Hello traders & UniDex enthusiasts! We’re going to use this article to tell everyone a little bit about the next steps we’re taking as a protocol for traders, a team, and general project direction. We’ve been quiet ever since we made our initial post about UniDex V3 and we’re ready to give some more details to the community & the progress we’ve made.

We’re going to divide this article into 5 separate parts outlining a quick highlight of how things currently work and their problems, and then sections of what’s coming up.

The Present

UniDex started out way back in October of 2020 promising 3 things. A superior limit order solution, derivates aggregation such as leverage & options, and meta-aggregation between other spot aggregators. Over time we achieved all of those things and more and let’s name a few examples from each.

1. Limit orders We wanted to deliver limits orders first and we did this during December 2020 with our initial beta launch. The protocol used an open relayer network to monitor and execute pending trades and has since been the standard for many other projects. Gelato, for example, forked and made sorbet finance while adapting relayers to only their gelato relayer network & Sushiswap used the same system but in combination with their bentobox. However, over time we realized that this model doesn’t actually work as efficiently as it should. Someone could fill an order but another relayer who used less gas could have filled the order for significantly more output tokens. While the protocol did also support market orders, it was never done OTC when it could and should have. CowSwap picked up on this and developed a protocol of “coincidence of wants” or CoW for short. Overall there was a lot to change as many new liquidity sources entered the ecosystem. Best practices also changed and we ultimately deprecated limit orders to work on a more robust system that fixes the weaknesses of what we know now.

Here’s a small easter egg for those that’s been with us for the past 2 years! Remember this old release UI? 👇

2. Derivatives Aggregation At the time, DyDx was the leading protocol accomplishing on chain margin trading. Over time new players entered the market such as Cap, Perpetual protocol, and XVIX finance. The goal was simple, provide an alternative frontend that let you place orders between the protocols at the best rate. There was some turbulence given players like perpetual protocol launched on xDai (now known as gnosis chain) so there was some fragmentation of liquidity. We also saw the emergence of alternative EVM networks like BSC as gas fees grew larger on ETH mainnet.

Regardless we partially achieved what we set out to do. Offer another protocols liquidity and trading pairs on our frontend for UniDex traders. We started with XVIX finance building an alternative frontend from scratch allowing you to use both UniDex and manage XVIX positions from 1 interface. It was a lovely partnership and we even scored “first to market feats” onchain through X Dev’s creation. A few of these things include frontrunning the entire market to being the first platform allowing you to trade TSLA synths with leverage. We helped launch around 5-6 other markets and started our journey into creating interesting derivate trading pairs. We launched in January 2021, the ability to trade the ETH FastGas GWEI price on-chain. It was around this time more players started becoming more popular such as Cap who allowed users to trade with leverage against a very large selection of stocks and other pairs. XVIX eventually deprecated the X2 protocol and created the Gambit protocol allowing users to long and short assets collateralized by a pool of assets including a stablecoin, GMT. We also built a new and fresh frontend from scratch which let us highlight our strengths in aggregation.

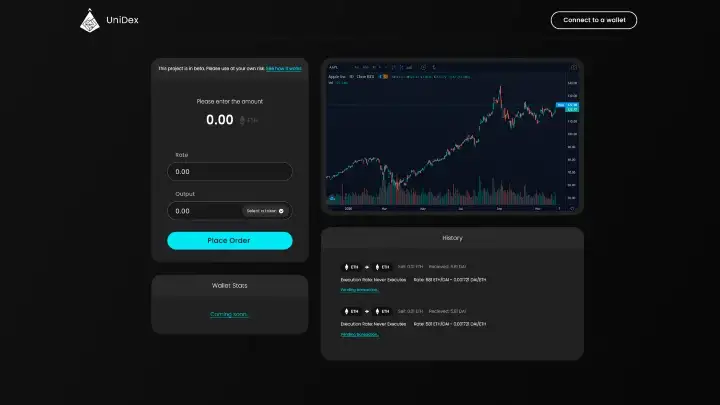

This new frontend is the one that is currently live at app.unidex.exchange and allowed users to create & manage positions on Gambit.financial on the BSC network. We also started to aggregate more leverage protocols like Perpetual protocol. We were finally aggregating leverage trading protocols with our new multichain aggregation terminal. Eventually, we also supported the GMX protocol which was the next iteration of Gambit, and we saw some success there too. However, we quickly saw some issues because of the limitations all perp platforms faced at the time.

Multichain bridging was still in its early stages and there were still too many discrepancies between leverage trading protocols to efficiently aggregate between. Some places had open interest caps with 0 slippage and others just didn’t in favor of gaussian curve market making. We put leverage trading aggregation on hold while we focused more on spot aggregation and picking up & improving an existing leverage trading protocol that stopped development which is what you see today at leverage.unidex.exchange.

3. Spot tradingSince the start, we provided an unrivaled aggregation strategy very early before others even picked up on the meta-aggregation strategy and realized its the best path forward. As mentioned before, we created the revamped meta-aggregation terminal in early 2021 allowing users to aggregate both leverage protocols & spot trades from multiple protocols. We started with 1inch, 0x, Paraswap, and pending limit orders created from other protocols & our own.

Since then we’ve expanded to a more robust list of sources aggregating between each custom DEXs, 1nch, Paraswap, 0x, Openocean, Kyberswap, Firebird finance, and pending limit orders.

However, we quickly realized we could easily take this multiple steps beyond. When swapping tokens you’re with either speed & maximum value extraction. On paper, aggregators seem like they're solving both however, they only really solve the speed part.

