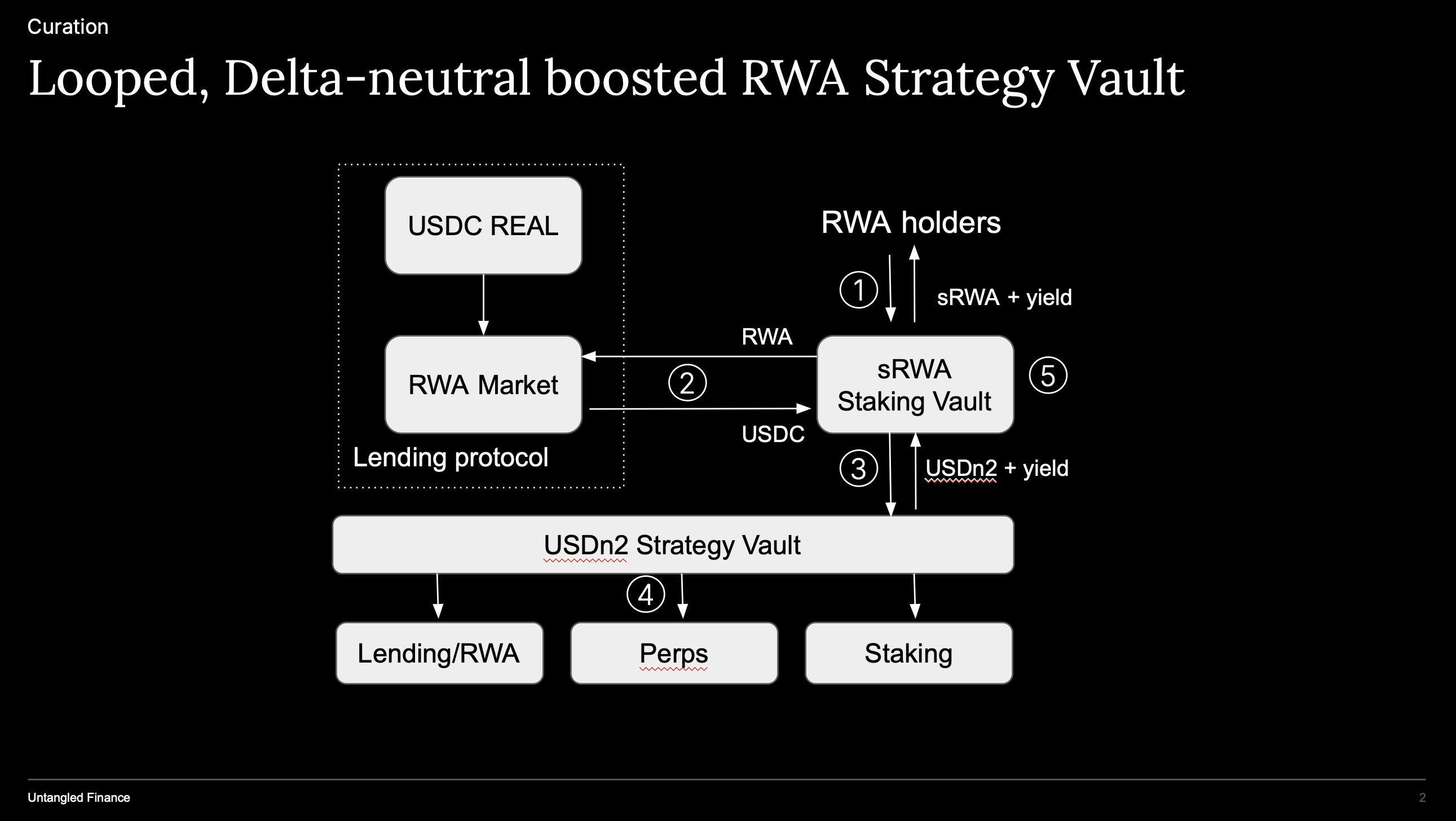

Untangled has launched the first levered, delta-neutral RWA vault on Arbitrum. At its core, the strategy allows tokenized money market fund holders to unlock additional returns via DeFi-native yield sources. The result is a capital-efficient structure that delivers enhanced returns, currently unavailable in TradFi, with risk-managed exposure.

