Money is not a commodity that serves as a medium of exchange, but a set of socially oriented technologies consisting of three basic elements

Full article 1982 words, reading time about 7 minutes, article rated PG

Using the Fei currency from the previous article, we find that the stone coins of Yap Island illustrate 2 things.

Money does not have to have reserves of precious metals in order to work: both fiat money and the stone coins of Yap Island are proof of this

Money does not have to be issued by the state in order for the economic mechanism to function properly: the premise is that money must be in harmony with the size of the economy

Let's review the 3 main functions of money.

With the development of the digital era, the first function of money has moved from the atomic state to the digital state. Online payment, called China's "new four inventions," is such that people do not have the slightest care about spending paper money while sweeping the code to pay. The breeze of electronic payment has turned many young people into moonshiners without a second thought.

Yap Island's stone coins have also shaken many people's ideas about the properties of money, such as movable, so the necessary properties of money are not becoming.

Exchangeable: whether physical or digital, the unit of money must be equal in value

Persistence: If money rots away or suddenly becomes air, there is no way to achieve the function of storing value

Divisible: large amounts and petty cash need to be divided into different amounts

Acceptable: accepted by everyone, at least in a large enough area

Limited supply: unfortunately, fiat money can easily fall into the trap of inflation, this is human nature, because the control of currency issuance decisions are actually a few people, the moral point is good, you can plant trees before, after the cool, poor moral will only drink hemlock thirst

So, I guess if you see this, Mr. Yu's doubts can be lifted, and he will naturally have his answer.

Everyone has their own position and interest angle regarding cryptocurrencies like Bitcoin. Whether you hear Warren Buffett's rat poison view or Justin Sun's take you to riches view, please calm down first and think about what they are reaping the benefits of saying so instead of blindly following and denying or affirming it.

I feel that this is the scientific attitude of learning, which enables us to understand the development of things change, not be ahead of the times to become a martyr, and not be behind the times and be abandoned. Let's look at the nature of money

