It’s the winter of 2018. Crypto markets have crashed and even blue chips like Bitcoin and Eth are down up to 90% from their all-time highs. One after another, projects that had launched to much fanfare with big promises are shutting up shop. And your Thanksgiving dinner is really awkward after your uncle sarcastically asked, “So… how is your Bitcoin investment doing?”

As other projects were folding, there was one that had the conviction and gumption to keep building. Launched in Feb 2018, OpenSea continued to diligently pursue its vision of becoming the ‘eBay for cyptogoods’. And the persistence paid off as it went on to become the most popular NFT marketplace and was recently valued at $13.3 billion. This writeup is an attempt at analyzing what led to OpenSea’s immense success as a product and where it can go from here.

But first, what’s an NFT?

Well, NFTs (non-fungible tokens) are a way to store ownership of an asset on the blockchain. It can be of digital assets like pictures, music, or even real world assets like land titles, diplomas. Since blockchain is completely decentralized and censorship resistant (at least Ethereum is), you don’t have to trust a third party to maintain the record of this ownership.

OpenSea is a marketplace built to interact with the underlying blockchain to create and trade NFTs representing digital assets like pictures, music, and even domain names on Ethereum. A marketplace is an avenue that facilitates the selling and buying of products. Think Amazon, Uber, and Airbnb. And a key property of most marketplaces is that they don’t really own the inventory of the product, they just allow others to sell (there are some exceptions like Amazon which sells their own products too).

Note: If you would like, you can get a more complete primer on NFTs here.

Is OpenSea really that popular?

Let’s look at the numbers. The table below compares different NFT marketplaces based on the number of users, transactions, and volume of Eth traded in the last 30 days. These stats are taken from DappRadar which queries the Ethereum blockchain to track various metrics for Ethereum applications.

As evident from above, OpenSea has left its competition in dust, or should I say in water droplets (get it? get it?). In the last 30 days, it has facilitated around $4.5 billion worth of trades (i.e. 1.5 million Ether), far outpacing all its rivals. To put it into context, eBay did around $6.6 billion worth of trades per month in the last quarter. While they deal with completely different products (OpenSea in digital assets on blockchain and eBay in physical goods), kudos to OpenSea for keeping pace with traditional marketplaces despite operating in the crypto niche.

What did they do right?

The success of a project cannot be attributed to just a few factors. It requires a great product, great team, great timing, and butt loads of luck. While OpenSea seems to have had all these, we can at least try to evaluate what exactly they did right to get to where they are now.

Quickly Built Supply and Demand

As Lenny Rachitsky (ex product manager in Airbnb) discussed in his newsletter, one of the biggest barriers to launching a marketplace is the aptly termed, ‘chicken-and-egg-problem’. How do you convince suppliers to list their product with you when there are no users on the platform to buy the product. And how do you convince the buyers to join unless there is already an inventory of products for them to check out?

The majority of the traditional marketplaces found success by first focussing on building supply. And so did OpenSea. They hustled and did everything they could to build the initial supply, which is perfectly summarized in the quote below by Richard Chen (general partner at crypto investment firm 1confirmation), as reported by The Generalist:

“Devin and Alex [co-founders of OpenSea] did a great job living in Discords to discover new NFT projects and out hustled Rare Bits [its close competitor at the time] in getting these projects listed on OpenSea and attracting most of the trading volume on OpenSea instead of Rare Bits. At the time we invested in April 2018, OpenSea was already doing ~4x the volume of Rare Bits.”

- Richard Chen

All these endeavors led to partnerships with multiple projects/artists early on. This included supporting Axies (arguably, the most popular game built on Ethereum), enabling buying of decentraland (the Minecraft like virtual game built on Ethereum) using their native toke MANA, partnering with Major League Baseball to sell MLB digital collectibles, offering official Deadpool digital collectibles, partnering with German football club Bayern Munich to list player card NFTs, and supporting trading of all those fancy .eth ENS names. This non-exhaustive list demonstrates the team’s zeal to partner with as many projects to build a steady stream of supply, and the foresight to cater to NFTs in a wide range of categories like gaming, art, sports, entertainment industry, domain names, etc.

