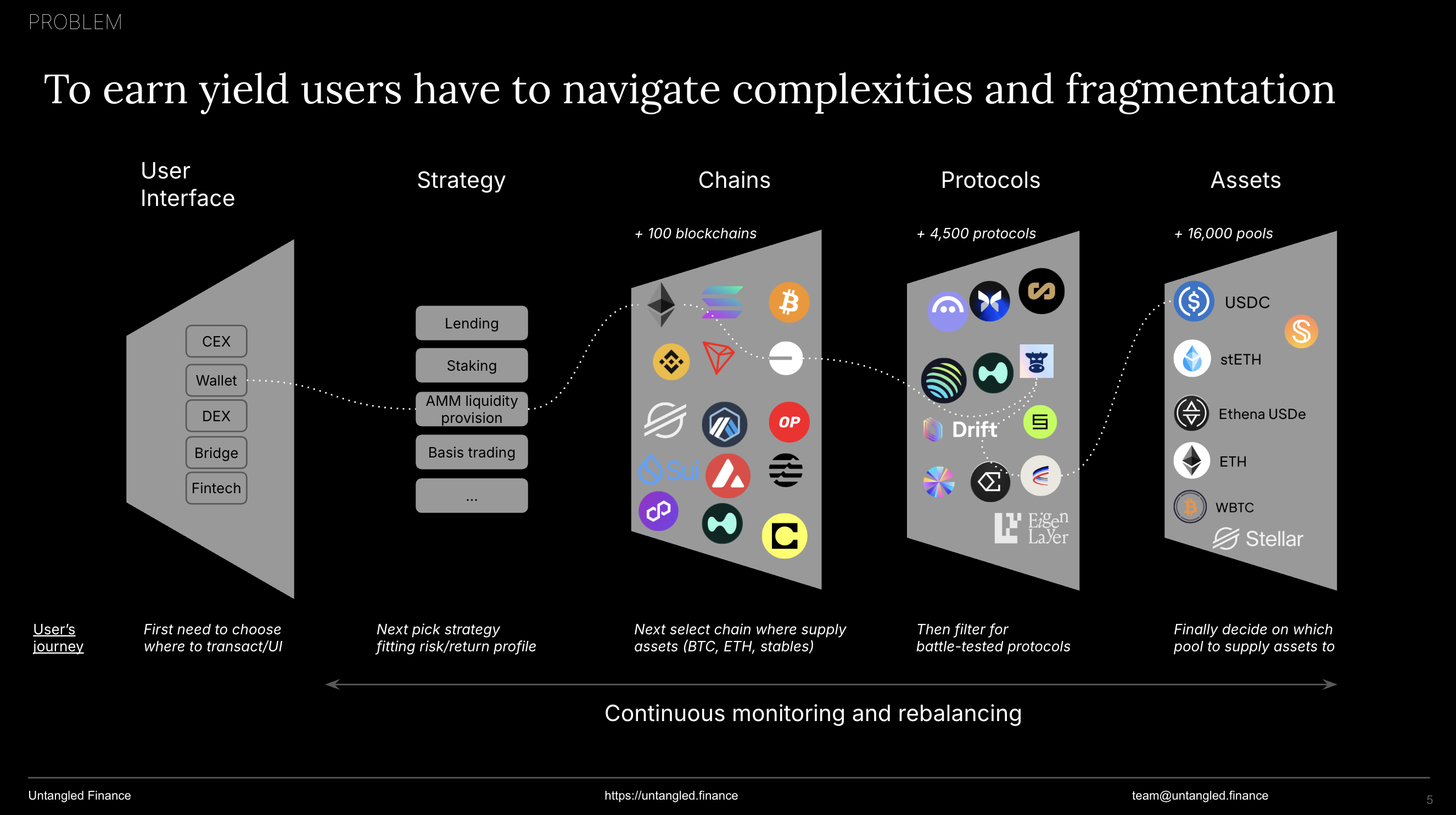

Today’s DeFi yield landscape is fragmented. With over 100 blockchains, 4,500 protocols, and 16,000 assets, investors face significant operational complexity in accessing on-chain yield. Identifying the right strategies, allocating capital across chains, and managing ongoing risk exposures demands time, expertise, and infrastructure.

