Hey friends 👋

With the markets looking like rollercoasters lately, I’ve been thinking a lot more about the importance of having a stable financial base 💰 Decentralized Finance is after all still finance. It can be a bit confusing sometimes because we use the word cryptocurrency to describe many different tokenized assets, from currencies and stores of value, to credits for use within a particular ecosystem, to investments in a meme, and even voting shares of decentralized organizations 😵💫

If you’re holding (crypto)currencies like stablecoins or something with more of a store of value proposition like Bitcoin or Ether, then just like in traditional finance, you’ll want to make your money make you money.

Of course, the lowest risk way to put your assets to work is in a savings account. The thing they don’t tell you in traditional finance however is that a “savings account” is just you providing capital to the bank for them to lend to borrowers. They do this and earn very lucrative returns, and yet they give you a very small portion and pocket the rest 😒

This is what has made decentralized lending apps so popular. A simple, independently auditable smart contract serves as the only intermediary between you and the person borrowing, meaning that for once, you get the lion’s share of the returns 🦁

Many protocols have made use of this, though they often do so by creating large pools of lended capital with market-driven interest rates that go up or down as frequently as every single block 🎢 What’s been missing from this ecosystem is stable rates.

That’s where Notional Finance comes in.

What is Notional?

According to their docs:

Notional is a protocol on Ethereum that facilitates fixed-rate, fixed-term crypto asset lending and borrowing through a novel financial instrument called fCash.

Basically, what Notional has done is come up with a way to provide certainty. Certainty helps reduce risk and help stabilize financial markets. It’s the reason why the US issues its debt (bonds) using fixed rates. With fixed rates, lenders know what returns they can expect and borrowers know how much they’ll be paying in the future to gain access to capital now.

And thanks to the flexibility of fCash, users can basically move value back and forth through time 🌀 If you’re a bit lost, don’t worry, I’ve got you covered.

Let’s take a look at exactly how this works 👨🏫

What the f(Cash)?

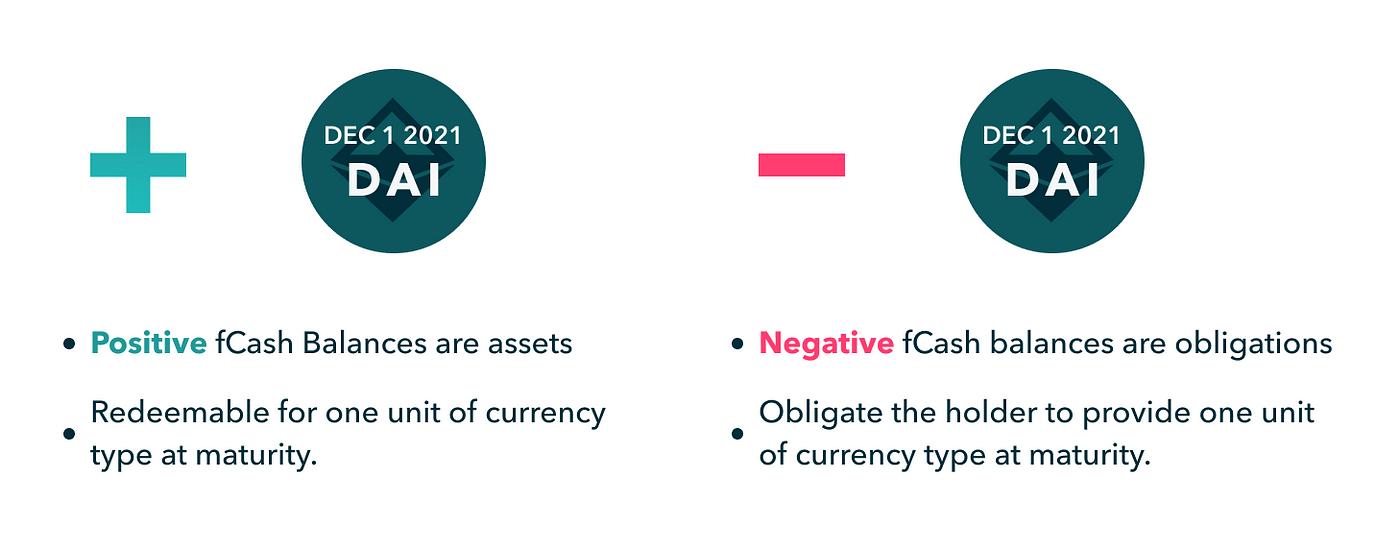

Put simply, fCash is like a receipt that shows who is owed what 🧾

To help illustrate this, let’s have a look at an example that I borrowed from Notional’s blog:

On Notional, two users can enter into an agreement where a lender gives 100 USDC to a borrower who promises to repay 105 USDC on December 1st.

fCash is how Notional defines that future payment of 105 USDC from the borrower to the lender. Here is how Notional keeps track of the future payment from borrower to lender using fCash:

• The lender receives +105 December 1st fUSDC (an asset redeemable for 105 USDC on December 1st)

• The borrower gets -105 December 1st fUSDC (an obligation of 105 USDC due on December 1st).