This hustle was complemented by user-centric features that enabled easy onboarding of suppliers. Listing of NFTs was permissionless which eliminated the need for any approvals or complicated onboarding. Further, OpenSea created a way to pass the cost of minting new NFTs on Ethereum from the seller to the buyer. Both these features significantly reduced the barrier to onboarding of budding artists/projects, which greatly contributed to the extensive inventory of NFTs on the platform.

Once a steady supply is built, the traditional marketplaces then start focusing on building demand. For OpenSea, it was a bit simpler to do this. After hustling to get the early partnerships and establishing themselves as THE platform to list NFTs, all the newer projects started listing their NFTs there and brought their customers along. Projects were also inherently incentivized to encourage their customers to use OpenSea because the project would get royalties on every secondary sale of the original NFT. Further, OpenSea’s demand growth was fueled by the NFT mania that started in the summer of 2021. Once the crypto world embraced this non-DeFi use case of blockchain leading to record-breaking transactions on Ethereum, guess who was there, ready to facilitate all those transactions and make a fortune the size of an open sea?

Maximized User Happiness

As discussed by Sarah Tavel in her blog post, a marketplace shouldn’t just focus on increasing supply, but also needs to implement product features to maximize the *happiness *of users. Just like what Uber did by creating frictionless payments through auto charging credit cards or Airbnb did by establishing the superhost program where hosts meeting the requirement get a special display badge thereby making them more attractive for new bookings. OpenSea excelled in this department too.

