A quick primer on staking and what it meant (or used to mean): Staking was a way for Proof of Stake networks to give token holders the ability to offer their tokens as collateral for the chance to validate blocks, whilst taking the risk that if they did not fulfill their responsibilities they could have some of their collateral slashed. In return, they would be rewarded with the native token for completing this work. Traditional staking rewarded users risking collateral and doing work: participating in actions necessary to the continued operation of the network or protocol.

As famously said, somehow, over time, the word ‘staking’ has been repurposed and redefined. Instead of receiving rewards for contributing to chain security with collateral at stake, modern “staking” just seems to mean idk we give you more coins as a reward if you don’t sell your current coins lol. - Cobie “ApeCoin & the death of staking”

Interestingly enough, I directly worked on the staking AIP for the ApeCoin Ecosystem and the Coby article was a super controversial and timely post during the vote for this proposal. For the record, I want to say that the Cobie take is one I fully agree with. “Lock your tokens and in exchange for doing so, you get more tokens.” However, I think this perspective is short sighted and I will look to explore the other side of staking through the rest of this article.

The Tokens of Today will Not Be Like The Tokens of Tomorrow

Tokenized networks have changed, and will continue to change as time progresses. The “old rules” don’t apply to the current day landscape of for instance, application-based tokens such as an NFT marketplace like LooksRare (LOOKS), a DEX like Uniswap (UNI), or an application like Brave (BAT).

If we continue to build consumer-based applications on the existing infrastructure we’ve laid out, it’s safe to assume that over time these apps will launch tokens and these application-based tokens will have different design choices to make compared to the networks launched in previous cycles - especially those on the infrastructure layer.

When I think of “staking” in the context of non L1/L2 blockchain applications, I think of staking programs as a way to:

-

Allow the core team to buy time from their token holders to achieve network effects / build utility

-

Get tokens in the hands of early participants to farm rewards from a network they’re willing to lock their tokens with

-

Ease sell pressure from institutional unlocks (investors & insiders) while network effects take place

-

NOT Meaningless rewards “get more tokens if you don’t sell your current coins lol”

-

NOT to put out a flashy 1,000% APY to attract mercenary capital

NOT to offer predatory tokenomics in order to make your current retail holders exit liquidity for insiders

…But there’s a fine line to balance.

The Framework

Put simply, giving users rewards later, for not selling tokens now is a great way for teams to buy time, reward their loyal holder base and ease the sell pressure from institutional unlocks.

