We’re now LIVE: https://mainnet.swivel.exchange

As announced earlier this week, the restrictions on our guarded mainnet will be lifted today at ~8:00 PM UTC!

The moment we’ve all been waiting for is here! With nearly two years since Swivel’s initial origin as our founder’s first project at ETHDenver2020, and a year since we first established a community and began true development, we are proud to say, “The most capital efficient yield-trading market in web3–Swivel’s mainnet–is now open to the public!”

We’re live with two USDC markets, (and more soon to come):

- March 24th — currently 9.64% APR

- June 23rd — currently 3.44% APR

Liquidity Incentives

Alongside our mainnet launch, we’re announcing the immediate launch of our genesis liquidity incentives!

As described briefly in our litepaper, unlike most protocols, we believe that incentivizing TVL is relatively naive, and as an effective alternative, protocols can target volume.

With that in mind, we’re happy to share the details of our volume based orderbook incentives.

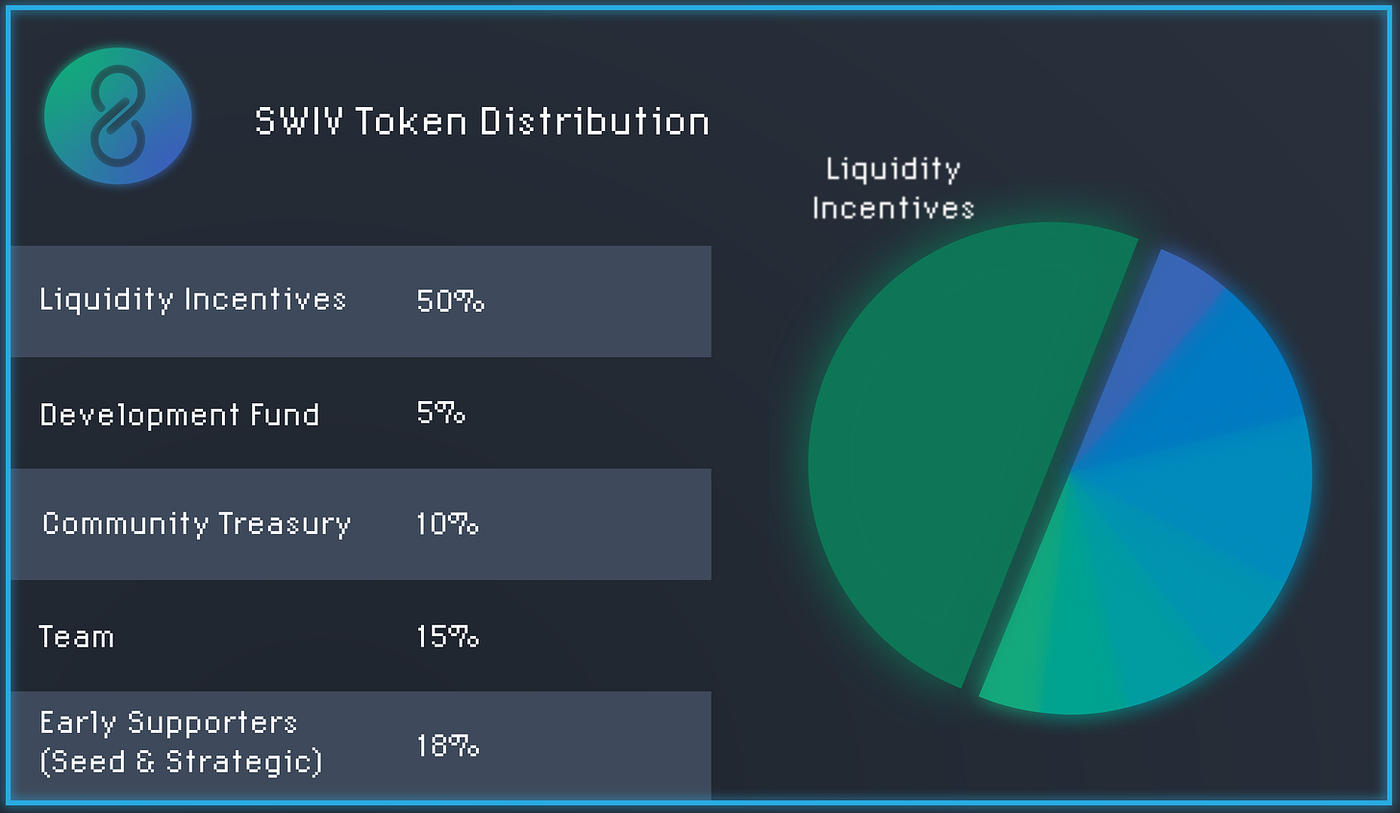

As visualized above, 50% of the SWIV token supply has been reserved to incentivize liquidity across our exchange.

These tokens will be distributed over roughly 4–5 years, with a target distribution of ~5,000 tokens per day for each market.

Of note, the liquidity incentive amounts and distribution structure will be subject to our community’s governance and may be revised over time.

Genesis Incentive Structure

Most contemporary orderbook based liquidity incentives are distributed based on a combination of liquidity snapshots that measure LP consistency, as well as volume based metrics (e.g. dYdX) that help identify market impact.

This combination unfortunately leaves most average users unable to capture incentives for their limit orders, as their minimal participation means they aren’t considered significant enough for rewards.

For our genesis incentives at Swivel, we are instead strictly rewarding volume (recorded on a daily basis).

If a user places a limit order and it is filled, they will be rewarded!

As shown above, for each market, there are 5,000 SWIV tokens allocated per day.

These tokens are then split proportionally based on the limit orders that have been filled in a given day.

