Starting off

GM UniDex community members!

We wanted to segment this article into 3 pieces the rundown, some history, and upcoming plans. Let’s dive in right away for those that just want the details.

-

UNIDX-ETH Spiritswap liquidity moved 80% ETH mainnet 20% Optimism on UniswapV3

-

The 20% on Optimism will reflect the same liquidity available on ETH mainnet thanks to UniswapV3 liquidity ranges & concentrated liquidity innovations.

-

Protocol deployed on Optimism with ~5% of protocol fees allocated to liquidity management. 50% of that 5% will go to passive liquidity seeding and the remaining half to liquidity mining rewards for community-provided positions.

-

Partnerships with active liquidity management services for UniswapV3 to further enhance the experience for passive LP providers.

-

Fee reward distributions for UNIDX holders will now take place on Optimism by default however, the user is now able to select a destination chain from either Arbitrum, Optimism, Fantom, or Polygon (effective immediately!)

Some History

A while back we faced a potential opportunity to move to a growing L1 ecosystem, and a chance to make a name for ourselves in the DeFi space. We gave the community a choice to vote if they also believed this L1 would be a good transition for further operations. The vote passed and we moved most of our governance to Fantom including fee distributions, voting, and community efforts. However, the ecosystem since then has changed a lot. L2’s have been deployed and have seen a more promising experience and long-term scalability compared to existing L1’s. We accomplished a lot on Fantom, and we’re proud of what we did bring to the table.

We held our spot as the largest #RealYield project on Fantom, were one of the first DAPPS on the network deploying even before Spookyswap, processed over $500,000,000 in trading volume, and were part of a growing community. But it wasn’t all good as many have realized. Despite being one of the most extensive products by offerings, volume, and seniority. There has been a lack of general acknowledgment and any incentives for our transition/entry into the ecosystem. We have not received a single grant or incentive for our participation in the ecosystem which in honesty is fine. But we hoped for more support that wasn’t tied to money anyway such as marketing support. Most of this was done with the help of Austin @FTMAlerts which is now known as @blockbytescom. We believe it’s better for the UniDex project to move its community governance (majority of token activity), its attention, and community activities to the ETH ecosystem once again. Let’s highlight whats changing as part of this move with an important note first.

Note the platform and the token will still and always be available on FTM. The platform cannot be shut down nor can the token be retracted. People can freely provide liquidity on exchanges like spiritswap or spookyswap and do arbitrage plays or whatever they wish. The team is simply moving their liquidity over to ETH & other L2’s for ETH like Optimism. And more importantly, this change affects the governance token, not the leverage & meta-aggregator platform.

Next Steps

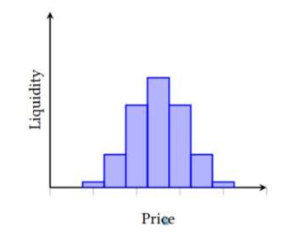

We will be moving liquidity back to the ETH UniswapV3 pool with 20% moving to Optimism’s UniswapV3 deployment. We will mirror the liquidity pool depth for most transactions used so that the price impact is identical and sufficient for smaller buys and lower gas costs (note that gas costs are actually lower than BSC by about 50%). We do this by stimulating a traditional orderbook with most of the liquidity sitting closer to the current market price and eventually narrowing into an infinite range similar to UniswapV2 or its forks.

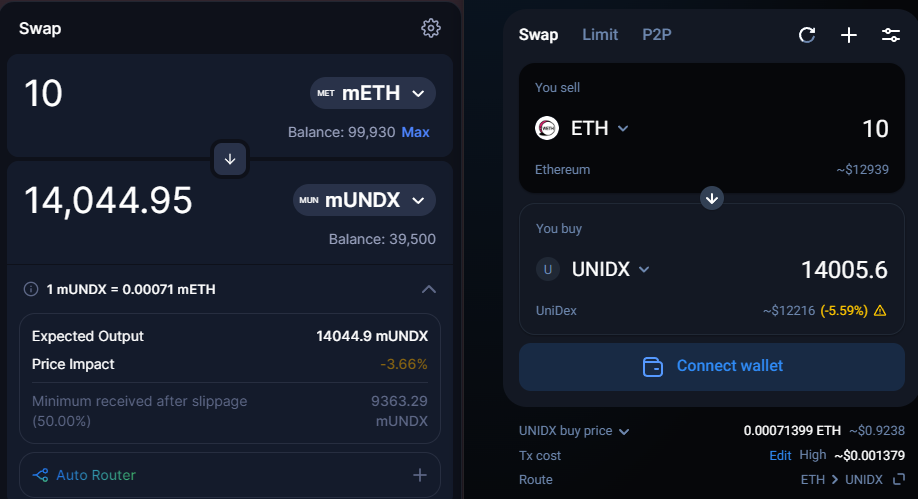

You can see here how efficient UniswapV3 is compared to UniswapV2 with concentrated liquidity. We simulated the amount of LP that would reside on Optimism with mock tokens by taking 20% of the existing pool and separating it into 6 different ranges similar to a balanced orderbook. Even with only 20% of the current liquidity, it still will net the same price impact as UniswapV2 which is the comparison on the right (our current live spiritswap pool). This liquidity on Optimism will be actively managed by the team to ensure things stay as they intended, but also allow for more deployment expansions on networks like Arbitrum with the same technique.

But of course, we don’t want just this small amount of liquidity to sit here…

The leverage platform will also be deployed on Optimism following the migration, and we will use ~5% of the collected fees for liquidity purposes. 2.5% (half of the 5% taken) will go to passive liquidity additions to the pool, while the remaining 50% (the other 2.5%) will go toward liquidity mining. This is our second answer to incentivizing liquidity, and we feel it’s a good time now that people can be much more flexible thanks to UniswapV3’s advancements.

Liquidity management tools like Arrakis finance & Popsicle finance can actually allow users to explore better LP vaults that give much more reason for community provided LP. We’ll explore partnerships but already have a few as we’ve been considering moving to UniswapV3 in the past which resparked some past relationships once more.

Fee distributions will take place on Optimism by default however, the user will now be able to choose between Abritrum, Fantom, Optimism, or Polygon to receive their protocol rewards. At a later date, we can also provide the option of a few whitelisted options including the UNIDX token. This will utilize the meta-aggregator in between more specifically the cross chain bridge meta-aggregator. This will be effective immediately, and all the user needs to do is vote off-chain on our snapshot.page and select a destination chain. No TX needs to be submitted as the user is simply signing for their vote similar to other governance proposals. This can be changed once a week, and if a user does not vote, then they will receive their reward on Optimism by default.

These changes will all go live starting Saturday with some things like the leverage platform going live sooner for initial testing purposes. We thank the Fantom ecosystem for supporting us while we were still growing. We hope the community will also enjoy the increased economic activity now available to users and holders alike.

Quick Links

Discord invite link — https://discord.gg/unidex

Twitter — https://twitter.com/UniDexFinance

Telegram Group — https://t.me/unidexfinance

Telegram Announcement channel — https://t.me/unidexapp

Website -https://www.unidex.exchange/

Leverage Terminal — https://www.leverage.unidex.exchange/

Business Inquiries — marketing@unidex.finance