomes suggest that fundamentals do matter, but only for a narrow subset of protocols. Ironically, these “winners” were often fairly or even fully valued, not undiscovered gems.

The takeaway isn’t that value can’t be found; it’s that most participants are poor at identifying it, and worse at entering at attractive valuations. Fundamentals may guide the best-in-class tokens, but they're the exception, not the norm.

Note: Annualized revenue was based on the 30D revenue SMA

Why Venture Capital Fails Long-term

Venture capital in crypto fails because it applies equity investing logic to speculation tokens. VCs analyze teams, technology, and total addressable markets as if they're buying shares in cash-generating businesses. Tokens aren't equity - they're speculation instruments with terminal decay.

This isn't improper timing or due diligence - it's the inevitable result of VC-driven bloat and “low float, high FDV” launch models.

Small VCs occasionally succeed - not because they pick better tokens - but because they exploit structure:

-

Early access

-

Information asymmetry

-

Pre-liquidity optionality

But these advantages disappear when funds scale. As firms raise larger vehicles, they're forced to write bigger checks into later rounds, at higher valuations, with longer lockups. The result is predictable and cyclical: every bull market mints a new generation of “successful” early-stage funds, which then raise larger AUM and fail in the subsequent cycles.

Lastly, long-only liquid funds represent the worst risk-reward tradeoff in the ecosystem. They:

-

Take early-stage risk (unproven protocols)

-

Without early-stage advantages (no information asymmetry)

-

While exposed to public market volatility

-

Without hedge fund tools (no shorting, no dynamic rebalancing)

They forego seed-stage upside yet lack the flexibility to actively manage downside. Most end up locked into semi-liquid altcoin positions with decaying narratives, thin liquidity, and limited optionality.

That said, their one advantage is mobility: they can exit faster than illiquid venture positions. But speed is not a substitute for edge.

In theory, the optimal crypto VC model is simple: maintain small AUM, write pre-seed or seed checks, and fully exit positions upon TGE or public listing. Venture capital - regardless of size or pedigree - is fundamentally unequipped to manage publicly traded assets.

Conclusion

In practice, the winners in crypto are those who systematically extract value without directional exposure:

-

Market makers (MMs) earn the bid-ask spread while providing liquidity.

-

High-frequency traders (HFT) exploit microprice discrepancies millions of times per day.

-

MEV bots extract value via block building, DEX-to-DEX arbitrage, sandwiching, and liquidations.

-

Delta-neutral strategies capture funding premiums, volatility, and mispriced risk across venues.

-

Centralized and decentralized exchanges monetize throughput via fees on cyclical - but persistent - trading volumes.

These models succeed not because they bet on the right assets but because these models are market-neutral, profitable irrespective of market conditions.

VCs exploit storytelling and early access, hedge funds leverage information asymmetries and discounted deals, market makers capture spreads, and arbitrageurs extract delta-neutral profits. The critical error isn't choosing the 'wrong' strategy: it's applying one strategy while having the structural position for another.

The issue is, most participants are unaware of which game they're actually playing.

Crypto rewards different strategies based on structural position. Therefore, the game isn't broken: participants simply need to understand which version they're equipped to play.