The exchange rate between USDC and fUSDC at the specific maturity represents the fixed interest rate that users receive on Notional.

As you can see, the lender knows how much they will receive and the borrower knows how much they will owe. This means that the borrower knows that they will need to deploy their borrowed capital in a way that returns more than the $5 they will owe. Likely they will take on additional risk, while the lender is happy to receive the $5 because they have a lower risk tolerance and want a guaranteed return — nothing wrong with that!

But how does Notional ensure that the borrower pays back their debt? 🧐

Collateralization

Unlike the bank who might arbitrarily decide to whom they want to lend — sometimes selecting those they expect to default in a sinister move known as predatory lending — most decentralized lending protocols rely on collateralization 🤝

What this means is that in order to take out a loan, borrowers must first put up collateral in high quality assets like Ether, wrapped Bitcoin, or certain stablecoins. Interestingly Notional offers a unique feature when providing collateral which is the option to mint nTokens, maximizing capital efficiency. As I’ll explain in the section below about How to Benefit from Notional, nTokens represent a stake in the the liquidity pools and earn passive income for the holder 💪

In order to reduce risk of liquidation, loans are overcollateralized. DAI, for example requires a minumum collaterlization of 120%, while Ether requires 150% due to its higher volatility. Now, 150% is still very close to the trigger for liquidation — I’ll explain what that means in a moment — so Notional suggests setting a ratio based on your level of experience in DeFi.

Check out this quote from their FAQ:

Here are a few example personas and the ratios they might choose:

The occasional DeFi user: 250% — 300%+ This user doesn’t want to be bothered keeping a close eye on their collateralization ratio. They don’t check the UI every day and are more concerned with peace of mind rather than optimizing their leverage. Setting a collateralization ratio in this range gives the user confidence that they mostly don’t need to worry about getting liquidated and only need to top up their balances if there is a significant market decline.

The active DeFi user: 180% — 200% This user tracks their positions and uses DeFi products every day but has no automated collateral management system. This user keeps close tabs on their collateral positions but knows that big price moves can happen overnight. Building in a buffer gives this user confidence that their collateral won’t be liquidated before they are able to top up their balances.

The professional: 160% — 170% This user is a professional who manages their collateral positions across DeFi with the help of an automated system. This user wants to get as much leverage as possible out of their collateral. They are comfortable with an aggressive collateral ratio because they know that their system automatically tops up their collateral if they approach the minimum collateralization ratio.

Is liquidation as scary as it sounds?

If your ETH (or whatever your collateral is) drops in value, such that your loan is not sufficiently collateralized, it will trigger a liquidation. Now a lot of people assume this means they lose all their money, but if that were true, no one would ever use DeFi 🤔

Basically, when the collateral falls below the threshold, a liquidator buys some of the collateral at a discount and repays the borrower’s debt with those funds. As as a result, the amount owed is now reduced, but the collateral is also reduced. The goal of course is to return to a safe level of collateralization ⚖️

In practice this should look a bit like this example from the Notional FAQ:

- A borrower deposits 1 ETH as collateral with a ETH/USDC exchange rate of 4,000.

2. The borrower then borrows 2,000 USDC. Their collateralization ratio is 200% because the value of their collateral is twice the value of their debt. Their liquidation price is 2,900 because at that price their collateral will be worth 145% of their debt.

3. The ETH/USDC exchange rate falls to 2,800. Their collateralization ratio is now 140% and they are eligible for liquidation.

4. A liquidator purchases 40% of borrower’s ETH at an 8% discount to the on-chain oracle price and places USDC in their account.

In this example, the liquidator will purchase about 0.4 ETH for about 1,037 USDC. This leaves the borrower with 0.6 ETH collateral, an outstanding debt of 963 USDC, and a collateralization ratio of roughly 175%.