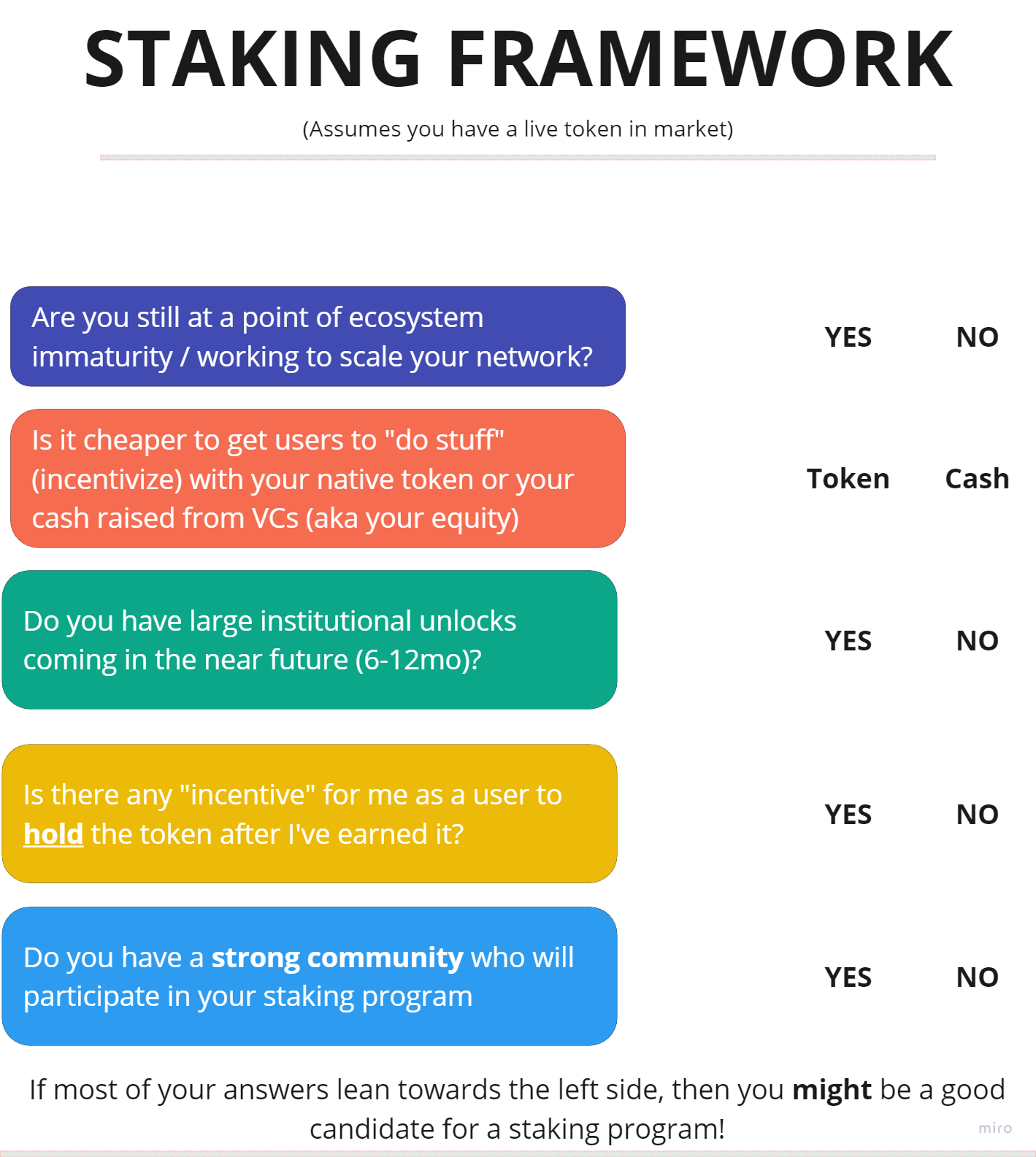

Below I’ve laid out a simple framework for builders to think through:

I think the biggest considerations to hone in on are #4, #1 and #3 in that order

No incentive to hold the token:

-

If there’s no incentive to hold the token after a user has earned it, the only logical action a user can take is to sell it (if they’re in the money - or just want to cut losses).

-

This leads prices to fall, others catch wind and a reflexive downwards spiral can happen, hampering your ecosystem growth before it even takes off.

Ecosystem Immaturity:

In the early stages of scaling a network your early adopters are more valuable compared to the incremental users you get at ecosystem maturity. Putting more of your tokens in the hands of those early adopters rewards them for the risk they’re taking today and can help build a stronger relationship with your community as the network grows into tomorrow.

For most teams, it takes years for network effects to build and sustain. On one hand, your token is an incentive mechanism to grow that ecosystem, but as mentioned in the point above, with nothing else to do with the token but sell, your ecosystem is at risk to crumble under sell pressure.

Institutional Unlocks:

- Any stakeholder who is locked for a period of months or even years will want to sell if they’re in the money. Using staking as a mechanism to combat some of that sell pressure can only work in favor for your ecosystem once institutional tokens unlock.

