I’ve seen an influx of RWA (Real World Asset) startups seeking funding over the last 3 months. In this short overview, I go into a bit more detail on the history of RWAs as well as explore how they fit into the context of a broader crypto supercycle and some challenges with the space.

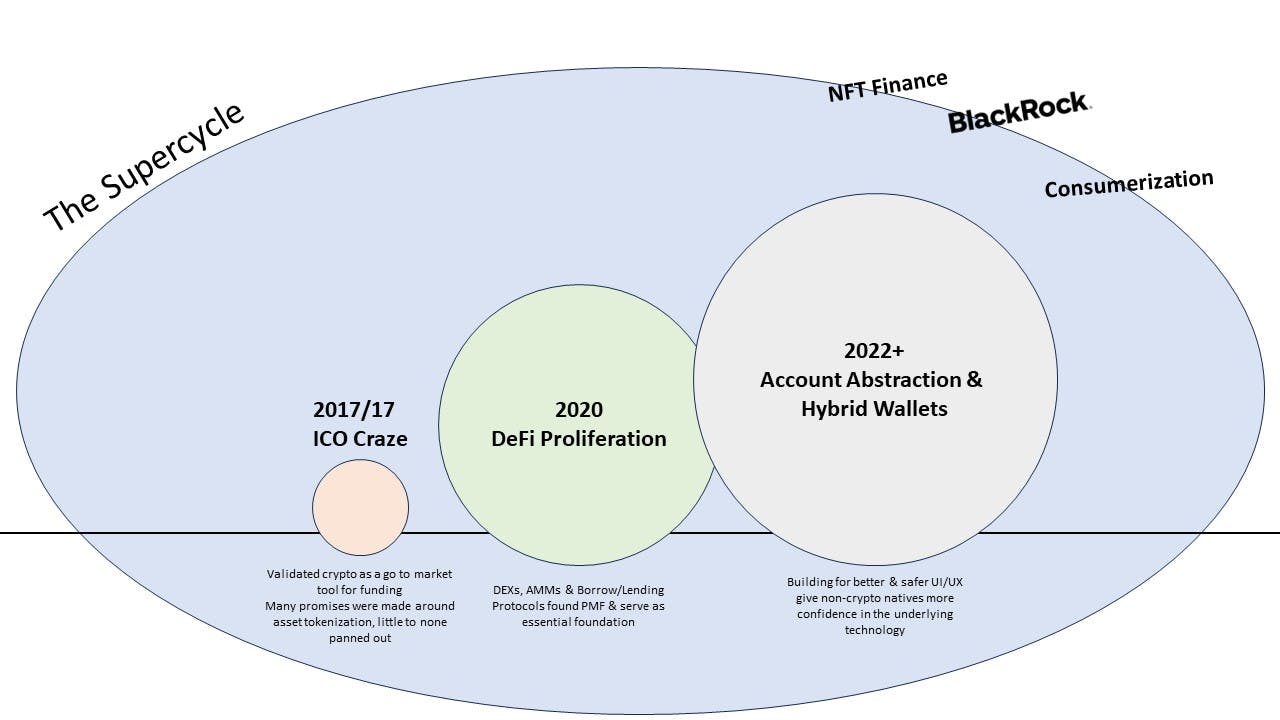

I think there are few key underpinnings for the growth of RWA-centric startups over the last coupe of quarters, those are 1) DeFi having product-market fit as a reliable source of peer to peer liquidity 2) Better user experience & account abstraction with platforms like MagicLink, Fireblocks and 3) Tailwinds from traditional asset managers entering the space 4) Addressing the “consumer” opportunity with RWAs.

Why do we even need asset tokenization?

-

Bringing RWAs on Chain can..

-

Increase transparency between borrowers & lenders for reporting, payments & instant NAV calculations

-

Reduce the cost of capital by directly connecting borrower & lenders with smart contracts

-

Increase speed to liquidity with trustless smart contracts

-

Become a more equitable means for “unbanked” or “edge case” customers such as sex workers, the US cannabis industry and other non traditional borrowers

-

Become a means for non-correlated yield for both sides of the market (crypto and non crypto users)

-

A short history on RWA (Real World Assets)

-

These were on the of the first large value props in the crypto space: “tokenize X illiquid asset to democratize access for those who otherwise wouldn’t get access”

-

The 2017 ICO & Tokenization era saw numerous projects raising funds by tokenizing various assets, including real estate, art, and commodities. Yet it faced immense regulatory scrutiny and challenges due to an opaque regulatory environment

-

Security Token Offerings (STOs) shortly emerged in 2018 as a regulated alternative to ICOs, representing ownership & investment in the before mentioned real-world assets, but in a compliant manner, classified as securities. STOs aimed to comply with securities regulations, providing a more secure and regulated approach to asset tokenization.

- Yet there are drawbacks to STOs, as they are often not as liquid as fungible tokens (ERC-20) https://securitize.io/invest/secondary-market

-

The proliferation of DeFi in 2020 brought further innovation in integrating real-world assets into the space. Aave, Compound, and MakerDAO allow users to borrow or lend cryptocurrencies against collateral, typically tokens such as Ethereum or selected base pair (native) assets.

Some Existing Companies in the Space

-

Protocols such as Centrifuge are leading the charge in smart-contract-based financing that brings together businesses (mortgages, streaming royalties & invoices) and Investors through DeFi by tokenizing their financial assets into NFTs and using them as collateral in their Centrifuge pool

-

Centrifuge Pools have financed >$421M in assets across 1,178 individual assets & seen 178%+ in TVL growth

-

Securitize is another platform that specializes in digital securities and asset tokenization. It provides technology and services to enable the issuance, management, and compliance of security tokens on chain.

- Most STOs are venture-fund oriented, compared to a more diverse pool of assets that Centrifuge has on it’s platform

-

Underpinnings & Tailwinds

-

The rise of white-label wallet solutions such as offers from Moonpay, Ledger and Magic Link provide the necessary UX for enterprises & even consumers to collateralize their assets they need liquidity from

-

“Tokenization engines” will also become popular as a means to create tokenization standards for the space

-

Of course, the DeFi infrastructure previously mentioned will only get better, especially with the rise of transaction batching & gas relayers

-

Traditional asset managers such as BlackRock entering the space with a Spot ETF powered by Coinbase will not only drive mindshare to the broader crypto space but likely drives a path towards some element of tokenized Blackrock funds (LINK)

Thoughts, Considerations & Challenges

-

Challenge:

-

Business development outside of traditional crypto venture funds or crypto native assets continues to be a challenge. Telling the story and complexity of DeFi is still a challenge for non crypto native users to move beyond pilot phases into real implementations.

-

Complexities within specific industry verticals could make it hard for the supply side of liquidity to gain any meaningful depth (think complexities around project finance styled companies)

-

Crypto still being an extremely small portion of the overall global asset class, which makes it difficult for there to be truly non correlated yield from RWAs

-

-

I personally would like to see more consumer applications of RWAs as a means to getting my feet wet with RWAs

-

There’s still a lack of consumerization within RWA tokenization (think mortgages, home refinances, luxury/collector automobiles), etc. Yet, fractionalization might be a new way to create a consumer facing tokenization product.

- NFT borrowing/lending protocols have been a means for “digitally native” consumers to use “tokenization platforms” but often times the rates and yields are highly correlated with the broader crypto market

-

-