Welcome UniDex community members, traders, and holders!

It’s time for our monthly update post on our progress for upcoming features and updates, newly formed partnerships, and the general ecosystem outlook. A lot was missed in April, but things will still come in May. Without wasting more time, let’s dive right in starting with $UNIDX related news.

$UNIDX

Starting off, the UNIDX token was added to the official zkSync bridge this week. This finally allowed us to have some real liquidity flowing into the network. We’ve already seeded roughly 40k in liquidity on Velocore, the leading (3,3) DEX on zkSync. We started with a $6,500 vote bribe to get some emissions going, but we’ll see how much we keep on zkSync based on the return for our POL.

We’ve moved liquidity away from Popsicle Finance’s WAGMI until more organic network usage is seen & the existing aggregators on the chain aggregate the DEX. If we see more usage, we may return to market making positions here, then use fee rewards for bribes on Velocore and keep the flywheel turning. But until that happens, we’ve been able to grow our liquidity stronger on other chains and through Velocore.

Our friends at Arrakis Finance have created an automated UniV3 liquidity vault with OP incentives! Since the ETH UniswapV3 LP is operating at less than ideal efficiency given the high gas fees, abnormal market activity, and not perfect arbitrage activity. Moving forward, we’ll move our entire POL to optimism on Velodrome & UniV3 through Arrakis, and there would be only community provided LP on mainnet. This does seem favorable given most of the liquidity for the sell side was already entirely provided by the community, while the buy side was provided by the team (although these positions have already been filled).

Potentially after this, a newly formed ve(3,3) DEX is adding native UniV3 liquidity pools on Arbitrum. Since we already market make on Arbitrum through TraderJoe and use liquidity optimizer vaults such as Gamma Finance. We will assess the launch and move POL there if things turn out well.

Magma Testnet

We partnered up with Caldera, an OP stack rollup hosting service that allows developers and protocols to customize their superchain compatible rollups with extra functionality.

This partnership is a bit more special because Caldera will help us accomplish some cool upgrades and functionality that would have taken much longer to develop had we done it ourselves. What does this mean for the testnet and its functionality?

It means…

-

Reliable uptime

-

Fast block times

-

Dedicated hosting

-

Native account abstraction

-

Still using UNIDX as gas

-

Custom pre-compiles

All these things that you already love plus some future additions. Our goal with the app chain isn’t just creating a fancy chain that uses UniDex as gas. The app chain benefits the leverage platform in ways that aren’t achievable on any existing mainnet deployment. It becomes the fastest, cheapest, and most reliable platform trade derivatives, unlike other chains where Perp DEXs rely on centralized keeper callback and clearing times.

Leverage

First, let’s cover the trading competition, our leverage protocol, and things related to the aggregator.

04/14 - 04/28 Trading Comp

The rules of the trading competition meant that whoever placed the highest in raw closed PnL during the two dates would walk away with prizes. Those winners are as follows…

0x17e07.eth - $10,000

0x97c8cf… - $2,500

0xf23761… - $1,500

The lowest PnL trader would also be rewarded $2,500, which goes to 0x1d378…

This loss also led to the most significant single daily pool gain since our deployment a year ago! We thank everyone for participating, and your rewards should go out shortly after this article is posted. We plan for more trading incentives and competitions in the future, but we’re holding off until our V2 protocol is deployed. We don’t want anyone holding a position they would have to close for the migration.

Let’s talk about that migration…

Leverage V2

Leverage V2 is the 2nd iteration of our leverage protocol that we initially deployed on March 31st, 2022. Many changes were made to the protocol, like price impact, dynamic spread, open interest limits per market, and under the hood changes to oracle mechanisms. But these things can be changed without modifying the deployed trading & oracle contract. We will deploy a new trading & oracle contract requiring a migration process for our listed upgrades.

Since all trades are stored in the trading contract, we’ve held off as long as possible from making upgrades that require contract changes. But now we’re ready to add some significant much needed features and changes that should help balance the protocol, give traders new tools, and future sustainability.

Here’s a short list of things that are changing…

-

Stoploss support

-

Limit order support

-

Take profit order support

-

OCO order support

-

Every order pays the keeper gas

-

Referral address support

-

Closing fee paid from position

-

Liquidation fee and threshold per market

-

Real price discovery from positions

-

Dynamic long and short fees to balance OI

-

Separate keepers for liquidation, open, and closing trades for max throughput

-

P2P order matching if OI maxed (after maxing OI, opposing orders stay settling until the opposing order is attempting settlement)

These changes will go live the same time aggregation goes live, which we’ll discuss below. These changes aimed to get the more basic things like stoploss, limit order, and other minor QoL things out of the way but also introduce some more groundbreaking additions that other platforms aren’t doing.