How does the levered, delta-neutral strategy work?

How it works:

-

RWA tokenholders stake their RWA into the Staking Vault in exchange for sRWA.

-

The Staking Vault borrows USDC from the RWA market on the Lending Protocol against RWA collateral.

-

USDC is deposited into the delta-neutral vault USDn2.

-

Part of the USDC may be allocated back to the RWA issuer, increasing RWA supply.

-

The Staking Vault receives yield from the underlying strategy, which accrues to sRWA holders.

Note that Credio, Untangled’s curation service, acts as a curator on both USDCReal and USDn2. Credio employs a proprietary optimisation engine to monitor and rebalance allocations among whitelisted markets. This strategy aims to earn a minimum yield equivalent to what lending protocols like Aave offer. During bull market cycles, the vault allocates more to perps to take advantage of high funding rates. In a market downturn, the vault allocates more to stable return options like Aave or RWAs.

USDn2 is live on Arbitrum mainnet. You can access it here.

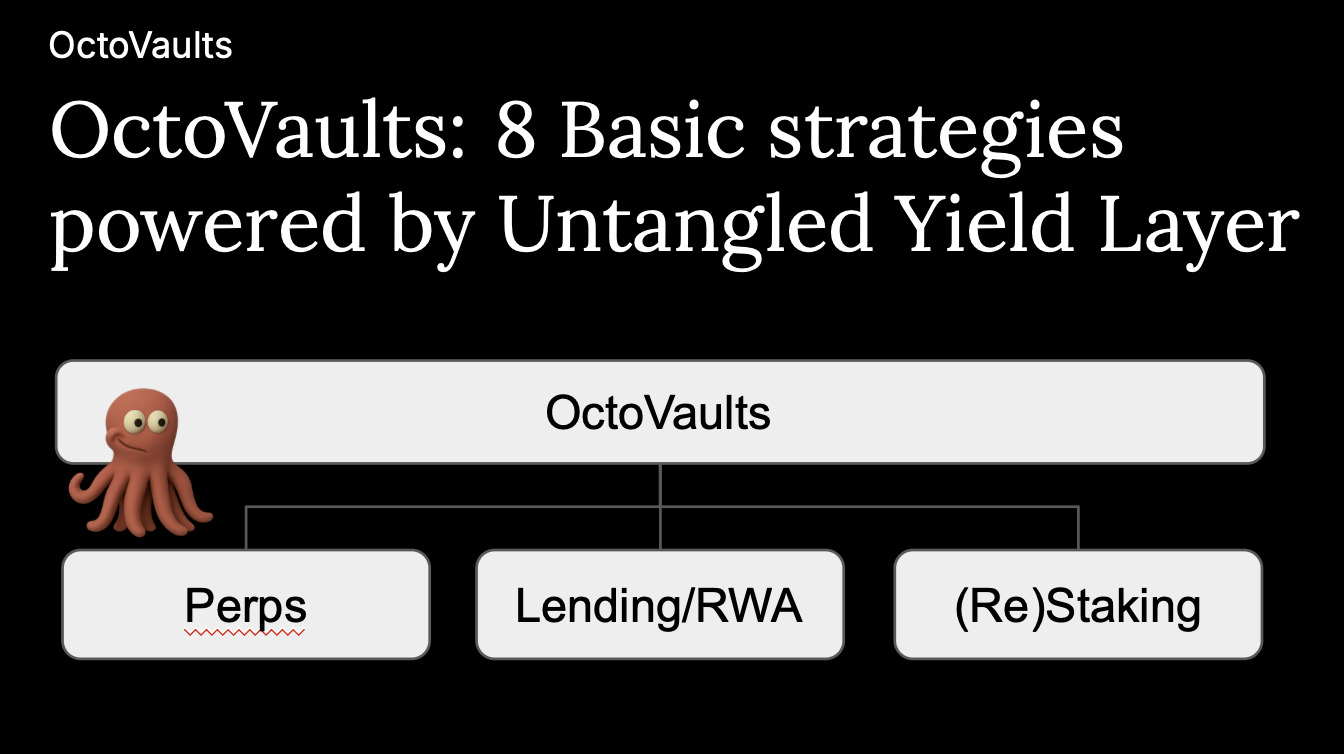

The Eight Base Strategies (OctoVaults)

USDn2 employs one of the eight base strategy configurations powered by OctoVaults, a programmable smart contract vault layer with access to whitelisted yield sources across staking, lending, and perps.

Vault strategies can be constructed using a combination of the following three primitives which encompasses the majority of DeFi yield :

-

Perpetual funding rates

-

Liquidity provision on lending protocols and DEXes

-

Staking and restaking rewards

-

Single-Source: Yield from only one source (e.g., liquidity pool on DEXes, lending or staking).

-

Perp + Perp: Arbitrage funding rates across two perpetual DEXs.

-

Perp + Lending: Borrow an asset (e.g., stETH), hedge with a short perp.

-

Perp + Staking: Hedge restaked stETH with a short perp.

-

Lending + Lending: Borrow and lend across two markets to earn spread.

-

Lending + Staking: Borrow staked ETH and restake it.

-

Staking + Restaking: Stake ETH in a staking protocol then restake in a restaking protocol.

-

All Three: Combine staking, perps, and lending. This is the base strategy used in USDn2.

Vault managers can build a strategy based on market conditions or risk appetite. Allocation policies, supply caps, and managed permissions are governed onchain.

