📝 Edit & Translate by @touyange 2022/12/12

On Monday, December 12, the APEcoin Staking system will officially start to generate returns for Ape holders. As we all know, BAYC has always been the leader in the NFT market over a long period. Every move it makes is closely watched by all NFT followers. Thus, this staking process, related operations, and the corresponding user feedback from the event will provide a good case study for future reference.

Currently, there are three main platforms for $APE staking: The official staking platform, BendDAO, and Binance NFT Market. We will organize the information from several aspects: analysis of a USD-based $APE economic model, general comments on the 3 different $APE staking platforms, and potential future benefits from these 3 competitors.

🧾 Catalog:

USD-based economic model

A brief overview of the staking features for the three staking options

Advantages and disadvantages analysis

Summary

Reference

1. USD-based economic model

$APE Coin staking mining model

In the first year, 100 million tokens will be released, with releases occurring every 90 days in the ratio of 0.35/0.3/0.2/0.15. The current market value of the $APE is calculated based on its historically low price of $2.6, resulting in a market value of $940 million. This model assumes that the market value of $APE Coin remains constant and only considers price changes due to changes in the supply of tokens in circulation. The graph below shows the fixed daily release of $APE for different categories.

Phase 1 - staking output for the first 90 days.

This table gives you a preliminary reference based on the current staking situation, calculates the $APE output of the first 91 days of staking, and calculates the annualized returns of the coin-based NFT holders according to the 2/N release plan:

-

BAYC 588%

-

2. MAYC 674%

-

3. BAKC 683%;

This model does not take into account the additional supply of $APE due to staking and unlocking.

USD-based $APE Coin price model

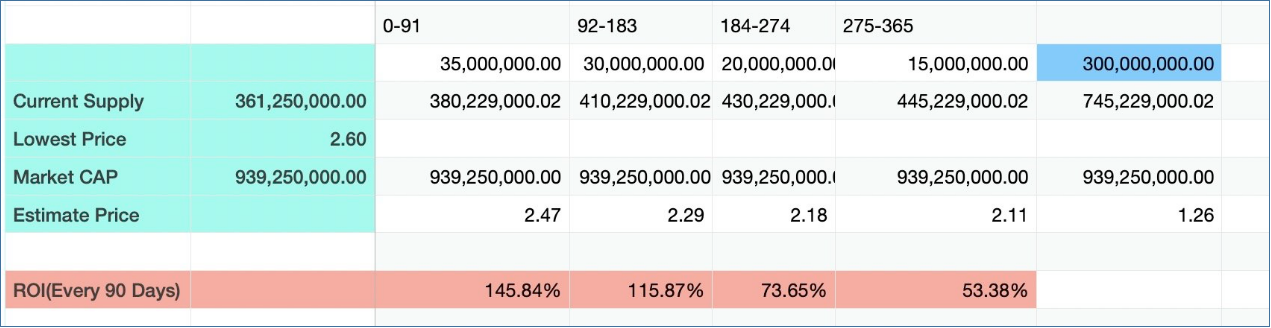

Assuming the overall market value remains constant, the valuation is calculated to be $940 million based on the lowest price of $2.61. Afterward, the price will be adjusted to $2.47, $2.29, $2.18, and $2.11 based on the release model for the first year of staking. Additionally, considering that 3 billion $APE Tokens will be unlocked in March of next year (in the worst-case scenario), the extremely low price will be around $1.26. This price is used to measure the ROI of the USD-based rate of return every 90 days.

The relationship between the number of participants under staking and the returns

Taking MAYC as an example, this graph shows the change in return rate at the different numbers of staking participation. This model assumes that 10,000 and 20,000 MAYC are fully staked, locking up as many as 150 million $APE. The daily yield of MAYC is 3.68 $APE, and the ROI for 3 months is 15.8%. In the extreme case of unlocking in March next year, there may be a loss in the USD-based measurement.

Phase 1 profit and loss table

Taking MAYC as an example, between different numbers of stakings and $APE price, make a profit taking table, you can see that if MAYC staking number reaches 6000 and $APE price falls to $3 when the staking starts to lose money. The table shows that if you have MAYC, 4 dollars often buy 2042 $APE, if $APE falls below 3.5 dollars and 5000 or more people staking, may face a loss.

Using MAYC as an example, this table shows the profit at different levels of staking participation and $APE prices. As the table reveals, if there are 6,000 participants in the MAYC staking and the price of $APE falls to $3, the staking will begin to incur losses. The table also shows that if you have MAYC and buy 2042 $APE for $4. If the price of $APE falls below $3.50 and there are 5,000 or more participants in staking, you may face a loss.

2. A brief overview of the staking features for the three staking options

BAYC official

Official staking is the cornerstone of the three staking options. The rest two options are essentially optimizations and improvements of official staking based on their own conditions. Official staking is the most secure and allows for maximum revenue. Yet the downside is that if you choose to stake your NFTs on the official staking platform, you will also need to stake the corresponding $APE coins to earn returns. Compared to the other two options, this option requires a larger amount of capital and is more awkward.

BendDAO

BendDAO is currently widely used by blue-chip holders as one of the most popular NFT lending platforms. Its pioneering feature of collateralizing NFTs to earn airdrops and other benefits has been quite convenient for many NFT holders. This time, BendDAO has developed a special staking system for the major event of $APE coin staking. You can choose to stake your BAYC, MAYC, or BAKC in the BendDAO staking system, select the $APE coin and NFT that you want to stake, and start staking after authorization.