The highlight of these changes would be how we’re handling order flow and balancing open interest. Fees would now act like a see-saw where the most one-sided a market becomes, the larger the fee with an equal decrease in fee for the minority position. Another technique we’re using is the ability to submit orders as pending settlements. A matching order for the opposite of the trade can be placed to balance the open interest while allowing for more trades. If the open interest becomes unbalanced again above the original cap, “JumpRate curve” funding rates would be kicked in to help balance OI again.

This is also used in lending platforms like Aave or Compound, and we’ll attach a graphic below to help you visualize how this would look in practice, with the “kink” being the point after the open interest cap is met.

We want to test some other changes more as things roll out and see how markets perform before enabling other mechanisms. These changes would require a migration from the old contracts to the new contracts, but we won’t be able to migrate these positions for users. Once we have a confirmed date and time for the new platform, we will give everyone 2 weeks to close their existing positions, and all markets will enter reduce-only mode. The keeper will only accept closing orders, and the UI will have the long and short buttons disabled. Nothing needs to be done for poolers as the exact same contracts will be reused for staking, and it will be a seamless transition from your perspective.

We’re just waiting for our last few reviews of the audit for the new contracts, as quite a bit has changed, and security comes first. Once the audit comes back passing, we will give everyone two weeks to migrate, and things will go live.