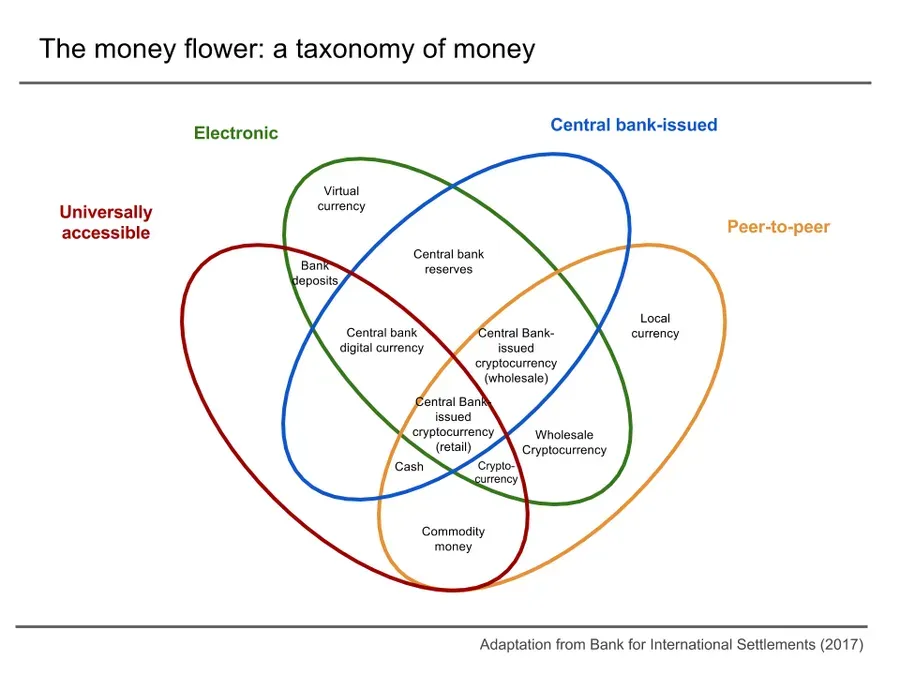

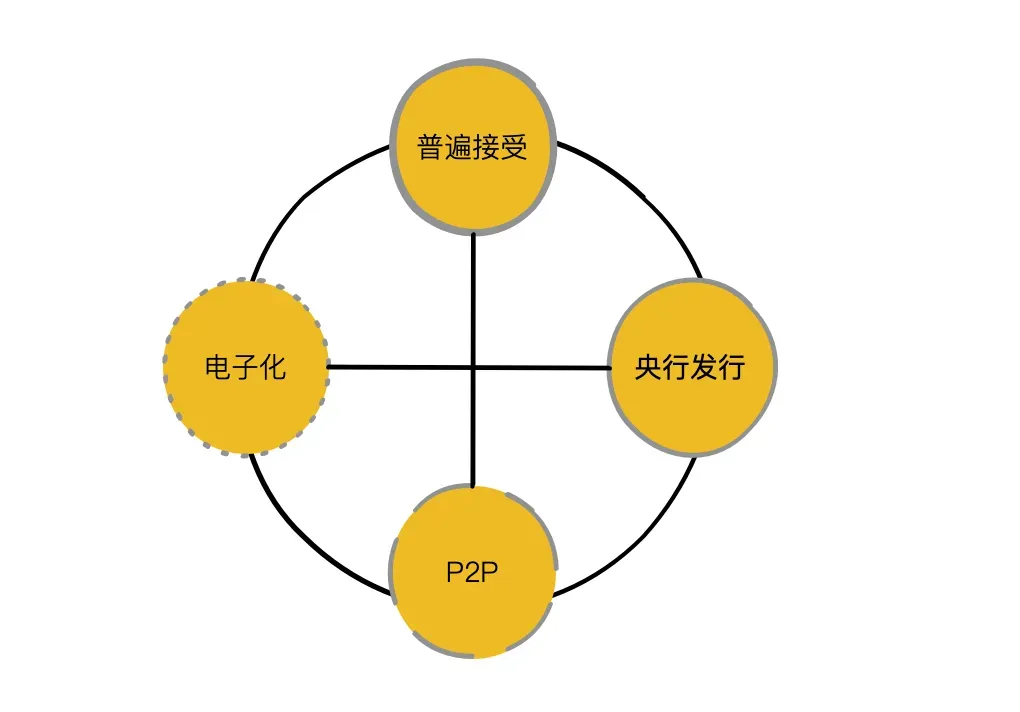

The Bank for International Settlements gives the classification of currencies.

Digital currencies are a special set of classifications, the exact meaning of which is understood according to the law and context. Different administrative regions have their own determination of digital currency, virtual currency, cryptocurrency, e-money, online payments, electronic cash and other types of money. And the different types of names may have conflicting meanings in the mouths of different government departments, financial intermediaries and law enforcement officers.

The following is a chart of the "money flower" classification from the Bank for International Settlements.

As can be seen in the figure, the Bank for International Settlements divides currencies into four broad categories.

The major categories cross over each other to form smaller classifications.

Cash: banknotes and fiat such as U.S. dollars, euros, yen and Chinese yuan

Bank notes: checks, credit cards, etc.

Physical currencies: gold, silver, oil, etc.

Central Bank Digital Currency (CBDC)

Retail cryptocurrencies issued by central banks: eCNY

Central bank-issued bulk cryptocurrencies: Project Inthanon-LionRock

Central bank reserves: gold and foreign-exchange reserves

Virtual currencies: Q-coin

Cryptocurrencies: bitcoin, ethereum, etc.

Bulk cryptocurrencies

Local currencies: Cigarettes in prison, Lao Gan Ma and Mayinglong

Cryptocurrencies are also money (currency), at least from the academic perspective of the Bank for International Settlements :D

The latest definition of "the essence of money": is a network of ledgers with a certain level of consensus

In more academic terms

The essence of money is the system of credit records and clearing mechanisms behind it

See "The Wild History of Money"

Money is not a commodity that serves as a medium of exchange but a set of social-type technologies consisting of three basic elements.

(i) An abstract unit of value used to measure the value of money

(ii) A system of credit records that allows individuals or institutions to keep track of their credit or debt balances as they engage in trade with others

(iii) The original bondholder can transfer the debtor's obligations to a third party to settle certain unrelated debts

The financial technology that has grown around money is a time machine built by human civilization.

It cannot move our bodies in time tracking. Still, it can move our money, expand our ability to imagine and calculate the future and quantify the past on a deeper level, and, like text, it broadens our space-time and plays a huge role in the entire human trade network.

Around money, human civilization grew banks and a more powerful mechanism for generating money (M2), which facilitated forward economic development, but the greed and fear involved and the innate flaws of the system also created periodic economic crises, and in response to the greed of commercial banks to keep inflating the volume of future money, we again devised central banking and state intervention to reconcile this contradiction.

In modern society, clocks coordinate our actions, printing (and the Internet) spreads knowledge and skills, money and finance enliven the economy, and all these public networks have brought human civilization to a great level (and also made the elites of each country depends on it, dreaming of a world for the public or a world for the themsleves)

History says.

He who works his heart rules over people, and he who works his strength rules over people, but he who rules money rules everything.

History also says.

There is an iron law in human society: in the absence of external pressure, the development of any organization evolves in a direction that favors that organization's elite.

This law applies to both well-paid corporate management and unions controlled by leading men, to both the U.S. Congress and Hollywood.

History also says.

In the capitalist system. The unequal distribution of financial gains leads to a widening gap between rich and poor.

The wealth gap is self-reinforcing, as the rich use more resources to expand their power; and also influence the political system to benefit themselves and give their children more privileges. For example, providing them with better education, thus creating a gap in values, politics and development opportunities between the rich and the poor.

As a result, those who are less affluent feel that the system is unfair and resentment arises from it.

As long as the standard of living of most people remains high, these disagreements and resentments do not turn into conflicts.

But if productivity growth stagnates, conflicts can intensify, so can blockchain solve these problems?

Follow me on Twitter to get the updates: