Lido Finance allows us to stake our ETH 1.0 by locking it until the proof of work to proof of stake transition completes while allowing us to earn interest and still be able to use our locked ETH in the form of stETH (using which you can participate in Defi ecosystem and still earn interests.)

In simpler words, you can earn interest on ETH with staking, and at the same time use stETH to borrow or lend on AAVE, Curve, Yearn, etc.

Jumping to: Should we invest in Lido?

Let’s talk about a few things before we draw any conclusions:

-

The Merge: The Ethereum network has been crawling towards the transition from PoW to PoS for a while now, but it looks we’re finally here. The Merge is expected to happen in June, 3 months from now. Here are a few points on why it matters:

- The interest for staking ETH right now is around ~4% and over 10.5M ETH has been staked in the Beacon chain. However, when this ETH merges with the PoW Ethereum Chain, this interest goes to ~10% which is ~2-3x.

https://twitter.com/0x_Lucas/status/1501614135540269057?s=20&t=GEqcL_MD3hQYsxt2h8YTNg

- The pressure on the price would also act as a factor since there’ll be a reduction of UPTO 90% in the issuance of new ETH; creating a significant supply shock, and removing the need for miners or validators to sell the ETH they own as they no longer would have to pay for their mining expenses.

- If a reduction in the supply of Bitcoin by 50% can start a new rally, imagine what might be the result of a 90% reduction in the supply of the most widely used blockchain network.

- My conclusion: This might make people highly bullish on ETH, and can trigger a new rally; which might, in turn, increase the value of ETH holdings by Lido.

-

The Illiquidity Problem: Staking ETH 1.0 to earn interest was great; however, once someone staked their ETH it will be locked until the state transitions are completely enabled. Lido solves this problem by introducing stETH, which is issued in a 1:1 ratio to the staked ETH.

- My conclusion: Allowing hodlers to lend or borrow using their assets while earning interests is a pretty cool and innovative thing. This kind of doubles the interest we‘re earning, and hence attracts more users over time. Here are some stats to support that argument:

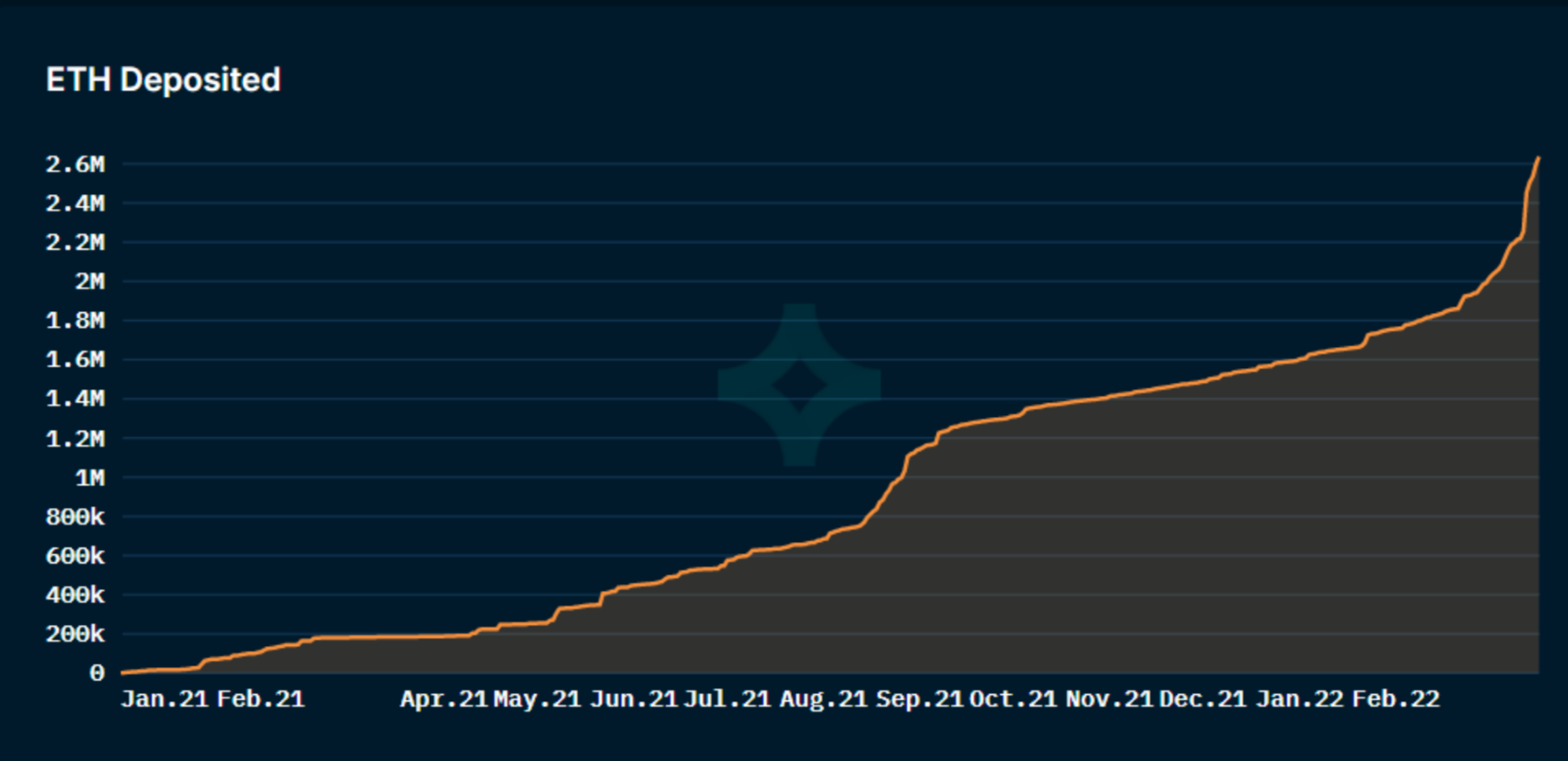

- According to data from Nansen, the ETH deposited in Lido has been rising significantly every time we see a dip in the market. Moreover, the Merge can also be one of the reasons people are buying more and staking their ETH.

- My conclusion: Allowing hodlers to lend or borrow using their assets while earning interests is a pretty cool and innovative thing. This kind of doubles the interest we‘re earning, and hence attracts more users over time. Here are some stats to support that argument:

- Market Share: Lido finance owns more than 80% share of the entire Ethereum staking sector, which continues to go higher.

- The solution to 32 ETH barrier: A investor needs a minimum of 32 ETH to stake for ETH 2.0, which was an opportunity for many centralized exchanges such as Binance to offer ETH staking services. However, Lido solves this problem, and now there is no minimum barrier for staking ETH.

- Revenue Stream: Lido applies a 10% fee on staking rewards, split between node operators, the DAO, and an insurance fund. This fee can be changed by the DAO pending a successful vote.

- My thoughts: Just looking at the volume of ETH staked on Lido, and a 10% fee on staking rewards is a decent piece of cake in terms of a revenue stream.

Final thoughts: Yes, I think we should invest in Lido, as staking ETH is going to be a very big market. Even though the future might be multi-chain, it is highly likely that Ethereum can prove to be the biggest of the surviving chains.

Furthermore, Lido Finance is now not just limited to ETH 2.0 staking, it is also expanding to other blockchains and providing UPTO 28% interest on Kusama.

Moving to Competitor Analysis:

- Parallel Finance: It is lending, borrowing, and staking platform built on top of the Polkadot ecosystem. In many ways it is similar to Lido finance, since staking DOT tokens locks them for a fixed interval, during that period we cannot un-stake our DOT tokens. However, with Parallel Finance, similar to stETH, we’d be able to earn interest in xDOT, which we can then use to interact with Defi protocols.

- Since the future might most probably be multi-chain, it can be a good investment opportunity to bet on products allowing to stake tokens on other chains as well.

- RocketPool: Rocket Pool is a direct competitor to Lido Finance that offers similar services as Lido and gives you rETH to interact with a Defi ecosystem. Moreover, unlike solo node operators, Rocket Pool only needs a node to stake 16 ETH, the other half of 32 is matched by the pool (investors can stake as little as 0.01 ETH).

Current & Potential Market Sizing

Lido finance leverages the shift of Ethereum from PoW to PoS and more precisely targets smaller investors who cannot afford to run their nodes to stake ETH 2.0. Moreover, since once Ethereum completely moves to PoS, there would be a need for a decentralized protocol that helps small individual investors to stake and earn interest on their ETH, and this is where Lido has a strong foothold.

We also saw the present market share of Lido Finance which is constantly rising over time, and with coming dips in the market, hodlers are accumulating more ETH and staking it on Lido.

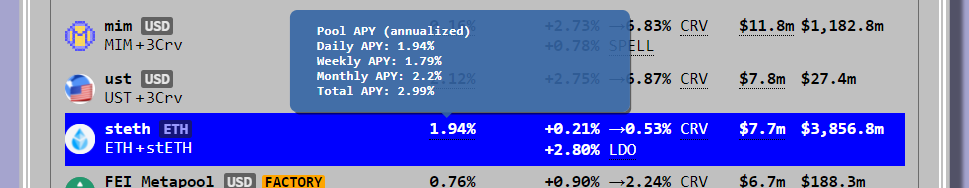

Not just that, there is a 1.7% daily APY of stETH on Curve.fi pool. Moreover, Curve has the highest stETH.

Talking about potential market sizing, I believe, Lido is already the largest decentralized ETH 2.0 staking platform, and moving forward, this gap can increase further. However, its market share can dwindle if an alternative with good marketing starts offering better services.