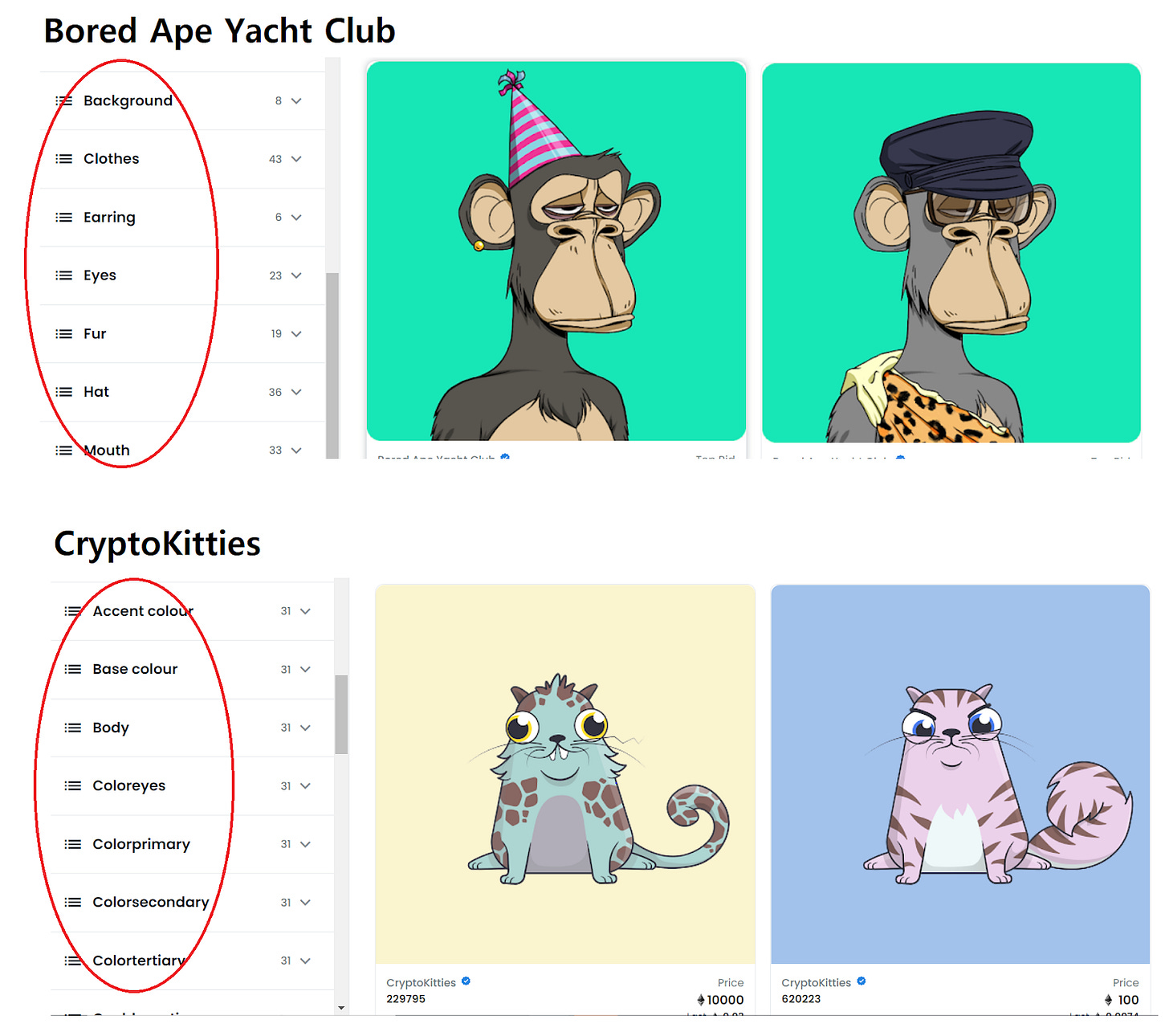

One of their big achievements was implementing robust filtering and sorting features to allow easy discovery of NFTs. This may seem trivial, but it is not. Every NFT collection has different traits and characteristics. OpenSea allows ‘custom’ filtering and sorting which changes based on the collection being viewed so that users can refine their search based on that particular collection.

Different Filters For Different Collections

Next, they took concrete steps towards addressing the biggest problem plaguing NFT enthusiasts, and Ethereum users in general, i.e. the prohibitively high gas costs. Gas cost is the fee that is charged for every transaction on the Ethereum network which gets paid to individuals who run the network, also known as miners. But because the demand for Ethereum is insanely high and the current capacity of the network fairly low, these fees can range anywhere from a few tens of dollars to a few hundreds of dollars (depending on the network traffic) for each NFT transaction. While OpenSea has no control over the gas costs of the underlying Ethereum network, they implemented multiple features to at least some-what mitigate these costs. They enabled auctions to happen off chain so that gas is only used once during the final sale, allowed auction prices to be lowered off chain so that price change doesn't require gas every time, introduced ‘lazy minting’ so that artists can mint NFTs for free and gas is paid by the buyer when they buy the NFT for the first time and integrated with Polygon, which is another blockchain network that interacts with Ethereum but has lower fees.

Continuing their focus on financial aspects of the product, OpenSea also allowed buying of NFTs with crypto other than Eth, especially stablecoins like Dai and USDC. This is especially useful because buying with Ether triggers a tax event in many countries and using stablecoins is an easy way to avoid that. That is, assuming you pay taxes on your crypto. If you don’t, you should!!!

Made The Right Choices

A good product is just one driver of success; a critical one, but not the only one. Each project faces innumerable choices in its lifetime, and what choice they make decides if they ride the waves of success in the open sea or capsize and sink. OpenSea made many right choices in their journey to the top.

First and foremost was their conviction in their mission. And the reason for their conviction, as reported by The Generalist, was something called ERC-721. It was a standard that was being parallelly built by the core Ethereum developers to dictate the creation and transfer of NFTs on Ethereum. The creation of the standard meant this area was important enough to warrant attention from the Ethereum developers and that all future NFT projects would adhere to this standard. So, they created a marketplace on top of the ERC-721 standard which could then support all future NFTs. By doing so, OpenSea delivered a significantly more convenient experience to buyers by aggregating the NFT supply. Before that, each project had to create its own marketplace, for instance, CryptoPunks and Axie had their own (and still do).

This conviction in NFTs is also what made them survive the crypto winter of 2018. When the crypto markets were abysmally down and not many projects were able to survive, OpenSea ran a lean team of just seven employees, kept charging transaction fees to keep the company afloat, and kept building.