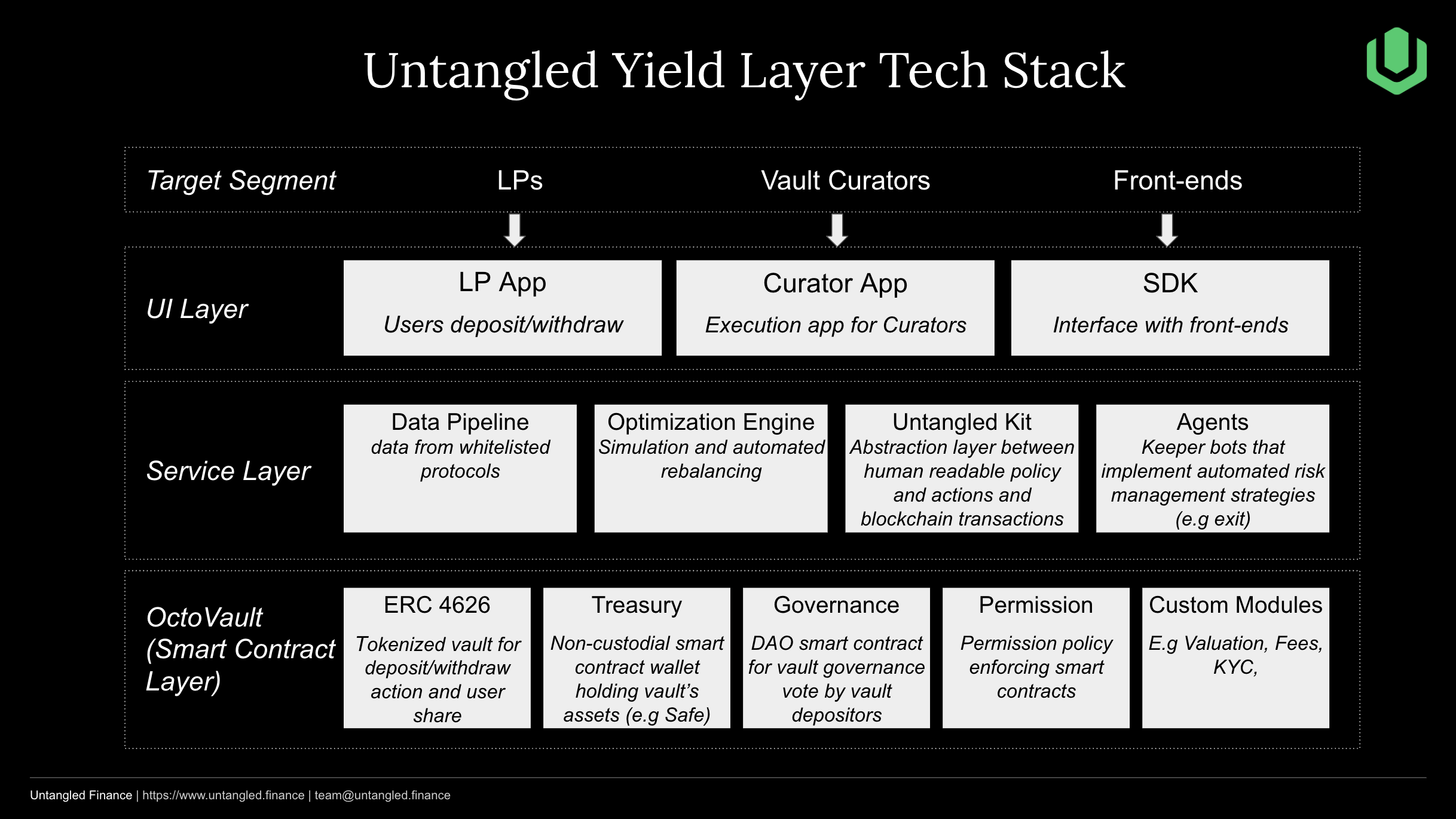

Untangled Yield Layer: Modular Strategy Infrastructure

OctoVault is the smart contract layer of Untangled Yield Layer (UYL), a modular platform for building, managing, and optimizing DeFi yield strategies. Untangled Yield Layer comprises three core components:

Smart Contract Layer, OctoVaults

-

Tokenized vault (ERC-4626): User deposits and withdrawals.

-

Treasury (Safe): Holds vault assets and executes trades.

-

Vault governance: is fully non-custodial. LPs are represented via DAO frameworks such as Aragon, with all strategy execution constrained by onchain policy modules.

-

Policy Modules: Granular permissions for vault manager vs. vault DAO

-

Custom modules

-

Strategy: Manage allocation weights and supply caps among whitelisted markets

-

Other custom modules such as KYC, fees, valuation

-

Service Layer

The Service Layer consists of

-

Data Pipeline: fetching data from whitelisted markets for monitoring dashboard and simulation/optimization engine

-

Optimization engine: Machine learning models that output target portfolio weights for rebalancing purposes

-

Untangled Kit: Abstraction layer between human readable actions and blockchain transactions. It incorporates standard methods for interacting with target protocols

-

Agents: Keeper bots that implement automated risk management strategies such as anti-liquidation

Vault curators can use Untangled’s optimization tools or integrate their own logic to rebalance between yield sources.

Credio, Untangled’s curation service, acts as a risk curator and allocator on vaults like USDn2.

UI Layer

-

LP App: For users’ deposits and withdrawals

-

Curator App: For managers to build, monitor and rebalance portfolios

-

SDK: Enables wallets and fintech apps to embed native “Earn” functionality without DeFi complexity.

What’s next?

With USDn2 being live we will shortly launch the staking vault component of the strategy, working with the following partners:

-

AlloyX, the issuer of an institutional-grade a tokenized money market fund managed by a global asset manager

-

A leading lending protocol pioneering in RWA markets

-

Leading perp DEXes

OctoVault is built on top of leading perp, lending, and RWA protocols as opposed to competing with them. Each vault is isolated and managed by a professional vault curator. The whitelisted markets, however, share a common liquidity layer.

Reach out to our team at team@untangled.finance if you want to learn more.