During the finals days of the year, crypto twitter was ablaze with hype surrounding the “SOS airdrop.” Anonymous aliens and monkeys were apparently just gifted more money than you make in a year.

A devastating day for the human-headed normies like myself.

So what was going on? What is SOS? Who’s giving it away and why? I wasn’t seeing any good explanations so I decided to dive in myself. Here’s what I found…

Background

In a Bloomberg report earlier this month, the OpenSea CFO, Brian Roberts, indicated plans for taking the company public, saying: "When you have a company growing as fast as this one, you’d be foolish not to think about it going public."

The NFT community was outraged.

The standard in web3 is for orgs to reward early users with an airdropped token, like @ensdomains did the month prior.

Instead, they were planning on selling shares to the public, making their VCs rich, and leaving everyone else behind.

➡️➡️ As a side note, the CFO later tweeted that their IPO plans were still nascent and that if they did IPO, they'd "look to involve the community." But for many, the damage was already done.

The Airdrop

On December 23rd, a prolific NFT collector known as “9x9x9” launched a project called “OpenDAO” on twitter, saying “let’s show VCs they can’t own web3!”

OpenDAO (a spin off “OpenSea”) created a crypto token called $SOS (also a sea reference) to do what OpenSea wouldn’t: reward early users of OpenSea with an airdropped token, in proportion to how much they spent on NFTs.

➡️➡️ Remember, this works because all NFT purchases are public on the blockchain

Coming so shortly after the IPO fiasco, the airdrop quickly gathered attention. A few exchanges quickly added support for trading, allowing investors to speculate. Kucoin moved first:

As investors piled in, the market cap grows and the tokens become more valuable And just like that, a multi-million dollar market is created out of thin air.

Many folks found themselves with six figure gains overnight. The community was going wild.

The DAO

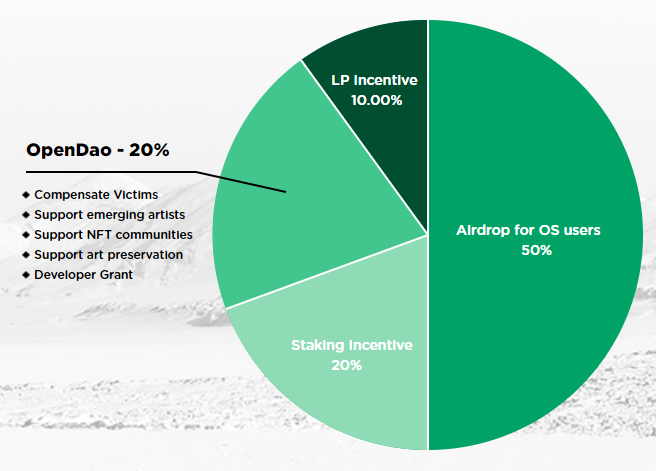

Airdropped tokens only account for 50% of the supply of $SOS. There's more at play…. 10% is reserved for liquidity providers, 20% for staking incentives, and 20% for OpenDAO.

What's that stuff for?

Those other pieces create infrastructure for the OpenDAO to operate as a decentralized organization, using the $SOS they own to further their goals:

“To compensate OpenSea scam victims, support emerging artists, support NFT communities, support art preservation, and encourage development”

(Read more on their website)

Takeaways

The success of this initiative reflects the strength of the community ownership model, and acts as a warning to those who violate that.

Since community membership is public on the blockchain, anyone can swoop in at any time to capture loyalty if you drop the ball.

Wasn’t seeing any comprehensive explanations of this, so figured I’d take a stab at it. Hope this was helpful!

➡️➡️Did you buy NFTs on OpenSea this year? Go to theopendao.com to see how much $SOS you’ve earned! (note: if you’re a mild spender like me, the reward might be less than the gas it costs to claim it)