Aggregation

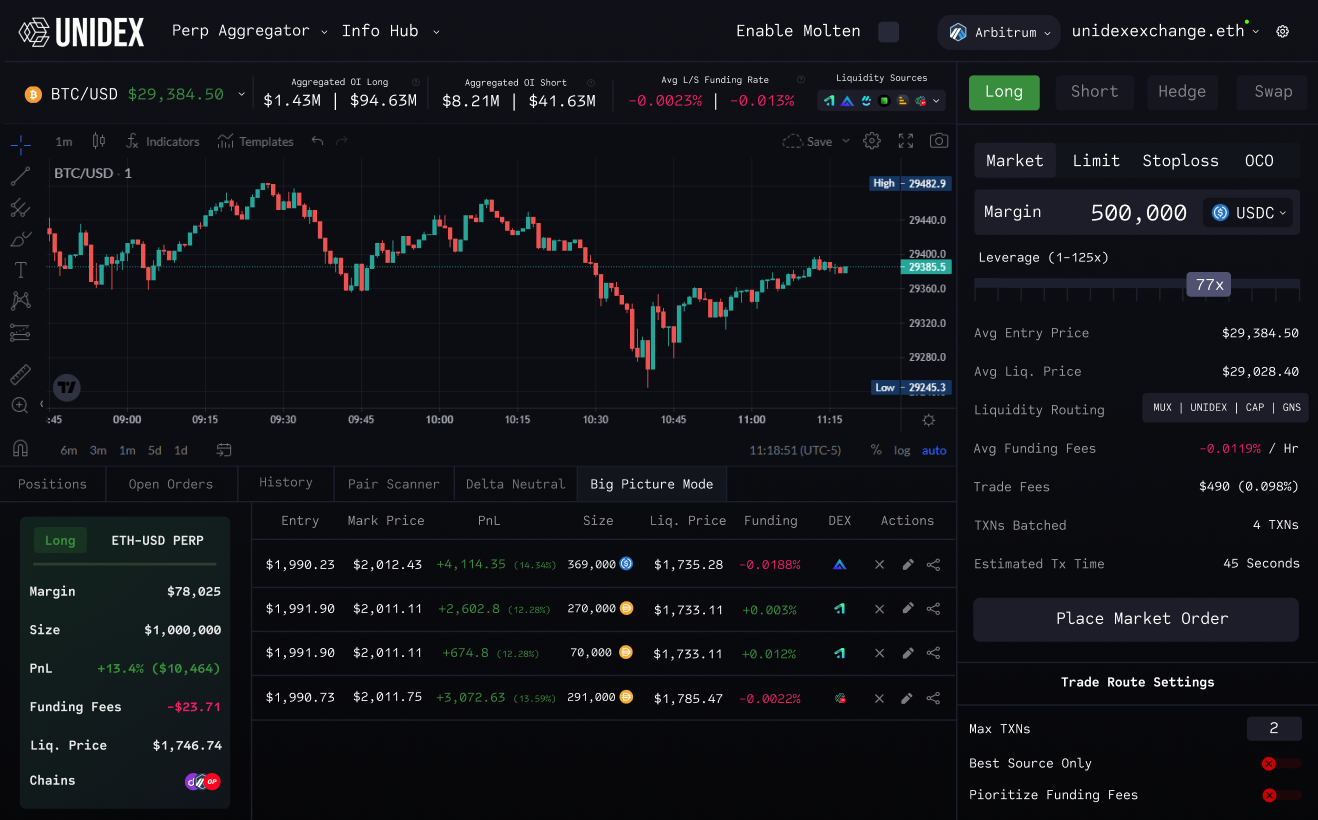

No audits need to be done with aggregated orders from other platforms just because of how we handle them. But now that we’re close to being live, we’re ready to share more details on whats available from launch.

Orders would be aggregated from +27 different perp DEXs, which you can find below.

Arbitrum - Gains GMX Mux CapV3 CapV4 MYC UniDex HandleFi

Optimism - UniDex Pika Kwenta (SNXv2) OPX Perpetual Protocol v2 Mux MMY

Polygon - Gains Metavault UniDex

Fantom - UniDex Mux MMY MPX

BSC - LVL Mux UniDex

Avax - UniDex Mux GMX

We’re still looking to onboard more platforms post-launch so reach out to us if you want your protocol to be aggregated into the mix! This new UI is built exclusively with the idea that trades are aggregated and data comes from multiple sources.

When you place orders, they are merged by the terminal to give you a clear overview of your current positions. Things like fees and liquidation prices are all averaged. However, things are not too different in the more modern space allowing for easier composability. Things change if you want to see a breakdown of how your aggregated position looks like when it’s split among multiple chains

You get a quick overview, manually edit individual positions, and see individual position health on each DEX into which the order was split. These orders are REAL aggregated orders meaning your fill is optimized in real time to ensure you get filled to the lowest price possible for longs and the highest price possible for shorts. Many platforms have now moved onto a synthetic price impact model or vAMM model, making real aggregated orders more crucial than ever before.

The user can also select individual trade settings to prioritize current funding rates when calculating fill sources or fill from your selected source. You can use the terminal to even create delta natural positions instantly as a market scanner or transaction builder. We’ll give you a full breakdown of the best way to place the trade, the best pair to trade, and how long it’ll take for you to break even after trading fees. Just one of the few things possible since we’ve integrated all perp DEXs into 1 UI.

We will make a dedicated post for everything LeverageV2 and PerpsV3 as there’s so much to cover that we don’t want to make this April wrap up post too long. Again, we’re waiting on our LeverageV2 audit to come back safe to launch, and with that, we will start pushing things live from there.

Delays

We set expectations that this would all be going live on March 31st however, we completely overestimated our ability to ship the new meta-aggregator, the new chains, the app chain testnet, and other surprises while also releasing the new perp platform from the ground up.

We want to say that we’re sincerely sorry for promising a timeline that we could not keep, and we do hope that the features and experience traders will make up for the constant delays. We want to make sure the security is tight, the experience is smooth, and we leave a good first impression when we make things live.

Swap Meta-Aggregator

Limit orders are finally going live now that all the bugs related to rate limits, execution delay, and minor UI fixes have been patched up. We expect limit orders to be ready by next week, where users can place meta-aggregated, surplus earning, and MEV-protected limit orders.

The benefit of using our limit orders vs a platform like 1inch’s would be that these don’t require matching orders to fill your order. In fact, these orders are filled from existing aggregators and matching orders which would allow for highly optimized order fills from places like 1inch or Paraswap with their solutions.

Trades are filled at the time of execution with positive slippage shared between the trader and collect protocol revenue unlike other solutions, which will pocket the entire amount and only return what was promised.

Let’s say you’re setting a limit order for 100 USDC → 1000 DAI in case of a depeg. Let’s also assume the market falls to a rate so that 100 USDC → 2000 DAI. Other solutions will only return to you the promised 1000 DAI while pocketing the other 1000 DAI. Our solution (and cowswap for mainnet) will return a percentage of the surplus, giving you more return on top of better fills.

Wrap up

Once again, apologies for the delays! We're working hard to bring you all the awesome stuff related to leverage as quickly as possible. Thanks for your patience and understanding. Stay tuned, and we'll keep the good things coming!

Quick links

Discord invite link — https://discord.gg/unidex

Twitter — https://twitter.com/UniDexFinance

Website -https://www.unidex.exchange/

Aggregation Terminal — https://app.unidex.exchange/

Leverage Terminal — https://leverage.unidex.exchange/

Business Inquiries — marketing@unidex.finance