As a meta-aggregator one of the core ideas is that the pathfinder between these Dex aggregators can change rapidly and some may give better rates than others. The meta-aggregator essentially assumes nothing changes once the user is satisfied with their quote and hits send. This presents a problem as you are limited to the power of the aggregators you pull from, and a better route is found essentially anywhere else a millisecond later.

We found that by doing at least 5 requotes before you commit to a swap, at least 20% of the time you can get a better rate within 10 seconds even as the market is flat.

The Upcoming Future

We’ll divide this section into 2 parts explaining the two distinct changes moving forward with both derivatives aggregation & spot aggregation.

They say Nasdaq was built to be the exchange for the next 100 years. We believe UniDex is positioned similarly and will be the leading DEX for the next 100 years as well.

Spot Aggregation V3

Moving forward we will be deprecating the current aggregation terminal which is live at app.unidex.exchange. We will be adopting a simpler and straightforward approach to the protocol & UI design surrounding everything spot related.

As for the UI goes we’re keeping things simple and have created an API for our pathfinder for platforms that want to make a professional UI on top of UniDex. We put a focus on speed, simplicity, and flexibility for this new platform.

Switching chains can be done in seconds compared to the lengthy and bloated aggregation frontend we currently host. The bells and whistles are limited to making things look pretty and not flooding the user with a bunch of information.

As for aggregation strategies, we’re releasing V3 of our aggregator which solves the problems V2 presented. Orders are filled in batch short-term auctions from ANY source removing the possibility of traders missing out on a deal they could have gotten better with a requote. Trades are constantly being quoted in small intervals and filled with cross orders (CoW orders), our existing meta-aggregation strategy, and community-built routing sources. This makes the aggregator much more open to future integrations as protocols can essentially add their DEX into the aggregator given they only need to fill the conditions of filling the user’s order with the requested tokens.

In the event that an aggregator is not present on a network, orders can still be filled through these OTC orders users create & fill the remaining liquidity from individual DEXs with a basic aggregation strategy.

Leverage Aggregation V2

Moving forward with the leverage trading terminal, we will be combining our stack for derivatives aggregation & the existing leverage trading terminal. The leverage terminal will efficiently become the clearing house & front page of DeFi perpetual leverage trading.

Orders will be filled in the order of UniDex LPs first > other Perp DEXs > Cross chain orders to other Perp DEXs. The reason we do this is that we’ve realized that idle traders on our platform waiting for either more liquidity or freed-up open interest isn’t doing anyone any favors. Traders will simply move onto another platform or will just open another tab to our existing platform to trade on top of GMX or Perpetual protocol.

Once the open interest on our LPs has maxed out, the remaining liquidity will be aggregated into other protocols just like before on our other terminal. We take this a step further by having the transaction move cross chain when things are no longer feasible on the same network. This utilizes the same technology powering existing bridges like multichain.org and the fusion network.

There’s no more worrying about cases like this as a trader.

Essentially, the leverage terminal is changing into a derivatives terminal that aggregates orders both multichain & cross-chain. Power users only need to use 1 interface in order to access multiple protocols liquidity for the same pair. This also means that UniDex is able to claim they support the widest range of trading pairs on the market. We can focus on trading pairs that aren’t available on other platforms while borrowing the trading pairs and liquidity of other platforms such as GNS and Perpetual protocol.

You can also use UniDex to create delta-natural positions or similar funding rate play based strategies with ease. For traders of size, you can now more easily manage your positions across multiple perp DEXs in a much more convenient manner & execute orders from these DEXs from UniDex as well.

So far we’ve planned out and supported the following protocols for our initial launch

-

Gains Trade

-

GMX

-

CapV3

-

UniDex

-

Pika

-

Metavault

-

Perpetual Protocol

Some of these protocols are going through major upgrades and naturally, we will support them as they release their respective upgrades. We know Arbitrum is getting very crowded with many perpetual leverage trading protocols and we see this as an opportunity for traders to extract the most value out of their positions.

UniDex pools will still exist and serve the purpose of filling orders before extending to other protocols for extra needed liquidity & pairs that don’t exist on UniDex. For fee revenue, the majority of these protocols support referral addresses so we can collect fees the same way as we also do while also increasing our user base considerably.

Timeline

These things have been in the works for a while already so these updates won’t take long to ship. We expect by end of January, both the simpler interface, the SwapV3, and the updated leverage aggregation terminal will be live for traders.

We still have a few other things specifically related to our leverage protocol that will be unveiled soon that will synergize massively with the changes we’re making with the terminal now. Our focus will be to create smart LPs that have semi-active market making, isolated risk, multi-stable pools, and 0 slippage swaps between the stables in that pool.

TLDR

So you wanted the quick summary…

-

The aggregation terminal will be deprecated in favor of a simple mode

-

Derivatives aggregation moved to the existing leverage trading terminal

-

UniDex becomes the most liquid spot trading aggregator

-

UniDex becomes the most liquid onchain leverage trading platform

-

Most amount of trading pairs supported

-

ETA 1-2 months for initial releases

That’s it for now! We still have a few other things that we will be unveiled soon as we mentioned but also other things like our rebranding, cosmos app chain, and rolling out features. We’ll be releasing more content in the short term highlighting these things so do keep your eyes peeled for when those drop.

Discord invite link — https://discord.gg/unidex

Twitter — https://twitter.com/UniDexFinance

Telegram Group — https://t.me/unidexfinance

Telegram Announcement channel — https://t.me/unidexapp

Website -https://www.unidex.exchange/

Aggregation Terminal — https://www.app.unidex.exchange/

Leverage Terminal — https://www.leverage.unidex.exchange/

Leverage Leaderboards — https://www.comp.unidex.exchange/

Business Inquiries — marketing@unidex.finance