Here Benddao introduces a unique market mechanism, where you could choose to stake your NFT without any $APE coins. In this case, the system will match your NFT with other staked $APE coins to achieve the result of share returns. You could also set the proportion and time of share benefits, the system will automatically match the settings for you.

Benddao charges a certain amount of the returns as the service fee for staking users.

Binance NFT Market

We all know that Binance, as the current exchange leader, would stir up a lot of volatility in the crypto market with every listing or delisting. However, its own NFT market has not gained much attention from the community. However, through recent intensive operations, it could be found that the Binance official start to arrange a lot of new resources to revive the Binance NFT Market. From actively accessing OPENSEA's information and blue-chip projects on the ETH to this APE staking event, we can easily see the ambition of Binance to achieve something in the NFT field.

In this $APE staking, Binance NFT Market (referred to as "Binance") directly launched two major activities. The first is that only staking NFT is required to obtain daily rewards without staking any $APE coin.

The second activity is to share the 10k $APE equivalent total prize pool by listing BAYC/MAYC/BAKC on the market.

Compared to other NFT markets that previously offered rewards for placing orders with their own tokens, Binance uses APEcoin here as the direct reward, which can be regarded as a heavy investment to attract holders to stake their own NFTs. This is a very bold behavior.

3. Advantages and disadvantages analysis

Market Background:

Currently, the market can be divided into two categories based on the ownership of Ape holders: "Ape holders without $APE" and "Ape holders with $APE" (there is also a group of holders who are always in a calm state of mind. They are even too lazy to claim the airdrop, and their accounts remain silent and do not participate in any activities. This case is not within the scope of discussion). Most of those who have NFTs and tokens are BAYC believers who have high recognition and loyalty to the BAYC brand. They will consider the official market first. Therefore, the rest staking platforms are competing for the user group of "Ape holders without $APE".

🐵 $APEStake.io

The official staking owns the highest security, could maximize earnings, and is easy to handle the assets. However, the disadvantage is also obvious: the lowest utilization rate of capital, the need to purchase corresponding $APE coin to activate the staking requirement, as well as the risk of $APE price decline. This mechanism is not friendly to the group of "Ape holders without $APE". On the basis of holding Ape NFTs, it is still necessary to purchase apes worth approximately $9,000/$40,000 (roughly estimated at the current price) to participate in the official staking event, which basically ignores this group.

🐵 BendDAO

The security is relatively reliable. There have been no reported cases of theft from the BendDAO and its open-source contract is trustworthy. The advantage of BendDAO is that the deposit and withdrawal of assets are relatively flexible. The minimum staking time could be as short as 1 Day. You can choose a shared income model to avoid staking APE coin and increase the utilization of capital and avoid the risk of $APE price decline. The disadvantage is that it needs to be paired, and it may not be able to match the full amount of tokens needed immediately. Everything depends on the actual situation, and a certain amount of staking revenues will be charged. Thus it is impossible to obtain full staking returns; the second disadvantage is that there are extra fees for withdrawing earnings.

🐵 Binance NFT Market

The security is extremely high since the market is backed by Binance, currently the largest CEX leader. The first advantage is that you also do not need to purchase $APE, which completely avoids the risk of $APE decline. Second, the expected earnings would be higher as Binance offers internal borrowing, with profits basically given to its users. So theoretically, the return is higher than BendDAO. Moreover, Binance NFT pairing mechanism is more efficient in the early stages and should be able to achieve perfect matching without any friction costs such as gas fees. BendDAO's P2P pairing mode makes it difficult to achieve perfect pairing (currently fully matched with 25 BAYC, 36 BAYC are pending). Binance has also launched the $APE lock-up campaign, attracting $APE holders to participate. In addition to matching with NFTs, it is also possible to participate in the limited-time activities of $APE regular financial products, with the current highest annualized return of 79%. There are also rumors that Binance is brewing a series of special benefits and activities for participating Ape NFTs holders, including but not limited to special prize pools, first-hand information and whitelists on potential projects, Bnft VIP groups, etc. As for the disadvantage, the current official rules do not seem fully flexible. It requires KYC and 30/60/90-day fixed staking periods. Additionally, withdrawing NFTs generally takes at least 48 hours to arrive. But Binance also offers on-demand staking, which could be taken into account based on your actual needs.

📚 Summary

The above information is a quick summary of the staking benefits over the three platforms by the authors. If the relevant information is updated, we will synchronize in the first time. You can make your own decision based on the actual situation or do some on-site investigations by yourself. We hope you can find the most suitable way to make your Ape NFTs get a warm home and maximize your profits in this staking event.

Welcome to scan the QR code to join the BNFT project discussion group. Ape holders can contact the administrator for verification and then enter the staking group. There is a special customer service to answer questions about the Binance staking event and holders will gain some special benefits from this event.

Reference

*Stake.io:

*https://app.apestake.io/pools

BendDAO Official Doc:*

***https://docs.benddao.xyz/portal/user-guides/ape-staking#accept-and-co-stake

Binance Official Announcement Board: https://www.binancezh.jp/en/support/announcement/binance-nft-marketplace-will-launch-ape-nft-staking-program-4352ac39da8640cc86435d981174a7e7

Special Thanks: *Our Ape friend Dr. Golden Dog's article about the $Ape economic model:

*https://mirror.xyz/fahayek.eth/fKt1MjA8VgSTtcJ3oUeLp5JIj1Ss1a_lHQTN76Tt1C4