In the example above, 0xmons traded 200,000 of 1,000,000 total nTokens that day. Given they committed 20% of the daily liquidity, 0xmons receives 1,000 SWIV tokens, 20% of the daily allocation.

Flexible Liquidity Incentives

Many protocols launch with aggressive incentives, and in the name of user acquisition commit to a long term incentive program that results in the rapid dilution of their token.

We believe that the mistake commonly made is not launching with aggressive incentives, but committing to a long-term static incentive structure.

That said, our liquidity incentives will undergo regular community review to ensure that our intended longer-term market participants are appropriately rewarded.

Toward the end of our second major reward epoch (April 7th), we will review the efficacy of our current incentives, present findings to the community, and discuss a proposal to test an alternative or continue with the current model.

Retroactive Distribution Update

For an updated list of all retroactive distribution recipients, see:

Retroactive Distribution Link

The currently displayed rewards may be diluted as additional recipients are added. If your address was not included, and you believe this is a mistake,please make a retroactive distribution request:

Retroactive Distribution Typeform

What’s Next

Come on by our Discord, drop some feedback and share your thoughts on strategy! There are a ton profitable strategies to bootstrap, from trading to incentive farming, so come hang out and share your alpha…

Or psyops and wait for others to bring the alpha to you. But bring some 🔥 and you might earn your way into t̷̨̒ḩ̵̥̒̚e̷͙̽̒ ̵̖̇͆b̶̝̍ö̸̦͂a̵̜̟̍̏r̵̢̙̈̕d̸́ͅr̸̰͂̓ỡ̴̧͙o̴͚̔̕m̵̗̿.

We’ll also be at ETHDenver next week to celebrate the launch and our projects ETHDenver anniversary! Come check us out during a couple panels, or just hang out and get help with your hacks!

We’ll also be hosting an AMA next Friday, live from ETHDenver! Make sure to get your questions on down to our Discord’s #AMA-questions channel!

About Swivel Finance

Swivel is the protocol for fixed-rate lending and tokenized cash-flows.

Currently live on Rinkeby and on Mainnet, Swivel provides lenders the most efficient way to lock in a fixed rate as well as trade rates, and liquidity providers the most familiar and effective way to manage their inventory.

Website | Substack | Discord | Twitter | Github | Gitcoin | Careers