The Problem: Complexity and Volatility in Yield Markets

Accessing DeFi yield involves more than just finding attractive rates. It requires a continuous, multi-layered process:

-

Evaluating chains, protocols, and pools;

-

Matching risk/return profiles to rapidly evolving strategies;

-

Monitoring exposures and responding to shifting market and protocol risk.

This operational overhead limits participation and creates inefficiencies in capital allocation, especially for traditional players and real-world fintechs.

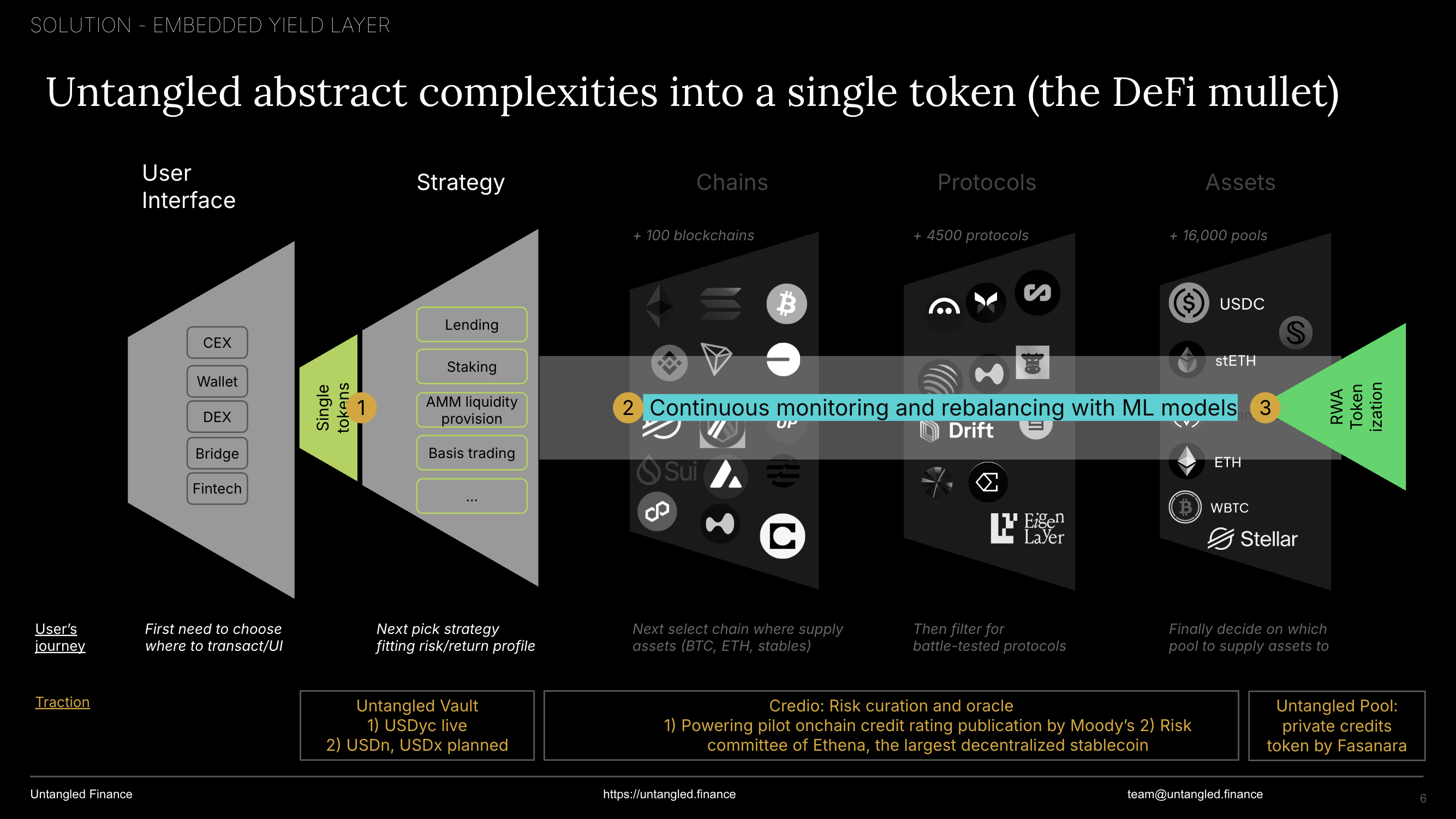

The Solution: Untangled’s Embedded Yield Layer

Untangled abstracts this complexity into a single, programmable yield token. Built for native integration with chains, protocols, fintech apps, wallets, and exchanges, the Embedded Yield Layer automates sourcing, risk curation, and execution.

Capital deployed into the system is dynamically allocated across vetted DeFi and real-world strategies. Yield accrues directly to the token—removing the need for end-users or institutions to actively manage positions.

The Architecture: Three Modular Components

-

Untangled Vault – A capital allocation and non-custodial portfolio engine that constructs and manages diversified strategies across chains, customized to institutional risk profiles. Go here a deep dive into how Untangled Vault works.

-

Credio – A decentralized risk oracle and optimization layer that ingests protocol data, applies quantitative models, and executes rebalancing decisions on-chain. Outputs are verified via zero-knowledge proofs, ensuring transparency and auditability. Go here for a deep dive into how Credio works.

-

Untangled Pool: Private Credit Tokenization – A tokenization layer enabling on-chain exposure to private credit portfolios, combining crypto-native yield with stable RWA cash flows. Go here for a deep dive into how Untangled Pool works.

Traction

Here are some highlights:

-

USDyc: A DeFi savings vault in the form of a liquid staking token, targeting 8-10% APY on USDC exposure. Users supply USDC to USDyc instances on Celo, Polygon and Stellar which is then deployed to yield opportunities on those blockchains plus Ethereum and Base. Explore USDyc vault here