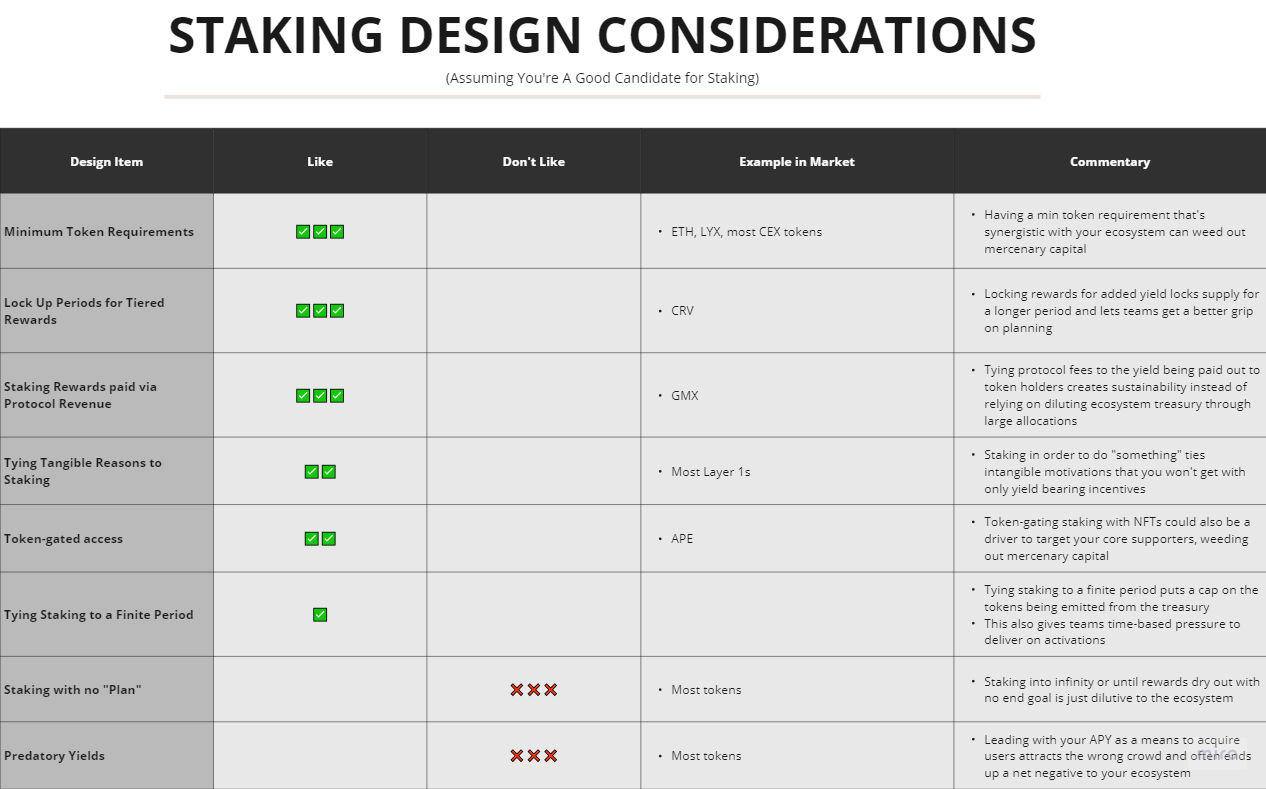

Assuming you’re a good candidate based on the above framework, let’s explore some ways to design your staking program. I laid out a few mechanisms I would like to see more ecosystems employ, but by no means is this an exhaustive list.

How to Design Your Staking Program

In my view, if you were to tie in a mix of the top 3 mechanisms to your staking design, I bet you’ll be ahead of 90% of the staking protocols out there.

-

Minimum token requirements are great thresholds to block dilutive stakers & mercenary capital.

- Tying that minimum amount to an ecosystem KPI is an even better design choice (see more about this below).

-

Lock up periods are also good mechanisms to employ as most DeFi participants are used to this mechanism already and give teams the ability to plan for the future.

-

Staking rewards being paid through protocol revenue is my personal favorite (insert regulatory issues here). UST & Terra told us “if you don’t know where the yield is coming from, you are the yield” and that couldn’t be closer to the truth.