So you see, the outstanding debt is reduced, the borrower still has some of their collateral, and of course they have the money they borrowed, some of which is no longer tied to any debt. We still want to avoid this since the reason you put up a collateral like ETH or wBTC is probably because you don’t want to sell it 🙅♂️

Best practice is to put up sufficient collateral and keep an eye out for big dips in the market so you can add more collateral or pay off your loan swiftly if needed. You could also, theoretically, become a liquidator, if you want to be the one benefiting from these discounted assets.

That brings me to my next thought…

How to benefit from Notional?

Lending

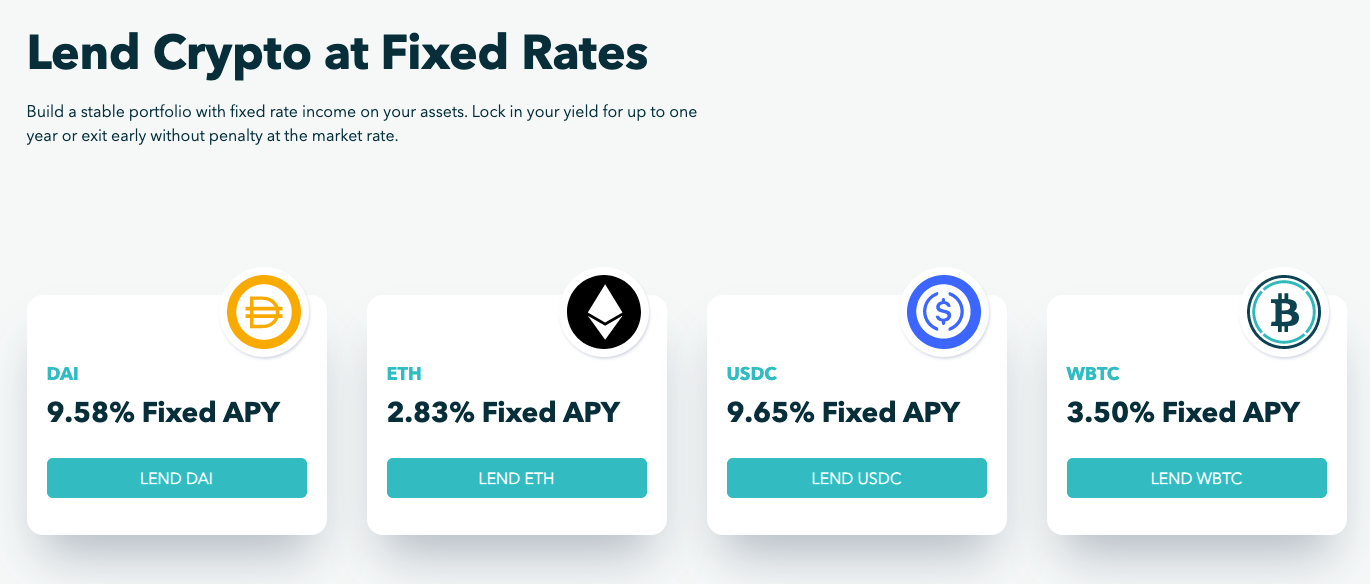

The simplest way to benefit is also the lowest risk. Become a lender and earn fixed rates that surpass many other DeFi protocols and far exceed anything you could find in traditional finance 🏦

Simply head over to Notional Finance, click Lend, connect your wallet, and deposit the amount you want at the maturity you prefer.