More recently, they faced some of the tougher choices when many of the high-value NFTs were sold at a lower price due to a bug in their code. They decided to reimburse the impacted users for their losses. Similarly, they also froze stolen NFTs in some cases. While they were criticized by some as this goes against the fundamental crypto ethos of censorship resistance, such steps definitely help build trust with their users.

What’s Next for OpenSea

What do you do after conquering the world sea? You try to crush every competitor that dares dethrone you, and continue your dominance. You do this either by becoming #1 in your category by a wide margin or expanding to other use cases or both.

OpenSea is already the dominant force in their category of NFT marketplaces. However, they face a very real threat from the new kid on the block, LooksRare. This recently launched NFT marketplace has a lot going on for them - has lower fees than OpenSea, has a native token which greatly increases its appeal to crypto natives, and shares ALL of its fees with token holders. As can be seen from the table earlier, LooksRare has already surpassed all other platforms and is inching closer to transaction and Eth volumes of OpenSea.

So is the answer that OpenSea launches their own token? It’s not that straightforward. Being a US company, OpenSea likes to play nice with the US regulators and cannot risk launching a token, only to incur regulators’ wrath which can hamper their operations. So the path forward for OpenSea is to continue maximizing the happiness of its users and potentially expand to other use cases. Below are some potential options:

- Go mobile. OpenSea already has a mobile app, but it’s very limited and doesn’t even allow trading of NFTs. The app needs to abstract away the process of creating a wallet, storing your seed (with the option to do it for advanced users), and complicated gas estimations. Basically, make the experience seamless enough to onboard crypto-noobs.

- Explore fractionalization of NFTs where the original owner of the NFT can split the ownership into multiple smaller tokens, that other people can then buy. This allows for shared ownership of the NFT. The chance to get exposure to blue-chip NFTs like BYAC and CryptoPunk which most just can't afford today will unlock new demand. And the original owner can benefit from increased liquidity and a potential ‘curator’ fee they can earn through the sale of fractionalized chunks. Win-Win!

- Consider partnering with a DeFi protocol (or create their very own!) to allow the use of NFTs as collateral to borrow money, at least blue-chip NFTs to begin with. This cross-pollination could unlock a whole new user base and demand for OpenSea.

- Vitalik recently talked about non-transferable NFTs that have potential uses like the issuance of college degrees, land titles, etc. While there are many considerations yet to be hashed out (like what if the owner wants to transfer to their own second wallet due to security concerns), OpenSea can lead the discussion in the community and maybe even write an ERC standard for it! They could even explore potentially creating a B2B solution that offers non-transferable NFT implementation for businesses that may want to use it.

It should be noted that some of the options mentioned above, like fractionalization of NFTs and utility as collateral, can bring OpenSea under the scrutiny of regulators. So they will have to tread carefully. In fact, regulation is a big potential hurdle that OpenSea needs to continuously monitor, given the general regulatory uncertainty about all things crypto. In fact, being a dominant player in the crypto community, they may even consider lobbying for crypto-friendly laws to help the ecosystem move forward. After all, with great power comes great responsibility!

If you found this interesting, feel free to share with your friends and subscribe if you haven’t already.

References

Couldn’t have done it without all the great information found in the resources below.

How to evaluate a product?

- The Power of Product Thinking by Julie Zhuo

- How to Improve your Product Sense by Shreyas Doshi

- Product Judgement by Paul Adams

How do marketplaces succeed?

- Constrain the marketplace by Lenny Rachitsky

- Decide which side of marketplace to concentrate on by Lenny Rachitsky

- Drive initial supply by Lenny Rachitsky

- Drive initial demand by Lenny Rachitsky

- Why marketplaces win by Lenny Rachitsky

- Hierarchy of Marketplaces - Level 1 by Sarah Tavel

- Hierarchy of Marketplaces - Level 2 by Sarah Tavel

- Hierarchy of Marketplaces - Level 3 by Sarah Tavel

OpenSea deep-dive

- OpenSea: The Reasonable Revolutionary by The Generalist