The year 2020 was a pivotal moment for decentralized finance, or DeFi.

As the world grappled with the pandemic and economic uncertainty, a new wave of financial innovation was taking place on the blockchain. Decentralized platforms and protocols emerged as a novel alternative to traditional finance, offering greater transparency, accessibility, and efficiency.

In this post, we’ll take a comprehensive look at the 2020 DeFi boom, including key platforms and protocols, the rise of DeFi tokens, the challenges and risks of DeFi, and the future of decentralized finance.

What is DeFi?

DeFi, short for decentralized finance, refers to a variety of financial applications and protocols that operate on blockchain technology. DeFi applications are built on decentralized, open-source networks that allow for peer-to-peer transactions without intermediaries like banks or other institutions. The most popular network is Ethereum.

Ethereum is open and permissionless, which allows anyone to participate and build on the network. This has led to a vibrant ecosystem of decentralized applications, with new projects and innovations emerging rapidly.

Key DeFi platforms and protocols

During the 2020 DeFi boom, a wide range of applications and protocols emerged, including decentralized exchanges and borrowing platforms. These applications and protocols provided users with new and innovative financial services that would otherwise be reserved for institutional investors.

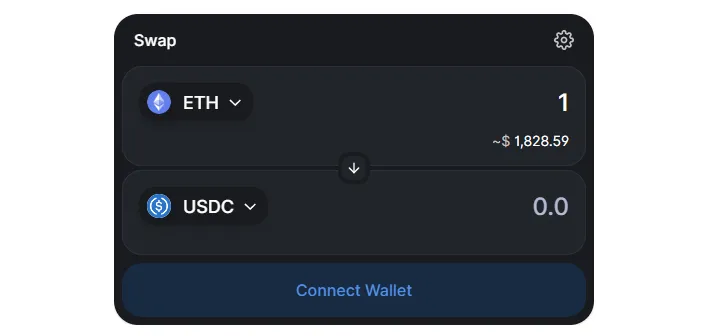

Uniswap was one of the most prominent DeFi platforms to emerge. Soon after, SushiSwap launched and gave people SUSHI tokens for trading on the platform and providing liquidity. Uniswap and SushiSwap are decentralized exchanges (DEX) that allow users to trade Ethereum-based tokens without the need for a trusted intermediary.

AAVE and Compound are two of the most popular lending and borrowing platforms. These platforms allow users to lend and borrow tokens without intermediaries, using smart contracts to automate the collateralized lending process. Users who deposit their tokens could earn a yield from others looking to borrow using the platform.

The rise of DeFi tokens

One of the defining features of the 2020 DeFi boom was the emergence of a new generation of token offerings. The most famous example is the launch of the SUSHI token. Many DeFi projects issued tokens to early users and liquidity providers to reward users and incentivize network participation and application growth.

Some of the most popular DeFi tokens that emerged during the 2020 boom are UNI, SUSHI, AAVE, and COMP.

The performance of these tokens in 2020 and 2021 was nothing short of remarkable. For example, Uniswap distributed free UNI tokens to their users in September 2020 and it quickly became one of the largest projects in the space. In May 2021, the project reached an all-time high of over $20 billion in market capitalization.

The success and challenges of DeFi

One of the main reasons for the success of DeFi is its ability to provide financial services to anyone with an internet connection, without the need for a traditional bank account. In addition, DeFi allows users to access a wide range of financial products and services, such as borrowing and lending, trading, and earning interest on their assets, all without the need for intermediaries.

While the 2020 DeFi boom was undoubtedly a success, it was not without its challenges and risks.

One of the most significant challenges for Ethereum was the high gas fees, which could make transactions prohibitively expensive. This has led to the development of scaling solutions such as layer-2 solutions like Optimistic and ZK rollups.

One of the main risks of DeFi is the possibility of smart contract vulnerabilities. Hackers exploit these vulnerabilities to steal funds from the platform or their users. In addition, the DeFi space is still largely unregulated, which can create uncertainty and risk for investors and users.

Conclusion

Like the 2017 ICO boom, the 2020 DeFi boom was a significant milestone for the cryptocurrency industry. It demonstrated the potential of blockchain technology to revolutionize and bring about a more open, transparent, and inclusive financial system for everyone.

As the space continues to evolve, we can expect to see new use cases and applications emerge. New projects will continue to emerge, and existing projects will continue to iterate and improve their products. It will be interesting to see how the space will intersect with traditional finance and how regulators respond to this rapidly evolving landscape.

While the DeFi space still faces challenges, it has a bright future ahead and will continue to innovate and grow in the years to come.