- From an ecosystem design & sustainability perspective, I would much rather pay a 2-5% yield based on the direct cashflows of the protocol than a 30 - 50% yield based on diluting the ecosystem treasury as a reward to “not sell”.

In Practice:

-

A web3-wireless network that rewards node operators on a weekly basis for providing coverage to their network.

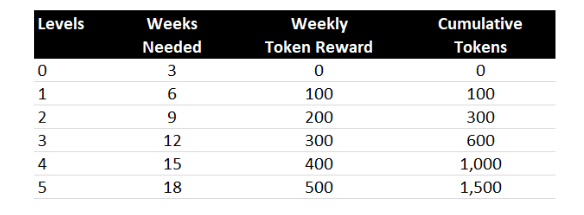

- Imagine a 5 pronged level progression system like the one below:

- Users who progress to level 5 and have at minimum 1,500 tokens in their wallet would be eligible to participate in the staking program.

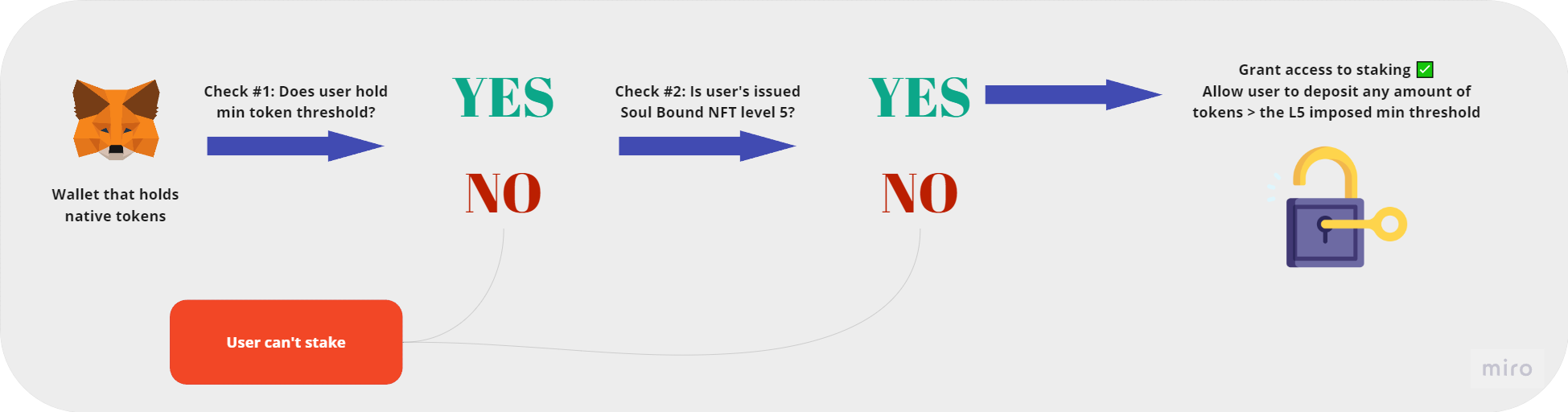

To take it a step further, we can implement more gamification and requirements to the staking system:

-

At every level progression, a user will be airdropped a dynamic soulbound NFT that represents their level progression (driven by their connectivity in the network)

-

The staking contract would check if the user has L5 status based on the updated metadata from the NFT.

- If and only if a user holds both the minimum token threshold AND achieves L5 connectivity they can stake.

-

A visualization is below:

Staking can be a valuable tool to control and direct not only user behavior, but also ecosystem growth.

By tying requirements to stake tokens to ecosystem KPIs and desired behaviors, you raise the bar for who’s eligible to earn your native tokens - a step in the right direction towards reducing ecosystem dilution. However, with added complexity comes additional risk and attack vectors for smart contracts. Not to mention the product, engineering and legal requirements associated with designing complex mechanisms such as this.

But like everything in this space, it’s about tradeoffs and making the ones with your users and ecosystem in mind will likely be a step in the right direction towards ecosystem growth.