Providing Liquidity

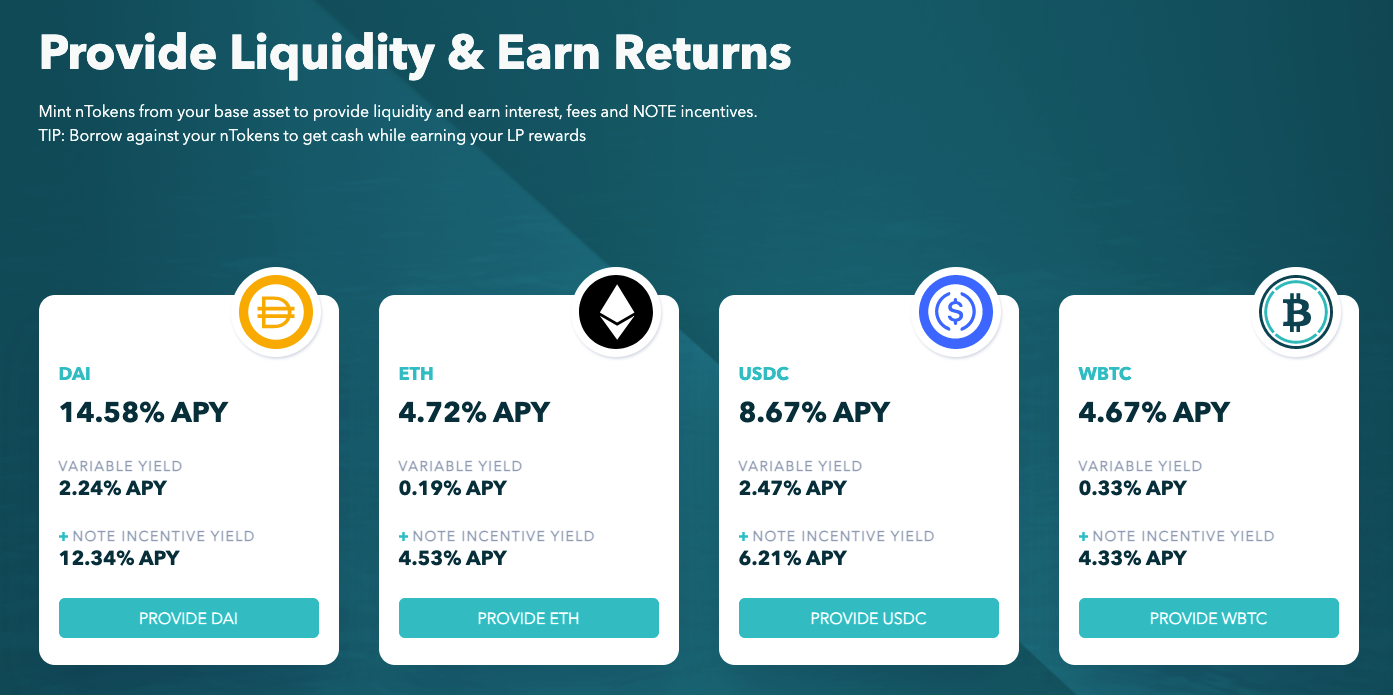

Another option that may appeal to the debt averse is becoming a liquidity provider (LP). On Notional, this is done in an innovative way. LPs deposit single assets and mint nTokens. These nTokens allow users to passively earn returns without requiring them to interact with individual liquidity pairings. If you’re familiar with the traditional way of providing liquidity, you will probably appreciate the elegance of this approach 👏

Liquidity providers will receive interest and fees, as well as rewards paid in NOTE, Notional’s governance token.

To participate, simply click Provide Liquidity, and deposit the token of your choice to mint the corresponding nToken.