-

USDn: An upcoming delta-neutral vault product. USDn could allocate to vaults or protocols that specialise in basis trading/delta-neutral strategies. More on USDn later.

-

Credio: Powering Moody’s on-chain credit rating pilot and contributing to Ethena Foundation’s risk governance (USDe stablecoin).

-

Karmen: A private credit pool launched with backing from Fasanara Capital, tokenizing SME credit assets in France.

Unlocking Use Cases

Untangled Embedded Yield Layer differs from other solutions in 2 important aspects:

-

Automated execution driven by a decentralized network of risk modelers, not centralized decision-makers.

-

Integrated yield sources from both crypto-native protocols and tokenized real-world credit RWAs.

This combination creates diversified, risk-adjusted yield portfolios, accessible via a single token and integrable across applications.

With the modular architecture, the components can be used on their own (as seen in some solutions above) or in combination with other components to create new products or use cases:

-

Fintechs and Neobanks can offer a seamless “Earn” feature. Users—especially in emerging markets—can access stablecoin-denominated yield from within their existing financial app.

-

Protocols and DAOs can deploy diversified savings products backed by top-tier DeFi and RWA strategies.

-

Decentralized networks can consolidate multiple staking positions into a single stake token, optimizing the cost-efficiency of securing their ecosystems.

Untangled is working on some of these new use cases and more on those later.

Conclusion

Untangled is building foundational infrastructure for embedded yield in the internet of value. By removing operational complexity and embedding DeFi and RWA yields into a single token, Untangled enables institutions, protocols, and fintechs to offer yield natively—securely, programmatically, and at scale.

For investors, it is a gateway to efficient yield generation. For builders, it is a turnkey backend for new financial primitives. For the DeFi ecosystem, it is a step toward real-world financial integration.