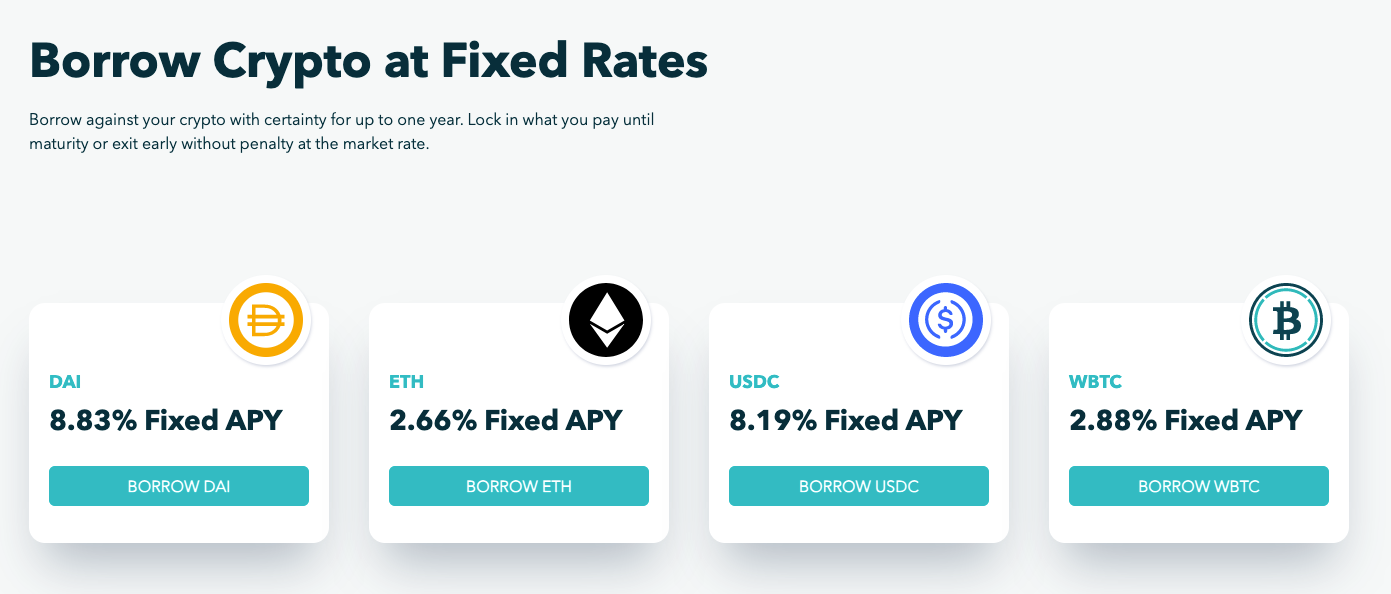

Borrowing

For every person who wants to lend money, there is at least one who wants to borrow. Borrowing money can serve any number of functions including covering emergency expenses or large purchases in the physical world. But probably the number one reason someone would want to borrow crypto is to buy more digital assets (cryptocurrencies or NFTs) or to participate in DeFi 💸

Examples

Here are some approaches ranked by risk:

One might choose to lend ETH, borrow USDC, and buy more ETH. This is called taking a long position and assumes that the price of ETH will go up more than the value of the interest accrued during that time 📈 There are always risks to going long on leverage, but it’s a common practice, and with fixed rate, collateralized debt, the risks are not so high as some alternative approaches.

Another option might be to purchase an NFT from a desirable collection while it’s still available at a lower price, then save up funds to pay back the loan, or simply take profits on the NFT (assuming your gamble was a success) 🎰 Depending on your knowledge of NFT collections and factors like the market’s continued interest in that collection or NFTs as a whole, this option carries varying levels of risk. Once again, I mention it because it’s something that people already do.

Lastly, one might borrow some USDC or DAI, swap it for other assets, and put them to work in DeFi to earn a higher rate of return. This, once again, comes with a varying level of risk. For example, swapping for UST, bridging to Terra and depositing into Anchor Protocol (for around 20% interest) would be a relatively low-risk experiment. But swapping for some novel token and providing liquidity in a pool that claims to provide 25000% returns, well… I’m just saying be careful (trust me) ⚠️

Speaking of which…

Risks

Notional does a lot right, meaning I don’t personally consider it risky, but as always there are some risks to be aware of. There is of course the obligatory warning that crypto is new and relatively unregulated, and we have to be cautious not to invest our rent money (when would that ever be a good idea?) 🛑 Then there is the risk of investing with borrowed funds (aka leverage investing). This is best left to experienced investors and those with a large buffer of cash in case things don’t go as planned.

But as I mentioned above, you can participate in Notional without ever borrowing any funds, if that’s outside your risk tolerance 🤝

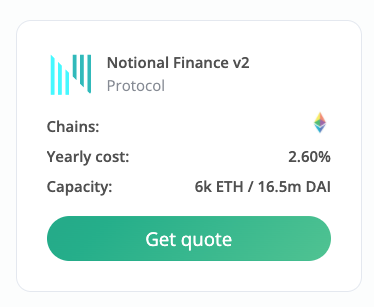

Lastly there is the risk that Notional could suffer a smart contract bug and be exploited. This has unfortunately happened to some DeFi protocols in the past. With that said, there is a solution to this as well. I’m happy to inform you that you can actually get insurance to protect your investment via Nexus Mutual.

That’s right, you can insure your Notional investment against:

-

contract bugs

-

economic attacks, including oracle failures

-

governance attacks

And all that peace of mind will cost is just 2.6% annually 🙌 More details here.

Conclusion

Certainty, in the form of stable interest rates, is a cornerstone of traditional finance. It’s a requirement for many lenders and borrowers alike; with good reason. Knowing exactly how much we can expect to earn, or to owe, opens up a world of opportunities.

If you’ve been reassessing your portfolio as of late, looking for ways to reduce volatility, or potentially free up some capital without selling your precious ETH or BTC, then you should definitely be taking NOTE.

Until next time,

Thumbs Up

This post is brought to you thanks to the generous support of Notional Finance.

If you enjoyed this blog post, consider collecting a copy. It's like tipping and receiving a unique digital collectible as a receipt.

To become a patron and unlock special perks, like Q&A in the newsletter, you can mint my non-fungible patronage NFT on Optimism, Zora, Base, or Ethereum

And for the cypherpunks, I accept anonymous tips with Zcash to my shielded address:

zs17a2mhl6xeu56cqqeqync9kddyg8gggcy6253l5evjdyw8l8j8f60eg40exr4wk27hnvfgkkgnju